- Panic Creeps Up as VIX Curves Invert for First Time Since March (bloomberg)

- CCTV reported that, for the Golden Week holiday (Mid-Autumn Festival), “There were a total of 395 million domestic tourism trips taken, a year-over-year increase of 75.8%, and domestic tourism revenue was 342.24 billion yuan, a year-over-year increase of 125.3%.” (chinalastnight)

- Ford, GM Lay Off More Factory Workers Amid UAW Strike. (barrons)

- Nvidia and Intel Are Bright Spots in a Soft Chip Market, Analyst Says (barrons)

- Amazon Stock Is Under Pressure. Why Two Analysts Think You Should Be a Buyer. (barrons)

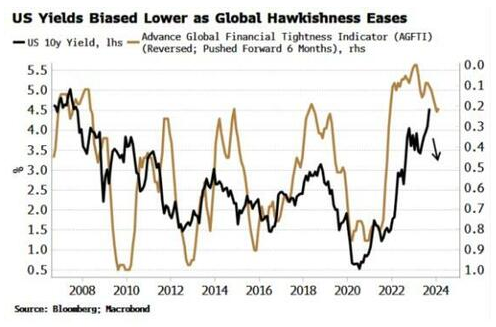

- 3 Reasons U.S. Treasury Yields Are Rising (barrons)

- Why Rising Interest Rates Hurt Bank Stocks Instead of Helping Them (barrons)

- Intel to Make Former Altera Into Standalone Business, Seek IPO (bloomberg)

- Americans Are Still Spending Like There’s No Tomorrow (wsj)

- Real Estate Investors Say Portugal Needs More Homes, Not Fewer Tax Breaks for Foreigners (bloomberg)

- Auto companies could sacrifice stock buybacks to help pay for union demands, analyst says (businessinsider)

- CHART OF THE DAY: China may be the source of surging US bond yields as Beijing dumps Treasurys (businessinsider)

- Medicare drug price negotiations move forward with all drugmakers participating, White House says (marketwatch)

- 5 Damaged Dow Jones Industrial Dividend Leaders Have Huge 2024 Comeback Potential (24/7 Wall Street)

- China Evergrande shares soar on speculative bets that ‘worst is over’ (scmp)

Category: What I’m Reading Today

Be in the know. 8 key reads for Tuesday…

- UAW Deal With Mack Trucks Is Good News and Bad News (barrons)

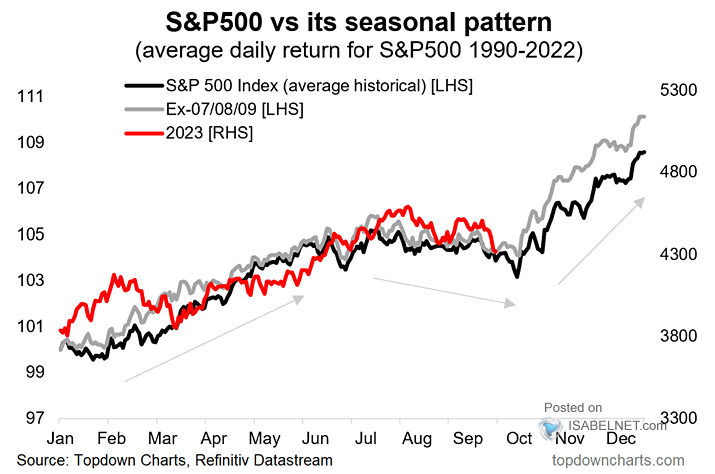

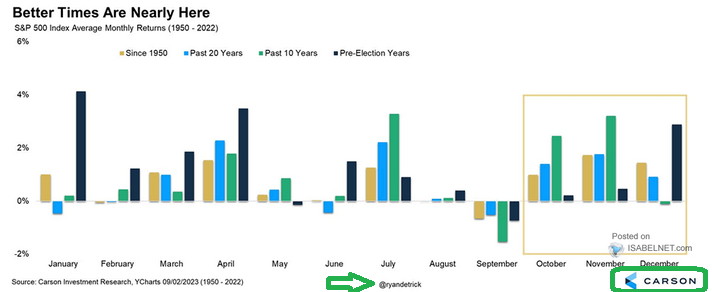

- Should You be Spooked About the Market’s Performance in October? This Expert Says No. (barrons)

- Boeing Stock Was Awful in September. The Case for Staying Invested. (barrons)

- A Rough September Is Finally Over. Now Is the Time to Buy Stocks. (barrons)

- Boeing Stock Was Awful in September. The Case for Staying Invested. (barrons)

- Why the Weight-Loss Drug Hype Looks Overdone (barrons)

- mRNA Proved Magic in Covid Vaccines. What Else Can It Do? (bloomberg)

- ‘We are not in the business of ice cream’: Big Oil CEOs defend themselves against climate criticism (cnbc)

Be in the know. 10 key reads for Monday…

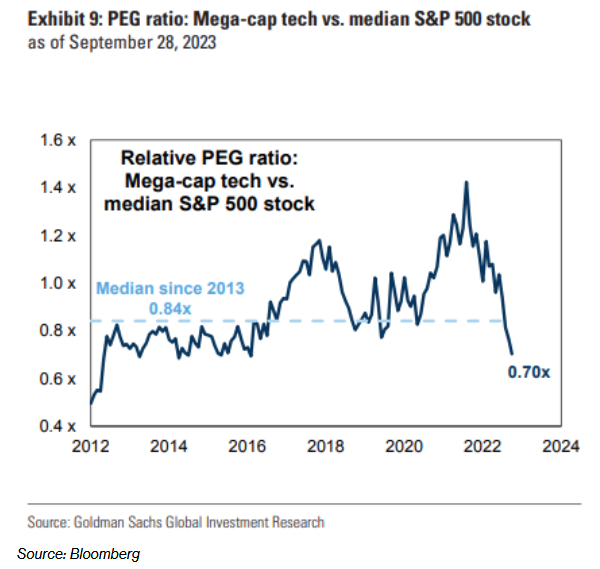

- Goldman Sees Earnings-Led Rally in Big Tech Stocks After Rout (bloomberg)

- Beijing may cut rates and bank reserve requirements again: BE (bloomberg)

- Gary Cohn Says Fed Should Be Done Raising Rates (bloomberg)

- The stuffiest country club stories we’ve ever heard (golfdigest)

- October’s First Trading Day Prone to Volatility, But S&P 500 Up 8 of Last 11 (almanactrader)

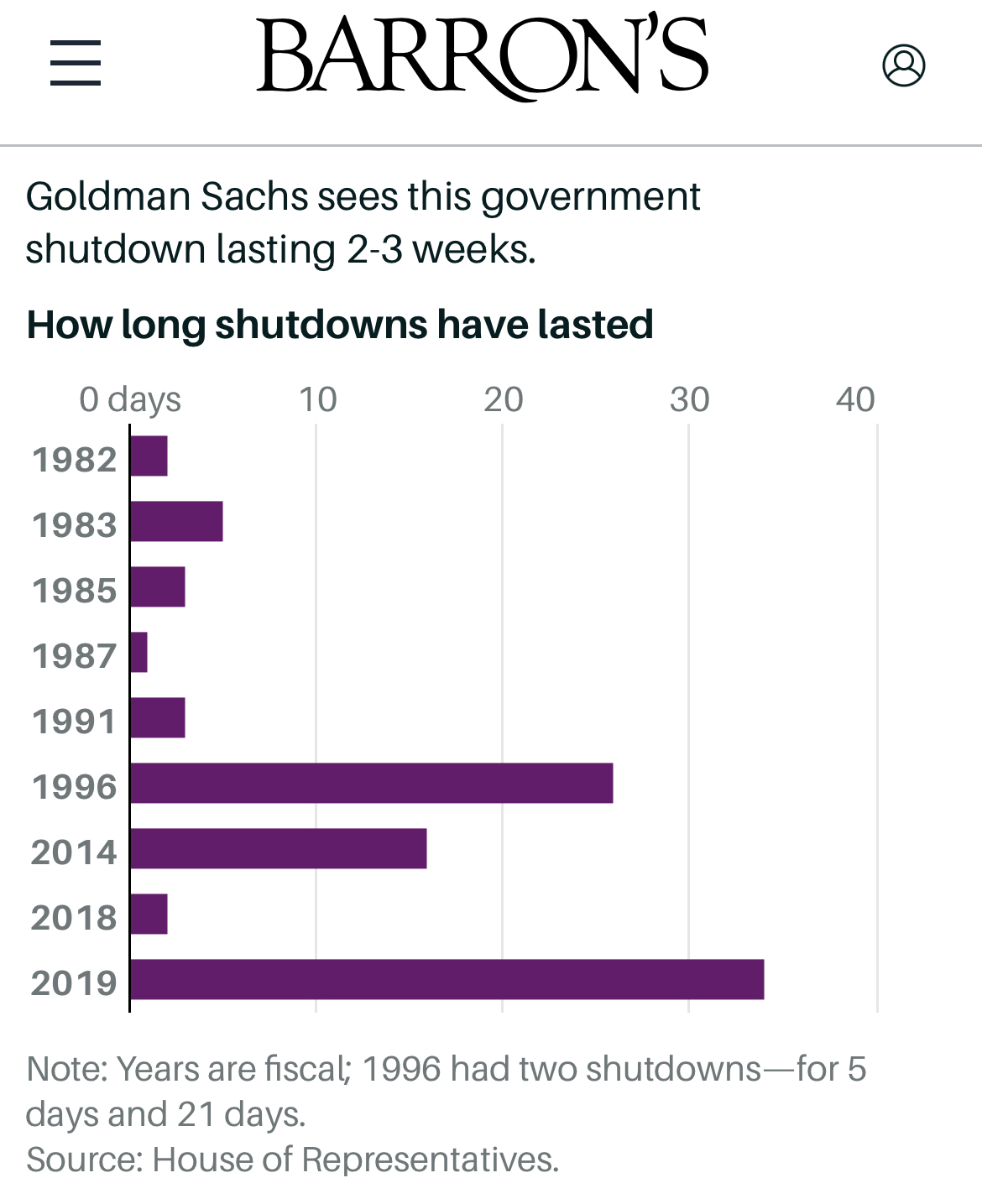

- Congress Averts Shutdown in Surprise Breakthrough (wsj)

- First Drive: Ferrari’s Soft-Top Roma Spider Is an Agile Brute Beneath Those Elegant Lines (robbreport)

- China Home Sales Saw Mild Recovery in September Amid Policy Push (bloomberg)

- CIA official says China ‘growing every which way’ on artificial intelligence (foxbusiness)

- CRISPR’s next advance is bigger than you think (ted)

Be in the know. 12 key reads for Sunday…

- Citigroup CEO Jane Fraser on layoffs, major overhaul: ‘Don’t have room for bystanders’ (nypost)

- House Passes Bill to Avert Government Shutdown, Sends to Senate (bloomberg)

- Huawei Takes Revenge as China Catches Up on Semiconductors (bloomberg)

- Portugal Upgraded to A- by Fitch on Declining Debt Ratio (bloomberg)

- What Worries UAW’s Striking Workers, in Their Own Words (bloomberg)

- The Fed is throwing ‘kerosene on the fire’ and needs to end rate hikes as inflation is probably already at 2%, billionaire real estate mogul Barry Sternlicht says (businessinsider)

- Apple Says Software, Apps Behind iPhone Overheating; Fix Coming (bloomberg)

- How Elon Musk’s Starlink Sparked a New Kind of Space Race (bloomberg)

- Atari 2600+ sees its future in retro gaming (cnbc)

- Shane Parrish on Wisdom from Warren Buffett, Rules for Better Thinking, How to Reduce Blind Spots, The Dangers of Mental Models, and More (#695) (tim)

- 10 Undervalued Wide-Moat Stocks (morningstar)

- The Big Read. What Lina Khan’s antitrust case could mean for Amazon (ft)

Be in the know. 10 key reads for Saturday…

- China’s economy stabilises, factory activity returns to expansion (reuters)

- How a government shutdown could complicate Fed’s fight against inflation (marketwatch)

- Disney+ password-sharing crackdown reportedly coming soon (foxbusiness)

- Intel’s stock scores its hottest quarterly winning streak since 2010 (marketwatch)

- Yellen warns government shutdown would be ‘dangerous and unnecessary’ (foxbusiness)

- Investors are pouring money back into global stocks following biggest outflow of the year (marketwatch)

- September Is Over. It’s Time to Buy Stocks. (barrons)

- ‘This Is Not a Covid Vaccine Company,’ Moderna CEO Says (barrons)

- Dollar Tree Insider Bought the Beaten-Down Stock (barrons)

- ASTON MARTIN UNVEILS F1-INSPIRED VALHALLA HYPERCAR (maxim)

Be in the know. 20 key reads for Friday…

- China’s Economy Improves in September, Satellite Data Show (bloomberg)

- Alibaba, NIO, XPeng Climb. Chinese Businesses Get a Regulatory Boost. (barrons)

- Automakers grow frustrated over pace of UAW negotiations as new strike deadline looms (cnbc)

- China Looks to Relax Data Rules to Allay Business Fears (bloomberg)

- Intel hails ‘landmark’ as high-volume EUV production begins at Irish plant (yahoofinance)

- 10-year Treasury yield falls from 15-year high after Fed’s preferred inflation gauge eases (cnbc)

- US Core PCE Prices Post Smallest Monthly Rise Since Late 2020 (bloomberg)

- Bank Stocks See Big Insider Buys (barrons)

- Bonds Remain Oversold After Fastest Yield Rise On Record (zerohedge)

- ‘I see more fear than anytime in my business career,’ says BlackRock’s Larry Fink (marketwatch)

- House Passes Some Late-Night Bills. Shutdown Still Looking Likely. (barrons)

- Buy This Defense Stock. It’s Cheap, and a Shutdown Won’t Hurt It for Long. (barrons)

- Nike Sees ‘Very Strong’ Demand in Year Ahead. The Stock Rallies.(barrons)

- Nvidia and Other Chip Stocks Had a Terrible September. Wall Street Remains Upbeat. (barrons)

- Where Did All the Dark-Suited Japanese Businessmen Go? (nytimes)

- Europe’s Richest Royal Family Builds $300 Billion Finance Empire (bloomberg)

- Forget the sell-off – Tech stocks have a ‘springboard for growth’ into 2024 that Wall Street has underestimated (businessinsider)

- Here Is What Stops, And What Doesn’t, When The Government Shuts Down This Weekend (zerohedge)

- Eurozone inflation hits two-year low (ft)

- S&P 500 Quarterly Returns (carson)

Be in the know. 23 key reads for Thursday…

- U.S. new-car sales seen rising more than 13% in September (marketwatch)

- China Industrial Profits Jump Sharply as Economy Stabilizes (bloomberg)

- If China Is So Weak, Why Are Commodities So Strong? (zerohedge)

- Here’s How Long a Government Shutdown Could Last (barrons)

- More UAW Strikes Could Be Coming. (barrons)

- Ford’s Factory Halt Is a Loss for Auto Workers and Consumers. Here’s Why. (barrons)

- The ‘Yield Curve’ Is Improving. These Types of Stocks Should Benefit. (barrons)

- JetBlue Issues Revenue Warning. It’s Not That Bad. (barrons)

- Fear on Wall Street? Shake it off, advise these strategists. (marketwatch)

- How Long Was the Longest Government Shutdown? It Depends Who You Ask. (barron’s)

- ‘We are in a bit of a vacuum that is scaring people,’ says Morgan Stanley portfolio manager of Treasury market selloff (marketwatch)

- U.S. economy grew 2.1% in the second-quarter, GDP shows (marketwatch)

- China Has Second Thoughts About Controlling Prices in Its Multi Trillion-Dollar Housing Market (wsj)

- What happens to the stock market if the government shuts down? The dollars and cents of it (usatoday)

- UAW’s Real Enemy Is Forced EV Conversion (zerohedge)

- Beaten down US solar sector may be primed for a rebound: Maguire (reuters)

- Alibaba’s Taobao and Tmall chief Dai steps away from roles at subsidiaries to focus on core e-commerce business: reports (scmp)

- China Names Lan Fo’an as Party Chief of Finance Ministry (bloomberg)

- The sentiment around Nike has gotten way too negative, says Oppenheimer’s Brian Nagel (cnbc)

- Detrick: Small cap stocks could lead a fourth quarter rally (cnbc)

- How Much Savings Do Americans Have Left, Anyway? (wsj)

- Who Is Detained Evergrande Founder Hui Ka Yan? His Rise and Fall Explained (bloomberg)

- US Consumer Spending Rose at Weakest Pace in a Year Last Quarter (bloomberg)

Be in the know. 18 key reads for Wednesday…

- China Assets Are ‘Ridiculously Cheap,’ Alberta Fund CEO Says (bloomberg)

- Banks Have Problems but Their Stocks Are Cheap. Here Are 5 Worth a Look. (barrons)

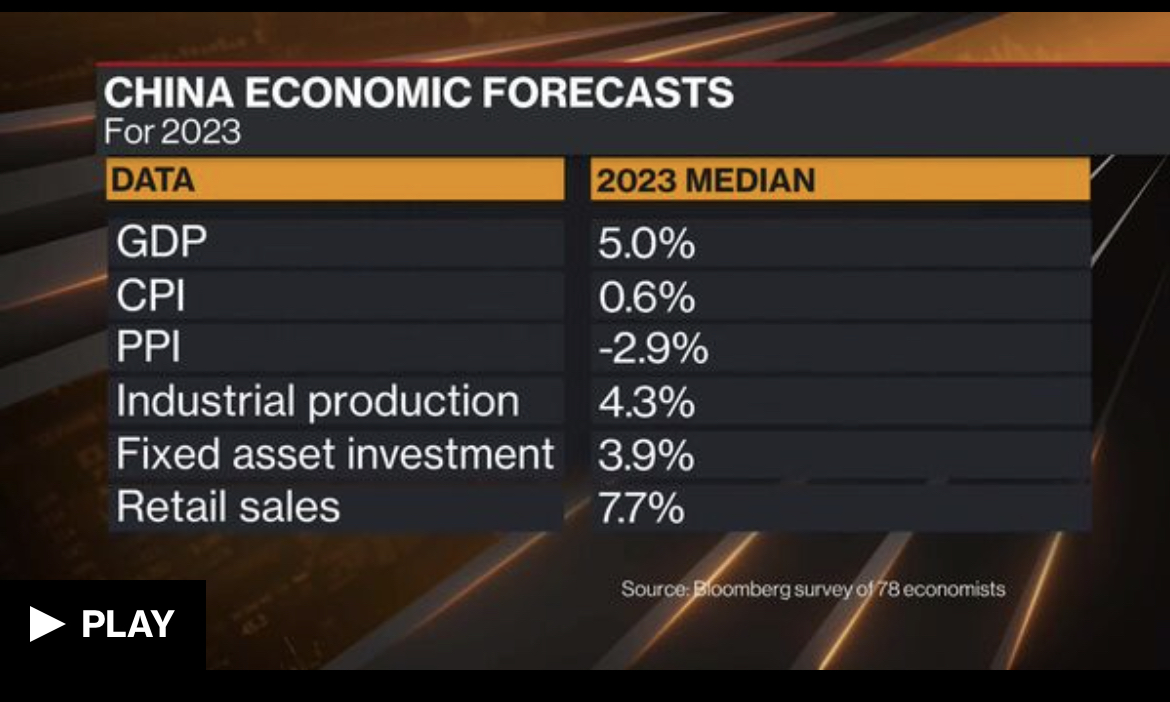

- China will just about meet its economic growth target of around 5% for this year, the latest Bloomberg survey shows (bloomberg)

- The Bull Case for the Stock Market Hinges on This Level for the S&P 500 (barrons)

- Amazon Prepares for FTC Fight. A Breakup Might Not Be the Worst Outcome. (barrons)

- For This Pro, China’s Slowdown Won’t Hold Back These Luxury Stocks (barrons)

- China Has Second Thoughts About Controlling Prices in Its Massive Housing Market (wsj)

- Europe’s Secret Weapon at the Ryder Cup Is a Data Geek Called Dodo (wsj)

- IPO Optimism Grows, Fueling Hope for Global Recovery (bloomberg)

- Amgen Could Get a Piece of the Obesity Market (wsj)

- China Starts Local Government Debt Swap Program (bloomberg)

- Musk Warns Biden-Backed 40% UAW Pay-Hike Risks Big 3 Bankruptcy (Again) (zerohedge)

- Nike (NKE) upgraded at CFRA as pullback makes shares more attractive (streetinsider)

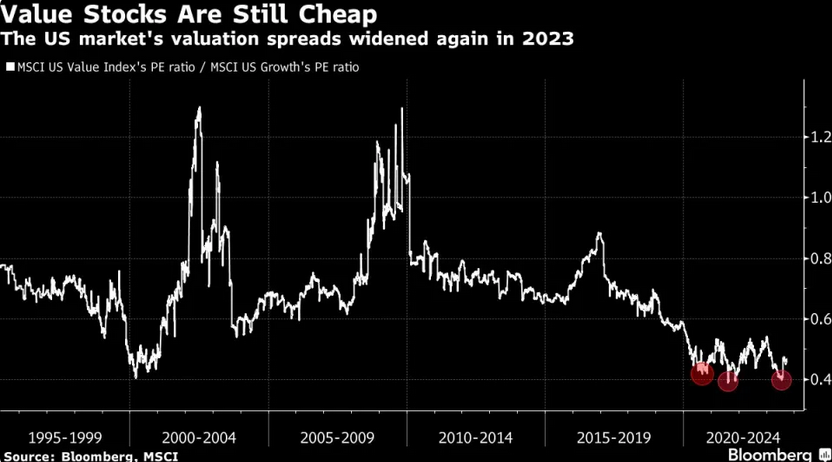

- Rob Arnott sees ‘just near perfect environment for value’ stocks (streetinsider)

- Don’t write off Hong Kong and mainland China despite headwinds, analysts say (scmp)

- FTC’s Amazon antitrust lawsuit faces high bar in US court -experts (reuters)

- China Growth Target Hangs in Balance (bloomberg)

- Emerging markets are ‘big-time on sale’, says NFJ Investment’s John Mowrey (cnbc)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Tuesday…

- Alibaba’s Cainiao Files for $1 Billion-Plus Hong Kong IPO (bloomberg)

- China’s economic situation isn’t as dire as it seems, and policymakers in Beijing were just expecting too much, economist says (businessinsider)

- This Is the ‘Perfect’ Time to Buy Value Stocks on Sticky Inflation, Rob Arnott Says (yahoo)

- Biden Heads to Strike. Can He Square Inflation and Unions? (barrons)

- Why Ford Struck a Deal (barrons)

- A Government Shutdown Is Close. What’s at Stake. (barrons)

- Hedge funds are boosting bets against U.S. stocks as selloff continues, Goldman Sachs says (marketwatch)

- 11 Beaten-Up Growth Stocks That Look Like Buys—and Aren’t Big Tech (barrons)

- Wall Street analysts expect the S&P 500 to rise 19% over the next 12 months. Here are their 10 favorite stocks. (marketwatch)

- Moody’s warns gov’t shutdown bad for USA’s credit — one month after Fitch downgrade (nypost)

- The Secret Ingredient of ChatGPT Is Human Advice (nytimes)

- Bond Traders Stung by Fed See US Shutdown as Next Big Wild Card (bloomberg)

- Hedge Funds Cut Stock Leverage at Fastest Pace Since 2020 Crash (bloomberg)

- Goldman Sachs: Buy these 22 stocks that will continue to outperform (businessinsider)

- Short Positions Pile Up in Nasdaq Futures, Citi Strategists Say (bloomberg)

- Government shutdown fears rattle US stocks, but history shows upside (streetinsider)

- The elusive Fed ‘soft landing’ nears. Why are Americans so mad about the economy? (reuters)

- Charlie Munger Emphasizes Self-Awareness And Strategy: ‘I Don’t Play In A Game Where The Other People Are Wise And I’m Stupid. I Look For A Place Where I’m Wise And They’re Stupid’ (yahoo)

- The Big Read. The debt-fuelled bet on US Treasuries that’s scaring regulators (ft)

- Economic & Diplomatic Progress Goes Unnoticed By Foreign Investors (chinalastnight)