Skip to content

Freshippo Opens a Store a Day in September Expansion Frenzy (alibaba )

Trendyol’s Path to Profitability in Pictures (alibaba )

Amazon to Invest Up to $4 Billion in an AI Start-Up. It’s a Warning to Big Tech Rivals. (barrons )

‘Get off the train’: Citi CEO sends tough message on big overhaul (ft )

The IPO Market Might Be Back. Why Investors Should Think Twice About Jumping In. (barrons )

Utility Stocks Won’t Be This Cheap for Long—and Their Dividends Still Shine (barrons )

One Auto Union Has Settled. Here Is What It Got From Ford. (barrons )

Disney, Netflix, Other Media Stocks Rise With End in Sight for Hollywood Writers Strike (barrons )

Opinion: This bargain-hunting fund manager is finding value in PayPal and other fintech stocks (marketwatch )

Attention Office Resisters: The Boss Is Counting Badge Swipes (wsj )

Ford’s Auto Workers in Canada Back Labor Deal With 15% Wage Bump (wsj )

Theme Parks Pin Hopes on a Fall Rebound After Summer Flop (wsj )

Ackman Doubles Down on Bond Short That’s Still Flawed (bloomberg )

Secret ‘James Bond’ Tunnels May Become a Tourist Attraction (bloomberg )

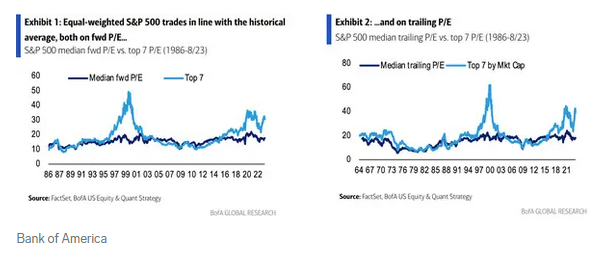

Opinion: Let’s debunk the bears’ top arguments against further stock market gains (marketwatch )

Why traders aren’t buying the Fed’s ‘higher-for-longer’ vision (reuters )

6 Hong Kong share listings this week set to raise up to US$458 million (scmp )

China Markets Rebound, Alibaba’s First Spinoff Approaches, Week in Review (chinalastnight )

The US is on the brink of a new growth cycle (ft )

Most strategies are focusing on ways to insulate China operations rather than reduce them (ft )

What the Fed is overlooking (scottgrannis )

Starbucks invests $220 million in China’s coffee market expansion (technode )

Alibaba to inject $2 billion into its Turkish unit as it doubles down on overseas plans (technode )

Domestic US Banks See Big Deposit Outflows Last Week But Loan Volumes Picked Up (zerohedge )

U.S. Dollar Double Top? (kimblechartingsolutions )

Hedge funds rush to unwind bets against gilts (ft )

America’s Billionaires Love Japanese Stocks. Why Don’t the Japanese? (wsj )

How Rupert Murdoch Outfoxed American Media (forbes )

Weekly Leading Economic Index (advisorperspectives )

The Most Expensive Homes in Every State, From Alabama to Wyoming (robbreport )

Review: Apple iPhone 15 Pro & Pro Max (maxim )

A black market, a currency crisis, and a tango competition in Argentina (org )

How Dumb Money Got So Smart (townandcountrymag )

How Hollywood insures its biggest stunts (thehustle )

Rory McIlroy says amateurs are ‘pretty scared’ of this shot. Here’s his easy fix (golf )

Disney Stock Could Climb 50%, J.P. Morgan Says (barrons )

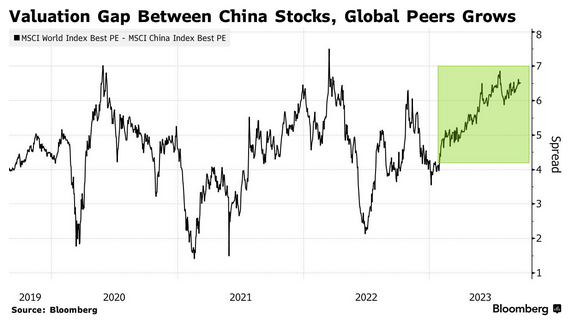

China Market Gloom Spurs Fund Managers to Seek for Hidden Gems (bloomberg )

Tech money is finally flowing again, and it may be just the beginning (marketwatch )

Yields Are Near Their Peak. You Shouldn’t Wait to Buy Bonds. (barrons )

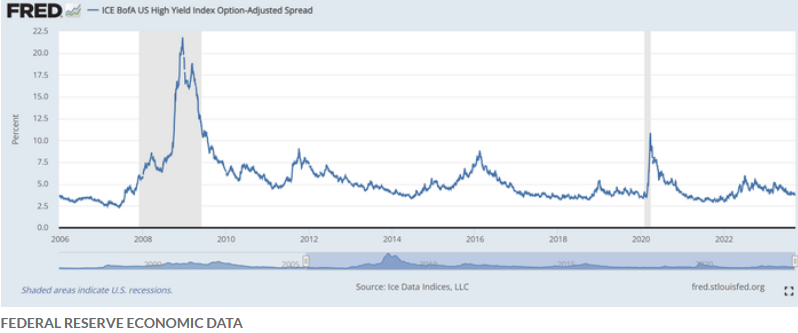

Bank Stocks Are Stronger Than You Think. It’s Time to Get In. (barrons )

Las Vegas Sphere’s Debut Could Lift 3 Dolan-Linked Stocks (barrons )

This Busted Bank Merger Is Fixing Itself. Its Stock Is Worth Buying. (barrons )

China Is in Trouble, but It’s Not as Bad as Some Think (barrons )

The Stock Market’s Drop Was the Worst Since March. Is It September or Something More Sinister? (barrons )

UAW Strikes at More GM and Stellantis Sites, But Spares Ford (wsj )

Novel Approach Would Avoid Shutdown, Force Congress to Keep Working (wsj )

Five Clues to Where the UAW Strike Is Headed Next (wsj )

The Hedge Fund Meltdown That Rescued Your Stock Portfolio (wsj )

Advance Auto Parts Insider Bought Up the Embattled Stock (barrons )

Auto parts makers’ stocks rally, as UAW’s expanded strike provides a boost (marketwatch )

The economy is about to slow down. That’s the time for retail stocks, says Goldman Sachs. (marketwatch )

S. and China Agree to New Economic Dialogue Format (nytimes )

Raffles London and the new era of super-luxe hospitality (ft )

Sam Corcos, Co-Founder of Levels — The Ultimate Guide to Virtual Assistants, 10x Delegation, and Winning Freedom by Letting Go (Plus: Creating Leverage with Tools, Systems, and Processes) (#694) (tim )

Part 3: 10 Of The Best Stock Market Investing Books Of All Time (2023) (acquirersmultiple )

How Shipping Helps Explain the World (bwater )

10 Best Value Stocks to Buy for the Long Term (morningstar )

Warren Buffett on Living Off Dividends In Retirement (dividendgrowthinvestor )

Alibaba, JD.com Stocks Rise on Report of China Easing Ownership Limits (barrons )

Alibaba’s Cainiao Plans to Raise At Least $1 Billion in Hong Kong IPO Soon (bloomberg )

US and China to launch economy and finance working groups to stabilise ties (ft )

Treasury Department Announces Launch of Economic and Financial Working Groups with the People’s Republic of China (gov )

This credit gauge shows investors still have risk appetite, despite recession fears (marketwatch )

UAW May Strike More Plants Today. Location Is Key. (barrons )

Amazon Is Latest to Add Advertising to Streaming (barrons )

Hedge fund titan Bill Ackman tells The Post why he remains bullish on NYC, talks presidential picks (nypost )

Podcast: Steven Rattner on the UAW Strike and the Challenges of Bidenomics (bloomberg )

Apple’s iPhone 15 Goes on Sale With Long Lines Around the World (bloomberg )

This October could become another ‘bear killer’ – Stock Traders Almanac (streetinsider )

The Enduring Lessons of ‘Dumb Money’ (institutionalinvestor )

What striking workers get wrong about automaker profits (yahoo )

Richest Family in South America Doubled Its Fortune on an Investment Analysts Hated (bloomberg )

BABA’s Cainiao Reportedly Plans US$1B HK IPO Application Next Wk (aastocks )

Fed Holds Rates Steady but Pencils In One More Hike This Year (wsj )

Fed’s Dot Plot Told One Story, Powell Another (barrons )

Iran’s Oil Exports Have Soared During Quiet Diplomacy With U.S. (wsj )

Iger says Disney will ‘quiet the noise’ in culture wars during intense DeSantis feud (nypost )

China Is in Trouble, but it Isn’t a Catastrophe. Investors Shouldn’t Run Scared. (barrons )

This Busted Bank Merger Is Fixing Itself. Its Stock Is Worth Buying. (barrons )

Oil Is Forcing Inflation Higher, But Relief Could Be Coming (barrons )

2 NYC hotels make list of world’s 50 best: ‘We are redefining luxury’ (nypost )

China Tests New Property Model in Xi’s Flagship City Amid Crisis (bloomberg )

For Starbucks, Target, and TJX, Now Is the Season. The Stocks Rarely Drop With the Leaves. (barrons )

FedEx Earnings and Guidance Lift the Stock (barrons )

The economy is about to slow down. That’s the time for retail stocks, says Goldman Sachs. (marketwatch )

Sphere Las Vegas Opens Soon. Take a Peek Inside Before the U2 Concert. (barrons )

Fed’s Message Is Louder Than Its Rate Call. Why That’s Critical for Investors. (barrons )

GM, Ford Stocks Fall as Strike Threatens to Drag On (barrons )

Utilities Won’t Stay Cheap. Their Dividends Are Shining. (barrons )

Stocks Should Shrug Off a Government Shutdown. But There Are Wild Cards. (barrons )

Cisco to Buy Splunk in Deal Valued at $28 Billion (barrons )

Fed’s revised dot plot for interest rates makes wall of maturing debt a bigger worry (marketwatch )

Latest UAW Threat: Strikes at More Ford, GM Plants If No ‘Serious Progress’ by Friday. (barrons )

This former Fed insider has 3 big takeaways from Powell’s press conference (marketwatch )

Fed predicts ‘soft landing’ for the economy — low inflation and no recession (marketwatch )

American Labor’s Real Problem: It Isn’t Productive Enough (wsj )

Corporate America Brings Its New Skinny Look to Stock Market (bloomberg )

Hedge Funds Add China Stock Shorts Even As Growth Bottoms (zerohedge )

Square and PayPal Are Getting New CEOs. What It Means for Their Stocks. (barrons )

Fed Debates When to Stop Raising Rates. What to Watch at Wednesday’s Meeting (wsj )

Boeing Sees Jet Demand Soaring, Led by China. Here’s Why. (barrons )

Biden thinks he’ll get ‘some kind of deal’ with China: Victoria Coates (foxbusiness )

China keeps benchmark rates unchanged as economy finds footing (reuters )

BofA’s Savita Subramanian Latest on Wall Street to Lift S&P 500 Target (bloomberg )

Ford Reaches Tentative Deal With Canadian Auto Workers (barrons )

Ford, GM Stocks Rebound To Pre-Strike Levels. Why Tesla Is the ‘Clear Winner.’ (barrons )

iPhone 15 and 15 Pro Review: Is Apple’s Most Expensive Phone Worth It? (wsj )

IBM Stock Gets a New Bull. Why Its Software Business Is ‘Misunderstood.’ (barrons )

Amazon to Bulk Up on Seasonal Workers This Year (barrons )

MSG Entertainment Stock Looks Set to Rise (barrons )

China Eases Visa Application Process to Attract Foreign Visitors (bloomberg )

Disney to Invest $60 Billion in Theme Parks, Cruises Over Next Decade (wsj )

Chinese stocks are due for an 8% rebound as market nears bottom, UBS says (scmp )

Huawei & Apple Sales Prove The Strength of The China Consumer (chinalastnight )

Buy this pharma stock that could more than double if it clears a legal battle, Jefferies says (cnbc )

Markets Show Signs of Reflation. Where to Invest Now. (barrons )

Bank of America: The stock market is primed for a 25% rally in the next 12 months. These 6 industries hold the best opportunities. (businessinsider )

Apple iPhone 15 Deals Are Out. What They Mean for T-Mobile, AT&T, Verizon Stocks. (barrons )

Latest UAW Threat: Strikes at More Ford, GM Plants If No ‘Serious Progress’ by Friday. (barrons )

Instacart Sets Its IPO Price at $30 a Share. Trading Starts Soon. (barrons )

S. economy is trending in the Fed’s direction, so expect Powell to tread carefully this week (marketwatch )

Carnival’s stock climbs after long-time bear says stop selling (marketwatch )

GE HealthCare Stock Is Too Cheap, Says Analyst (barrons )

CEO of Naspers and Prosus Steps Down (wsj )

Disney to Invest $60 Billion in Theme Parks, Cruises Over Next Decade (wsj )

Desperate NYC parents spending millions, lying, moving across the country to get kids into Ivy League schools (nypost )

Amazon Opens a New Chapter for Its Gadget Business, and for Alexa (bloomberg )

Treasury yields hold steady as investors await economic data, Fed meeting (cnbc )

Goldman Sachs says the yield curve isn’t signaling a recession this time, but a restrictive Fed policy (businessinsider )

Shelter will be the category driving disinflation going forward: JPMorgan Asset Management’s Berro (cnbc )

Bond Market at Risk of Third Annual Loss Needs a Dot-Plot Rescue (bloomberg )

US, China Officials Meet in Malta to Keep Channels Open (bloomberg )

Beijing to support unicorns by fast-tracking IPO and large funding approvals (technode )

Ant Group’s consumer credit unit secures RMB 4 billion consortium loan (technode )

Taiwan Dollar Slump Seen Ending on China Recovery, Chip Outlook (bloomberg )

Lineup Will Hold It Over Until Next Year (bloomberg )

Where the Strike Stands. How to Read Offers From Auto Makers and the UAW. (barrons )

New Cancer Drugs Are Changing the Odds. The Latest on Treatments. (barrons )

Disney asset sales won’t break the bank, but they will move legacy media forward (cnbc )

This Chinese partner could be the savior for beaten-down PayPal, Mizuho says (streetinsider )

Meituan Says Sales in First 30 Mins of iPhone 15 Pre-order Exceed RMB200M (aastocks )

Amazon Makes 3 Groundbreaking Announcements This Week That Hint at Its Future Growth Plans (fool )

Those trying to pick AI winners should remember the dotcom days (ft )

This stock market signal points to the S&P 500 surging 25% within the next year (businessinsider )

UAW President Says Stellantis 21% Pay Hike Offer a ‘No Go’ (barrons )

Fewer Losers, or More Winners? (Howard Marks )

Warren Buffett’s intrinsic value mantra might lead you to boring companies but predictable cash flows (financialpost )

#395 – Walter Isaacson: Elon Musk, Steve Jobs, Einstein, Da Vinci & Ben Franklin (lexfridman )

The 10 Best Dividend Stocks. These undervalued stocks with reliable dividends are worth considering. (morningstar )

Automakers, UAW Spend Strike’s First Day in War of Words (bloomberg )

Hedge Funds Hiked Bullish Oil Bets to 15-Month High on OPEC+ Cuts. Net long positions rise to highest level since June 2022 (bloomberg )

Frontier Airlines CEO says workforce got ‘lazy’ during pandemic (foxbusiness )

Fed unlikely to raise rates in November, says Goldman Sachs (reuters )

What if Jerome Powell pulled off a soft landing and nobody noticed? It’s the economy’s Groundhog Day (fortune )

How scientists are using artificial intelligence (economist )

From commodities to retail, China’s economy is showing signs of life after Beijing’s stimulus frenzy (businessinsider )

Trump bemoans high interest rates and indicates he might pressure Fed to lower (cnbc )

Have Million-Dollar Gene Therapies Finally Reached An Inflection Point? (investors )

Ford Lays Off 600 Workers at Plant Targeted by UAW Strike (barrons )

This Highflying Defense Stock Stumbled. That’s a Reason to Buy. (barrons )

20 stocks of aerospace and defense companies expected to grow sales most quickly through 2025 (marketwatch )

1-800-Flowers Executives Bought Up Stock (barrons )

Hunting Season on Banks Might Be Over (barrons )

The Big Question for the Fed: Not How High Rates Will Go but How Long They’ll Stay There. (barrons )

Auto Stocks Rise as UAW Strike Gets Reaction From Wall Street (barrons )

‘Sell Rosh Hashanah, buy Yom Kippur’ stock-market pattern is just a calendar event (marketwatch )

Small-Cap Stocks Are in the Doghouse. What Could Lift Them Out. (barrons )

‘Dumb Money’: The Movie vs. What Really Happened (wsj )

Demands for Tips Are Up. Actual Tipping, Not So Much. (wsj )

Amazon Searches for Its Next Big Hit (wsj )

UAW Strike Exposes Detroit’s Dysfunction (wsj )

Whatever the UAW Strike Outcome, Elon Musk Has Already Won (wsj )

Striking UAW Can’t Bring Back the 1950s or Wish EVs Away (bloomberg )

Warren Buffett poured $3 billion into Dow Chemical during the financial crisis. Here’s the story of how he helped the manufacturing titan – and doubled his money. (businessinsider )

Battle Over Electric Vehicles Is Central to Auto Strike (nytimes )