Skip to content

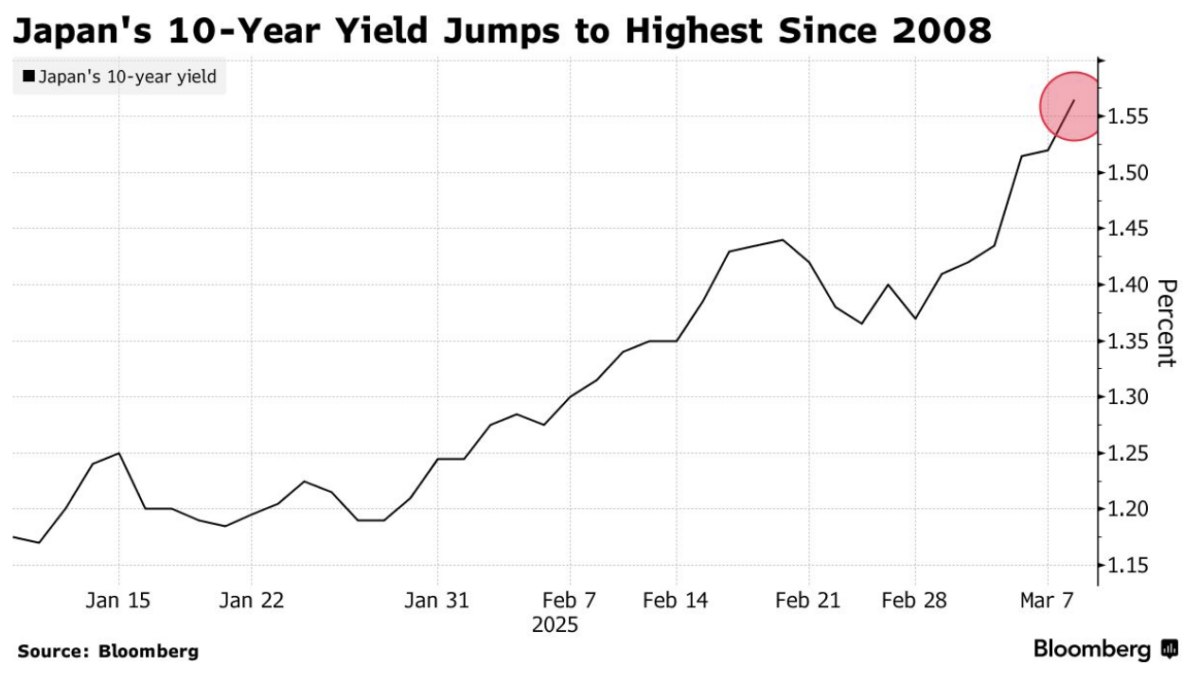

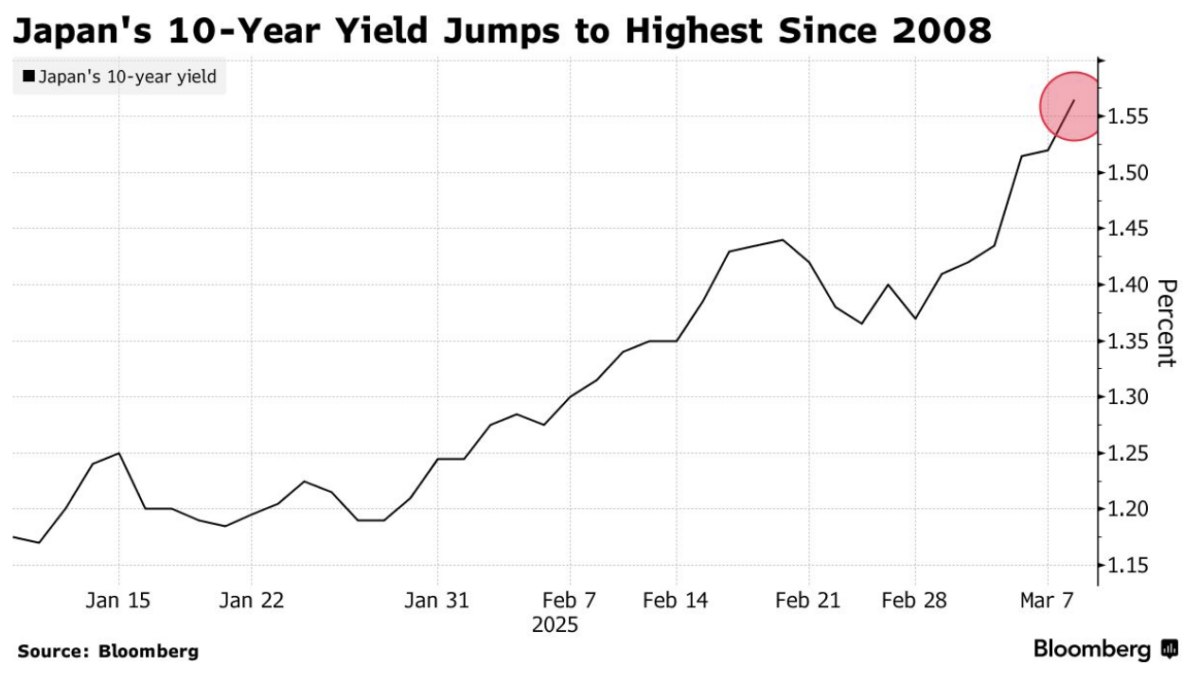

- Japan 10-Year Yield at Highest Since 2008 on Bets for BOJ Hikes (bloomberg)

- 3 CEOs Just Spent Millions Buying Their Beaten-Down Stock (barrons)

- Disney’s Parks Chief Sees Fortnite as Key to Its Future (bloomberg)

- Mainland Chinese Investors Buy Record Amount of Hong Kong Stocks (bloomberg)

- How Natural Gas Became America’s Most Important Export (bloomberg)

- Nvidia Stock Drops. Why Shares Keep Falling. (barrons)

- Beacon, QXO in ‘friendly’ talks on $11B deal as QXO aims to double EBITDA (streetinsider)

- How Alibaba’s new RISC-V chip hits the mark for China’s tech self-sufficiency drive (scmp)

- International-Stock Funds Finally Wake Up (wsj)

- ‘Chaos creates opportunities’: Wall Street sees dip as buying chance (yahoo)

- JPMorgan joins Goldman, hikes euro area’s 2025 economic growth forecast (reuters)

- China’s car sales rise 1.3% in first two months of 2025 (reuters)

- Who Likes Tariffs? Some U.S. Industries Are Eager for Them. (nytimes)

- What the Dot-Com Bust Can Tell Us About Today’s AI Boom (wsj)

- Trump’s Tariff Whipsaw Is Handing European Stocks Another Win (bloomberg)

- Unlocking the housing market: Here’s what would get more homeowners to sell (fastcompany)

- Mortgage rates fall again with largest weekly decline since mid-September (foxbusiness)

- North Face President Caroline Brown Shares Ambitious Go-Forward Plan (shopeatsurf)

- Vans Is Getting in on the Thin-Soled Sneaker Trend (footwearnews)

- Disney reveals details for new theme park rides based on beloved franchises (foxbusiness)

- Gimme Credit (oaktreecapital)

- Near-term gloom, long-term boom (scottgrannis)

- A look at some of the creative ways companies try to dodge high tariffs (npr)

- US Markets Are Trailing the World as Aura of America First Fades (bloomberg)

- 44 housing markets where inventory has spiked, and homebuyers have gained power (fastcompany)

- Catering to protein-rich diets is a tasty business (economist)

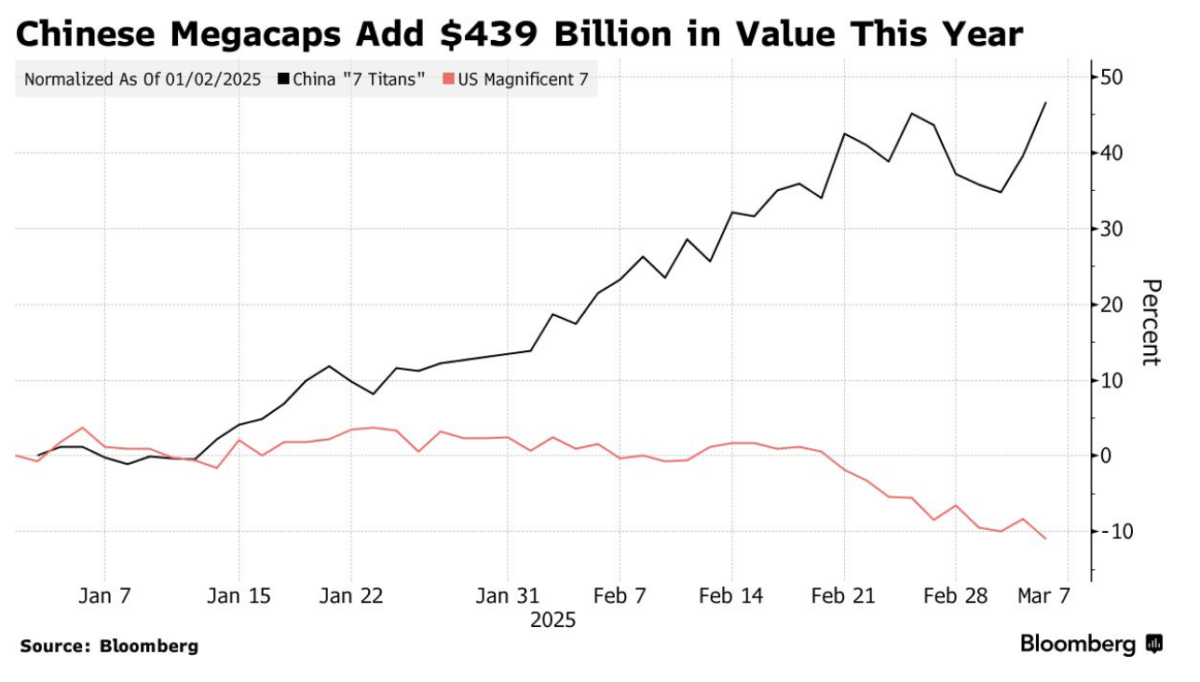

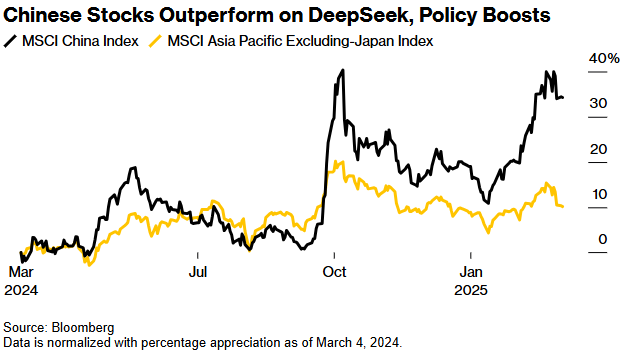

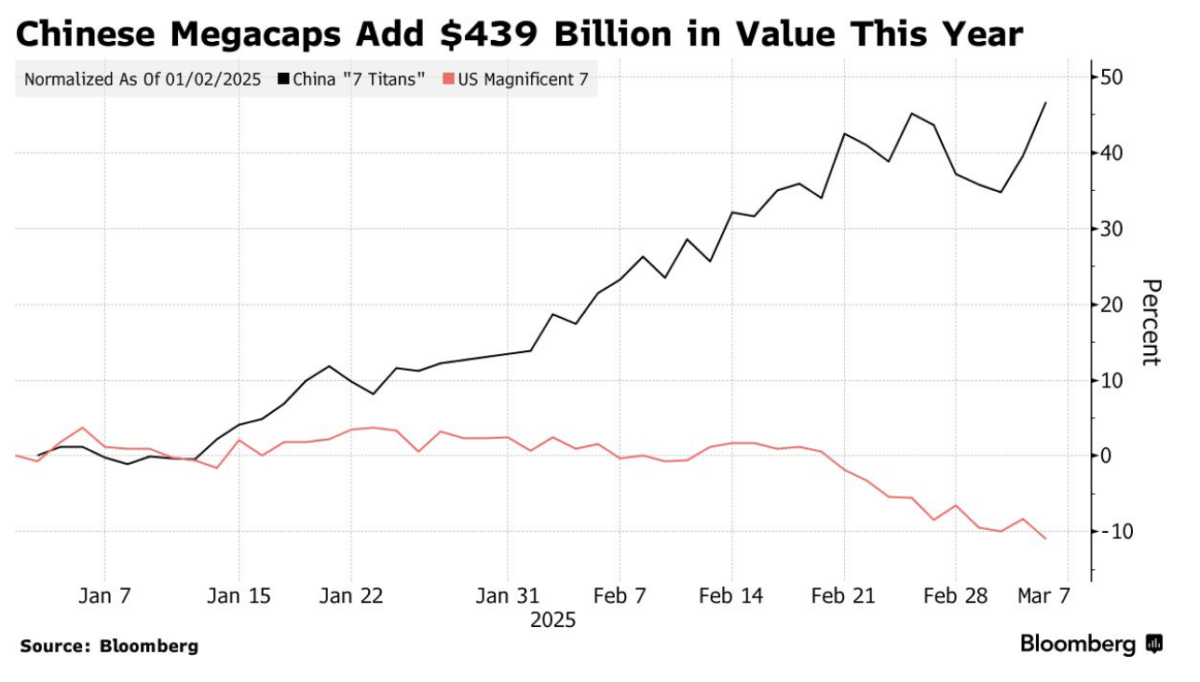

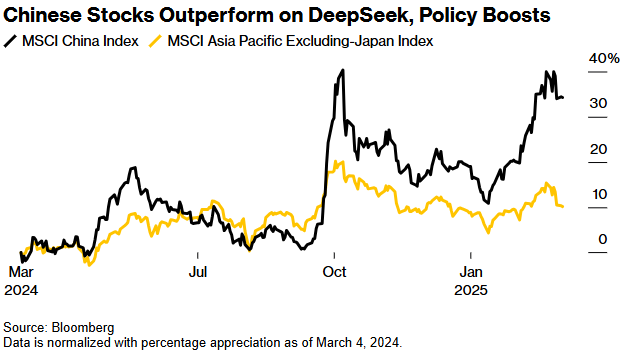

- China’s Seven Titans vs Wall Street’s Magnificent Seven: DeepSeek sparks stocks re-rating (yahoo)

- Should You Forget Home Depot and Buy These 3 Housing-Related Stocks Instead? (yahoo)

- This Rare, Barely Driven Lamborghini Sían Is Now up for Grabs (robbreport)

- 51 fun stats for 51 years of the Players Championship (golfdigest)

- The Myth Behind Daylight-Saving Time (wsj)

- 5 collector cars to put into your garage this week (classicdriver)

- Cainiao’s AI+Logistics Wins China’s Top AI Science & Technology Award, Leading Innovation in Logistics (alizila)

- Trump Is Engineering a Global ‘Paradigm Shift.’ It Doesn’t Favor U.S. Stocks. (barrons)

- The Mag 7 Stocks Are No Longer Magnificent. Where the Charts Say They Go Next. (barrons)

- Money-Market Fund Assets Hit Record $7 Trillion as Investors Seek Safe Havens (barrons)

- Trump’s ‘chaotic’ policy approach is creating opportunity for investors (marketwatch)

- Euro on course for best week since 2009 (ft)

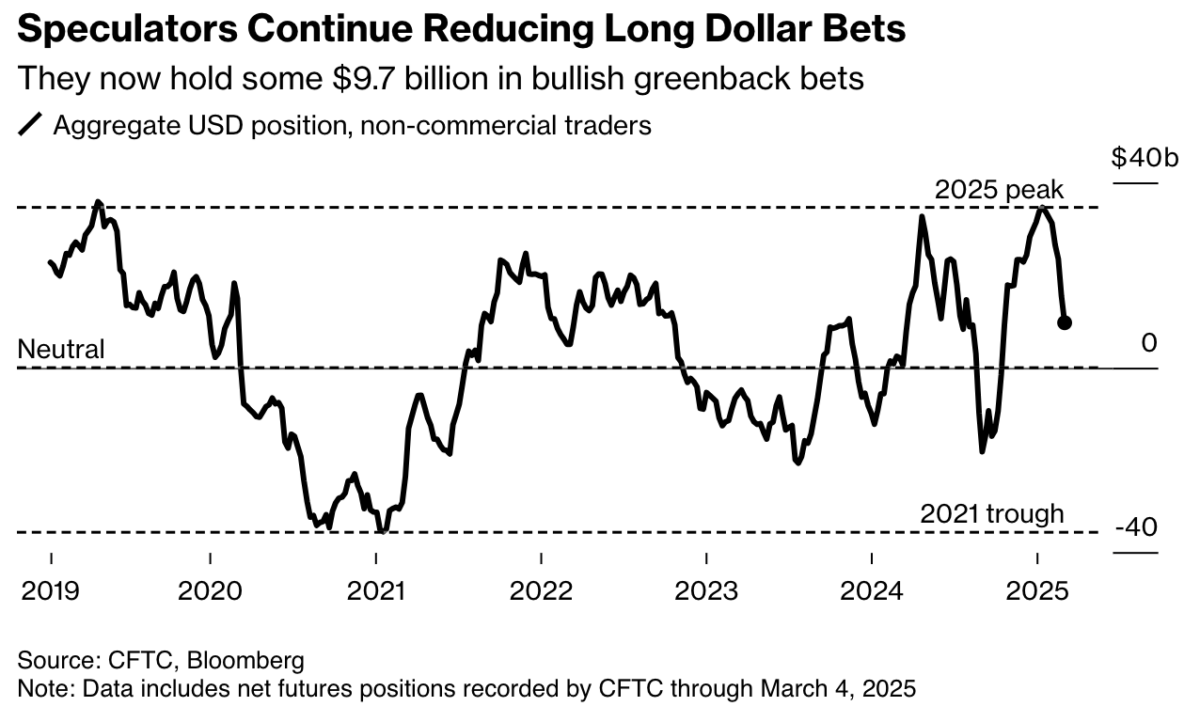

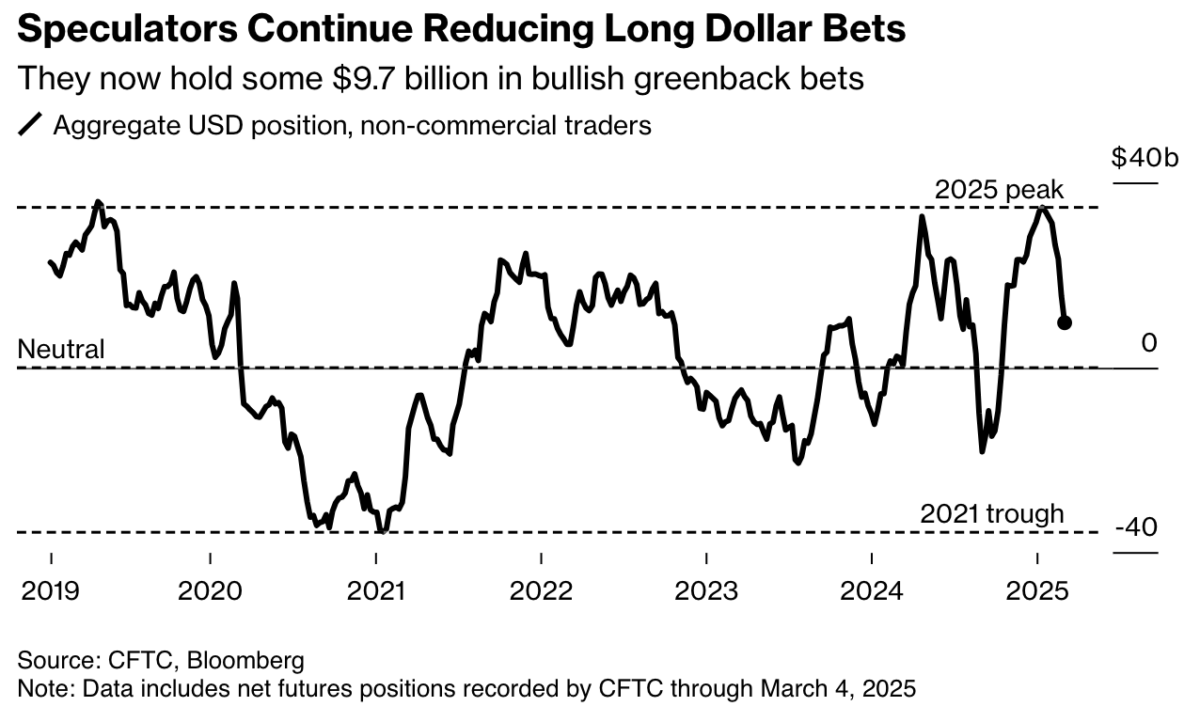

- Dollar Has Its Worst Week Since 2022 as JPMorgan Turns Bearish (bloomberg)

- European (fund flow) Exceptionalism (ft)

- Boeing ties employee incentive plan to company-wide performance (reuters)

- When Europe Leads Markets, Value Shares Dominate (zerohedge)

- Retail trading frenzy drives NASDAQ to move to 24-hour trading (streetinsider)

- What We’ve Learned From 150 Years of Stock Market Crashes (morningstar)

- Nasdaq 100 Tumbles Into a Correction as Tech Selloff Intensifies (bloomberg)

- Humanoid Robots Are Starting to Work Human Warehouse Jobs (futurism)

- Solar Stocks Are in Rough Shape. Buy This One Anyway. (barrons)

- US backtracks on Canada-Mexico tariffs in latest sharp shift on trade (ft)

- European Stocks See Most Inflows in Decade Amid Defense Splurge (bloomberg)

- Hong Kong stocks cap best week in 2 months on China policy support (scmp)

- CEO Bracken Darrell Brings VF Corp.’s Reinvention Back to Wall Street (wwd)

- Eurozone Grew More Strongly Than Thought at End of 2024 (wsj)

- Euro Set for Best Week Since 2009 as BofA Boosts Forecast (bloomberg)

- China’s Top Tech Stocks Add $439 Billion as ‘Mag Seven’ Sink (bloomberg)

- Mortgage Rates Fall to Lowest Level Since December. What It Means for Buyers. (barrons)

- What Automakers’ Tariff Reprieve Means for Car Buyers (wsj)

- The AI Trade Got Crushed. It May Take Time to Rebuild. (barrons)

- 10 Stocks That Could Gain as Dollar Weakens (barrons)

- Sorry, American firms, the AI trade has moved to China (businessinsider)

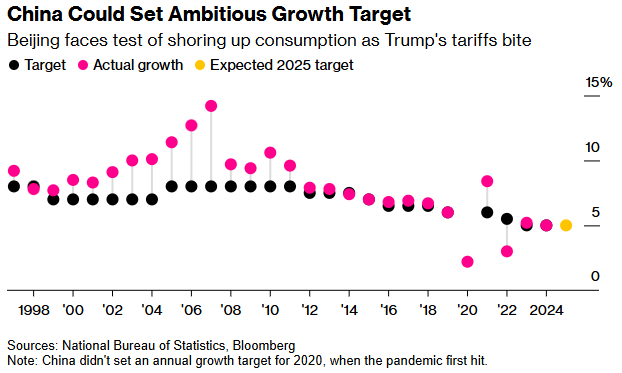

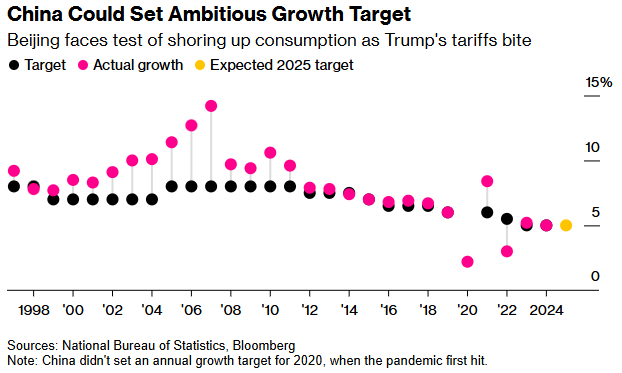

- NPC Press Conference Signals Upcoming Consumption Boost Plan (chinalastnight)

- Investors push money market assets over $7tn as US equities wobble (ft)

- US Hiring Rises at Solid Pace, Unemployment Unexpectedly Higher (bloomberg)

- China’s Growth Focus, Stable Yuan Fan Hopes of Better Liquidity (bloomberg)

- China Had Record $540 Billion of Exports in Rush to Beat Tariffs (bloomberg)

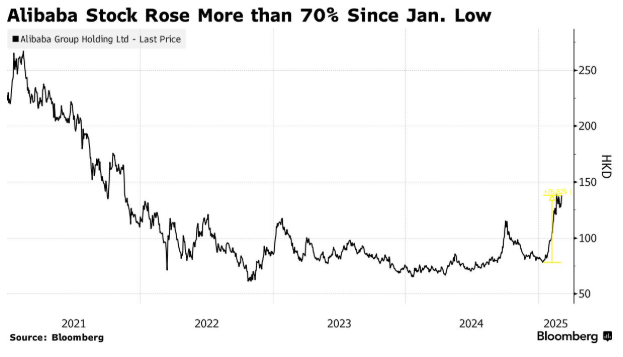

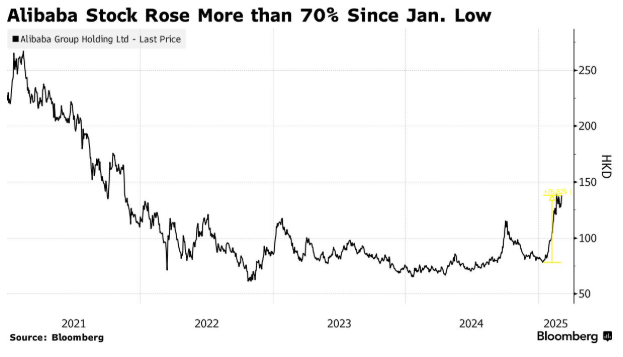

- Alibaba Stock Is Rising. The China AI Spotlight Is Shifting From DeepSeek. (barrons)

- With Trump’s tariffs paused, ‘Big Three’ automakers may race to build inventories (marketwatch)

- Japan’s 10-Year Bond Yield Reaches Highest Since June 2009 (bloomberg)

- China Steps Up Support for Tech Sector as AI Enthusiasm Soars (bloomberg)

- AI-led boom of Chinese stocks revives refinancing activities in Hong Kong (scmp)

- ‘Better than DeepSeek and OpenAI’: Alibaba touts open-source AI model that beats rivals (scmp)

- NPC’s Government Work Report Reviewed – Consumption, Consumption, Consumption & AI (chinalastnight)

- China’s Commerce Chief Wrote to US Seeking Dialogue Last Month (bloomberg)

- JD.com Sales Rise Most in Years After China Consumers Awaken (bloomberg)

- Euro touches 4-month peak; eyes on ECB policy meeting, outlook (streetinsider)

- US stocks struggle as ‘America First’ bets backfire (ft)

- ECB Cuts Again and Signals Easing Phase Is Nearing Its End (bloomberg)

- Hot Stocks from 2024 Have Grown Cold (morningstar)

- Hims & Hers Stock Is Due for a Crash Diet. The GLP-1 Surge Is Fading Fast. (barrons)

- US Employers Announce Most Job Cuts Since 2020 Amid DOGE Layoffs (bloomberg)

- One big takeaway from Trump’s speech? He needs a weak dollar. (marketwatch)

- Market Turmoil Pushes Low-Volatility Stocks Into Driver’s Seat (bloomberg)

- Home Builders Are Hurting. Their Stocks Are Good Buys. (barrons)

- Tariffs Won’t Slam the Economy. Not Unless Consumers Panic. (barrons)

- The spring could have huge rallying months, says Fundstrat’s Tom Lee (youtube)

- China Sets Strong Growth Target as It Hits Back at U.S. Tariffs (wsj)

- Beijing Ramps Up Efforts For Tech Independence (wsj)

- Dollar Dinged by Trump Tariffs, Suffers Worst 2-Day Decline Since 2023 (barrons)

- Disney to Cut More Staff as It Gears Up for Netflix Battle. Here’s Why. (barrons)

- Germany’s ‘Whatever It Takes’ Moment Powers European Markets (wsj)

- Trump to Decide on Canada, Mexico Relief Today, Lutnick Says (bloomberg)

- Weekly mortgage demand surges 20% higher, after interest rates drop to the lowest since last year (cnbc)

- Trump says he wants interest on car loans tax deductible if US-made (usatoday)

- Europe Leads Emerging-Market Rally as US Dominance Is Challenged (bloomberg)

- Investors should be wary of analyst ratings (ft)

- NPC Preview, China Markets Shake Off Tariffs (chinalastnight)

- Commerce Secretary Howard Lutnick: This is not a trade war, this is a drug war (youtube)

- Bernstein lifts China internet stock targets on AI momentum (streetinsider)

- China to Issue $69 Billion in Special Bonds for Big Banks (bloomberg)

- Trump’s Broad Canada-Mexico-China Tariffs, Explained (wsj)

- TSMC Faces Pressure to Keep Some Chip Tech in Taiwan. What That Means for Intel. (barrons)

- UK Housing Set for 2025 Recovery, Building Suppliers Say (bloomberg)

- “America Is Back” – 12 Takeaways From Trump 47’s First Major Policy Speech To Congress (zerohedge)

- Treasury Secretary Scott Bessent shrugs off Wall Street’s Trump tariff ‘selloff’ (nypost)

- On Second Count, ABC Says Oscar Viewership Increased (nytimes)

- The 10 Best Dividend Stocks (morningstar)

- US private payrolls slow sharply in February (reuters)

- Tesla Offers Buyer Perks to Drum Up Interest With Sales Slumping (bloomberg)

- Advance Auto Parts Revamps Supply Chain in Effort to Reverse Sales Slump (wsj)

- Small-Cap Stocks Are Beaten Down. Buy Them. (barrons)

- U.S. Natural Gas Rallies as Near-Term Forecasts Add Demand (wsj)

- Trump Tariffs Kick in Today. How China, Canada, and Mexico Are Reacting. (barrons)

- Tariffs Are an ‘Act of War,’ Buffett Says. What They Mean for the Stock Market. (barrons)

- The 10 Stocks Hedge Funds Love— and Hate—the Most (barrons)

- Treasury Yields Fall to Multi-Month Lows With US Growth in Doubt (bloomberg)

- Xi Leaves Door Open for Talks With Measured Response to Trump (bloomberg)

- Euro Hits 2025 High Versus Dollar on Europe Defense Spend Bets (bloomberg)

- Dollar falls to three-month low as tariffs and growth fears rattle markets (streetinsider)

- Rotation out of US Big Tech and the Magnificent 7 is likely to continue: JPM (streetinsider)

- Hong Kong’s $353 Billion Margin Loan Boom Fuels Big Gains, Risks (bloomberg)

- China’s National People’s Congress Is Coming. 5 Things to Watch. (barrons)

- Chinese funds’ US$35.9 billion bet on Hong Kong stocks fuels world’s best rally (scmp)

- Downloads of Alibaba’s AI Model Exceed DeepSeek (chinalastnight)

- Alibaba Expands Freshippo With 100 New Stores in 2025 Targeting More Cities (benzinga)

- Exclusive: China to publish policy to boost RISC-V chip use nationwide, sources say (reuters)

- Elon Musk’s Tesla Introduces 0% APR Financing On Model 3 Purchases Amid Falling Demand (benzinga)

- U.S. auto sales down 2.3% in February, additional tariffs on Mexico and Canada cause for concern (marklines)

- Bitcoin tumbles 9%, reversing most of the rally from Trump’s crypto reserve announcement (cnbc)

- Nvidia Stock Plummets. 5 Reasons Shares Are at Their Lowest Price Since September. (barrons)

- Trump, Chip Maker TSMC Announce $100 Billion Investment in U.S. (wsj)

- What record levels of uncertainty mean for the stock market (marketwatch)

- Best Buy Grows Quarterly Sales as PC Market Rebounds (wsj)

- 10 Stocks with the Largest Fair Value Estimate Increases During Q4 Earnings (morningstar)

- Exclusive: Nvidia and Broadcom testing chips on Intel manufacturing process, sources say (reuters)

- Mainland China Investors’ Sway Over Hong Kong Stocks Is Growing (bloomberg)

- Xi Prepares to Unveil China Stimulus Plan as Trade War Heats Up (bloomberg)

- Big Tech Pain Is Mounting as Risk-Wary Traders Dump Winners (bloomberg)

- Alibaba-Backed Zhipu Raises $140 Million as DeepSeek Heats Up AI (bloomberg)

- Wall Street can’t stop talking about the ‘Mar-a-Lago Accord.’ Here’s how the currency deal would work. (marketwatch)

- Alibaba’s open-source Sora-like AI video model tops third-party rankings (scmp)

- Taking stock: all eyes on China’s ‘two sessions’ for catalysts to drive AI-fuelled rally (scmp)

- Mortgage rates are falling, but it’s not helping sell more homes. Are lower house prices next? (marketwatch)

- Here’s How Government Spending Has Grown—and Where the Money Is Going (wsj)

- China EV Sales Were Hot in February. Tesla Needs a Rebound. (barrons)

- Chinese Buyers Are Ordering Nvidia’s Newest AI Chips, Defying U.S. Curbs (wsj)

- Disney Cruise Line reveals new details on its two new ships (thestreet)

- Alibaba Cloud’s Industry Leadership Recognized by Top Global Research Firms (alizila)

- Dollar Falls After U.S. Tariff Remarks (barrons)

- Intel is back—stop talking about breaking it up: Craig Barrett (fortune)

- Things to watch at China’s 2025 ‘two sessions’ (globaltimes)

- U.S. CEOs Signal Highest Confidence in Two Years (seeitmarket)

- Finally for homebuyers: ‘A step in the right direction’ (yahoo)

- Alibaba completes full acquisition of Cainiao’s minority shares, implements employee exit plan (technode)

- McKinsey sees lithium demand stabilising and expects next upcycle (yahoo)

- Alibaba begins spring hiring with 3,000 internship roles focused on AI (scmp)

- That Escalated Quickly (carsongroup)

- Alibaba’s research arm launches new RISC-V processor for high-performance computing (scmp)

- Shop The North Face Windbreaker All Our Favourite Celebrities Are Coveting (elle)

- Disney Sees Sell-Out for Oscars Ads — And Not Just on TV (variety)

- Do You Know How Much Energy ChatGPT Actually Uses? (digg)

- In James Bond, Amazon gains a thrilling new asset (economist)

- The business of second-hand clothing is booming (economist)

- Whatever You Do, Don’t Cancel Disney Plus or Max in March (cnet)

- Macau Gaming Revenue Beats Estimates in Sign Slowdown Is Easing (bloomberg)

- Inside TGL, Tiger Woods and Rory McIlroy’s Grandiose Indoor Golf League Experiment (gq)

- 5 collector cars to put into your garage this week (classicdriver)

- How Ferrari’s 290 MM Became One Of The World’s Most Coveted Cars (maxim)

- The 50 Greatest Luxury Cars of All Time (robbreport)

- The U.S. Stock Market Is Looking Played Out. It’s Time to Shift Some Assets Abroad. (barrons)

- Disney’s ‘Stitch’ poised to become 2025’s most popular toy as NYC Toy Fair ramps up: sources (nypost)

- Bessent Says Housing Will ‘Unfreeze’ in Weeks, Sees 2% Inflation (bloomberg)

- Texas Needs Equivalent of 30 Reactors to Meet Data Center Power Demand (bloomberg)

- Big Food Stocks Have Hit Tough Times. Some Fresh Ideas Might Help. (barrons)

- AI Fever in Power Stocks Moves From Nuclear to Plain Natural Gas (wsj)

- Tesla Stock Rose, but Not Enough to Avoid Its 2nd Worst Month on Record (barrons)

- Uncertainty Hits the Dollar, Bond Yields. The Trump Trade Is Stuck. (barrons)

- America First? Not When It Comes to the Stock Market. (barrons)

- A Value Investor’s Thoughts On DeepSeek And The Next Phase Of AI (forbes)

- UK small caps ‘most unloved’ stocks in the world (ft)

- European stocks’ comeback (ft)

- Will the Consumer Pullback Endanger Economic Growth? Here’s What to Watch. (barrons)

- The first quarter is on track for negative GDP growth, Atlanta Fed indicator says (cnbc)

- DeepSeek Reveals Theoretical Margin on Its AI Models Is 545% (bloomberg)