Skip to content

Steve Roth says offices are like malls. Is that good? (therealdeal )

JPMorgan Sees ‘Very Attractive Valuations’ in China (bloomberg )

US says formally invites new Chinese foreign minister Wang Yi to Washington (reuters )

The U.S. is downgraded. How much does it matter to markets? And the surprise asset that may benefit. (marketwatch )

opinion content. Beijing must start spending to secure China’s economic future (ft )

Ford’s U.S. sales rose nearly 6% in July (cnbc )

BAE Systems shares near fresh high as order backlog hits record amid defense budget boosts (martketwatch )

CVS Stock Rises on Earnings and Revenue Beat (barrons )

Fitch’s U.S. Credit Downgrade Is a Bad Look. Why It’s Not a Disaster. (barrons )

Bank Stocks Could Soon Catch Up. How to Play It. (barrons )

The Memory Chip Nightmare is Nearly Over (wsj )

It Might Be Quitting Time for the Fed’s Rate Hawks (wsj )

A Prominent Wall Street Bear Is Turning More Bullish. That’s How Much Stocks Have Rallied. (barrons )

Wall Street’s Biggest Bull Just Got a Little More Cautious on the Stock Market (barrons )

Opinion: U.S. and Europe are finding that breaking up with China is hard to do (marketwatch )

Starbucks sees a big rebound in China (marketwatch )

Employers Cut Off Access to Weight-Loss Drugs for Workers (wsj )

Miami Sees Its First Population Drop in Decades (wsj )

Why the US Credit Rating Was Cut by Fitch and What It Means (bloomberg )

BofA Joins Fed in Reversing Recession Call Amid Growing Optimism (bloomberg )

Amazon Unveils Biggest Grocery Overhaul Since Buying Whole Foods (bloomberg )

Earnings have been coming in better than expected, says Hightower Advisors’ Stephanie Link (cnbc )

Private sector added 324,000 jobs in July, well above expectations, ADP says (cnbc )

Dan Loeb hails AI as a decade-defining technology like the PC and Internet – and says a severe recession looks unlikely (businessinsider )

Visualizing How S&P 500 Sectors Perform Over The Business Cycle (zerohedge )

Match (MTCH) shares rally 12% on strong results/guidance; BTIG upgrades to Buy on Tinder strength (streetinsider )

BorgWarner’s second-quarter results beat estimates on auto parts demand (reuters )

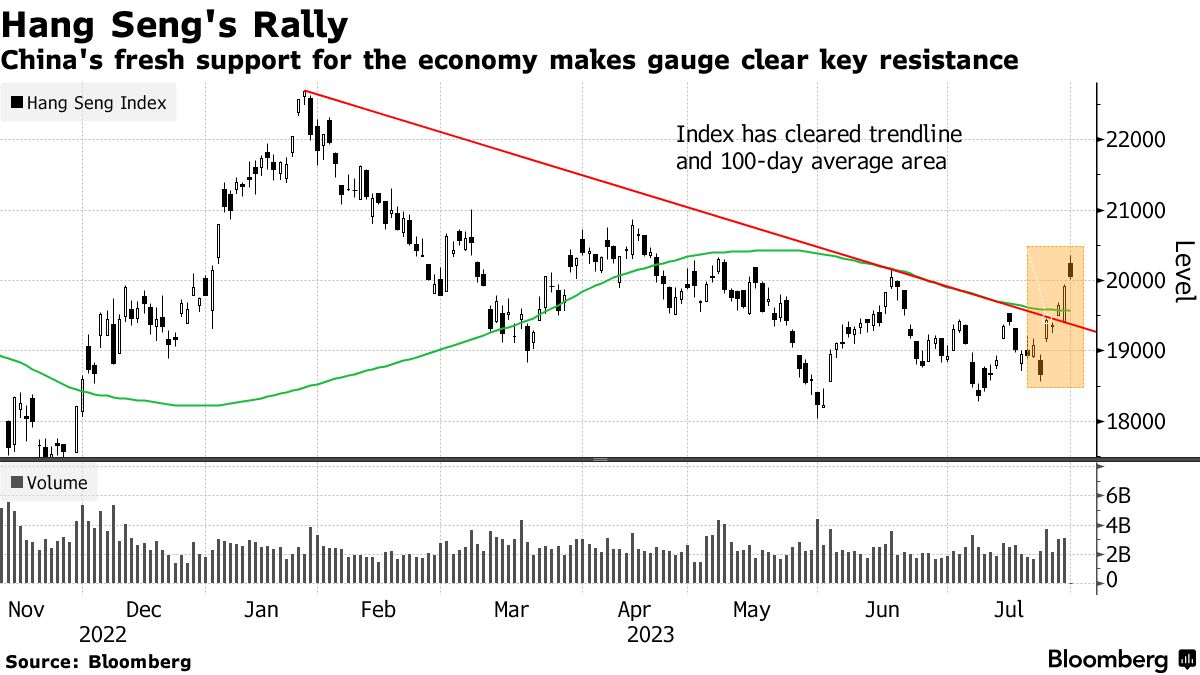

China’s Stock Rally Holds Promise as Bullish Indicators Emerge (bloomberg )

China’s Big Tech firms in expansion mode after Beijing’s positive policy shift (scmp )

China Is Trying to Make Its Gloomy Consumers Spend More (nytimes )

Wharton professor Jeremy Siegel says the stock market is headed to new all-time highs thanks to a strong economy and resilient corporate earnings (businessinsider )

China Vows More Economic Support as Recovery Continues to Wane (bloomberg )

China should act decisively to pull economy back from the brink: Cornell professor (cnbc )

Strategists Scramble to Catch Up as S&P 500 Rally Rumbles On (bloomberg )

China Seeks to Boost Consumption to Spur Growth Recovery (bloomberg )

Biogen’s New Boss Is Delivering, but Stock Isn’t Pricing It in Yet (wsj )

Apartment Buildings Are Popping Up Everywhere. How the Glut Changes Rent. (barrons )

Home Buyers Feel Stuck. Why Wall St. Is Bullish on Housing. (barrons )

Merck Tops Expectations. More M&A Could Be Next. (barrons )

Piper Sandler raises S&P 500 target for 2023 as stock-market breadth expands, positive earnings underpin equities (marketwatch )

S. Treasury increases borrowing estimate for third quarter to just over $1 trillion (marketwatch )

The S&P 500 Has New Price Target. The Runaway Market Explains the Big Number. (barrons )

Manufacturing stalled in the first half. But now the stage is set for a recovery, says JPMorgan. (marketwatch )

Carnival bonds climb after cruise operator says it will save $120 million a year by retiring $1.2 billion in high-cost debt (marketwatch )

New Ultrasound Therapy Could Help Treat Alzheimer’s, Cancer (wsj )

CVS to Shed 5,000 Jobs in Cost-Cutting Push (wsj )

Miami Is Shrinking (wsj )

People Are Hiring D-List Celebrities to Deliver Their Bad News (wsj )

Wall Street Economists Are Looking at a September Rate Pause (bloomberg )

Economist Behind Popular Recession Gauge Worries She Created a ‘Monster’ (bloomberg )

The ‘A’ word and these 2 other factors can unlock Amazon (AMZN) shares – Evercore ISI (streetinsider )

Top stock pickers hit by ‘tremendous’ amount of uninvested cash (ft )

China’s Cabinet Urges Cities to Roll Out Property Policies (bloomberg )

These 21 ‘strong buy’ large and mega-cap stocks have the highest price upsides relative to their counterparts, according to Wall Street’s top analysts (businessinsider )

KraneShares: There are green shoots ahead for undervalued China stocks (cnbc )

China just unleashed broad stimulus measures to fire up the economy (businessinsider )

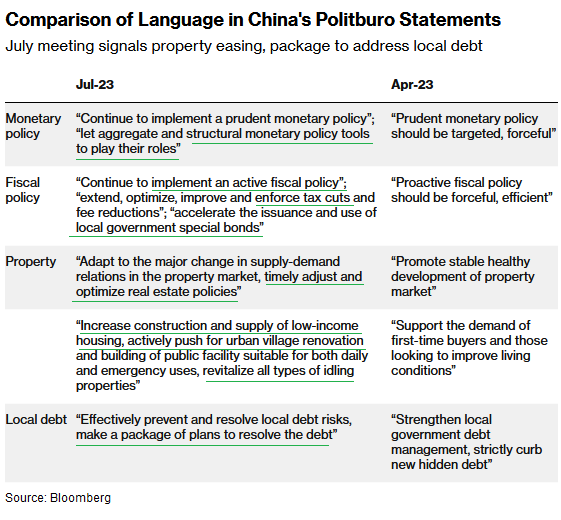

Beijing Signals It’s Not Just All Talk This Time (zerohedge )

Intel deepens China presence with Shenzhen chip innovation centre (scmp )

Beijing’s latest signals of support spur investor optimism (bloomberg )

Hiking the last mile on inflation (npr )

For the stock market, bad news is back to being good. Here’s why, says a Goldman Sachs economist (marketwatch )

Disney Goes Back to the Future (nytimes )

Jack Ma’s Ownership of New Firm ‘1.8 Meters’ Revealed, May Be BABA’s New Agriculture & Fisheries Biz (aastocks )

Michael Milken was the junk bond genius who symbolized a ‘decade of greed’ but he was no Bernie Madoff (nypost )

Mental Models: The Best Way to Make Intelligent Decisions (~100 Models Explained) (fs )

How The Housing Bears Got the Last Year All Wrong (bloomberg )

Here Are the Actual Mechanics Behind Powering AI (bloomberg )

Barclays Sees a Turning Point Coming for American Restaurants (bloomberg )

Want to Become a Millionaire? Follow Warren Buffett’s 4 Rules. (entrepreneur )

M2 update: inflation still headed to zero (scottgrannis )

They Said What? CEOs Keep Talking About a Soft Landing. (barrons )

Martens stock leads European gains after report of activist investor buying (marketwatch )

Opinion: CEOs say their companies can’t afford a cold war between the U.S. and China (marketwatch )

China’s factory, services sectors show weakness, need for stimulus (reuters )

China’s Economic Growth Problems Mount. Why The Stocks Are Fine. (barrons )

This Bank Data Could Offer Clue on Rates. Check It Out Today. (barrons )

Citigroup raises S&P 500 target for 2023 on increased chances of ‘soft landing’ (marketwatch )

Amazon says it’s delivering more packages in one day or less after overhauling delivery network (cnbc )

How Much More Will Homebuilders Have To Reduce Prices To Increase Sales? (zerohedge )

Tech bulls lift Hong Kong stocks to 3-month high before Beijing measures (scmp )

Rebound in M&A Activity (cnbc )

Wedbush’s Dan Ives lays out his expectations for tech earnings this week (cnbc )

Why the Drivers of Lower Inflation Matter (wsj )

Commercial property markets aren’t closed (ft )

1st 8 or 9 Days of August Weaker Pre-Election Years (Almanac Trader )

Katie Ledecky passes Michael Phelps for most individual golds at world championships (npr )

Zillow is so sure that U.S. home prices have bottomed that it just issued bullish calls for these 48 housing markets (fortune )

The 50 Greatest Luxury Hotels on Earth (robbreport )

Test-Driving The 207-MPH Flying Spur Speed On The Ultimate Bentley Road Trip (maxim )

Watch This $4 Million McLaren Solus Race Car Win The Goodwood Festival Of Speed Shootout (maxim )

The Aston Martin Valour Is An Awesomely Old-School V12 Muscle Car (maxim )

2023 Lotus Emira Review: Playtime Is Over (thedrive )

Ant Group plans restructuring ahead of Hong Kong IPO (technode )

Alibaba logistics unit Cainiao offers domestic express services, directly competing with rivals (technode )

The Disney Magic Will Return. It’s Time to Buy the Stock. (barrons )

China Moves to Bolster Consumer Industries, Grow Fledging Bourse (bloomberg )

Billionaire Mark Mobius says he’s so bullish on emerging markets that all his money is outside the US (businessinsider )

Investing in Liberty Stock Is Tricky. Do It Anyway. (barrons )

‘It’s a great, great time for bulls’: Soft-landing views solidify in U.S. stock market (marketwatch )

Investing in Liberty Stock Is Tricky. Do It Anyway. (barrons )

For the Stock Market, Earnings Are Everything—and More Than Enough (barrons )

Eli Lilly, Pfizer, and Others Are Working on Weight-Loss Pills. What to Know. (barrons )

Small-Cap Stocks Have Struggled. Here Are 6 Whose Time Has Come. (barrons )

The U.S. Economy Is Sticking the Soft Landing (wsj )

Biogen Deal for Reata Signals a Turn to Rare Diseases (bloomberg )

China’s Central Bank Chief Is Task Master Xi Couldn’t Let Retire (bloomberg )

Hedge Funds Turn More Bullish Across Energy as Prices Rally (bloomberg )

Traders Are Risking It All on Bets That Market Boom Will Last (bloomberg )

Intel stock rallies after earnings show AI data-center beat, strong PC sales (marketwatch )

The Fed’s favorite inflation measure cooled down even further in June (cnn )

8 Book Recommendations By Joel Greenblatt (acquirersmultiple )

The Pritzkers: Buffett’s Blueprint (substack )

Billionaire Ken Fisher on how to invest in AI, intelligently (theglobeandmail )

Ford Earnings: Remarkable Strength As Pro Segment Profits Explode (morningstar )

Intel jumps 7% as it returns to profitability after two quarters of losses (cnbc )

China Bulls Look for Redemption as Beijing Shows Policy Resolve (bloomberg )

Biogen agrees to acquire Reata Pharmaceuticals for $7.3 billion in cash (marketwatch )

China’s housing ministry is getting ‘bolder’ about real estate support (cnbc )

The Disney Magic Will Return. It’s Time to Buy the Stock. (barrons )

Drugmakers Want to Crush Medicare’s Pricing Power. They’ll Probably Succeed. (barrons )

Fed Goes From Stocks’ Boogeyman to Markets’ Pal (barrons )

Key US Inflation, Wage Measures Cool in Boost for Soft Landing (bloomberg )

US Consumer Sentiment Rises to Highest Since 2021 as Prices Ease (bloomberg )

Bank of Japan Surprise Foreshadows End to Key Anchor for Global Bond Yields (bloomberg )

Hedge funds rush to buy China stocks on economy stimulus prospects – Goldman (reuters )

China Asks Banks to Bankroll Tech in Latest Private Sector Boost (bloomberg )

GDP grew at a 2.4% pace in the second quarter, topping expectations despite recession calls (cnbc )

The Most Interesting Economic News This Week Won’t Come From the Fed (barrons )

The S&P 500 Hasn’t Had Many Ugly Days This Year. That’s a Pretty Good Sign. (barrons )

Federal Reserve Raises Interest Rates to 22-Year High (wsj )

Dow Notches Longest Winning Streak Since 1987 (wsj )

Biotech Stocks Join AI-Fueled Rally (wsj )

PacWest, Banc of California Merge to Get Smaller. Others May Follow. (wsj )

Investors Can Read the Fed’s Poker Face (wsj )

What Fed Hikes? Much of Americans’ Debt Is Still Riding Ultralow Rates (wsj )

Inside the world’s hardest place to get a reservation with a 4-year waitlist (nypost )

How Regional Banks Got Healthy Again (nytimes )

A Beach Club Dinner and Jamie Dimon’s Touch: How PacWest Was Rescued (bloomberg )

Rolls-Royce Takes the Fast Lane Out of Pity City (bloomberg )

Meta stock gains after earnings, guidance from Facebook parent top expectations (yahoo )

Ant IPO Gets Back To Where It All Began (chinalastnight )

Big Tech earnings are sending the bears into hibernation mode, says Dan Ives (cnbc )

Alibaba Cloud to Support Meta AI Model for Chinese Users. Why It’s a Big Deal. (barrons )

CN State Media Says Stimulus Measures for Capital Mkts Anticipated to Be Launched Intensively (aastocks )

“Something Very Strange Has Happened”: Albert Edwards Stunned By “The Maddest Macro Chart I Have Seen In Many Years” (zerohedge )

Chinese stocks set to bounce back as strong earnings revive confidence: analysts (scmp )

Alibaba Cloud Releases All-in-one HTAP Database Solution (aastocks )

Inflation is heading to zero, according to the one factor Jerome Powell absolutely will not discuss (marketwatch )

Microsoft, Google Are Key Earnings Movers After S&P 500 Hits New High; Fed Rate Hike Due (ibd )

Google Earnings Beat Views Amid Rising AI Investments To Drive Ad, Cloud Growth (ibd )

Fed Set to Raise Rates to 22-Year High and Decide If It’s Done Hiking (bloomberg )

AT&T’s Results Eclipse Lead Problems (barrons )

Global Economy Shows Signs of Resilience Despite Lingering Threats (nytimes )

Fed Set to Hike as Hawks and Doves Diverge (bloomberg )

How Jack Ma’s Ant Group Is Inching Toward IPO Reboot (bloomberg )

Rolls-Royce Enters Fast Lane on Turnaround: The London Rush (bloomberg )

Boeing’s quarterly results top expectations as airplane deliveries pick up pace (cnbc )

Think there’s an AI bubble in the stock market? Think again. (businessinsider )

Month-End Politburo Meeting Happens Sooner Than Expected (chinalastnight )

I’m excited for what Alzheimer’s drugs will do for patients, says GE Healthcare CEO Peter Arduini (cnbc )

This is the start of a new tech bull market, says Dan Ives after Big Tech earnings (cnbc )

Chinese Investors Are in a Waiting Game: BNP Paribas (bloomberg )

3M Earnings Beat. The Stock Is Rising. (barrons )

3M raises full-year profit forecast (reuters )

‘We Were Wrong’: Morgan Stanley’s Wilson Offers Stocks Mea Culpa (bloomberg )

China hints at bringing in a stimulus package to support its faltering economy (businessinsider )

Cracks Inside the Fed Deepen at Crucial Moment in Inflation Fight (bloomberg )

China Names Pan Gongsheng as New Central Bank Governor to Revive Economy (bloomberg )

China’s New Central Banker Once Fixed a Crisis. He May Need to Again. (nytimes )

China’s Foreign Minister Replaced After Unexplained Absence (wsj )

S. Weighs Potential Deal With China on Fentanyl (wsj )

GM tops earnings estimates and raises guidance for the second time this year (marketwatch )

It’s Microsoft Earnings Day. Watch AI and the Cloud. (barrons )

Dividend Stocks Are a Victim of AI’s Success. It’s Time to Buy. (barrons )

Verizon Delivers Earnings Beat Despite Revenue Miss. The Stock Is Rising. (barrons )

Alphabet Kicks Off Big Tech Earnings on Tuesday (barrons )

GM delivered 691,978 vehicles in the U.S. in the second quarter, up from 582,401 delivered in the second quarter of 2022. (barrons )

Stocks of Chinese developers jump after Beijing signals support for property sector (marketwatch )

Stock-market ‘meltup’ will continue as long as there’s no sign of recession, says Steve Eisman of ‘Big Short’ fame (marketwatch )

Why the Fed Isn’t Ready to Declare Victory on Inflation (wsj )

Here Come the Family EVs (wsj )

No one is really embracing this rally as an upward new bull market, says Fundstrat’s Tom Lee (cnbc )

GM CFO Jacobson on Second-Quarter, Outlook, EV Demand (bloomberg )

President Xi Gets Involved in 2nd Half Economic Planning (chinalastnight )

Chinese Traders Hope Xi’s Lifeline Will Sustain Rally (bloomberg )

Xi Goes Into Overdrive to Talk Up the Economy: Balance of Power (bloomberg )

Warren Buffett Lifts Fossil Fuel Bets (bloomberg )

The Fed needs to stay put on rates (ft )

Hedge Funds Brawl Over Battered Commercial Real Estate (wsj )

Commercial Real Estate Sentiment vs. Reality (bloomberg )

China has announced a slew of measures to bolster its economy. Here’s what we know so far (cnbc )

President Xi Chairs CCP Politburo Meeting, Laying out 2H23 Econ Work (aastocks )

China Holds Off on Major Stimulus as It Signals Property Easing (bloomberg )

China’s Alibaba says will not join Ant Group share buyback (reuters )

Xi’s Housing Speculation Warning Left Out of Politburo Statement (bloomberg )

Earnings Are the Tech-Stock Rally’s Next Big Test (barrons )

The AI Bubble Isn’t Big Enough. Why There’s More Upside Ahead for Big Tech. (barrons )

Restaurants Are Packed Again. Earnings Will Show How Long They’ll Stay That Way. (barrons )

Elon Musk Says Twitter Will Change Its Logo to X (wsj )

IPO Market Awakens From Long Slumber (wsj )

Why Businesses Can’t Stop Asking for Tips (wsj )

Big Pharma Bets Big on China (wsj )

Beijing Offers Love, but Chinese Entrepreneurs Aren’t Buying It (nytimes )

Fed, ECB Weigh End-Game After Next Rate Hikes to Curb Inflation (bloomberg )

A ‘momentous week’ ahead as the Fed, ECB and Bank of Japan near pivot point (cnbc )

China to resume 15-day visa-free entry for citizens of Singapore and Brunei (cnbc )

Podcast: Why We May Be About to See the Shortest Housing Cycle Ever (bloomberg )

China Politburo Shifts Stance on Property, Keeps Fiscal Language (bloomberg )

China to Review Official Appointments, Removals Tuesday (bloomberg )

China’s Options to Retaliate in Trade Fight With US Are Limited (bloomberg )

Altice USA Said to Be Considering a Sale of Cheddar News (nytimes )

China’s Politburo Aims To Stabilize Property Market By Intensifying “Counter-Cyclical Adjustments” (zerohedge )

AT&T, Verizon Investors Have More Than Lead Cables to Worry About (wsj )

China Addresses Investor Concerns in Global Fund Meeting (bloomberg )

The Fed and the Dollar (bloomberg )