Skip to content

Margin Debt Hits Record High. Investors Are Amping Up Risk. ( barrons ) PayPal Needs Help From Its Oldest Friends—Consumers ( wsj ) European Stocks Are Still on Sale. Where to Shop Now. ( barrons ) Humanoid Robots Finally Get Real Jobs ( wsj ) Chinese Investor Buying Fuels Bullishness for Hong Kong Stocks ( bloomberg ) Trump’s Tariff Threats Revive Interest in $44 Billion Alaska Gas Project ( nytimes ) Mortgage Rates in US Slip to Lowest Since Middle of December ( bloomberg ) Chinese Stocks Are Beating U.S. Stocks. Where to Find the Bargains. ( barrons ) Dividend stocks are soaring in 2025, as investors adopt a defensive strategy amid market selloff ( marketwatch ) Investors See ‘2017-Like’ Rally in the Making for Emerging-Market Currencies ( bloomberg ) Venu is done. Here’s how Fox, Disney and WBD plan to go it alone in sports streaming ( cnbc ) Trump Says Canada, Mexico Tariffs to Take Effect, Adds New China Duty ( bloomberg ) UK firms turn more hopeful on economy, plan to hire more, Lloyds says ( reuters ) Why the US exceptionalism trade is faltering ( reuters ) China tech startups race to capitalise on DeepSeek fever, Xi’s meeting ( reuters ) Alibaba CEO Wu meets Chongqing party secretary for possible AI partnerships ( scmp ) Mainland Investors Buy Alibaba in Size ( chinalastnight ) Nvidia bounced from the $3 trillion market cap club after shares fall more than 8% ( cnbc ) Hormel’s stock boosted by revenue beat, though challenges lie ahead with turkeys and nuts ( marketwatch ) Extremely fearful stock-market sentiment shows investors scare easily right now (marketwatch )

Boeing Makes a Management Change. It Could Be Key to Profitability. (barrons )

Alibaba makes Sora-style video AI models open source (scmp )

Nvidia Gives ‘Underwhelming’ Report After Two Years of Blowouts (bloomberg )

Stocks Decline After Nvidia Earnings Disappoint (yahoo )

Yeti Stock Is Beaten Up. It’s More Durable Than It Looks. (barrons )

Salesforce Stock Falls. Earnings Were Overshadowed by Negative Guidance. (barrons )

GM Hikes Dividend and Unveils Stock Buyback Plan (barrons )

AppLovin Stock Sinks After Two Short Reports (barrons )

Robinhood Exec’s New Plan Starts $40 Million of Stock Sales (barrons )

Lowe’s Stock Is Rising. Home Improvement Might Be Turning a Corner. (barrons )

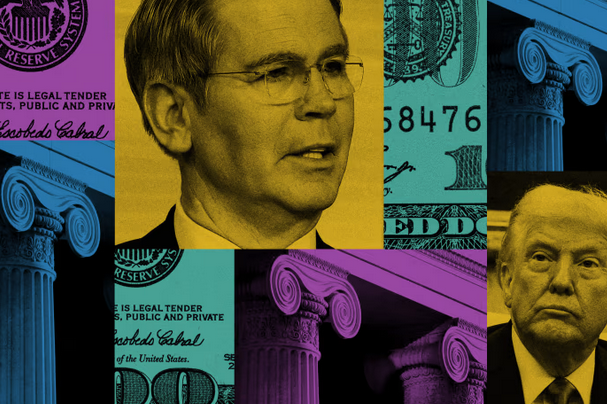

Trump’s Treasury Chief Has a Plan for Bonds. The Market Is Glad It’s On Hold. (barrons )

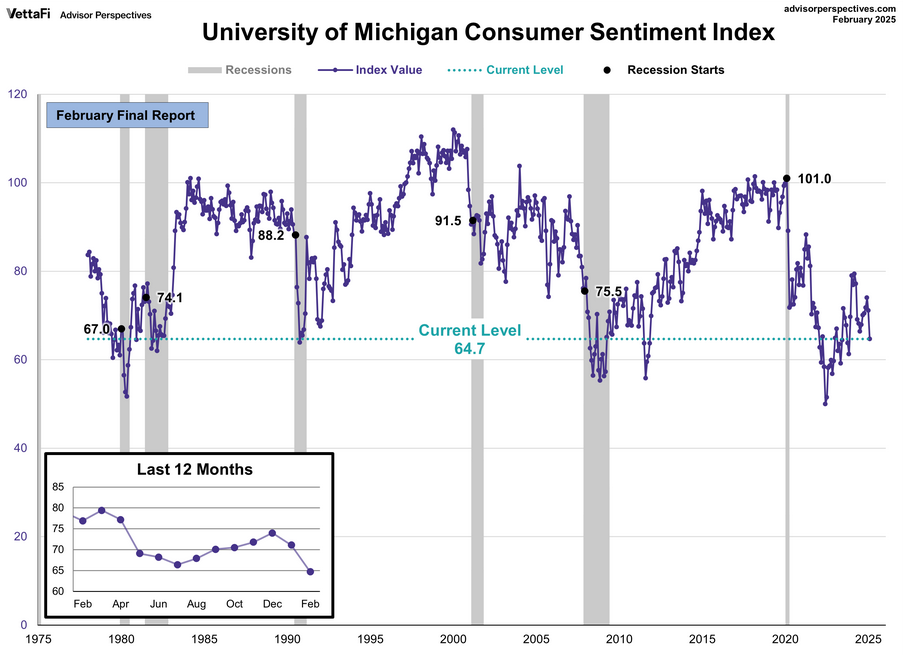

The Economy Is Still Fine. Americans Are Still Gloomy. (wsj )

Japan Sees Fewest Births on Record, Deepening Demographic Crisis (bloomberg )

Make Them a Mar-a-Lago Accord They Can’t Refuse (bloomberg )

Yen Traders Raise Focus on Japanese Data as Economy Shifts Gears (bloomberg )

White House Orders Agencies to Prepare ‘Large-Scale’ Staff Cuts (bloomberg )

A Billion People Are Watching Podcasts on YouTube Every Month (bloomberg )

Nvidia warns of growing competition from China’s Huawei, despite U.S. sanctions (cnbc )

10-year Treasury yield ends at nearly 11-week low (marketwatch )

US bond yield slide hits dollar (ft )

PayPal Sees Earnings Growth as Firm Streamlines Businesses (bloomberg )

Popular momentum trades like Palantir and AppLovin are unraveling. Don’t expect them to bounce right back. (marketwatch )

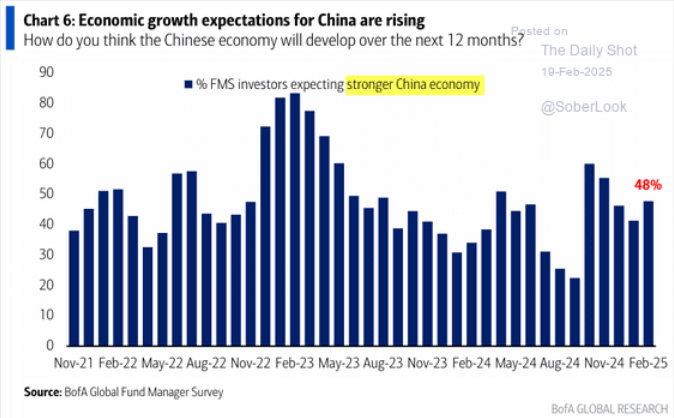

Xi Brings China’s Big Tech Companies Back In From the Cold (bloomberg )

MicroStrategy Stock Tumbles. The Value of Its Bitcoin Hoard Is Falling. (barrons )

Healthcare Stocks Should Be Hurting. How the Sector Became This Year’s Top Performer. (barrons )

Bitcoin Sinks, MicroStrategy Dives As Initial Trump Euphoria Sours (investors )

House Passes GOP Budget Plan as Holdouts Relent (wsj )

Meet the World’s 24 Superbillionaires (wsj )

Xi also tells officials to promote sustained economic recovery (bloomberg )

Forget MAGA, Investors Want MEGA: Make Europe Great Again (wsj )

PayPal has some big new growth targets. Can it hit its marks? (marketwatch )

BofA Strategist Hartnett Warns S&P 500 Rally Draws Investor Skepticism (bloomberg )

Nvidia Drifts Ahead of Make-or-Break Earnings (barrons )

Palantir Stock Falls Again. Why Its Losing Streak Won’t End. (barrons )

Investors’ euphoric outlook on the markets has largely faded, replaced by a creeping sense of uncertainty (marketwatch )

These stock-market sectors are dominating the S&P 500 so far this year as investors play defense (marketwatch )

The AI Trade Is Unwinding. The Market Isn’t Waiting for Nvidia Earnings to Sell. (barrons )

Mexico-Canada Tariffs Are Still Up in the Air, White House Says. The Market Had Already Caught On. (barrons )

Industrial Stocks Have Taken It on the Chin. 6 to Buy on the Dip. (barrons )

What Do Mass Federal Layoffs Mean for the Labor Market? (wsj )

What Is Quantum Computing, and Why Does It Matter? (wsj )

Alibaba previews new AI reasoning model to challenge DeepSeek R1, OpenAI o1 (finance.yahoo )

Trump says US will sell $5M ‘gold cards’ to foreigners: ‘Green card privileges-plus’ (nypost )

Tax Cut Chances Rise as House Passes Budget Targeting Safety Net (bloomberg )

How Temu’s Online Dollar Store Became a Trade War Target (bloomberg )

US Consumer Confidence Drops by Most Since 2021 on Outlook (bloomberg )

What a ‘Mar-a-Lago Accord’ Would Mean for the Dollar (bloomberg )

PayPal is betting big on Venmo (QZ )

PayPal touts ambitious growth plans during annual investor day (finance.yahoo )

PayPal Investor Day Touts Profit Roadmap, Venmo Monetization, Merchant Platform (finance.yahoo )

Jefferies starts coverage on Stanley Black & Decker with ‘buy,’ sees 20% upside (finance.yahoo )

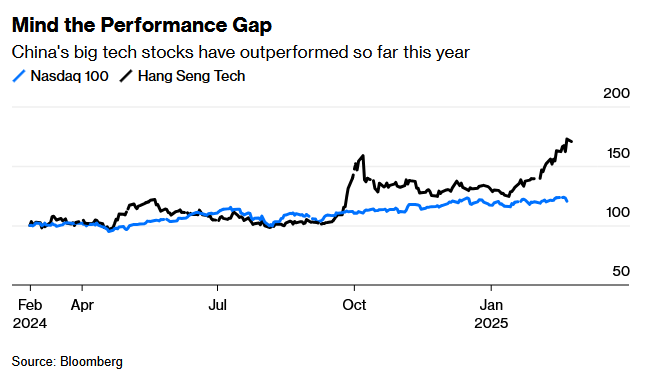

A Chinese Alternative to the Magnificent Seven Has Arrived (bloomberg )

Is China investable again? (ft )

Bessent, Republicans in Congress Kick Start Tax Cut Talks (bloomberg )

Why retail darling Palantir has seen its stock plunge more than 20% in a week (businessinsider )

It’s now a stock picker’s market as more shares outperform the S&P 500. Here’s what that means for your portfolio. (marketwatch )

Europe’s Earnings Outlook Brightens as US Wobbles in AI Race (bloomberg )

U.S. Stocks Have Trounced Other Markets. Here Are 3 Risks to American Exceptionalism. (barrons )

Who needs a CEO? Not Intel. Its stock has soared this month without one. (marketwatch )

Microsoft Cancels Some Data Center Leases, TD Cowen Says. What It Means for the AI Trade. (barrons )

Palantir Stock Falls Again as Slump Enters 4th Day. What’s Worrying Investors. (barrons )

Starbucks to Cut 1,100 Jobs Amid Turnaround Effort (barrons )

Hims & Hers Stock Tumbles Despite Beating Expectations (barrons )

Did Warren Buffett Snub Bank of America Stock in His Shareholder Letter? (barrons )

Nike Stock Can Make a Comeback. A New Bull Sees ‘Changes Afoot.’ (barrons )

Opinion: The ‘Magnificent Seven’ are out; these stocks are in — but there’s one catch (marketwatch )

“We see INTC’s foundry potentially gaining steam under a renewed push by the Trump administration to bring AI chip production to the US,” Rakesh wrote. (barrons )

Junk Bonds Are Pricey. That’s Not a Bad Thing—For Now. (barrons )

Palantir Stock Is Off the Charts. Why It’s Time to Sell. (barrons )

Trump Wants the Dollar to Be Mighty But Weak. It Makes No Sense. (barrons )

Bundle of Disney+, Hulu and Max Has a Strong Hold on Viewers. It’s Even Stickier Than Netflix. (wsj )

DOGE Claims It Has Saved Billions. See Where. (wsj )

The U.S. Economy Depends More Than Ever on Rich People (wsj )

What Do Mass Federal Layoffs Mean for the Labor Market? (wsj )

Warren Buffett Defends His Growing Cash Pile (wsj )

Apple pledges $500B toward US economy, will add 20K jobs as Trump tariffs loom (nypost )

Trump Says Planned Tariffs on Canada, Mexico ‘Going Forward’ (bloomberg )

Yen Volatility Nears Six-Week High as Tokyo Inflation Gauge Eyed (bloomberg )

Celsius CEO talks new acquisition and rise of sugar-free energy drinks (cnbc )

Nvidia’s stock has gone nowhere for months. What can give it a jolt? (marketwatch )

Nvidia’s earnings to be a test of AI chip demand as DeepSeek sows spending doubts (reuters )

Intel Unveils Xeon 6 Chips, Doubling AI Performance and Powering Next-Gen Data Centers (yahoofinance )

Jim Cramer on PayPal Holdings, Inc. (PYPL): ‘Maybe PayPal Should Be The FinTech We Own’ (finance.yahoo )

Jefferies starts coverage on Stanley Black & Decker with ‘buy,’ sees 20% upside (finance.yahoo )

“Understandably, really outstanding businesses are very seldom offered in their entirety, but small fractions of these gems can be purchased Monday through Friday on Wall Street and, very occasionally, they sell at bargain prices.” (ap )

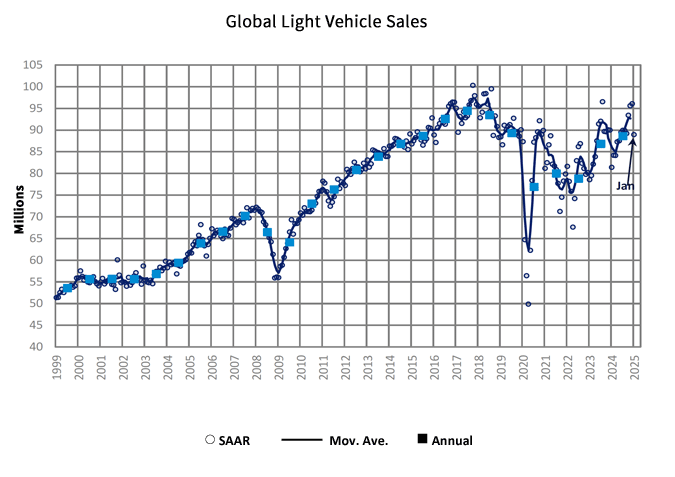

GlobalData Global Light Vehicle Sales Update (January 2025) (marklines )

S. Market: New Vehicle Sales Recover, BEV Expansion Slows (marklines )

Options Traders Line Up Hedges Before Pivotal Nvidia Earnings (bloomberg )

The Three Names You Need to Know to Understand the Future of the International Monetary Order (bloomberg )

China Developers Buy Land at 20% Premium in Bet on Market Bottom (bloomberg )

This Chinese AI Bet Has Outperformed Magnificent Seven Names Like Meta and Google This Year. Alibaba stock soared after a strong earnings beat, bringing its year-to-date gains to 60 percent. (inc )

The rise and fall of Long Term Capital Management (npr )

Can the president override Congress on spending? (npr )

The Brain Science of Elusive ‘Aha! Moments’ (scientificamerican )

James Bond Works for Jeff Bezos Now. What Does That Mean For 007’s Future? (gq )

Ferrari’s Classiche Division Is the Master of Rebuilding Icons, Even Wrecked F40s (rt )

Alibaba’s Core Businesses Reignite Growth as AI Strategy Delivers Strong Results (alizila )

AliViews: Eddie Wu on Alibaba’s Q3 Earnings (alizila )

Oil Speculators Turn Sour as Bullish Wagers Get Trimmed Back (bloomberg )

Trump Targets China With Biggest Salvo So Far in Second Term (bloomberg )

Zelenskiy Says He Would Be Ready to Quit for Sake of Ukraine Peace (bloomberg )

Alibaba to Spend $53 Billion on AI Infrastructure in Big Pivot (bloomberg )

Alibaba CEO Wu Says AGI Is Now Company’s ‘Primary Objective’ (bloomberg )

Shein’s annual profit down by more than a third, FT reports (nypost )

United States Michigan Consumer Sentiment (tradingeconomics )

What does Jack Ma’s return to the spotlight mean? (bbc )

Short sellers are closing in on some shocking tech stocks (thestreet )

When S&P 500 is Up in January and February Full-Year Record Nearly Perfect (almanactrader )

About all this ‘Mar-a-Lago Accord’ chatter (ft )

Hedge funds are feeling their oats (ft )

Here’s What Ukraine Possesses In Natural Resources—As US Reportedly Nears Deal To Secure Minerals (forbes )

Buffett says Berkshire ‘will forever’ deploy most of its capital in equities and never prefer cash over good businesses (fortune )

Why Xi Jinping is making nice with China’s tech billionaires (economist )

Sotheby’s Wants You to Buy Classic Cars, and They’ll Lend You Millions to Make It Happen (robbreport )

13 Best Cowboy Boot Brands for Men Prove Western Wear Is Timeless (mensjournal )

Big Ford F-150 Lightning Lease Deal Lops Off $10,500 and Tosses in Home Charger (thedrive )

Ant Group hires for development of embodied intelligence humanoid robots (technode )

What A PGA Tour-LIV Reunification Could Look Like (mygolfspy )

Alibaba will be the big winner when it comes to AI in China, says Wedbush’s Dan Ives (cnbc )

Palantir Insiders Keep Selling Shares After $4 Billion Windfall in 2024 (bloomberg )

Is Miami’s FII the hottest conference for billionaires? ‘It’s way better than Davos’ (nypost )

Consumer Sentiment Soured at the End of February (barrons )

Treasury Yields Weaken on Slow U.S. Activity Data (barrons )

Chinese Tech Stocks Rally After Upbeat Earnings (bloomberg )

Bessent, China’s He Swap Objections Over Tariffs, Growth Model (bloomberg )

All 27 James Bond movies ranked, according to critics (businessinsider )

Ryan Cohen Boosts Alibaba Stake to $1 Billion (wsj )

Ant Group’s Profit Rises With Jack Ma Back in the Public Eye (bloomberg )

“The whole idea hopefully is lower the value of the dollar, lower the value of interest rates, bring down the debt burden in the country. And that’s what they’re trying to do.” (bloomberg )

Japan’s inflation rate climbs to a 2-year high of 4% in January, supporting rate hike calls from BOJ members (cnbc )

Alibaba to ramp up AI, cloud investments as quarterly profit surges (scmp )

Fed Minutes Reveal Little Appetite for Near-Term Rate Cuts (wsj )

The Wild Economics Behind Ferrari’s Domination of the Luxury Car Market (wsj )

China’s Power Elite: A Guide to the Tech Kingpins Who Met Xi Jinping (wsj )

The Weird New Putting Technique That’s Driving the Golf World Completely Nuts (wsj )

Drop Your Gloves! Are Team USA and Canada Delivering the Hockey Showdown of the Decade? (wsj )

USA vs. Canada: Teams all tied up in third period of 4 Nations finale thriller (nypost )

Nikola, E.V. Start-Up That Once Thrilled Investors, Files for Bankruptcy (nytimes )

Elon Musk wields chainsaw on stage, says he and Trump are battling ‘the matrix’ (usatoday )

Boeing CEO says Musk ‘helping in a big way’ on timing of Air Force One planes (usatoday )

Hedge Funds Reload Option Trades for Yen Gains in Coming Months (bloomberg )

Trump Meets Tiger Woods, Golf Execs as PGA Tour-Saudi Deal Looms (bloomberg )

US Mortgage Rates Drop for Fifth-Straight Week, Falling to 6.85% (bloomberg )

Fed’s Bostic Sees Two Cuts in 2025 Amid Uncertain Outlook (bloomberg )

Alibaba shares soar 11% in Hong Kong after stellar earnings as China’s e-commerce sector recovers (cnbc )

Magnificent Who? The S&P 500 Powers Ahead Without Big Tech. (barrons )

Palantir extends losses on report of defense budget cut (streetinsider )

Ant Group jumps into humanoid robots as China’s AI advances (scmp )

Alibaba Cloud AI model Animate Anyone 2 simplifies making of lifelike character animation (scmp )

Alibaba’s AI Bonanza, Trump China Comments & Premier Li on Raising Domestic Consumption (chinalastnight )

China backs Trump’s Ukraine peace bid at G20 as US allies rally behind Zelenskiy (reuters )

Dollar hits year-to-date lows as bulls get nervous (reuters )

Alibaba Stock Soars After Earnings Beat. It’s All About AI. (barrons )

Morgan Stanley Drops Bearish China Stocks Call (bloomberg )

Jefferies raises targets on China tech stocks on AI growth (streetinsider )

Fed officials weighed slowing or pausing bond drawdown last month (reuters )

Trump Floats Giving DOGE Savings to Public, Defending Cost Cut (bloomberg )

Trump Says New China Trade Deal Is ‘Possible’ Despite Tensions (bloomberg )

Trump Turns on Zelenskiy, Leaving Ukraine Few Options Amid War (bloomberg )

Japan’s Food Inflation Is Becoming Harder for BOJ to Overlook (bloomberg )

Fed Minutes Signal Officials on Hold Until Inflation Improves (bloomberg )

The CEO of Four Seasons Offers 10 Takeaways About White Lotus (bloomberg )

Trump to Halt NY Congestion Pricing by Terminating Approval (bloomberg )

What Happens When Private Credit Loans Get in Trouble (bloomberg )

China issues action plan to stabilize foreign investment in 2025 (people.cn )

BABA-W Reportedly Launches Large-Scale Recruitment Drive for AI To C Biz w/ 90% of Positions in AI Tech & Product R&D (aastocks )

Palantir CEO Karp’s New Plan to Sell $1.2B of Stock (barrons )

Palantir plunges after CEO Karp changes share sales plan, Pentagon budget cut report (cnbc )

Palantir drops on report Trump administration plans defense cuts (finance.yahoo )

Etsy, Inc. Reports Fourth Quarter and Full Year 2024 Results (etsy )

Yen Climbs to Strongest This Year Versus Dollar on BOJ Hike Bets (bloomberg )

China’s latest strategy to get consumers spending: a clampdown on rip-offs (scmp )

Alibaba opens data centre in Mexico, ramping up AI infrastructure expansion (scmp )

Fed Wants More Gains on Inflation Before Cutting Rates Again, Minutes Show (barrons )

Trump’s 25% Auto Tariffs Hurt These Stocks the Most (barrons )

Alibaba Earnings Are Coming. China’s AI Battle Is Heating Up. (barrons )

They’ve Been Waiting Years to Go Public. They’re Still Waiting. (nytimes )

Why Intel could be worth more than $200 billion if it breaks up (finance.yahoo )

China January bank lending hits record high on policy stimulus (reuters )

Chinese Investors Buy Most Hong Kong Stocks in Four Years (bloomberg )

How the world’s biggest online dollar store got sucked into Trump’s trade war. (bloomberg )

Xi’s Embrace of China Tech CEOs Spurs Hope of Big Economic Shift (bloomberg )

Japan Opposition Party Eyes BOJ’s ETFs to Pay for Free Schooling (bloomberg )

Times Square Is Now a Dining Destination. Here’s Why and Where to Eat (bloomberg )

Intel Has Biggest Rally Since 2020 on Breakup Speculation (bloomberg )

BofA Survey Shows Investors Haven’t Been This Risk-On Since 2010 (bloomberg )

Trump Floats 25% Tariffs on Autos, Chips and Pharmaceuticals (wsj )

Trump Wants to Bring Down Treasury Yields. Here’s What to Know. (wsj )