Skip to content

Alibaba Stock Jumps, Trip.com Set For Break Out On Latest China Stimulus Plans (investors )

China’s Politburo mentioned these two words for the first time in more than a decade. Stocks soared. (marketwatch )

A statement from the Chinese Politburo said it will “implement more proactive fiscal policies and moderately loose monetary policies, enrich and improve the policy toolbox, [and] strengthen extraordinary counter-cyclical adjustments,” according to an English translation. (marketwatch )

Nvidia reportedly facing China antitrust probe. Why that matters for the stock. (marketwatch )

Ant Group gets new CEO as billionaire founder Jack Ma talks up AI in rare appearance (cnbc )

China’s Latest Stimulus News Is All About. (barrons )

Jack Ma makes rare speech at Ant Group’s 20th anniversary (scmp )

Trump says he won’t try to oust Powell from Fed. That’s a near-term positive for stocks, according to Tom Lee. (marketwatch )

Nvidia Stock Drops. China Is Probing the AI Chip Maker. (barrons )

It’s time to sell the U.S. dollar, Morgan Stanley says (marketwatch )

The switch from the speculative to the highly speculative may see these investors get burned (marketwatch )

Alibaba, Nio Stock Jump. What China’s Latest Stimulus Push Is All About. (barrons )

Trump Targets Canada With Tariff Threats—and Trolling (wsj )

Dividend Stocks Are Primed for a Comeback in 2025 (wsj )

Why Disney Is Plowing Cash Into a Cruise Line Expansion (wsj )

Mondelez Exploring Takeover of US Chocolate Maker Hershey (bloomberg )

Google Unveils New Quantum Computer With Mind-Boggling Speed (bloomberg )

Steve Cohen Spends $1.6 Billion on Mets Payroll With Soto Bet (bloomberg )

‘Moana 2’ Cruises to Another Record Weekend and $600 Million Globally (bloomberg )

China’s New Monetary Policy Echoes 2008 Stance (bloomberg )

China vows ‘more proactive’ fiscal stimulus measures, ‘moderately’ looser monetary policy (cnbc )

China’s top leaders are set to discuss GDP growth target, stimulus measures amid economic worries (cnbc )

Chinese Premier Vows to Do Everything Possible to Expand Demand (bloomberg )

China loosens monetary policy stance for first time in 14 years (ft )

National Team Buys Stocks Before Economic Conference, Week In Review (chinalastnight )

Proactive Fiscal Policies & “Moderately Loose” Monetary Policy Unleash Hong Kong Buying (chinalastnight )

China Politburo policy shift spurs surge in stocks, bonds (reuters )

Proactive Fiscal Policies & “Moderately Loose” Monetary Policy Unleash Hong Kong Buying (chinalastnight )

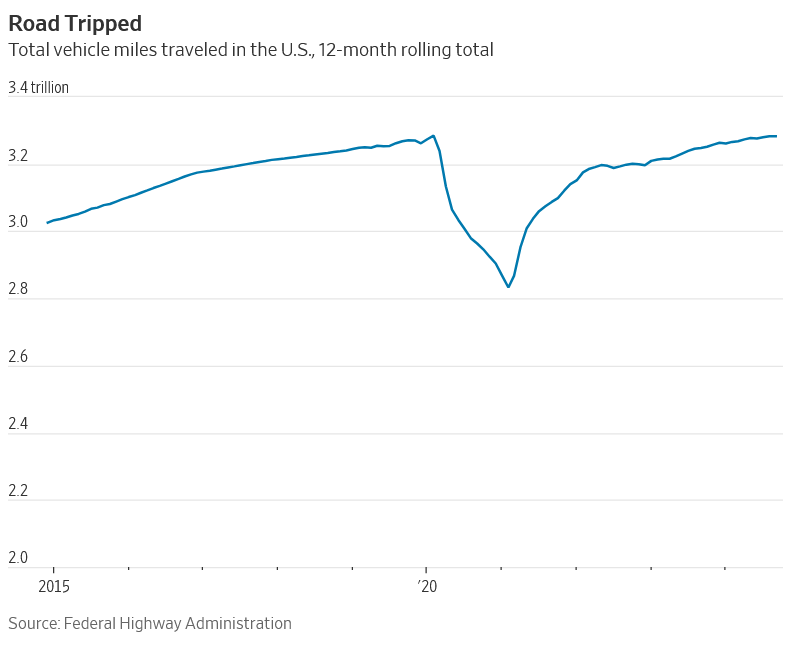

Americans’ Cars Keep Getting Older—and Creakier (wsj ) Jobs Data Should Cement a Rate Cut. What’s Uncertain Is Everything Else. (barrons ) Why investors fear the AI revolution may face a ‘Napster’ problem (com ) Ant Group President Cyril Han to Assume CEO Role From March 1 (bloomberg ) Retail returns: An $890 billion problem (cnbc )

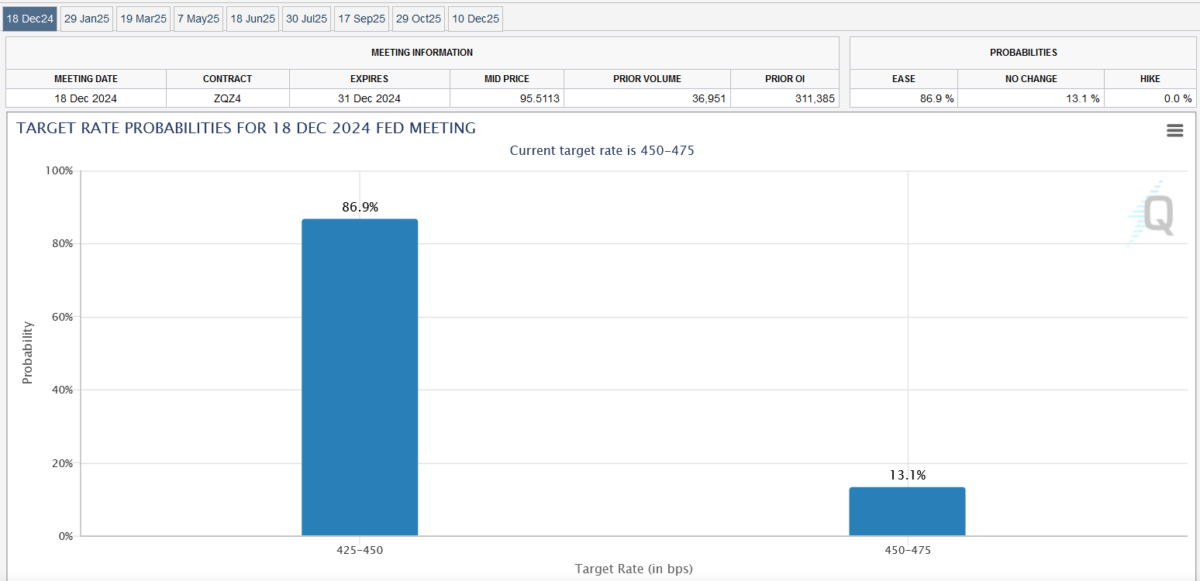

November Jobs Report Isn’t as Strong as It Looks. What It Means for the Fed. (barrons )

Odds of a Quarter-Point Rate Cut in December Spike (barrons )

DOGE Plans to Cut $500B From Over 1,200 Programs. Just 24 Make Up the Most of It. (barrons )

Bill Gross Is On the Alert as Momentum Mania Sweeps Wall Street (bloomberg )

US Consumer Borrowing Jumps on Surge in Credit-Card Balances (bloomberg )

Hormel Foods (HRL) Raises Dividend for 59th Consecutive Year (dgi )

Why The Classic Ferrari Daytona Is So Coveted By Collectors (maxim )

China Has ‘a Lot of Room’ to Raise Fiscal Deficit, Xinhua Says (bloomberg )

10-year Treasury yield falls to lowest since mid-October after strong jobs report (marketwatch )

Intel’s New Board Members Offer Clues About CEO Search (barrons )

Trump picks former senator Perdue for ambassador to China (ft )

Intel adds some much-needed help to its board (marketwatch )

BofA’s Hartnett Warns Froth Is Building in US Stocks, Crypto (bloomberg )

Hiring Bounced Back in November, With 227,000 Jobs Added (wsj )

Unemployment rate ticked up to 4.2% (wsj )

Trump Picks Musk Confidant as AI, Crypto Czar (wsj )

As the U.S. Stock Market Booms, It’s Time to Look Abroad. 12 Picks From Our Experts. (barrons )

Temu’s Operations Suspended in Vietnam (wsj )

For Small-Cap Stocks, Look Past the ‘Trump Trade’ (wsj )

This market maven raised his S&P 500 target three times this year. Now he says there’s too many bulls (marketwatch )

Stock buybacks soar as holiday rally breaks records (marketwatch )

Wall Street veteran David Rosenberg offers up apology for his stock-market pessimism (marketwatch )

Hong Kong stocks rise on stimulus hopes ahead of key China economic meeting (scmp )

Investors search for fresh China stimulus signs ahead of economic conference (scmp )

Xinhua Editorial Highlights Domestic Consumption Increase (chinalastnight )

BOJ is holding cards close to its chest on December rate hike (reuters )

Hong Kong’s IPO Activity Emerges From Drought (wsj )

AlipayHK Becomes Official Partner of NBA China Games (aastocks )

Is This Wildly Overvalued Stock Market Doomed? Yes, but Maybe Not Yet (wsj )

Disney Boosts Dividend 33% After Achieving Streaming Profit (bloomberg )

CN Regulators Raise Refinancing Ratio for Stock Repurchases & Increases to 90% from 70%: Rumor (aastocks )

Trump Vows to ‘Impound’ Money Congress Appropriates. Can He Do It? (bloomberg )

Powell Addresses Shadow Chair Proposal, Reiterates the Fed Isn’t in a Rush to Cut Rates (barrons )

Waller Is Leaning Toward a December Cut. This Is Why. (barrons )

The Necktie Is Making an Office Comeback (wsj )

November Electric Vehicle Sales Roar (Silently) (chinalastnight )

PDD ‘s Temu Asked to Suspend Operations in Vietnam: Rumor (aastocks.com )

Jeff Bezos says he’s optimistic about Trump, will help administration reduce regulation (cnbc )

French government toppled in no-confidence vote brought by opposition (cnbc )

GXO Spurns Acquisition Offers as CEO Wilson Steps Down (bloomberg )

Is it time to buy China? The Chart Master talks the technicals (cnbc )

Intel Considers Outsiders for CEO, Including Marvell’s Head. Intel also is considering Cadence veteran Lip-Bu Tan (bloomberg )

CEOs Are Getting Tossed Out at Record Pace (bloomberg )

Trump Mulls Replacing Hegseth With DeSantis (wsj )

Wall Street is betting on a strong US economy in 2025: Morning Brief (finance.yahoo )

Private payrolls grew by 146,000 in November, less than expected, ADP says (cnbc )

Alibaba to sponsor China’s Lunar New Year gala to reach thrifty consumers (scmp )

Dollar Tree Stock Jumps After Earnings Beat. Now It’s Seeking a New CFO as Well as a CEO. (barrons )

Intel’s Next CEO? Why Apple, TSMC, Marvell Executives Could Be in the Mix. (barrons )

Breaking Down Trump’s Tariffs on China and the World, in Charts (wsj )

Oz “the Wall Street Mentalist” blindly guesses 2 top stocks (cnbc )

INTEL’S BOARD SHORTLISTING POTENTIAL CEO CANDIDATES, INCLUDING FORMER BOARD MEMBER LIP-BU TAN, SOURCES SAY (wikipedia )

Devils dominate struggling Rangers, cruise to easy win at MSG (cbsnews )

China Leaders Plan to Discuss GDP Target, Stimulus Next Week (bloomberg )

Alibaba Cloud aims high in Southeast Asia with new AI partners (scmp )

Long Island couple wants to ‘Make Christmas Great Again’ — with this giant 42-foot, $3K inflatable lawn Santa (nypost )

A Santa Rally Could Lead to a Sober January. Be Cautious—Not Bearish. (barrons )

Small-Cap Stocks Are Breaking Out. The Big Test Is Coming. (barrons )

The S&P 500 Is Set for Back-to-Back 20% Gains. What History Says Happens Next. (barrons )

China Bans Export of Materials Key to Making Chips. How These Stocks Reacted. (barrons )

‘Contrarians aren’t being rewarded,’ and short sellers of U.S. stocks are giving up, says Citigroup (marketwatch )

This bank’s outrageous predictions include the dollar tanking (marketwatch )

Trump reportedly jokes Canada could be 51st U.S. state if tariffs wreck economy (marketwatch )

AI data centers need power. How long can our aging grid meet demand? (marketwatch )

Yelp reveals its Best New Restaurants of 2024 — and an NYC spot topped the list (nypost )

Art Cashin, Wall Street veteran for over 60 years, dead at 83: ‘True giant in our industry’ (nypost )

Musk, Vivek face target-rich environment for vile federal regs and waste (nypost )

Intel’s Chief Executive Is Out Amid Chipmaker’s Struggles (nytimes )

Trump’s Election Powers US Business Sentiment to Multi-Year High (bloomberg )

China’s AI balancing act — beating the U.S. but keeping the tech from threatening Beijing’s rule (cnbc )

Intel has more than 65% of the market for traditional PCs and 85% of the server market, according to Edward Jones. (businessinsider )

China Economic Work Conference Dates Announced (chinalastnight )

Intel CEO Gelsinger Retires. The Stock Is Gaining. (barrons )

’Tis the season to go car shopping, and there’s some cheery news for buyers (marketwatch )

Macau Gaming Revenue Rises 14.9% in November, Exceeds Estimate (bloomberg )

Googling Is for Old People. That’s a Problem for Google. (wsj )

America’s Biggest Apartment Owner Takes a Leap Into Modular Homes (wsj )

‘Moana 2’ Lifts Box Office to Thanksgiving Record With $221 Million Haul (wsj )

For EV Startups, Things Are Going From Bad to Worse (wsj )

Meet the Billionaires Taking Over Professional Bull Riding (wsj )

Sales of Bibles Are Booming, Fueled by First-Time Buyers and New Versions (wsj )

The Best TV Shows of 2024: Small-Screen Sophistication (wsj )

Latest U.S. strike on China’s chips hits semiconductor toolmakers, Reuters reports (cnbc )

Critics said Musk ‘overpaid’ for Twitter. Thanks to Trump and xAI, it could actually be a steal. (businessinsider )

Bull market is setting up a December chase, says Carson Group’s Ryan Detrick (cnbc )

Confidence surges among small business owners (cnbc )

Online shoppers set Thanksgiving Day spending record after big discounts (cnn )

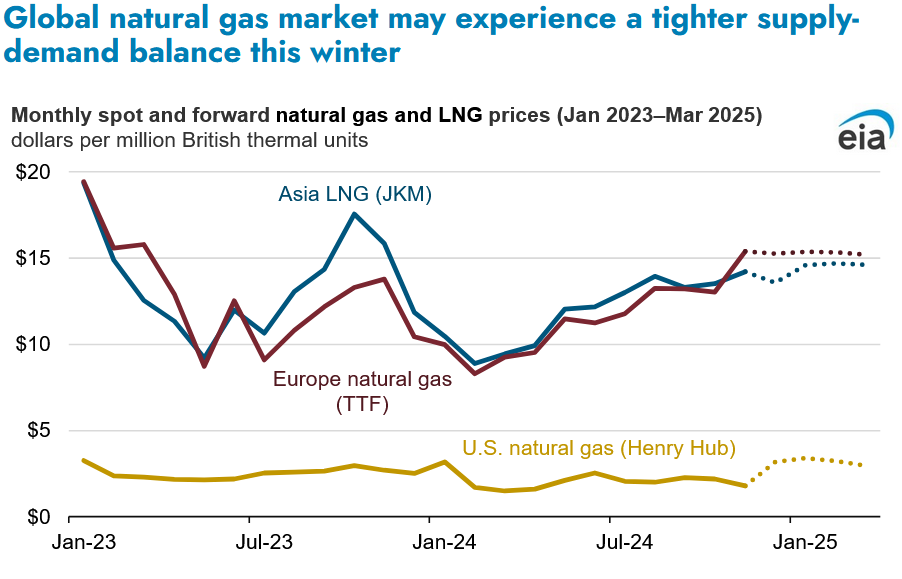

Global natural gas market may experience a tighter supply-demand balance this winter (eia )

Who Is Scott Bessent? Wall Street Is Delighted by Trump’s Treasury Pick (inc )

Tim Barry Is Out As CEO Of Walgreens Clinic Partner VillageMD (forbes )

Target Is in Trouble. How it Could Turn Business Around. (barrons )

Trump Tax Cuts 2.0: How They Will Affect You (barrons )

Nuclear Energy Wins New Fans—Even in New York State (barrons )

Where to Look for Undervalued Technology Stocks (barrons )

What Trump’s Immigration Plans Mean for America’s Job Growth (wsj )

A Simpler Citigroup Begins to Take Shape (wsj )

Mexico’s President Says She’s Sure Country Can Avoid US Tariffs (bloomberg )

Trudeau, Trump Discuss Trade, Border at Crucial Mar-a-Lago Meeting (bloomberg )

What the Top 1% Really Pays the IRS. They kick in 40.4% of income taxes, nearly double their income share. (wsj )

Zelenskiy Open to Cease-Fire If NATO Protects Unoccupied Areas (bloomberg )

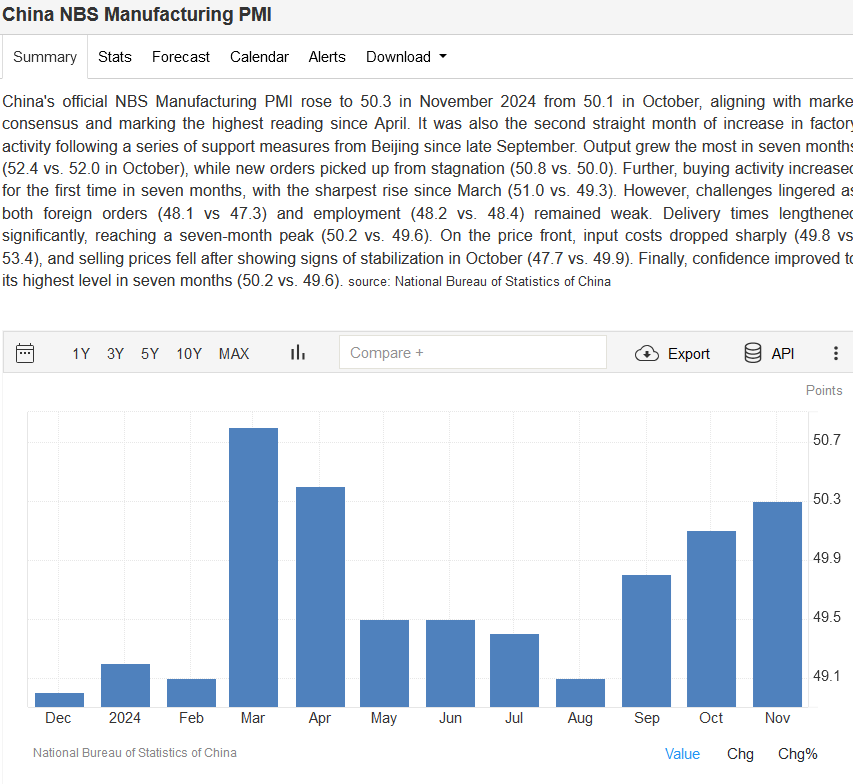

China Factory Activity Grows for Second Month (tradingeconomics )

Australia bans most users under 16 from social media (usatoday )

‘Moana 2’-led Thanksgiving box office could be best in post-pandemic era (cnbc )

MDB Capital president and chief marketing strategist Lou Basenese joins ‘Cavuto: Coast to Coast’ to discuss Disney’s recent turnaround. (foxbusiness )

Stimulus Bets Drive Chinese Stocks Higher Before Key Meeting (bloomberg )

Elon Musk: the ‘wild card’ in Trump’s dealings with China (ft )

‘I wouldn’t be too worried about the next 12 months’, says Fundstrat’s Tom Lee (cnbc )

Don’t Rule Out a Santa Claus Rally, Despite the Market’s Impressive Gains (BARRONS )

How Elon Musk, Donald Trump And DOGE Will Take On The Federal Government, And What It Means For The S&P 500 (investors )

Trump has been secretly communicating with ‘man crush’ Jamie Dimon about White House agenda for months: sources (nypost )