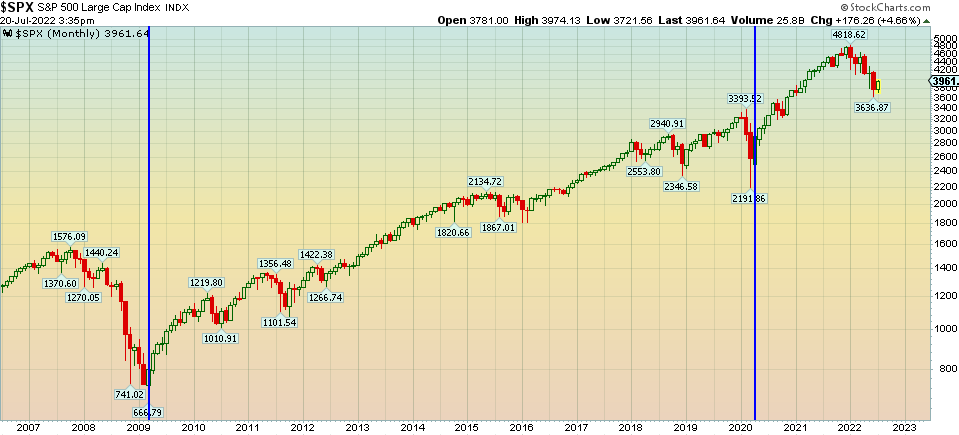

Last Thursday morning we published our article “As Bad Is It Gets,” and so far that has proven to be true:

Thursday marked the near term lows and as I write this, the S&P is up almost 7% trough to peak and the Nasdaq up almost 9% trough to peak:

In 2021, country Star Chris Stapleton won CMA “Album of the Year” for “Starting Over.” We picked this theme for the article as the following lyrics may be pointing the way forward:

But nobody wins afraid of losin’

And the hard roads are the ones worth choosin’

Someday we’ll look back and smile

And know it was worth every mile…

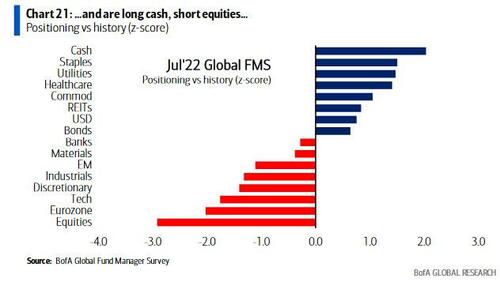

If we look to the Bank of America Global Fund Manager Survey from this week, we see that most managers are positioned “afraid of losin'” and as such, cannot win.

July 2022 Bank of America Global Fund Manager Survey Results (Summary)

The “hard roads” are stepping in at times like these when others are selling in the hole. We saw it with China stocks bottoming in March. We saw it with Biotech bottoming in May. We may now be seeing it with the general indices in July.

We believe these trends are just beginning and that the general indices may be next. As we frequently remind viewers on our weekly videocast, “amateurs deal in absolutes, professionals deal in probabilities.” Right now the probabilities suggest (but do not guarantee) better days ahead for the indices.

Here are the key measures of sentiment we are looking at this week – as well as how the biggest managers are positioned:

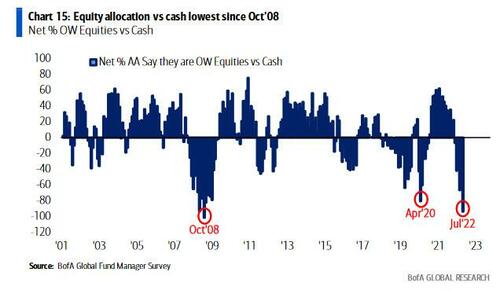

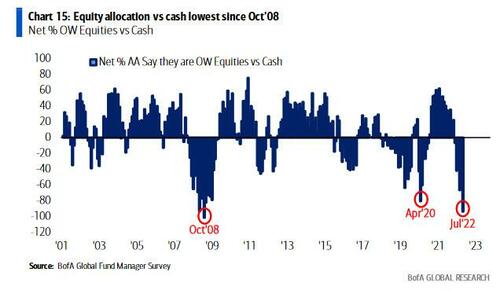

Lowest equity allocation since the GFC and Pandemic. Bears will say that the S&P fell another 30% (temporarily) after the October 2008 lows. They are the same folks who were bearish from 2009-2014 and missed a monster bull market.

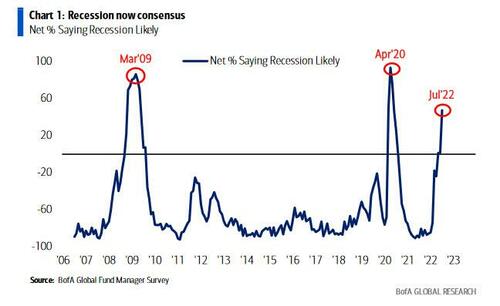

Everyone now believes we are going to have a recession. Look at the last two times recession consensus was this elevated and what the stock market did next:

Here’s the secret: THEY WERE RIGHT. We did have recessions in both instances, but the MARKET IS A DISCOUNTING MECHANISM and priced it in ahead of time. The market rallied well before the recession was “declared.”

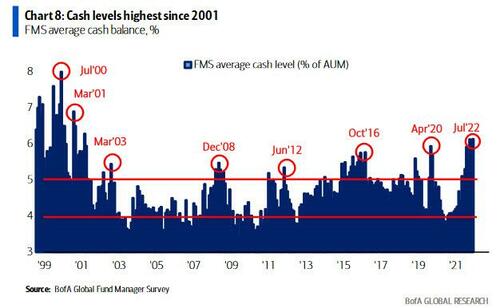

Managers’ largest position is cash. Highest since the 9/11 terrorist attacks. All of this money will be panicking back INTO the market as quickly as it PANICKED OUT once the tide turns.

Managers’ largest position is cash. Highest since the 9/11 terrorist attacks. All of this money will be panicking back INTO the market as quickly as it PANICKED OUT once the tide turns.

No one is positioned for any good news at present (Geopolitical, Earnings, Inflation). When something clicks, everyone will be waiting for the next “shoe to drop” and miss it – just as most missed the pandemic lows in 2020 when we put this note out a couple of days before the low:

Yahoo! Finance

On Friday I joined Seana Smith, Rachelle Akuffo and Dave Briggs on Yahoo! Finance to discuss my stock market outlook. Thanks to Taylor Clothier, Jeff Cohen, Seana, Rachelle and Dave for having me on:

–U of M Consumer Sentiment at 51.1. Since 1980, last 3x it dropped below 58, it marked the lows in sentiment and peak in inflation. Avg S&P gains 12 months later were +20.87%.

-Fed does want to “reduce demand” but they don’t want to DESTROY the economy. They promised $47.5B in Quantitative Tightening in June. They only did $7.5B (and were net buyers of Treasuries). GOAL: Jawbone TOUGH on inflation, but raise as little as possible to bide time until commodity rollover shows up at the cash register for consumers.

Beige Book showed signs of a slowdown in demand and increased risk of recession.

Waller: “Market participants looking for 100bps in July getting ahead of themselves. 75bps get us to neutral in July”

Fed can’t go 100bps into a slowdown without breaking things (see recent rise in jobless claims to 244k).

Whether FED will succeed or not depends on how quickly recently weakened commodity prices will show up in Consumer Prices.

1. CPI and PPI couldn’t have been any worse. It is backward looking. Oil, Copper, Corn, Soybeans, Cotton, platinum, Cocoa have all collapsed.

2. Earnings continue to hold up for the time being. Would you rather sell 10 hamburgers at $10 or 8 hamburgers at $15. Companies still passing through cost. Earnings have come down in REAL TERMS by staying steady in NOMINAL TERMS with 8%+ inflation. $250 for 2023 = $230 (without inflation). The big “estimates takedown” has already happened in real terms.

3. Average hourly earnings in the jobs report were manageable- running at 3.7% annualized.

4. Have to be in groups that will do well in a SLOWER GROWTH ENVIRONMENT moving forward: Biotech: (XBI up ~32% since May lows). With a half dozen multi-billion dollar biotech takeouts in recent weeks, “animal spirits” are back for the sector. Drug approvals on tap as FDA normalizes. Value Tech: FB (11.9x 2023 eps), AMZN (down 40%) etc

EARNINGS:

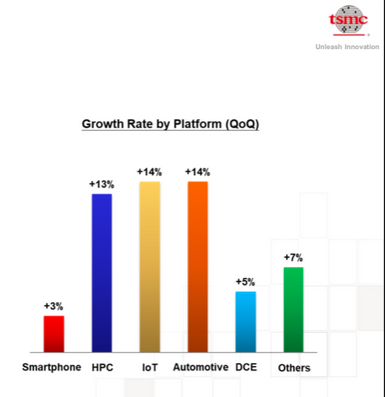

TSM: Beat on Top Line, Bottom Line and Raised Guidance. Good look on Auto Chips (+14% yoy) which means shortage abating = glut of new cars coming will collapse New/Used car prices (key component in CPI)

JPM: As quickly as deals dried up, they will come back huge once market stabilizes. “Consumer/Corporate balance sheets in great shape. No cracks yet.”

Option Skew. Measures cost to insure catastrophe (deep out of the money puts/calls). VIX measures “at the money.” Skew down at pandemic low levels, why? Nothing left to insure – house already burned down! Happens near inflection points historically.

CGTN America

On Monday I joined Phil Yin on CGTN America to discuss Bank Earnings, Housing Stocks, Fed Policy and general market outlook. Thanks to Delal Pektas and Phil for having me on:

Watch FULL interview in HD directly on CGTN America

Now onto the shorter term view for the General Market:

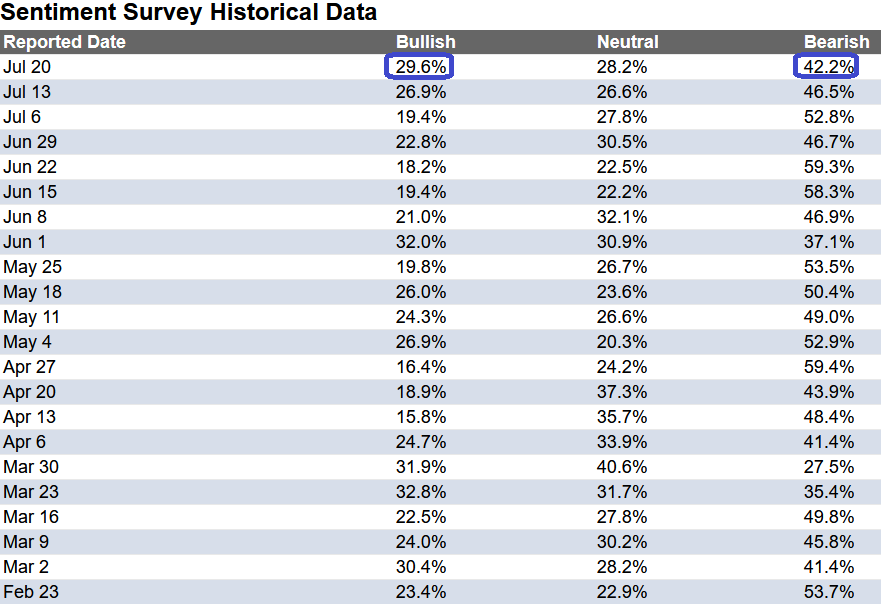

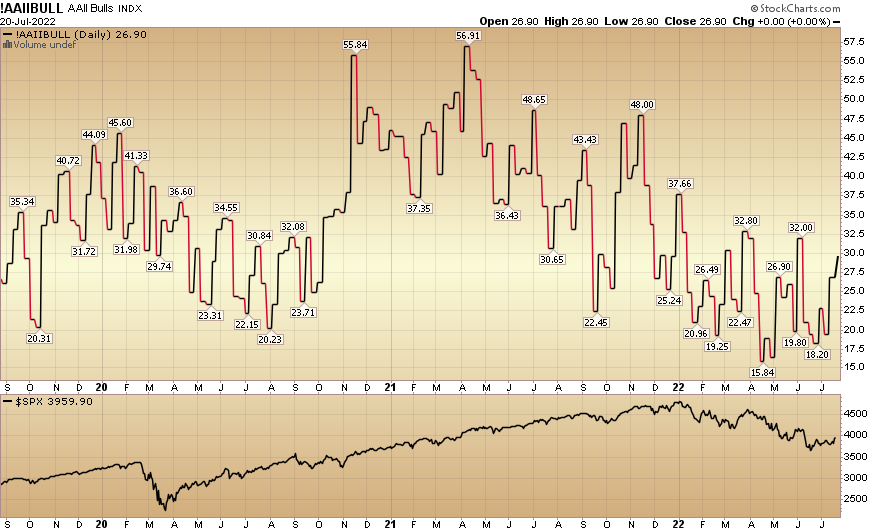

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 29.6% this week from 26.9% last week. Bearish Percent dropped to 42.2% from 46.5%. Retail investors’ fear is starting to thaw.

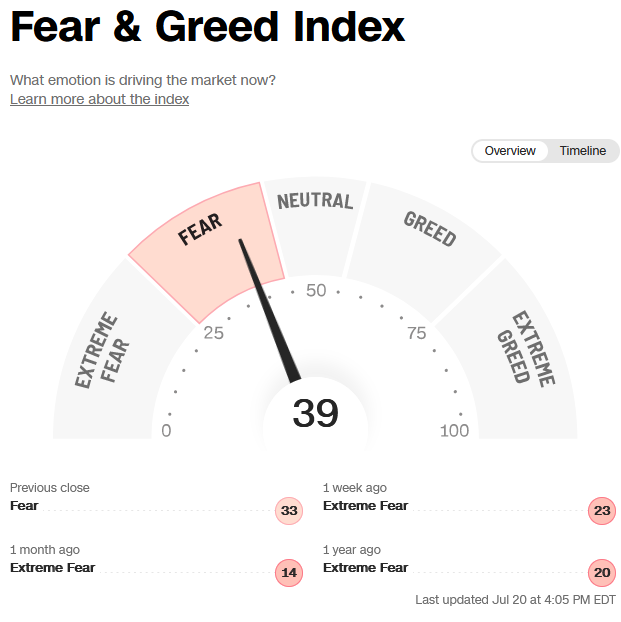

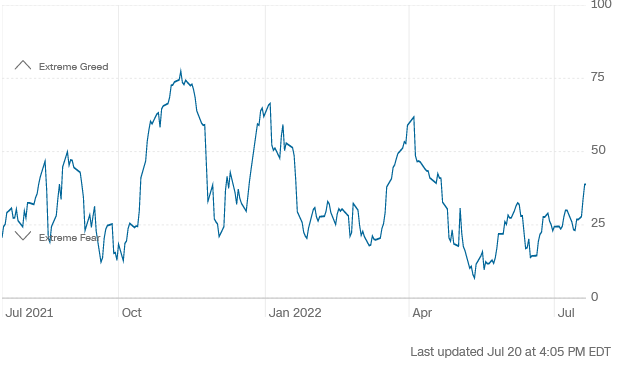

The CNN “Fear and Greed” moved up from 24 last week to 39 this week. This still shows fear, but it is now easing. You can learn how this indicator is calculated and how it works here: (Video Explanation)

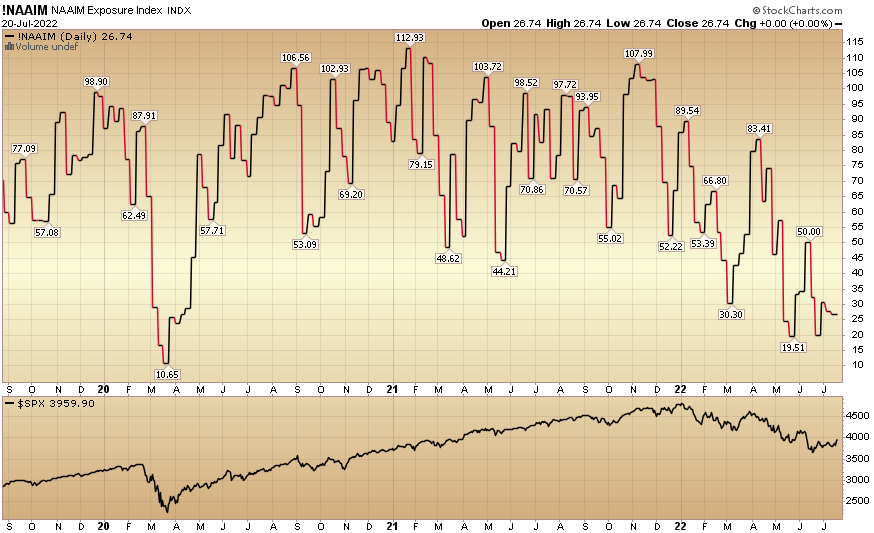

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 26.74% this week from 27.85% equity exposure last week. Active managers missed the rally since Thursday. Any unexpected further positive news will force them back into the market aggressively.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Remember, “the hard roads are the ones worth choosin'”…

Someday we’ll look back and smile

And know it was worth every mile…