Key Market Outlook(s) and Pick(s)

Yesterday, I joined Mary Calvi on CBS News to discuss the Fed, Rates and more. Thanks to Mary and Claire Phelan for having me on:

Watch in HD directly on CBS News

On Thursday, I joined Taylor Riggs on Fox Business to discuss Trump, interest rates, rotation, and stock picks. Thanks to Taylor, Jake Mack and Kathryn Meyers for having me on:

On Thursday, I also joined Sarah Al-Khaldi on CNA Singapore to discuss Trump, deregulation, interest rates, and other implications. Thanks to Sarah and Audrey Tay for having me on:

Updates on BABA, EL, GOOS, QXO

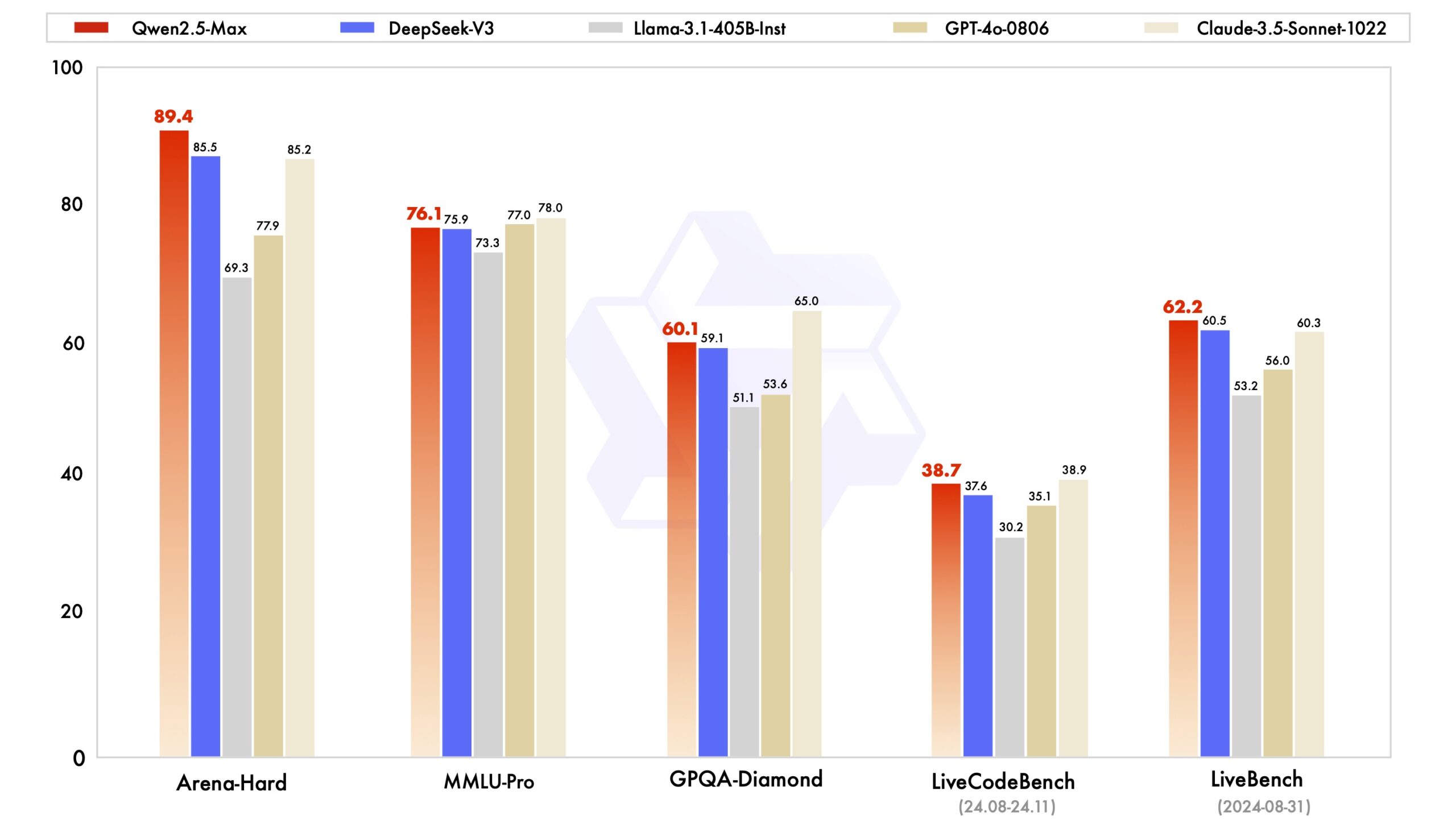

1) Alibaba ($BABA) released the latest version of its Qwen large language model, Qwen 2.5 Max, and it’s not only beating out local competitors like DeepSeek’s V3, it’s outperforming ChatGPT and Meta too. Maybe Jack Ma was onto something when he joked that “AI” stands for “Alibaba Intelligence.” Who’s laughing now? (Click here for full article)

2) Estee Lauder ($EL) is working with Evercore to review its portfolio of 20+ brands, which could lead to some being sold as new CEO Stéphane de La Faverie takes over and works to turn the beauty giant around. (Click here for full article)

3) Canada Goose ($GOOS) just got the green light from the Ontario Securities Commission to buy back up to 10% of its public float, doubling its U.S. share repurchase capacity. In other words, our slice of the pie just got 10% bigger, without putting up any additional equity. (Click here for full article)

4) QXO ($QXO) is going straight to Beacon Roofing Supply shareholders with its $124.25 per share all-cash offer (~$11B) after Beacon’s management rejected the bid. Beacon has until February 14th to respond, and after that, QXO can either extend the offer, let it expire on February 24th, or make an improved bid. (Click here for full article)

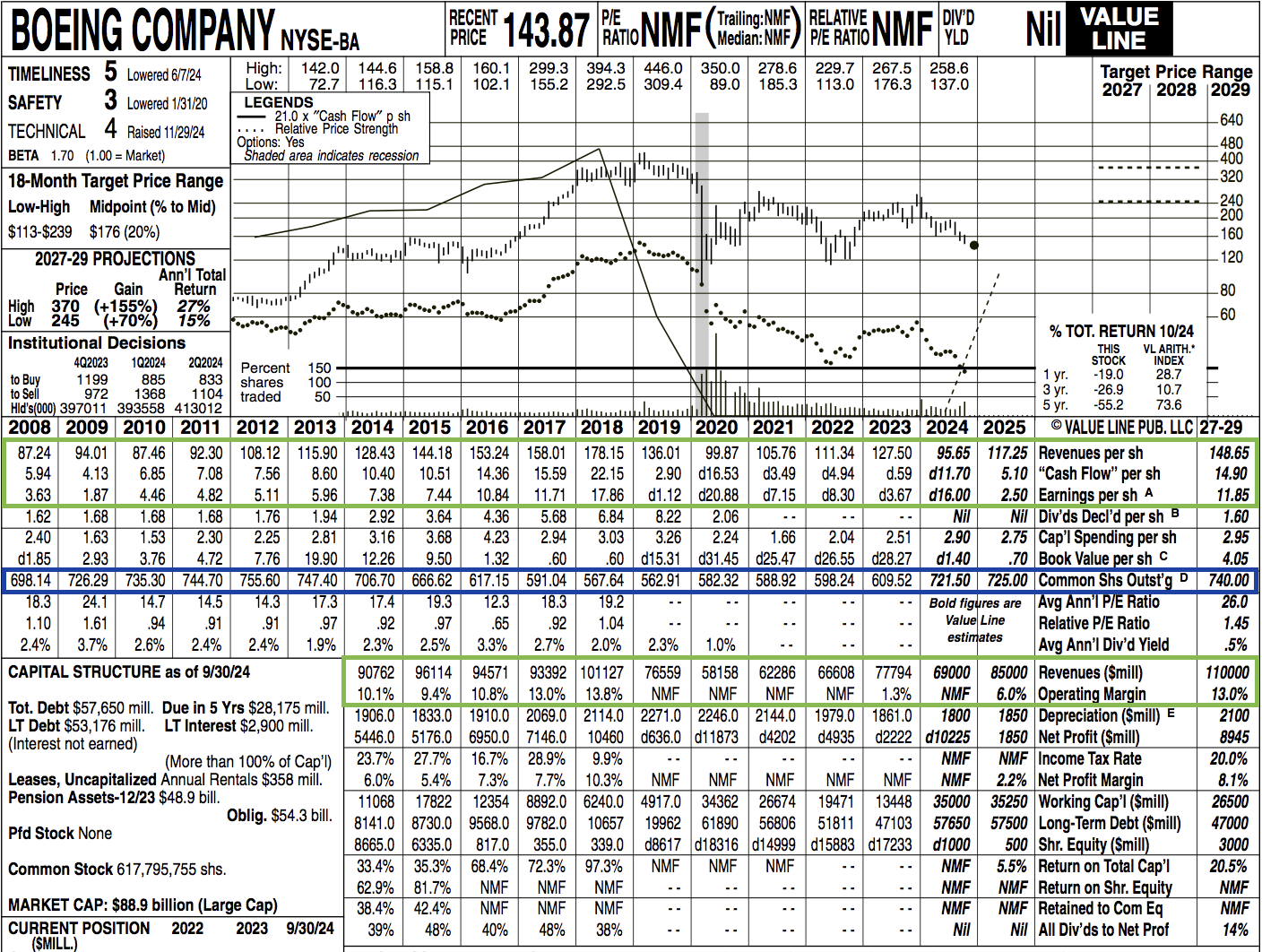

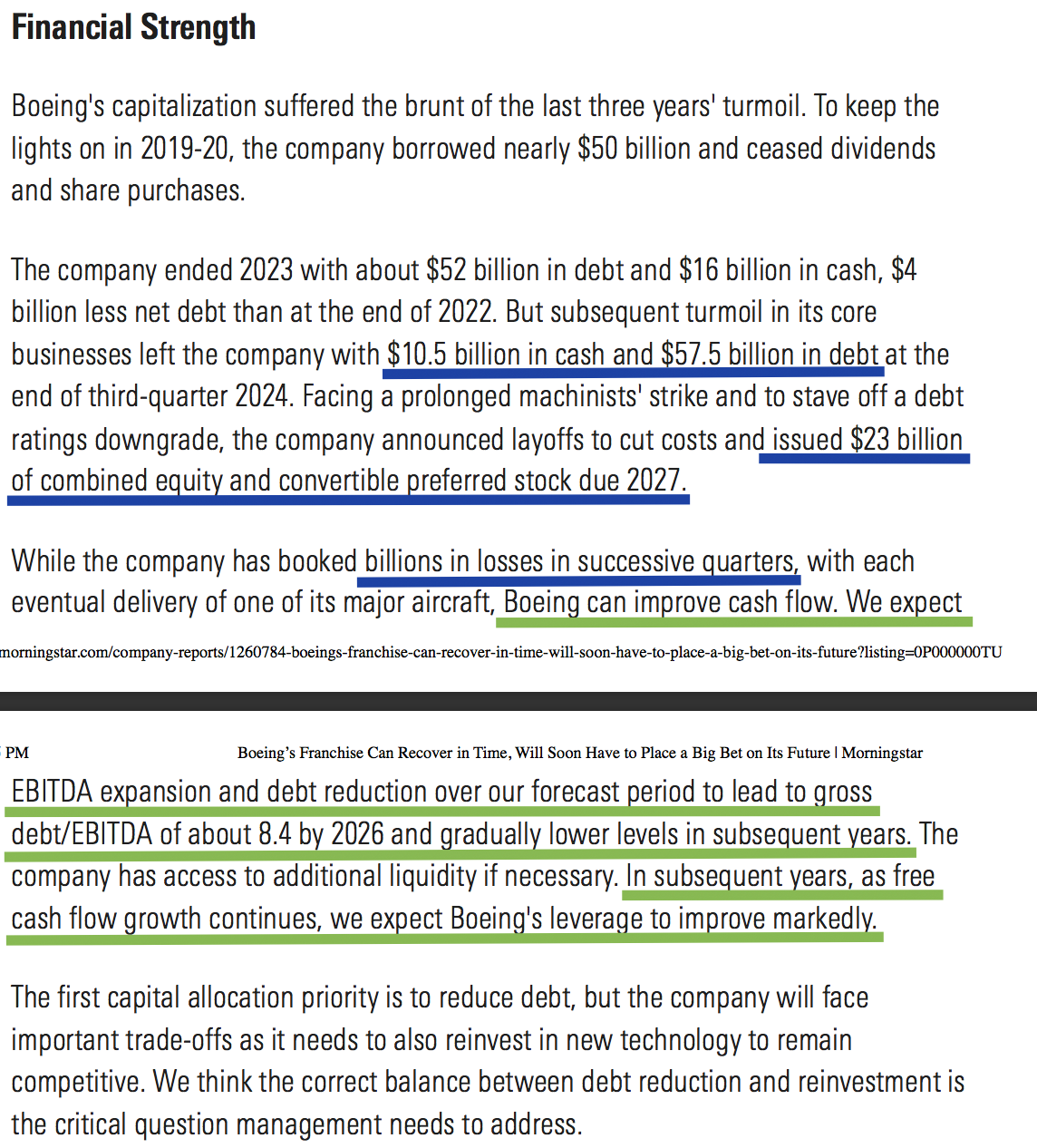

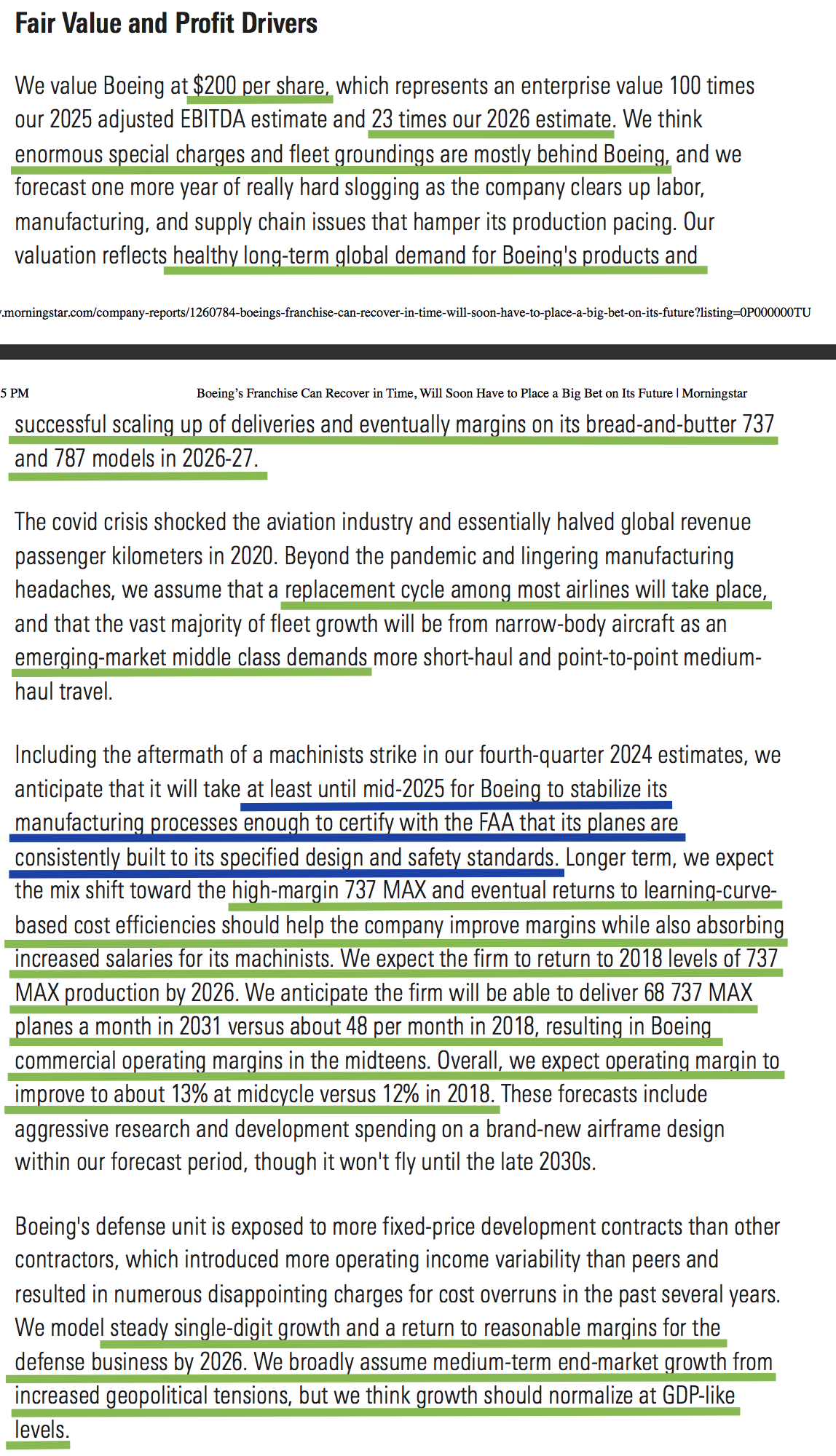

Boeing Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

CEO Kelly Ortberg joined “Squawk on the Street” following the earnings call yesterday. Here’s what he had to say:

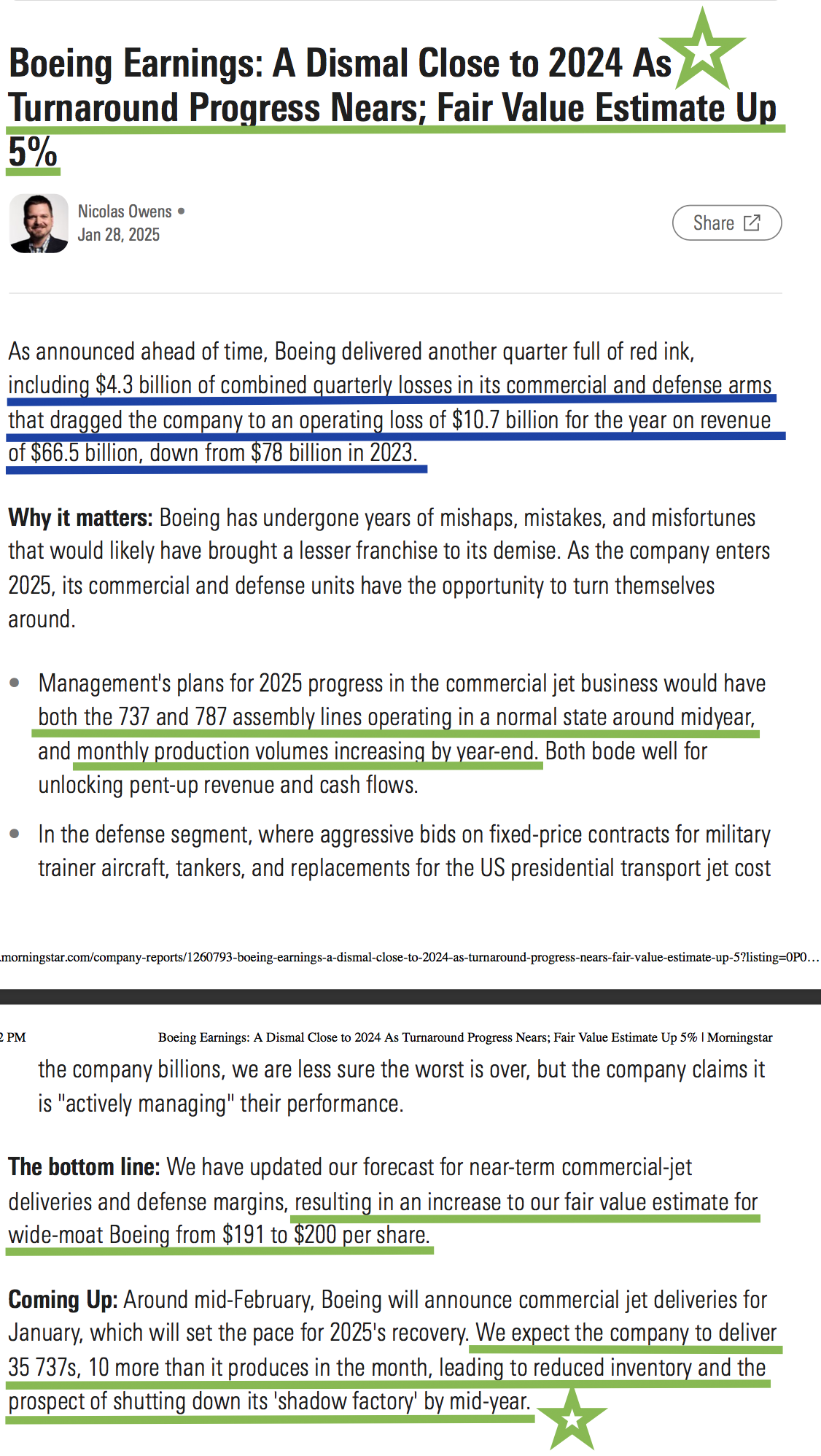

Morningstar Analyst Note

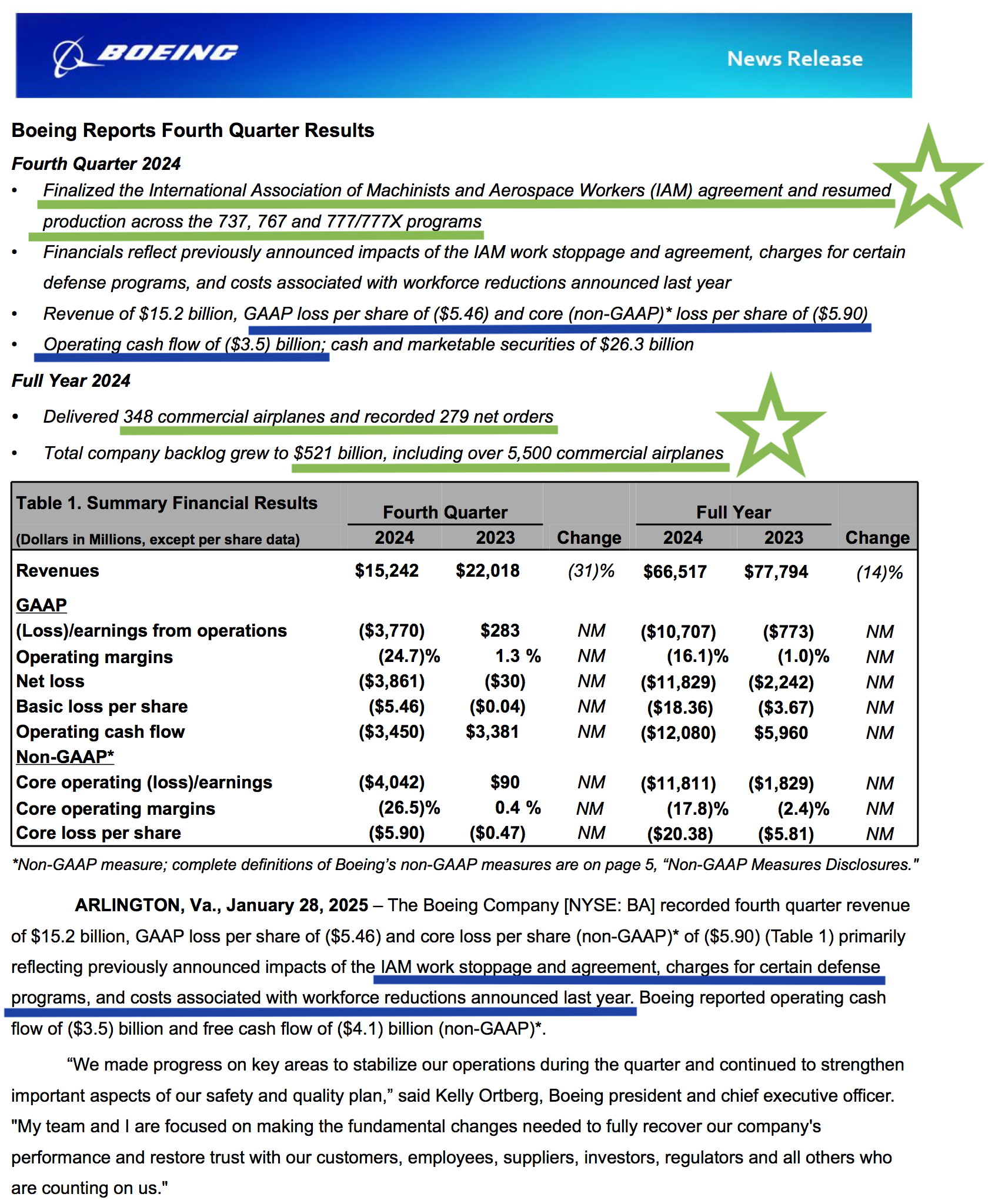

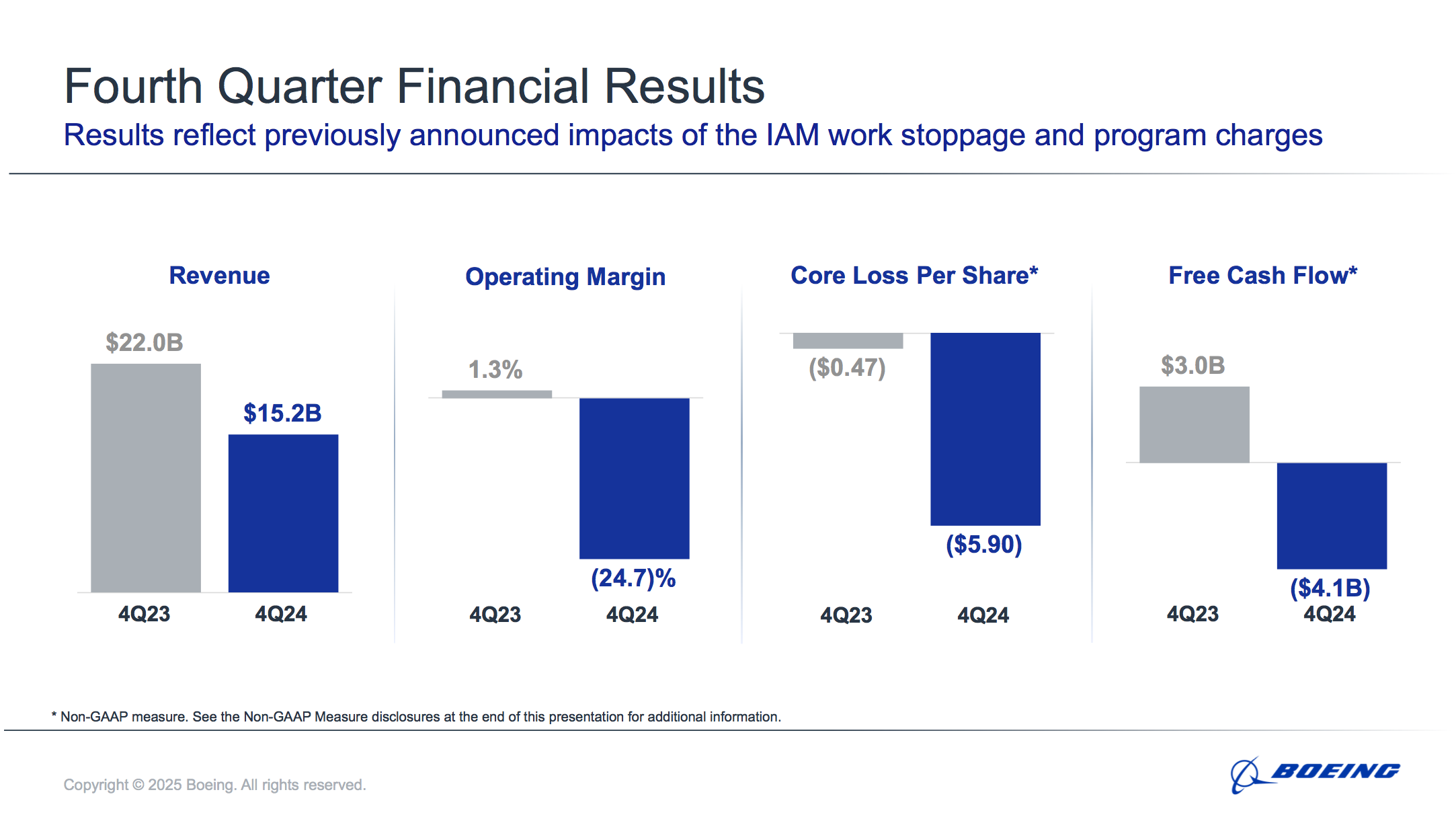

Earnings Results

10 Key Points from Boeing’s Jan. 28 Earnings Results and Call

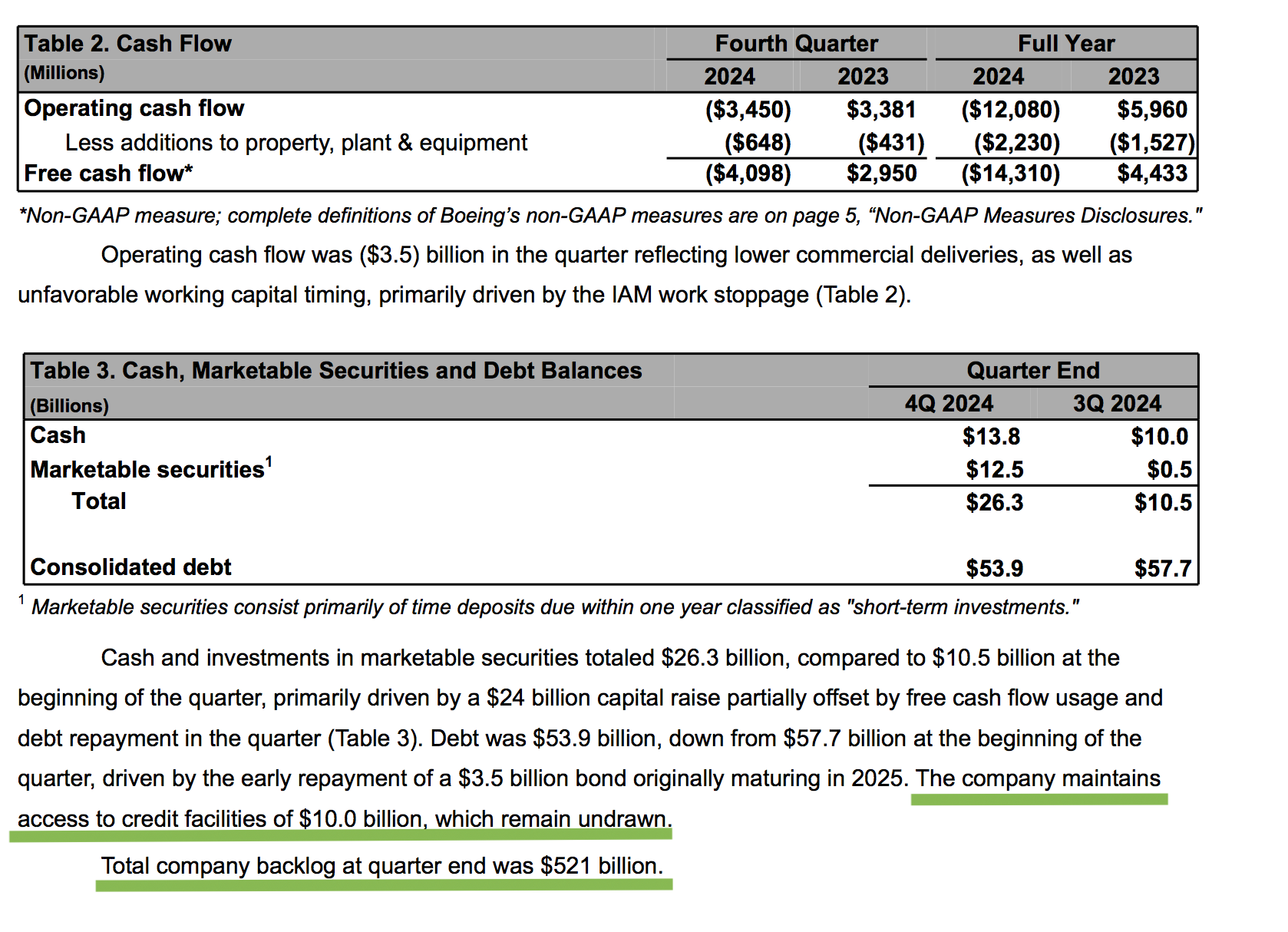

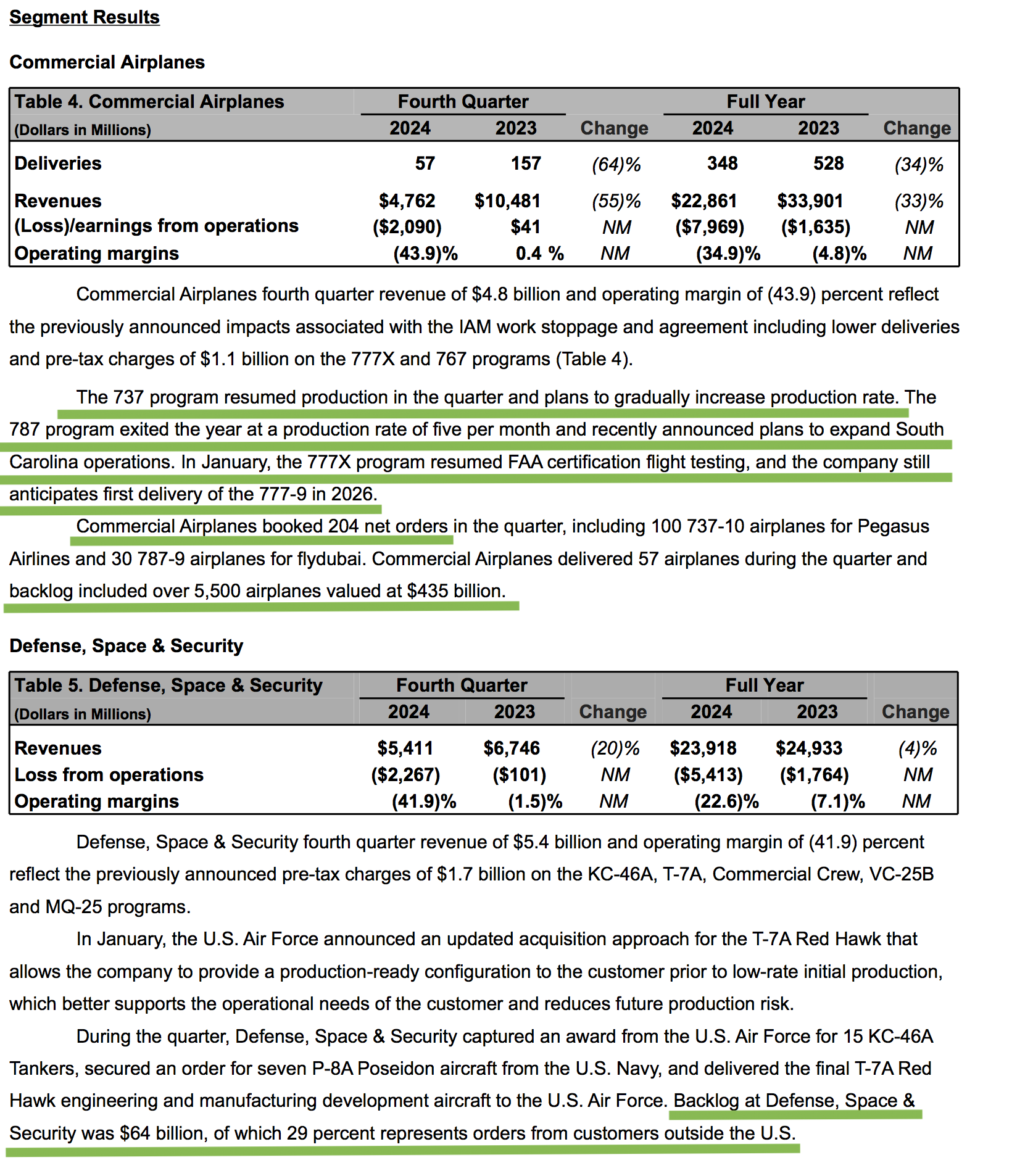

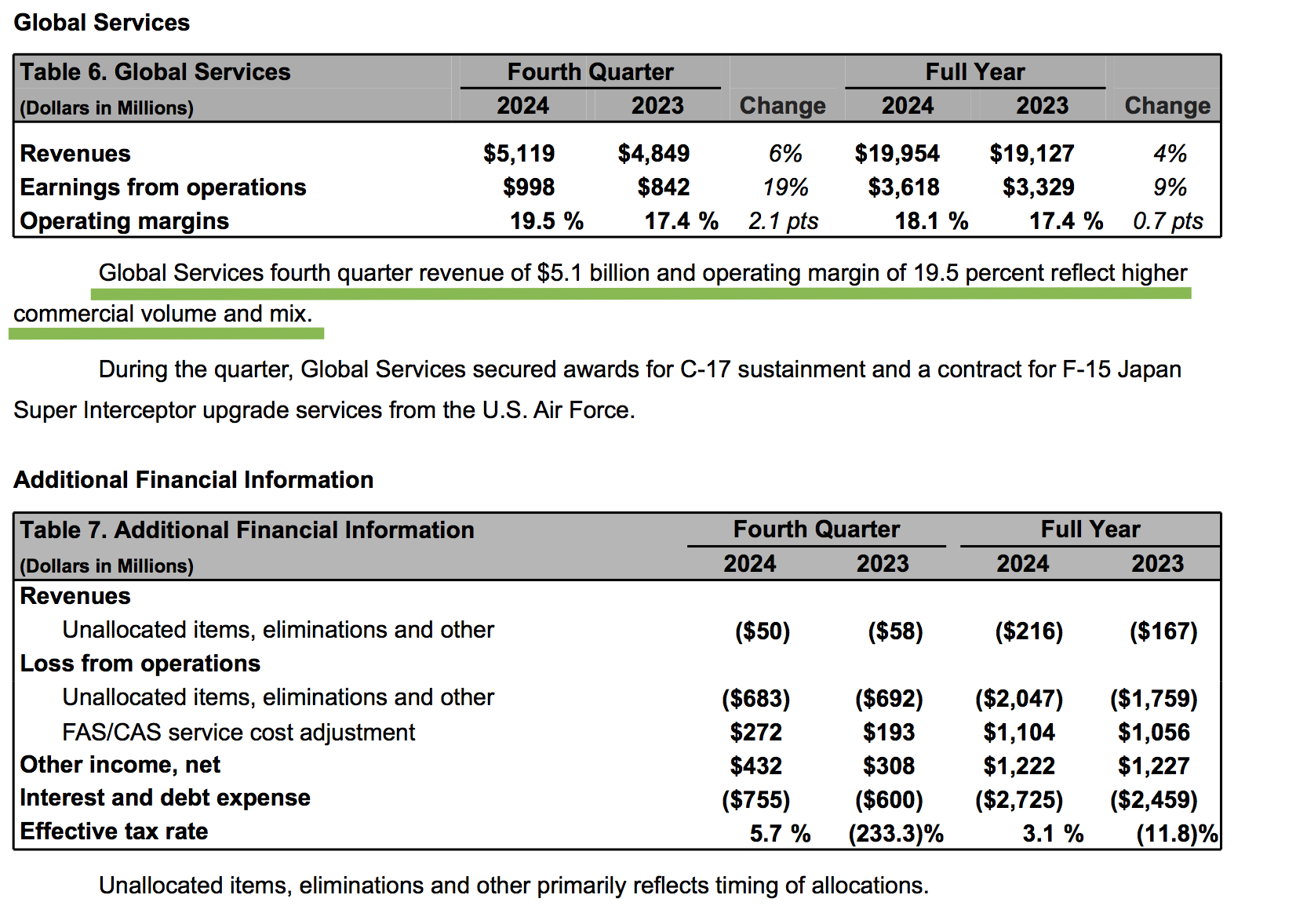

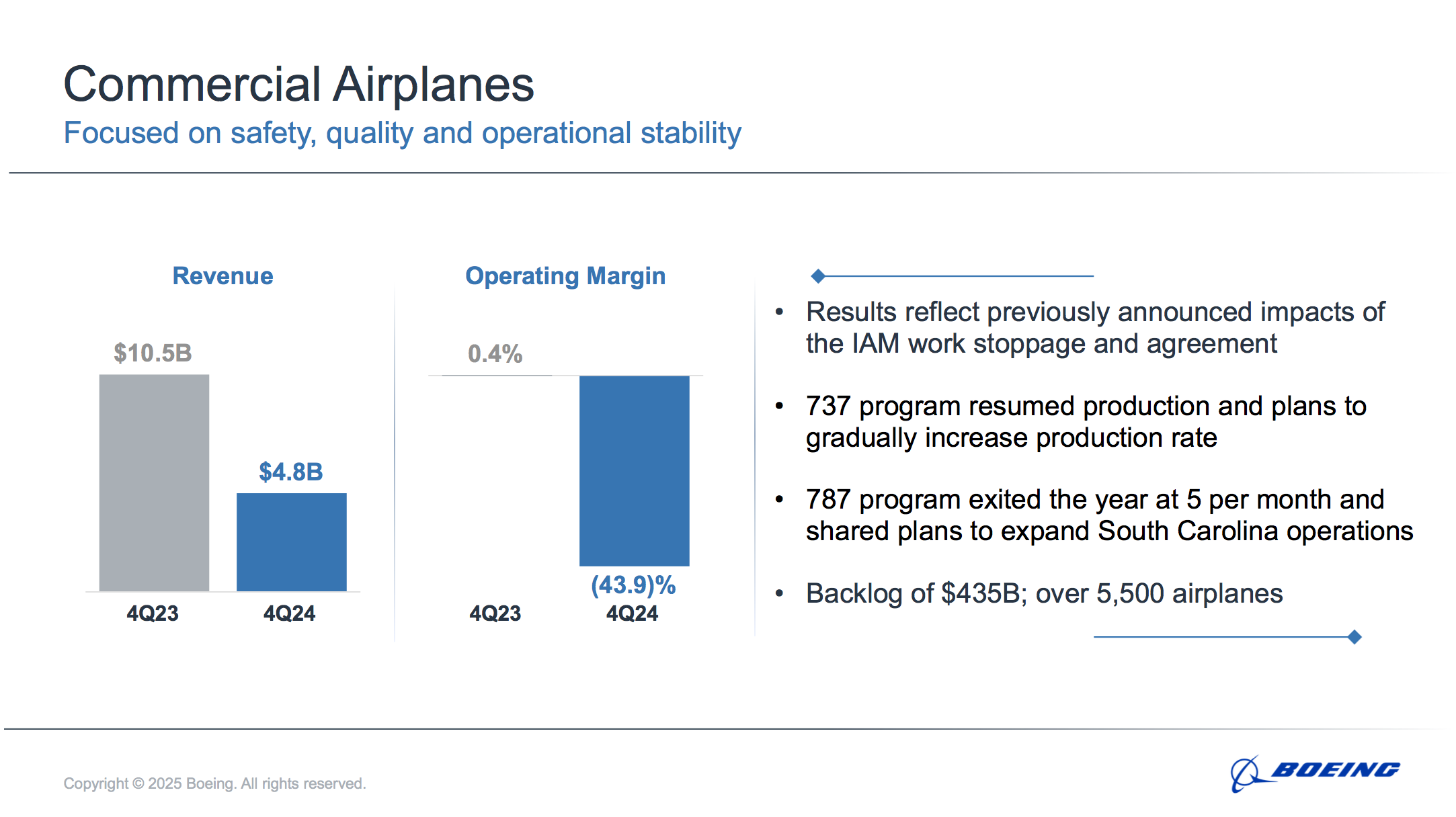

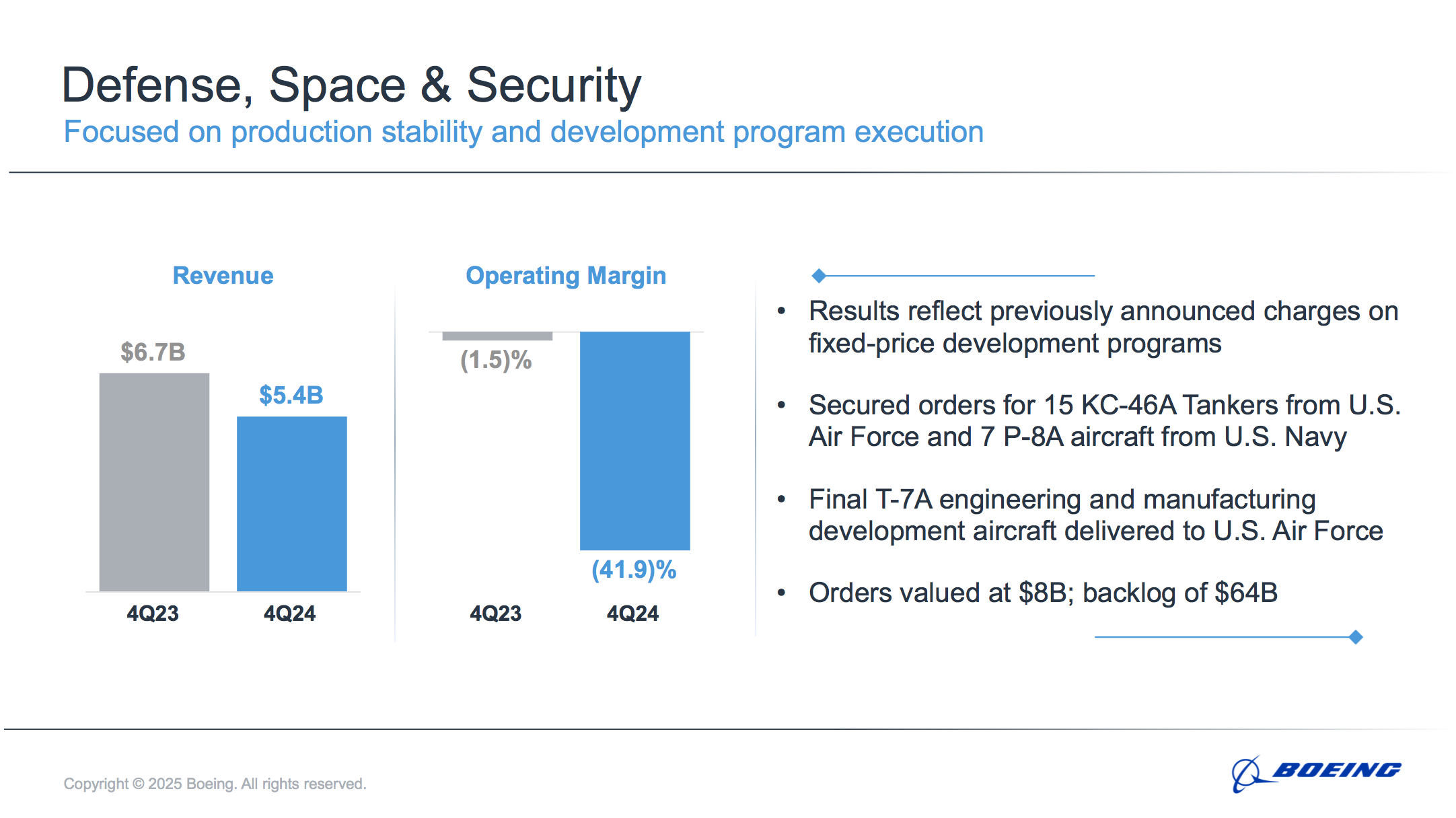

1) Total company backlog grew to $521 billion, including over 5,500 commercial airplanes.

2) The 737 program continues to show production improvements and is exceeding internal estimates, delivering 36 airplanes in Q4, including a ramp-up to 18 in December. January is off to a strong start, with 33 airplanes delivered and four days remaining.

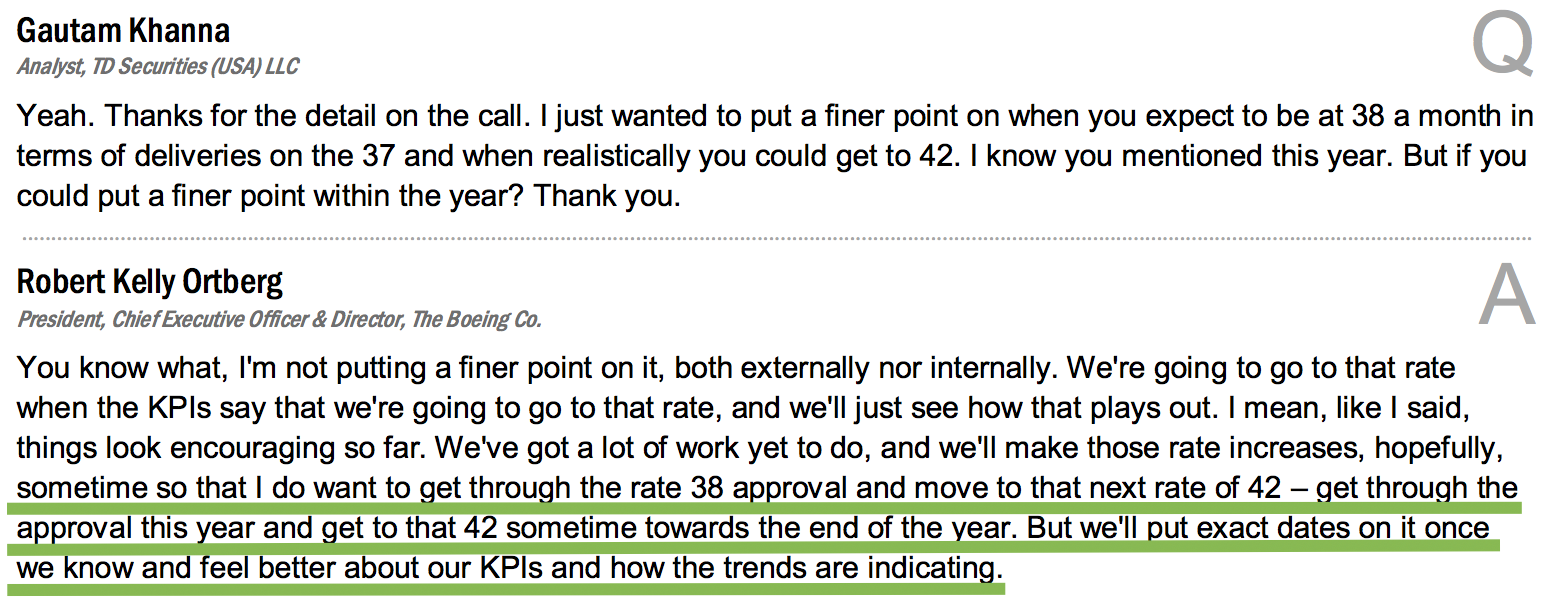

3) Management anticipates production exceeding 38 airplanes per month later this year, pending FAA approval. Early indicators for all production KPIs are positive and trending in the right direction.

4) The FAA reported “significant improvements” in production systems and has agreed on a plan for increasing the production rate beyond 38 per month.

5) Boeing has a sufficient parts inventory to sustain 737 MAX production at a rate of 38 per month, including fuselages, which were previously a limiting factor before the strike.

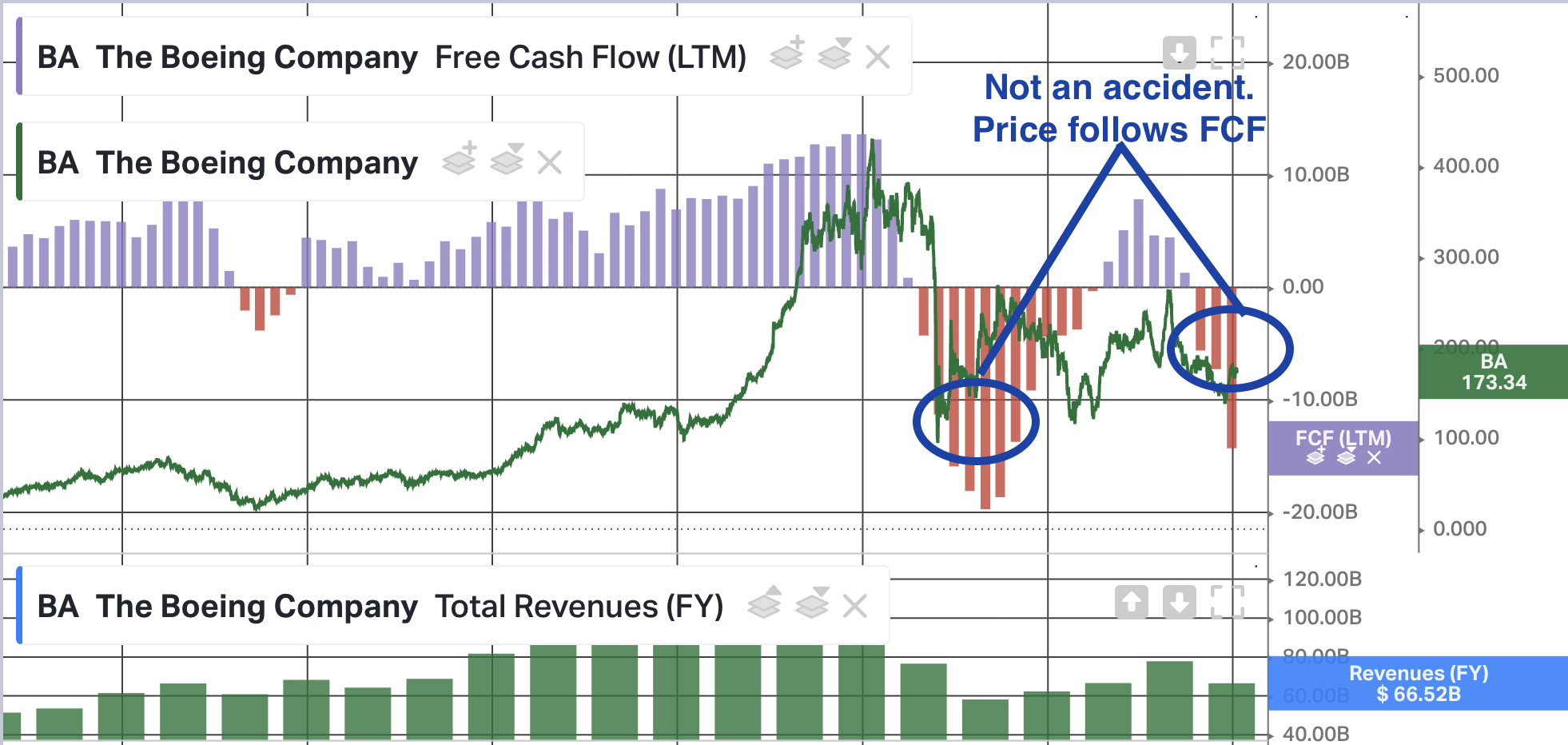

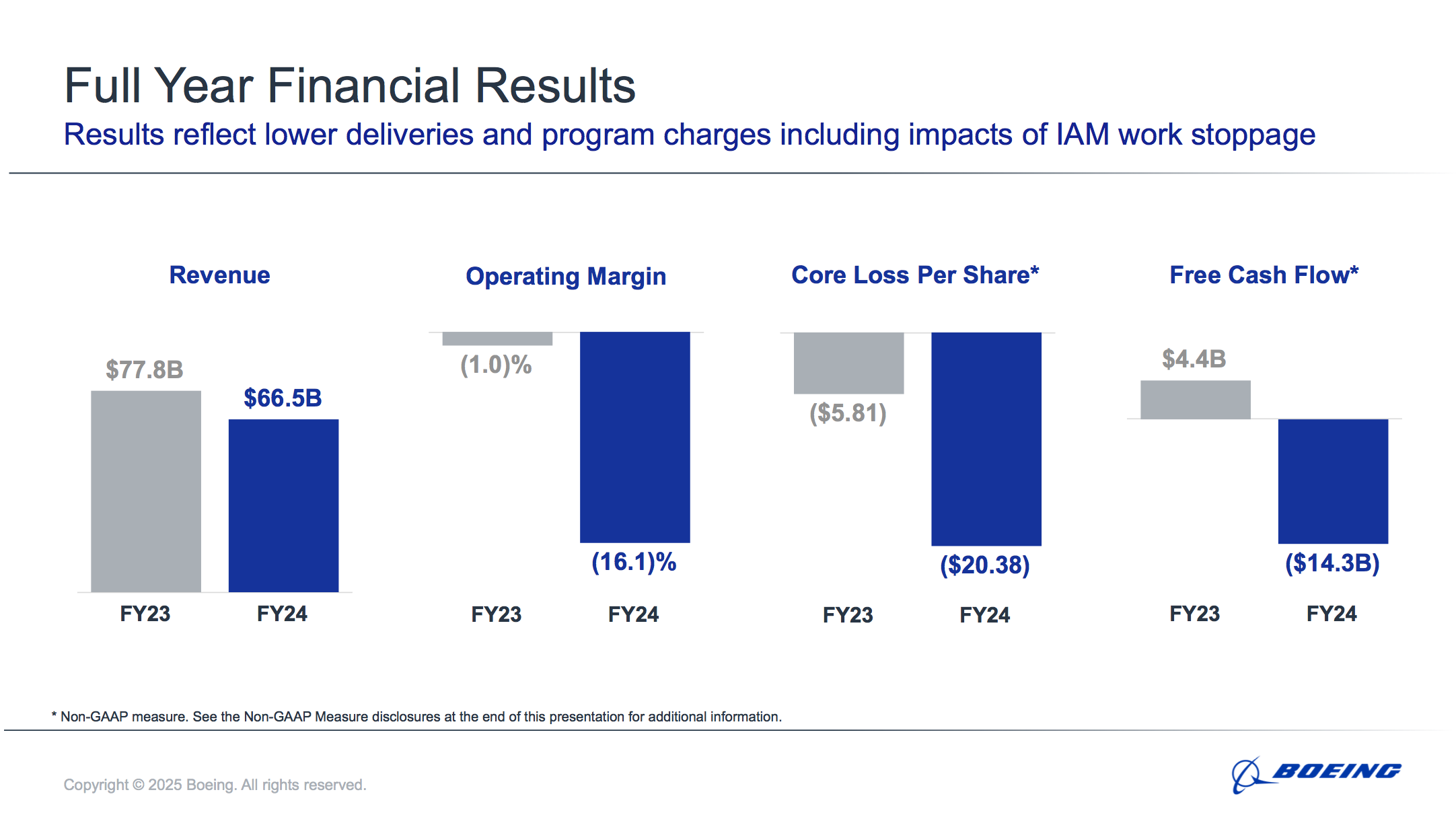

6) The first half of 2025 is expected to have negative free cash flow, flipping to positive in the second half. However, strong momentum heading into 2026 positions BA well for a solid year of free cash flow.

7) Management hinted that once they receive FAA approval to increase production, they could reach production levels of 42 airplanes by the end of the year. The long-term goal remains closer to 50 MAX jets a month.

8) Expects to deliver ~80 787 airplanes in 2025, with potential for upside.

9) Management is still hinting at the potential sale of non-core assets, including Jeppesen, but a major restructuring of BA is off the table.

10) Boeing continues to make progress in restoring its culture and core values, including the implementation of a single enterprise score for all annual incentive plans.

VF Corp Update

CEO Bracken Darrell joined Jon Fortt on CNBC following the earnings call today. Here’s what he had to say:

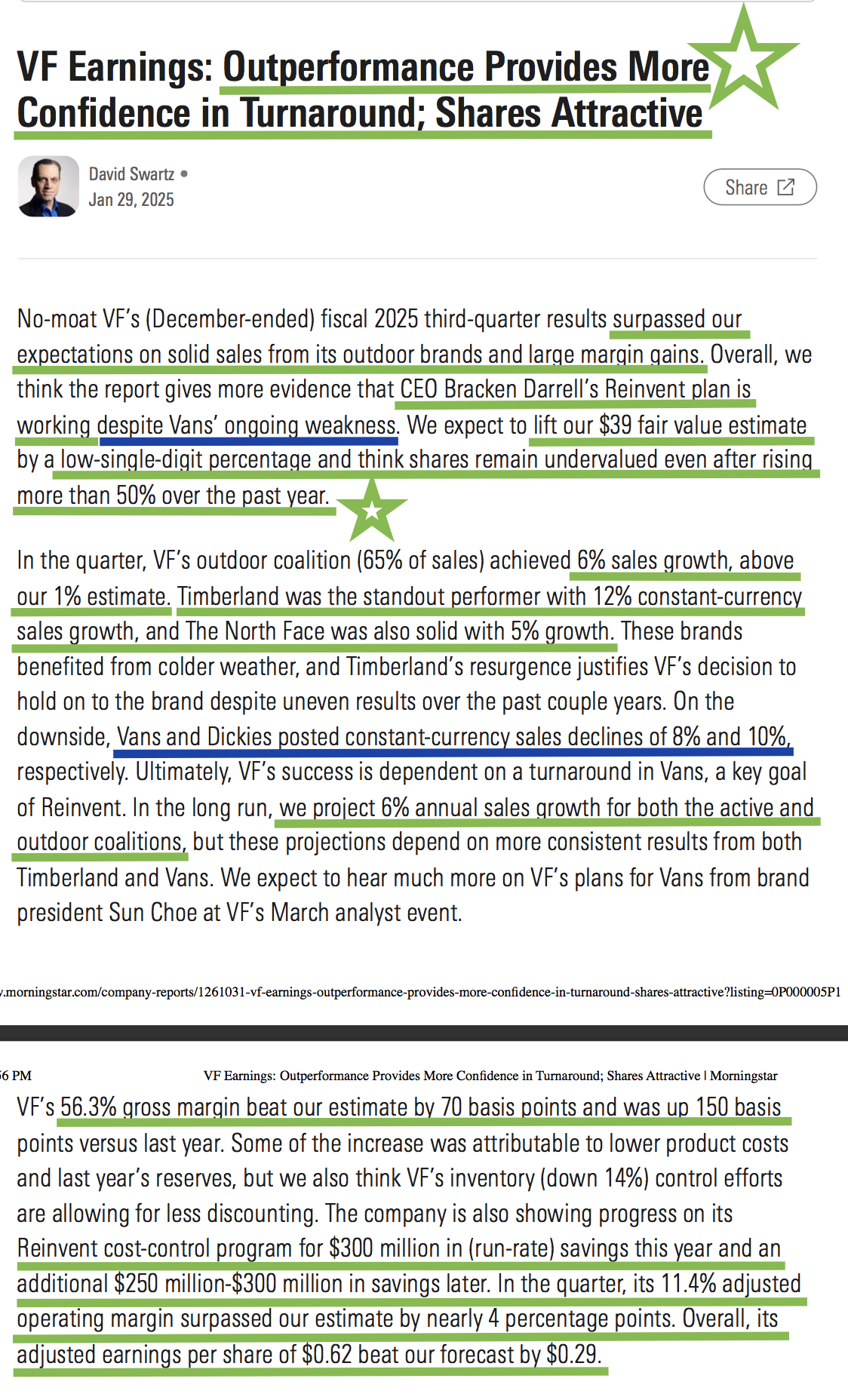

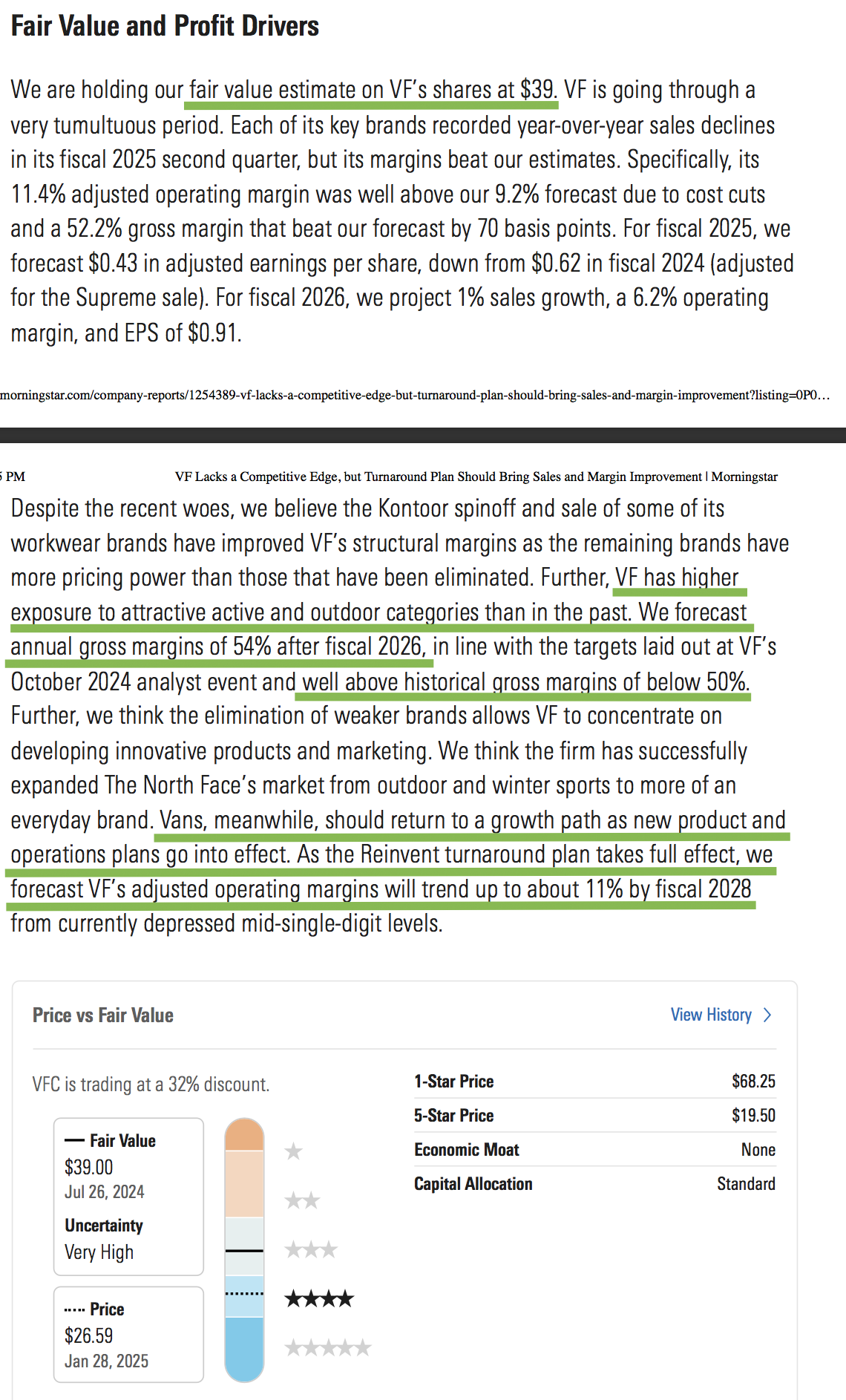

Morningstar Analyst Note

Earnings Results

10 Key Points from VF Corp’s Jan. 29 Earnings Results and Call

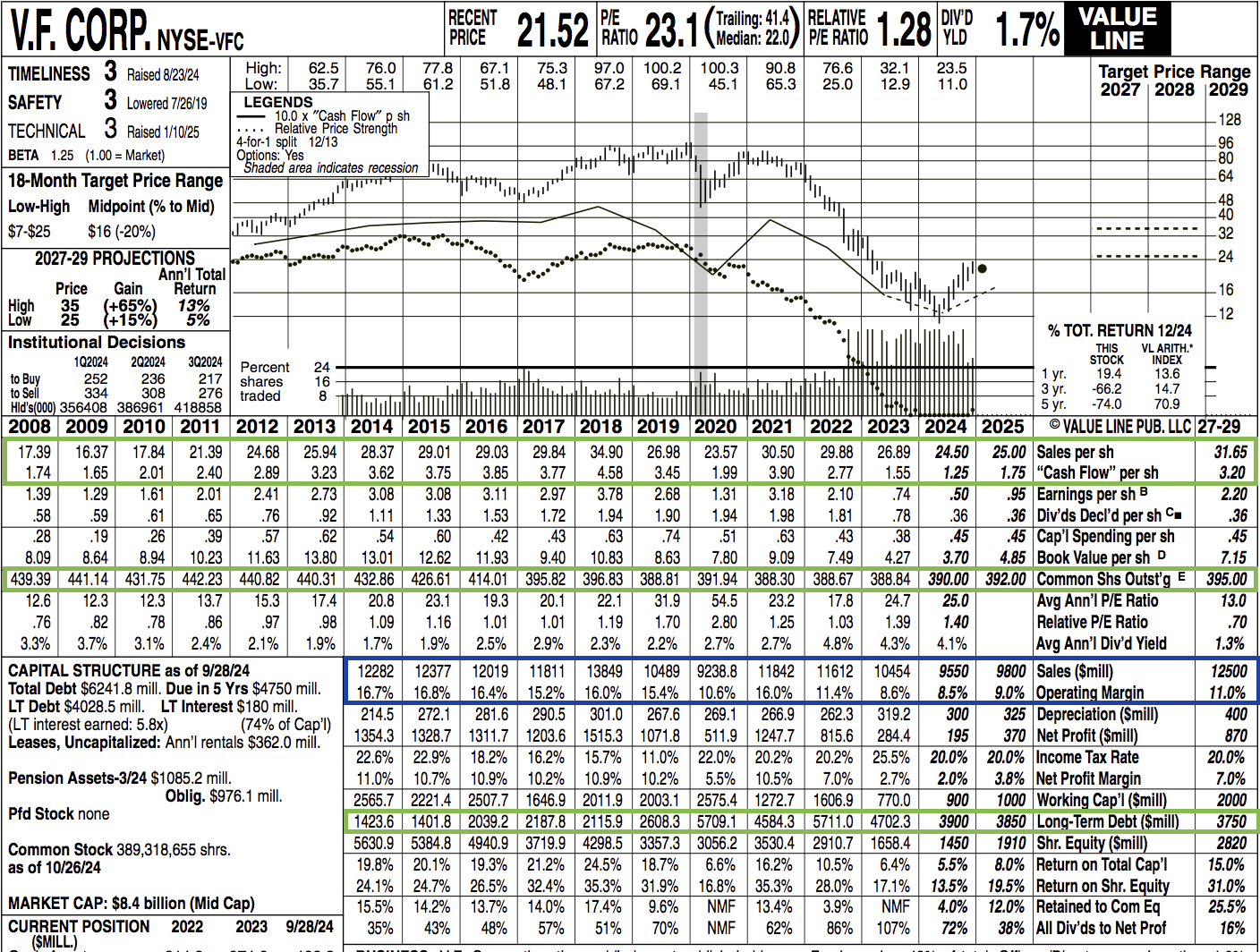

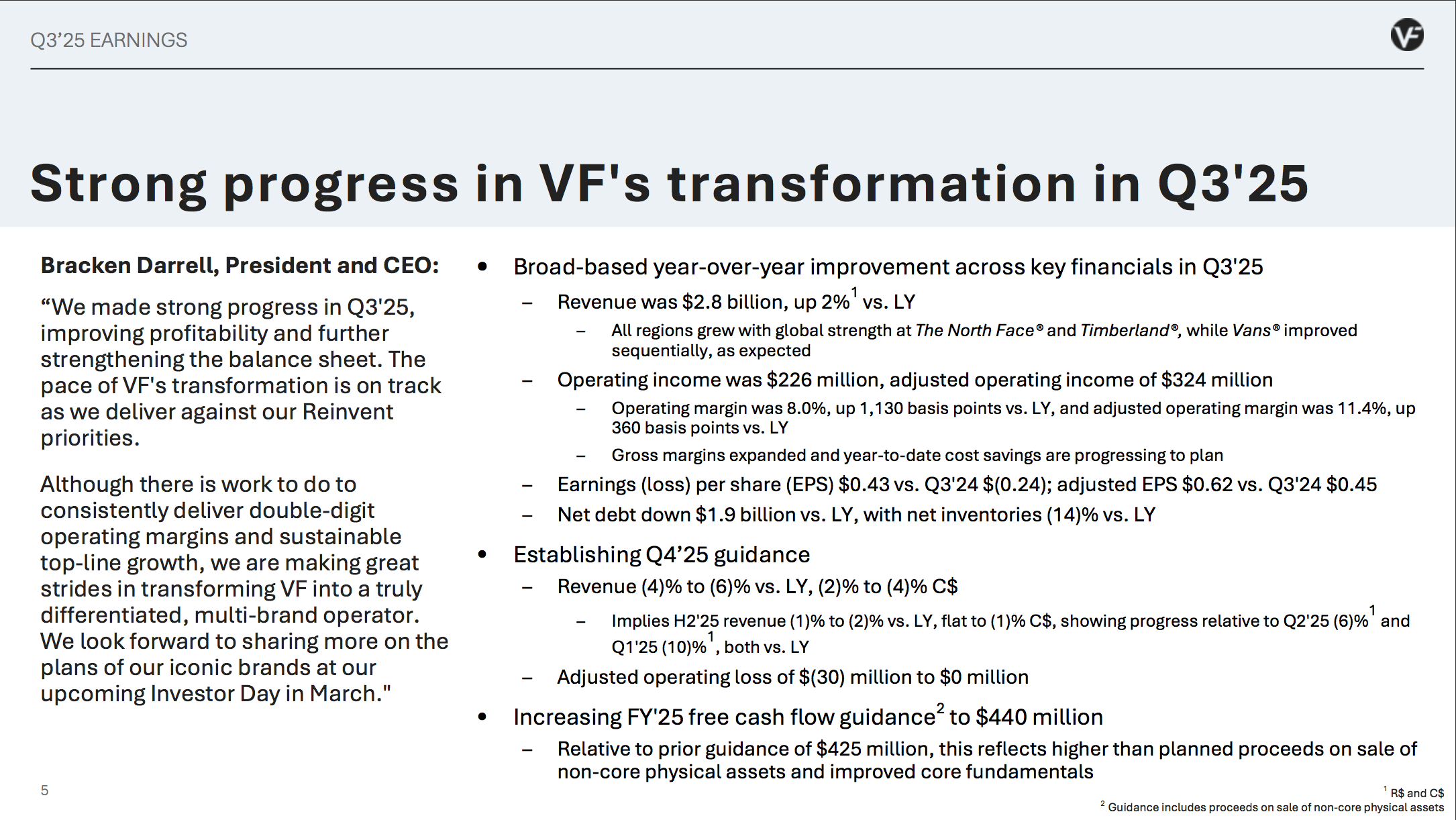

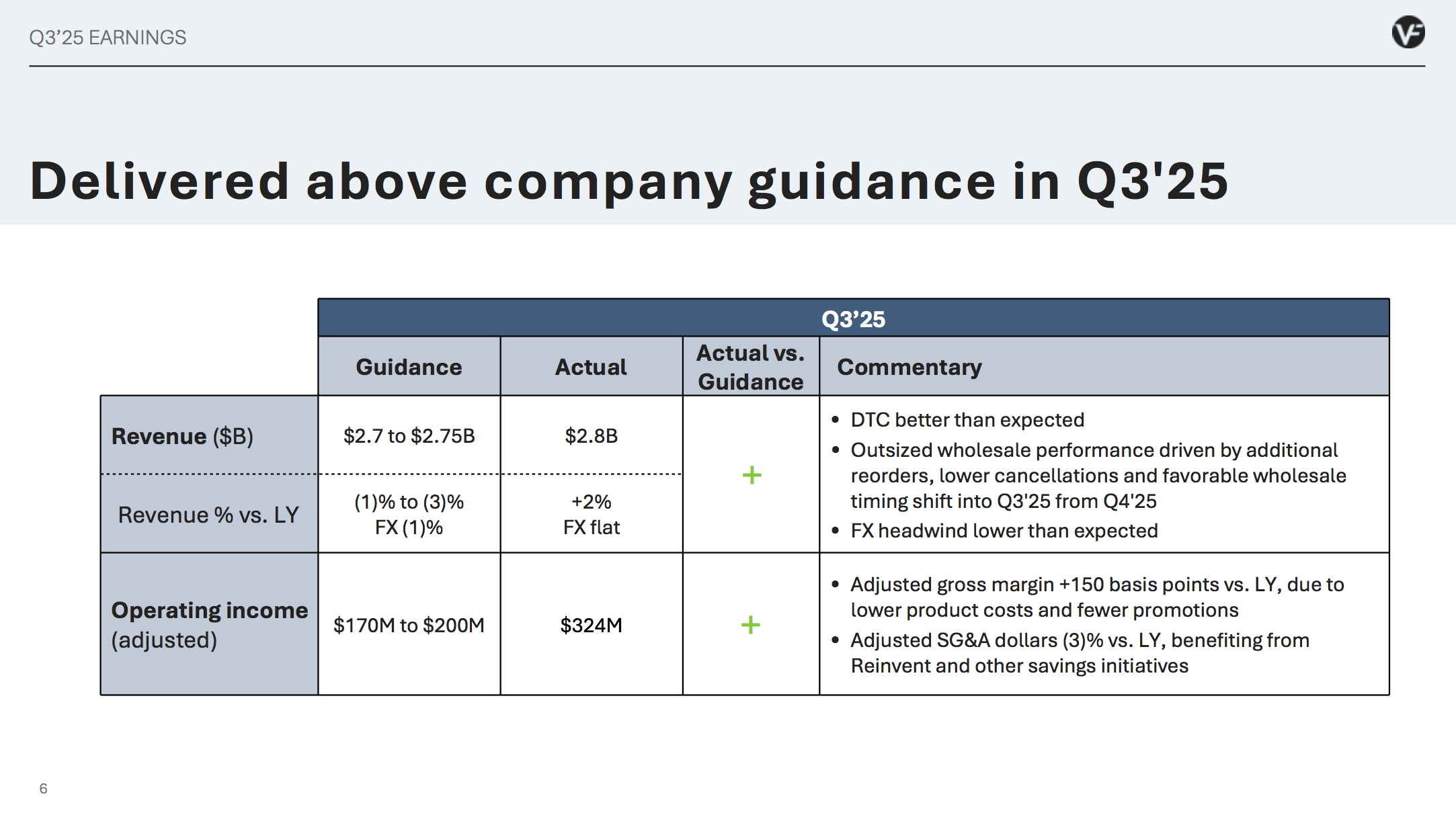

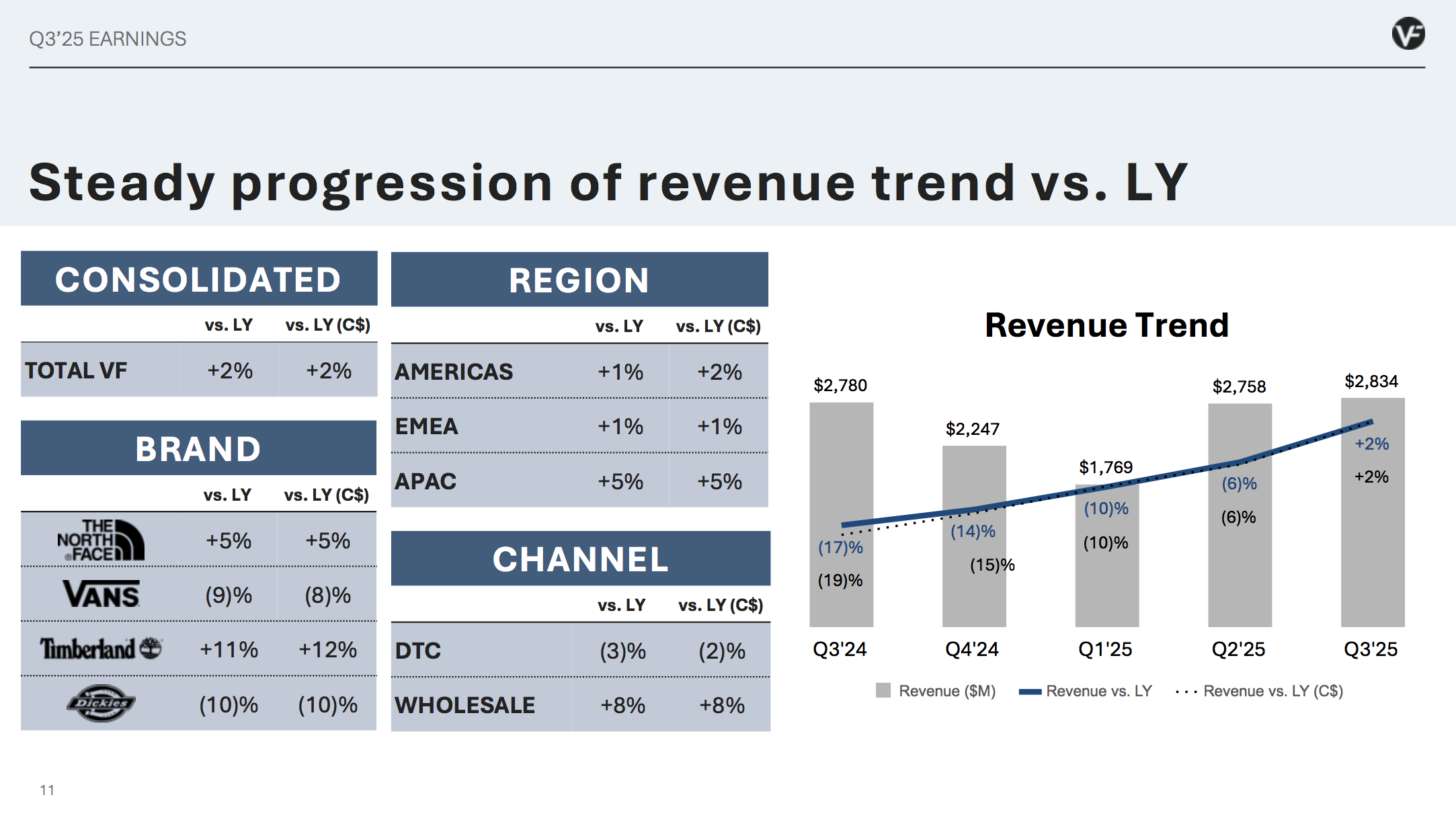

1) Beat earnings estimates: Revenue of $2.83B (+1.8% Y/Y) beats estimates by $80M. Q3 Non-GAAP EPS of $0.62 beats by $0.28.

2) EBIT came in way ahead of expectations at $324M, beating the $207M consensus and blowing past the $170M to $200M guidance. Gross margins were up by 150 basis points, and operating margins jumped 360 basis points to over 11%.

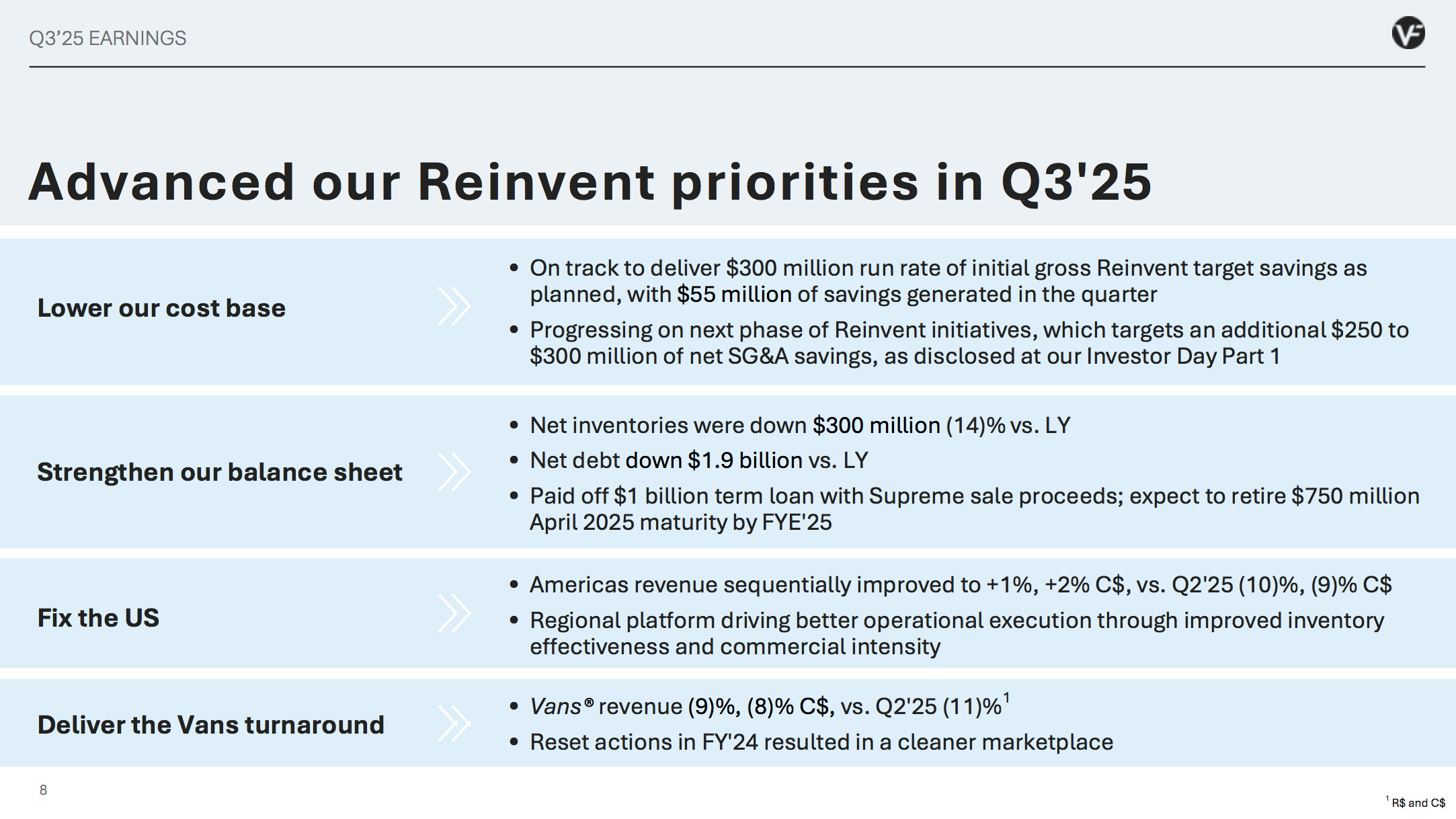

3) Revenue grew by ~2%, and almost every brand showed sequential improvement. The Americas had another strong quarter, turning positive for the first time in over two years.

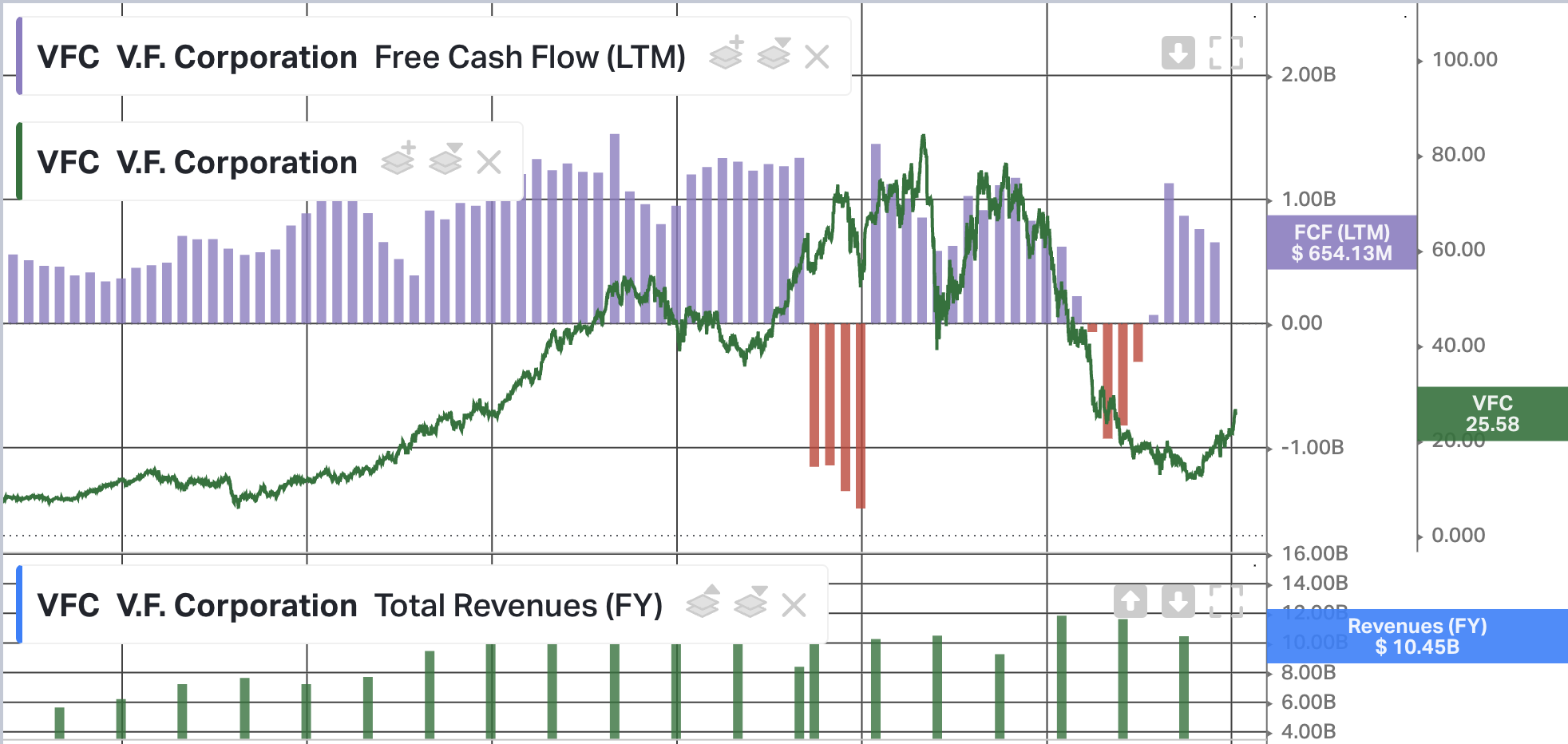

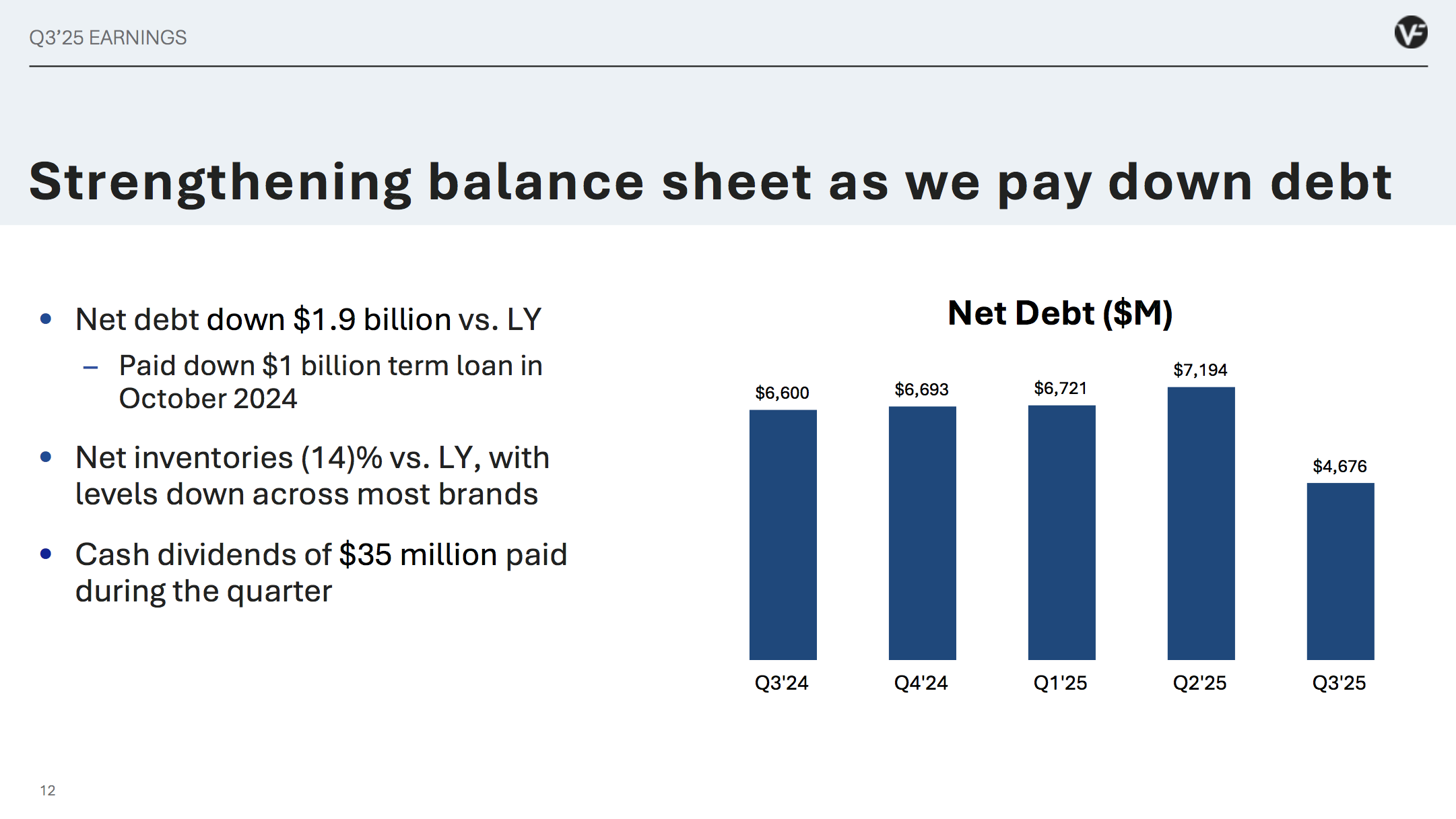

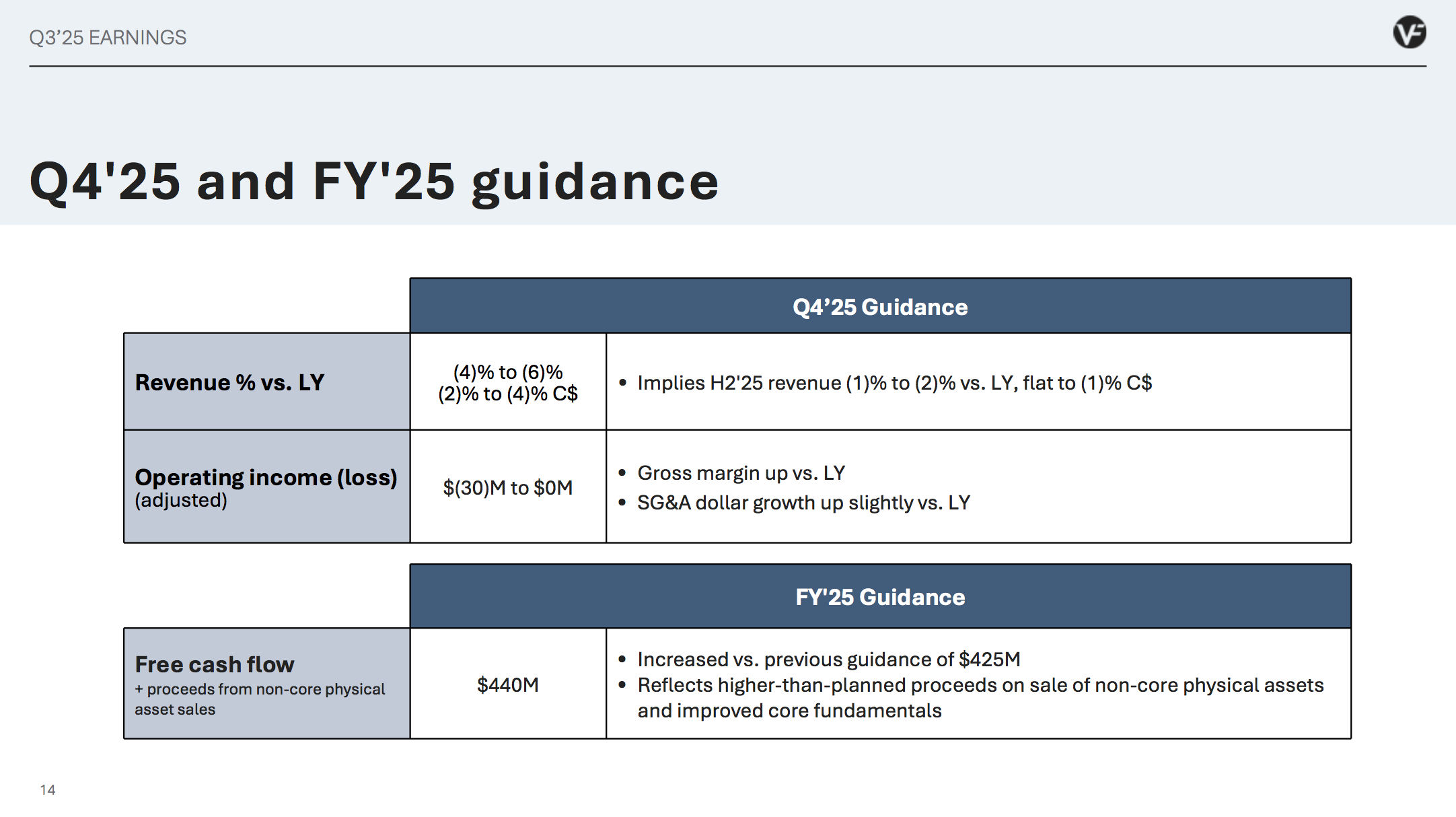

4) Top priority is still deleveraging the balance sheet, and the increase in FY’25 free cash flow guidance to $440 million from the prior $425 million is exactly what investors need to see.

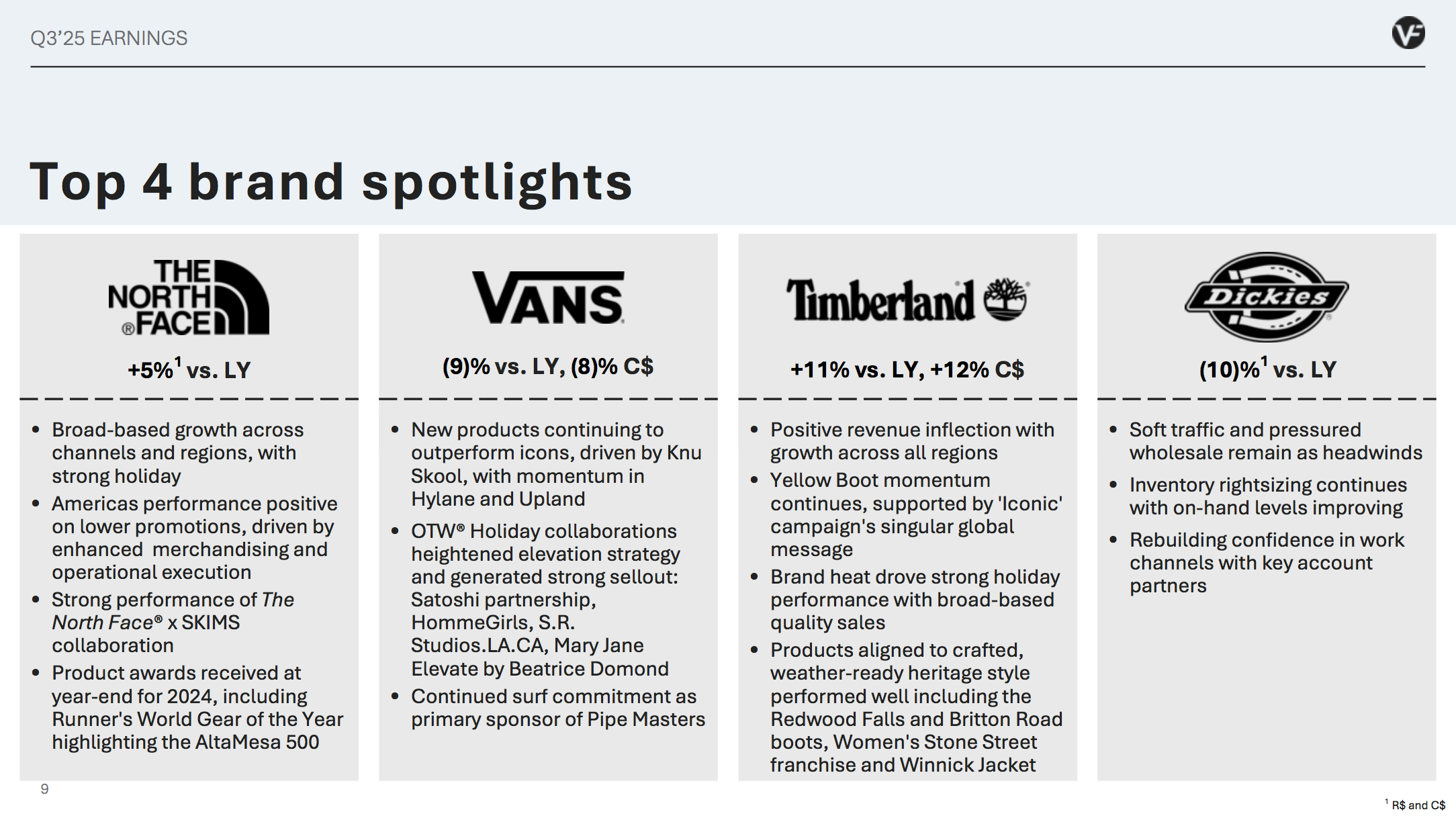

5) The North Face saw a 5% revenue increase compared to last year, with growth across all regions. Additionally, the collaboration between The North Face and SKIMS became one of the fastest-selling collections in the brand’s history.

6) Vans keeps improving, with Knu Skool staying the top growth driver and the second-biggest franchise globally. This strong performance in new products is key for the turnaround.

7) Timberland was a bright spot for the quarter, with revenue up 12% compared to last year.

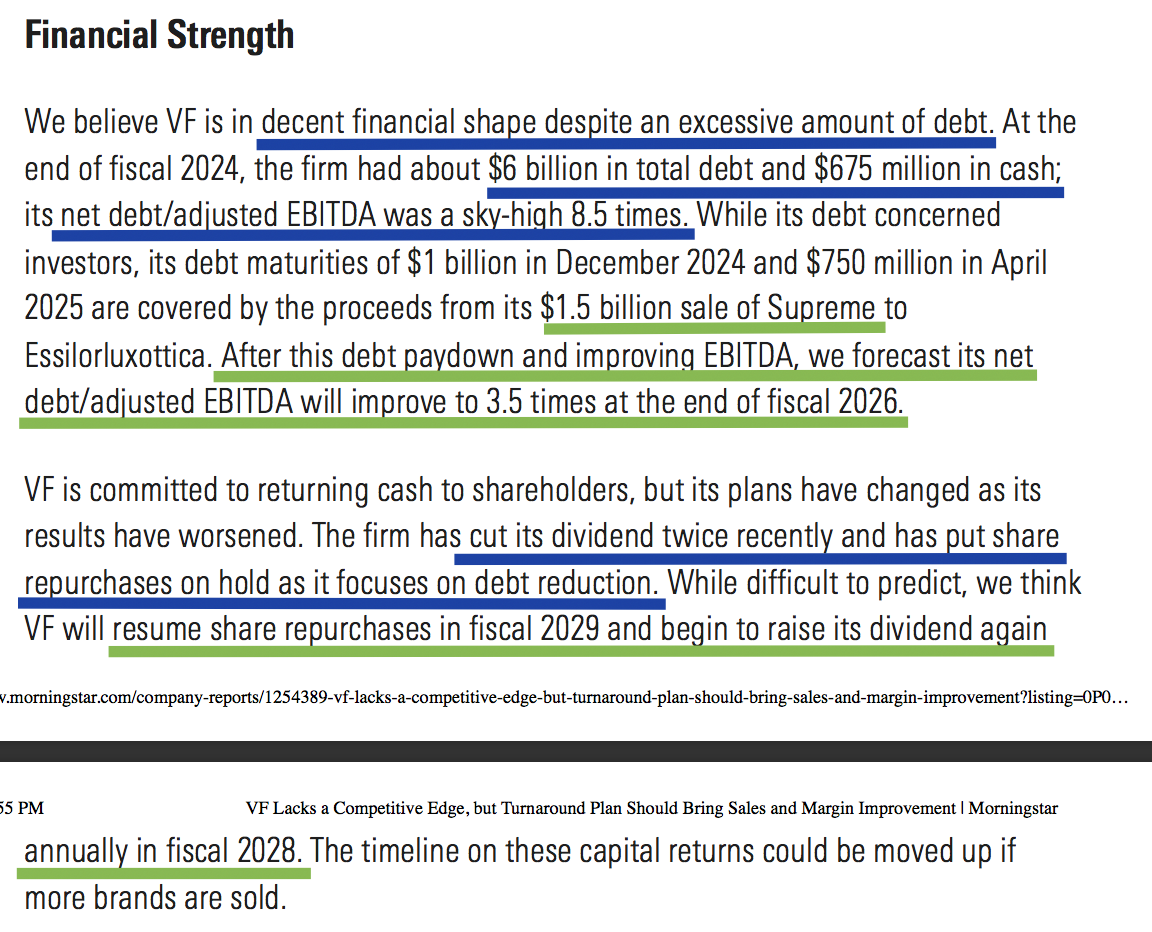

8) Reduced net debt by nearly $2 billion compared to last year. Excluding lease obligations, net debt has been cut by almost 40% over the past year, and the company remains on track to achieve its overall goal of 2.5x net leverage.

9) Paid off $1 billion term loan with Supreme sale proceeds; expect to retire $750 million April 2025 maturity by FYE’25.

10) Progressing to the next phase of the Reinvent initiatives, which aim to achieve an additional $250 to $300 million in net SG&A savings.

General Market

The CNN “Fear and Greed” ticked up from 43 last week to 48 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

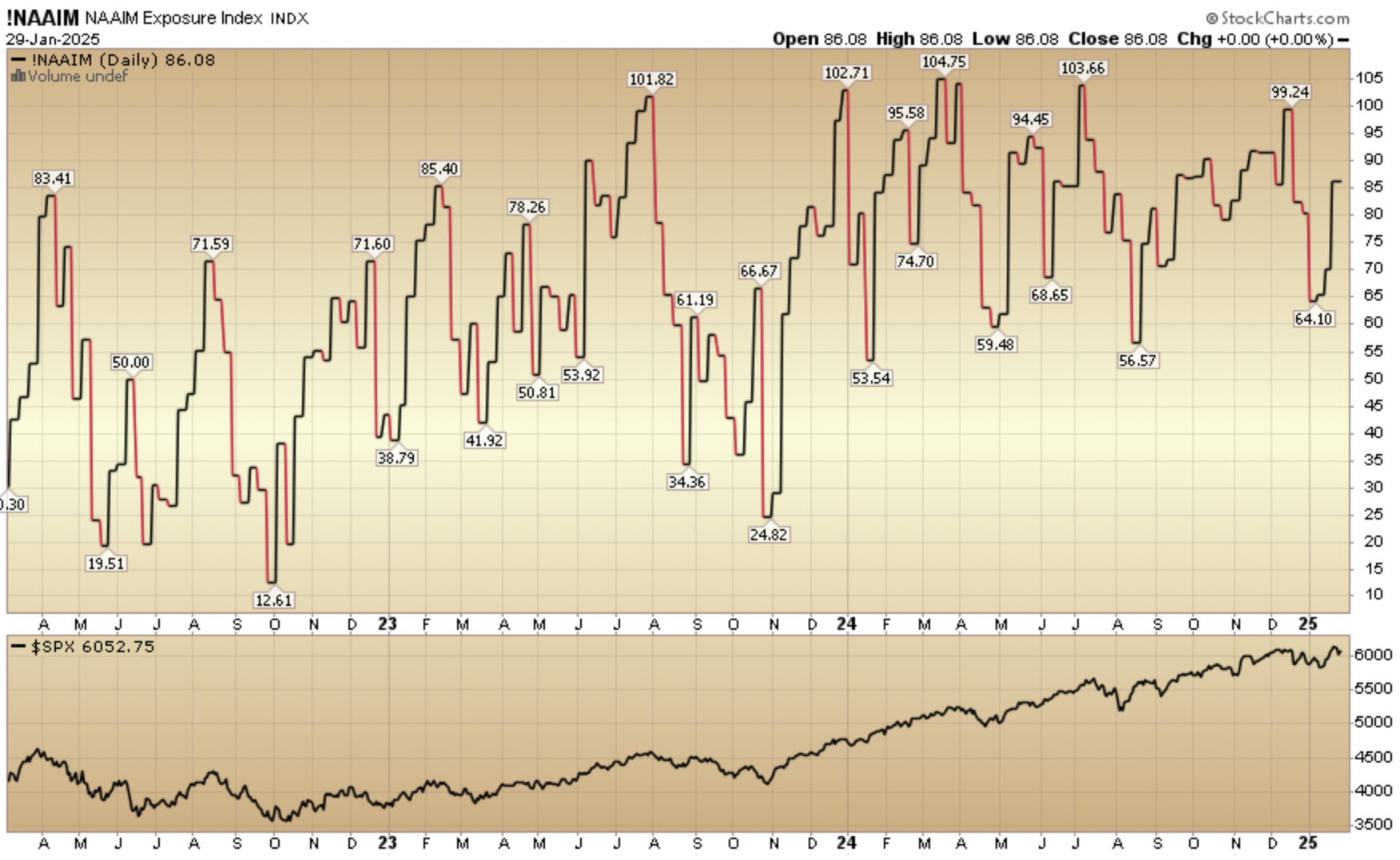

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 86.08% this week from 70.21% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms