Boeing Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

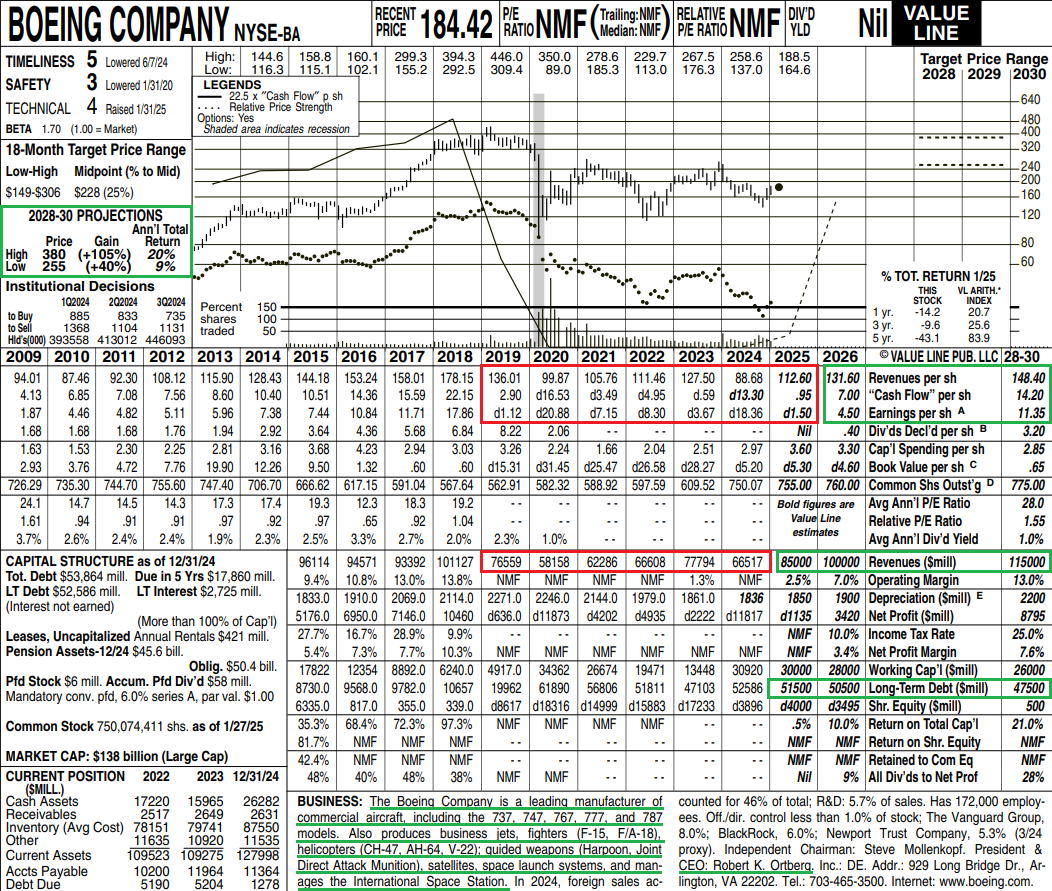

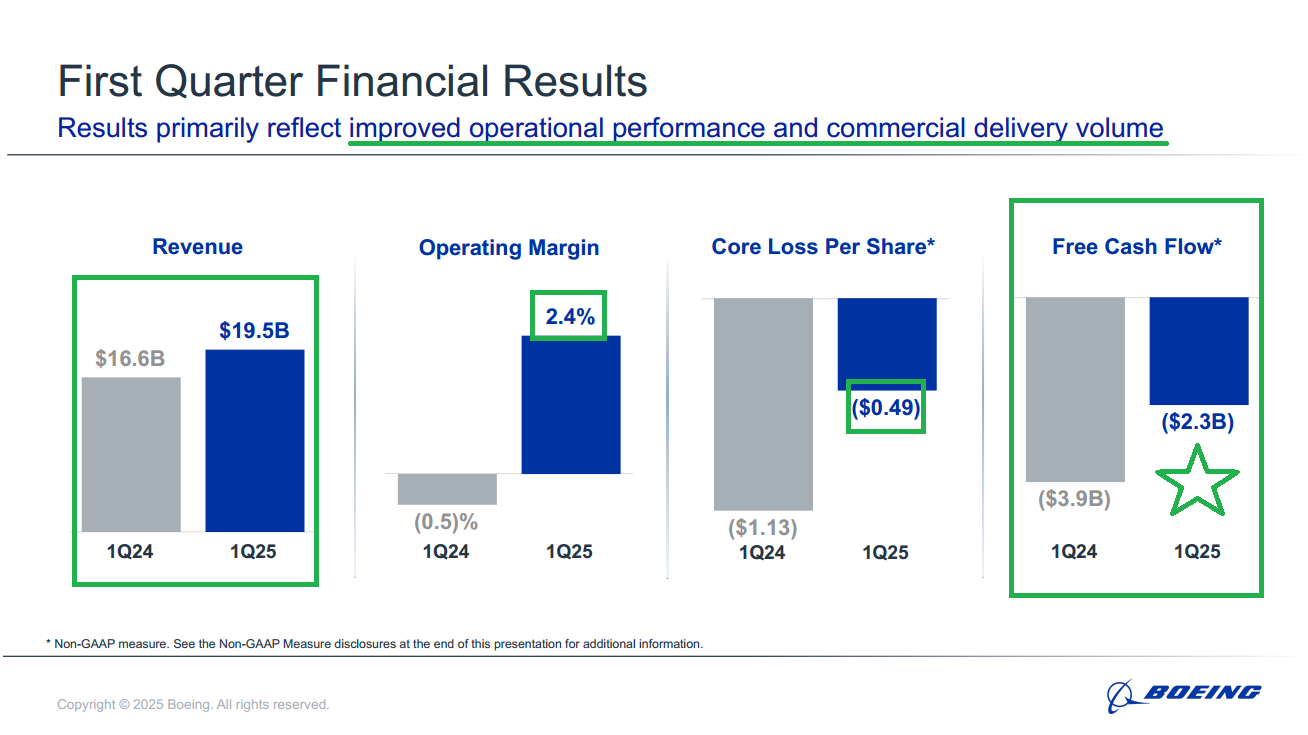

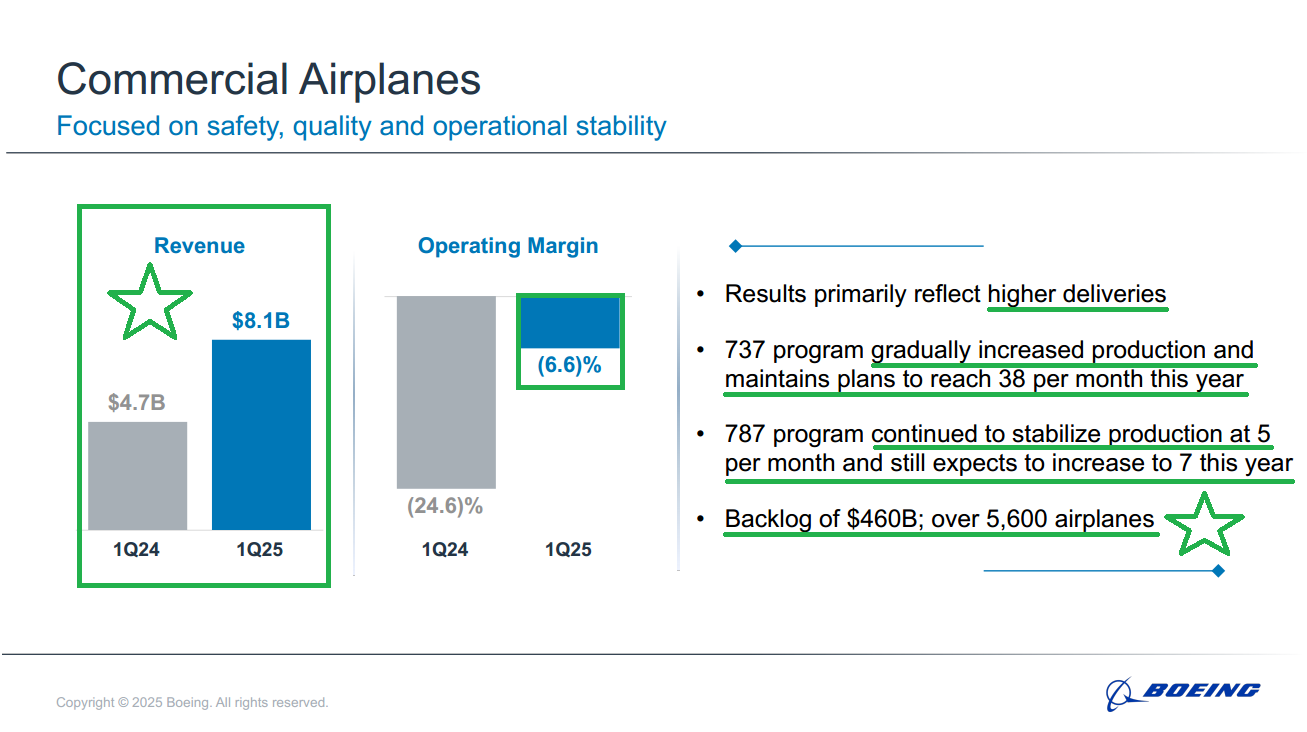

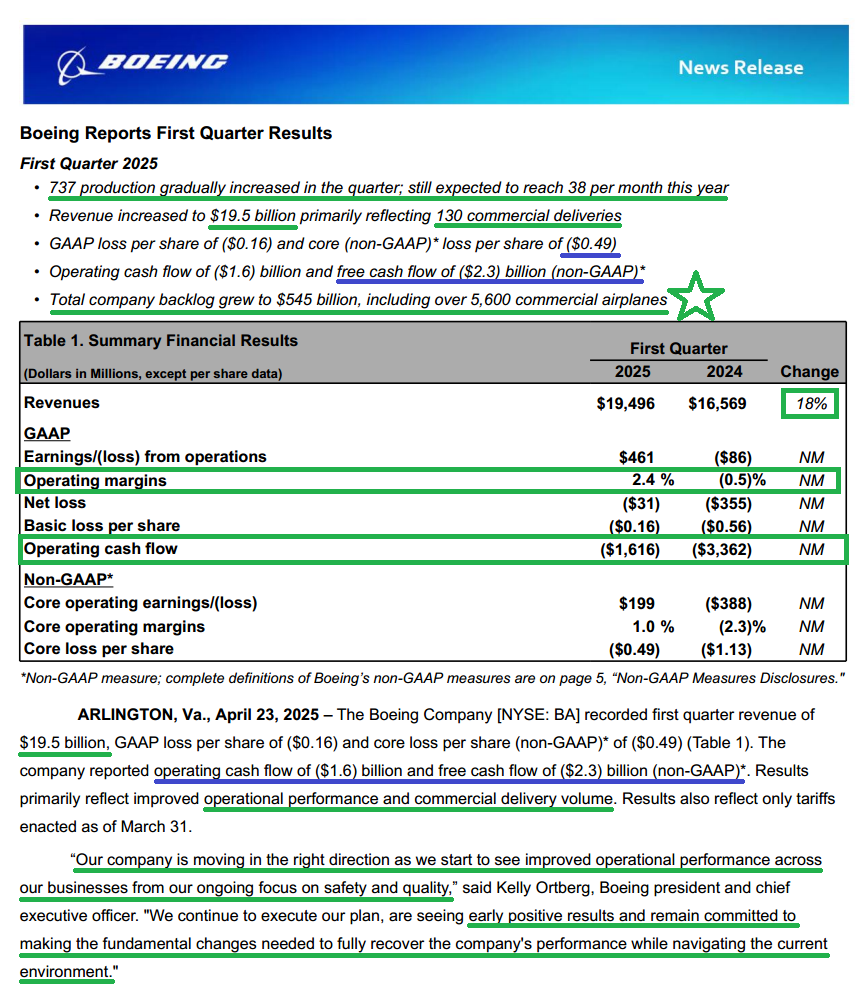

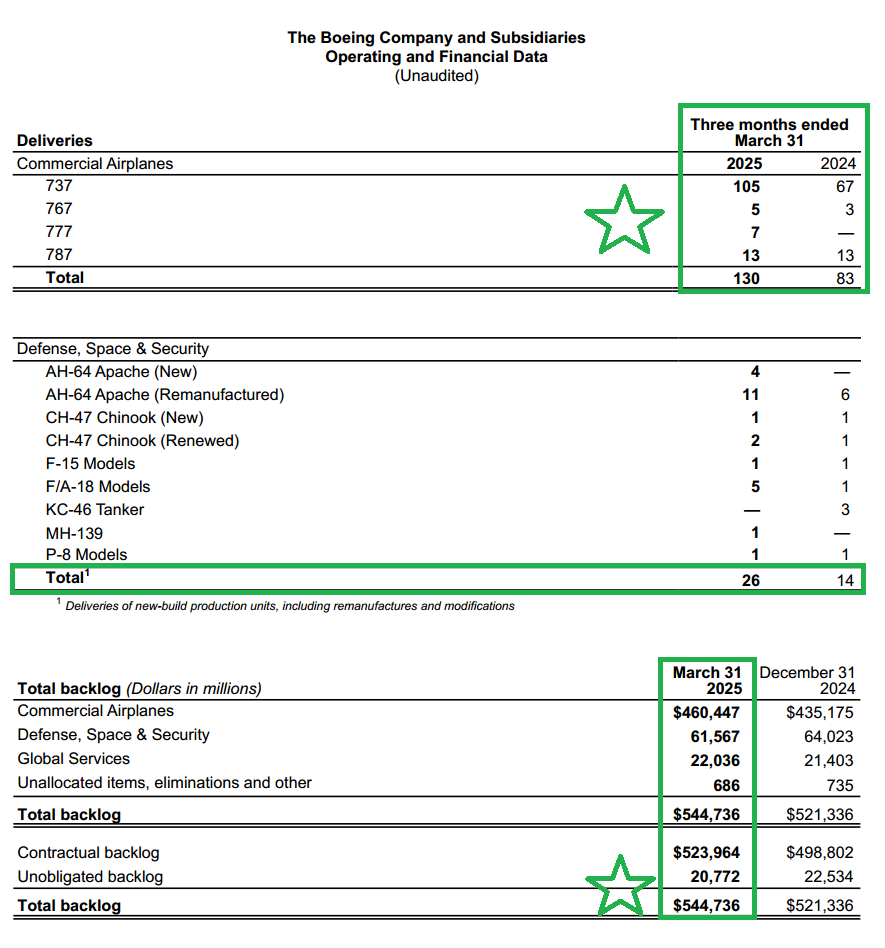

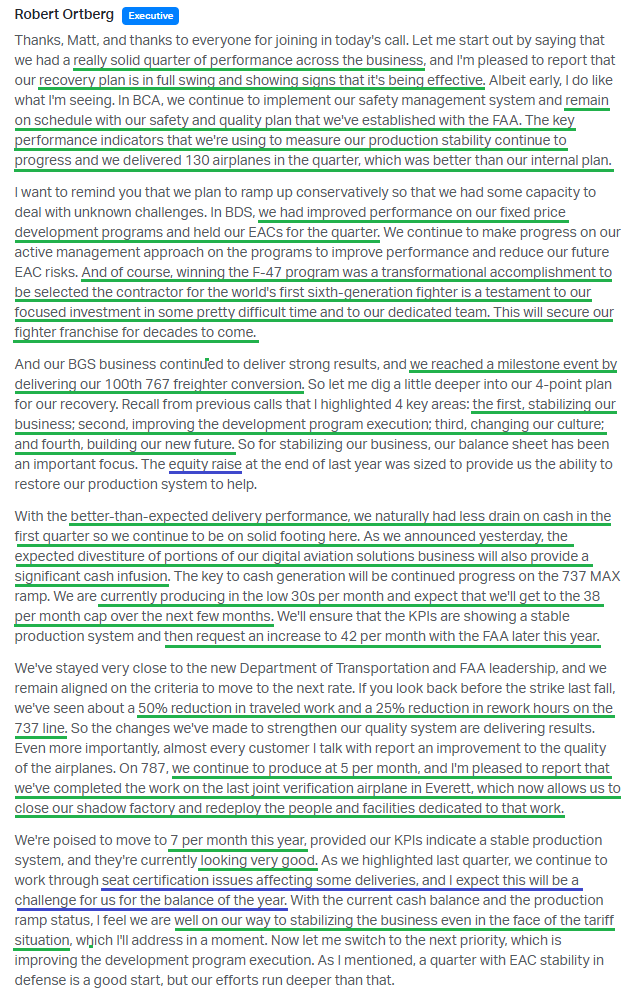

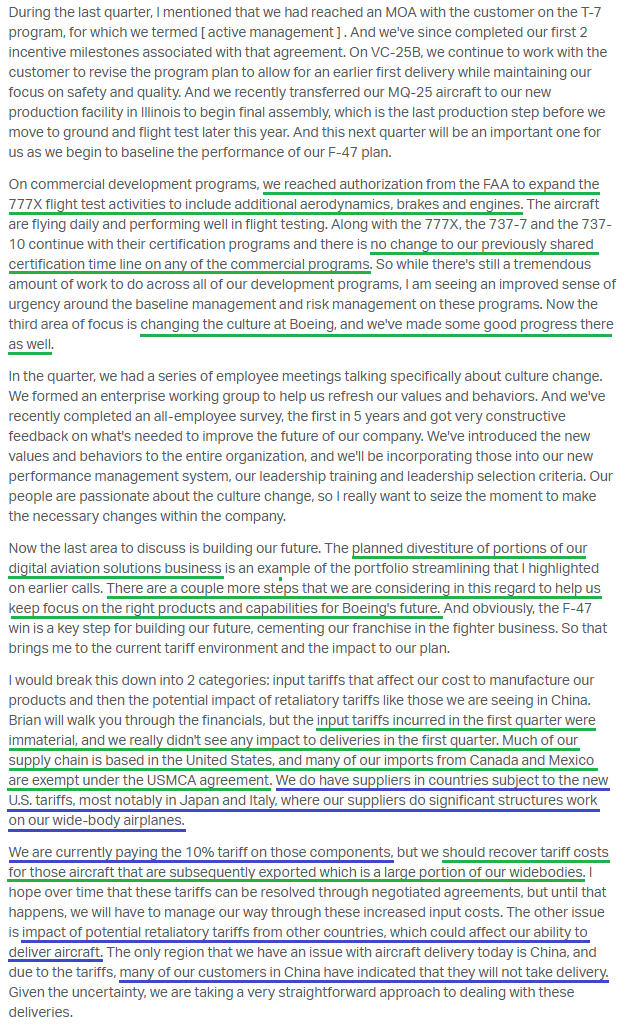

Boeing delivered a strong Q1 earnings report yesterday, beating top and bottom-line expectations. Revenue came in at $19.50 billion (+18% YoY), slightly ahead of consensus estimates at $19.49 billion. EPS was ($0.49), MUCH BETTER than consensus expectations of ($1.25).

The market certainly liked what it saw and viewed Q1 as a step in the right direction. It feels like investors are finally waking up to what we’ve been pounding the table on for the better part of the last year. Boeing, despite its flaws and missteps (and there have been plenty), still operates in a GROWING GLOBAL DUOPOLY WITH OVER A $0.5 TRILLION BACKLOG. You can get a lot of things wrong, but when you’re in a business like that, it’s hard not to have a recovery.

Like we’ve said before, customers of Boeing really have two options:

1) They can say, Boeing, I’ve had enough of your issues and delays. I’m taking my business to Airbus. To which Airbus will say, Fantastic, we’re happy to have you. You can expect your plane in about 10 years.

OR

2) Boeing, this process has been frustrating. Please get your act together. I’d really like that plane now, and if you’ve got any extras, I’ll take all I can get.

And in real time, we’re seeing that dynamic play out. Countries and airlines are jumping at the chance to scoop up any planes refused by China and move up in the queue.

So certainly, Boeing has that kind of business working in its favor. But they also have something else going for them, which we like to call the Kelly Ortberg effect. During his time at Rockwell Collins, Ortberg doubled sales in six years and quadrupled the company’s value for shareholders before selling it to United Technologies at a nice premium in 2019. More importantly (and unlike his predecessor), he comes from a hands-on engineering background. When you’re in the business of making planes, that’s a pretty helpful quality. Now Boeing is his next project, and we wouldn’t be surprised to see similar results over the long term.

Speaking of Kelly Ortberg, he joined CNBC following the earnings release yesterday. Here’s what he had to say:

Here’s a detailed breakdown of everything you need to know following Boeing’s first quarter:

10 Key Points

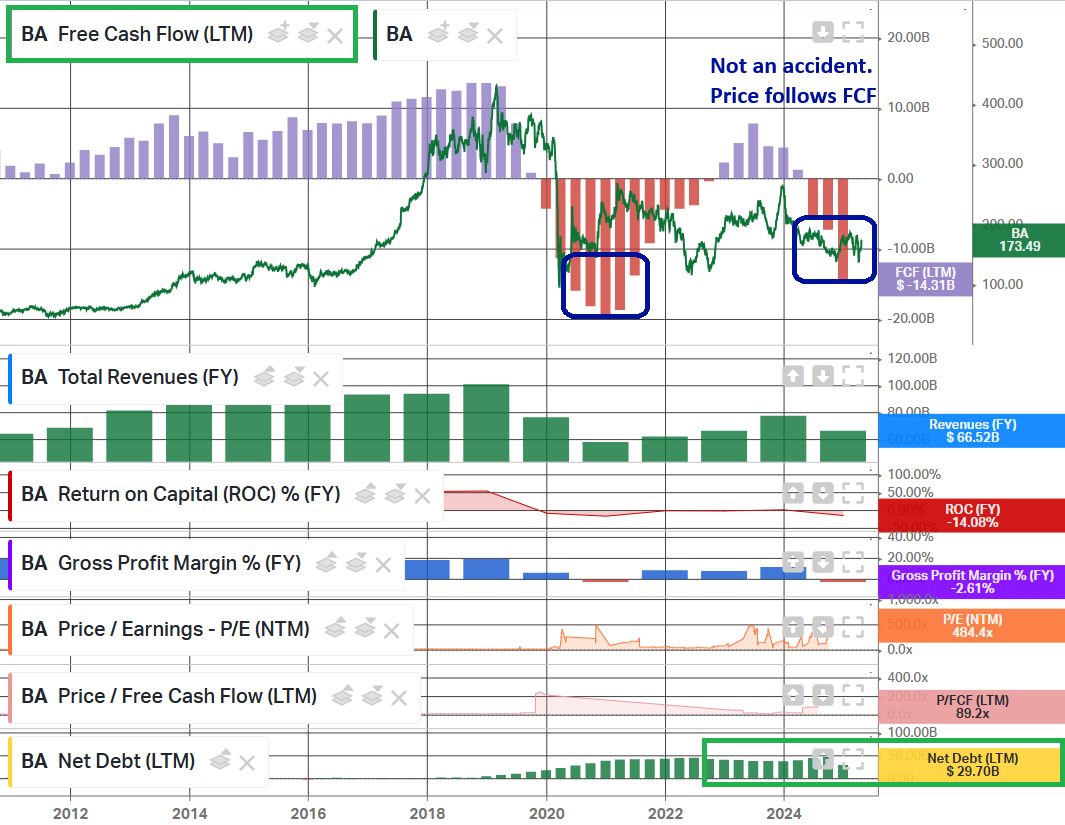

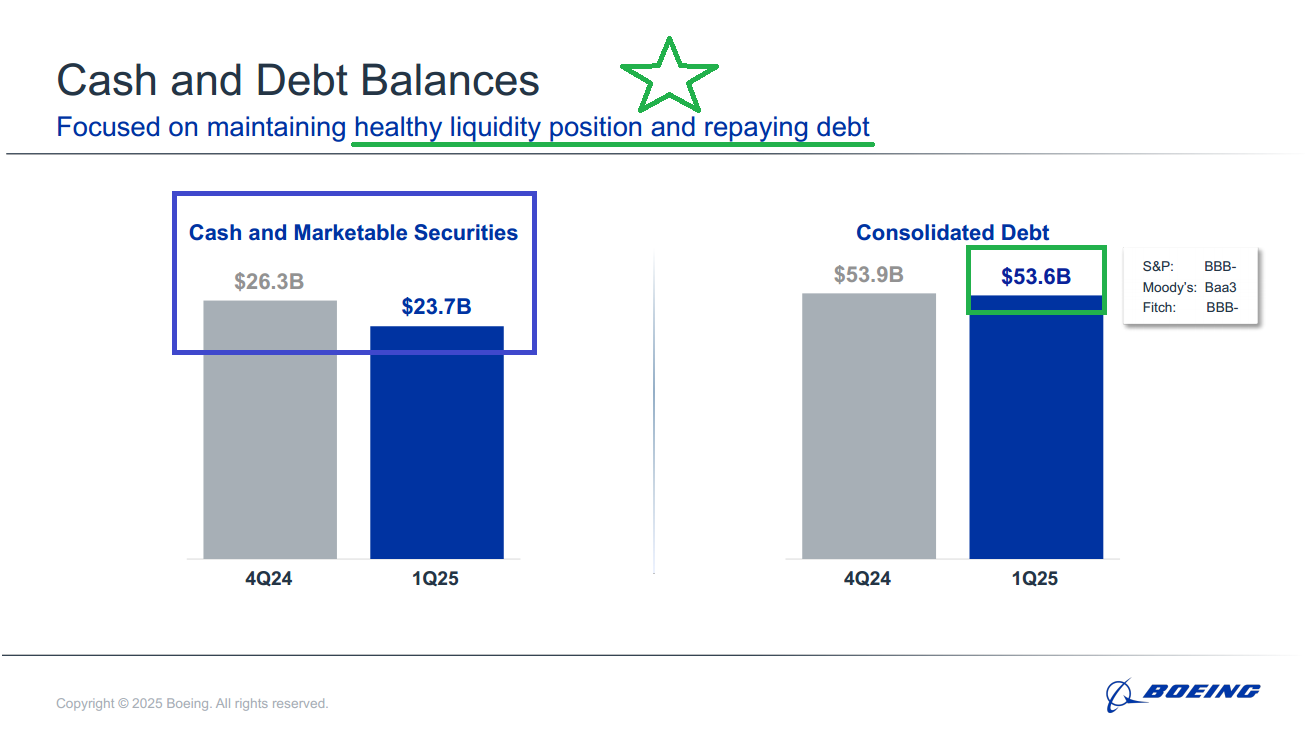

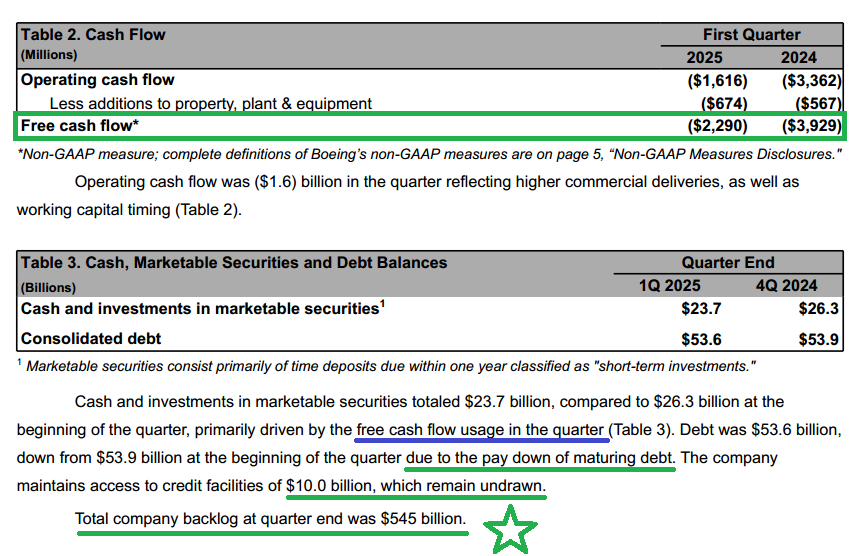

1) Free cash flow usage came in MUCH BETTER THAN EXPECTED at ($2.3B), versus previous Q4 guidance of (~$4B) and analyst consensus estimates of ($3.6B). Boeing remains well on track to achieve positive free cash flow in the second half, with an acceleration into year-end. The previous full-year FCF usage guidance of ($4-$5B) remains unchanged, but it assumes a “CONSERVATIVE PLAN.” If Kelly Ortberg and the team continue executing as they are, expect that usage to look MUCH DIFFERENT.

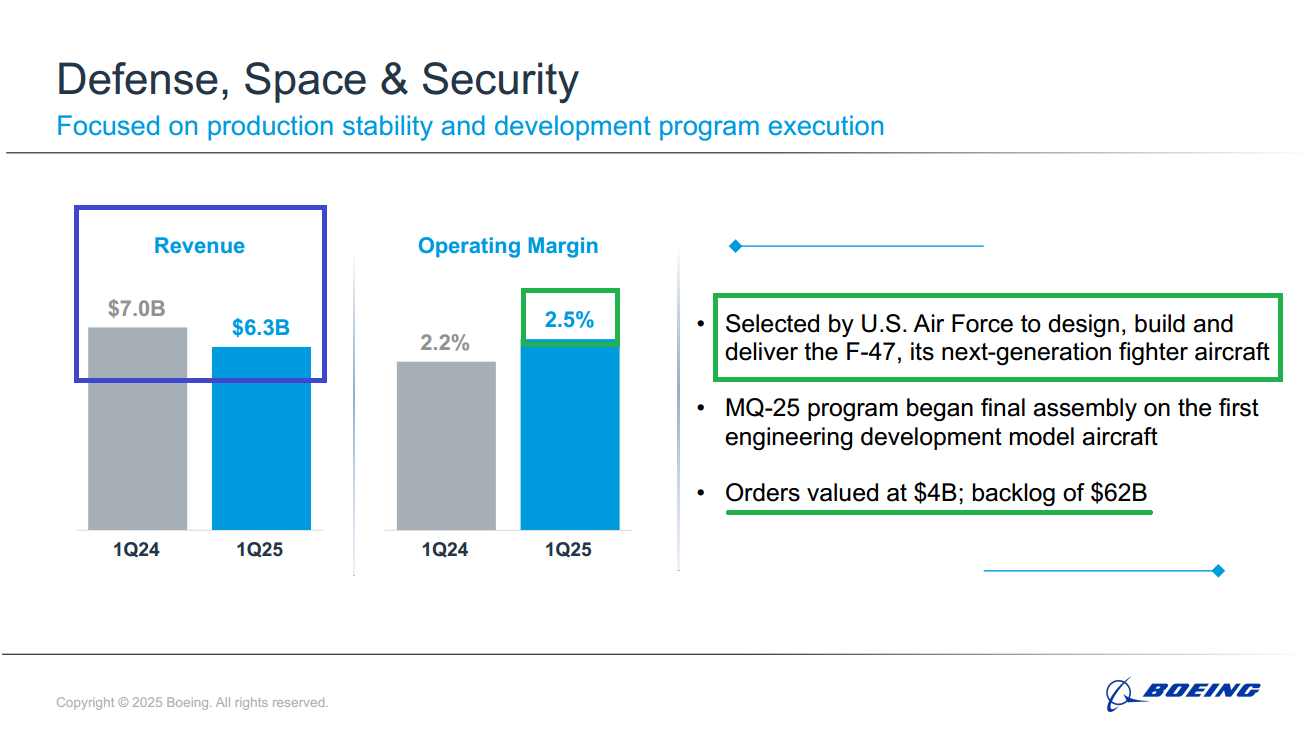

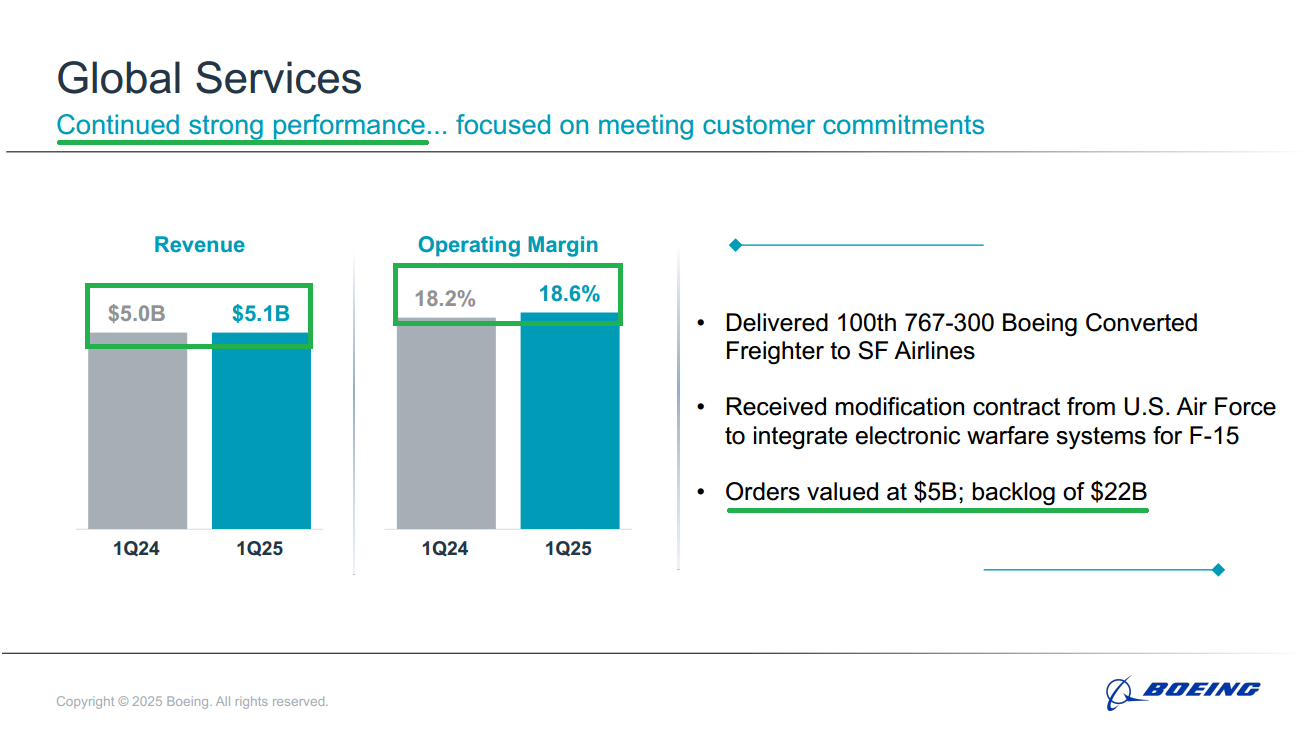

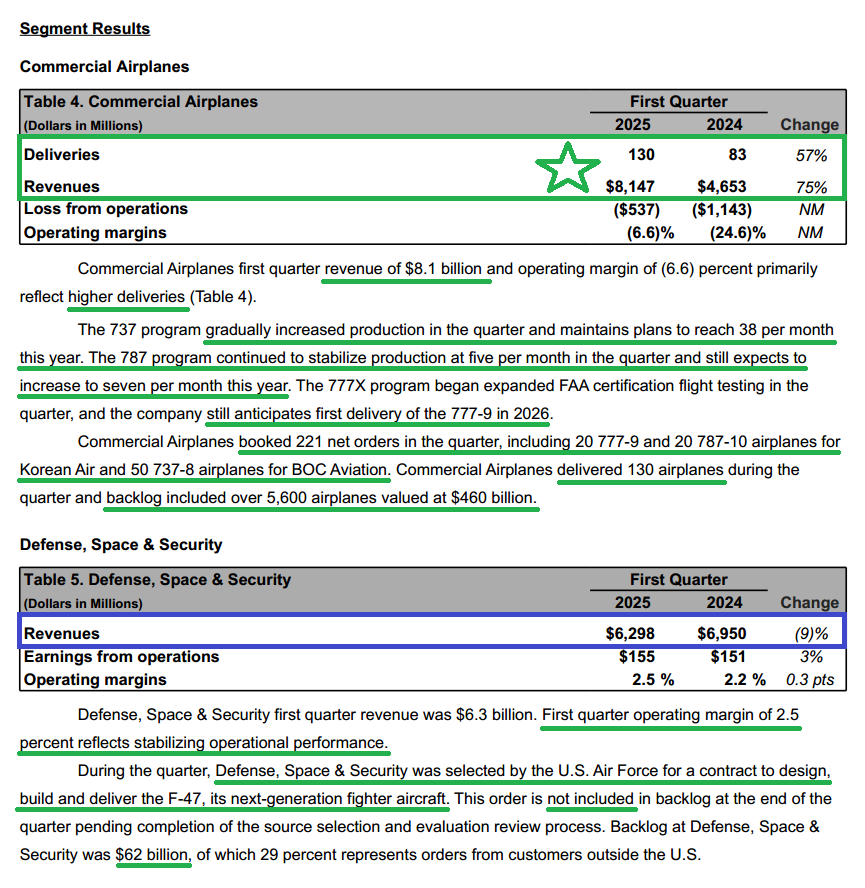

2) Commercial backlog grew by more than $25B sequentially, reaching $460B, which includes over 5600 airplanes and translates to more than 7 years of production. Total commercial bookings during the quarter were 221 net orders. Defense, Space, and Security booked $4B in orders, growing the backlog to $62B, which DOES NOT INCLUDE the new F-47 contract. Including Global Services backlog, this brings TOTAL COMPANY BACKLOG to $545B.

3) 737 MAX production continues to ramp up, currently running in the low 30s per month with plans to stabilize at the 38 per month cap OVER THE NEXT FEW MONTHS. Once production settles at that level, Boeing will request FAA approval to increase to 42 per month, a move expected later this year. After that, output will rise in increments of 5 per month, with at least 6 months between each step. This puts Boeing well on track to reach its 50+ per month production target during 2026—levels not seen since the pre-crash/pre-pandemic peak of 52 737s per month back in 2018.

4) 787 production is currently running at 5 per month, with the next rate increase to 7 expected in the coming months and the potential for even higher output into year-end. With an extra $1B invested in the Charleston facility, production capacity is certainly not an issue here. The long-term goal remains to return to DOUBLE DIGIT MONTHLY PRODUCTION RATES.

5) The elephant in the room for Boeing was tariff exposure, particularly the risk associated with China. Management did a great job laying out their framework on this. China represents about 10% of Boeing’s commercial backlog and around 3% of the total company backlog. Management had planned for roughly 50 China deliveries this year. Nine of these planes are not yet in the production system, and management has already begun working to reassign those positions to other customers. For the remaining 41 planes, Boeing will begin remarketing them, mostly through repainting and other cosmetic changes, before reassigning them to other customers. At the end of the day, China tariffs are a short-term headwind for Boeing and will not jeopardize the production recovery. There is ZERO pullback in demand for aircraft. Everyone wants the planes, and Boeing will have no problem remarketing them to new customers.

6) The net annual impact of tariffs on input costs is less than $500 million annually. Boeing already has a solid inventory buffer, all at pre-tariff costs. Aluminum and steel are virtually all US-sourced and represent just 1-2% of the average cost of the airplane, with most other imports from Canada and Mexico exempt under the USMCA agreement. Outside of that, Boeing’s exposure is primarily to Japan and Italy, where they have already begun paying the 10% tariff on those components. However, with ~80% of commercial deliveries occurring outside the US, management expects to recover these tariff costs once the planes are delivered.

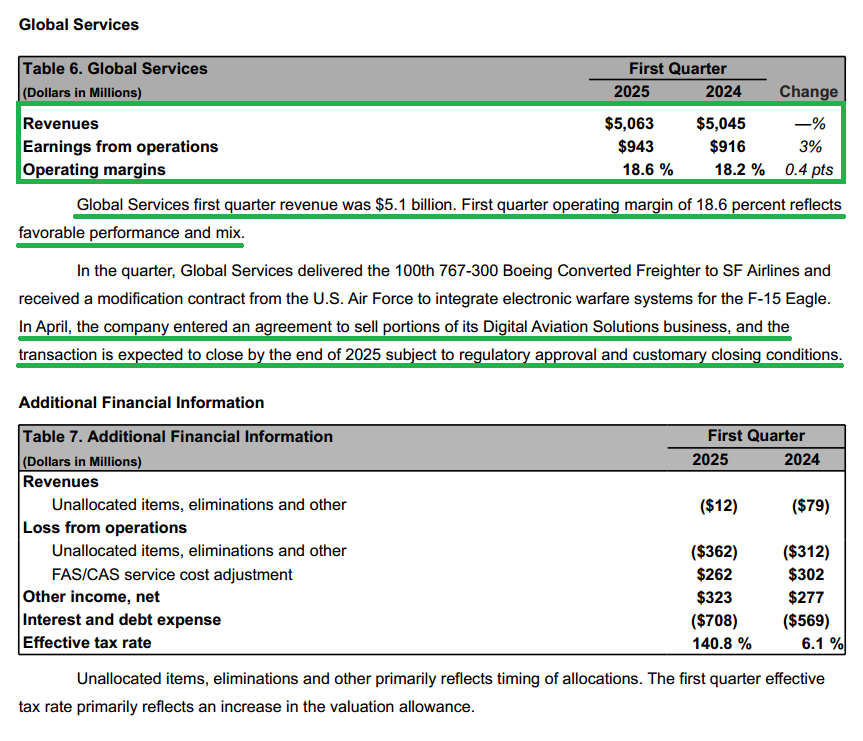

7) Boeing is selling parts of its Digital Aviation Solutions business to Thoma Bravo in an all-cash $10.55B deal, pruning the portfolio to double down on what it does best: making planes. The deal is expected to close by year-end, with ~$10B in net after-tax proceeds.

8) The 777X received FAA authorization for additional aerodynamics, brakes, and engine testing, with daily flights ongoing and performing well. The first delivery is still expected in 2026, which will be a massive step in reducing the cash burn associated with the program, which saw an $800M increase in inventory during Q1.

9) During Q1, Boeing was selected as the contractor for the world’s first sixth-generation fighter jet, winning the F-47 program. The deal is expected to exceed $50B and, most importantly, is structured to guarantee profit through the development stage, unlike previous fixed-price contracts that carried undue risk and turned into money-losing ventures.

10) All six KPIs continue to perform well and show stability, with every metric currently in the green, including final ticketing, which had been below required thresholds during Q4.

Earnings Call Highlights

Morningstar Analyst Note

General Market

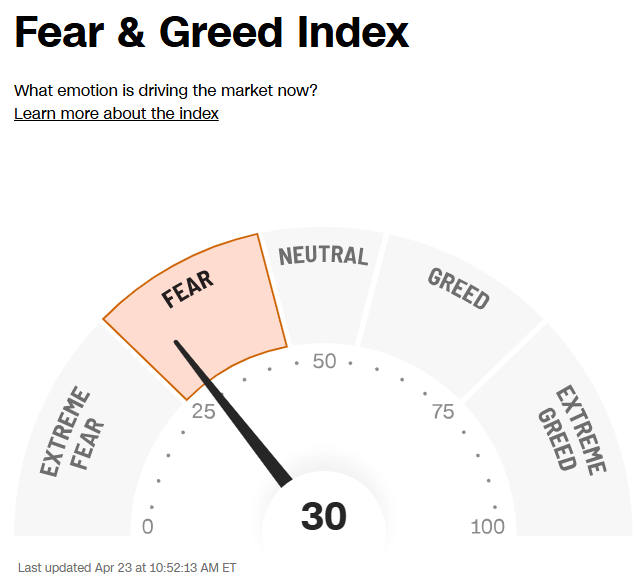

The CNN “Fear and Greed Index” ticked up from 18 last week to 30 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

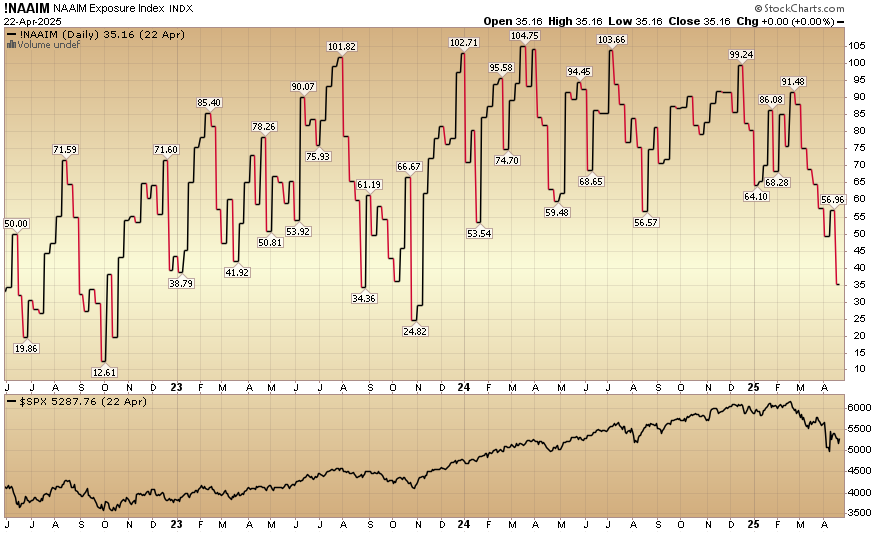

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 35.16% this week from 56.96% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.