General Market Updates

On Friday, I joined David Lin on “The Lin Report” to discuss implications of the front-loaded 50bps Fed cut. Thanks to David for having me on. As always, my conversations with David have a history of going viral and pulling significant engagement. This was a good one! Watch here to find out why:

On Wednesday, I joined Neil Cavuto on Fox Business to discuss the prospect of cuts and the implications on equities looking forward. Thanks to Neil and Jenna DeThomasis for having me on:

Also on Wednesday, I joined Chris and Mary on CBS News to discuss the Fed and impact on consumers. Thanks to Camille Smith for having me on:

On Monday, I joined Sean Callebs on CGTN America to expound on the impact of Fed Cuts – particularly as it relates to currencies, Emerging Markets and China. Thanks to Sean and Ryan Gallagher for having me on. Shortly after this interview (~1.5 hours later), the PBOC Chief announced a 50bps rate cut (and other stimulus measures were unleashed):

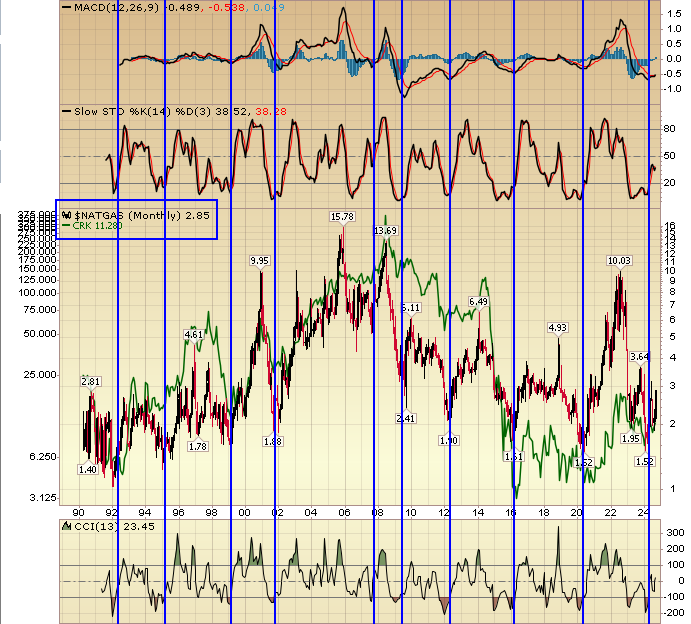

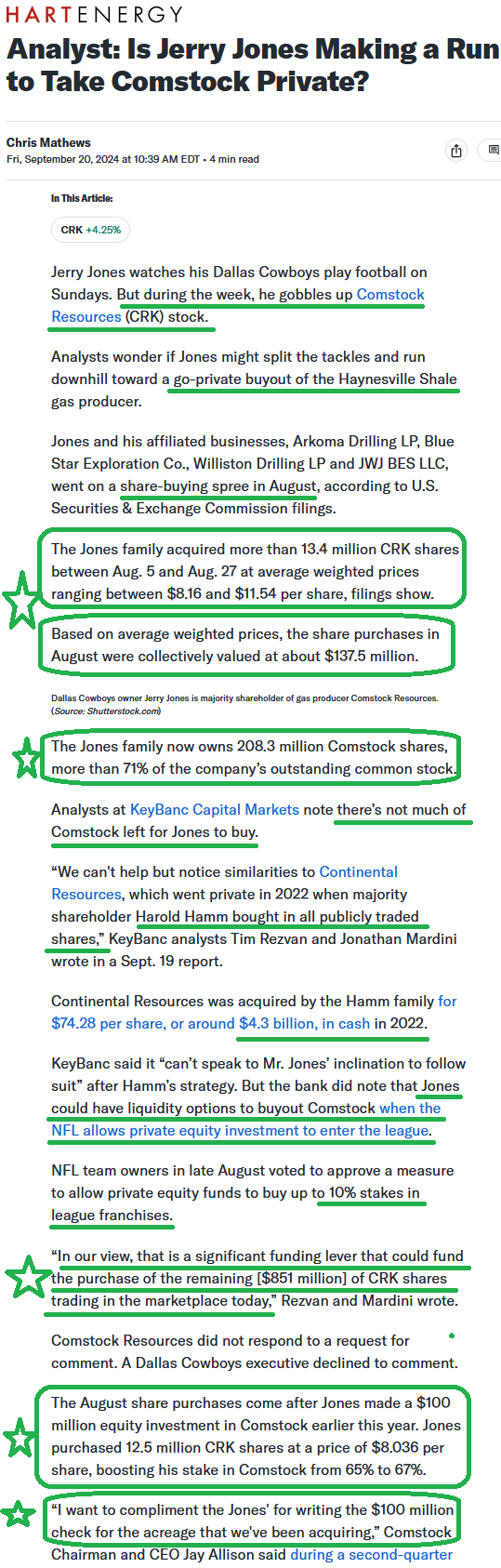

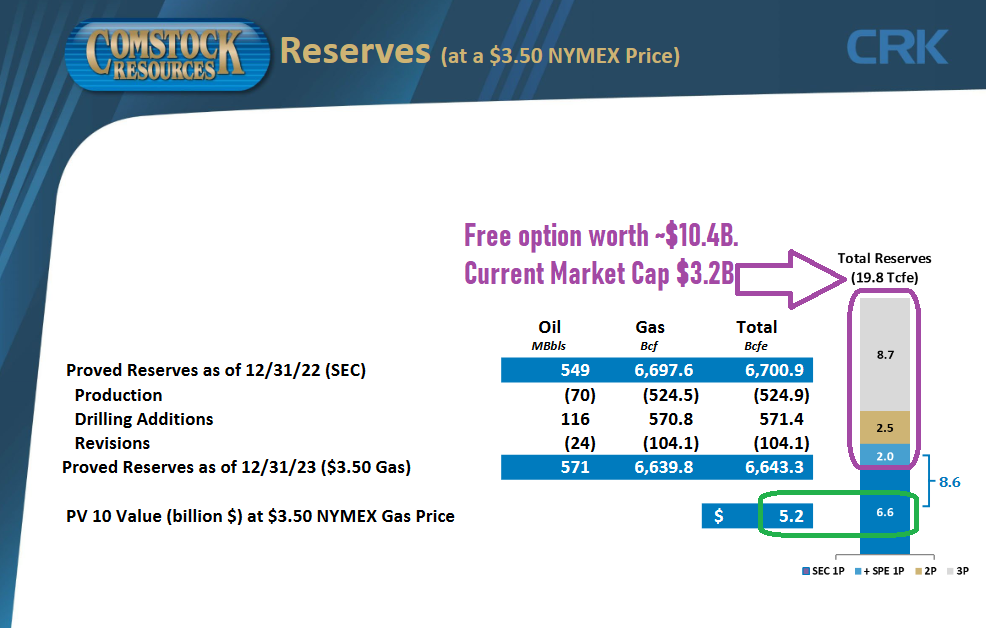

Comstock Resources Update

Each week we try to cover 1-2 companies we own and/or have discussed in previous podcast|videocast‘s.

Tune In

Thursday morning I will be live at the NYSE with Kristen Scholer at 9:30am followed by Yahoo! Finance at 2pm with Brad Smith. Friday I will be on Fox Business with Liz Claman at 3pm.

Here are a few things I am thinking about that I intend to touch on:

– How investors should position after rate cuts/ahead of potential rate cuts/Where investors should be putting their money:

Key themes:

- Un-Magnificent 493 will outperform Magnificent 7 (earnings growth accelerating for 493, decelerating for 7)

- Small Caps outperform Large Caps by 11% in first 12 months following first cut.

- Value outperforms Growth in the first 6 months following 1st

- Discretionary will outperform Staples as managers hit excess overweight “defensives” ahead of Fed cut.

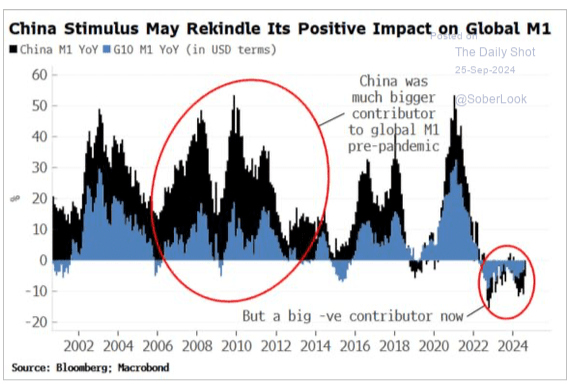

- Emerging Markets with outperform Developed Markets as dollar continues to weaken (China stimulus – launched monetary bazooka with rate cuts, mortgage rate reduction, $100B stock market fund). Starting fiscal stimulus with $22B in handout to poor.

– How should investors play this most recent rally:

-Many positioned for volatility in September that didn’t really come. In an election year there is tendency to see October pre-election stock market volatility prior to year-end rally following the election.

-Sentiment still not extreme as Consumer Confidence, Growth Outlook and Profit Outlook from managers still subdued.

– “The stock market is never obvious. It is designed to fool most of the people, most of the time.” — Jesse Livermore Right now a lot of people are expecting an October correction so potentially, the “most pain” would be grinding sideways (consolidate) until election to burn through all of the put premium. Time will tell…

– Favorite sectors/least favorite sectors

-Buy Small Caps/Value/EEM. 50bps cuts in, another 50bps in 2024/100bps in 2025. Rates decline for borrowers (Sm Cap/EEM), USD weaken helps EEM/China.

-Avoid Utilities/Staples (defensives) (overstretched short term)

– Tips for investors – if on major margin, lighten up into October volatility. We are staying mostly invested and will ride any bumps – but low leverage.

– What’s the most underappreciated/under the radar indicator right now that most market participants are missing? OR What’s the biggest overlooked risk?

One in the same. Option Skew (cost to insure 1-2SD corrections) hit a 10 year record. Shows managers have bought a lot of protection against a big correction. This CAN precede corrections but not always:

What is skew?

The SKEW index is calculated using S&P 500 options that measure tail risk—returns two or more standard deviations from the mean—in S&P 500 returns over the next 30 days. The primary difference between the VIX and the SKEW is that the VIX is based upon implied volatility round the at-the-money (ATM) strike price while the SKEW considers implied volatility of out-of-the-money (OTM) strikes.

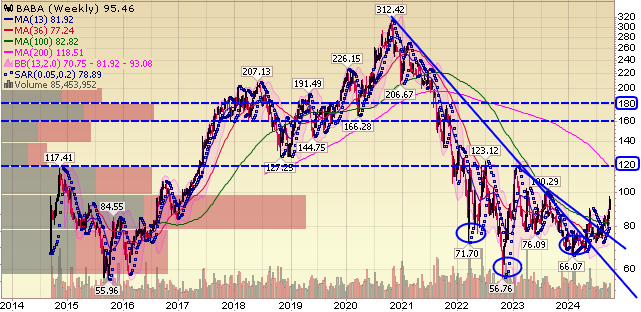

BABA Update

I didn’t intend to do an update on Alibaba this week – as I just did one after earnings in August:

However, given the developments of Government stimulus I thought it would make sense to touch base on it.

Fiscal Stimulus this week (so far):

- The ministries budgeted 154.7 billion yuan ($22 billion) for financial assistance and subsidies to people in extreme poverty, orphans and the homeless.

Monetary Stimulus this week (so far):

Source: (JPM & GS)

- Most comprehensive set of monetary easing since 2015. Key points (a) much larger than expectations (b) came all at once (with intent to restore market confidence).

- #1 – MONETARY EASING = Cutting the RRR -0.5% and the 7D reverse repo rate -0.2% to 1.5%

- #2 – MORTGAGE RATE CUTS = Lowering the IR on outstanding mortgage. The PBOC announced mortgage rates will be cut by an average 0.5%, which they estimate to ease mortgage burdens for 150m people.

- #3 – LOWER PROPERTY DOWNPAYMENTS = Lowering the downpayment on 2nd homes from 25% to 15. This will make the 2nd home downpayment in-line with 1st homes.

- #4 – SETTING UP NEW SWAP FACILITY – To allow funds/brokers/insurers to tap PBOC liquidity to purchase equities. This will start at Rmb500bn in size with the potential to increase over time.

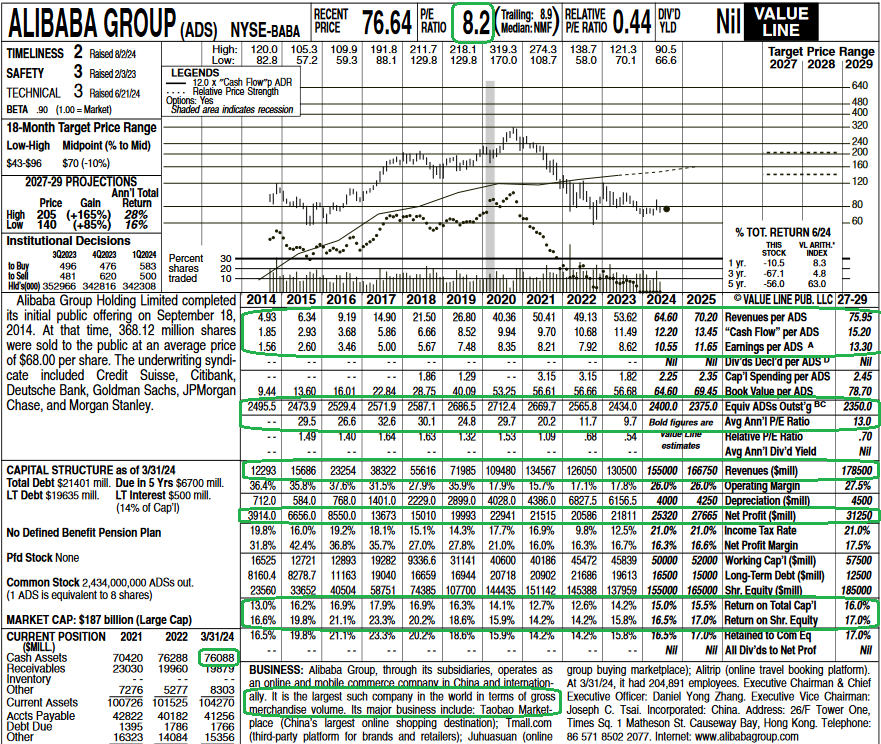

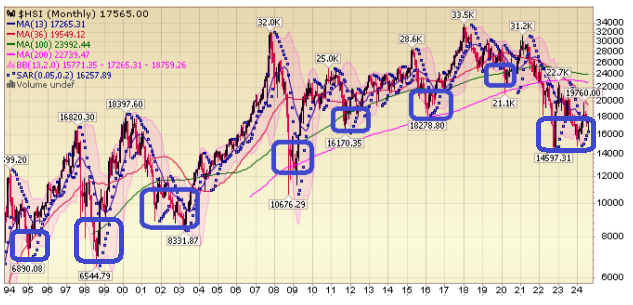

BABA has been trading between $65-80 most of the year. Now up ~50% off the lows ~$95 and just getting started. With Xi now serious about stimulus to meet 5% GDP target (both monetary and fiscal), individual Company fundamentals begin to matter again:

BABA traded at these levels shortly after IPO in 2014 (10 years ago). Since then: Revenues per share up 13x, Cash Flow and Earnings per share up ~6.5x. Double digit ROIC and generating $20-25B/yr FCF.

Buybacks Accelerating. Regaining share from PDD (Temu). Cloud business #1 in China/AI and gaining share/profitability. International up >30%.

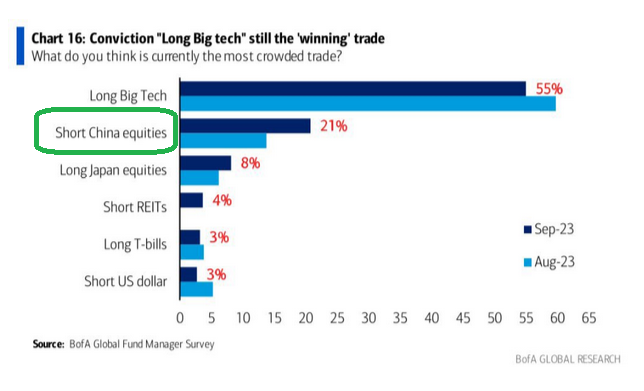

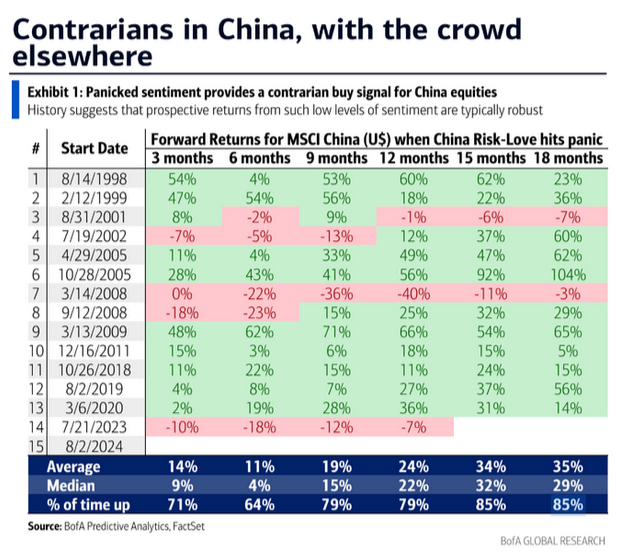

Very interesting time for all of these managers to get caught short Chinese Equities:

2 things to remember regarding Alibaba:

- People will doubt/hate the rally all the way up (the recency bias around “fake-outs” will have them buying short-term tops and selling short-term bottoms all the way up). When it becomes a consensus long (Opinion Follows Trend…) and commentators are uniformly enthusiastic about China/Alibaba, we will lighten up. We are a LONG way from that. This is in its nascent stages in my view.

- When you think “this time is different” on every pullback, pull up this chart we posted in August and sit on your hands or go for a long walk! (Opinion, not advice! See terms)

Now onto the shorter term view for the General Market:

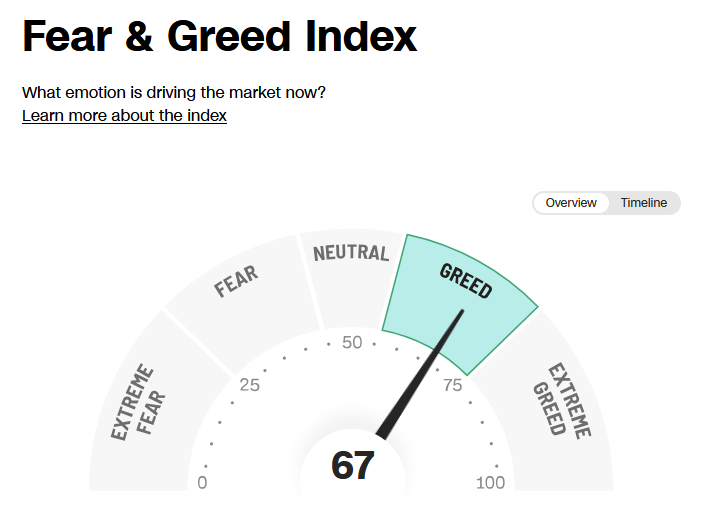

The CNN “Fear and Greed” moved up from 55 last week to 67 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 87.46% this week from 71.93% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 87.46% this week from 71.93% equity exposure last week.

Our podcast|videocast will be out Thursday night. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1, Q2 and Q3 raises so far this year. We successfully closed out our Q3 raise for smaller ($1M-$5M) accounts in July. We will be re-opening to smaller accounts ($1M+) in coming week(s). You may enter your info here to be among the first callbacks when we re-open.

Larger ($5-10M+) accounts can access “open enrollment” here.

*Opinion, Not Advice. See Terms