Last week we said, “while everyone debates whether we are going to have a ‘September Swoon’ or not, take a step back and look for sectors/stocks that have already had a ‘Summer Swoon’ and buy the quality stocks that are on sale.” In that context we talked about BA, CI, and EOG.

Our sanguine view has not changed. Here’s why:

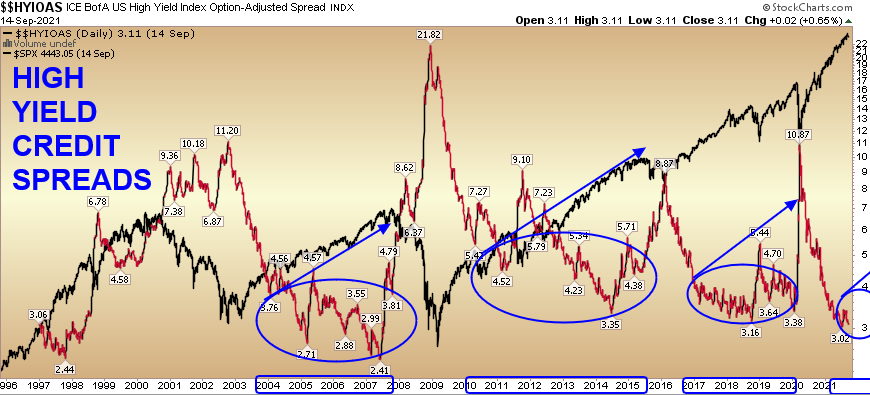

- High Yield Credit Spread contraction in EARLY DAYS:

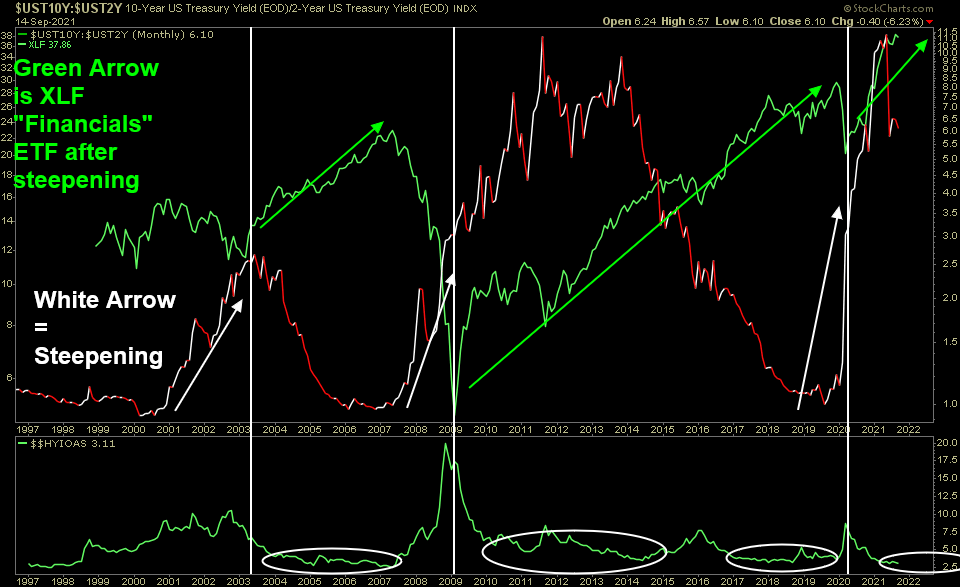

While I’ve shown the TOP part of this chart many times as a way to debunk the idea that we are “due” for a 10-20% correction because of “valuations” (i.e. you don’t get a bear market [20% correction] without a recession, and you don’t get a recession without a yield curve inversion and a choke off of credit), the bottom part of this chart is new. The green line at the bottom represents high yield credit spreads. While they are very compressed and credit conditions are as good as they’ve ever been, when they come off such pronounced levels (i.e. credit contraction/scare), the loose conditions tend to persist for multiple years (see featured chart at top of article citing multiple years of expansion after credit spreads come down) before blowing out once again. We are around one year into the credit cycle.

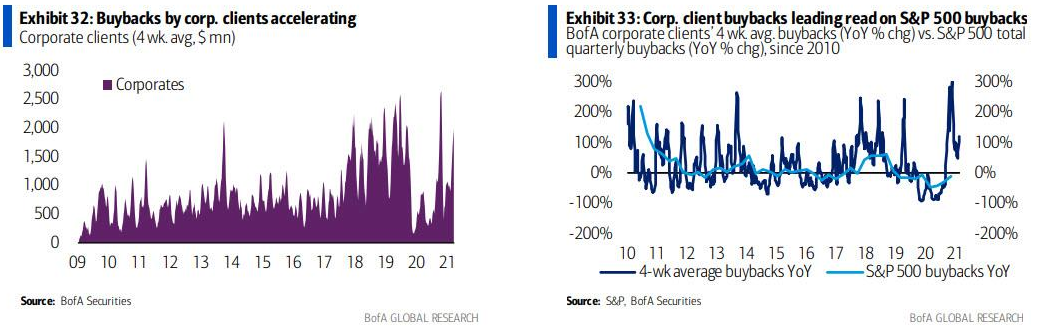

While I’ve shown the TOP part of this chart many times as a way to debunk the idea that we are “due” for a 10-20% correction because of “valuations” (i.e. you don’t get a bear market [20% correction] without a recession, and you don’t get a recession without a yield curve inversion and a choke off of credit), the bottom part of this chart is new. The green line at the bottom represents high yield credit spreads. While they are very compressed and credit conditions are as good as they’ve ever been, when they come off such pronounced levels (i.e. credit contraction/scare), the loose conditions tend to persist for multiple years (see featured chart at top of article citing multiple years of expansion after credit spreads come down) before blowing out once again. We are around one year into the credit cycle. - CORPORATE BUYBACK ANNOUNCEMENTS: ~$750B and more to come…

- Unyielding Liquidity: Assuming the Fed Announced a $15B Taper (per month) in November – to commence in December (I happen to think it will be punted until Q1 2022), it would still take until July 2022 to unwind the program, and over that period, ~$450B of additional liquidity would be pumped into the system (over and above the ~$4.2T pumped in since the pandemic). That figure excludes another ~$200-300B of principal and interest reinvestment:

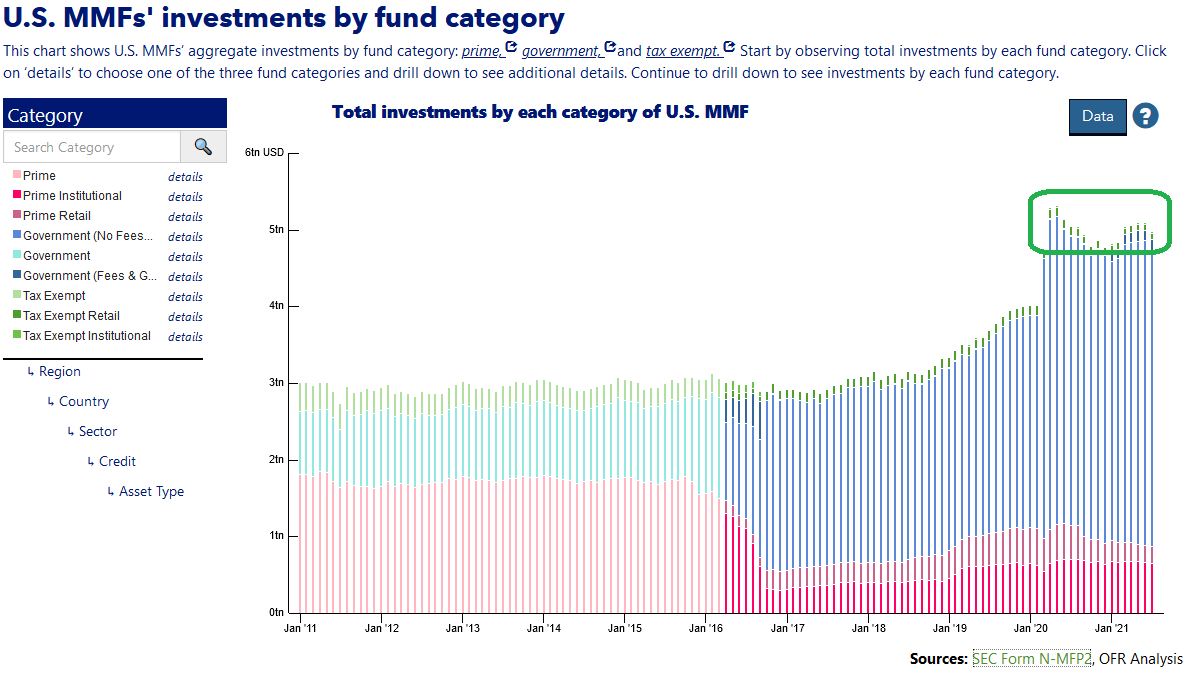

- ~$4.5T in Money Market Funds (currently losing purchasing power on a daily basis due to inflation):

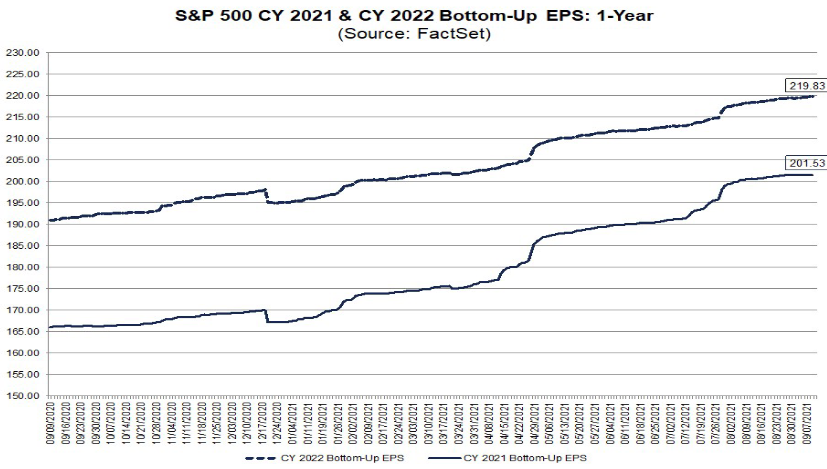

2022 S&P 500 Earnings Estimates still too low. Just a hand full of months ago 2022 estimates were at ~$200. Today they are near $220. Considering where we are in the CAPEX cycle and Inventory Restocking, we think estimates can move up to ~$230 before the end of the year.

2022 S&P 500 Earnings Estimates still too low. Just a hand full of months ago 2022 estimates were at ~$200. Today they are near $220. Considering where we are in the CAPEX cycle and Inventory Restocking, we think estimates can move up to ~$230 before the end of the year.

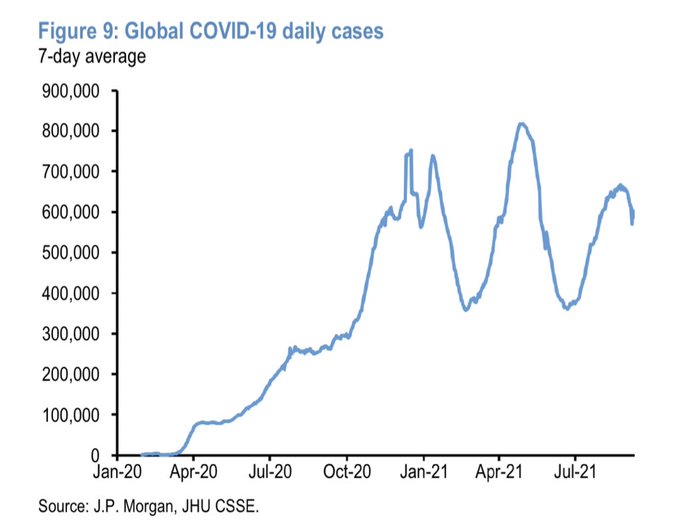

- Global Delta Cases seem to be rolling over:

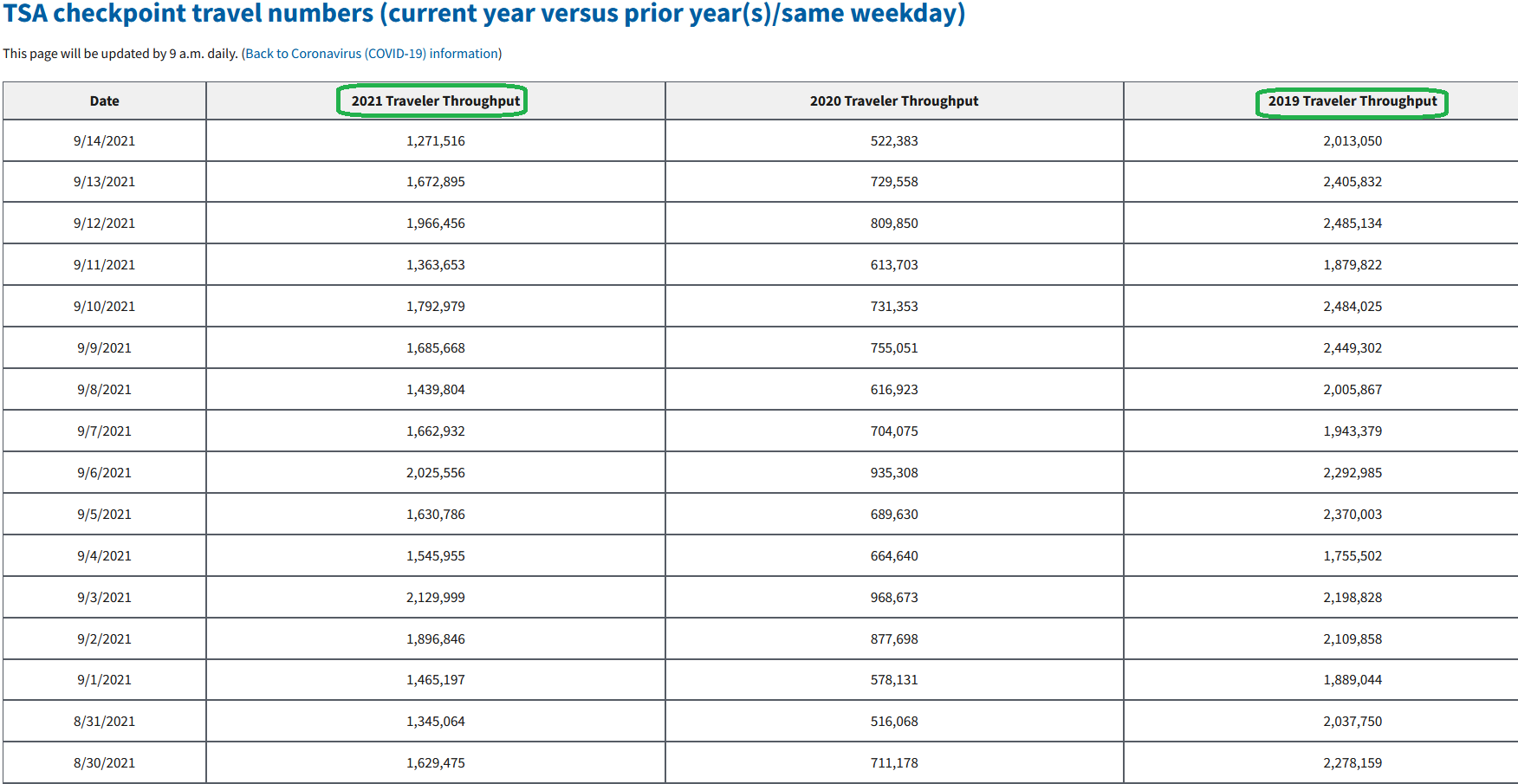

- Travel holding up despite Delta, huge pent-up demand (for both leisure AND business) as case count continues to subside:

- Rotation: IF we follow the same pattern leading up to the taper implementation as we did in 2013, the 10-yr yield should approach ~2% by Q1 2022 – even if we have some short term fits and starts.

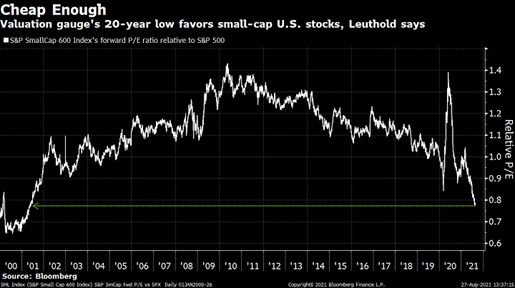

This is supportive of those “re-opening” sectors that have taken a breather since Q2 (small-caps, emerging markets/commodities, value/cyclicals) :

This is supportive of those “re-opening” sectors that have taken a breather since Q2 (small-caps, emerging markets/commodities, value/cyclicals) :

Because of their (cyclicals, value, re-opening stocks) relative underweight in the general indices (to tech), we could see violent upside rallies in many stocks that have seen “summer swoons” (down ~20-30%) even without the general indices doing much. Mid-single digit gains for the general indices through year-end would be realistic, but some (re-opening) stocks that fell 20-30% from June-September due to delta could be up 20,30,40 and even 50%+ before year-end. We’ve covered a number of them on our recent podcasts|videocasts in recent weeks and will cover it this week as well…

Because of their (cyclicals, value, re-opening stocks) relative underweight in the general indices (to tech), we could see violent upside rallies in many stocks that have seen “summer swoons” (down ~20-30%) even without the general indices doing much. Mid-single digit gains for the general indices through year-end would be realistic, but some (re-opening) stocks that fell 20-30% from June-September due to delta could be up 20,30,40 and even 50%+ before year-end. We’ve covered a number of them on our recent podcasts|videocasts in recent weeks and will cover it this week as well…

BofA Fund Manager Survey

On Tuesday I put out a summary of Bank of America’s September Global Fund Manager Survey – which questions ~200 managers with ~$800B AUM.

September Bank of America Global Fund Manager Survey Results (Summary)

Here were the key findings:

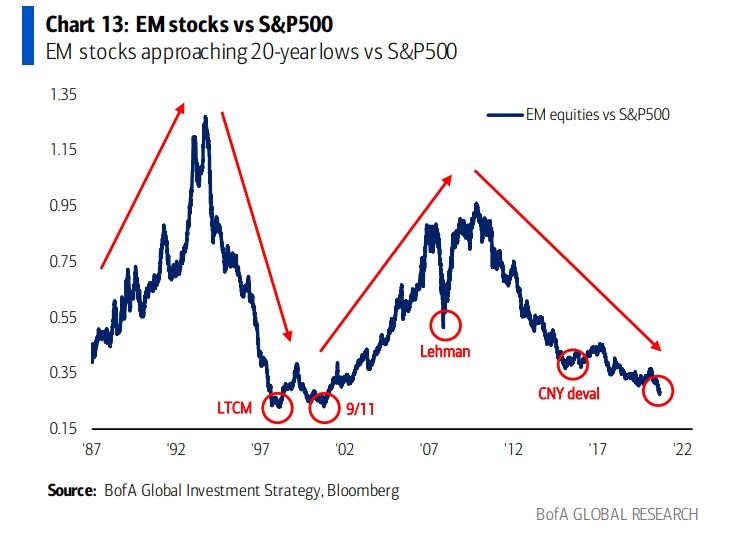

- While waiting for Chinese stocks (and the daily negative headlines) to finally turn has felt like Chinese water torture, Wikipedia, “Chinese water torture or a ‘dripping machine’ is a mentally painful process in which cold water is slowly dripped onto the scalp, forehead or face for a prolonged period of time. The process causes fear and mental deterioration in the subject. The pattern of the drops is often irregular, and the cold sensation jarring, which causes anxiety as a person tries to anticipate the next drip” we think the end may be near. Despite non-stop “worst-case” headlines coming from the Communist Party on a daily basis, most Chinese stocks have still held their bottoms from 3 weeks ago. Couple this with weak economic data and regional covid shutdowns, the Chinese government will be incentivized to unleash aggressive stimulus to offset their premature tightening from six months ago and self-harming economic policies of late – which have led to loss of confidence from foreign investors. Managers have ratcheted up their expectations of this policy turn in September. China is the largest weight in the MSCI Emerging Markets Index, at ~35%:

- Profit Expectations peaked in March 2021, just as they did in December 2009 and February 2002 – both of which were the BEGINNING of new cycles, not the end:

- Managers are expecting another $1.9T in stimulus to be passed in the US:

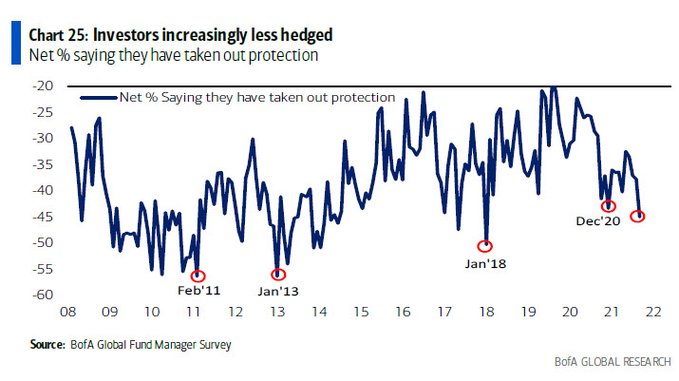

- Investors are less hedged, which is common at the beginning of a new business cycle (see 2009-2013):

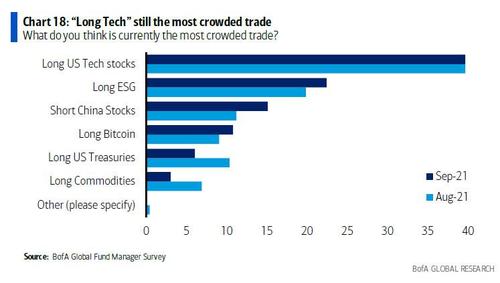

- Long Tech is the most crowded trade:

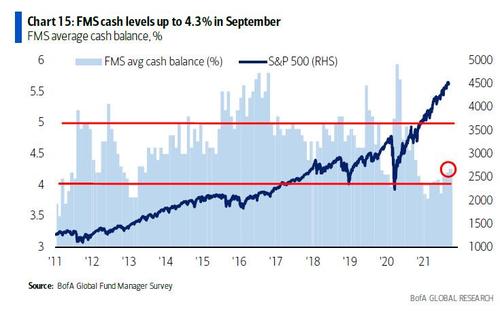

Managers built up cash (off low levels) this month just as they did during the 2013-2014 rally.

Now onto the shorter term view for the General Market:

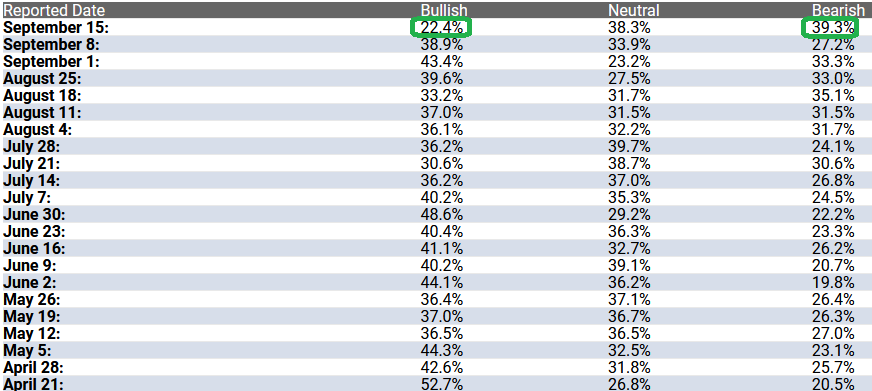

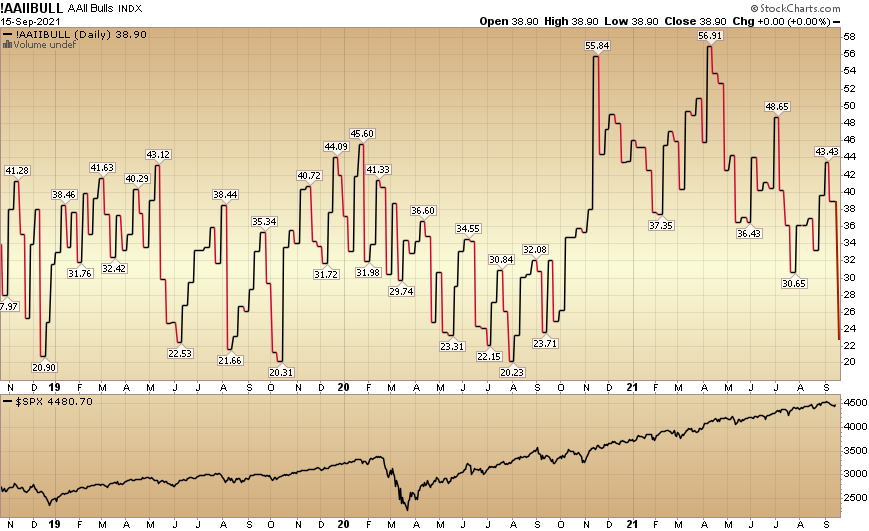

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) collapsed to 22.4% from 38.9% last week. Bearish Percent exploded to 39.3% from 27.2% last week. After months of “no man’s land” readings, we finally got something useful today. Retail sentiment is scared….

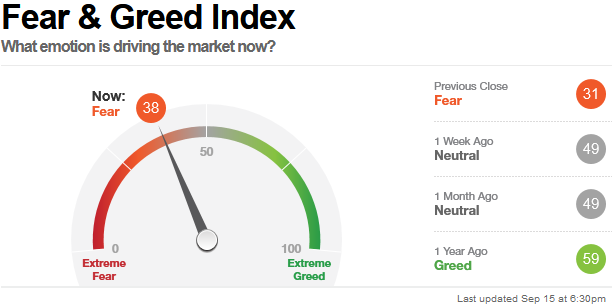

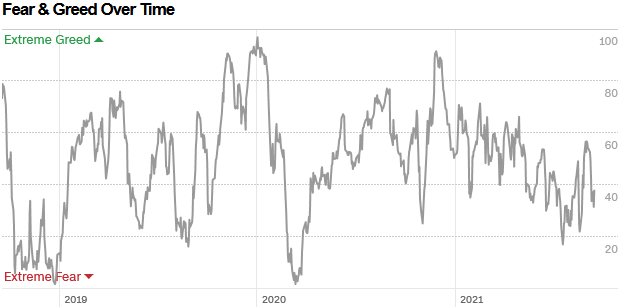

The CNN “Fear and Greed” Index declined from 49 last week to 38 this week. Fear has crept back in. You can learn how this indicator is calculated and how it works here: (Video Explanation)

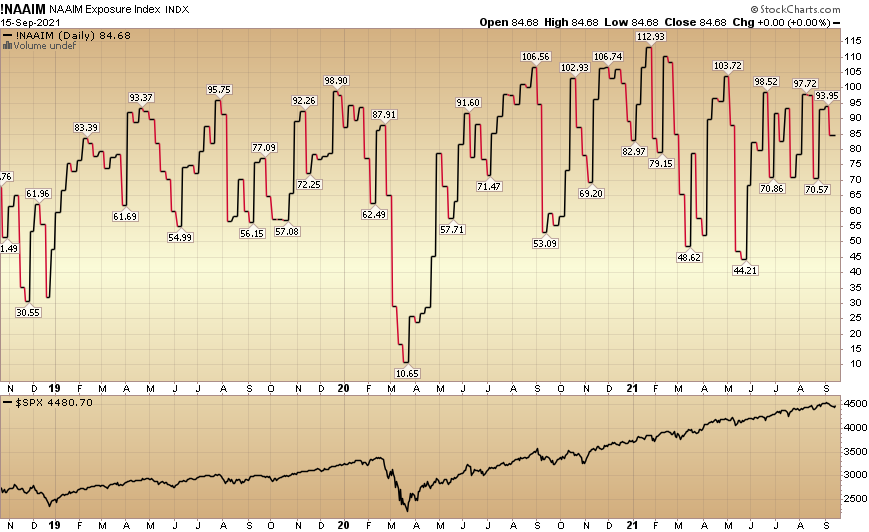

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 84.68% this week from 93.95% equity exposure last week.

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 84.68% this week from 93.95% equity exposure last week.

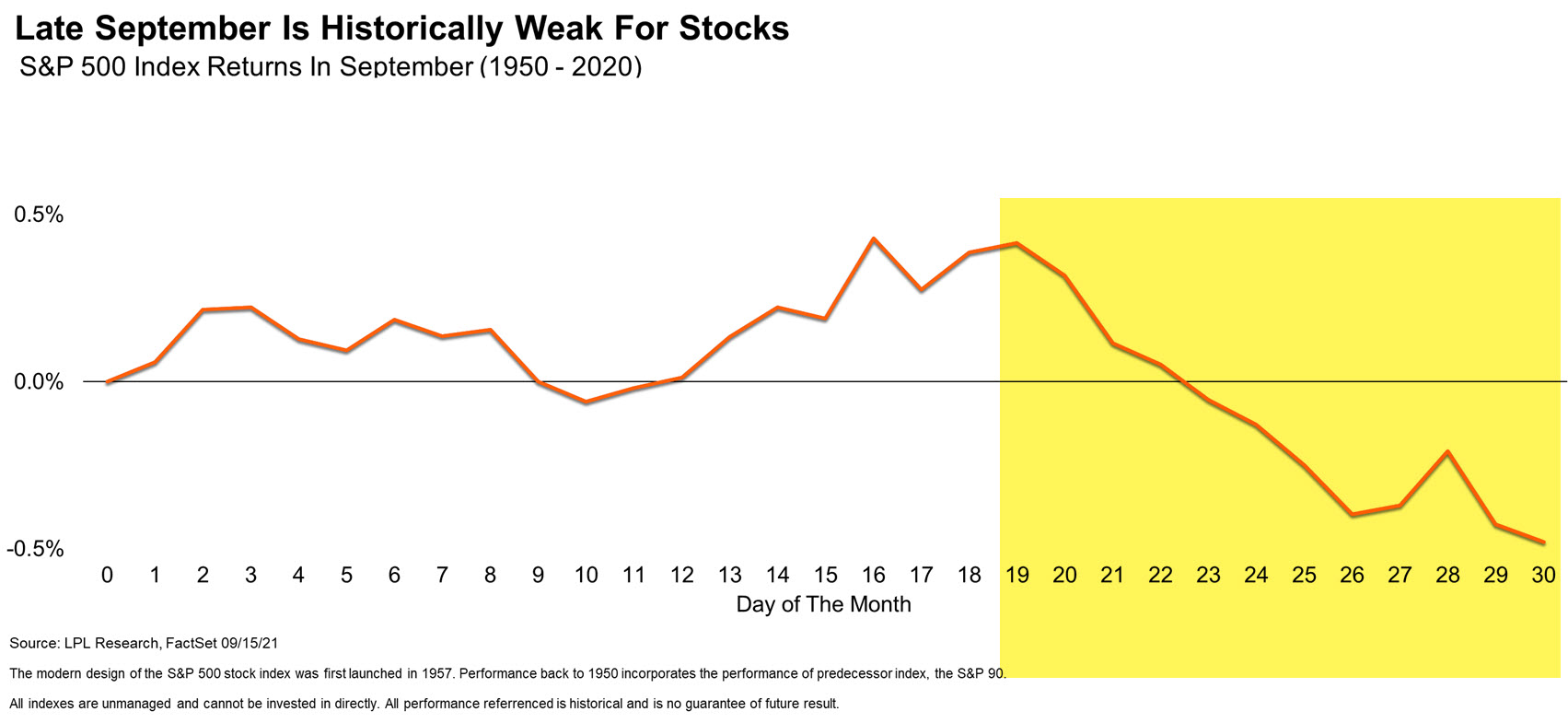

Yesterday, Ryan Detrick of LPL put out the following chart of historic data to beware of seasonal weakness in the back half of September. More than previous years, this year everyone has been looking for a September crash – with multiple banks recently calling for 10-20% corrections after the S&P was red multiple days in a row (opinion follows trend). When everyone is looking for the same thing is when it usually doesn’t happen – as the market is designed to fool most of the people, most of the time:

As we said in previous notes, while everyone debates whether we are going to have a “September Swoon” or not, take a step back and look for sectors/stocks that have already had a “Summer Swoon” and buy the quality stocks that are on sale. There are more high qulaity companies on sale than you can imagine…