As a tradition, my wife and I take the girls (and a pre-made Thanksgiving Dinner) to our place in NYC to watch the parade. This was our view today overlooking Bryant Park:

As the Turkey and sides now slowly warm up, the floats blowing in the wind remind me of all of the different crosswinds we are facing moving into 2022.

When Chair Powell announced the Taper on November 3, the market initially responded as one would have expected (with a day delay). On November 4, we saw the 10yr yield rise, and the re-opening trade reassert itself (value started to outperform growth):

So why didn’t this follow through? There were two key factors:

So why didn’t this follow through? There were two key factors:

- A new wave of COVID/Delta started to reemerge – particularly in Europe – and Austria initiated a lockdown. If this cascades to more country shutdowns, the idea is that managers will have to bid up those few tech stocks that will still be able grow in a slower growth economic environment (caused by government shutdowns). This is not our base case, but it was the market’s initial knee-jerk reaction.

- A rising view that Lael Brainard was in contention to become Fed Chair (this ultimately did not come to pass – which is why yields ticked up following the Powell re-appointment on Monday).

On Friday I was on Fox Business – The Claman Countdown – with Liz Claman discussing these exact issues. Thanks to Liz and Ellie Terrett for having me on:

Watch Directly on Fox Business

Here were the show notes:

The Austrian Lockdown came as a surprise to markets this morning. Germany would not rule out a lockdown, and as such there is a bid for safety (in treasuries) and a move OUT of the re-opening trade – for the time being (oil down, banks down, tech up). Oil is also down on talks of China/US releasing oil from their respective strategic petroleum reserves.

Positive Development: The US government bought 10 million treatment courses of Pfizer’s Covid-19 Pill for $5.29 B yesterday. FDA decision is expected to come before year-end. As this rolls out, the probability of further shutdowns diminishes as any spikes in breakthrough cases will be met by a potent anti-viral (Pfizer says it cuts the risk of hospitalization or death by 89% in vulnerable adults).

*We do not believe the global economic recovery is in jeopardy.

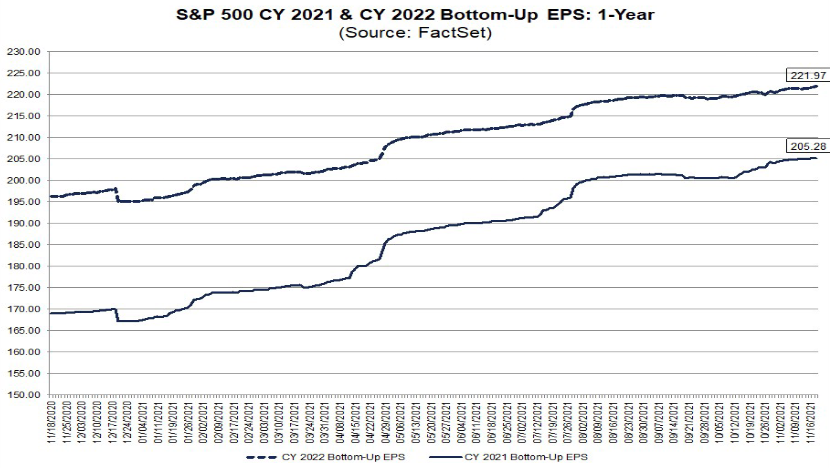

U.S. consumer and economy still looking solid – with strong retail sales (up 1.7% mom), improving employment situation (4.6% unemployment rate), and Q3 earnings growth of over 40% yoy (expectations were for 27.5%). Looking at 2022 earnings projections for the S&P 500 at ~9% for 2022 it would be reasonable to expect mid single-digit to low double digit returns for the S&P 500 next year (with greater volatility than 2021 – as liquidity will be coming out of the market post-taper and the market will start to discount the new environment).

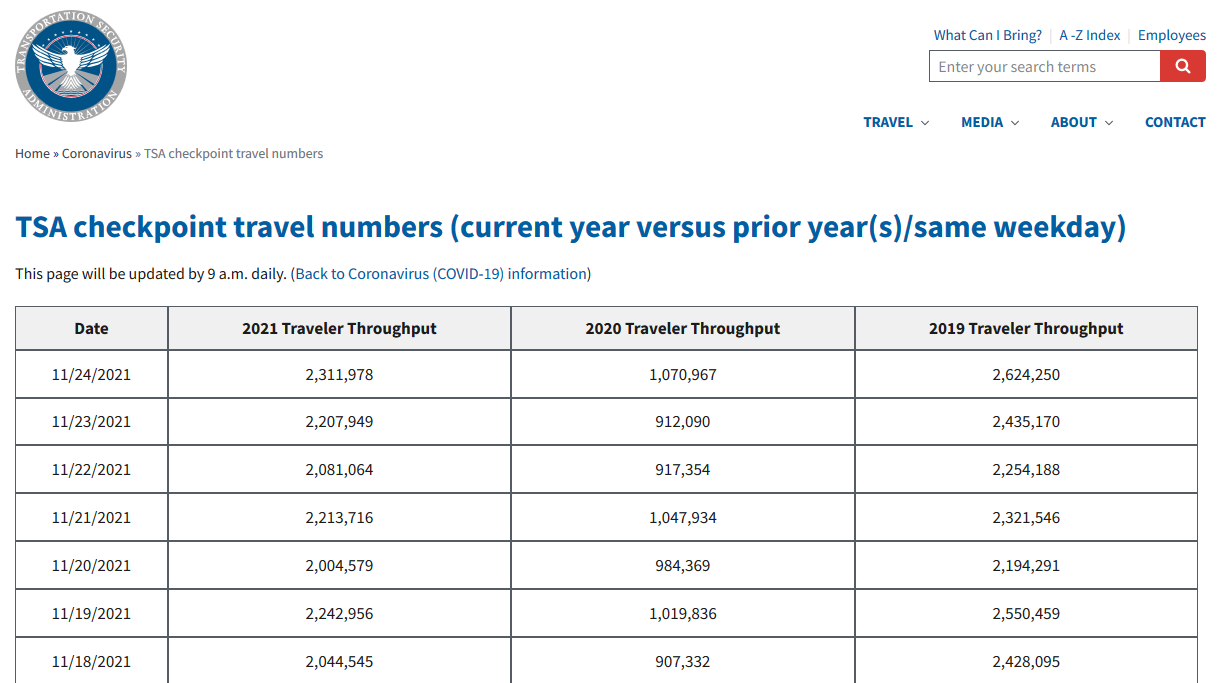

So while Austria is on lockdown and Germany is considering it – Americans are traveling like its 2019:

2022 Earnings Growth is expected to come in ~9% and the current EPS consensus ticked up to ~$222 last week:

And the Fed (according to the Minutes that came out yesterday) can’t taper fast enough. They are now debating accelerating the timeline (which would potentially move up the first rate hike). From Barron’s:

“The minutes reiterate officials’ view that rising prices are connected to reopening bottlenecks, and thus, are temporary. However, the minutes also suggest officials have become less sure in their assessment that inflation is transitory.”

In coming weeks we will face the key test – does the 10 year yield PEAK (at of the start of Taper) as it did in 2013 (see chart above), OR does it push higher 2-2.5% before peaking for the cycle? This is the most important thing we are watching because the yield curve is currently flattening (see below). If the 10yr yield does not move up to a more natural level – steepening the curve and allowing banks to extend credit/make money – this could be a very short cycle.

Our base case is that this recent flattening will be short lived. We would anticipate the 10-yr yield pushing through its recent high of ~170bps and re-steepening the curve for another year or two before flattening once again. If we are wrong, we will look to move to safety within months after an inversion [the market has a tendency to peak 6-18 months following a 2/10 inversion (2yr treasury yield exceeds 10yr treasury yield)].

The good news is that we don’t have to predict it – as the market gives you plenty of notice and time to run for the hills – even after inversion.

A Bull in a China Shop

The last couple of months have been a slog for owners of Chinese equities, but we think the timing is about to change. Goldman Sachs recently put out a note that reiterated many of the points I’ve covered in our recent podcast|videocast(s). I’m going to cover just the key points here, but we will spend much more time on this subject in tomorrow’s (Friday) podcast|videocast.

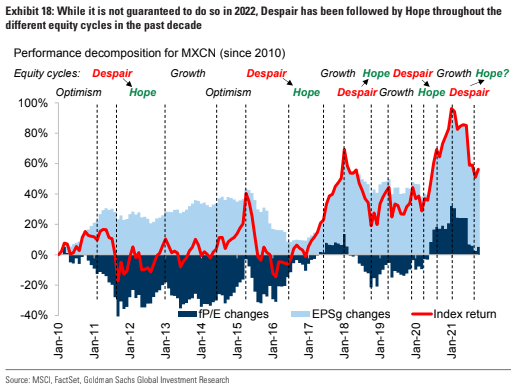

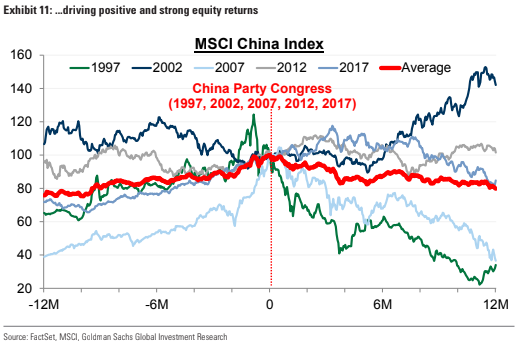

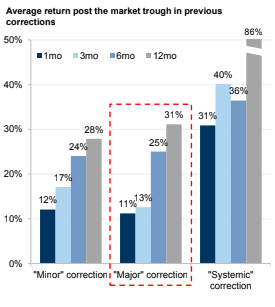

The table above gives a visual for what we have been talking about over many weeks: These crackdowns happen every 3-4 years and are followed by spectacular returns. This particular recovery may prove to be more robust than normal due to the fact that the 20th National Party Congress meets in November 2022. As you can see in the table below – MSCI China has tended to perform well on PE expansion, generating roughly 30% 12m returns on average ahead of that event, with an 80% ex-post probability of positive returns.

The table above gives a visual for what we have been talking about over many weeks: These crackdowns happen every 3-4 years and are followed by spectacular returns. This particular recovery may prove to be more robust than normal due to the fact that the 20th National Party Congress meets in November 2022. As you can see in the table below – MSCI China has tended to perform well on PE expansion, generating roughly 30% 12m returns on average ahead of that event, with an 80% ex-post probability of positive returns.

Chinese policymakers may now accept slower growth in the near term for a more resilient economy in the long run relative to previous cycles, but it still seems likely to Goldman that policy will be loosened marginally to better fend off systemic risks and to avoid a sharp deceleration before the transition takes place.

Goldman is pessimistic on earnings growth (anticipating +7% versus +14% consensus). They also see Chinese GDP coming in below 5% due to the property slowdown/deleveraging (lowest on record outside crisis years). Where they get their optimism from is re-rating and PE expansion. Chinese Stocks are now trading at the bottom end of their 5yr average at 12.7x earnings (a 30-40% discount to global equities).

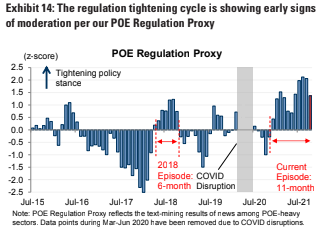

Another key factor leading to Goldman’s optimism is their “regulation timing model” which shows the worst may be in the rear view mirror.

The pre-congress 12 month returns of 30% are also supported by their data on the post market trough returns at 31% 12 months out:

While these are index returns they are discussing, the implication is that some stocks will rebound 30-50% and even 100%+ over the same period. Remember, “OPINION FOLLOWS TREND.” Right now, opinion could not be more bearish or despondent. People are being scared out of their holdings left and right. We have been rolling out our options and buying more stock.

While these are index returns they are discussing, the implication is that some stocks will rebound 30-50% and even 100%+ over the same period. Remember, “OPINION FOLLOWS TREND.” Right now, opinion could not be more bearish or despondent. People are being scared out of their holdings left and right. We have been rolling out our options and buying more stock.

Goldman is specifically OVERWEIGHT China Internet citing the trading at 25x fP/E and 0.8x fPEG – close to the trough levels in their respective 5Y ranges. The removal of left-tail regulation risks from its DCF-based valuation should drive meaningful re-rating for the sector.

The de-rating of Chinese stocks stands in sharp contrast to still-elevated valuations for US/global equities, with MSCI China being priced at a 28% discount to MSCI ACWI and 42% to SPX, and China Tech (Internet) trading 18% cheaper than US Tech, the widest gap in 2 years.

GOLDMAN REPORT SUMMARY: Chinese stocks will have a better year in 2022 as the market recovers from a “Major” correction and transitions into a “Hope” phase where PE expansion typically trumps weak fundamental growth and drives strong equity gains.

The belief that valuations should recover is predicated on:

a) China’s need to ease policy somewhat to rein in systemic risks, making it an outlier globally when most countries in the world will be withdrawing stimulus;

b) the 20th Party Congress will be convened in Nov next year, and equities tend to perform well on valuation expansion ahead of the event as stability takes priority on the policy agenda;

c) the potential for regulation clarity/intensity to improve, which helps compress left-tail valuation risks for Internet companies and boost their fair value; and,

d) prevailing valuations (12.7x) are at the lower bound of the 5-year range, and China’s valuation discounts to global equities are almost at all-time highs. The re-rating upside could be amplified by the close-to-record-low allocation by global mutual funds (470 bps underweight).

Now onto the shorter term view for the General Market:

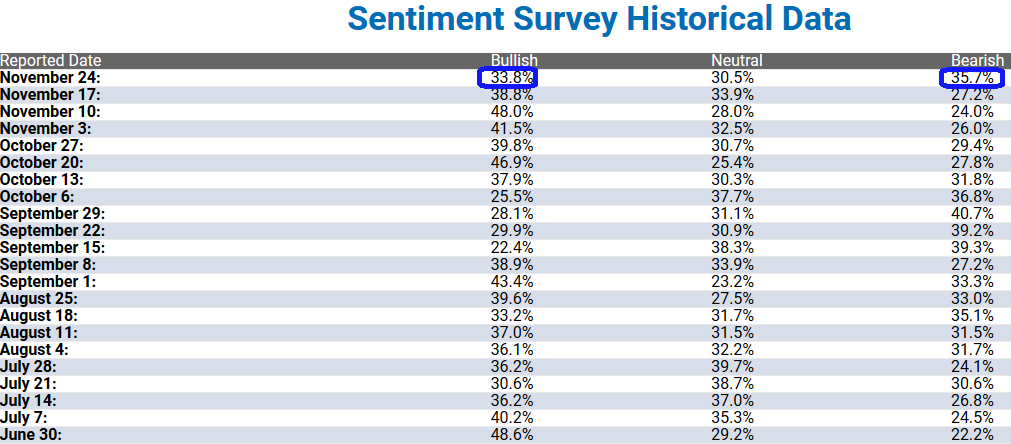

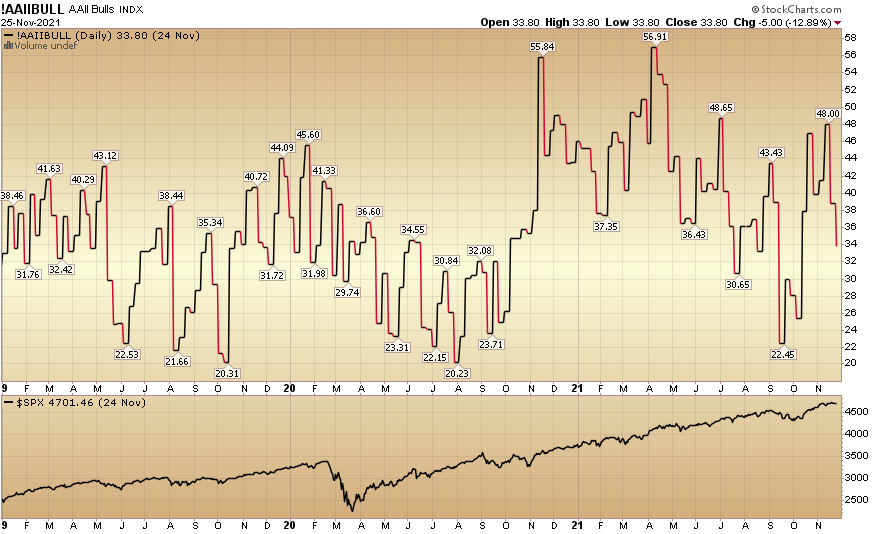

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to to 33.8% this week from 38.8% last week. Bearish Percent jumped to 35.7% from 27.2% last week. Retail exuberance is rolling over.

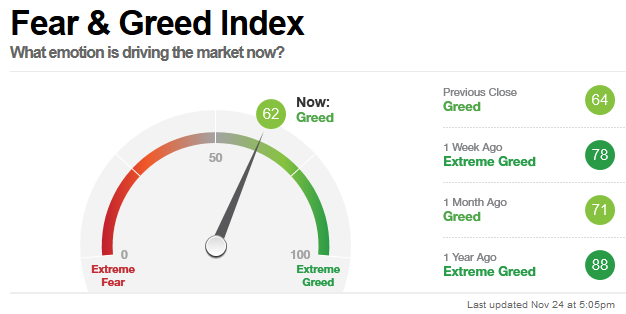

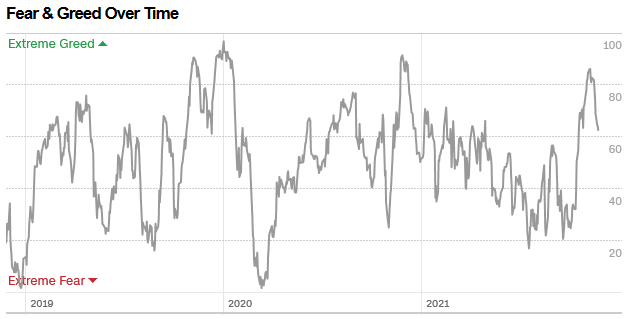

The CNN “Fear and Greed” Index dropped from 79 last week to 62 this week. This is a generally neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

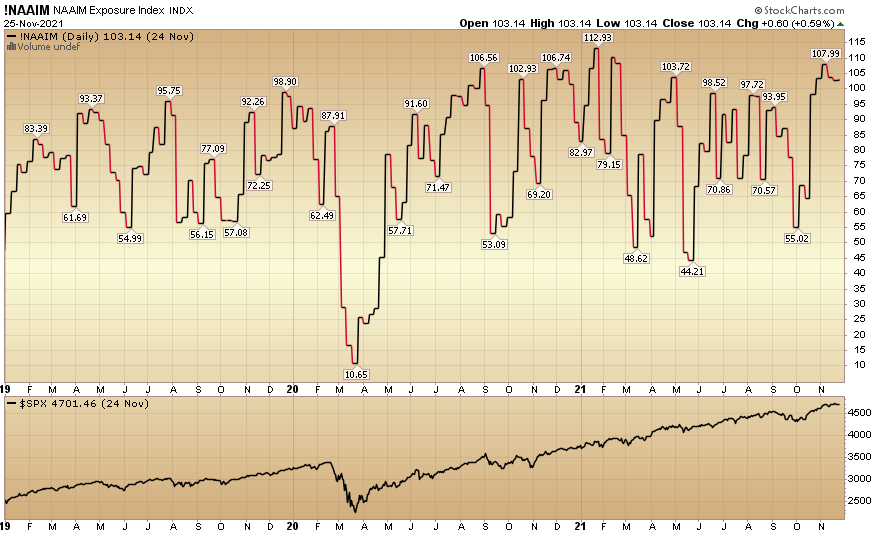

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 103.14% this week from 103.69% equity exposure last week. Managers continue to chase into year end – as they were underweight with the market pressing higher through earnings season.

I look forward to going into greater detail on tomorrow’s podcast|videocast. Thanks for reading on a special Holiday. Enjoy the Turkey, Football and Family. We’re going to take a walk up to Rockefeller Center now to see the tree and then back for dessert. Happy Thanksgiving…