The December survey covered 281 fund managers with $728 billion under management.

OUTLOOK:

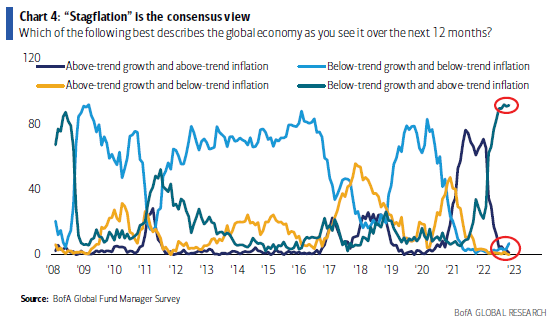

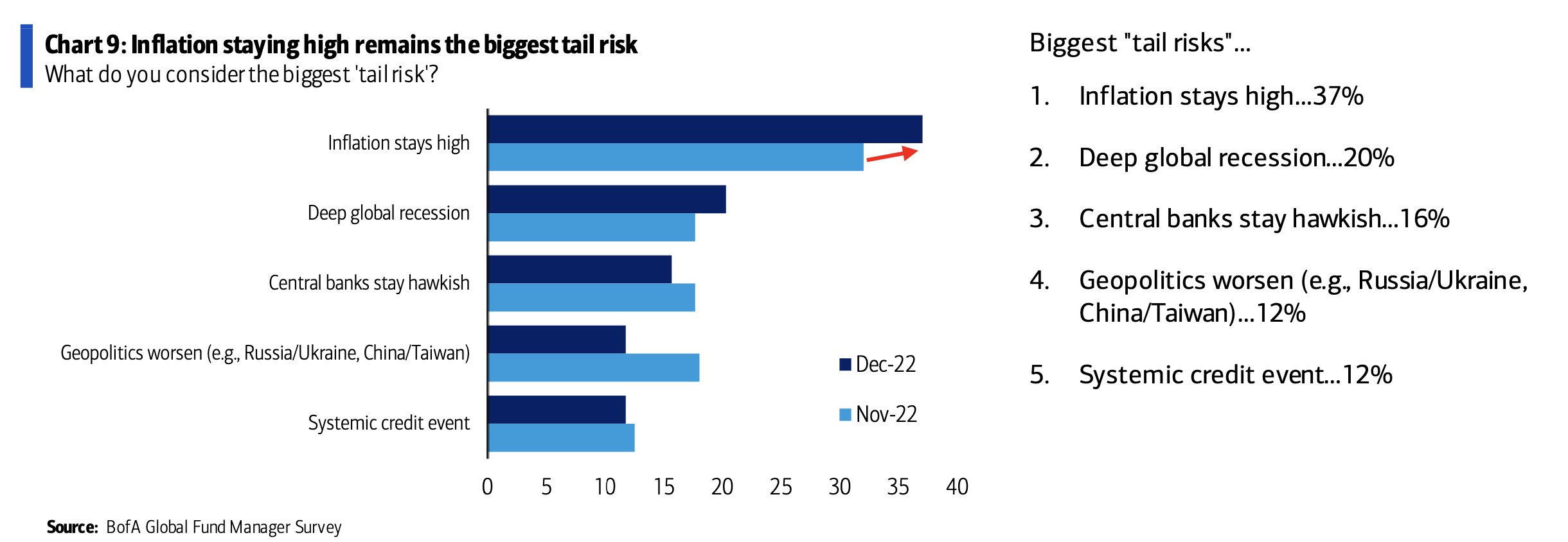

-90% of respondents expecting lower prices within the next 12 months.

-For 2023, market participants have said they expect equities to face a rough first half followed by a rebound in the second.

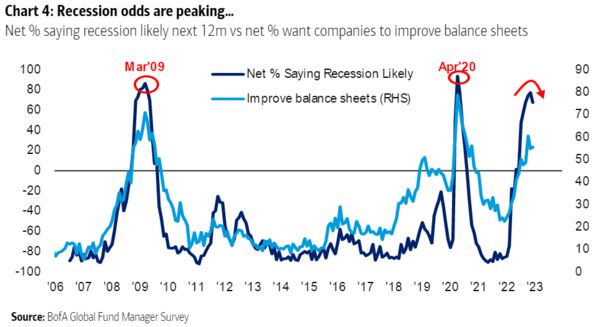

-A net 68% of investors say a recession is likely in the next 12 months, softening from 77% in November.

-Consensus expectations see the U.S. Consumer Price Index (CPI) specifically falling to 4.2% over the next 12 months.

-Expectations for lower inflation bolstered expectations for lower short-term rates, with the highest number of investors (42%) calling for a fall in short-term yields since March 2020.

-The federal funds rate is expected to peak at 5% in the second quarter of 2023.

-Profit expectations improved slightly, with a net 74% of investors expecting global profits to decline over the next 12 months, down from 83% in November.

-42% of surveyed managers are expecting short-term yields to fall, which is the highest response since March 2020.

SENTIMENT:

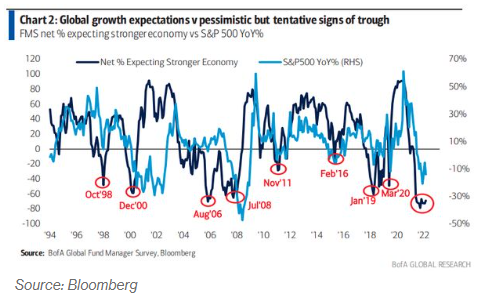

-A net 69% of respondents expect weaker growth next year, a modest improvement from the 73% in November, reflecting what strategists led by Michael Hartnett called “stable pessimism” among investors.

– 75% of managers in the December survey forecast a stronger China economy in 2023, up significantly from a net 13% in November and the most optimistic survey result since May 2021.

-27% of the survey participants said government bonds will be the best-performing asset in 2023, followed by stocks at 25%.

-Fund managers are bearish on European equities in the near term, with 88% of participants in the bank’s regional survey projecting downside for earnings amid slowing growth.

-Expectations for an outright economic downturn also improved last month, with a net 68% of investors expecting the global economy to tip into recession next year, down from 77% in November.

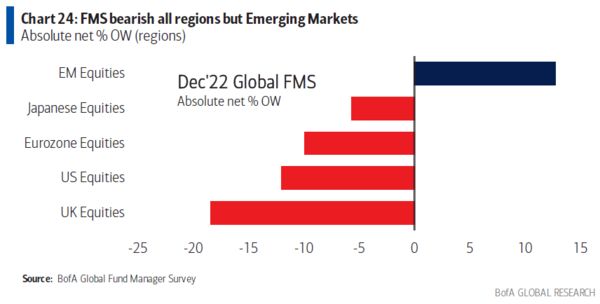

POSITIONING:

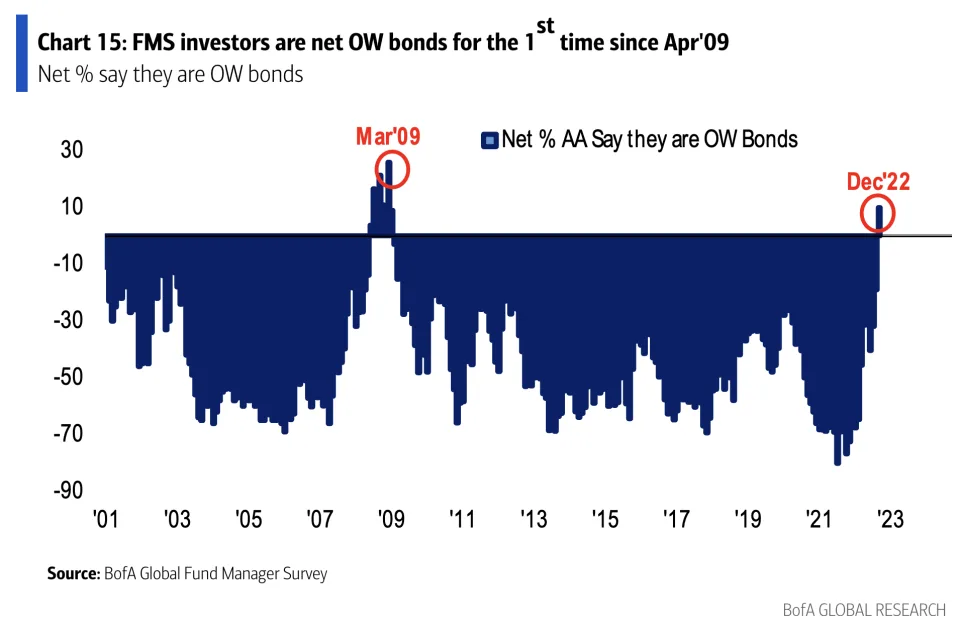

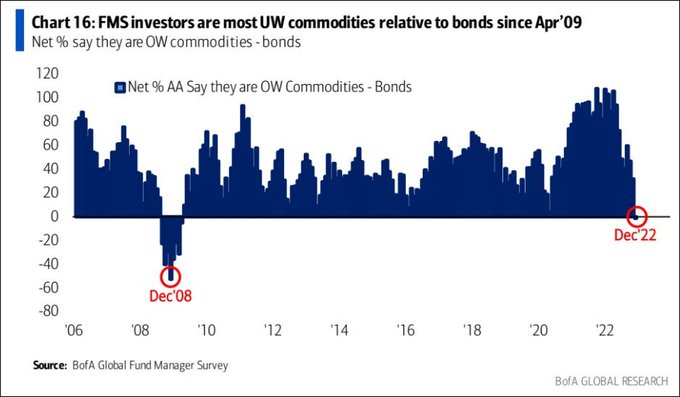

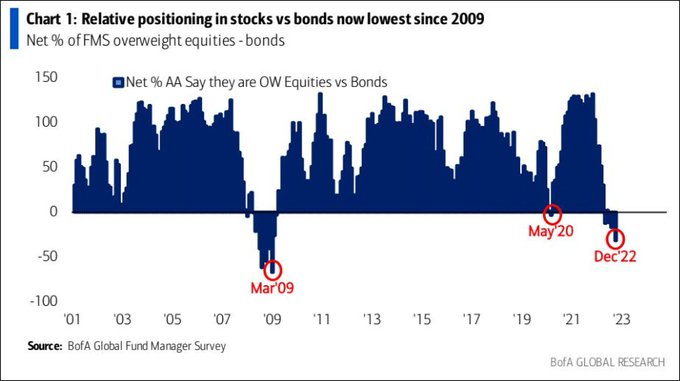

-Relative positioning in equities over bonds already at its lowest since 2009.

-Investors were net 10% overweight bonds for the first time since 2009.

-51% expect the dollar to depreciate the most — the biggest share since May 2006.

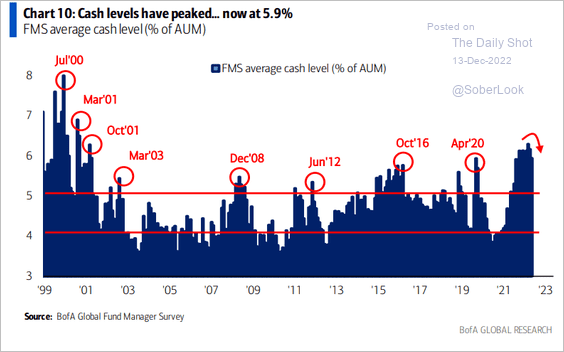

-As risk sentiment begins to ease, cash levels dropped to 5.9% in December, down from 6.2% in November and 6.3% in October. The long-term average cash level for the fund manager survey is 4.9%.

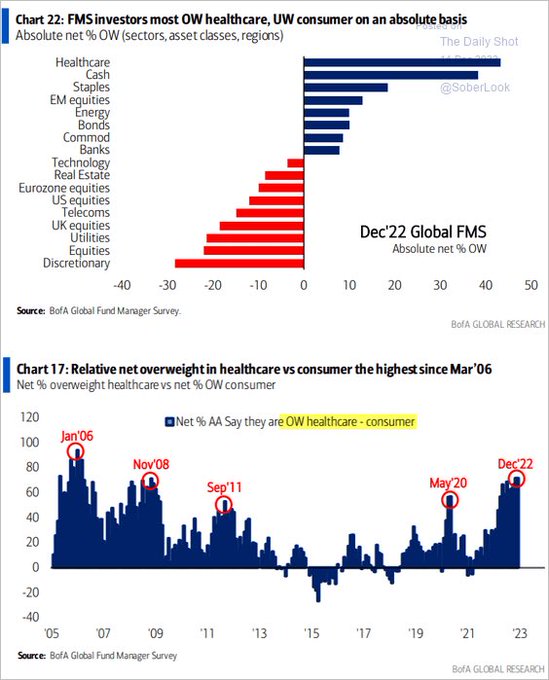

-Investors are most overweight health care relative to consumer discretionary since March 2006.

MOST CROWDED TRADES:

-Most crowded trades: long US dollar, short China equities, long oil, long ESG assets, short EU equities and long T-bills.

BANK OF AMERICA COMMENTARY:

BANK OF AMERICA COMMENTARY: