Key Market Outlook(s) and Pick(s)

On Friday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, tariffs, opportunities, Boeing, and Disney. Thanks to Stuart and Christian Dagger for having me on:

On Monday, I joined Charles Payne on Fox Business to discuss the market’s bottoming process, outlook, and picks. Thanks to Charles and Nicholas Palazzo for having me on:

On Tuesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, tariffs, and deals. Thanks to Stuart and Christian Dagger for having me on:

On Monday, I joined Mady Mills on Yahoo! Finance for the full show to discuss markets, outlook, and stock picks. Thanks to Mady for having me on:

On Monday, I also joined Steve Lai on BBC News to discuss tariffs, semiconductors, and more. Thanks to Steve, Bianca Mascarenhas, and Adam Hancock for having me on:

On Wednesday, I joined Kristen Scholer on NYSE TV to discuss markets, outlook, volatility, and stock picks. Thanks to Kristen and Mel Montanez for having me on:

Lastly, on Wednesday, I joined Diane King Hall on Schwab Network to discuss positioning, markets, outlook, and stock picks. Thanks to Diane, Heidi Schultz, and Ally Thompson for having me on:

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 195 institutional managers with ~$444B AUM:

April 2025 Bank of America Global Fund Manager Survey Results (Summary)

Here were the 5 key points:

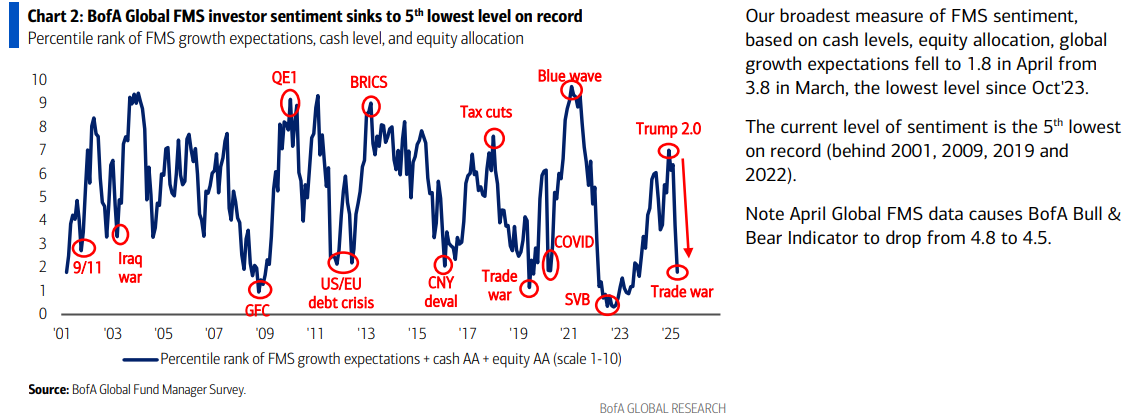

1) FMS investor sentiment is now at its fifth lowest level on record, behind only the 2009 GFC, 2018 Trade War, and SVB in March 2023 (ALL OF WHICH WERE SIGNIFICANT BUYING OPPORTUNITIES).

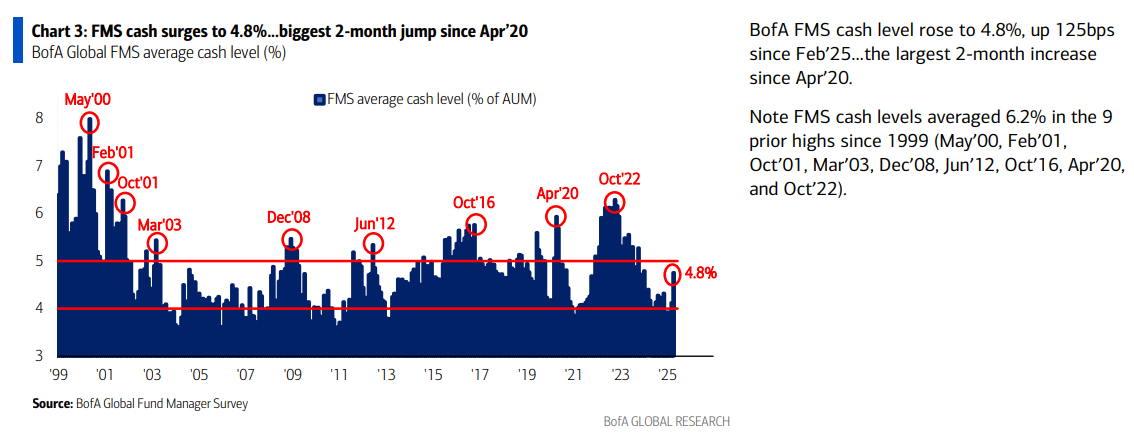

2) Cash levels continue to climb, now at 4.8%, with the biggest two-month jump since April 2020 — all coming off the 15-year low recorded in February’s survey.

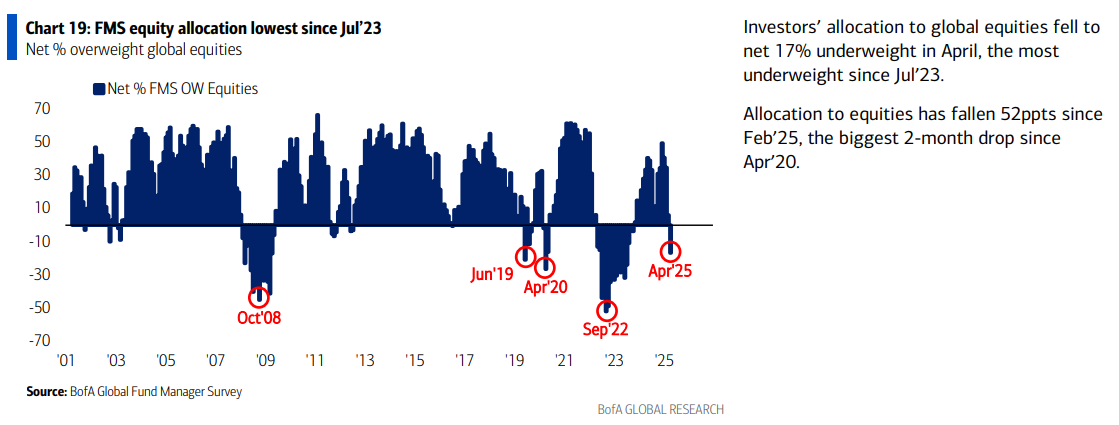

3) FMS equity allocation is now at its lowest level since July 2023, falling to a net 17% underweight — the largest two-month drop since April 2020.

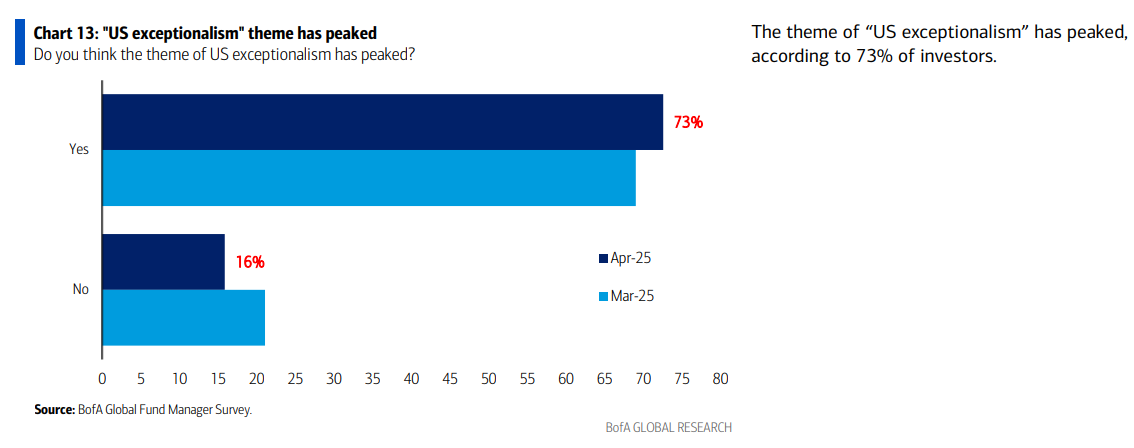

4) Opinion continues to follow trend, with 73% of investors now believing the theme of “US exceptionalism” has peaked.

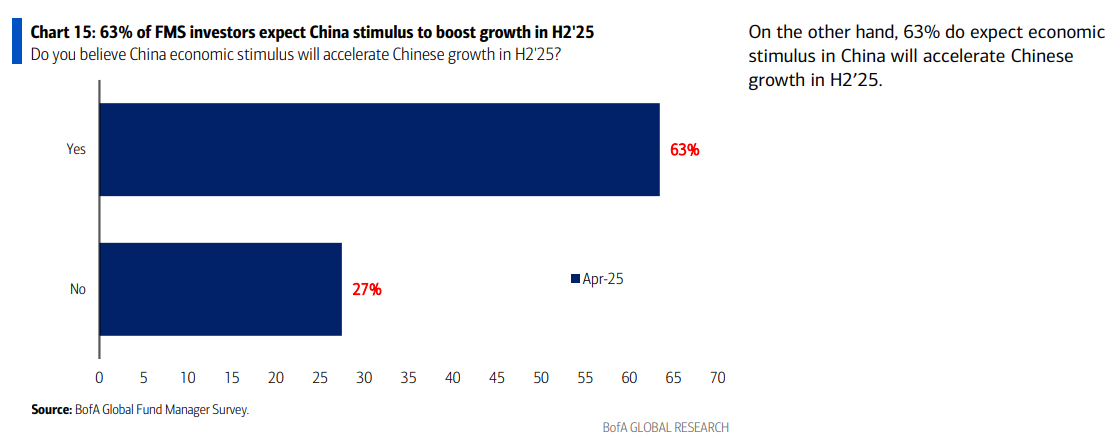

5) 63% of FMS investors now expect China stimulus to boost growth in H2 2025. We agree.

China & Alibaba Update

Last week, we thought it would be helpful to break down, on a company by company basis, the overall exposure to tariffs compared to the market’s reaction and perception. In nearly every case, market fears FAR OUTWEIGHED the actual FUNDAMENTALS. In fact, in some instances, companies could even be NET BENEFICIARIES of the tariffs. One such example was Alibaba.

“Tariffs: Perception vs. Reality” Stock Market (and Sentiment Results)…

With all the noise surrounding the tit-for-tat trade war tariffs between the US and China, we thought it would be valuable to take a closer look in this week’s article.

Like nearly everyone, we’re in the camp hoping for a quick and mutually beneficial deal between the world’s two largest economies.

In fact, when both countries put their egos aside, the path to a mutually beneficial deal seems relatively straight forward.

Scott Bessent did a great interview yesterday on Yahoo! Finance, discussing, among other topics, what the deal could look like. I highly recommend listening to the entire interview, but pay attention to around the 13-minute mark for his take on what the deal could actually look like.

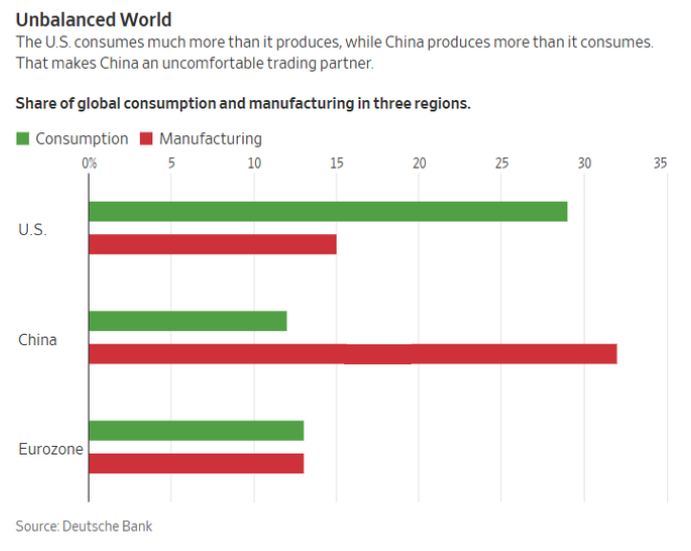

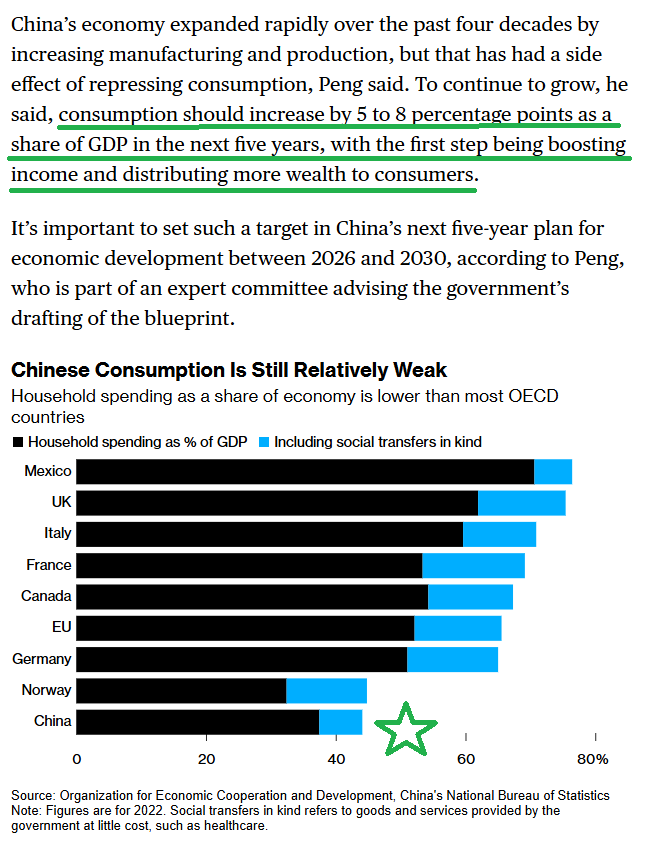

The general idea behind a potential deal would involve China focusing more on domestic consumption and less on state-subsidized manufacturing, while the US cuts back a bit on consumption and builds up its manufacturing base. Looking at the chart below, it’s pretty clear why this rebalancing makes sense for both sides.

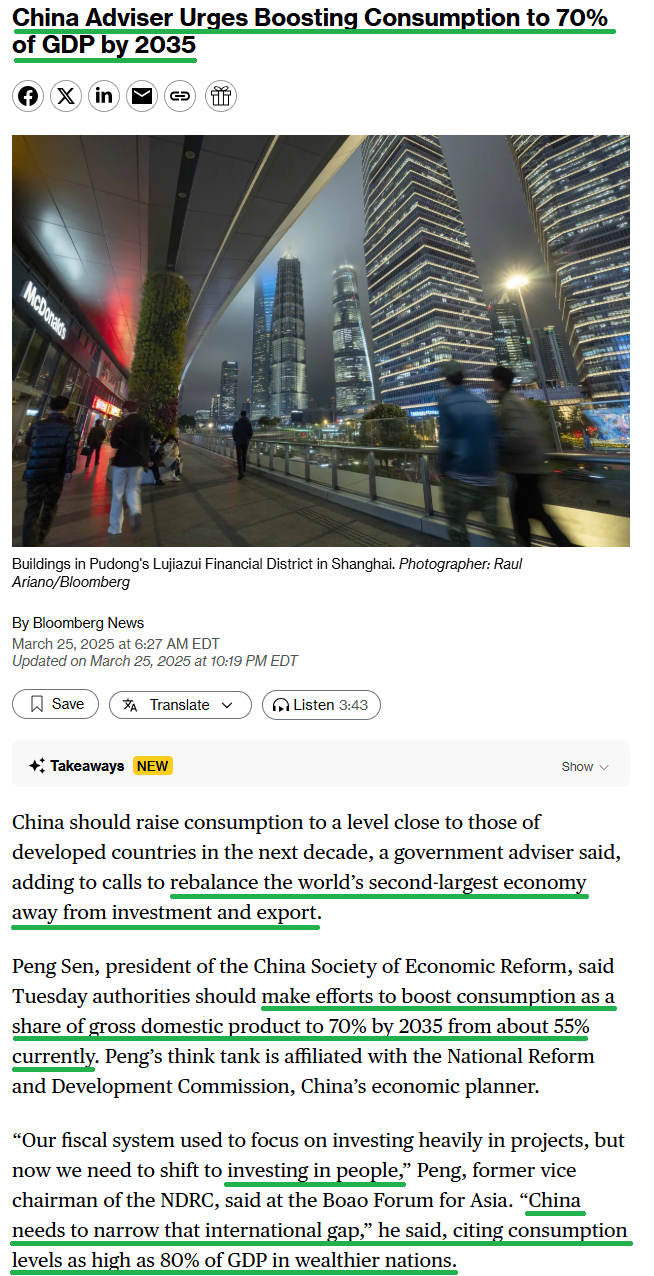

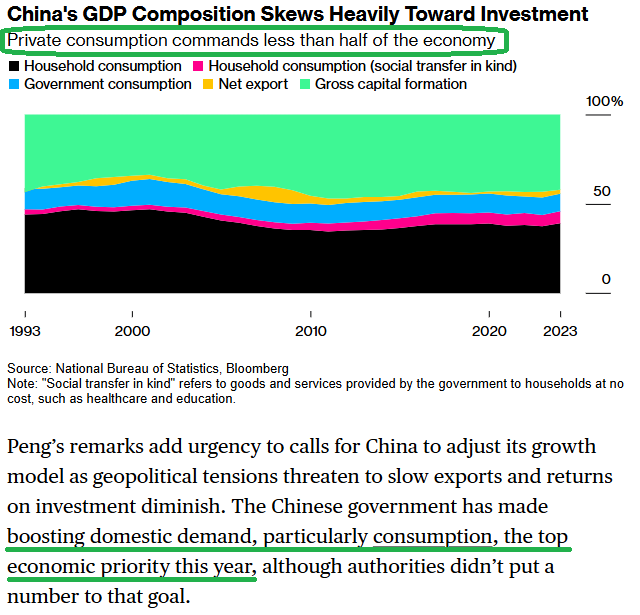

If you’ve been with us for a while, you know that this shift in China towards a consumption-driven economy is something we’ve been talking about, along with the Chinese government, for a long time. In fact, the Chinese government has made boosting domestic demand, particularly consumption, the TOP ECONOMIC PRIORITY THIS YEAR. Right now, consumption makes up about 55% of overall GDP in China, compared to 70-80% in wealthier nations. China is aiming to hit 70% by 2035.

I can’t emphasize enough how massive this shift toward consumption really is. To put it in perspective: China’s GDP in 2024 was $18.8 trillion, with consumption making up about 55% (~$10.34 trillion). If they hit their target of ~5% growth this year and then slow to just 3% annually through 2035, reaching their 70% consumption goal would mean $18.57 trillion in consumption alone by 2035. Let that sink in. An $8.23 trillion jump in new annual consumption.

And who’s best positioned to benefit? ALIBABA, THE TOLL TAKER OF THE MIDDLE CLASS, holding ~40% of the e-commerce market and still growing. It’s hard to imagine they don’t capture a massive slice of that pie.

So clearly, this shift is something they’re already working on, with or without a deal.

The article below does a good job explaining this in detail:

So, here’s how we see it: if a deal is reached between the US and China, we’ll probably see an even bigger push towards domestic consumption in China. And if the tariffs stick around, China will have no choice but to shift towards consumption to make up for the hit to export-driven GDP growth. Either way, Alibaba will be laughing all the way to the bank.

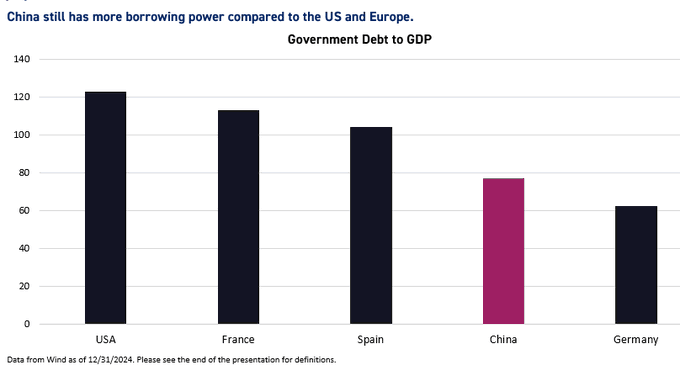

It’s also worth pointing out that China has a pretty powerful toolkit to speed up this shift toward domestic consumption – namely, the long-awaited and much rumored bazooka style stimulus. Unlike its Western counterparts, China didn’t pump out stimulus during the pandemic, so they have plenty of room to use both monetary and fiscal tools. That’s a luxury the US and Europe just don’t have, and the market seems to have recognized it and begun to price this in.

In fact, maybe this is why the Chinese government held back on pulling the trigger. Perhaps they saw a potential Trump 2.0 term and a trade war on the horizon, so they decided to hedge their bets and keep some ammo in reserve.

Either way, they have the tools, and now, more than ever, a good reason to use them. There’s over $20 trillion sitting in household deposits waiting to be spent. It’s time to unleash the bazooka…

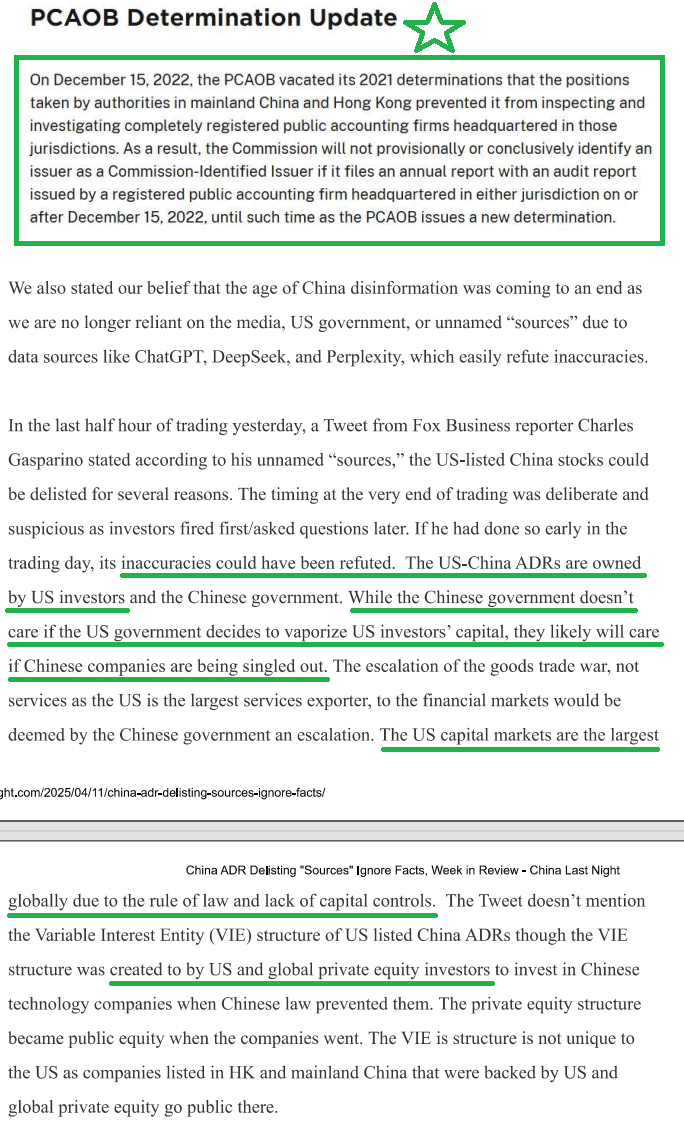

Shifting from domestic consumption and stimulus to a less exciting topic, we figured it would be a good time to address the elephant in the room, something we thought was in the rearview mirror: delisting.

Rumors began circulating this past week after Fox Business Senior Correspondent Charles Gasparino published the tweet below:

Brendan Ahern put out a great article the next day breaking down the rumors and laying out the facts. He also hosted a “Tariff Briefing” webinar that covered, among other things, delisting fears. I highly recommend giving it a listen below:

Fears around delisting are nothing new. We went through the same cycle back in 2021 and 2022, which ended with the Chinese government stepping in and changing its laws to allow the PCAOB full access to inspect U.S.-listed Chinese companies. Alibaba, along with nearly 300 other ADRs, passed those audits with flying colors.

Now that the PCAOB has had access for over two years, it’s tough to see a logical case for delisting.

And if betting on delisting or calling China “uninvestable” has been your belief the past couple of years, it hasn’t exactly been a profitable one.

But, just as we discussed in last week’s article, WE NEED TO BURDEN OURSELVES WITH THE FACTS. Not the rumors. Not the noise. What are the actual facts? And here they are:

1) US ADRs are held by US investors, not the Chinese government or Chinese investors. Over $800B of US investor capital sits in the 286 Chinese ADRs. DELISTING CHINESE ADRs WOULD DO NOTHING BUT VAPORIZE NEARLY A TRILLION DOLLARS OF US INVESTOR CAPITAL, ALL WHILE THE CHINESE GOVERNMENT LAUGHS ALL THE WAY TO THE BANK.

2) On the flip side, China holds $1.3 trillion worth of US Treasuries and $370 billion worth of US equities. They could easily liquidate these in retaliation. If lowering the 10-year yield is this administration’s top priority, it’s hard to believe they’d cross the line and open the door for such retaliation. It’s natural to make threats when you don’t get what you want, but doing so would be the equivalent of shooting yourself in the foot on the world stage.

3) The US has the #1 capital markets in the world because rumors like this DON’T HAPPEN. Foreign companies, whether from China or elsewhere, pay enormous fees to list in the US. Weaponizing delisting for political purposes wouldn’t exactly encourage foreign companies to IPO or list here in the future, and it would undermine the strength of American capital markets.

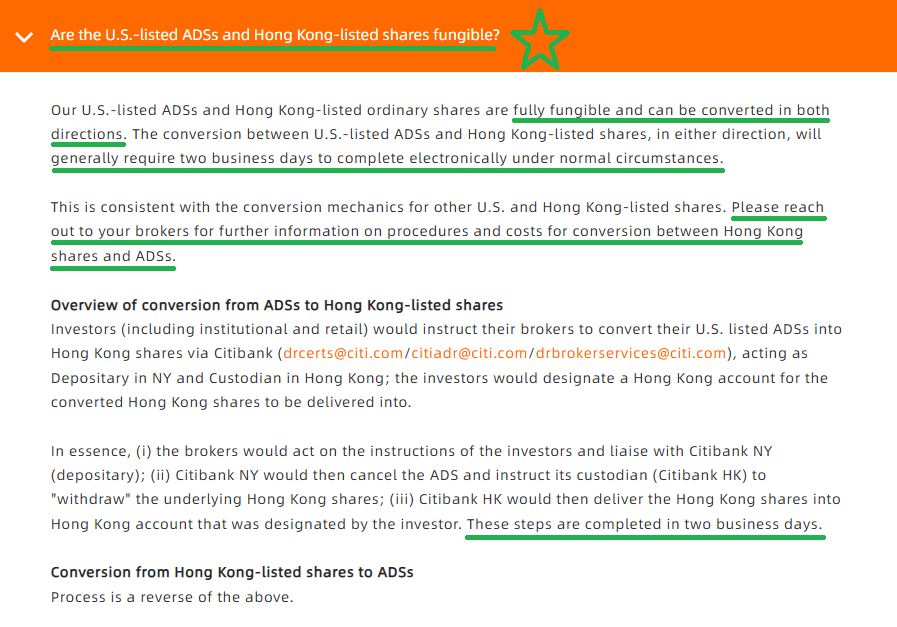

Now, if fears over delisting are keeping you up at night, BABA shareholders can easily convert their US ADSs to Hong Kong-listed shares. There is no real downside to doing so. A step-by-step guide directly from Alibaba is listed below.

Again, we see this as an unlikely scenario and a hard line in the sand. What really matters is that you FOCUS ON WHAT YOU CAN CONTROL. And when you buy high-quality businesses when they are marked down, good things tend to follow. Alibaba is no different.

General Market

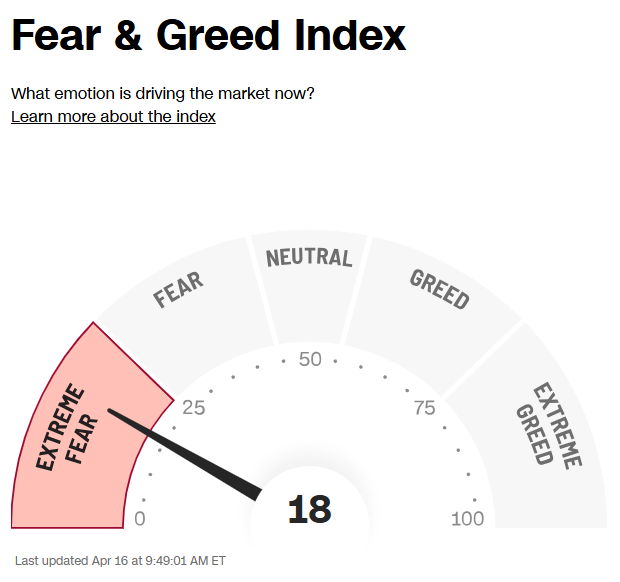

The CNN “Fear and Greed Index” ticked up from 16 last week to 18 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

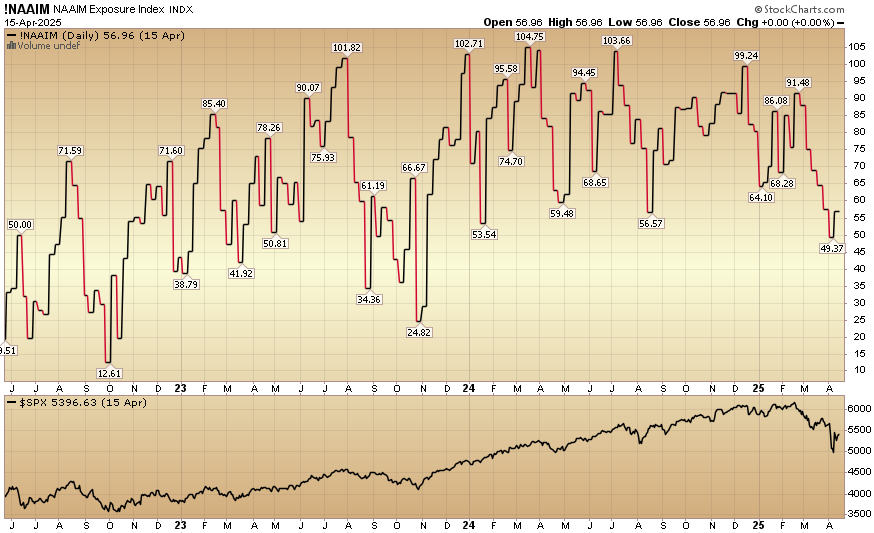

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 56.96% this week from 49.37% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

We’re excited to announce the successful close of our Q2 raise. Congratulations to all the new clients who came in.

Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.