Fox Business

In Monday, I had the opportunity to join the great Charles Payne on Fox Business to discuss the market rotation, Nvidia, Intel, and general outlook. Thanks to Charles, Kayla Arestivo and Nicholas Palazzo for having me on:

Watch in HD directly on Fox Business

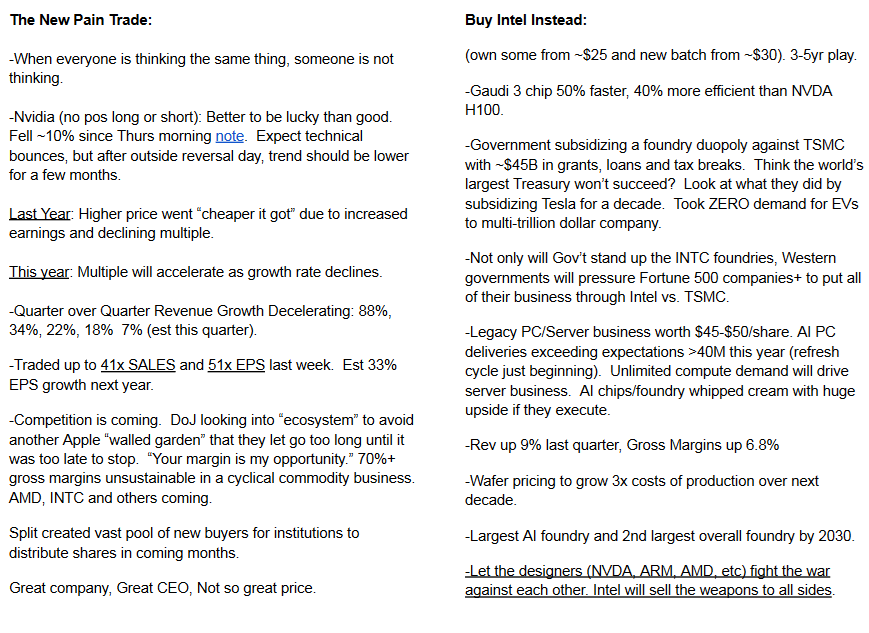

Here were my “show notes” ahead of the segment (last Thursday morning’s note referenced in segment and in notes below):

On Tuesday, I had the opportunity to join the amazing Liz Claman on Fox Business to discuss the market rotation, DIS, DEO, and general outlook. Thanks to Liz, Jake Mack and Kathryn Meyers for having me on:

On Tuesday, I had the opportunity to join the amazing Liz Claman on Fox Business to discuss the market rotation, DIS, DEO, and general outlook. Thanks to Liz, Jake Mack and Kathryn Meyers for having me on:

Watch in HD directly on Fox Business

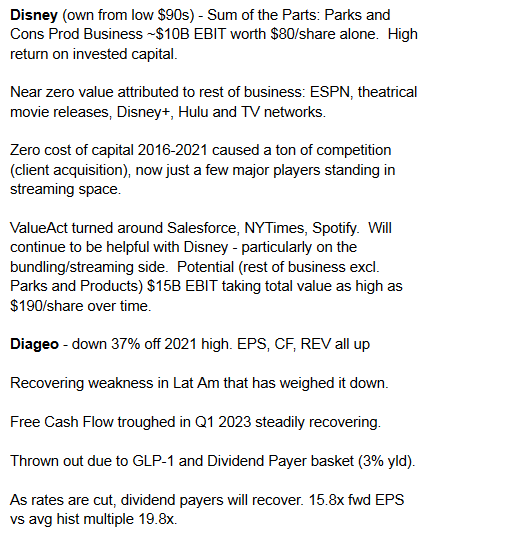

Here were my additional “show notes” ahead of the segment:

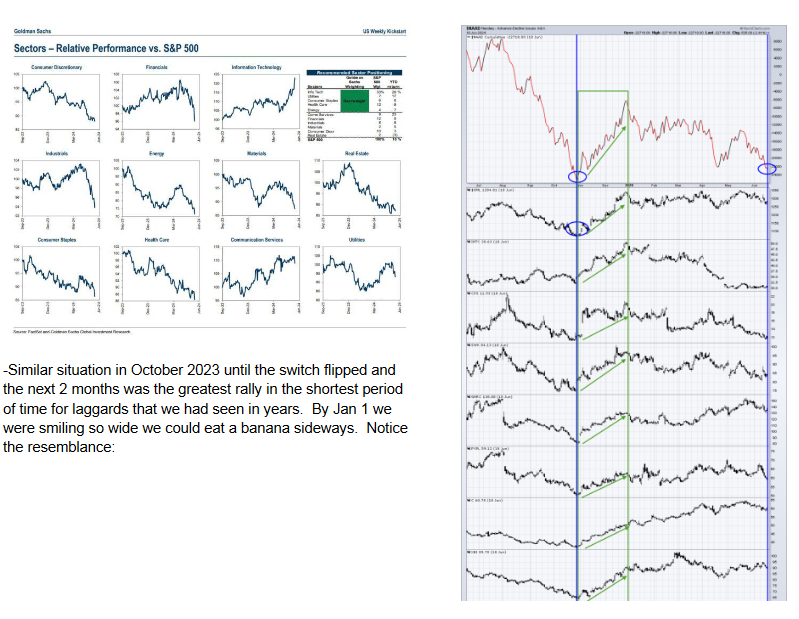

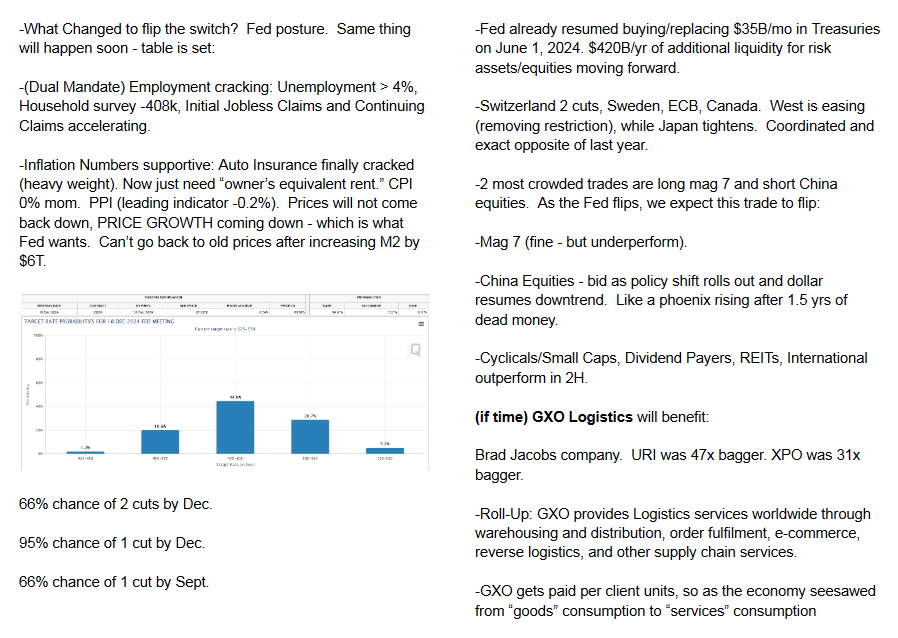

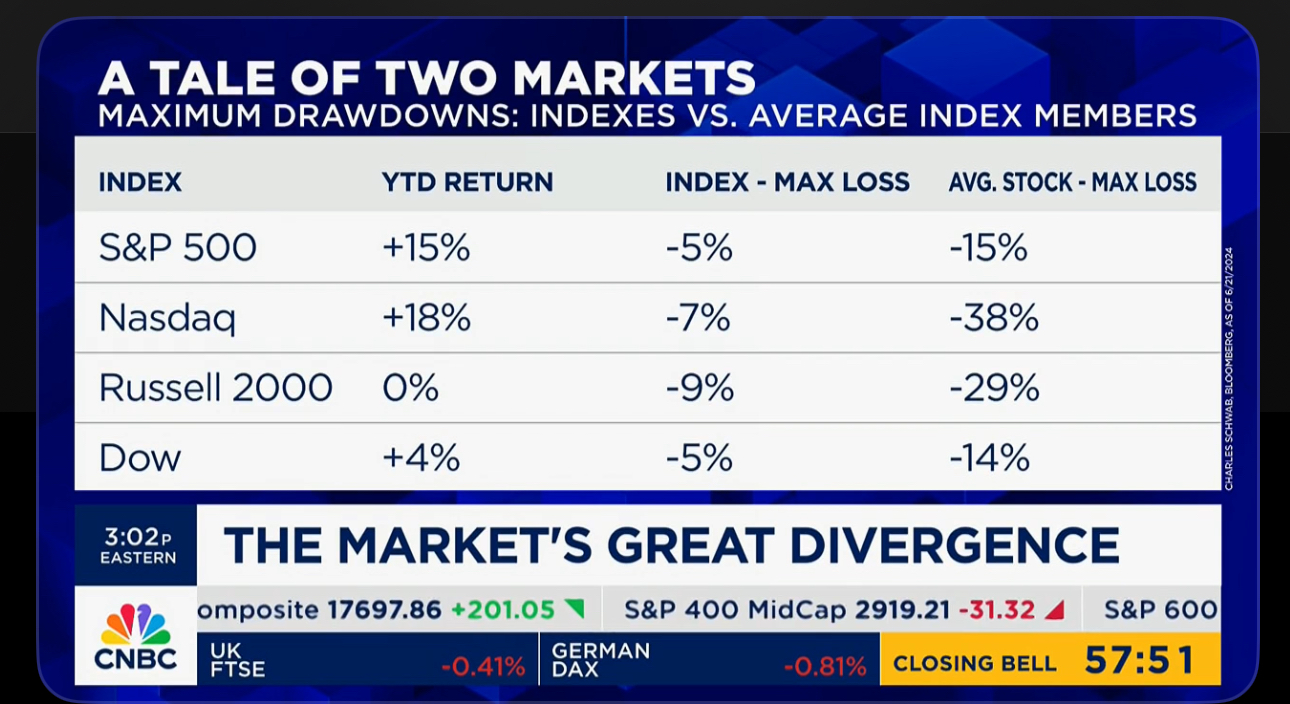

***This afternoon on the podcast|videocast we will cover ~80+ market/economic charts/data tables that support the “sea change” view that we laid out with Liz above (and in our note/podcast last week). Here’s a preview of coming attractions and why it’s about to change aggressively and quickly for the better:

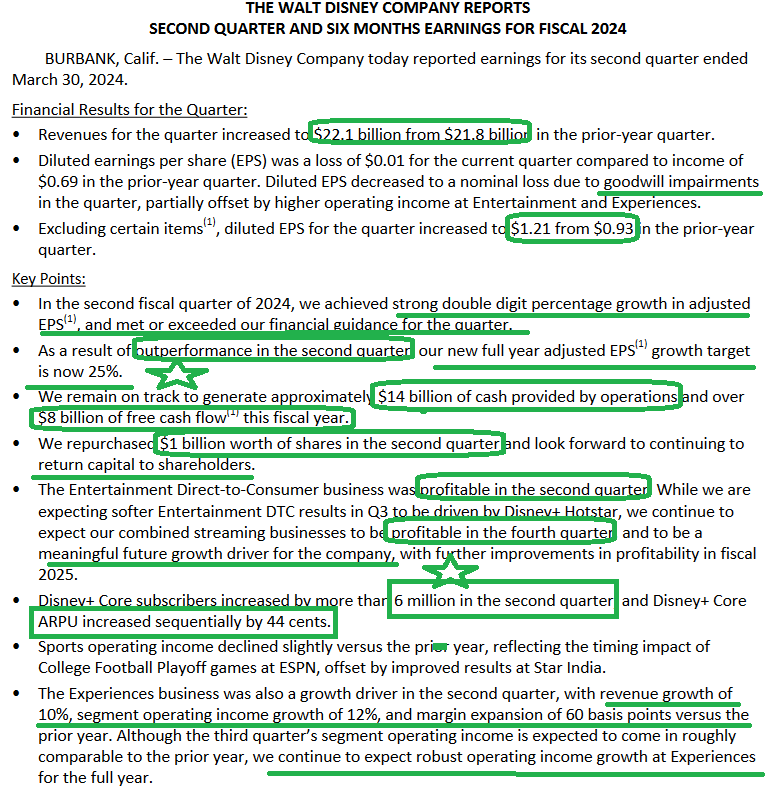

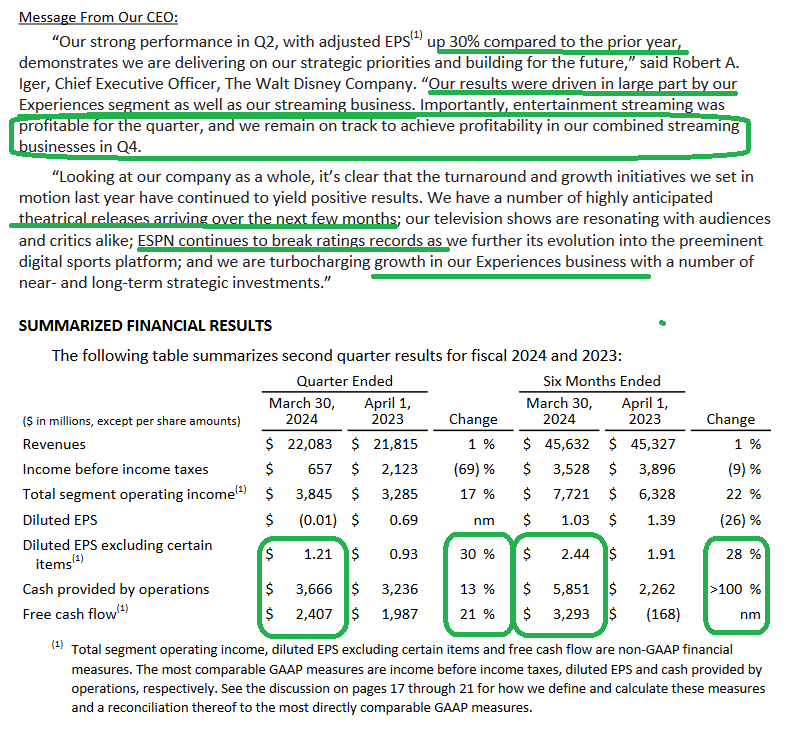

Disney

We put out this article on Disney in January when it was trading around $89:

It’s important to understand the history of the Disney cycle and how it’s “rhyming/repeating” once again (explained above). Today we will update the thesis based on new information received.

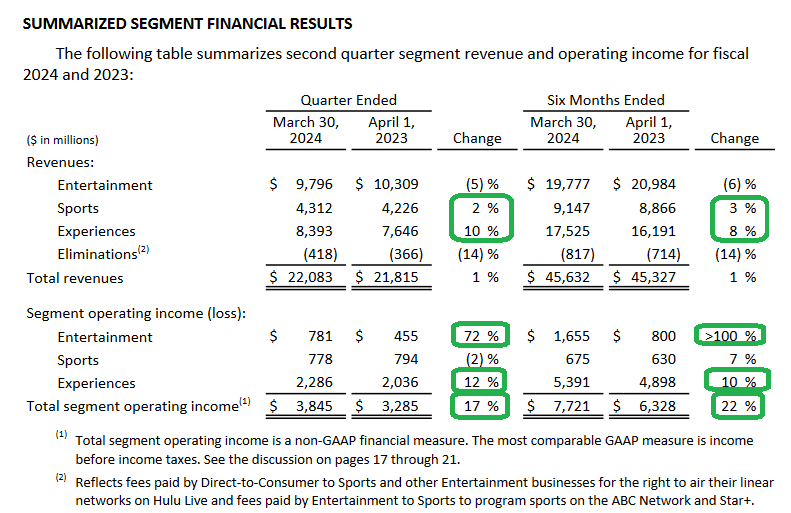

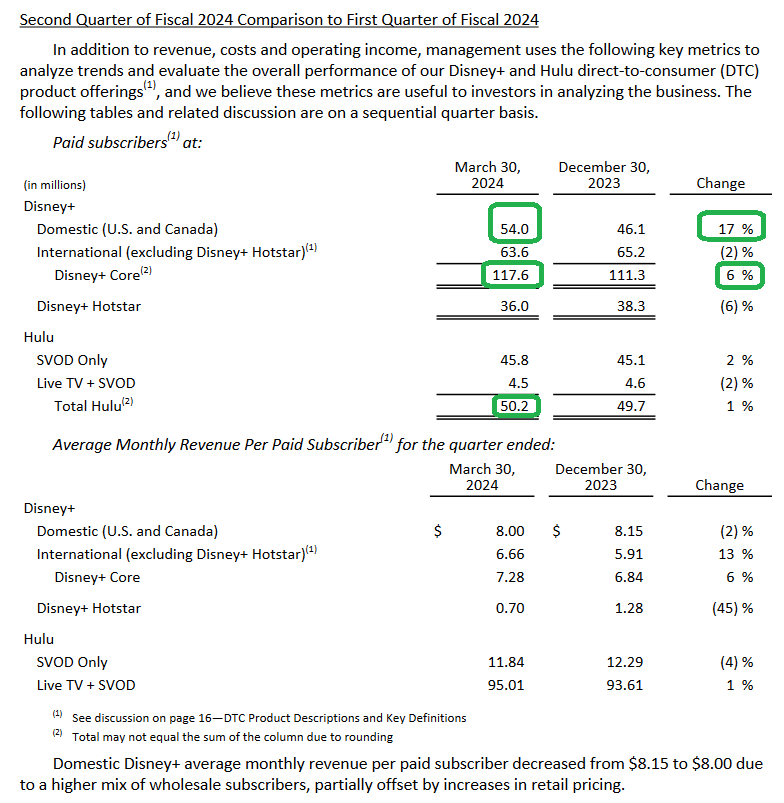

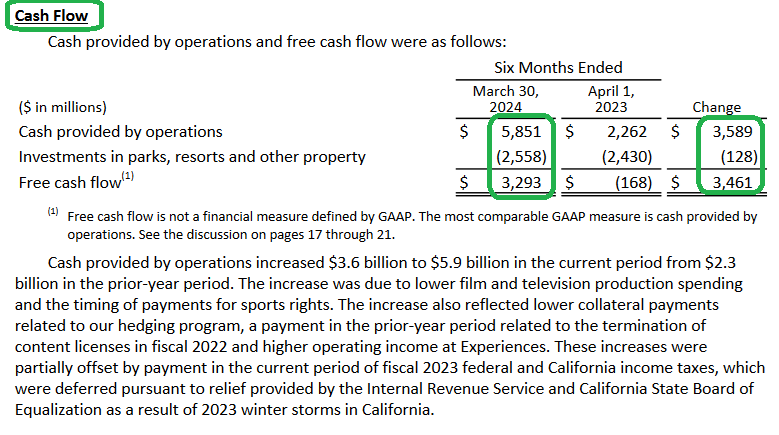

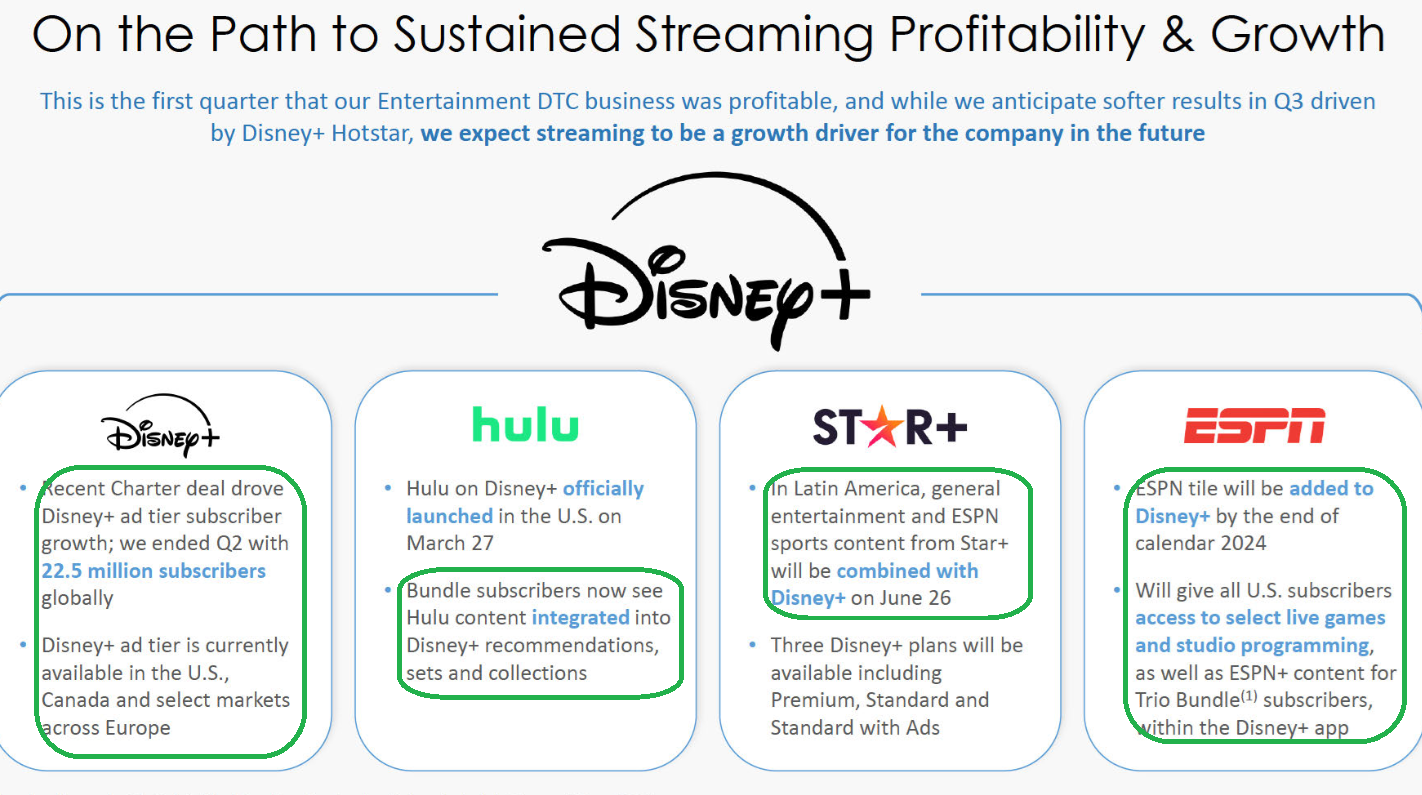

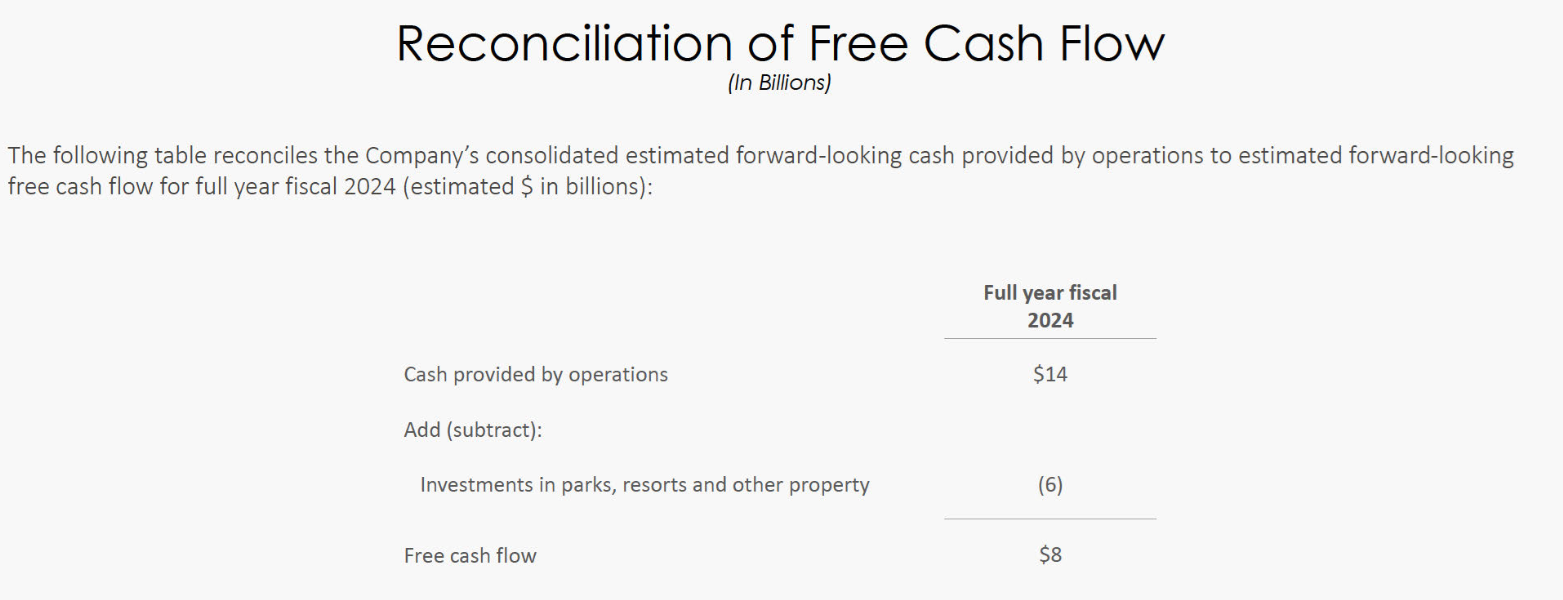

Q2 Earnings:

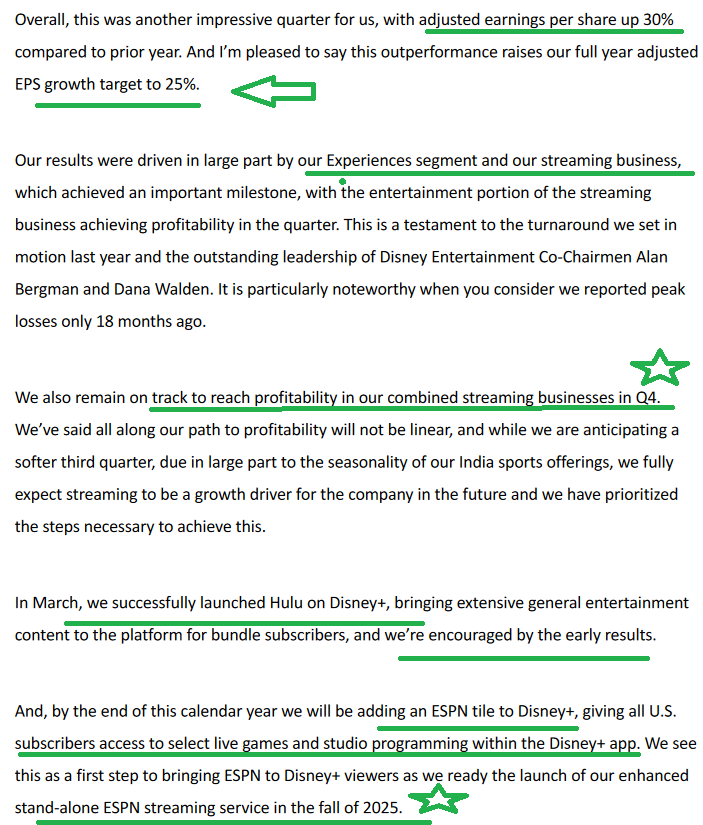

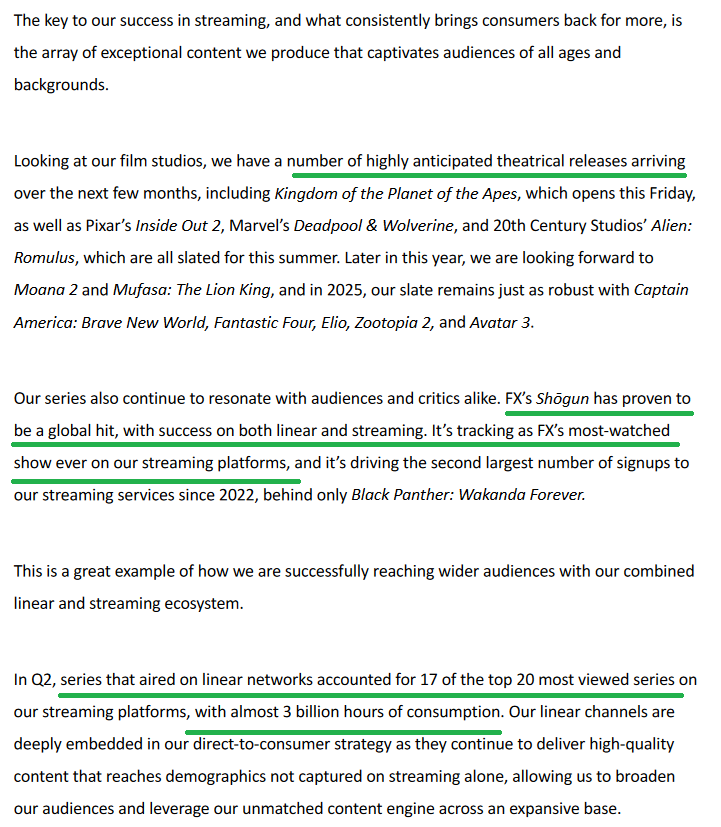

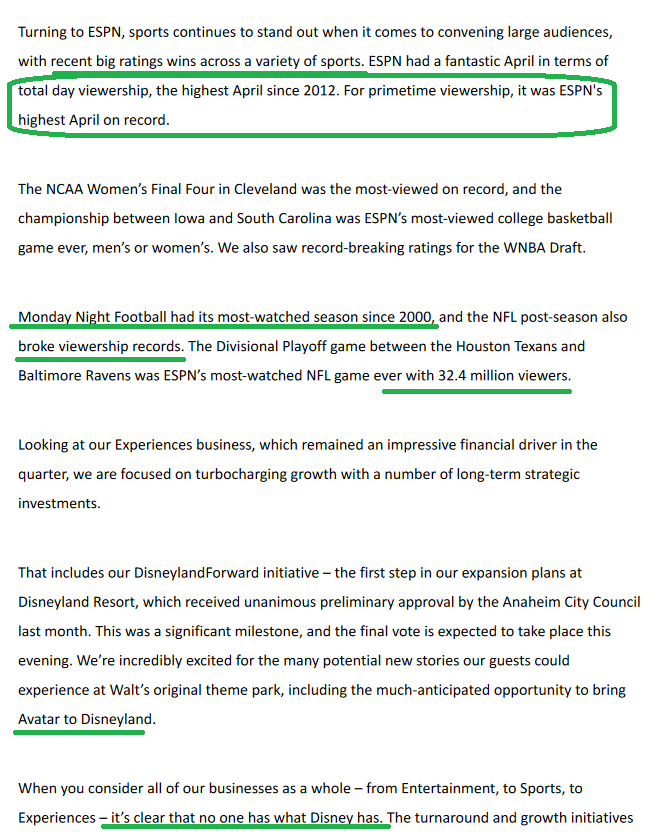

Earnings Call Transcript Highlights:

Bob Iger, Chief Executive Officer, The Walt Disney Company participated in a question-and-answer session at the MoffettNathanson Media, Internet & Communications Conference on Wednesday, May 15, 2024:

Bob Iger, Chief Executive Officer, The Walt Disney Company participated in a question-and-answer session at the MoffettNathanson Media, Internet & Communications Conference on Wednesday, May 15, 2024:

Now onto the shorter term view for the General Market:

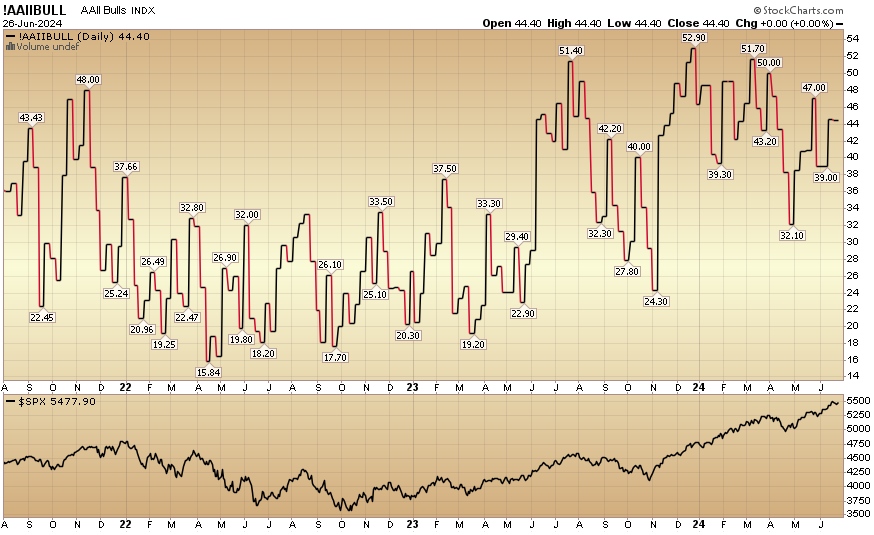

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 44.5% from 44.4% the previous week. Bearish Percent rose to 28.3% from 22.5%.

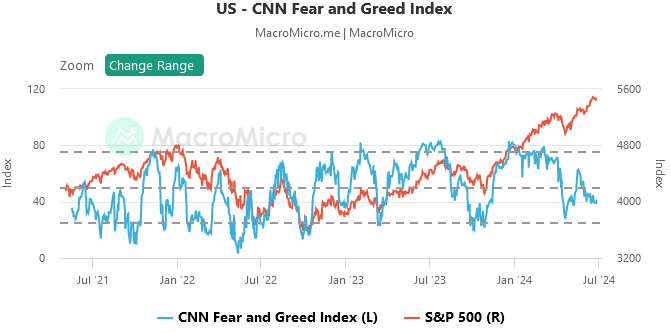

The CNN “Fear and Greed” flat-lined from 42 last week to 41 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” flat-lined from 42 last week to 41 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

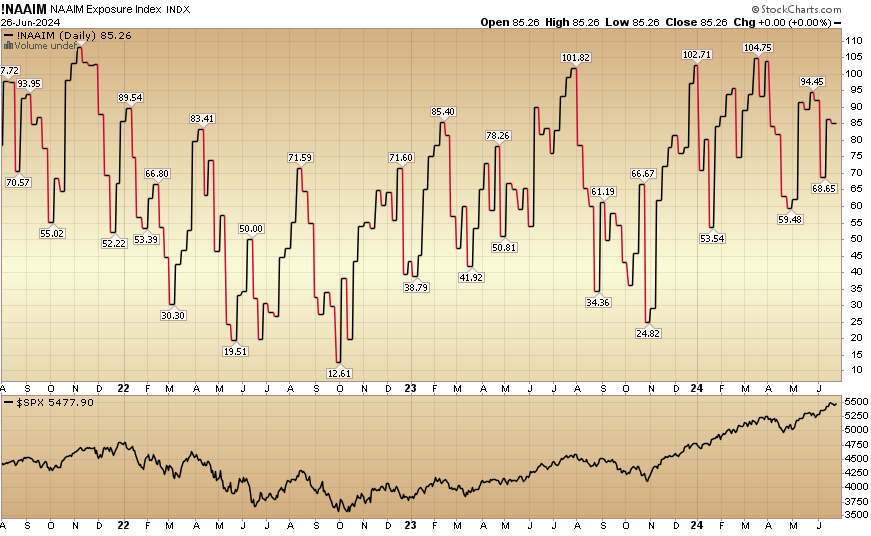

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 85.26 this week from 86.30% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients who came in so far this year during our Q1 and Q2 openings. We still closed to smaller accounts ($1M+) again as of ~2.5 months ago and will remain closed to smaller accounts until sometime in Q3. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.