Yesterday, I read an article in the Wall Street Journal that chronicled Journey’s 1981 hit “Don’t Stop Believin’.” The genesis of the Billboard hit (and ending ballad to the Soprano’s series), was a streak of bad luck for Journey keyboardist-guitarist Jonathan Cain.

As Jonathan relays, “Everything was caving in on me in 1977. I had my own band in Los Angeles, but our record deal fell through. I also couldn’t get to first base as a singer-songwriter, my dog got hit by a car and needed surgery, and my girlfriend, who lived with me and split the rent, left. I called my dad for a loan.”

On the phone, I told him nothing was working out and that maybe I should just give up on music. He wouldn’t hear of it. He said, “Your blessing is right around the corner. Sit tight. Don’t be discouraged. And don’t come home to Chicago. Don’t stop believing.” He also said he’d send me the money.

While on the phone, I grabbed my song-idea notebook to jot down his last phrase—“Don’t stop believing.” I wanted a reminder. Then I closed the notebook and forgot about it.

A few years later Journey was working on its Escape album and we needed another song. Steve Perry asked if I had one that was catchy.

That evening, while leafing through the pages, I came across my father’s phrase. I came up with chords for a chorus and a melody that I could imagine Steve singing: “Don’t stop believin’/ Hold on to that feelin’.”

In 1982, my parents came to Chicago to see Journey perform at the Rosemont Horizon theater. I surprised them with the song. After, when I went up to see them, my father said, “Very clever, son. Good thing you didn’t stop believing.”

And the rest, as they say, is history…

So how is this relevant to the current stock market environment? The answer to this is two-fold:

- While the market feels frothy and “over-valued” there is still upside opportunity. A very close friend – who has a couple million of his 401k in cash since last year – called me this week and asked if he should get back into the market. He knows I was pounding the table to buy everything under the sun last Spring and Summer, but what was I supposed to say now? His 401k options were very limited (couldn’t put him in individual/undervalued stocks), so here’s what I told him:

The easy money in the general indices has been made IN THE SHORT TERM. With the S&P 500 up ~112% off its pandemic lows, you will not see the same type of returns in the next ~18 months. What was a ‘low volatility’ environment in 2021 (with 3-5% pullbacks) will turn into a higher volatility market in 2022 (with 5-10% pullbacks) as liquidity is slowly removed from the market. That said, if you step back and look at the big picture, we are still in the early stages of a new business cycle. Looking back at 2013 the S&P 500 gained 32.39% ANTICIPATING the Fed’s taper, and gained ANOTHER 13.69% in 2014 DIGESTING taper. As it relates to a 401k, you have 15+ years until you even look at it. I told him what I would do in his shoes with International Equities, Domestic Equities, Bonds and Inflation Protected bonds. The question is not whether he should be getting exposure today, the question is whether his $2M 401k will be worth $5M, $6M or $7M by the time he starts drawing on it (by the rule of 72, your money will double every 10 years at a 7.2% return or every 7.2 years at a 10% return). In short, who cares if we get a 10%+ correction in the next 12 months? We will, so what? With long term money it’s about ‘time in the market’ not ‘timing’ the market. He can buy individual stocks and allocate to managers for alpha with other accounts and money (after his long-term money is set on auto-pilot).”

He got the picture…

2. I’ve never seen a market that felt so frothy (and in some pockets “overvalued”) that simultaneously had so many high quality stocks that were still “on-sale”, dramatically undervalued, and persistently suppressed – in the short term. Many market participants are having a hard time looking through short-term “supply chain bottlenecks, labor shortages, travel demand, material shortages and regulatory crackdowns” as it relates to several industrials, staples, biotech, healthcare, travel & leisure stocks, and Chinese Tech companies. We have already seen some examples of a nascent recovery – in recent weeks – with Chinese Tech and US Health Insurers – but Travel, Industrials, Biotech and Staples have remained in the doghouse. When this changes, it will change quickly…

Journey had it right in their timeless anthem, “don’t stop believing.” When you have done the proper work (fundamental analysis) and know what you own, the difference between those who become exceedingly wealthy and those who never make it big is PATIENCE and TEMPERAMENT. If you are buying $1 worth of NORMALIZED earnings power/growth for 50 cents, what’s the difference if it takes 3 months or 18 months to double (or triple)?

The difference is that most people get shaken out BEFORE the double due to short-term noise/headlines (or a bad quarter), short-term under-performance pressures, or chasing the latest “shiny object” after it has already doubled and the juice is out of the lemon. If you’re confident you’ve done the work, you simply have to bide your time until the rest of the market catches up – and your selection reverts back to trend intrinsic value. Once the “shiny object” chasers come for your stock (after the double – or triple), help them out and give them what they want. As the old saying goes, “when the ducks are quacking, feed them.” On the other hand, if you don’t know if your work is right, you shouldn’t be in the name (or you should be sized to reflect the lack of certainty or inherent risks in the short-term aberration/discount).

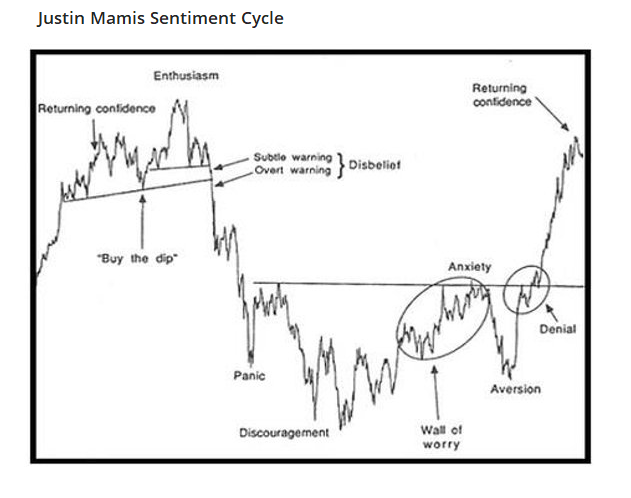

In short, buy and add during the “discouragement and aversion” periods (of high quality proven franchises) and sell during periods of “confidence and enthusiasm” for your selected security.

Bonds, James Bonds…

On Friday I was on Fox Business – The Claman Coundown – with Liz Claman. Thanks to Liz and Ellie Terrett for having me on. In this segment I made a highly “non-consensus” statement about bonds. It’s not time yet, but I laid out when and why it might be coming in the next few months…

Here were my Show Notes ahead of the segment:

Chair Powell indicated in the last press conference that he needed to see a “decent” jobs report before moving ahead. His comments today indicate he’s feeling pressure. Whether he announces in November without seeing a jobs report (or more likely December after he sees two “decent” jobs reports), the market has already been pricing it in. The 10yr yield has moved up from ~130bps to ~170bps in a month since his press conference.

In May 2013 (the last taper) Bernanke intimated he wanted to taper, by the time he announced in December 2013 the 10yr yield had moved up from 162bps to ~3.00%. That was the PEAK in yields for the next 5 years. So while everyone thinks yields will keep rising once they START tapering, history shows that yields may STOP rising upon announcement.

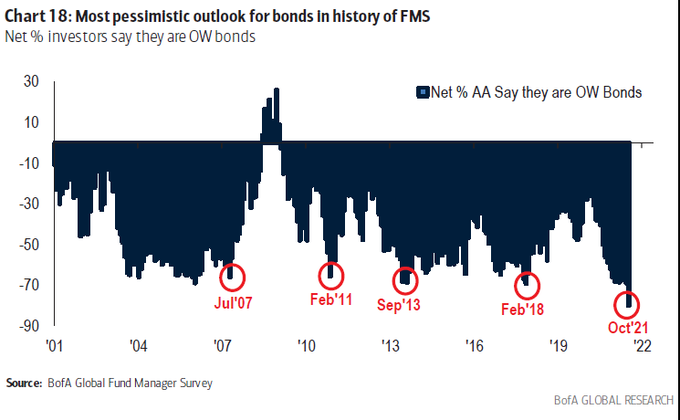

Looking at the Bank of America Global Fund manager survey this week, managers had their lowest allocation to being overweight bonds in history. They are all short on one side of the boat. My bet is the 10yr yield hits a 2 handle (>2%) by the time they start taper in coming months. At that time it will be an opportunity to BUY bonds as all the sellers will be out, and the Fed will still be adding ~$660B of purchases/re-investment during the ~8mo. wind-down.

As for equities, the S&P 500 rose 32.39% in 2013 ANTICIPATING TAPER, and rose another 13.69% in 2014 DIGESTING TAPER. Expect MORE volatility next year than this year as liquidity comes out. The 3-5% pullbacks we had this year will turn into 5-10% pullbacks next year, but we are still in the early stages of the new cycle that started last summer.

Activision Blizzard (if time):

–Fell ~25% off its recent highs due to bad employment practices – which they are working to correct.

-Trading at 18.3x 2020 Est. earnings. Expected to grow earnings 14% next year.

-Last qtr. Revenues up 19% yoy.

–Call of Duty franchise continued to benefit from engagement among its large user base.

-Recent launch of Burning Crusade Classic helped support strong growth in net bookings for the World of Warcraft franchise.

–King Digital also fared well, supported by the success of Candy Crush.

-Reports Nov 2.

Tommorow’s News Yesterday…

On my Cheddar TV appearance – on October 11 (just before Earnings season began), I said that the consensus estimates of 27.5% earnings growth in Q3 was too low and we could finish with >40%. NO ONE was calling for that. Here’s where we are as of last night with 60% of the S&P 500 left to report:

CNBC, “Nearly 40% S&P 500 companies have reported earnings and more than 80% of them beat Wall Street expectations, according to CNBC calculations. S&P 500 companies are expected to grow profit by about 37.6% in the third quarter.”

As consensus 2022 EPS guidance comes up, it will make the forward multiple look a lot more reasonable before year-end.

In the meantime, you will have some great companies sell off big due to short-term costs and supply-chain issues. These will be your opportunities to set the table for 2022. Great companies you hold will have bouts of volatility due to Earnings noise, Taper, Fed Appointments, Washington Policy, China Relations/Crackdowns, etc. These are gifts to take advantage of (initiate or add to high-quality positions). Remember, it’s not what happens, it’s what you do about it that makes all of the difference…

Now onto the shorter term view for the General Market:

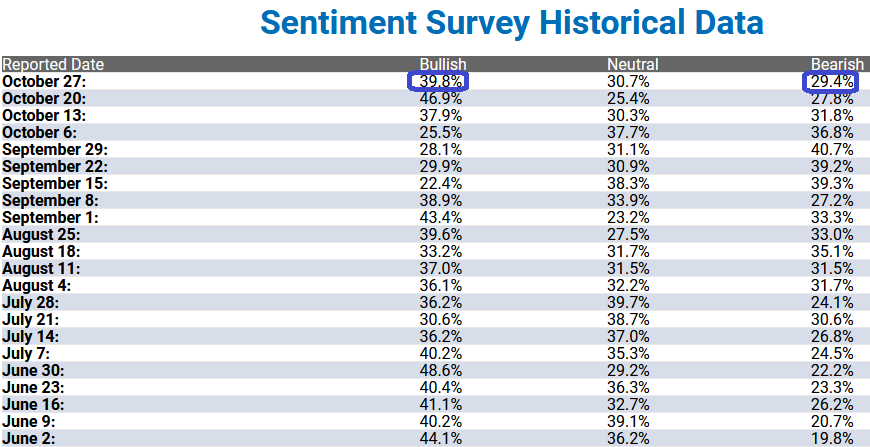

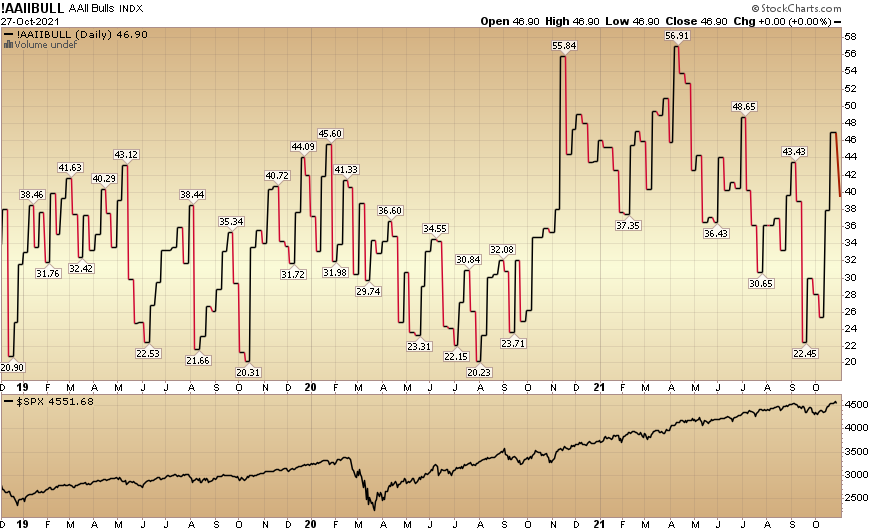

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 39.8% this week from 46.9% last week. Bearish Percent ticked up to 29.4% from 27.8% last week.

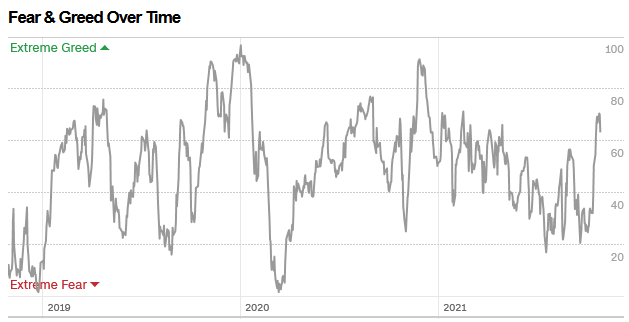

The CNN “Fear and Greed” Index ticked down from 67 last week to 63 this week. This is still in the neutral range of sentiment. You can learn how this indicator is calculated and how it works here: (Video Explanation)

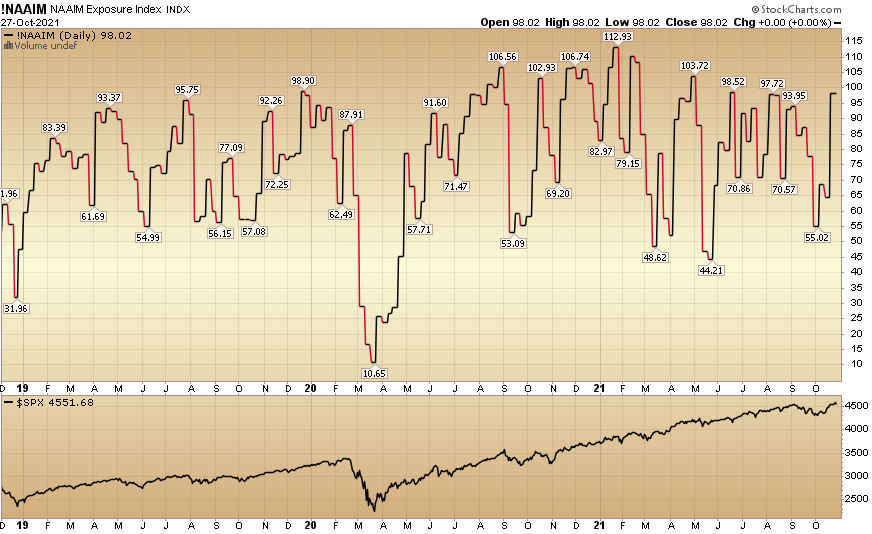

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 98.02% this week from 64.46% equity exposure last week. Managers are chasing into year end – as they are underweight with the market pressing higher into year-end.

Remember, when you have done your analysis and identified the reasons for the short-term aberration in price, ask yourself whether the downside catalyst will be temporary or if it will permanently impair earnings power on a go-forward basis. If the answer is “temporary” for a long-term high-quality proven franchise, and you can buy it on sale, do so. Then it’s just a matter of time until price converges with its intrinsic growth trend and value. In the interim, “don’t stop believin’…”