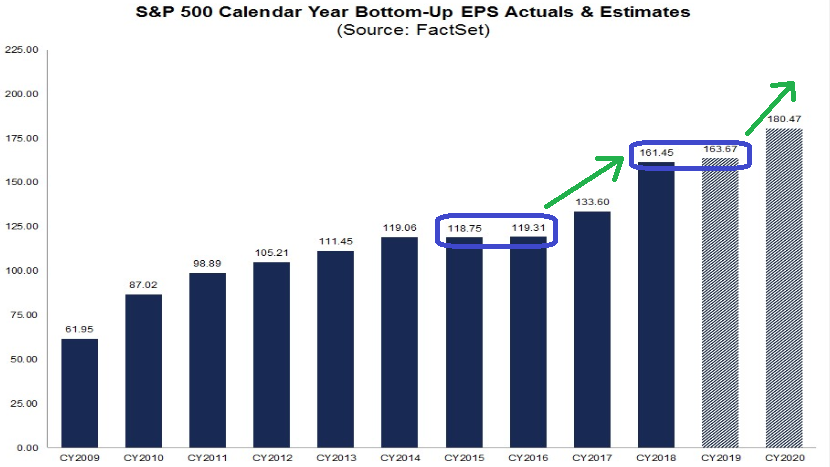

2020 S&P 500 Earnings Estimates are still holding strong at $180.47 – or a jump of 10.4% over 2019. This will be our first jump in Earnings growth since the 2016-2017 period.

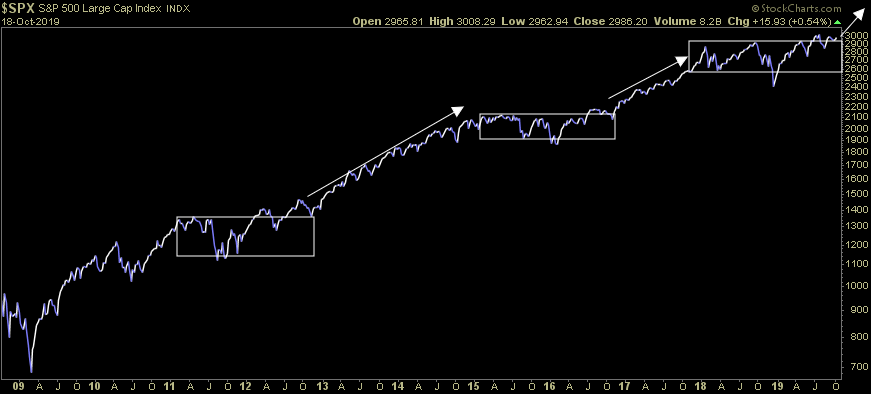

As was the case in 2015-2016 when earnings were flat for two years – yielding a flat S&P 500 – we are coming off 2 years of flat earnings and price 2018-2019. Just as the stock market began to discount the jump in 2017 earnings (~+11%) in early Q4 2016 (after 3 consecutive quarters of negative year on year earnings growth), we may be facing the same exact scenario now that earnings are coming in stronger than expected.

As markets gain comfort with Q3 being “less bad” than expected (and likely finishing out just below flat year on year), the S&P will start to sniff out the 10%+ earnings growth of 2020 and re-rate accordingly – just as in early Q4 2016.

Factset Data:

So far for Q3 2019 (with 15% of the companies in the S&P 500 reporting), 84% of S&P 500 companies have beat on Earnings, and 64% have beat on revenues. At this point, the earnings beat rate is above the 5 year average of 72%.

The bottom-up target price for the S&P 500 is 3323.16, which is 10.8% above the closing price of 2997.95. This is in-line with earnings growth estimates of 10.4% but gives no credit for multiple expansion – which is well within the realm of possibility – considering the discount rate has dropped 50bps in the last couple of months and we’ll likely get another 25bps cut before year-end.

The Energy sector is expected to see the largest price increase at 21.5%, as this sector has the largest upside difference between the bottom-up target price and the closing price.

The Real Estate and Utilities sectors are expected to see the smallest price increases of 2.5% and 3.7% respectively. These sectors have the smallest upside differences between the bottom-up target price and the closing price for this sector.