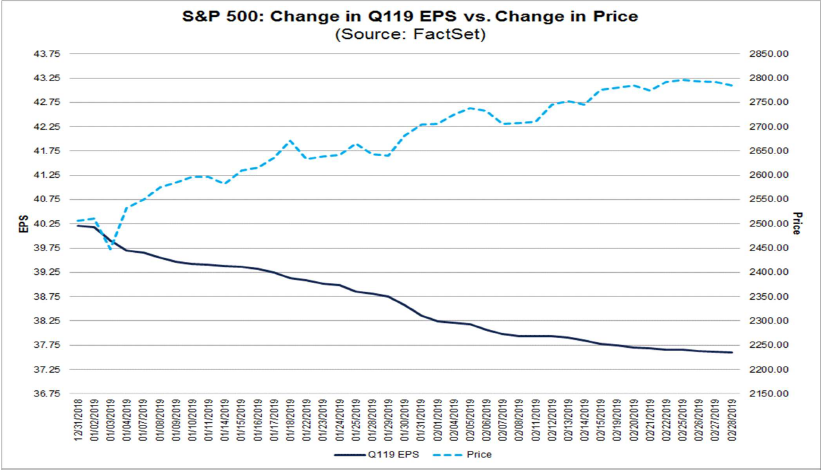

Chart/Data Source: FactSet

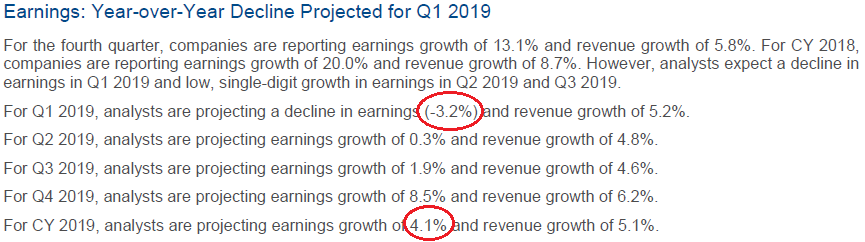

As you can see in the above chart, the S&P 500 climbed for the first two months of the year while earnings estimates for Q1 and 2019 full year declined. CY 2019 Earnings Estimates are currently as follows:

The 4.1% earnings growth (as estimated by FactSet) assumes earnings of ~$170 for the S&P500 in 2019 (all back-end loaded for Q4). Q1 earnings will be negative year on year.

Using this morning’s price of 2808 on the S&P 500, this implies a 16.51x forward multiple. If you use Howard Silverblatt’s (S&P Global) 2/21/2019 estimate for 2019 earnings of $166.36 you are at a 16.87x forward multiple. This is above the 10 year average of 14.6x and the five year average of 16.4x. Keep in mind that the discount rate on those earnings has gone up significantly in the past 12 months due to fed raises (which should compress the multiples somewhat). People pay LESS for future cash flow and earnings power as interest rates go up. The fact that the Fed has claimed to be on hold does not negate the fact that rates have gone up materially already (relative to where they were).

So what has to happen for prices to go up?

- Multiples have to remain this high and the 4.1% estimate has to stop coming down (it was double digits just a few months ago). If the multiple remains elevated AND estimates stay at 4.1%, we could see the S&P 500 as high as 3,061.48 this year.

- We could sign a material deal with China which would potentially lead to earnings estimates going UP (although this is partially priced in).

- There could be an outlier event of a Brexit referendum in which the populace votes to stay in the EU. This would also modestly increase global growth estimates.

As the two key catalysts to the upside are weeks and months away respectively (and not guaranteed by any means), there is not much in the short term to act as a catalyst. 96% of the S&P 500 has reported for Q4 and we are now nearing the blackout period before Q2 where companies will be prohibited from buying back shares. In the absence of positive earnings reports, stock buybacks, and global trade deals, it is more likely than not we will consolidate (partially pullback) the gains from the beginning of the year over the next few weeks or so.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.