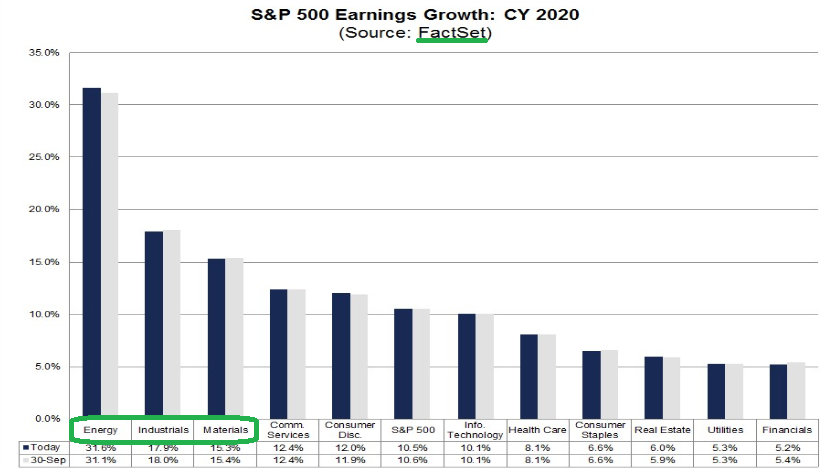

Data Source: FactSet

Everyone knows the classic song by Johnny Nash, “I Can See Clearly Now”

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

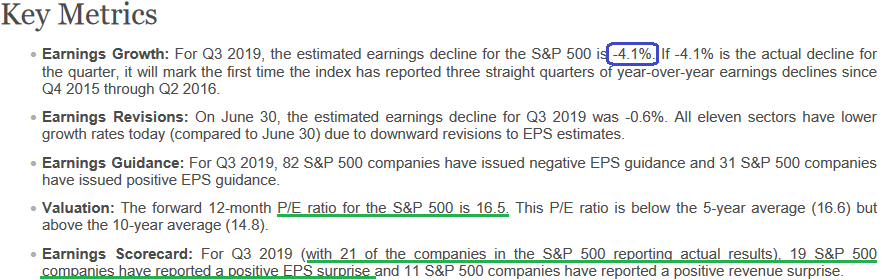

The BAD news is: S&P 500 is expected to report a decline in earnings of -4.1% for the third quarter (down from -3.8% at the end of the quarter – just 4 days ago).

The GOOD news is: From the end of the quarter through the end of the earnings season, the earnings growth rate has typically increased by 3.7% on average (over the past 5 years) due to the number of positive earnings surprises. (FactSet)

This implies we should finish earnings season at around -.01% year on year. This will mean 3 consecutive quarters of negative earnings growth.

Why could this be good news? Read our previous article(s) here:

The forward 12-month P/E ratio is 16.5, which is below the 5-year average but above the 10-year average. This is important considering we have just lowered the discount rate by 50 bps over the past few months and another 25bps cut is expected before year-end. This gives meaningful room for multiple expansion in expectation of a double digit earnings jump in 2020.

For CY 2020, analysts are projecting earnings growth of 10.5% and revenue growth of 5.7%.

The bottom-up 12 month target price for the S&P 500 is 3322.86, which is 14.2% above the closing price of 2910.63.

The largest earnings growth for 2020 is expected to come from the Energy, Industrials and Materials Sectors: