Source (above): Factset

Howard Silverblatt, Senior Index Analyst, Index Investment Strategy, for S&P Dow Jones Indices at S&P Global has taken DOWN 2019 EPS from $175.78 on November 7, 2018 to $167.64 in the last couple of weeks. At an S&P500 price of 2767 this morning, that implies the market is trading at 16.5x 2019 earnings (above the 5yr average of 16.4x and the 10yr average of 14.6x). Keep in mind this is in the face of a discount rate that continues to increase (which should naturally pressure multiples). Factset 2019 EPS estimates are still up around $170 but that still implies a high range multiple of 16.27x 2019 Est EPS. This us up from 14.6x at the trough in December.

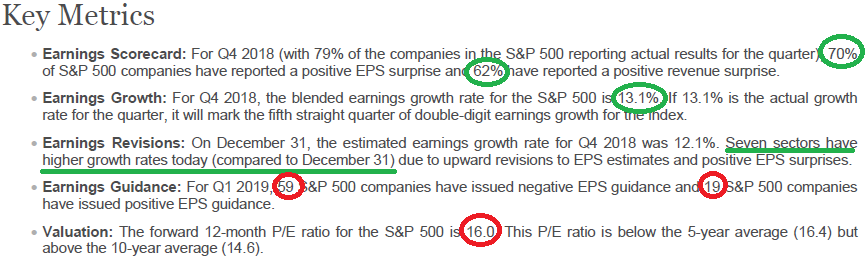

The optimism is justified in the short term as Q4 earnings and revenues came in better than expected for a 70% and 62% respective beat rate (13.3% yoy growth). Guidance has been mixed to weak.

A few things could happen to justify trading in this range:

- Real China Deal (earliest end of February/early March).

- New Brexit Referendum (Brits vote to stay in EU) – month(s) off (lower probability).

- US Dollar weakens: ($USD was ~5% stronger against the Euro yoy Q4. This hurt US earnings and helped EU earnings)

- Post-Earnings buybacks will help some, but earnings catalysts now largely in the rear view mirror.

We continue to believe the market will consolidate/digest (partially pullback) January/Early February’s gains in the coming weeks. If estimates can remain strong through this period, there may be some light at the end of the tunnel (most of the data is still solid ex-December retail sales and Atlanta Fed Q4 GDP revision down to 1.5% this week: GDPNow). We will continue to watch earnings/revisions/guidance on a daily basis and make adjustments as the data comes in.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.