EXCLUSIVE: Cooper Standard (Ticker: CPS) Interview and Background

I had the pleasure to interview the Chairman and CEO of Cooper Standard – Jeff Edwards (CPS is one of our largest holdings). I am very grateful to him for taking the time out and participating in this long-form format. It enabled us to get granular on the details of the business, where we’ve come from and more importantly – where we are going!

This conversation exceeded any expectations of what I had going in and I believe you will find this to be one of the most important hours of content I have ever put out. I hope you enjoy watching it as much as I enjoyed hosting it:

You can also find this interview directly on Cooper Standard’s Investor Relations Page:

CEO Interview with Great Hill Capital

To find out more about Cooper Standard go to:

Cooper Standard Investor Relations

To find out more about Tom Hayes and Great Hill Capital go to:

About Tom Hayes and Great Hill Capital

Not Investment Advice (Terms & Conditions):

Terms of Use

CPS Investment Background:

In May 2022, we built up a position in Cooper Standard at a basis of ~$5.50. We discussed it on our podcast|videocast to clients and public viewers alike. On June 7, 2022 we broke our Cooper Standard (CPS) thesis publicly on Fox Business for the first time (when it was trading ~$6/share):

The stock is up about 2.6x so far, and we believe it hasn’t even left the station yet.

Here is some information from our original thesis and updates:

Latest Update:

Key Market Outlook(s) and Pick(s)

On Monday, I joined Taylor Riggs on Fox Business “Claman Countdown” to discuss markets, sentiment, positioning, Intel, and Alibaba. Thanks to Taylor, Liz, and Jake Mack for having me on:

On Friday, I joined Diego Laje on CGTN America to discuss Tesla, DOGE, and Elon Musk. Thanks to Diego and Kamelia Kilawan for having me on:

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 205 institutional managers with ~$477B AUM:

March 2025 Bank of America Global Fund Manager Survey Results (Summary)

Here were the 5 key points:

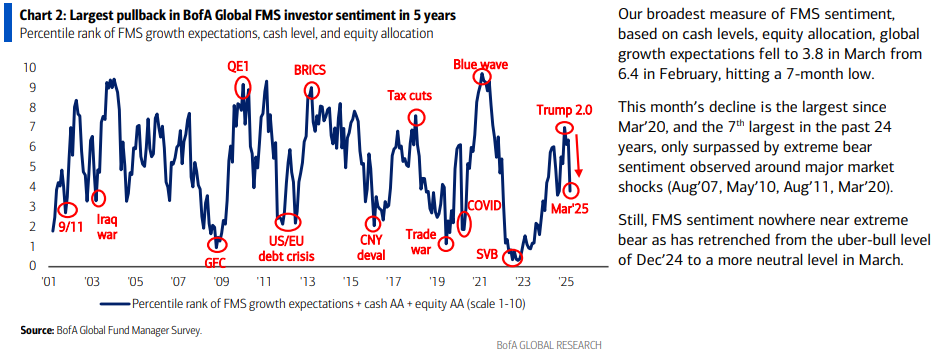

1) Largest pullback in FMS sentiment since Mar’20 and 7th largest in the past 24 years:

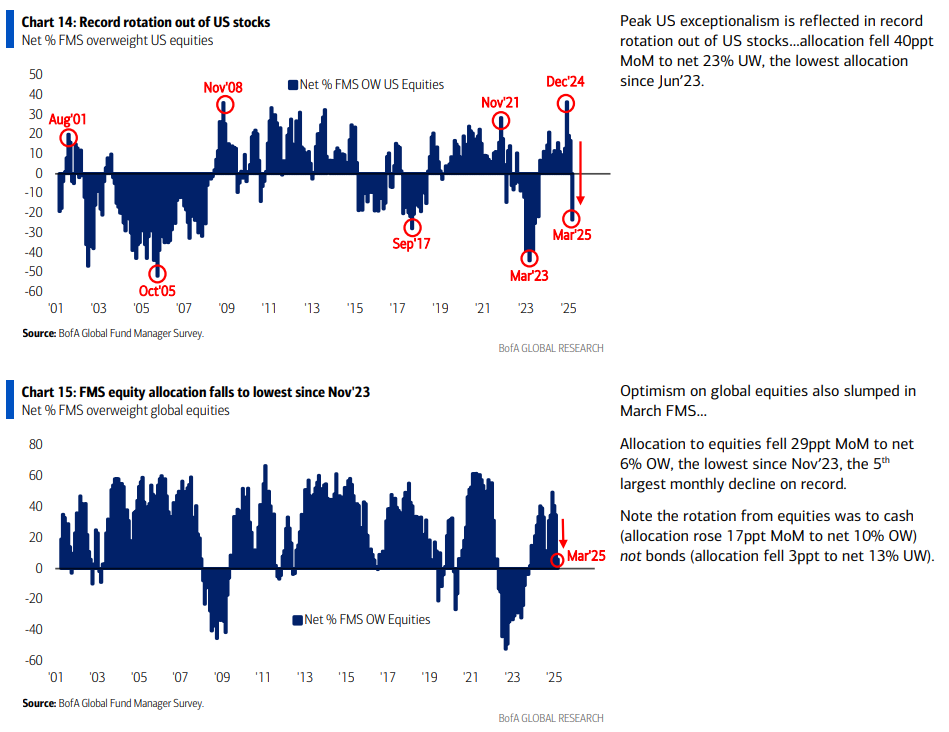

2) Record rotation out of US stocks, falling to a net 23% underweight, the lowest allocation since Jun’23:

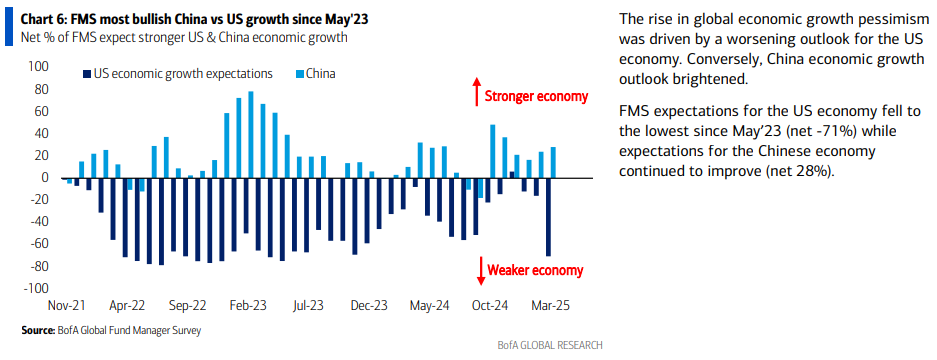

3) Opinion follows trend, as managers are most bullish on China vs US growth since May’23:

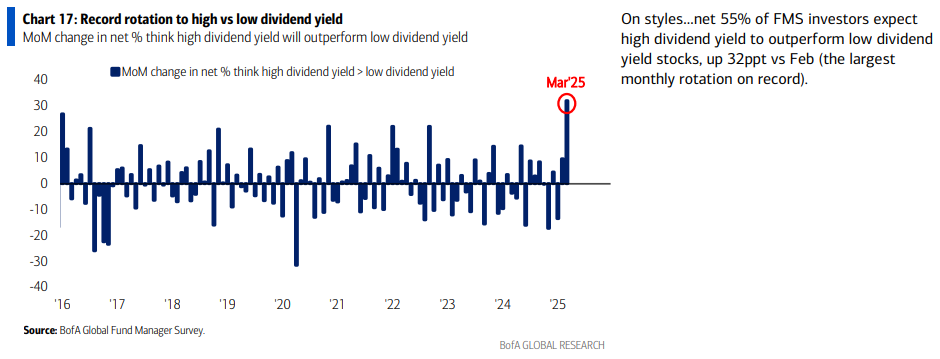

4) Dividend stocks continue to get a bid, with the largest monthly rotation on record into high vs low dividend yield:

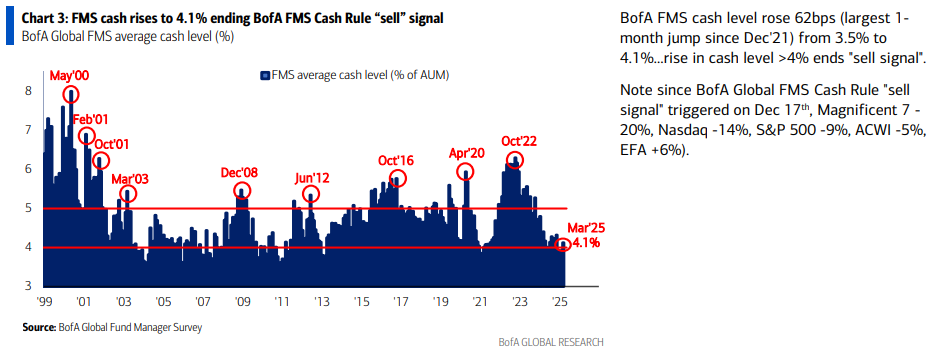

5) FMS cash levels went from a 15-year low just last month to their largest one-month jump since Dec’21:

Latest China & Alibaba Update

This past week, China rolled out an “Action Plan for Boosting Consumption,” which might be the Chinese equivalent of “doing whatever it takes…” Take a look below:

(h/t P.V.)

Alibaba is what we like to call the toll taker of the middle class recovery in China. Vigorously boosting domestic consumption, AKA tapping into the $20 trillion-plus of household savings on the sidelines, would put quite a few dollars in the hands of BABA. Needless to say, we believe things are just getting started…

Crown Castle Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

Earnings Results

Morningstar Analyst Note

Key Takeaways

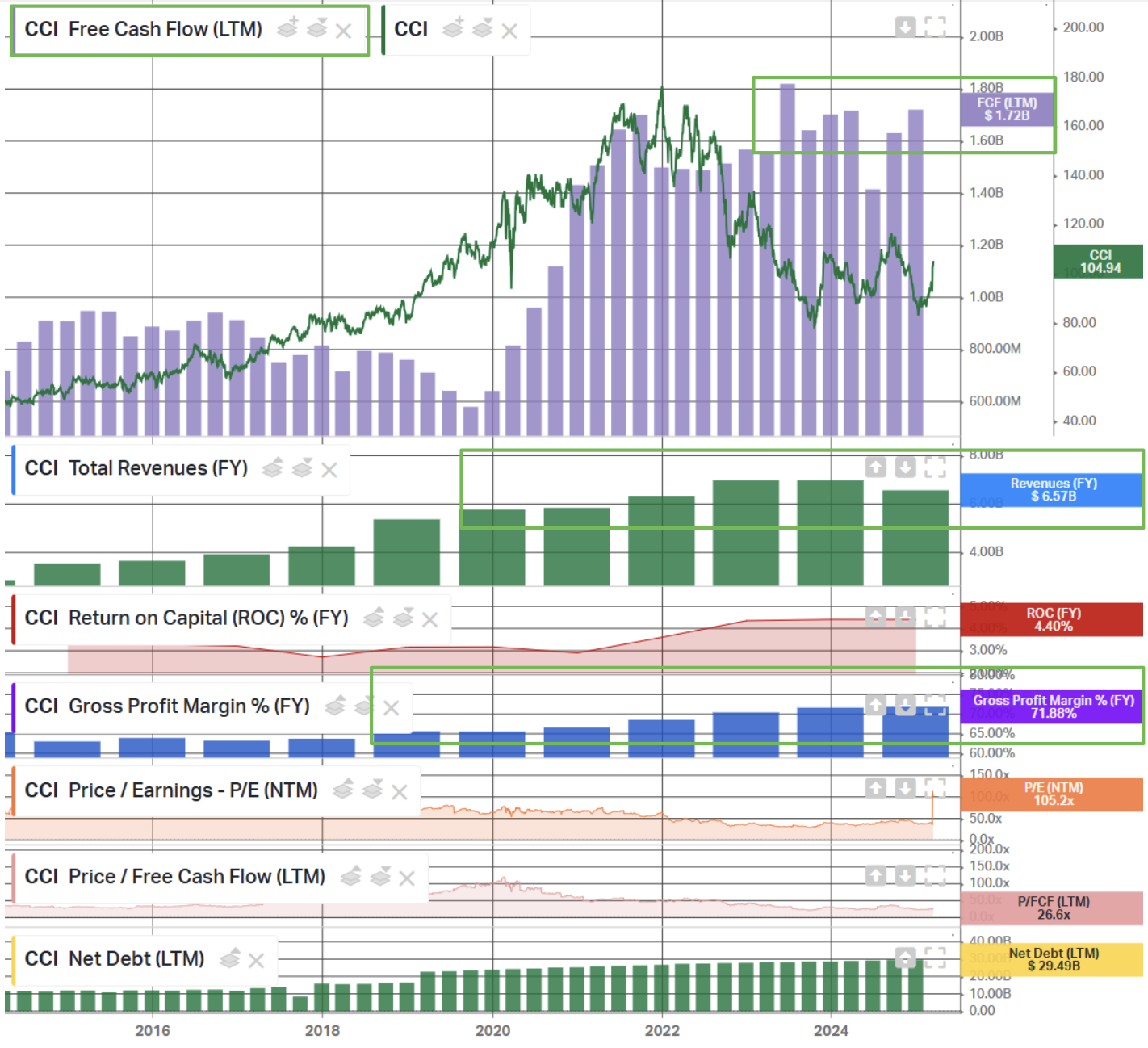

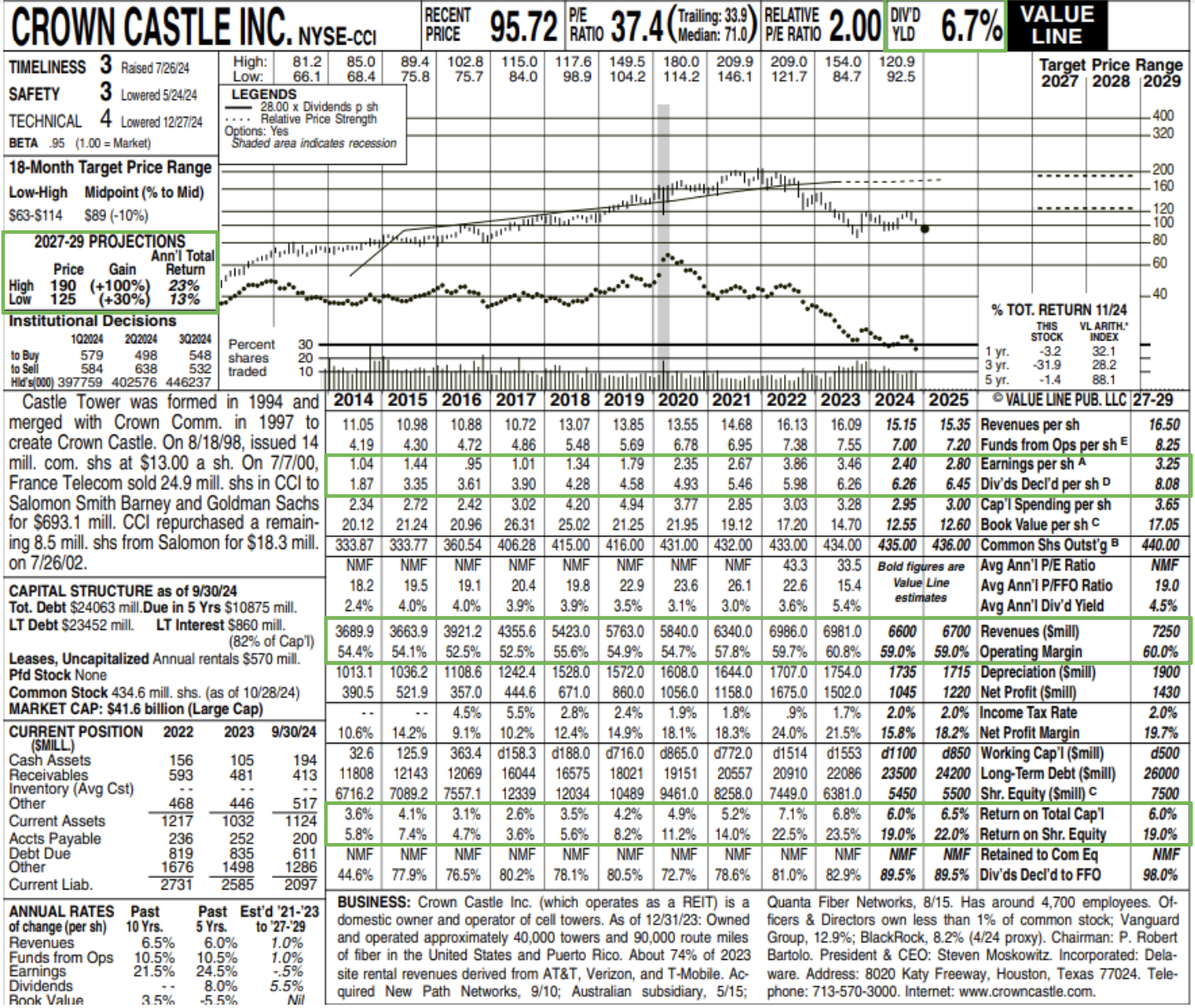

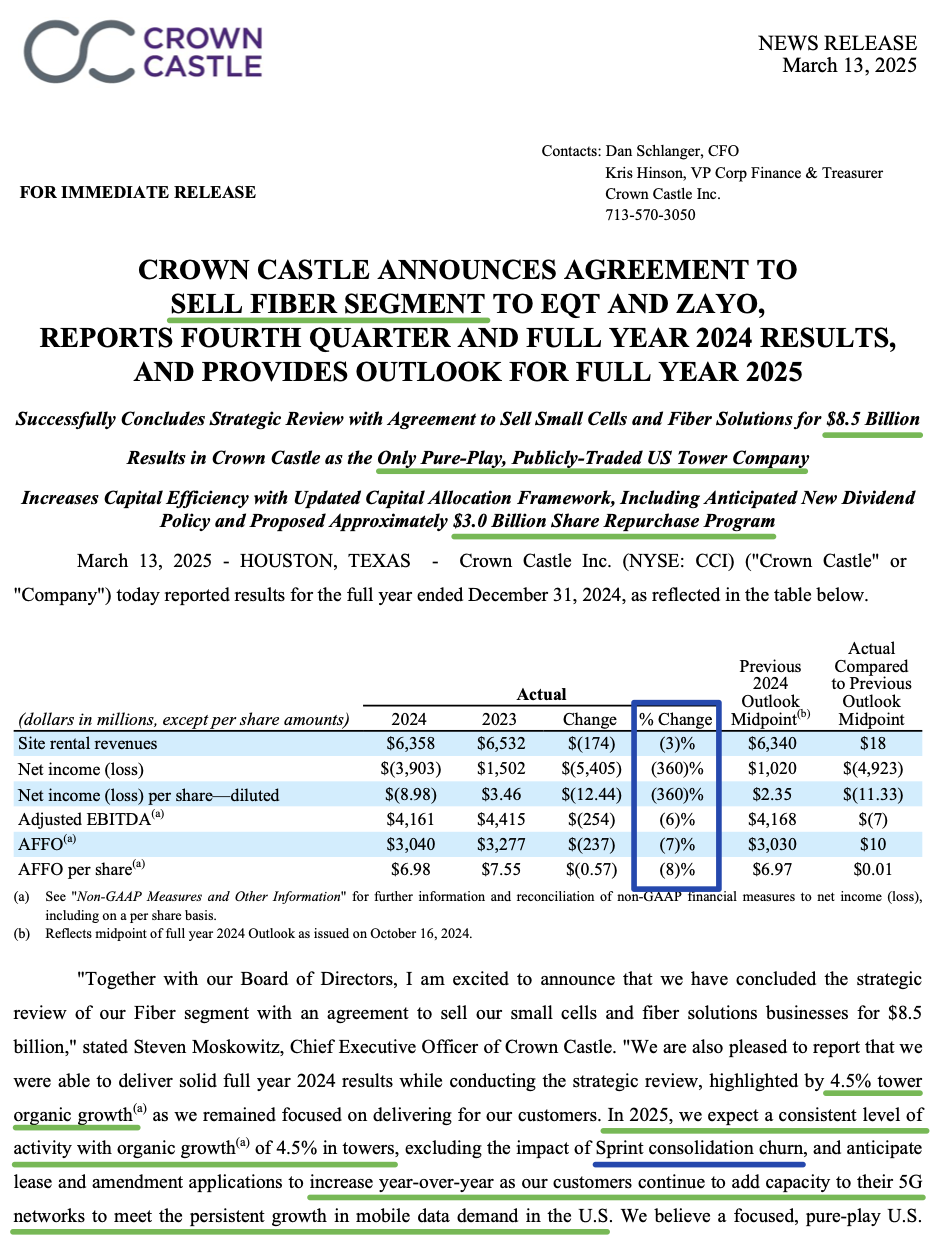

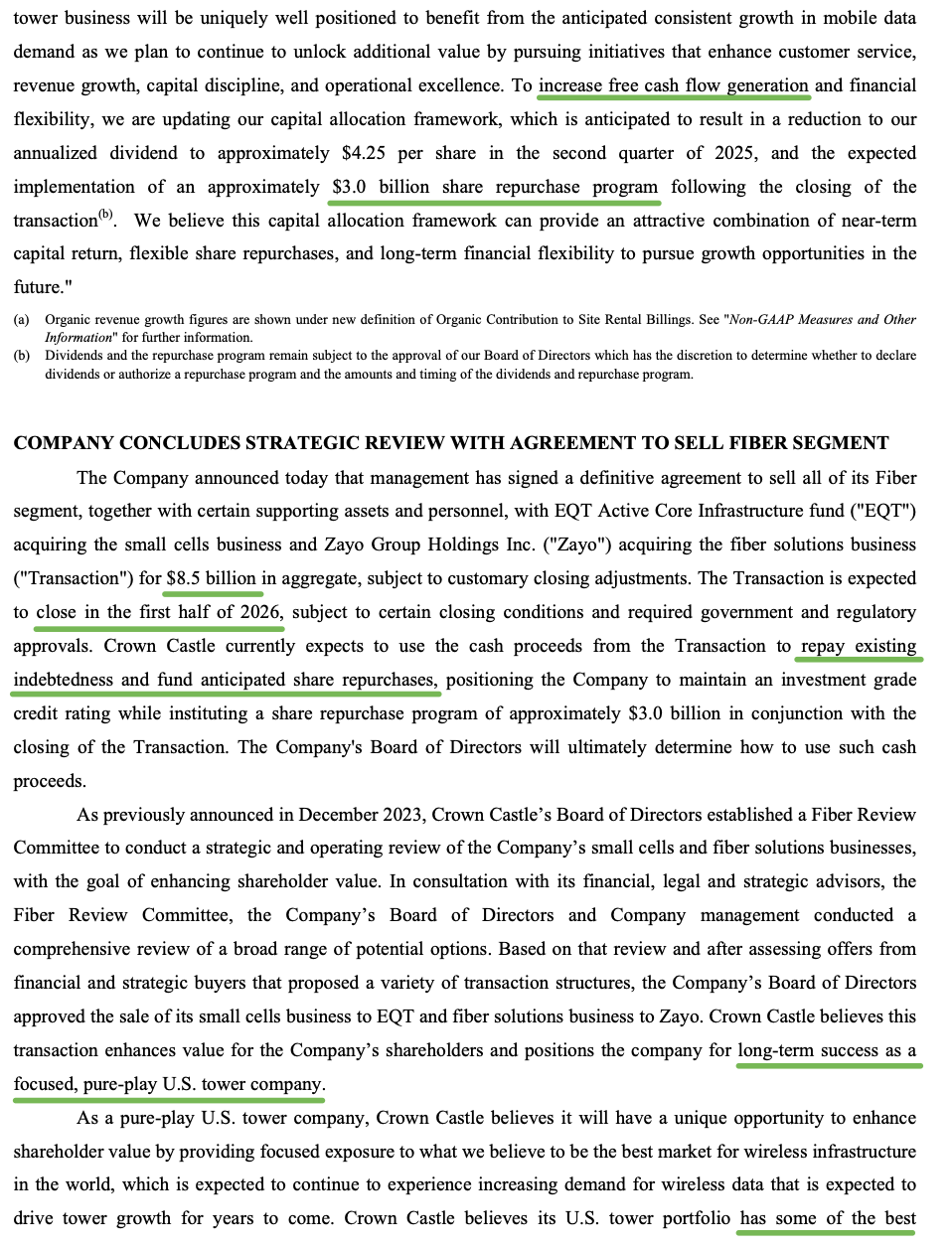

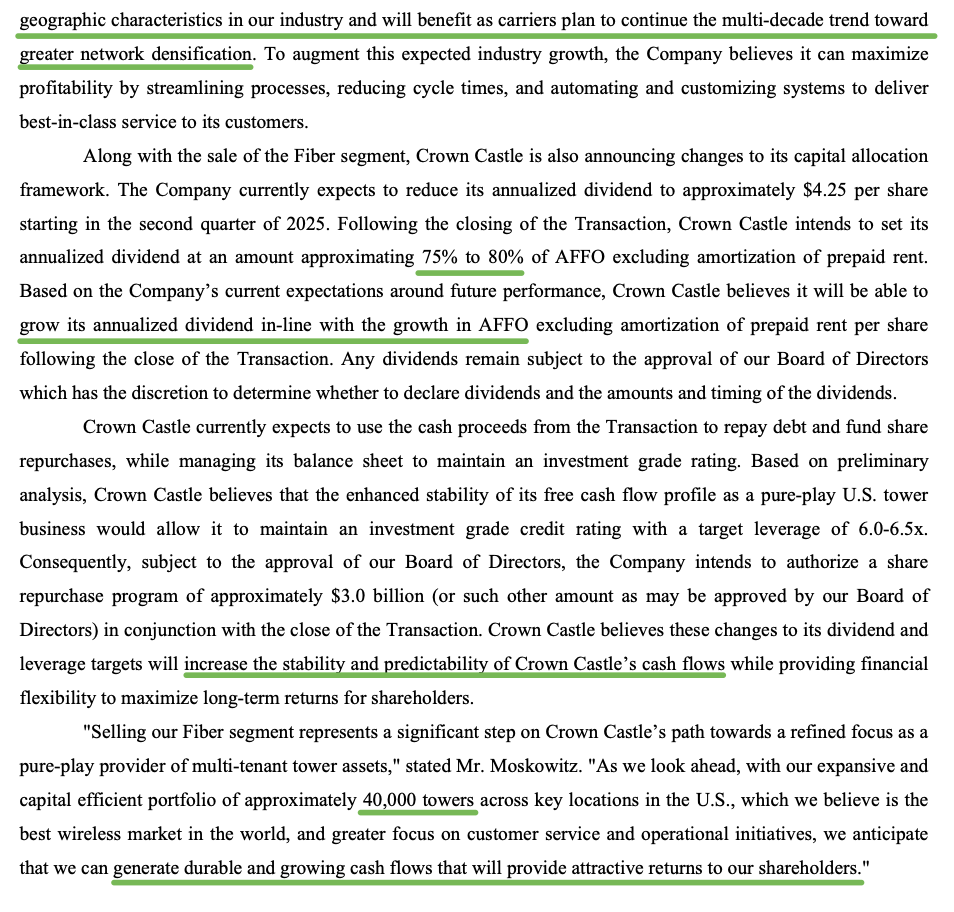

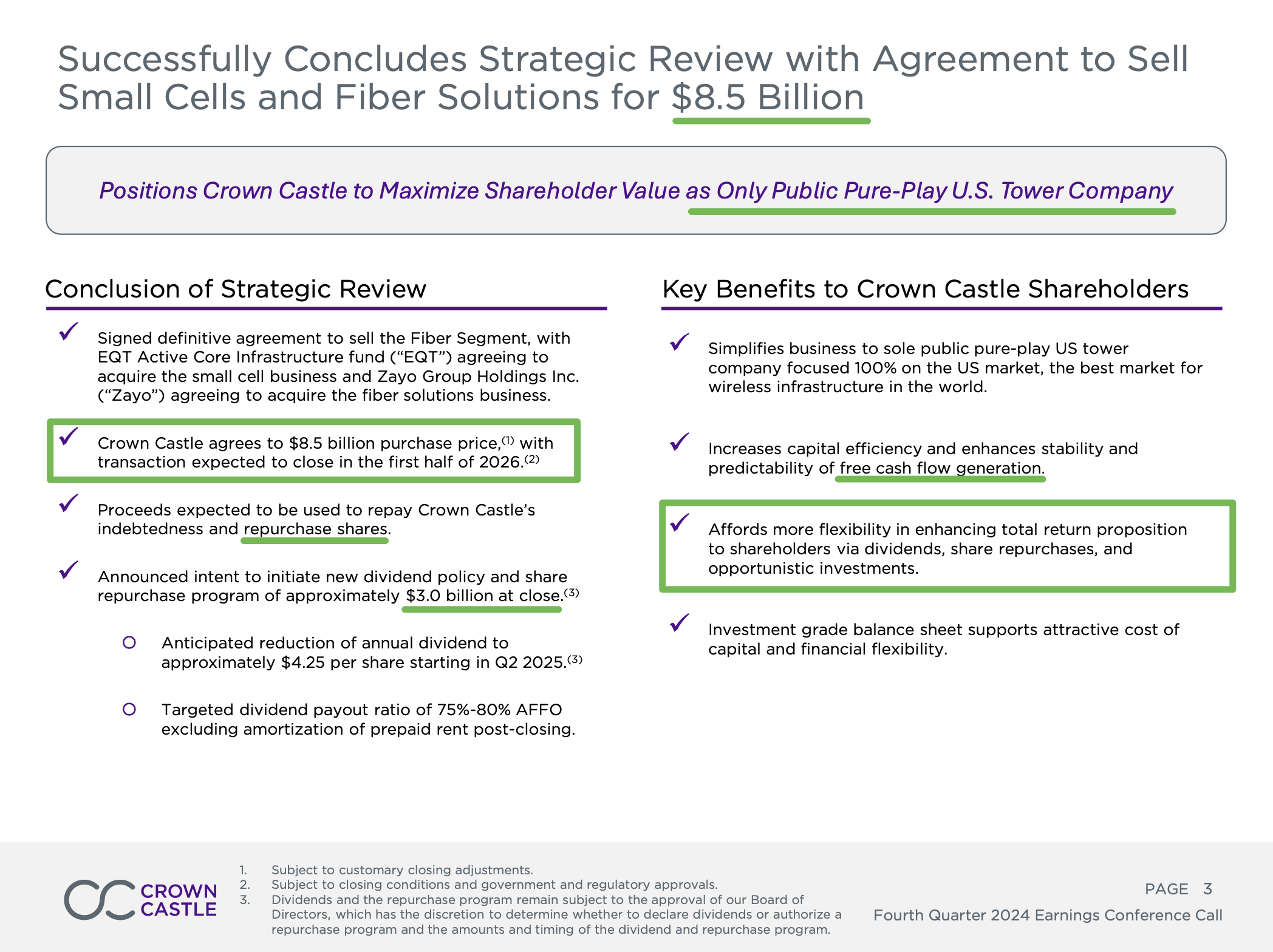

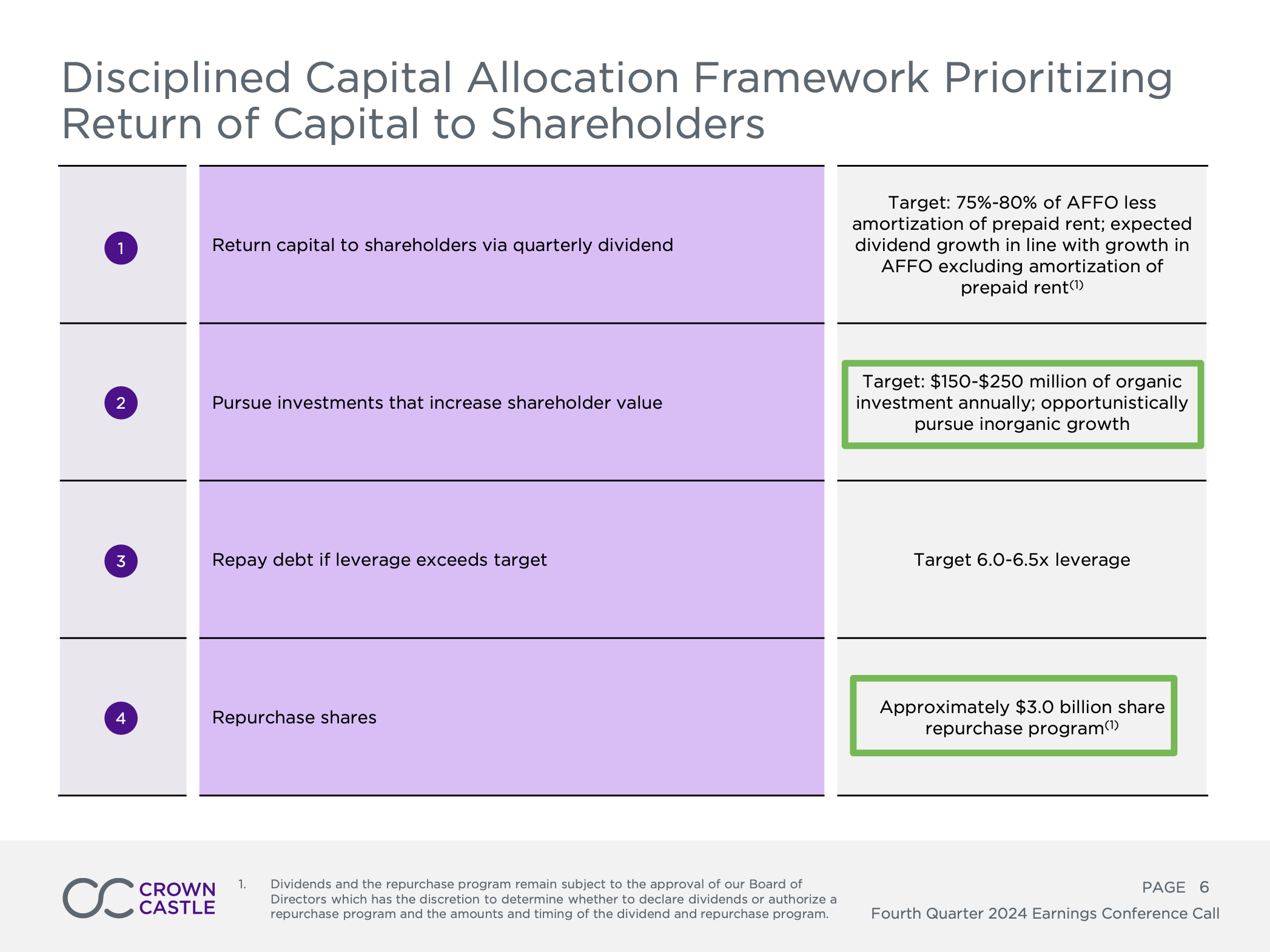

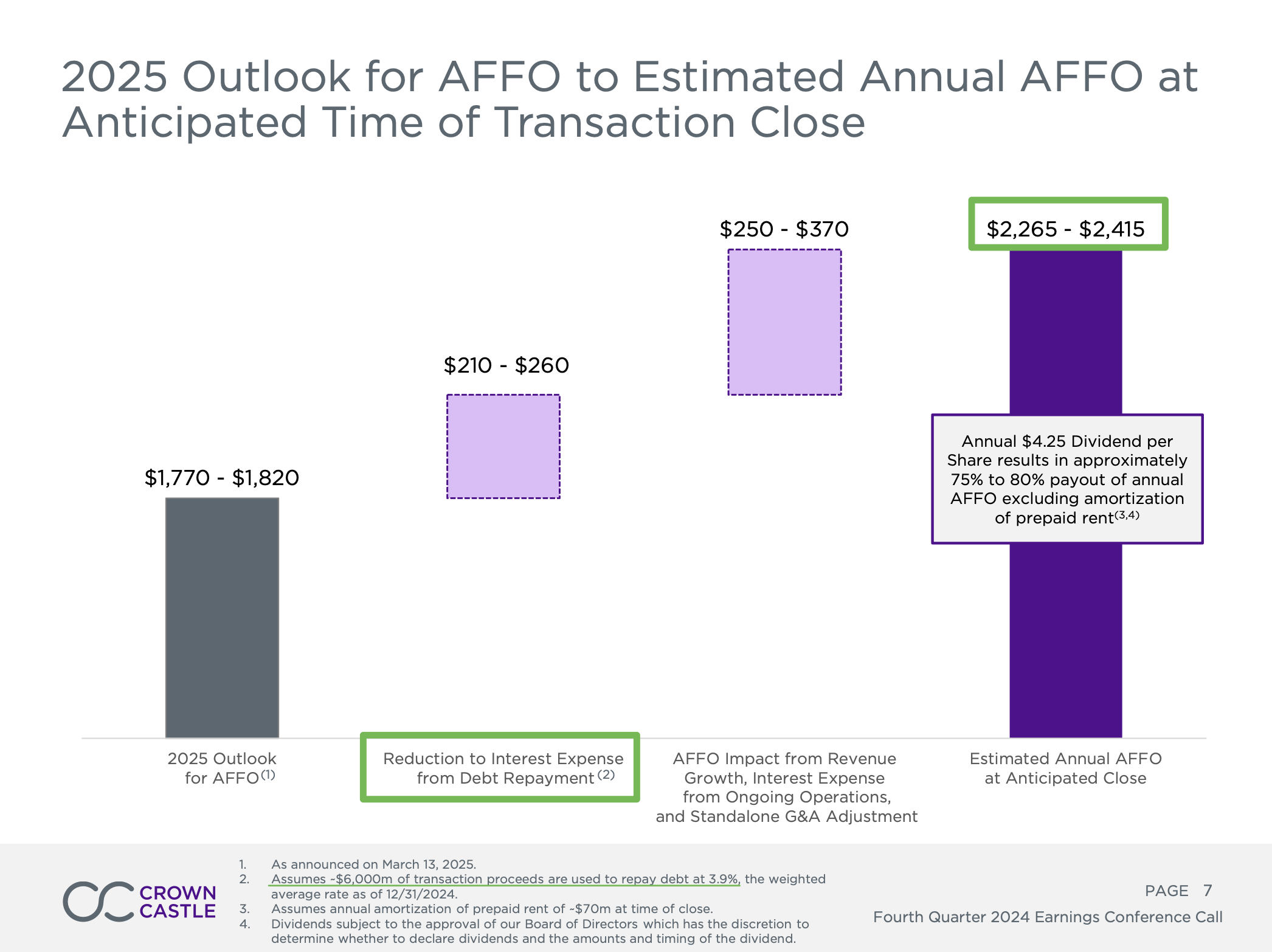

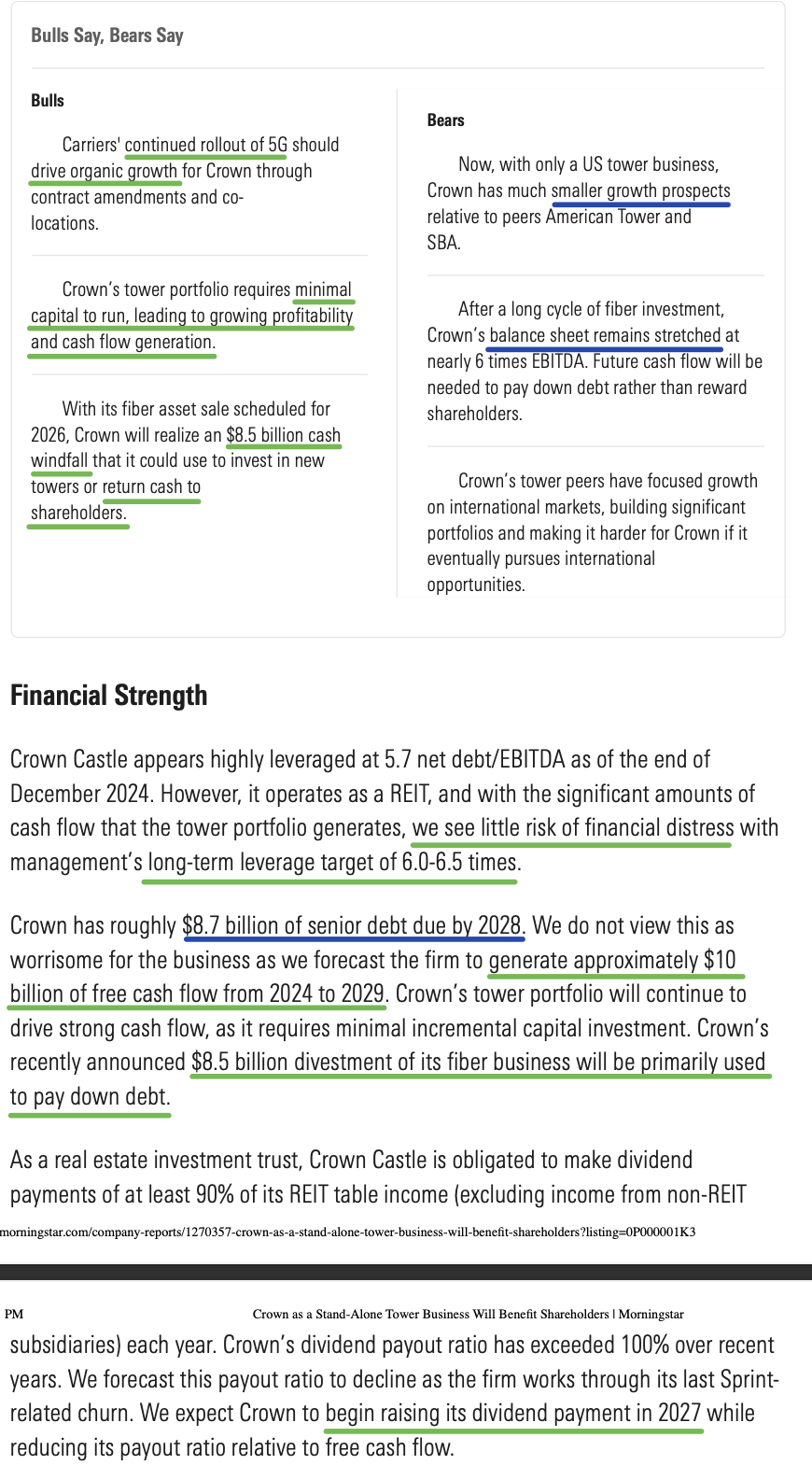

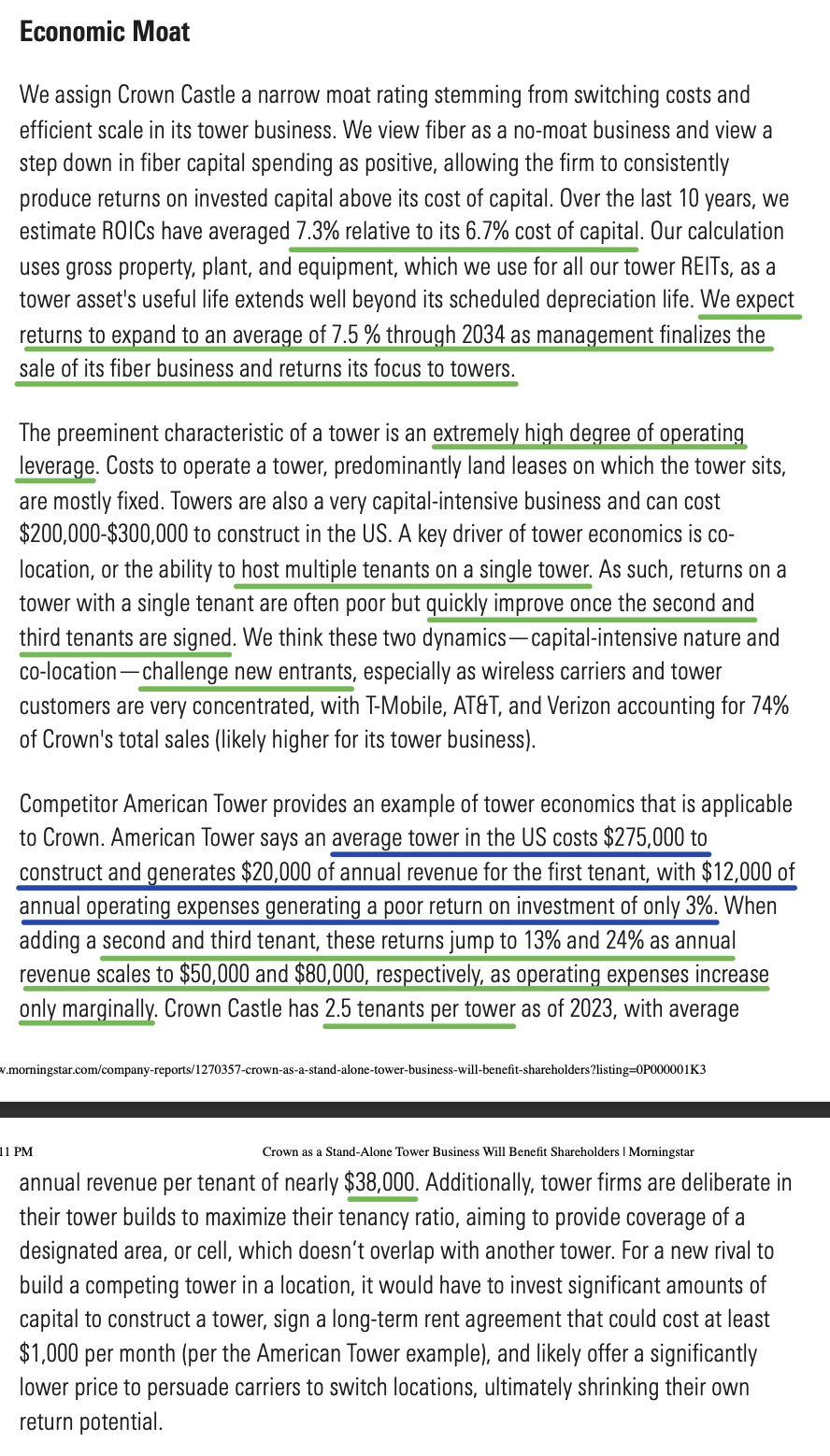

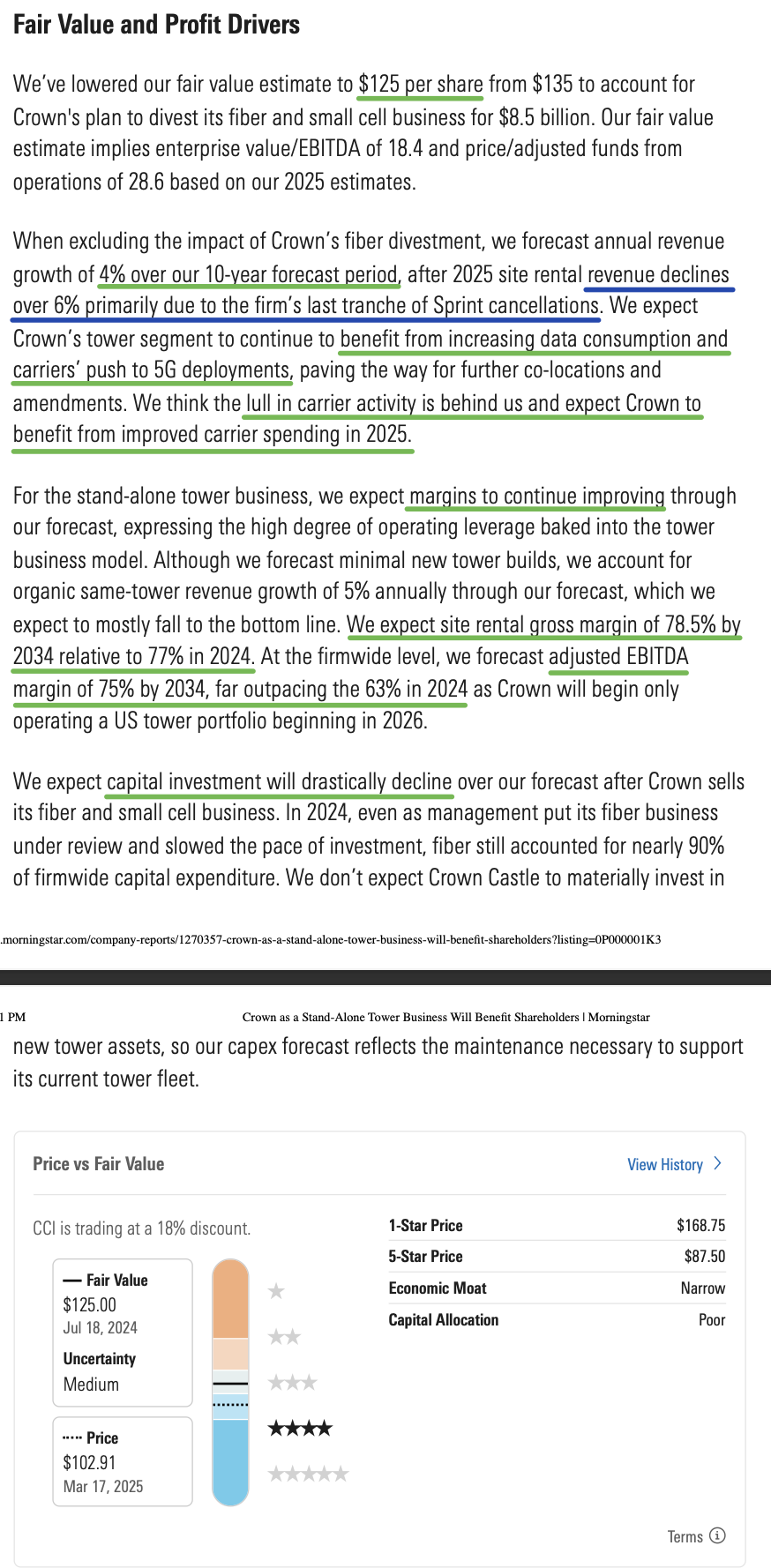

- Announced the sale of the fiber segment to EQT and Zayo for $8.5B, expected to close in the first half of 2026. Proceeds will be used to repay long-term debt ($6B of debt repayments, reducing interest expenses by $210M to $260M), with the remainder allocated for SHARE REPURCHASES. The fiber business, which was highly capital-intensive (over $19B in capex since 2015, with over 90% of 2024 capex dedicated to fiber), had limited synergies with the towers business and had become somewhat of an albatross around CCI’s neck, overshadowing the highly attractive tower business. Capital investment will SIGNIFICANTLY DECREASE, with a new focus on FREE CASH FLOW GENERATION and returning capital to shareholders, rather than top-line revenue growth.

- Announced a $3.0B share repurchase program, set to begin upon the closing of the fiber sale.

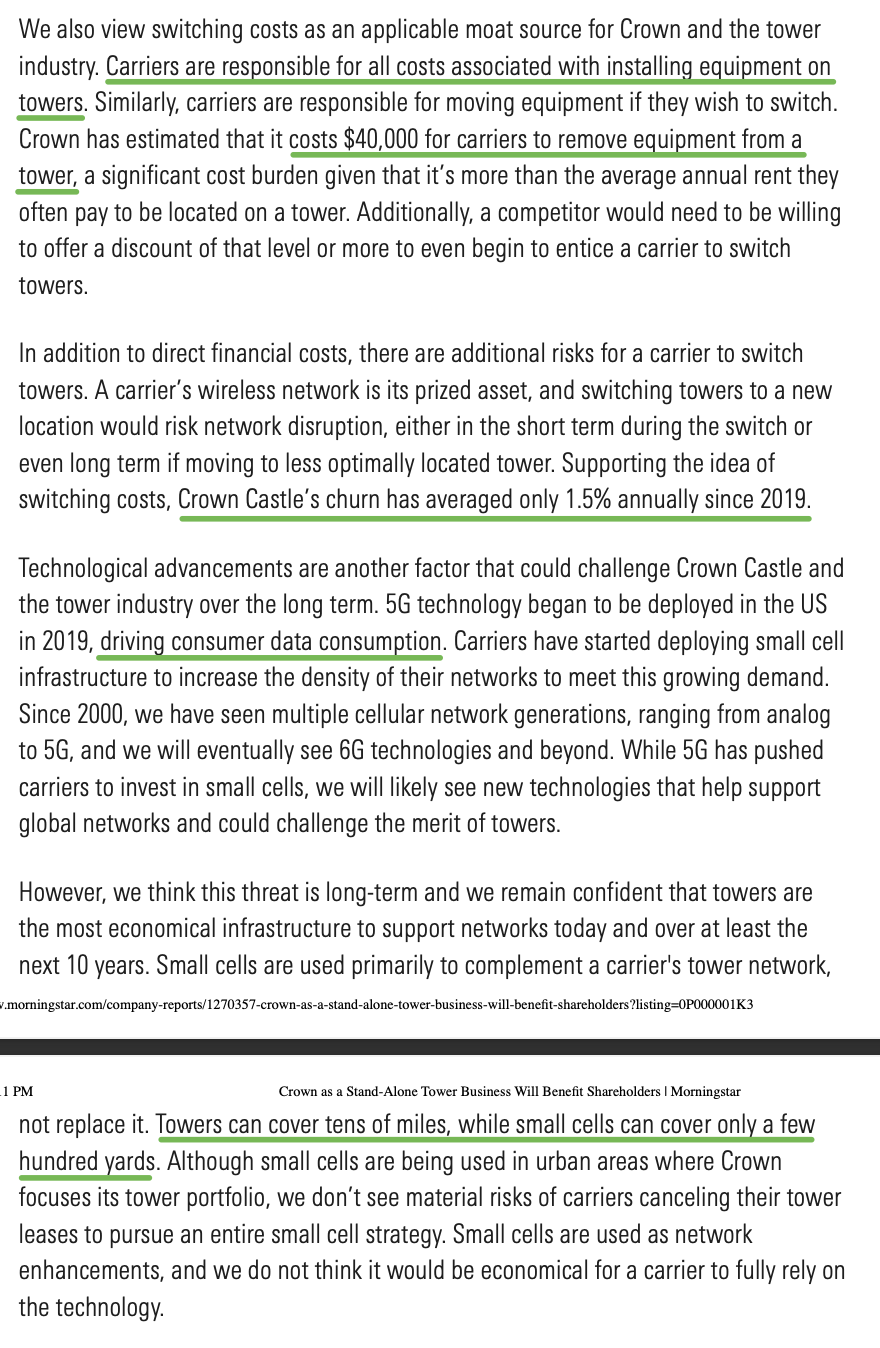

- Crown Castle is now the only PURE-PLAY, publicly traded U.S. tower company with over 40,000 towers that require MINIMAL incremental capital investment and have high OPERATING LEVERAGE and 3% annual rent escalators.

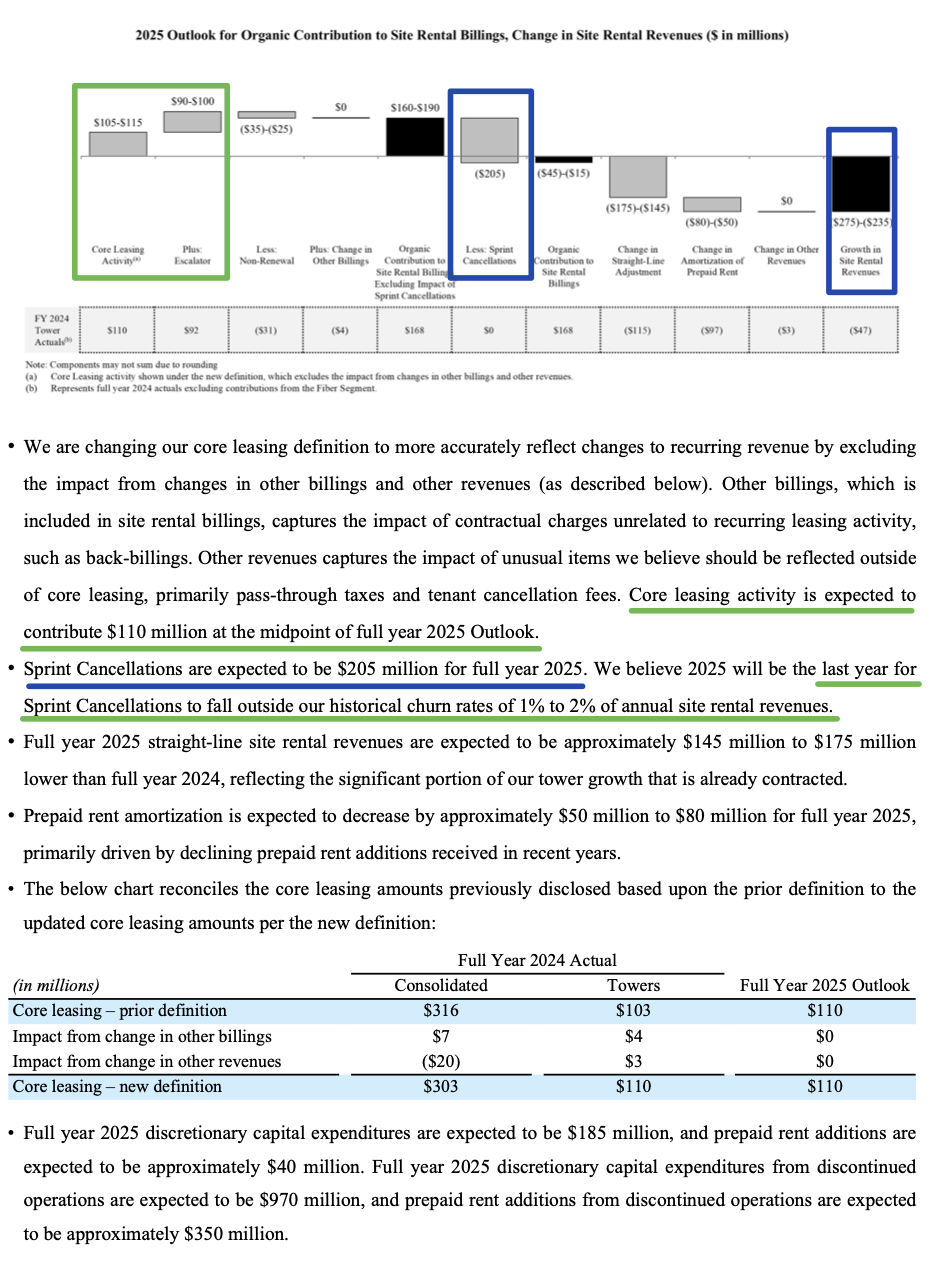

- Delivered 4.5% organic growth in towers, 12% in small cells, and 25% in fiber solutions. Management expects 4.5% organic growth in 2025, excluding the impact of Sprint churn.

- Reduced the dividend to $4.25 per share (yield still north of 4%), targeting an annual dividend payout of 75% to 80% of AFFO, with expected growth in line with AFFO growth.

- 2025 is expected to be the last year for Sprint cancellations to fall outside historical churn rates of 1% to 2% of annual site rental revenues. Outlook for churn is at an ALL-TIME LOW going forward (<1%)

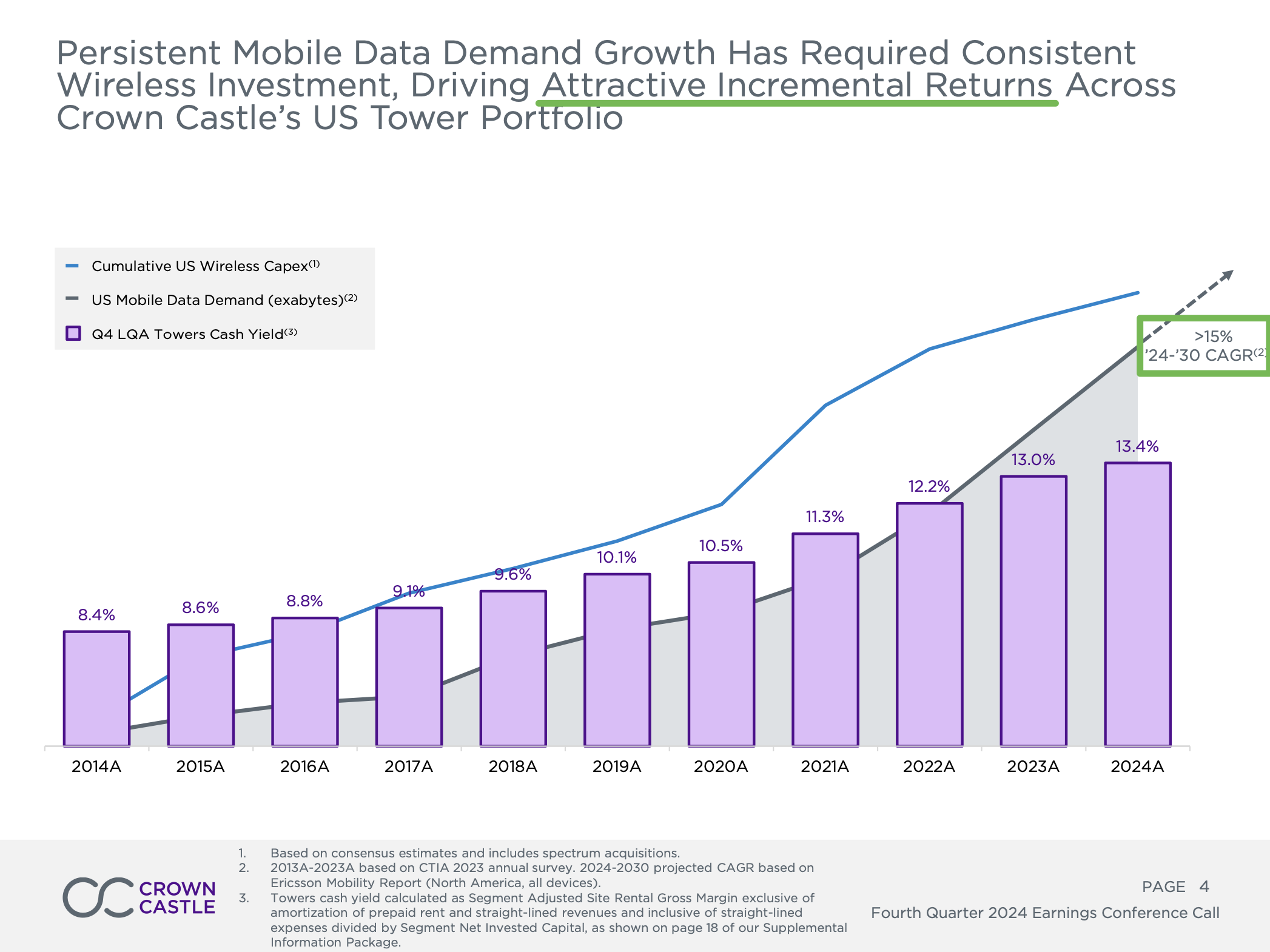

- Secular tailwinds remain intact, with U.S. mobile data demand expected to grow at a >15% CAGR from 2024 to 2030. Carriers continue to expand and densify their networks to meet demand, with wireless carrier spending expected to remain positive, at a rate of $30B or more annually.

- Over $100M in structural reductions in operating costs annually, along with a ~$200M reduction in net capex.

- Expected annual AFFO at the anticipated close of the sale transaction is ~$2.3B, compared to current expectations of $1.8B.

- Annual organic capex is now expected to be between $150M and $250M, with management INCREASING the hurdle rates in the project pipeline and only opportunistically pursuing value-enhancing growth.

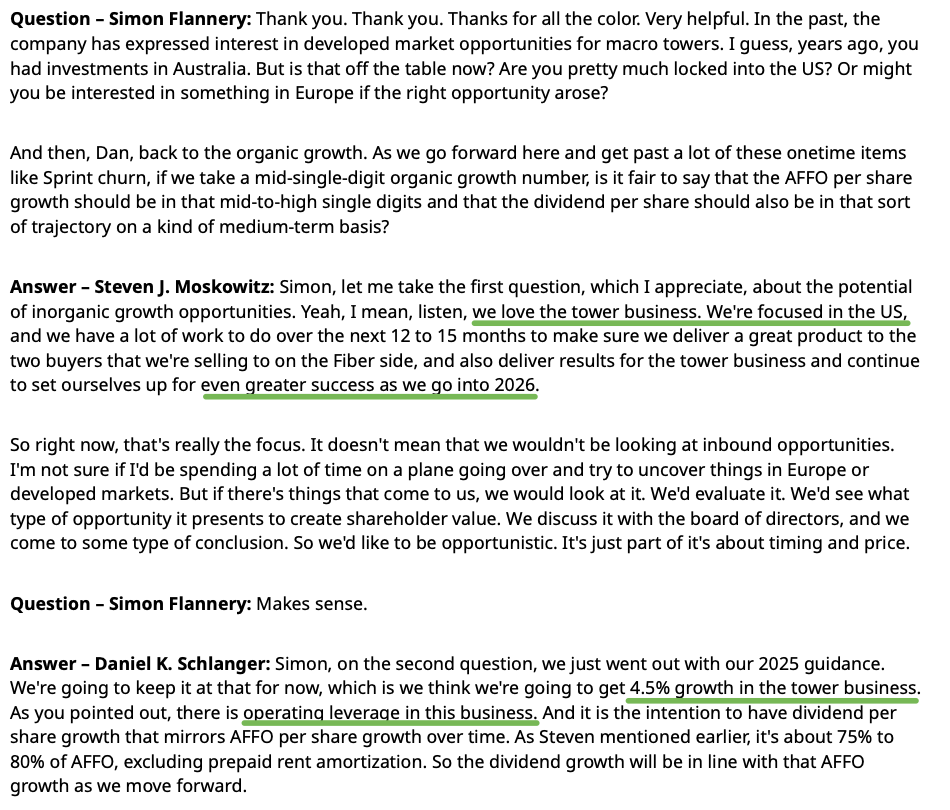

Earnings Call + Q&A Highlights

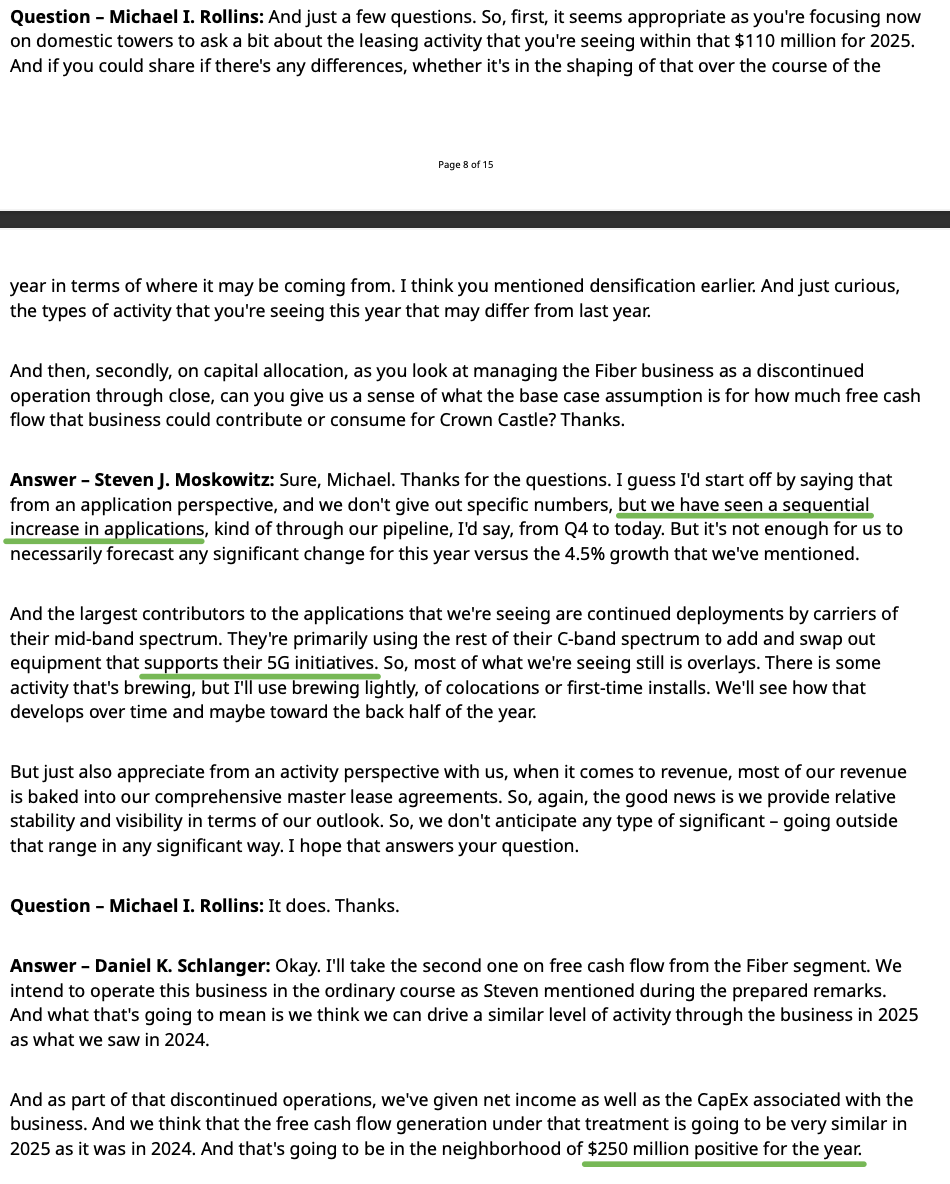

Asos Update

While this has been a tiny position for us, we have consistently been on alert for new information that would warrant making it a half size or even full-sized position. We have yet to be impressed. Our instincts about whether a “consultant” could make a good CEO have thus far been proven correct. We hope we are proven wrong and will upsize if he starts to deliver…

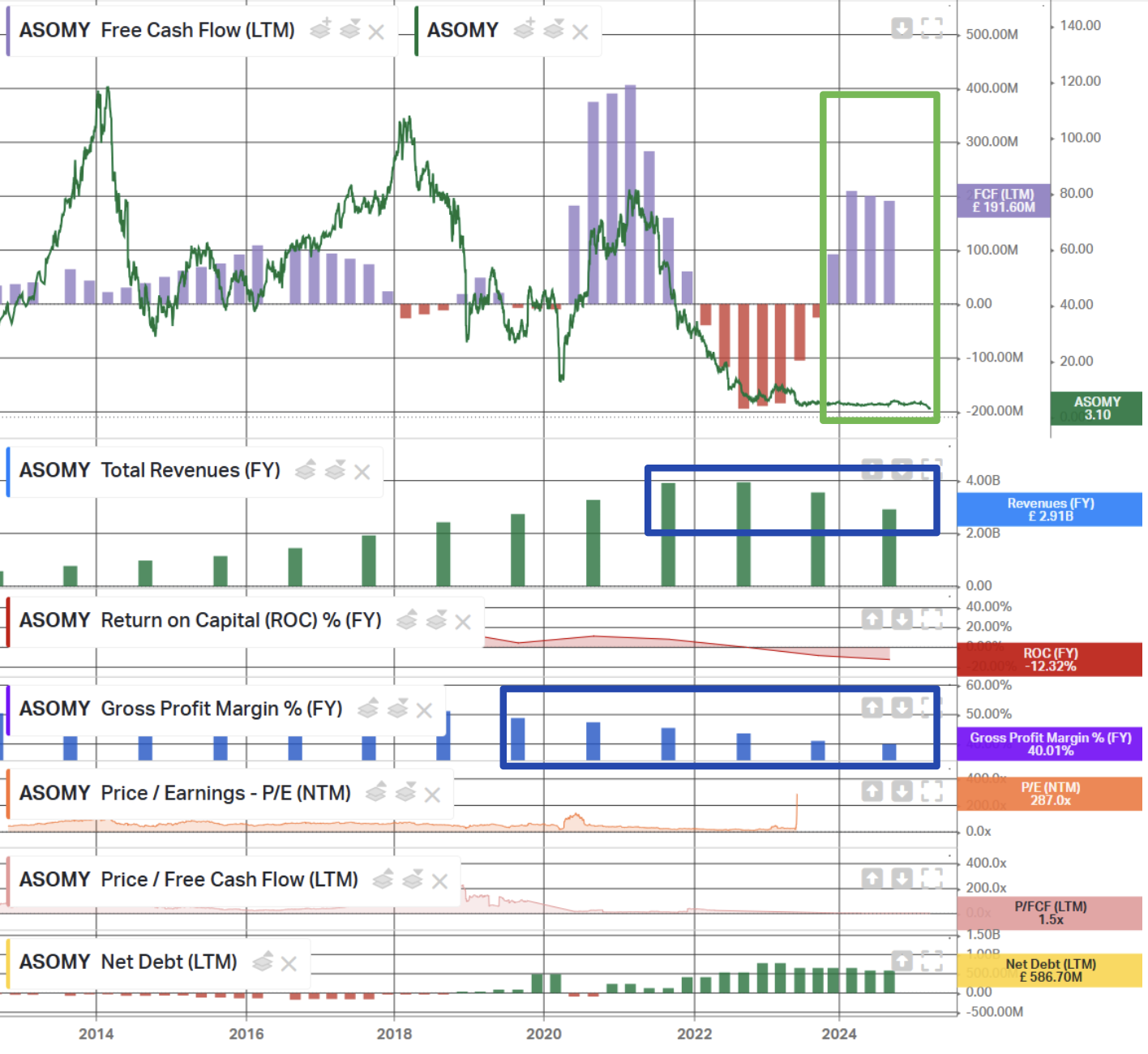

Earnings Results

Key Takeaways

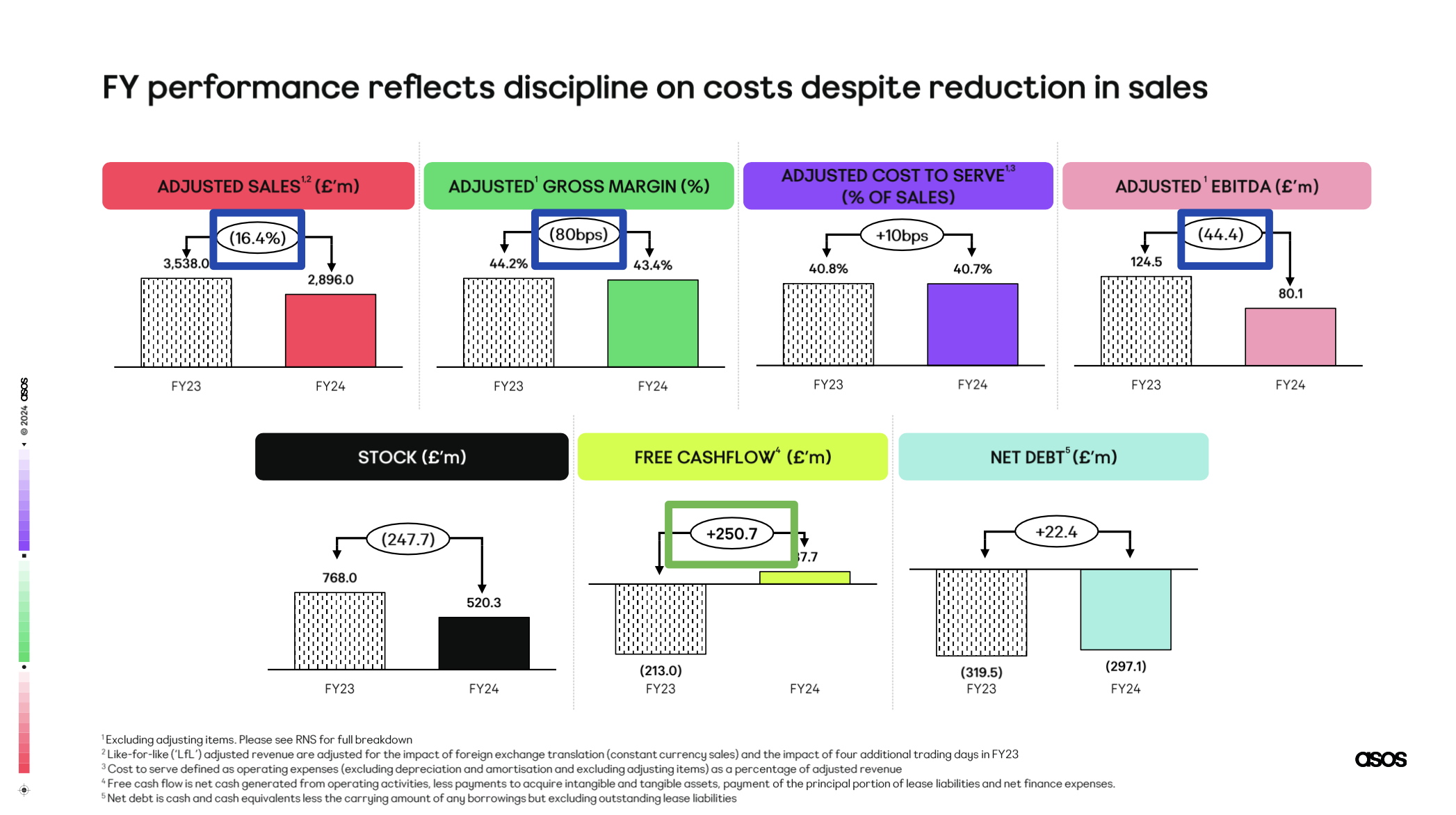

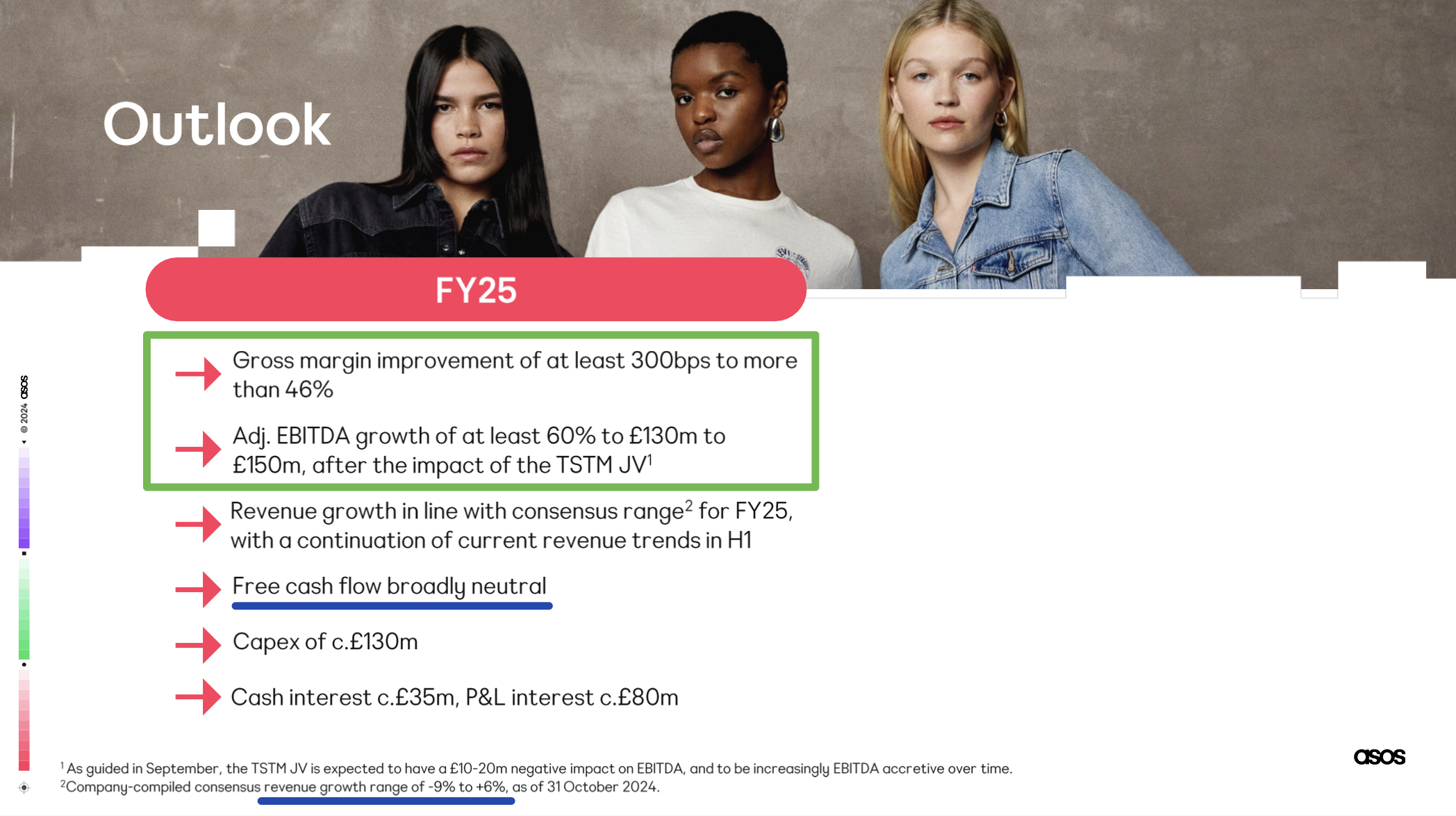

- Expects at least a 300 bps increase in gross margin to over 46%, and adjusted EBITDA to increase by at least 60%, reaching $130M to $150M. Management expects to achieve these profitability targets regardless of revenue levels, as the focus shifts away from heavy discounting and unprofitable segments.

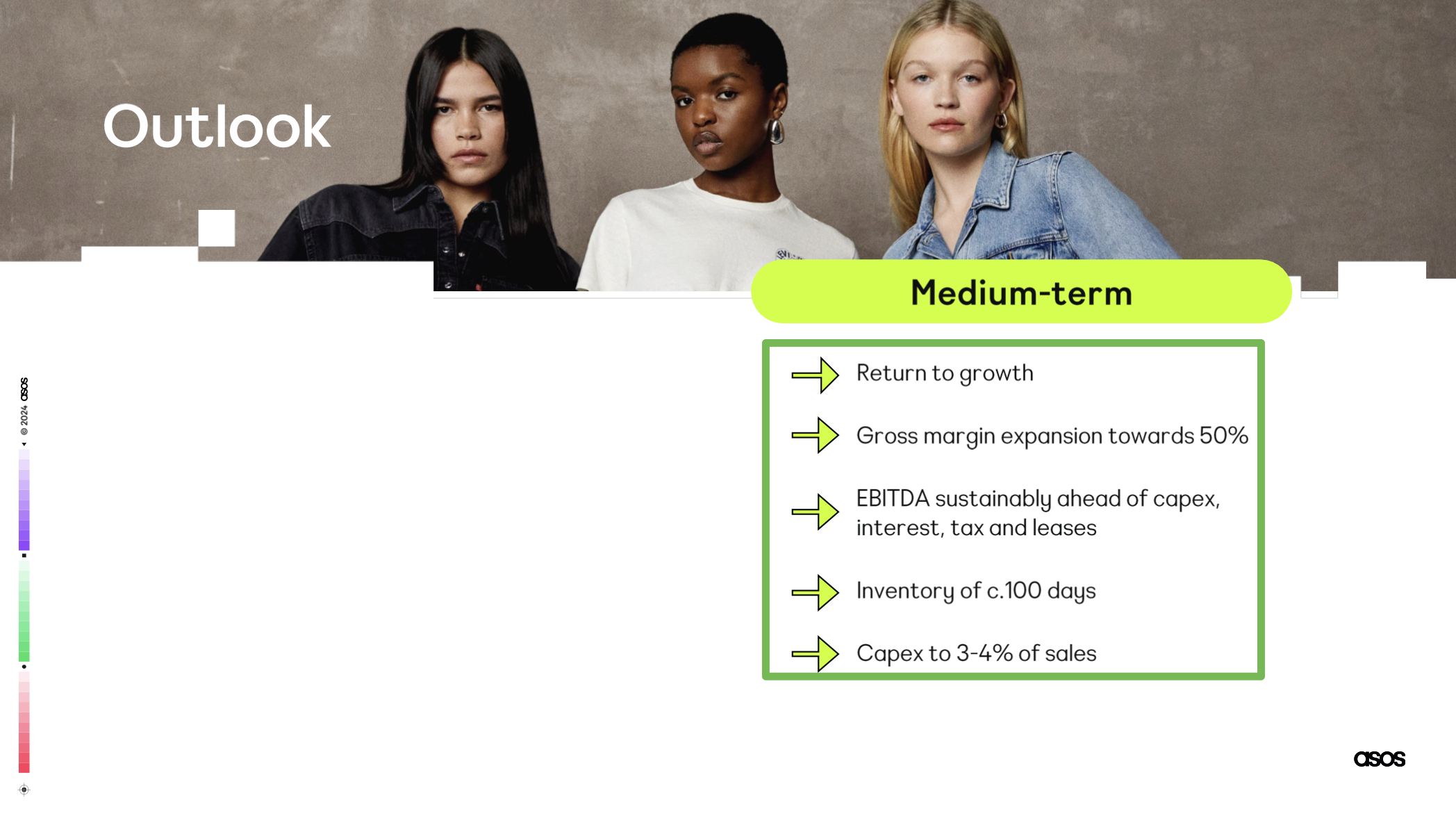

- Long-term targets remain intact, including returning to growth, gross margin expansion towards 50%, EBITDA margins of ~8%, inventory around ~100 days, and capex at 3-4% of sales.

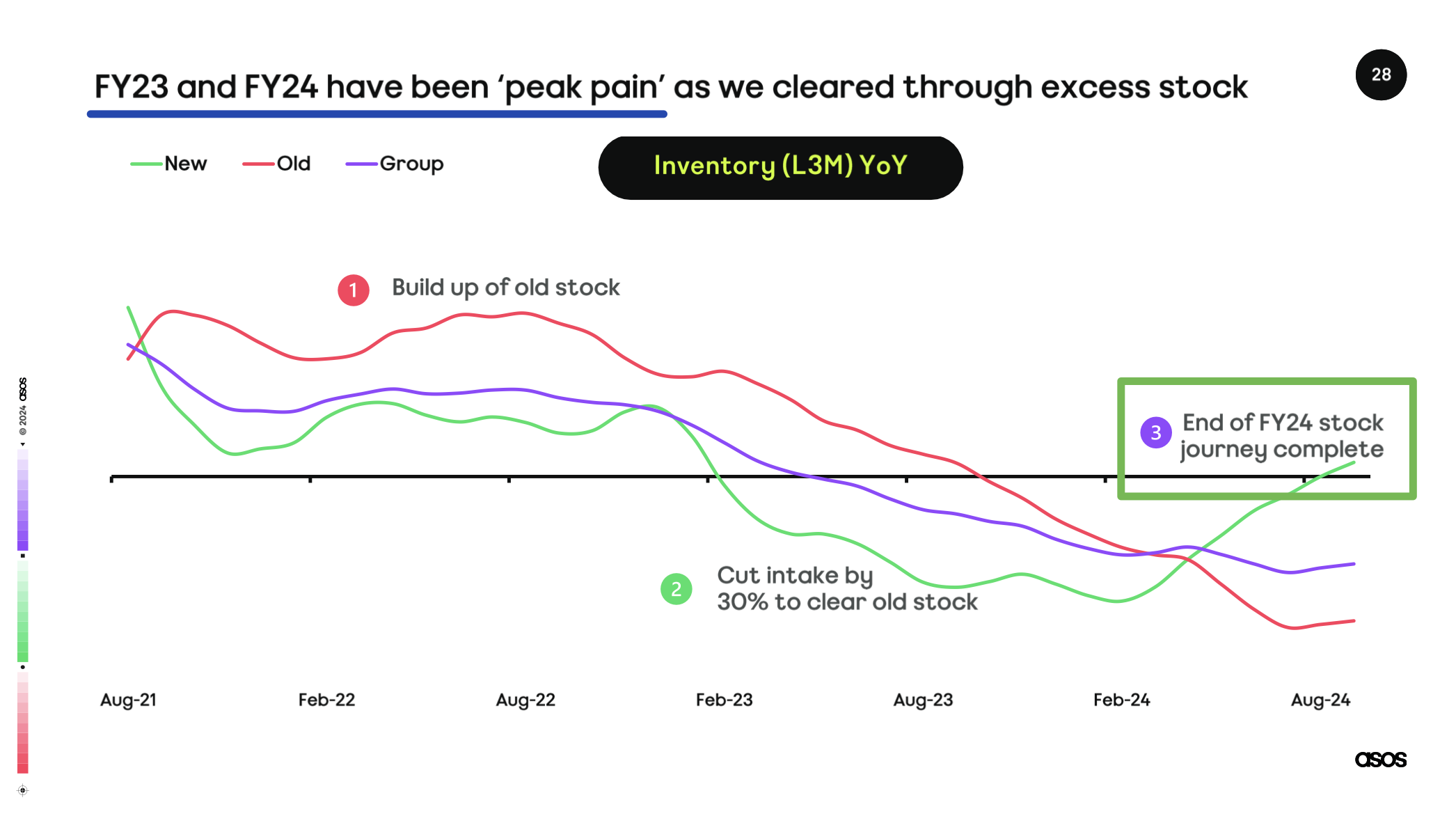

- Inventory position down ~50% since FY22 to $520M, with old stock down ~75%.

- Positive free cash flow of $37.7M, up from a loss of $213M during FY23. Free cash flow for FY2025 is expected to be broadly neutral.

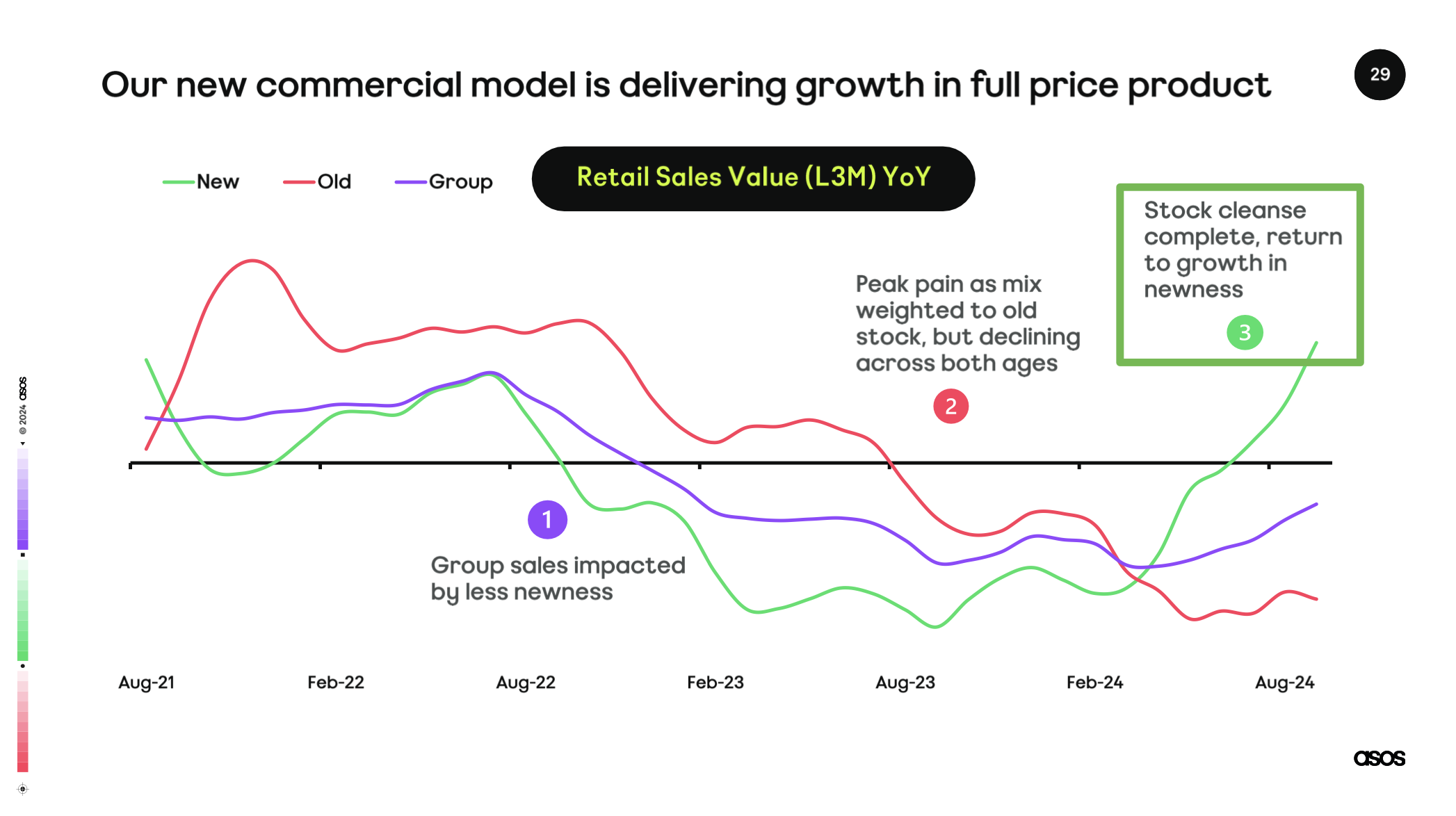

- Top-line revenues remain under pressure, down 16%, but management continues to see green shoots, such as new product sales up 24% YoY. For FY2025, management expects revenues to fall within the consensus range of -9% to +6%.

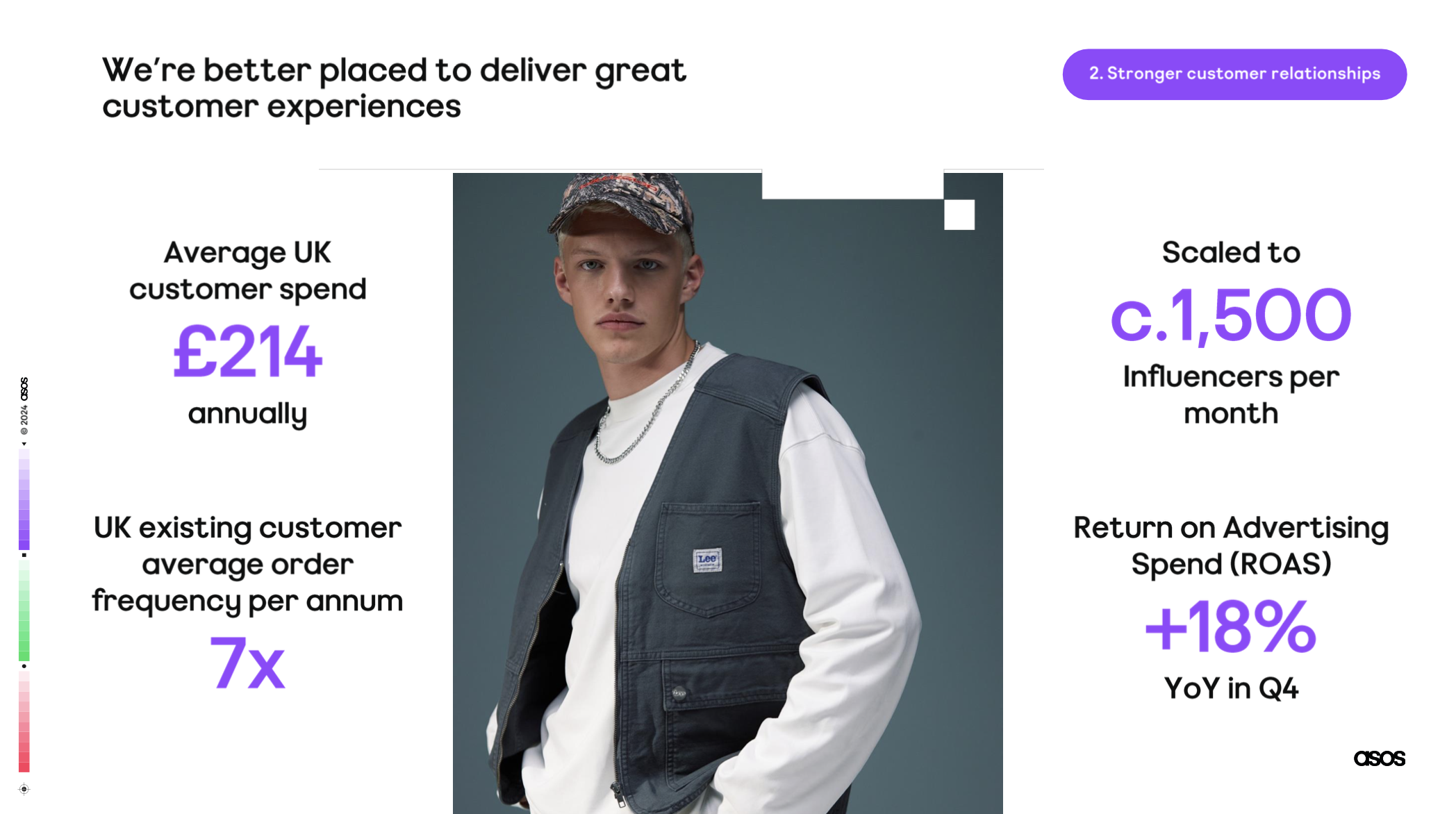

- Collaborating with ~1,500 influencers per month by the end of ‘24, with media return on advertising spend increasing by 18% in Q4.

General Market

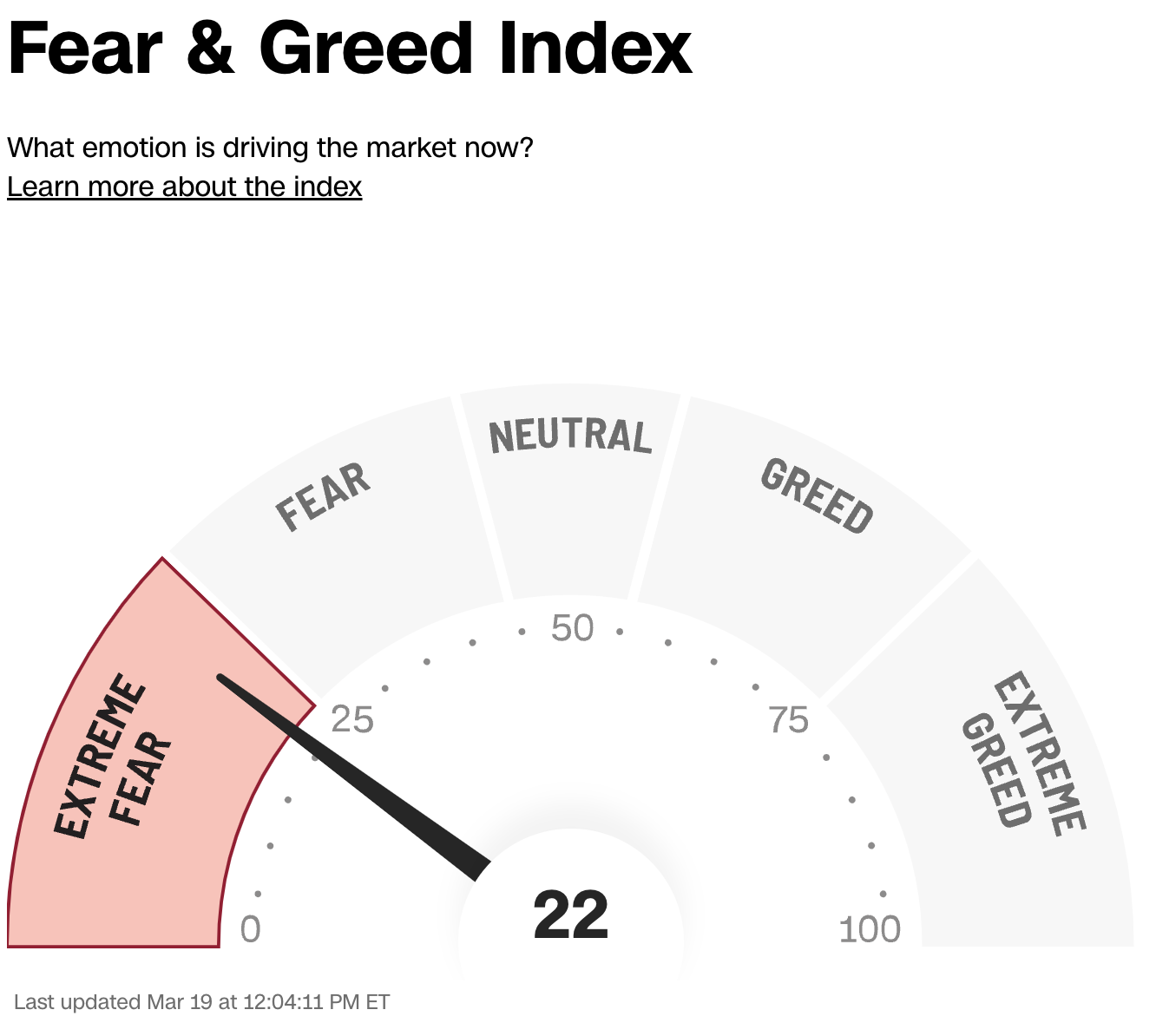

The CNN “Fear and Greed Index” ticked up from 19 last week to 22 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

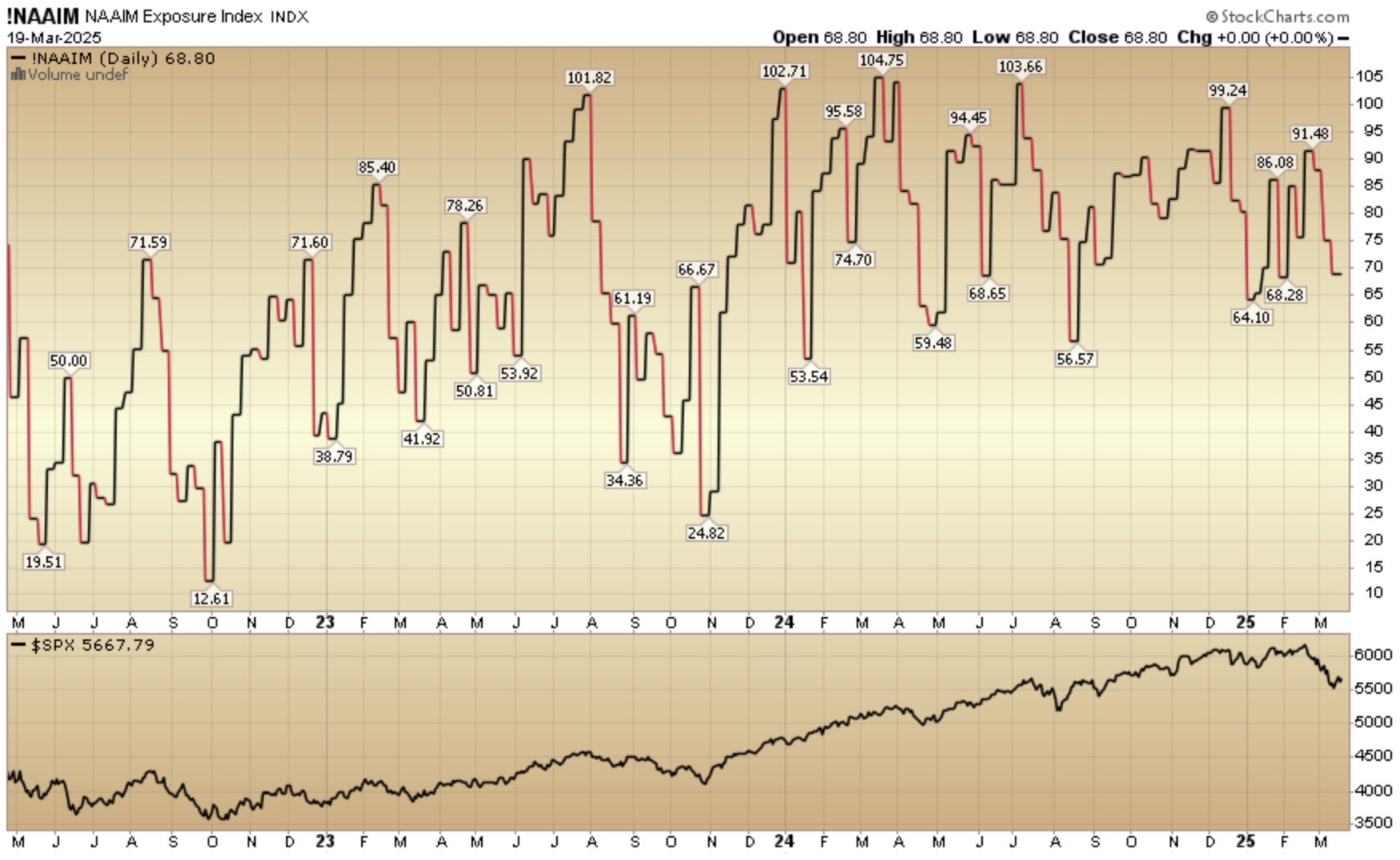

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 68.80% this week from 74.96% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our 2024 and Q1 2025 raises. You could not be better positioned for what we believe will continue to be a highly rewarding year in 2025. This view is based on what has already taken place in 2025 as well as much of the data we have shared in recent weeks on our podcast|videocast(s), coupled with our proprietary methods of expressing and executing upon those views on your behalf.

We will re-open to smaller accounts $1M+ again starting April 1st.

Congratulations to all of you I had the pleasure of speaking with and on-boarding last week – when we opened up the queue for inquiries. We expect your applications to be approved in the next week by IB so that we can begin deploying capital on your behalf on April 1.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms