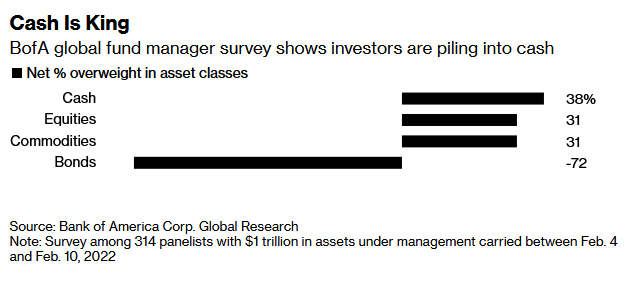

The February survey covered 314 managers with $1 trillion in assets under management.

OUTLOOK:

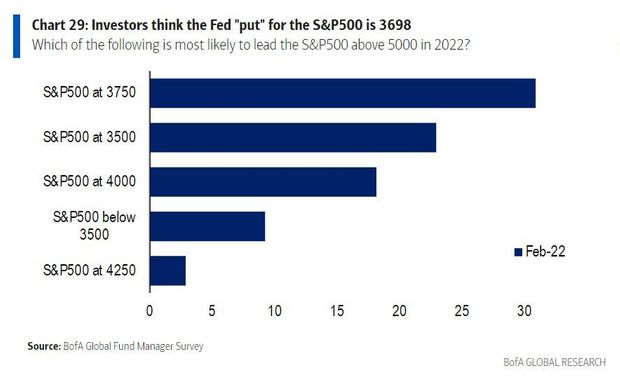

-Fed “Put” ~3698 on S&P 500 (when they would step in aggressively).

-Fed “Put” ~3698 on S&P 500 (when they would step in aggressively).

-37% of respondents said a drop in U.S. consumer price inflation to 3% would push the S&P 500 above 5000.

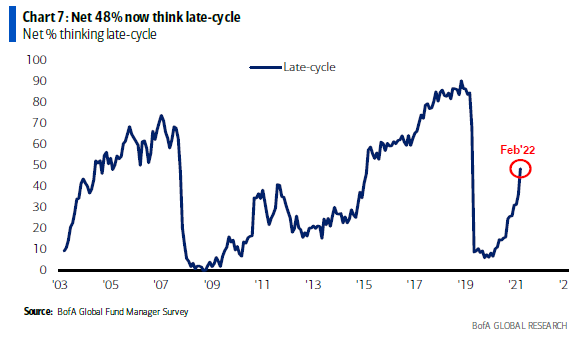

-48% of fund managers in the BAML Fund Manager Survey think it is now late-cycle.

-Liquidity conditions also deteriorated to the lowest since May 2020.

SENTIMENT:

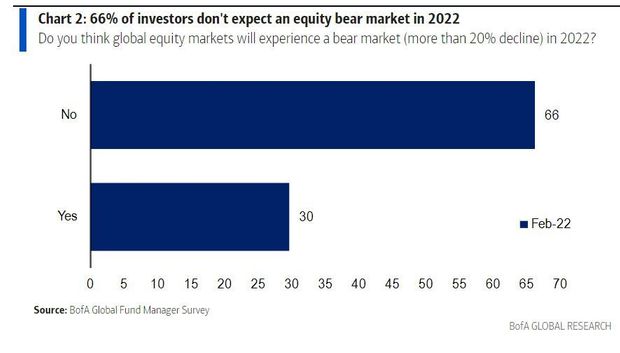

-Most investors don’t expect a bear market this year, with earnings and the economy still growing.

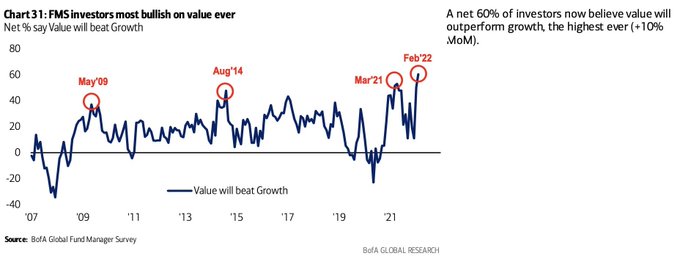

-Highest amount of Fund Managers are bullish Value over Growth, EVER.

-About 30% of the investors surveyed expect an equity bear market in 2022, driven by fears of interest rate hikes and slower growth.

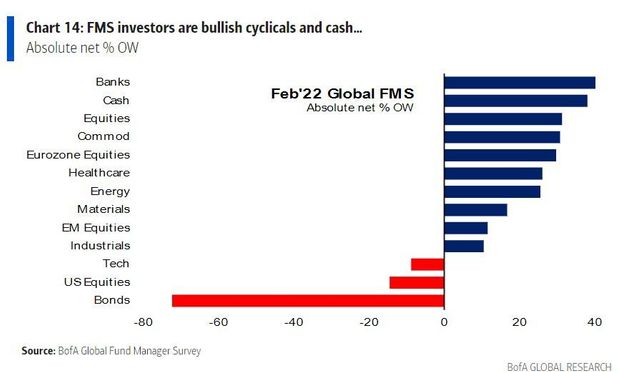

POSITIONING:

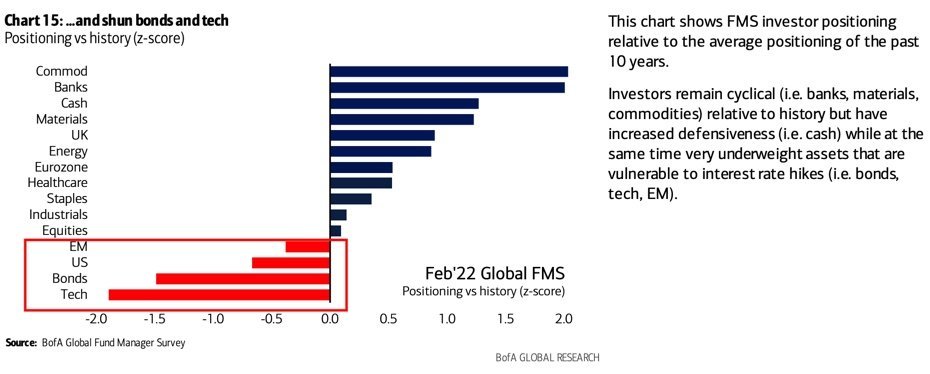

-Cash levels rose to 5.3%, highest since May 2020.

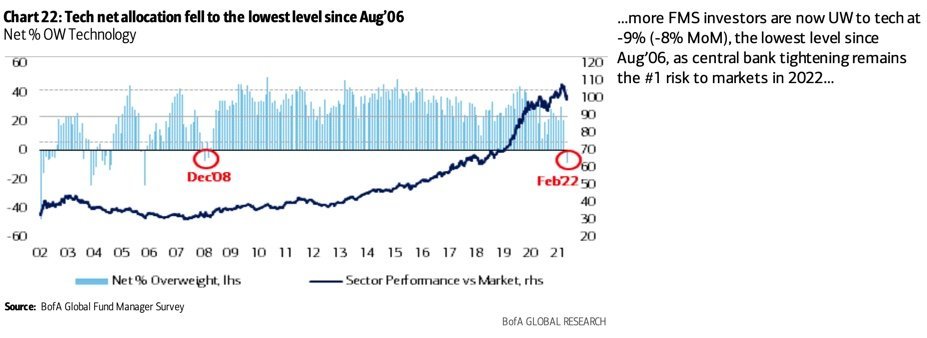

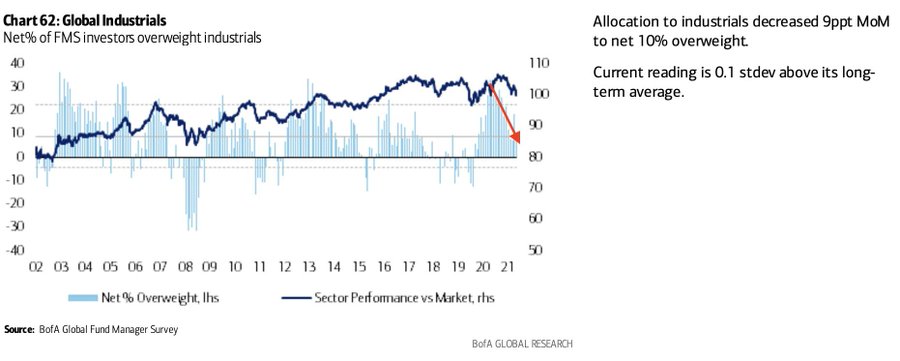

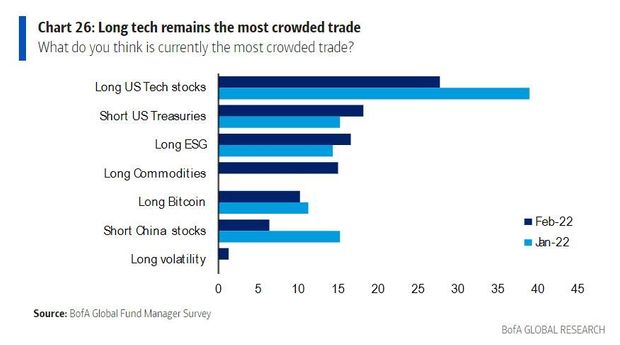

-Investors have been fleeing technology stocks, with the survey showing a net underweight at minus 9%, the lowest since August 2006.

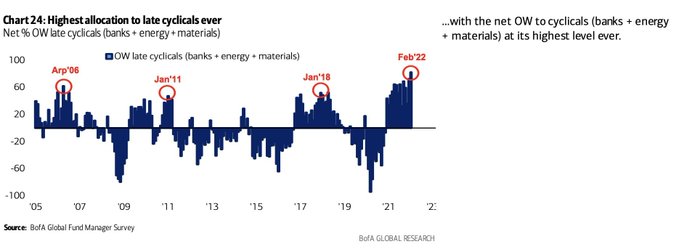

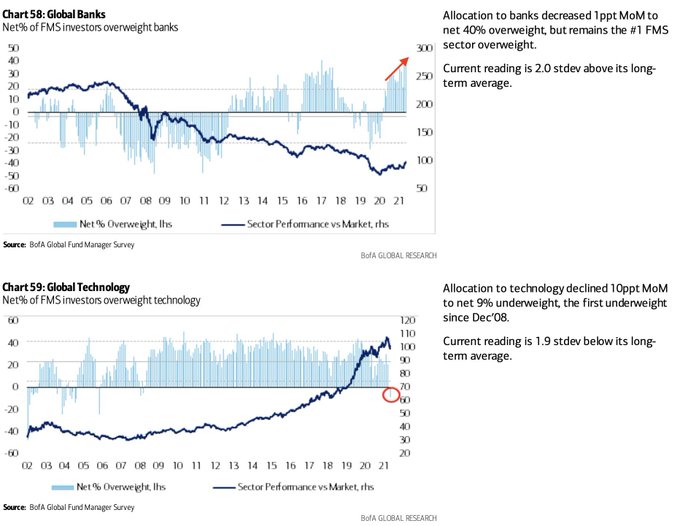

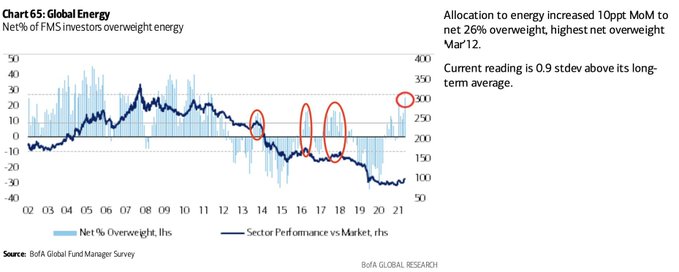

-Highest allocation overweight to cyclicals (energy+banks+materials) ever.

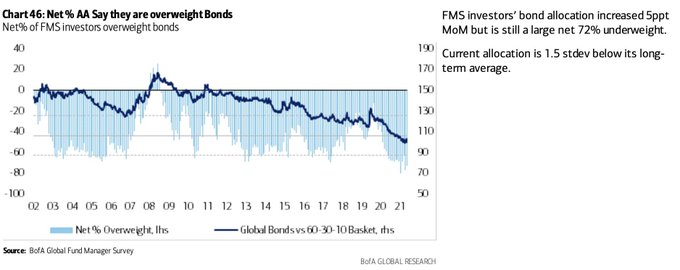

-Bonds are hated. Belief yields will continue higher prevalent.

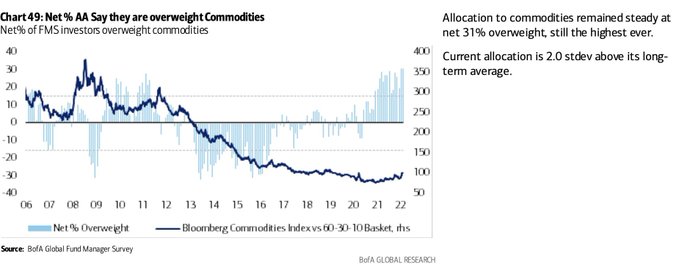

-Allocation to commodities remained at the highest in history.

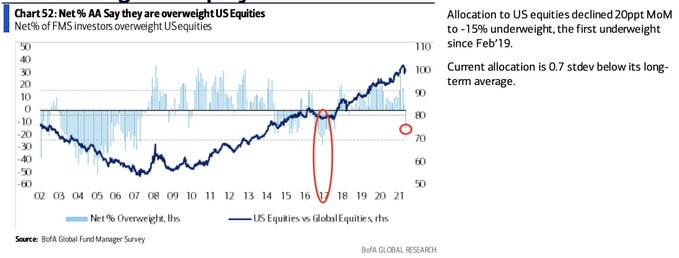

-First time managers underweight US equities since Feb 2019.

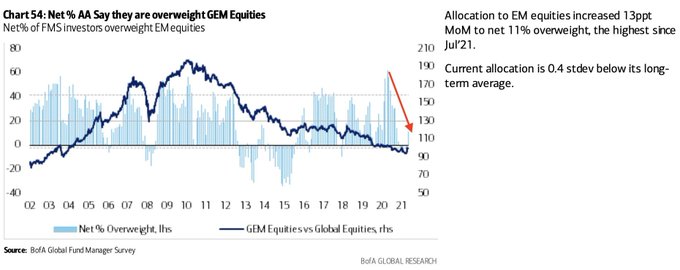

-Allocation to EM equities has fallen dramatically since Jan 2021.

-They love banks now and hate tech.

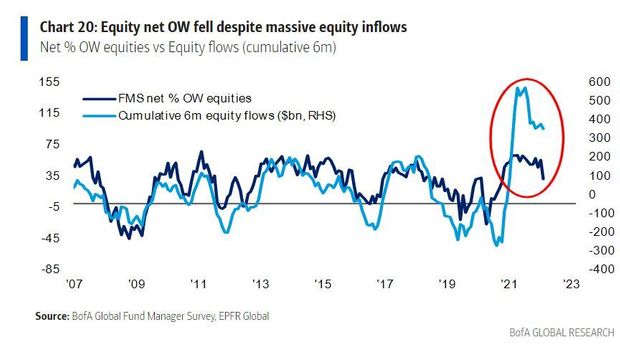

-Equity allocations drop to 31% overweight from 55% in January.

-Investors have “long” bets on banks, cash, commodities and euro zone equities, while they are shunning bonds, the U.S. and tech.

MOST CROWDED TRADES:

-While long U.S. tech remained the most crowded trade in the survey – a trend that’s persisted for more than two years – conviction is on the wane, at 28% in February compared with last month’s 39%.

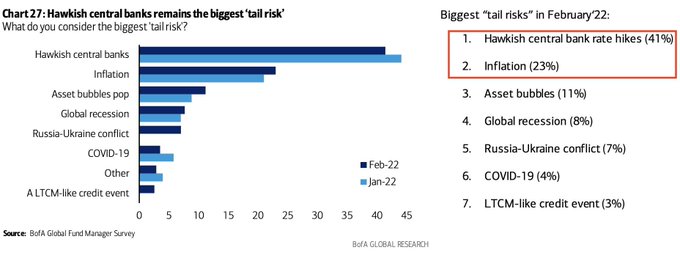

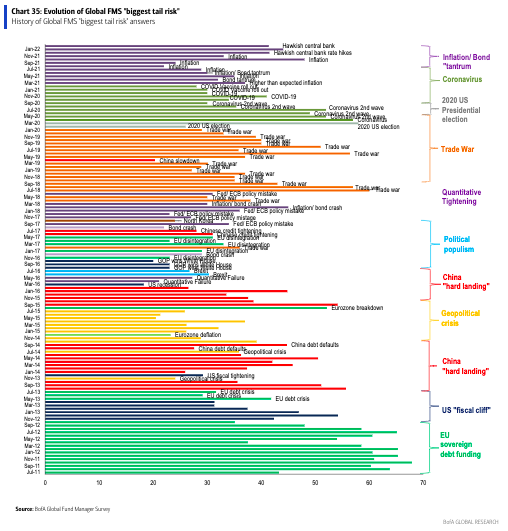

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY:

BANK OF AMERICA COMMENTARY:

Bank of America strategists, “bearish (e.g. cash levels jumped to 5.3%) but not extremely bearish (e.g. investors remain long cyclical stocks vs bonds)… FMS investor probabilities of a credit event (3%), recession (12%), and bear market (30%) are too low”

Michael Hartnett said overall equity allocation has dropped sharply, with just under a third of its clients bullish on stocks, down from more than half of them in January.