Last week I took the family down to Key West for a little R&R. Since we only had five days, I tried to pack in as much activity as possible: Parasailing, Jet Skiing, Snorkeling, Dolphins, and Deep Sea Fishing.

By far, the most fun for me was deep sea fishing. It was the most successful outing I have ever experienced. I credit my wife Kaitlyn for doing the proper diligence and hiring in the best Captain on the Island to take us out.

Mutton Snapper

Captain Billy and his partner Ryan have a reputation for success in getting their clients to catch fish. We heard all morning on his radio that peers were having no success, and yet, we kept pulling them up. If you listened to the podcast|videocast last week you heard my goal was to catch a shark to mount over our pool. Billy said ours was one of the longest Carribean Reef Sharks he had seen. 7-8 foot range. He had to send the measurements to the taxidermy company in order for them to create a replica from photos and dimensions.

Captain Billy and his partner Ryan have a reputation for success in getting their clients to catch fish. We heard all morning on his radio that peers were having no success, and yet, we kept pulling them up. If you listened to the podcast|videocast last week you heard my goal was to catch a shark to mount over our pool. Billy said ours was one of the longest Carribean Reef Sharks he had seen. 7-8 foot range. He had to send the measurements to the taxidermy company in order for them to create a replica from photos and dimensions.

Before:

After:

So why are Billy and Ryan so successful for their clients – while their peers flounder for scraps? Very simple, they know where the fish are and they go there! One thing that was evident was that they did NOT go where the FISHERS were, they went where the FISH were.

You see Billy was raised in Key West and his Father ran the business before him. He knows the waters like the back of his hand. He goes where the other Charters don’t. In other words, he goes against the crowd for big rewards.

Now hooking a big fish is one thing, reeling it in is another…

Reeling in this shark took all of the strength I had. I wasn’t sure if the pole, reel or my forearm would break first, but ultimately got it reeled in.

So how does this apply to markets? In last week’s note we covered that while we were pounding the table on Banks and Energy in 2020, no one else would touch them. Now that they have all doubled and tripled EVERYONE WANTS THEM.

As such, we have been trimming across the board and harvesting some profits. While we still like these groups over the next few years and will hold some (and possibly add back on any real weakness), in the short term it feels exuberant. There are new areas that have more upside in a shorter amount of time at this stage – even if they continue to modestly push higher.

When all of the FISHERS are congregating around one area, it’s likely that most of the prize fish have been had for the time being. It’s time to pull up anchor and go to where the next group of prize FISH are. You have to accept it will be lonely for some time until word gets out on the radio that you are hooking the prizes (just as it was in 2020). Slowly but surely more FISHERS will come to your spot and the FISHING will be good for some time. But once ALL the boats have dropped line, it’s time to cut bait and move onto the next prime area.

So if we know where the FISHERS are, where are the FISH? The secret to success in this business is to fish where others are not (and then be patient)…

On Tuesday I was on Fox Business – the Claman Countdown – with Liz Claman talking markets and an unloved sector we are leaning into. Thanks to Ellie Terrett and Liz for having me on:

Watch in HD directly on Fox Business

Here were my notes for the segment on Tuesday:

Majority of pain in rear view mirror at this point:

You historically DO NOT get 20% bear market corrections in the S&P 500 without a Recession.

Recessions are preceded by an inversion of the Yield Curve (2/10 spread). While the curve has been flattening since June of last year, we are nowhere near inverting.

A recession is defined as 2 quarters of negative GDP growth. The US is expected to grow ~4% GDP in 2022.

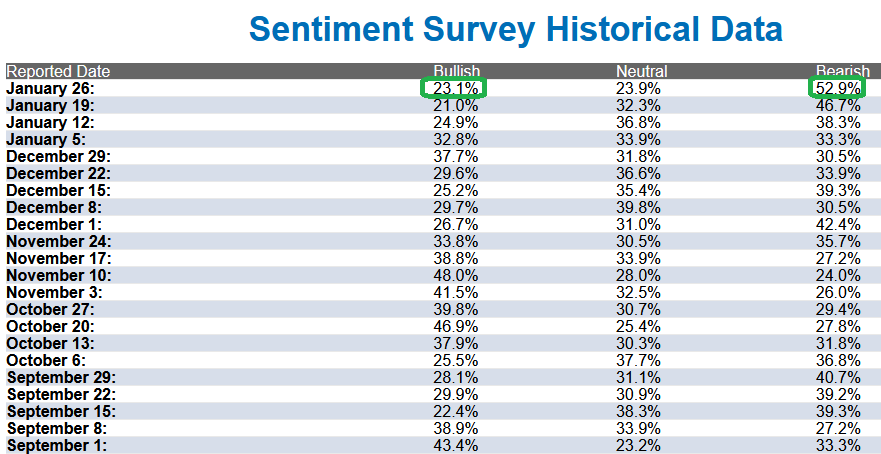

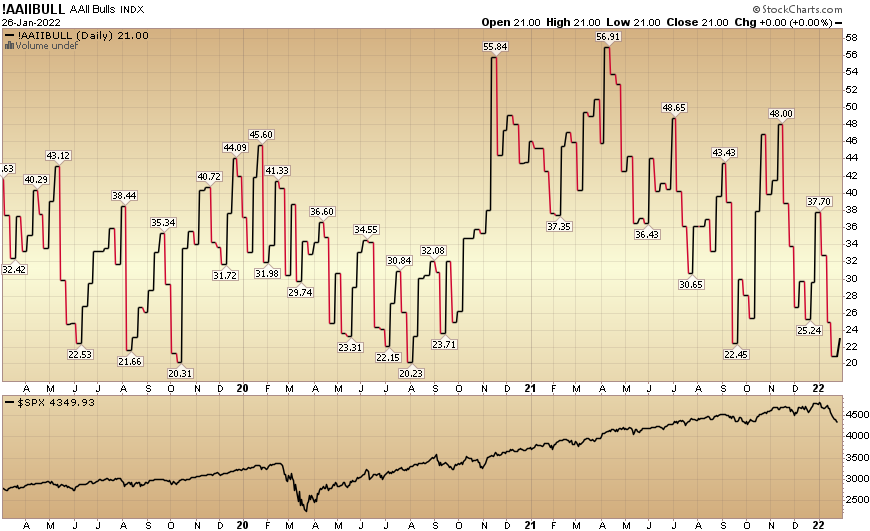

Sentiment washed out: AAII Bullish Percent hit 21% last week (lowest since 2020). AAII Bearish Percent hit 46.7% (highest since 2020). These levels usually occur near short-term bottoms.

VIX hit 38 yesterday (peak fear), backing off a bit today.

CBOE Total Put/Call Ratio hit 1.26 yesterday – another extreme – meaning people were buying puts for protection at the exact wrong time. The time to buy insurance is BEFORE the fire, not after the house is leveled! This level is usually associated with reversals.

What the market needs for a tradable bottom: 1) continued strong earnings from beaten down tech. IBM was a good start, MSFT will be critical tonight. 2) Federal Reserve back off timing on balance sheet runoff/quantitative tightening. The Fed minutes spooked investors when they spoke of starting QT at the first rate hike (as soon as March). Market will respond well if that is walked back a bit on Wednesday.

Areas of opportunity among the wreckage: Biotech – Sector down ~20% last year. Demand will pickup again as Omicron subsides and doctor visits, procedures, script demand recovers. Reversion trade.

On Wednesday, I emphasized the importance of the Fed backing off on their Quantitative Tightening rhetoric prior to the Press Conference. Thanks to Taylor Clothier, Sara Dramer, Alexis Christoforous, Adam Shapiro and Karina Mitchell for having me on:

Watch in HD directly on Yahoo! Finance

Here are a few of my notes from before the segment:

Fed/FOMC meeting Thoughts:

-4 rate hikes for 2022 are currently priced in and expected.

-Likely to signal 25bps hike for March.

KEY TO MEETING: Balance sheet roll-off timeline. When Fed minutes were released on January 5, it spooked the market. The minutes implied they would start Quantitative Tightening (reducing the balance sheet) as soon as the first rate hike (Mar). It caused the S&P to decline ~12% intraday on Monday, and the Nasdaq to decline ~18%.

If they walk back this error and push off QT for some time, the market will rally. If they imply faster QT, there will be more pain. Our bet is they will tread carefully this time.

To put it in perspective, the last QT began almost 1.5 yrs AFTER the 1st rate hike. This led to a yield curve inversion 1.5 yrs later followed by a recession.

Since all policy (loosening/tightening) shows up in the real economy 6-9 months later (on a lagged basis), they MUST be careful not to do too much at once. Start with the hikes and see how it goes. Add SLOW QT 6-18 months later.

And finally, on Tuesday I joined Rachelle Akuffo on CGTN Amrica to discuss Microsoft Earnings and impact of the Activision Blizzard deal moving forward. Thanks to Ai Xing and Rachelle for having me on:

What’s Getting Crowded?

Just over a week ago we put out a summary of the Bank of America Global Fund Manager Survey. In last week’s note we pointed out the three key takeaways:

1. Net allocation to the tech sector fell 20% month-over-month to 1%, the lowest since December 2008.

2. Overweight positions on bank stocks rose to 41% among BofA’s clients, closing in on a record set in October 2017.

3. Net overweight positions in commodities rose to a historical high in January. The last time commodity euphoria was even close was 2011.

Click the link to last week’s note to see what happened to these groups the last time positioning was this extreme: last week’s note

So now we know where all of the FISHERS have run to: (banks and energy). We still like these trends over the next few years, but in the short term too many poles are chasing too few remaining prizes.

They have left Tech and Biotech fisheries empty. That is where we have leaned in over the past week and a half. We are primarily focused on biotech because it was down over 20% last year. Historically, the sector has followed up bad years with record years. For our tech exposure we are largely concentrated in (China Tech) Alibaba.

Considering there’s no one fishing in these waters (yet), like Captain Billy and Ryan, we’re likely to come up with quite a few prize fish in coming months. Once word gets out on the radio, all of the other boats will come. That is some time off, but when the time comes, we’ll help the crowd out, take some profits, pull up anchor, and move to the next set of prize-laden waters…

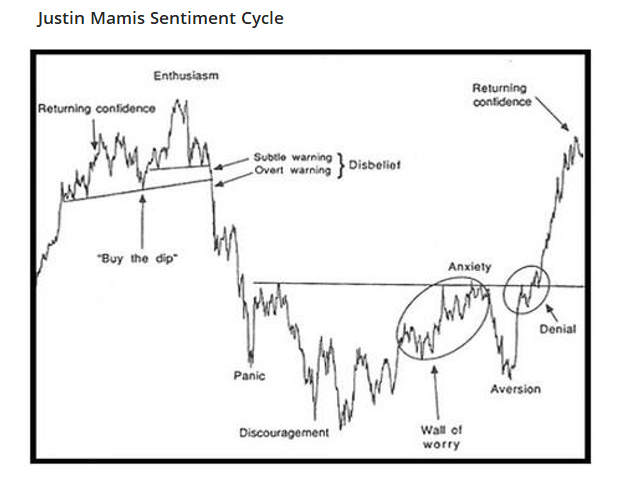

Keep in mind, it’s one thing to catch the fish, it’s another thing altogether to keep it on the hook as you’re trying to reel it in. We’ve referenced this sentiment chart many times in the past. The bottom part is what it looks like when the fish is trying to get off the line (i.e. your stock temporarily goes against you in the short term). If you know what you own (by looking under the surface of the water and seeing the prize [fundamentals]) you will be inclined to hang on through the short term turbulence and finally reel the prize into your boat. When the other boats start crowding, you’ll know you’ve already won and can move on to your next conquest.

The Fed

A Bloomberg reporter from Asia reached out after the close for my thoughts on the Fed Meeting. Here’s what I told him:

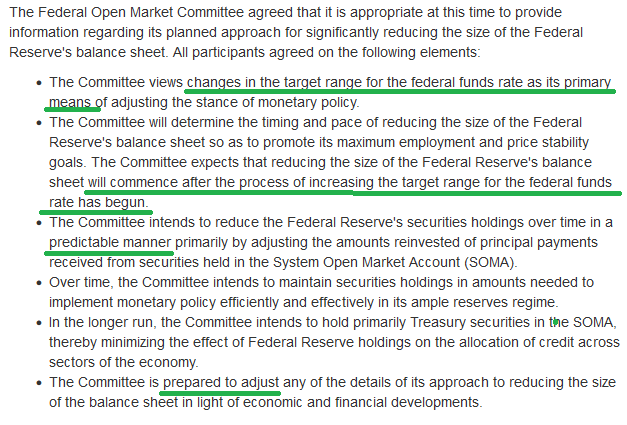

“There was nothing new in the Fed press release or conference other than Chair Powell saying the balance sheet runoff would happen sometime AFTER rate liftoff. This is a clarification of the Fed minutes from December – which implied they could potentially start simultaneously.

The hint of a rate liftoff in March is already priced in. Any uncertainty is now related to the beginning of quantitative tightening.

We usually find that the first move is the wrong move when it comes to Fed meetings. Today markets were weak following conference, and after working through some short term chop, we expect a bid to come back into the market after 3 weeks of constant selling.

Tech was the worst hit, so may be the first to get bid in the short term. So far tech earnings have been strong with IBM and MSFT. Tomorrow’s AAPL earnings will be the key moving forward.

China tech showed weakness today. We think this is short lived and represents one of the highest return contrarian plays for 2022. While the developed world tightens in 2022, China will continue easing and setting the stage for a nice recovery of beaten down leaders like Alibaba and Tencent.”

In the addition to the Fed Statement, the FOMC laid out their “principles” for balance sheet reduction. What was new here is that they would wait until AFTER starting rate liftoff to commence QT. In his elaboration, Powell said they would start to talk about it over the next few meetings. This implies a summer start (at the earliest). It also means if bottlenecks ease and inflation starts to moderate, it could be pushed back further. This is generally a positive development:

Now onto the shorter term view for the General Market:

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 23.1% this week from 21% last week. Bearish Percent jumped to 52.9% from 46.7%. Retail trader/investor optimism is flushed out. They are the most scared they have been since 2020. This usually occurs near inflection points:

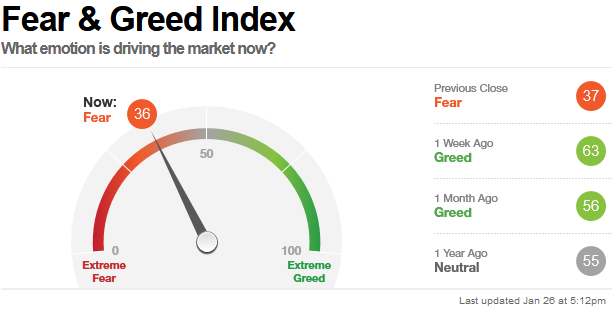

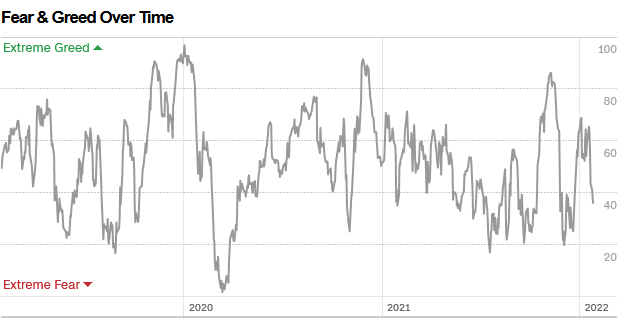

The CNN “Fear and Greed” Index dropped from 59 last week to 36 this week. There is fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

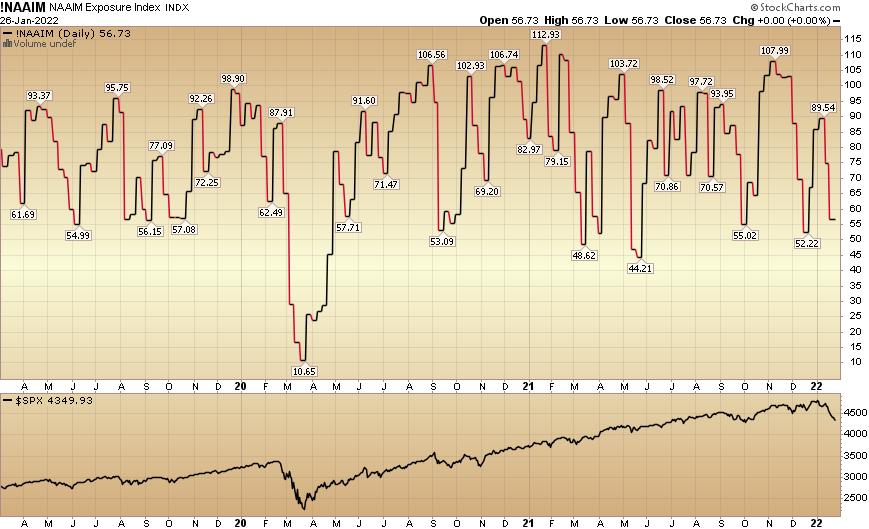

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 56.73% this week from 74.78% equity exposure last week.

This was my closing commentary from our January 6 note (after they released the Fed Minutes on the 5th):

“The next Fed meeting is Jan 25-26. By then, the only data the Fed will have is likely a decent jobs report from this Friday – and limited evidence that inflation is rolling over. As I said in our podcast|videocast all last year – when people were looking for big crashes – we were not going to get one. We would be limited to a handful of 3-5% pullbacks given all of the liquidity.

This changes in 2022. I expect to see 8-10%+ mini-corrections moving forward. If we continue to gain strength in coming weeks, I’m inclined to harvest some profits and build a little cash going into the Fed meeting. Their recent hawkish pivot is not expected to change until inflation rolls over, and I think the earliest signs of that will be in March. February may create some great opportunities to go shopping for those who harvested a little cash. For the longer term investors, you’ll likely just hold on through the air pockets. They haven’t inverted the curve yet, so no recession is on the horizon in the near term – just a bit of turbulence…”

We have put a significant amount of capital (that we raised per above) back to work into the biotech sector in the past week+. We will continue to selectively add in coming weeks as/if further opportunity presents itself.

The podcast|videocast will be out on Friday this week.