As I get older, I listen less to what people say and simply watch what they do. On Wednesday, the market was down as a reaction to what was said in the Fed Minutes (from the December meeting).

The key surprise was the idea that they would consider running off the balance sheet potentially right after the first rate hike (which could be as early as March). The last time they engaged in “quantitative tightening” was 2018 – which inverted the yield curve in ~1.5 years.

I Dare You

While the [2yr Treasury Yield : 10yr Treasury Yield] stopped racing toward 1 this week (also known as inversion), I think it would be aggressive for the Fed to:

- Implement 3 rate hikes in 2022.

- Start balance sheet runoff as early as March.

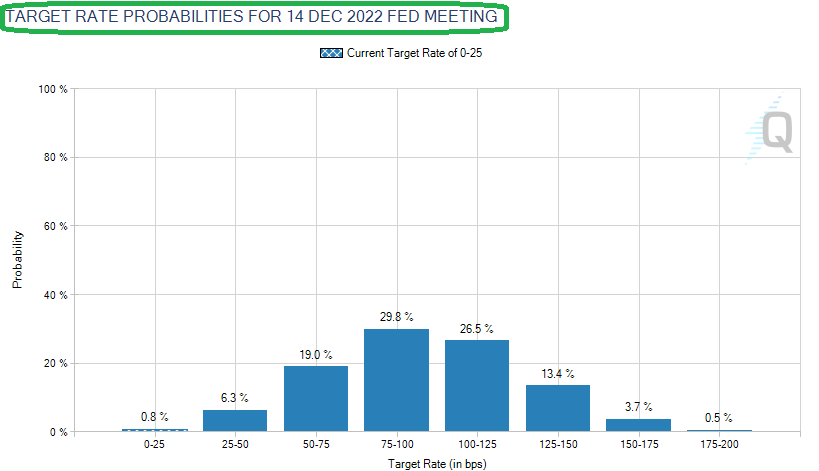

The market is now betting on 3 hikes in 2022:

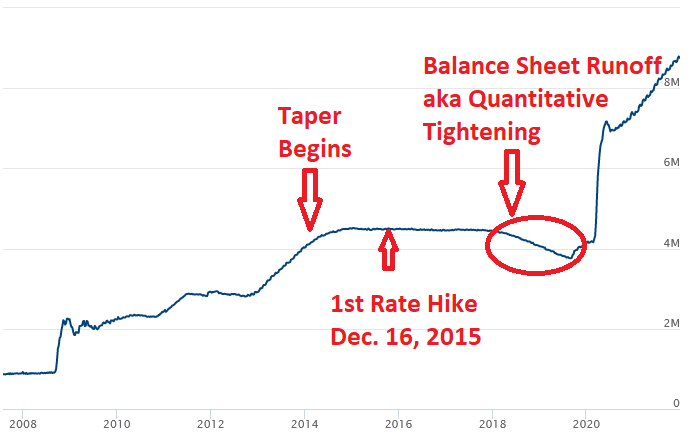

To put it in perspective, on December 18, 2013 the Federal Reserve Open Market Committee announced they would be tapering back on QE3 at a rate of $10 billion each meeting. The taper was completed in October 2014 – 11 months after they began the tapering process.

They then waited ~15 months after the taper was completed to start hiking rates, and then another two years before they began their balance sheet runoff program (Quantitative Tightening). It took approximately 1.5 years after they began the balance sheet runoff before inverting the yield curve – and 6 months later we were in recession.

The only explanation for accelerating the Taper (5 months this time versus 11 months last time), accelerating rate hikes (expected 0-3 months after taper this time versus 15 months after taper last time), and balance sheet runoff/Quantitative Tightening (right after first rate hike this time versus ~2 years after first rate hike last time), is a complete emotional knee-jerk panic at backward looking inflation data. That is literally the only plausible explanation for talk about completely taking the punch bowl away all at once…

IF they follow through with anything like what has been proposed in the fed minutes (3 hikes in 2022 coupled with balance sheet runoff), they will invert the yield curve within 12 months and we’ll have a recession within 24 months guaranteed. This likely guarantees a political change in the Executive Branch in 2024 which is very aggressive for a group that is supposed to be apolitical. Presidents don’t get re-elected in the middle of a recession. Just ask Bush Sr., Carter, and Trump…

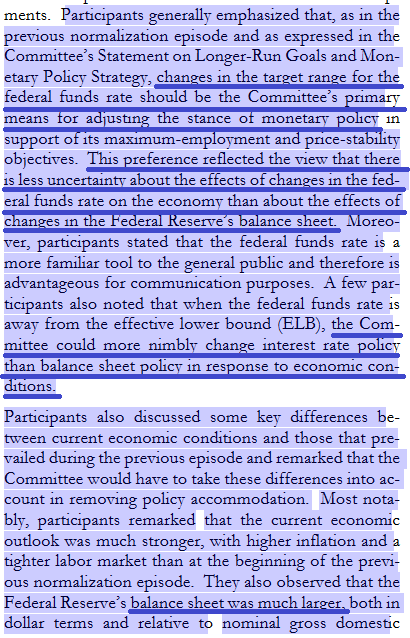

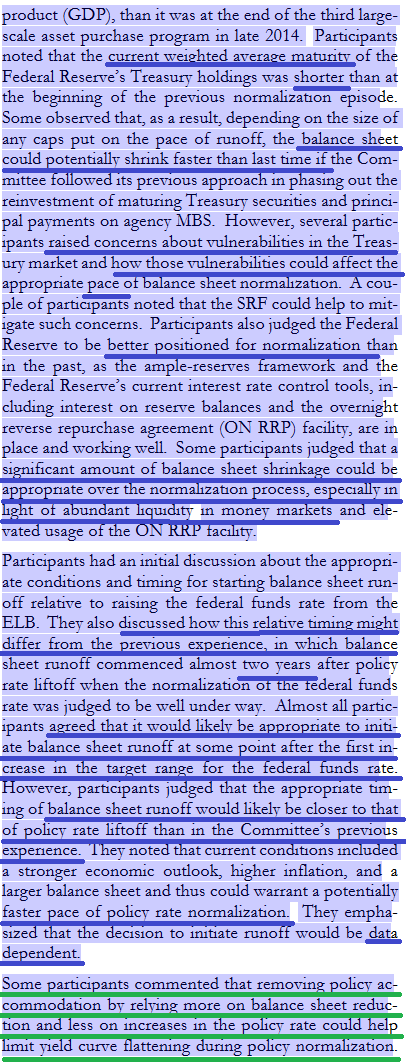

The question is WILL THEY? Their talk wasn’t cheap on the accelerated taper. Chair Powell did an about face within days of his re-appointment. Now we have to wait and see if they are seasoned pros who will be thoughtful, patient, and data dependent moving forward, or emotionally react to short term spikes in data and headline noise. Here is the key text from the December Fed Minutes:

This last line is especially important. It indicates that they are cognizant about the implications of a flattening yield curve. The implication is that IF they move forward with balance sheet runoff after the first rate hike, perhaps they will be less aggressive on the pace of subsequent hikes as they are draining liquidity with the balance sheet runoff. That would potentially meet their goal of keeping the yield curve steep – while cooling a “hot” economy at the same time.

It would be an innovative – but untested approach. The more likely outcome is that by the time they meet to discuss the second hike, inflation will have moderated (still above-trend, but declining ROC) and perhaps they will moderate their hiking pace in-line with the new data. That would be the ideal “soft-landing.”

The most important thing to keep in mind is that these minutes were likely coincident with peak readings across all inflation measures. Time will tell, but when we look back, it will likely be clear that this panicked rhetoric you see above was a short-term overreaction.

Outlook

On Friday, Jack Denton included me in his article in Barron’s with a quote about my outlook for 2022. My general take was more volatility, but positive returns for the year. I repeated a similar sentiment on a clip for Gerri Willis on Varney & Co. (Fox Business) the same morning. Thanks to Gerri and Ellie Terrett for including me in Gerri’s segment. Wednesday we saw a taste of what’s to come…

Tom Hayes – Varney & Co.– Fox Business Appearance – 12/31/2021

Value

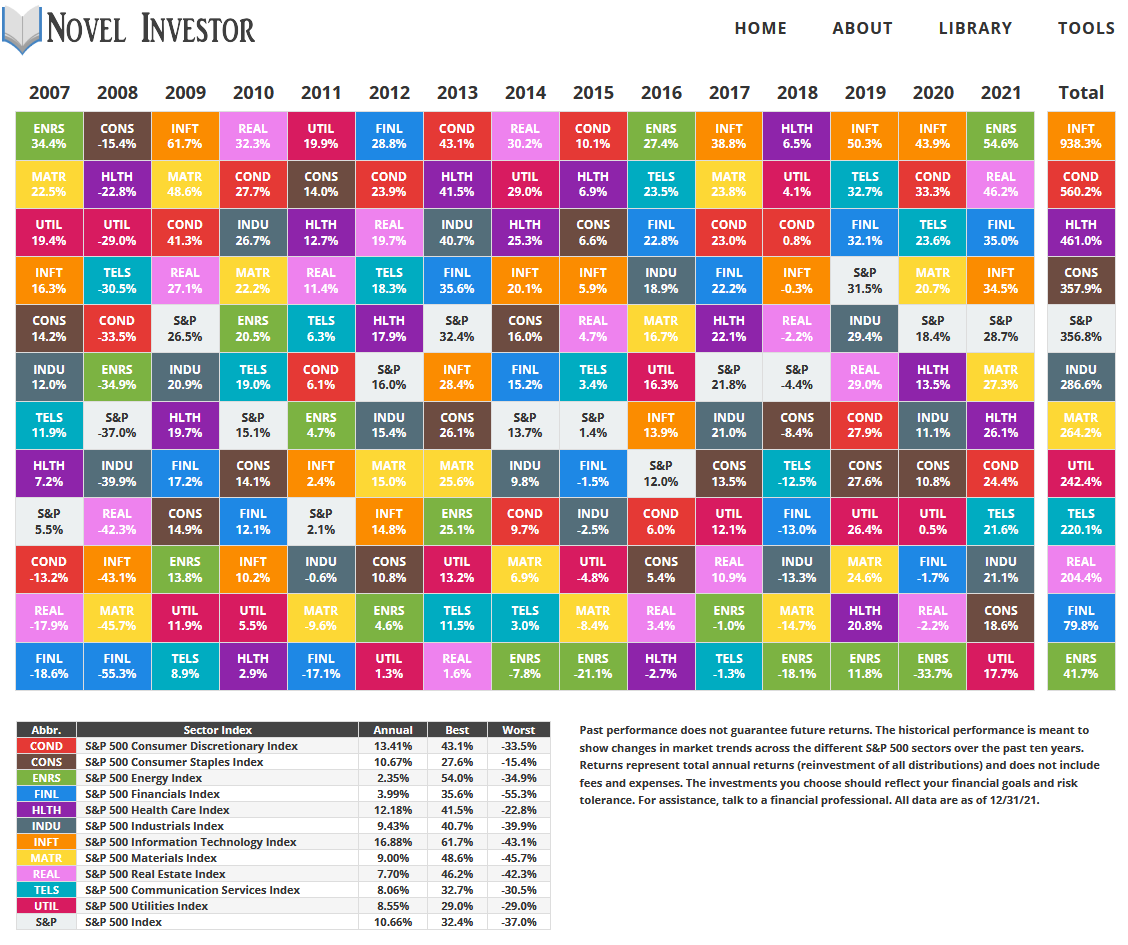

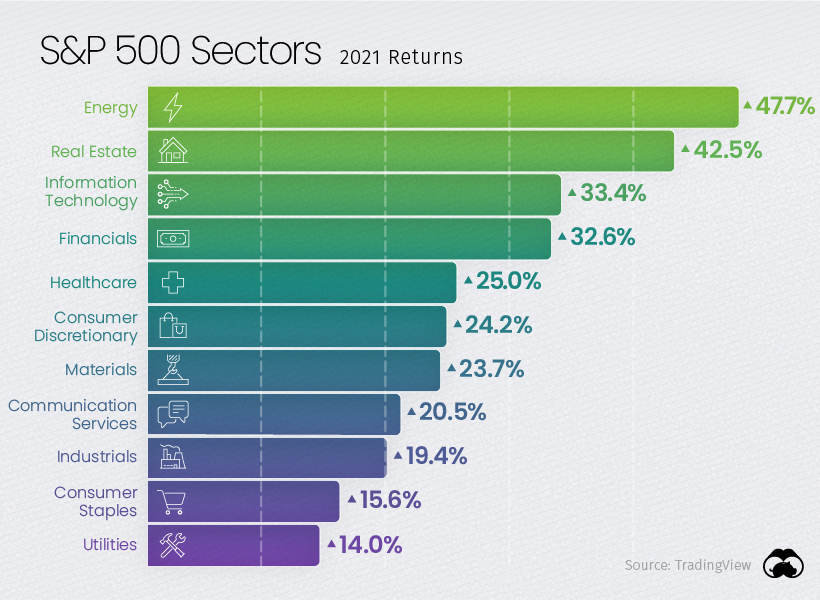

Value is trying to climb back into pole position as it did in Q1 of 2021. The Q1 move in 2021 – despite lack of follow through for the remainder of the year – was enough to make Energy the top performing sector in 2021.

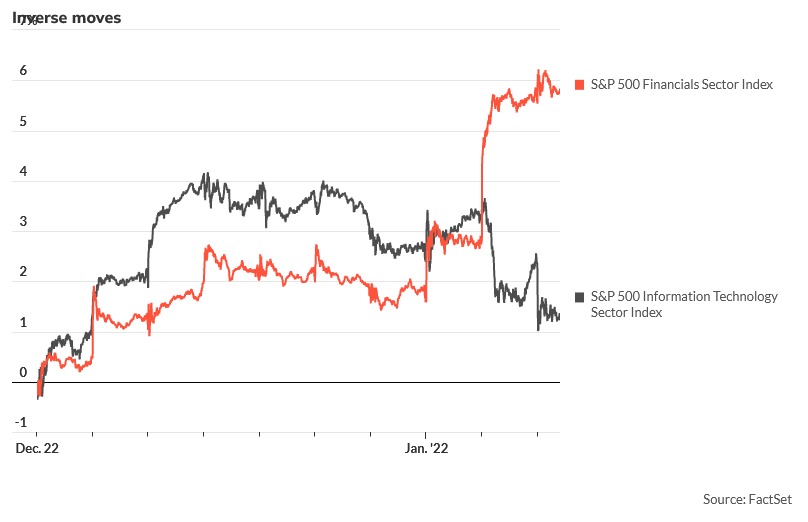

(source: factset via MarketWatch)

(source: factset via MarketWatch)

We have the ascent and “breakout” of the 10yr yield to thank for this early rotation. We’ll now see if we get follow though in coming weeks:

For those who have followed my podcast|videocast for some time you know our base case was 2-2.25% 10yr yield in Q1 2022. However, we also pointed to the last cycle when the 10yr yield peaked (counter-intuitively) when they announced taper and started coming DOWN as they were slowly pulling out as a buyer (i.e. new demand showed up).

Follow through in this breakout would favor a continuation of the nascent 2022 value trend. A breakdown would bring a bid back into beaten down tech.

We favor value…

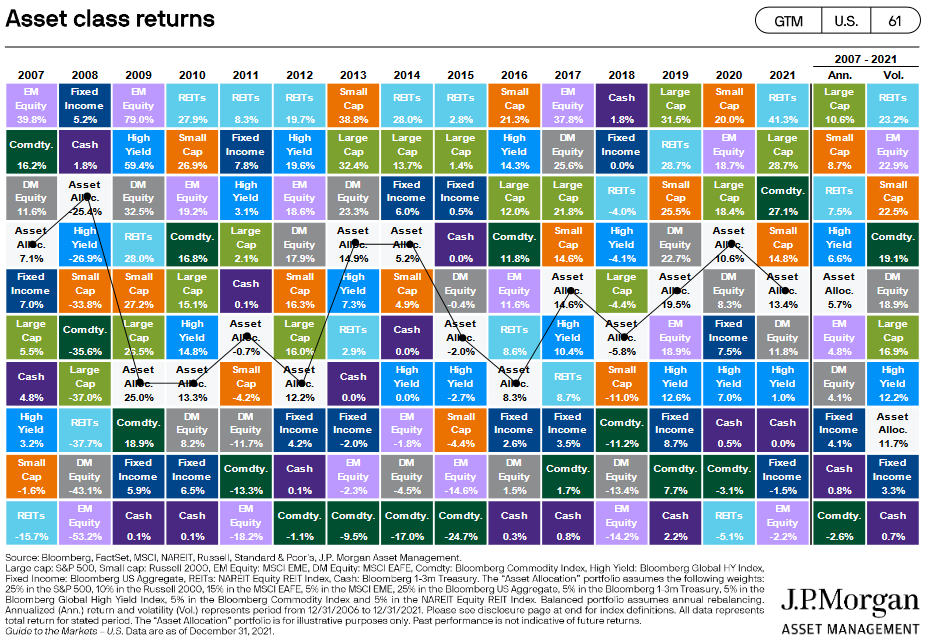

Rotation – Last Shall Be First

As we look at both the sector rotation chart and asset class rotation charts we find one common denominator: It is unusual for a sector or asset class to lead two years in a row. As such, we like to look for laggards to put new money to work. This year we focused on Industrials (for sector) – and Emerging Markets (China is biggest weight) for asset class. Most of our new adds have been in these two groups in recent weeks. That does not mean we drop everything else, it simply means we lean into where there is value and don’t chase what has already made the biggest part of its move.

As we look at both the sector rotation chart and asset class rotation charts we find one common denominator: It is unusual for a sector or asset class to lead two years in a row. As such, we like to look for laggards to put new money to work. This year we focused on Industrials (for sector) – and Emerging Markets (China is biggest weight) for asset class. Most of our new adds have been in these two groups in recent weeks. That does not mean we drop everything else, it simply means we lean into where there is value and don’t chase what has already made the biggest part of its move.

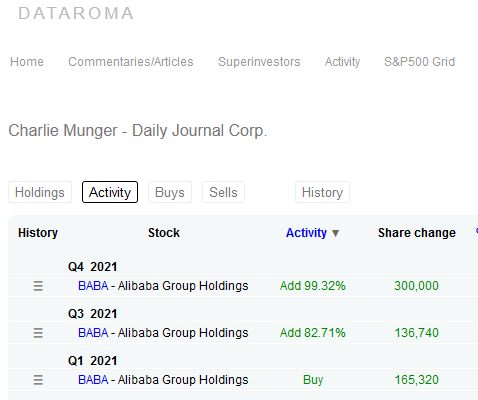

Charlie Doubles Down on his Double Down

My favorite movie of all time is Swingers – starring Vince Vaughn and Jon Favreau. This scene perfectly describes what we saw from Warren Buffett’s billionaire partner Charlie Munger this week:

Unlike Mikie (Jon Favreau’s character), Charlie recently took the right bet to double down on his double down on his Alibaba position when the odds favored him. Data from Tuesday’s filing:

Mikey – on the other hand – lost because he had no edge or bankroll to play the correct odds over a series of time. He got stopped out on both bankroll and time.

Stocks on the other hand give you all the time you need when the odds/fundamentals support a reversion to intrinsic value. We covered this in depth in last week’s note (very important analysis comparing to MSFT in 2013):

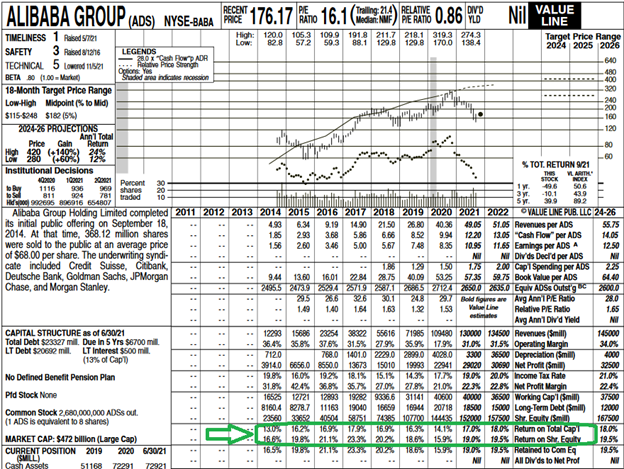

Alibaba’s numbers (odds):

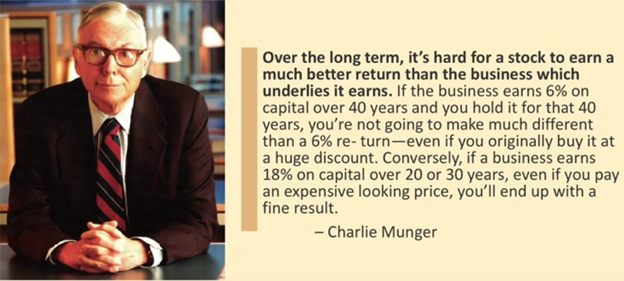

One of the factors that I didn’t mention in last week’s article and podcast/videocast is return on capital. What Charlie fails to mention in the image/quote below is the inverse – which I have stated here:

One of the factors that I didn’t mention in last week’s article and podcast/videocast is return on capital. What Charlie fails to mention in the image/quote below is the inverse – which I have stated here:

IT’S HARD FOR A STOCK TO EARN A MUCH WORSE RETURN THAN THE BUSINESS WHICH UNDERLIES IT EARNS ON CAPITAL (OVER TIME).

Looking at the data below you will see the average return on invested capital for Alibaba since inception is 18%. If you compound 18% ROIC from its 2014 IPO opening price of ~$92.70 it gets you to $295 intrinsic value over 7 years (on the US ADS price – equivalent percentage on 9988/BABAF). This is not reflected in the current price (~$120), but like holding a ball under water – eventually it will erupt back to its level. That excludes the continued compounding that will accrue in the interim – and the forward growth expectations/multiple expansion that occurs when SENTIMENT inevitably changes.

I went into some longer term outlook/targets on the videocast last week.

Very Short Term Bounce?

We cover our intermediate term view at the end of the article, but very short term (Thursday/Friday) we could be in for a bounce off these extreme levels.

Now onto the shorter term view for the General Market:

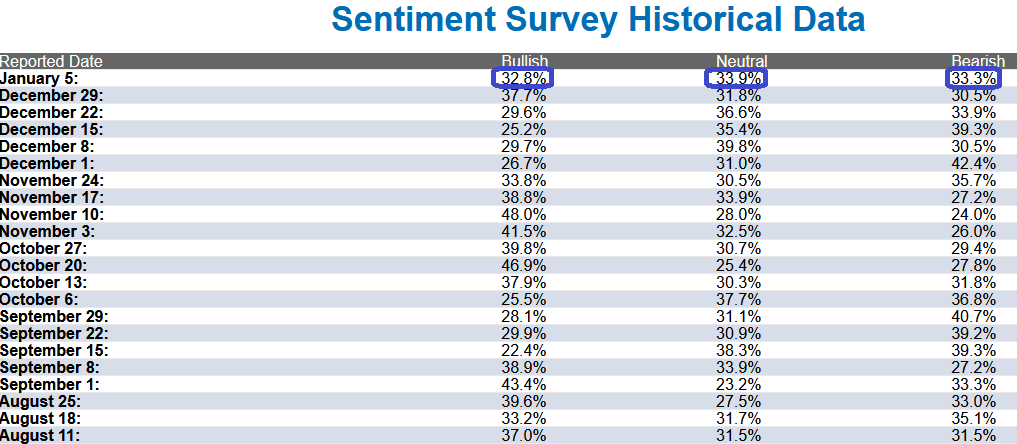

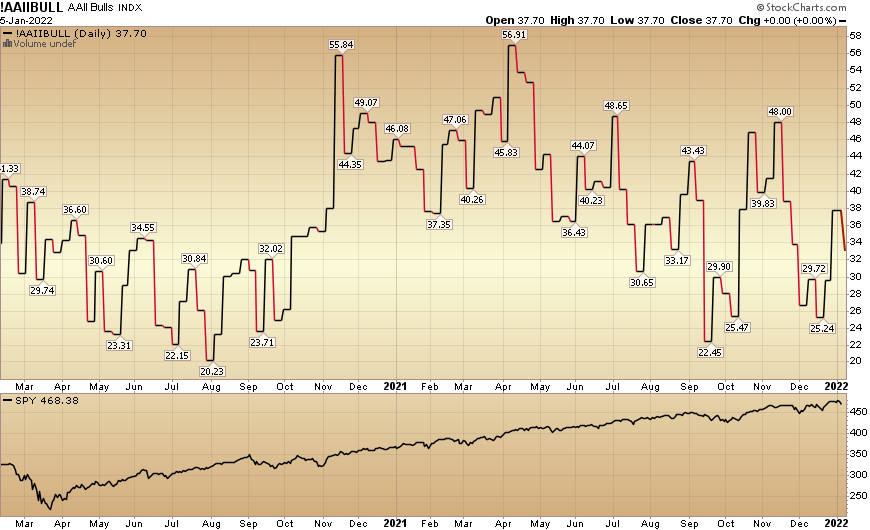

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 32.8% this week from 37.7% last week. This is a neutral reading.

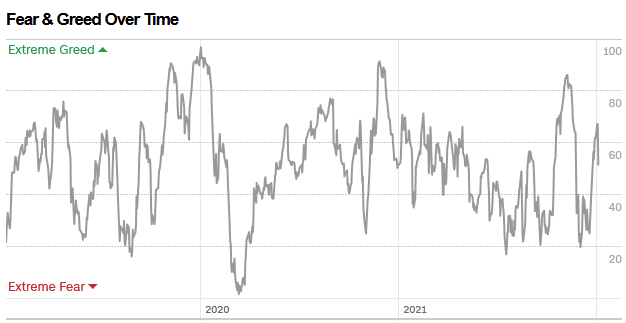

The CNN “Fear and Greed” Index backpedaled from 60 last week to 51 this week. This is still a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” Index backpedaled from 60 last week to 51 this week. This is still a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

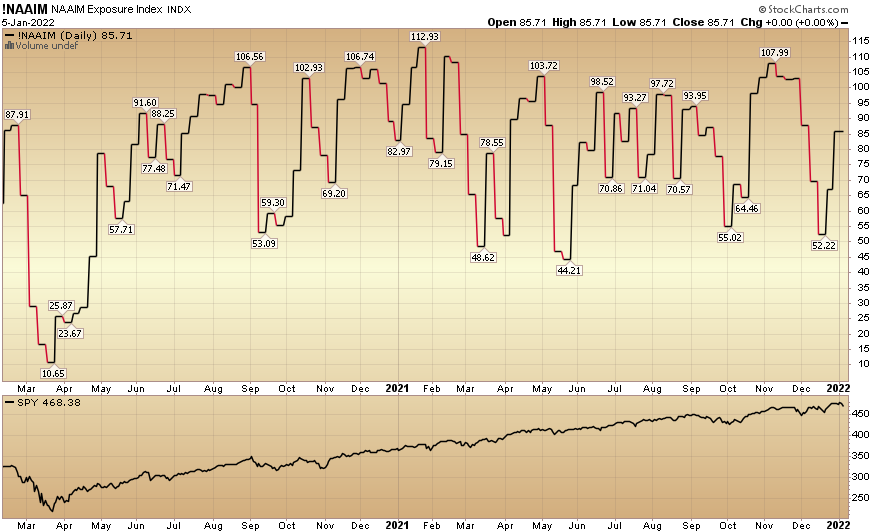

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 85.71% this week from 67.02% equity exposure last week. Managers have increased their exposure.

The next Fed meeting is Jan 25-26. By then, the only data the Fed will have is likely a decent jobs report from this Friday – and limited evidence that inflation is rolling over. As I said in our podcast|videocast all last year – when people were looking for big crashes – we were not going to get one. We would be limited to a handful of 3-5% pullbacks given all of the liquidity.

This changes in 2022. I expect to see 8-10%+ mini-corrections moving forward. If we continue to gain strength in coming weeks, I’m inclined to harvest some profits and build a little cash going into the Fed meeting. Their recent hawkish pivot is not expected to change until inflation rolls over, and I think the earliest signs of that will be in March. February may create some great opportunities to go shopping for those who harvested a little cash. For the longer term investors, you’ll likely just hold on through the air pockets. They haven’t inverted the curve yet, so no recession is on the horizon in the near term – just a bit of turbulence…