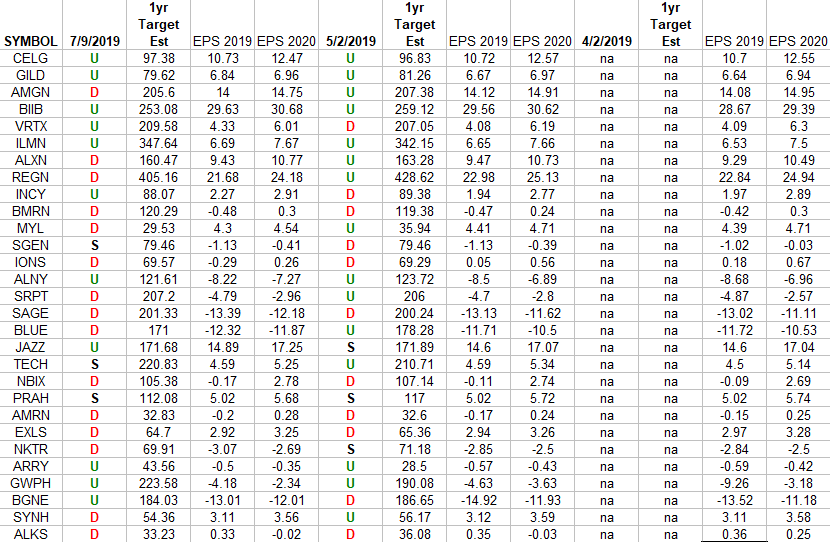

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top weighted stocks. The column under the date 7/9/2019 has a letter that represents the movement in 2019 earnings estimates since the most recent print (5/2/2019). “U” means 2019 estimates are UP in the last 68 days. “D” means 2019 estimates are DOWN in the last 68 days. “S” means 2019 estimates have remained the SAME in the last 68 days. The column entitled “1yr Target Est” is the Wall Street consensus 12 month price target for each stock. You can see how it has come up or come down in recent weeks.

What this table is telling us is that estimates have remained relatively stable. More estimates came DOWN for 2019 in the past 30 days than went UP 11:15 ratio. The rest remained the same.

The cumulative earnings power of these 29 stocks was revised UP by .80% in the past 68 days.

The top weighted components or the IBB have recently been rebalanced and this will be reflected in our next report ~8 weeks from now. We kept the previous components today in an effort to compare apples to apples.