I find more value in looking at individual company’s fundamentals than focusing on Macro/Fed, etc. The reason is, one you can control and one you can’t. You can control your investing framework (analysis of fundamentals) and apply it consistently across opportunities that meet your criteria.

You cannot control the timing in which companies that fit the bill inflect from undervalued to overvalued. Some do it in a year, most take 2-3 years, and some take up to five – but over a concentrated book of 8-12 good companies with inflecting or growing free cash flow, you can see meaningful results over a reasonable amount of time (~36 months is the right window).

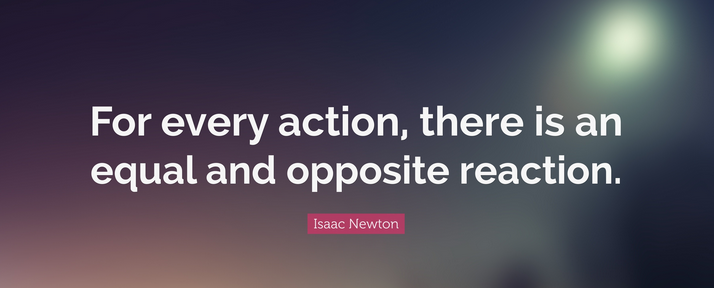

If your framework is sound, it works like all other immutable laws. Gravity works just about 100% of the time. If you drop a ball from the top of a building, it goes UP approximately how many times? ZERO (give or take). If you hold a beach ball under water (against its natural level), when pressure is released the rebound is abrupt. For every action, there is an equal and opposite reaction.

For us, we like to focus mostly on high quality companies that have a long history of performance through many different macro cycles – and because of their business moat – have strong recoveries when they emerge from their cyclical troughs. We generally avoid companies that start with “if” and lean into companies that start with “when” they recover. This mosaic of analysis comes from many years of experience, solvency analysis, cash flow analysis and durability analysis.

Once that aspect of our process is satisfied, we run through two final filters to manage risk:

1) If this position goes to zero – as it relates to quality and size – (in the context of the portfolio) will they take me out on a stretcher? ANSWER MUST BE NO.

2) If I raised the capital to buy the entire company at the price it is quoted in the market today, would the Board be insulted and have me escorted off the premises? ANSWER MUST BE YES.

The first question addresses the possibility that there’s something that we don’t know that we don’t know (and probably can’t know). There is no way to insure against this low probability scenario. It ensures humility and acknowledges that there’s no such thing as a “sure thing.” You manage around that risk by 1) owning multiple companies (but not too many that you can’t outperform over time), and 2) very limited leverage.

By sticking with rigor to a long developed process, you do not worry about short term day-to-day fluctuations or for “macro” events to catalyze the price movement. You simply know that over time, price will always catch up to fundamental performance. On the long side, this means that as the fundamentals consistently improve (i.e. the earnings power and cash flow increases) while the price stays the same or moves down, when it ultimately moves, the price movement to “catch up” will be ABRUPT to the upside. This is an immutable law like gravity.

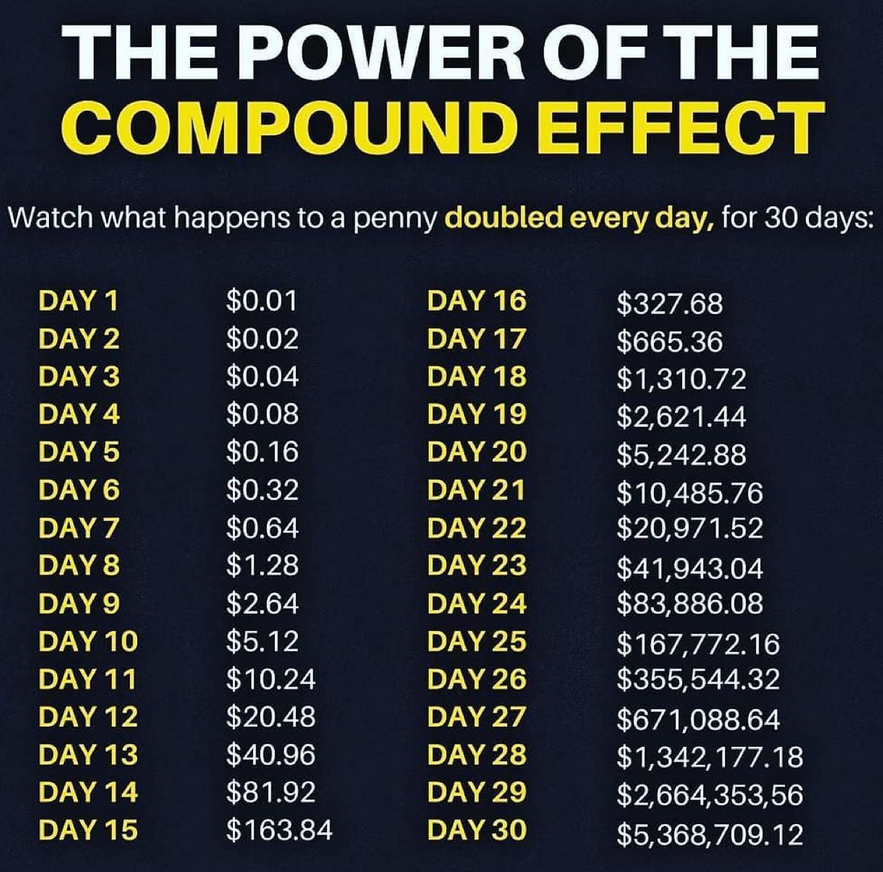

Ralph Waldo Emerson had this truth in mind when he said (in his essay on Compensation), “If you serve an ungrateful master, serve him the more. Put God in your debt. Every stroke shall be repaid. The longer the payment is withholden, the better for you; for compound interest on compound interest is the rate and usage of this exchequer.”

That “compound interest” that Emerson refers to is embodied in parabolic moves higher after a stock has not moved for years (while the underlying fundamentals have improved) and then all of a sudden goes straight up. An extreme example of this is the late Charlie Munger’s pick of Chinese automaker BYD. He persuaded Warren Buffett (Berkshire Hathaway) to invest in it in 2008-2009. Here’s what happened:

They suffered drawdowns of 87%, 61%, 58% and 62% before finally realizing a 21x (2000%+ return). After 12 years invested they were only MODESTLY up. Why were they able to hold tight when everyone else was puking out 4 separate times?

1) Low Leverage. They weren’t getting “stopped out” chasing price up and down.

2) Fundamentals were improving even when “price” wasn’t:

The same is true for stocks that are excessively overvalued and the stock price has continued to go up (while the underlying fundamentals have deteriorated) and then all of a sudden it collapses.

The key is to do the work “under the hood” and use your x-ray glasses to find these opportunities. Then execute and wait across a basket of 8-12 great opportunities. Some will move higher, faster than expected. Some will be doubles and some will be 10x+. Some will take longer, but ultimately make you a higher IRR. Some you will be wrong, but if you bought with a large enough “margin of safety” you can reallocate to better opportunities. But in aggregate you will have leveraged these immutable laws to outsized success.

And with that said, let’s get to the Macro!

Fox Business

On Monday, I had the opportunity to join David Asman and Lauren Simonetti on Fox Business’ “Varney & Co.” to discuss market concentration, 2H outlook, abrupt change coming, and a couple of picks. Thanks to Preston Mizell for having me on:

Watch in HD directly on Fox Business:

Watch in HD directly on Fox Business

On Tuesday, I had the opportunity to join Neil Cavuto on Fox Business’ “Cavuto Coast to Coast” to discuss Fed policy, Powell testimony, Labor Market, Cut Odds and timing, risks, Inflation, political implications, Global Central Bank stats and implications, cyclicals, Trump/Biden, Earnings season, seasonal outlook, high expectations, life secret and more! Thanks to Jenna DeThomasis for having me on:

SEGMENT #1 (top of show):

Watch in HD directly on Fox Business

In SEGMENT #2 (bottom of show), I discussed tech, 1H vs. 2H strategy, Earthquake?, Un-Magnificent 493?, overdone or more to come?, Last First? (2 reasons why), Indices returns?, rate sensitivity, etc:

Fed

In one of my recent media appearances on the David Lin Report I said that the Fed will not wait until 2% inflation to cut rates. On Tuesday, Powell confirmed this view:

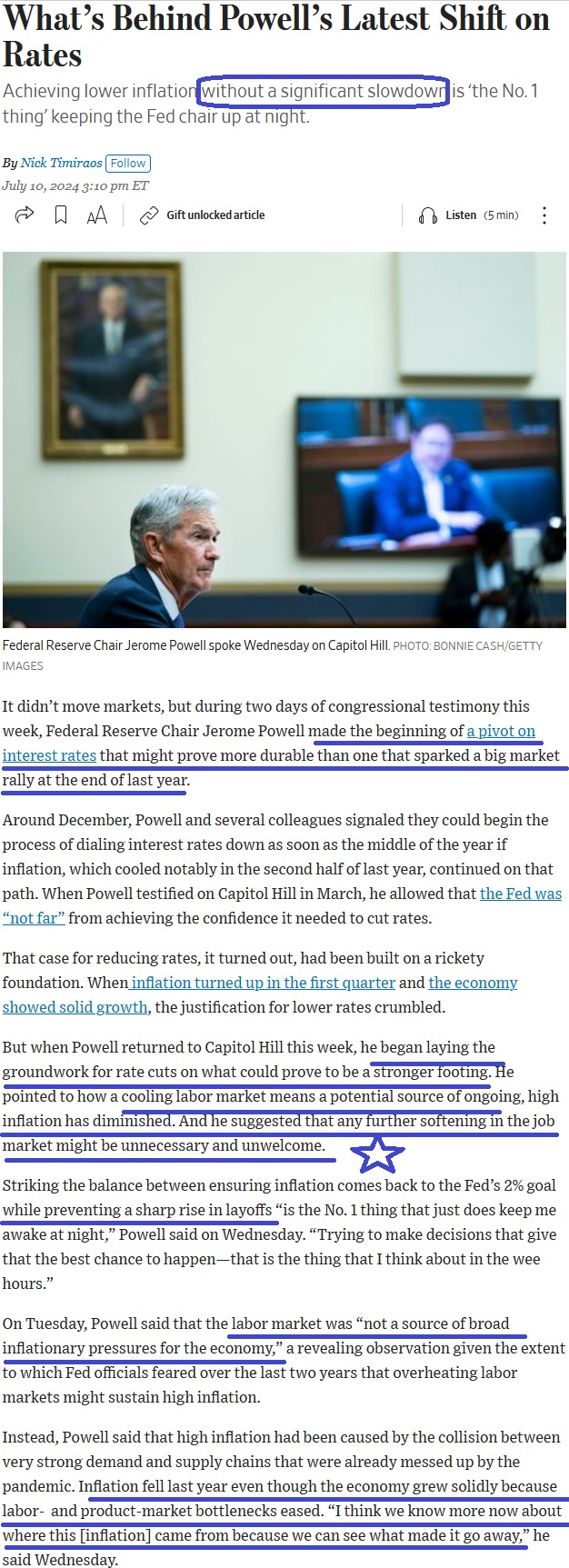

His whisperer (Nick Timiraos of WSJ) came out a couple of hours later with confirmation of the dovish view:

Now onto the shorter term view for the General Market:

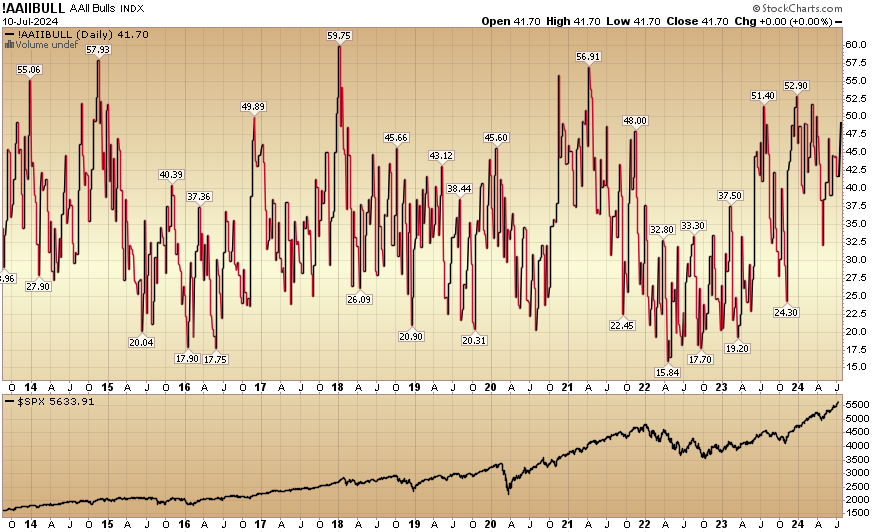

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 49.2% from 41.7% the previous week. Bearish Percent dropped to 21.7% from 26.1%. Retail investors are becoming quite enthusiastic.

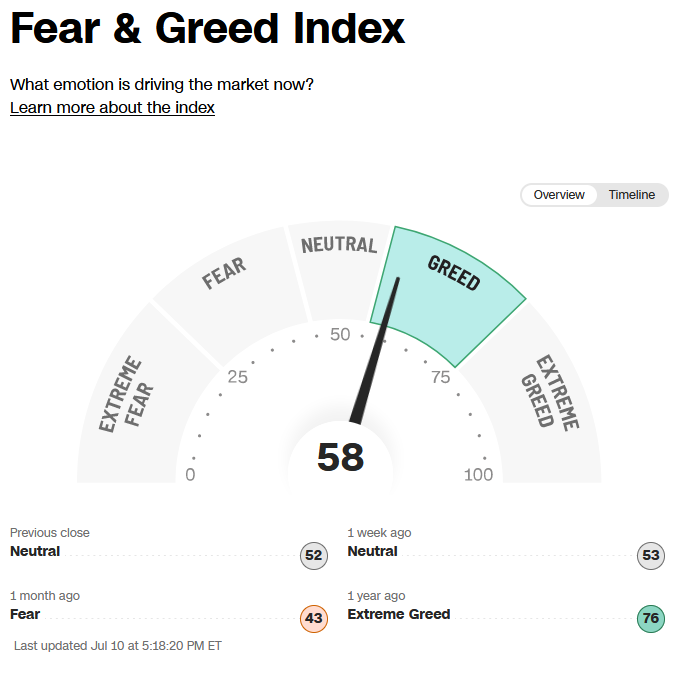

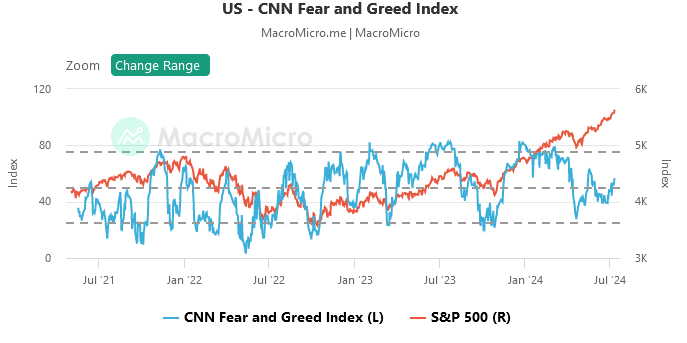

The CNN “Fear and Greed” ticked up from 53 last week to 58 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” ticked up from 53 last week to 58 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

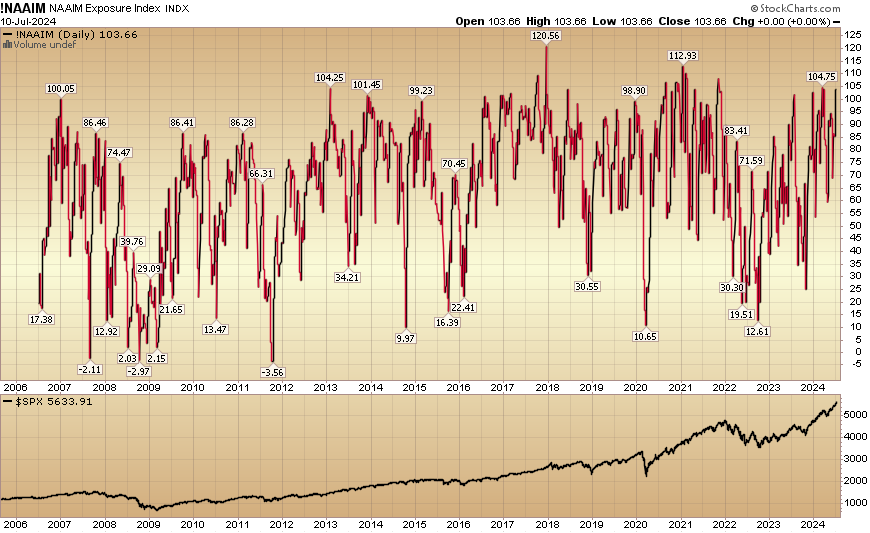

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 103.66 this week from 85.44% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 103.66 this week from 85.44% equity exposure last week.

Our podcast|videocast will be out later tonight. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1 and Q2 raises. We are now re-opening to smaller accounts $1M+ again starting today and will remain open for the next two weeks. To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.