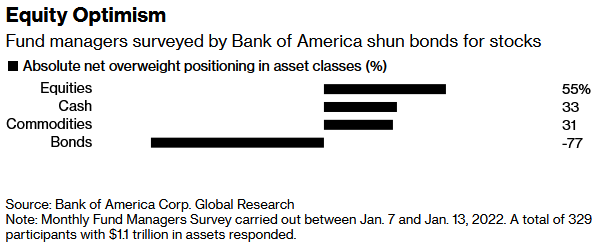

The January survey covered 329 managers with $1.1 trillion in assets under management.

OUTLOOK:

-Only 36% think inflation is permanent, while 56% think it is transitory.

-Only 36% think inflation is permanent, while 56% think it is transitory.

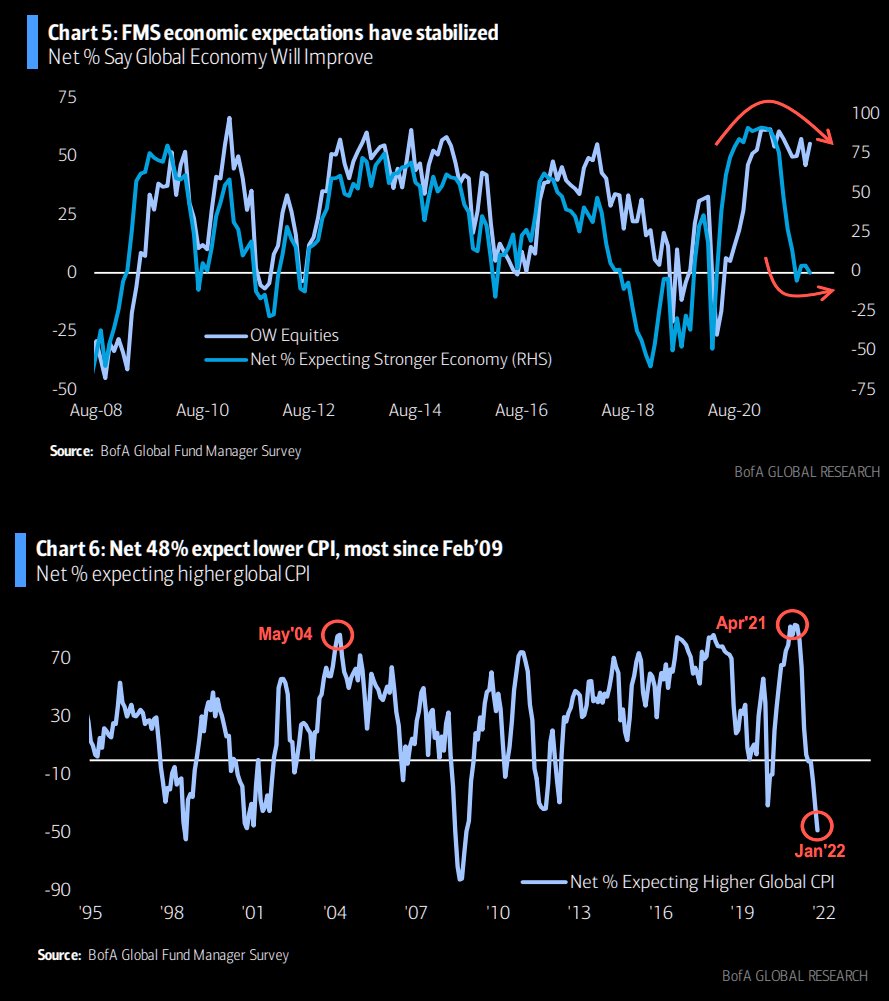

-A net 48% forecast lower inflation – the highest level since 2009.

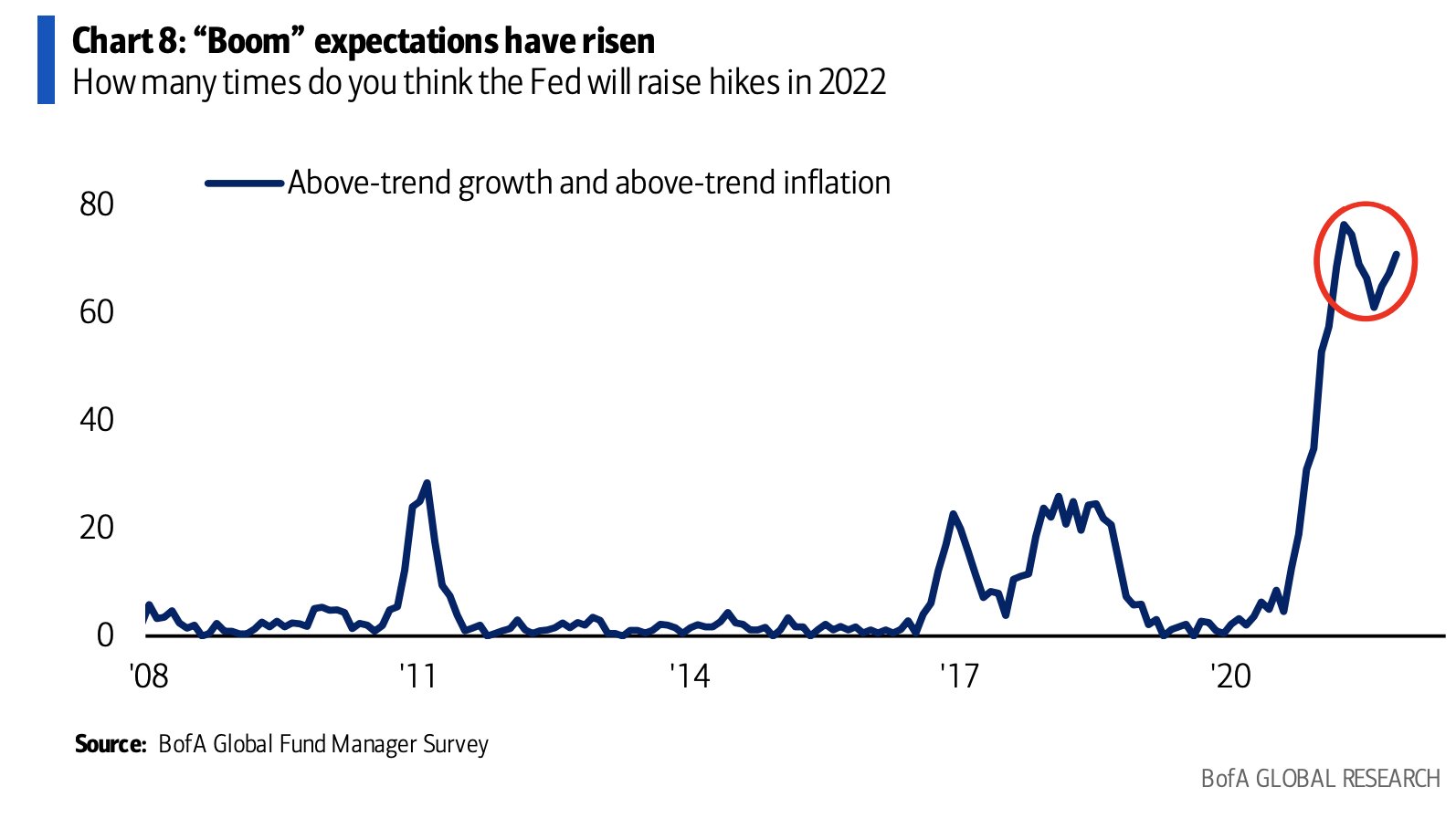

-The share of fund managers who expect the Fed to begin quantitative tightening after the first rate hike jumped to 72% from 16% a month ago.

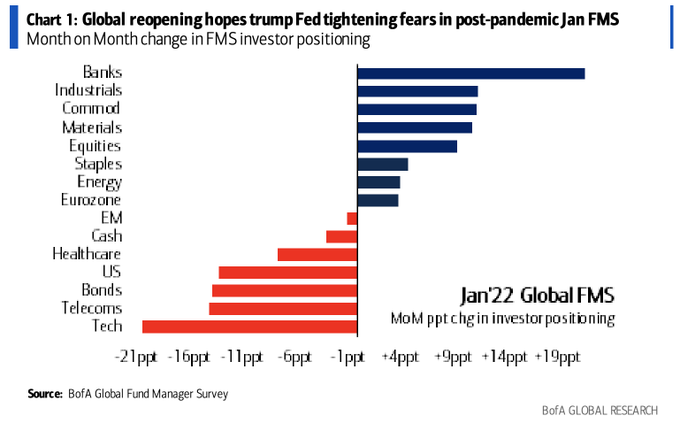

-Global reopening hopes trump [Federal Reserve] hike fears in a bullish post-pandemic survey.

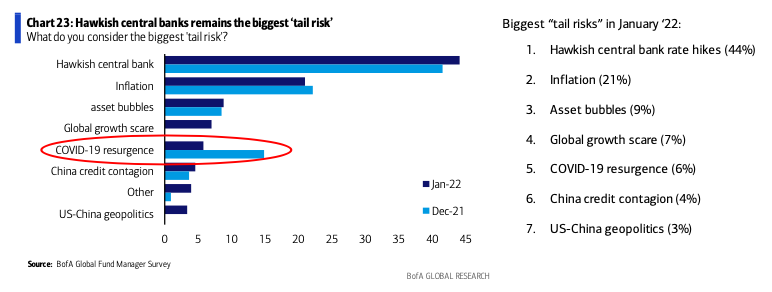

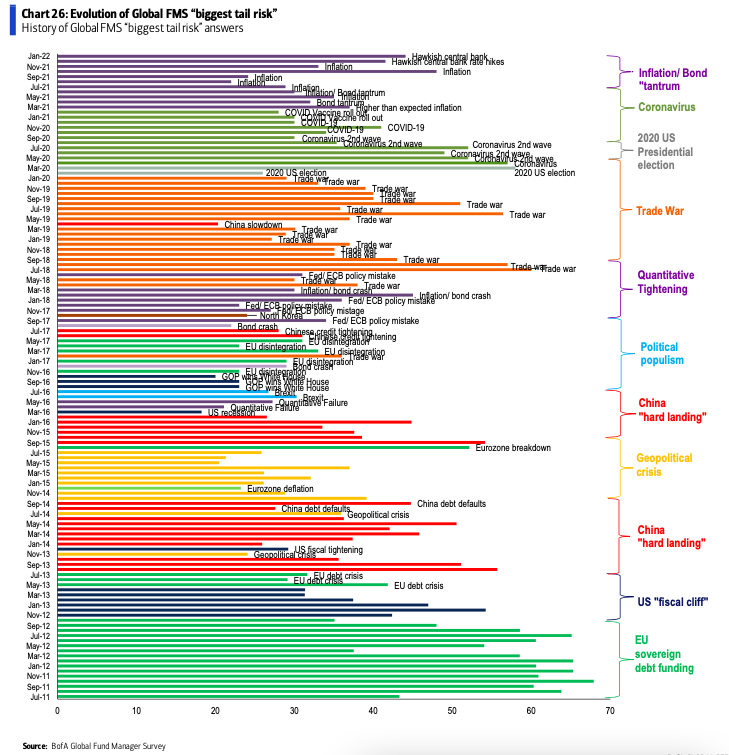

-Central bank tightening remains the #1 risk to markets in 2022.

-Global fund managers expect inflation — not economic growth — to decline this year.

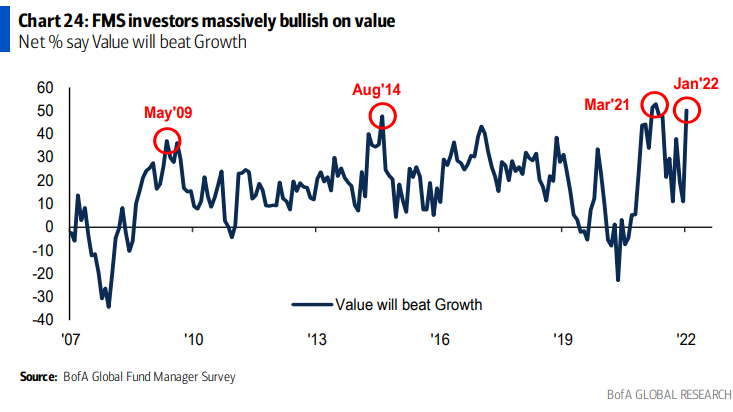

-A net 50% believe value stocks will outperform growth peers.

-FMS investors now on average expect three Fed hikes in 2022 (+1 MoM).

-Investors now expect the first hike announcement to take place mid April 2022 (up from July 2022).

-Over 20% of respondents expect the Chinese economy to also improve.

-Expectations for US dollar appreciation rose to 25%.

SENTIMENT:

-Optimism continues to abound for stocks, despite the Federal Reserve signaling a more aggressive policy tightening to tame surging prices.

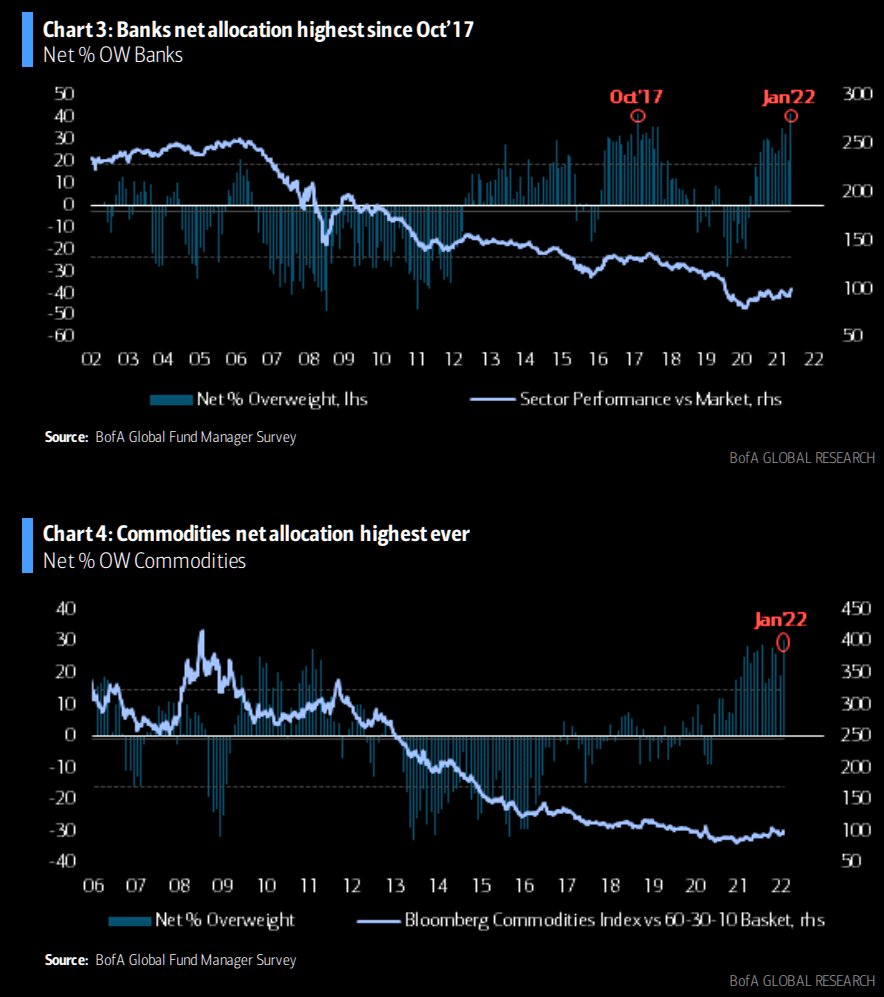

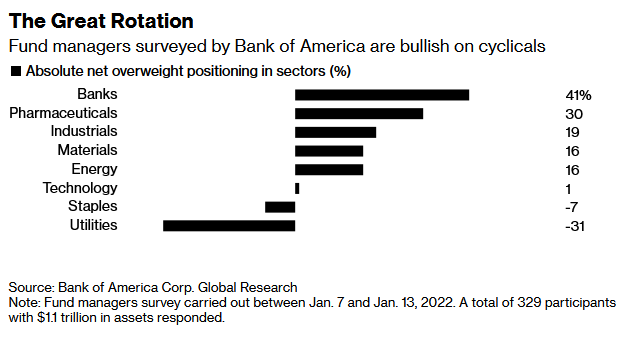

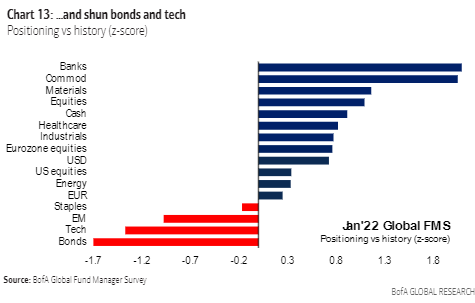

-Market participants are shifting from credit to commodities, from growth to value, and from tech to banks.

-Only 7 out of 100 investors believe there will be a recession in the next 12 months.

-Investors predict three Fed hikes in 2022, and the highest number since December 2018 expect a flatter yield curve.

-Only 6% of the 329 participants surveyed between Jan. 7 and 13 see a resurgence of the pandemic as the greatest risk.

-The macro outlook regarding global growth and profit expectations remained stable, with 71% anticipating a “boom.”

POSITIONING:

-The spread between overweight positions on stocks and bonds increased to peaks last seen in January 2011, as underweight positions on equities fell to an all-time-low.

-The spread between overweight positions on stocks and bonds increased to peaks last seen in January 2011, as underweight positions on equities fell to an all-time-low.

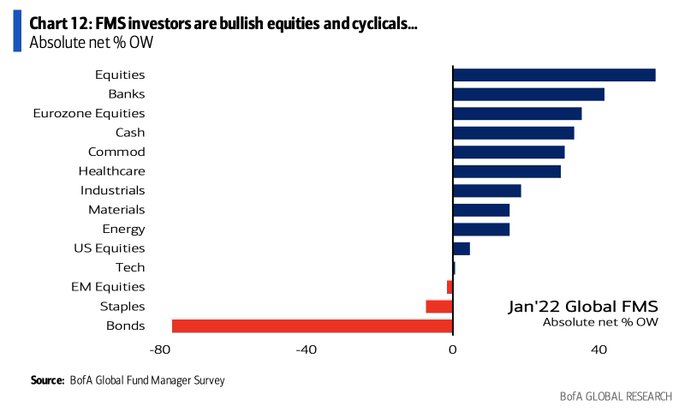

-Net overweight positions in commodities rose to a historical high in January.

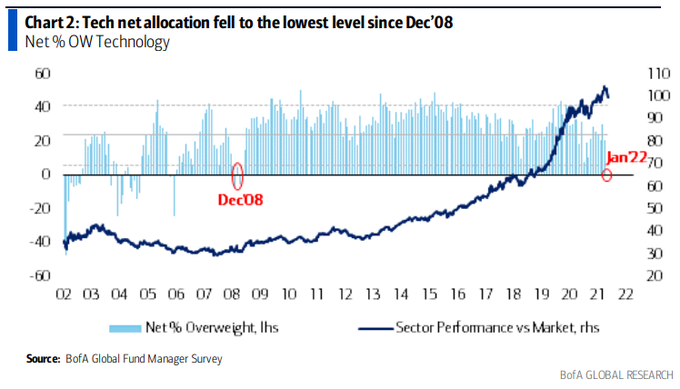

-Net allocation to the tech sector fell 20% month-over-month to 1%, the lowest since 2008.

-Overweight positions on bank stocks rose to 41% among BofA’s clients, closing in on a record set in October 2017.

-A record-high 31% of investors are overweight commodities, while their tech exposure has fallen to the lowest since 2008.

-Fund managers were 55% net overweight in stocks, compared with 77% net underweight in bonds.

-Allocations for utilities were net underweight 31%, and for staples the net underweight number was 7%.

-Allocation to bank stocks soared 21 percentage points in January to a net overweight position of 41%, the highest since the record month of October 2017.

-For pharmaceutical stocks, the net overweight number was 30%.

-For industrials it was 19% net overweight.

-For materials and energy it was 16% net overweight.

-In January, investors were also increasingly bullish on the EU due to a global reopening on trade, with investors “very overweight.”

MOST CROWDED TRADES:

1) long tech stocks

2) short U.S. Treasuries

3) short China stocks

4) long ESG

5) long Bitcoin

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY:

“Global reopening hopes trump Fed hike fears,” BofA strategists led by Michael Hartnett wrote.

“Assets were reallocated to cyclicals on a shift to global reopening trades this month,” Hartnett said.

“Central bank tightening remains the #1 risk to markets in 2022,” strategists led by Michael Hartnett wrote in the survey.

“Investors are very long equities, particular in the EU, as well as cyclical banks, commodities and industrials while they shun bonds, defensives (utilities, staples), and EM,” the analysts said.