Data Source: Bank of America

210 Managers overseeing $570B AUM responded to this month’s BofA survey.

OUTLOOK:

•72% expect stronger global growth. This is up 11 percentage points from last month (highest level since January 2014).

•36% – the highest figure recorded – expect the global economy to get “a lot stronger” and profits to improve in the next 12 months.

•Conviction in the recovery is low, just 14% saying it will be ‘V’ shaped, 30% say ‘W’ Shaped – up from 21% last month. 44% expect a “U” shaped recovery.

•37% of respondents see higher global consumer price inflation in the next 12 months, but only 5% said inflation will be a lot higher.

•71% still think that the stock market is overvalued (down from 80%).

•The percentage of investors expecting the euro to appreciate also rose in July.

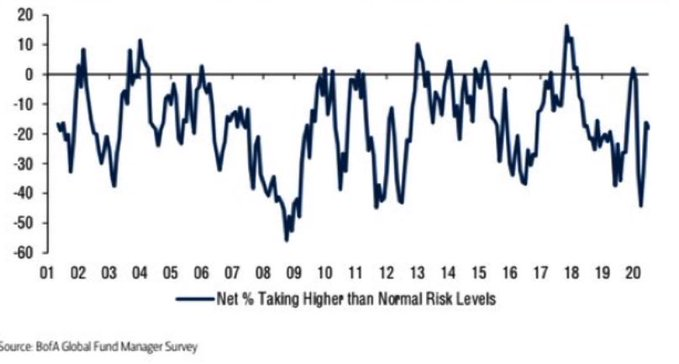

•Wall Street’s $24 trillion rally yet to elicit “greed.”

•54% say the Federal Reserve will not inplement yield curve control in September.

SENTIMENT:

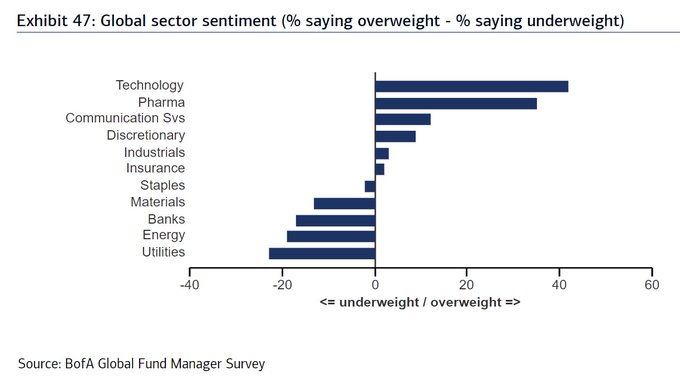

POSITIONING:

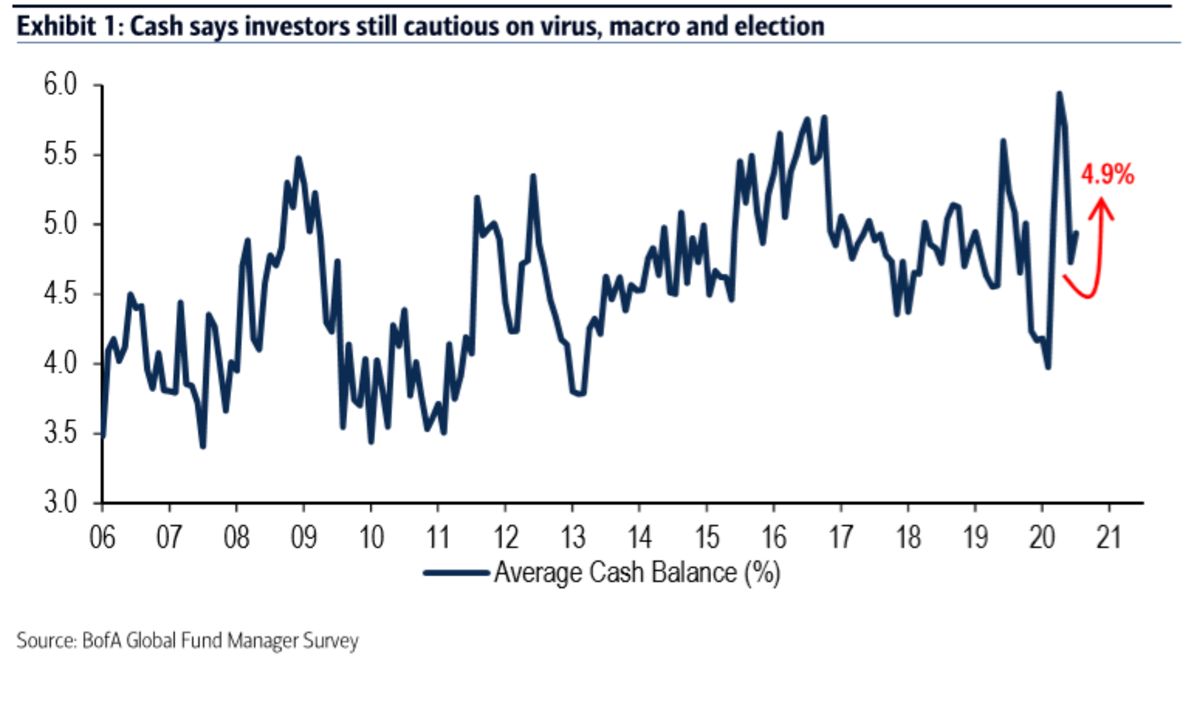

•Cash up to 4.9% from 4.7%. This is down from April/May, but still on the high side. (10-year average is 4.7%)

•Cash up to 4.9% from 4.7%. This is down from April/May, but still on the high side. (10-year average is 4.7%)

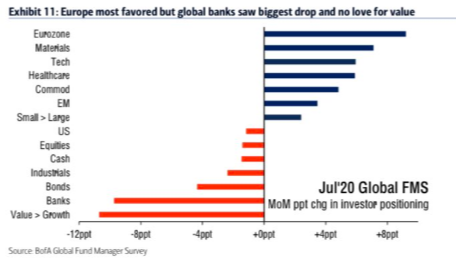

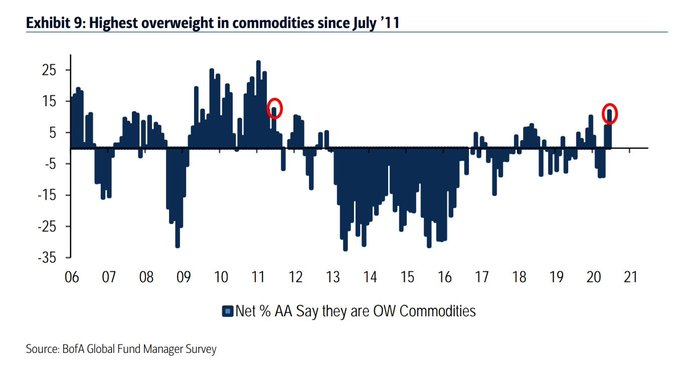

•Allocation to commodities was the highest in July since 2011 at Net 12% of respondents.

•Big jump was seen in European equity exposure driven by the European Union’s fiscal policies. Currently 16% net overweight allocation to Euro equities (up 9%).

•Allocation to U.S. equities declined 1 percentage point to net 21% overweight; the U.S. remains the survey’s most popular region

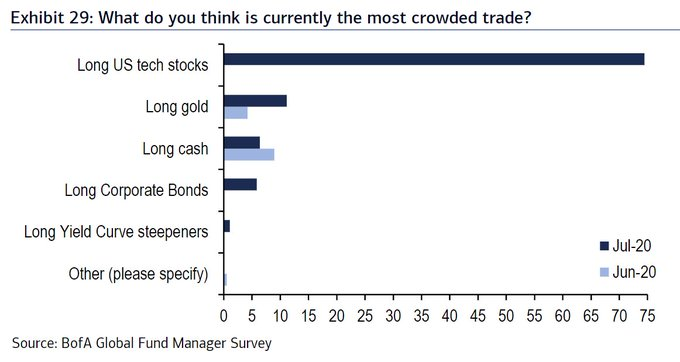

MOST CROWDED TRADE:

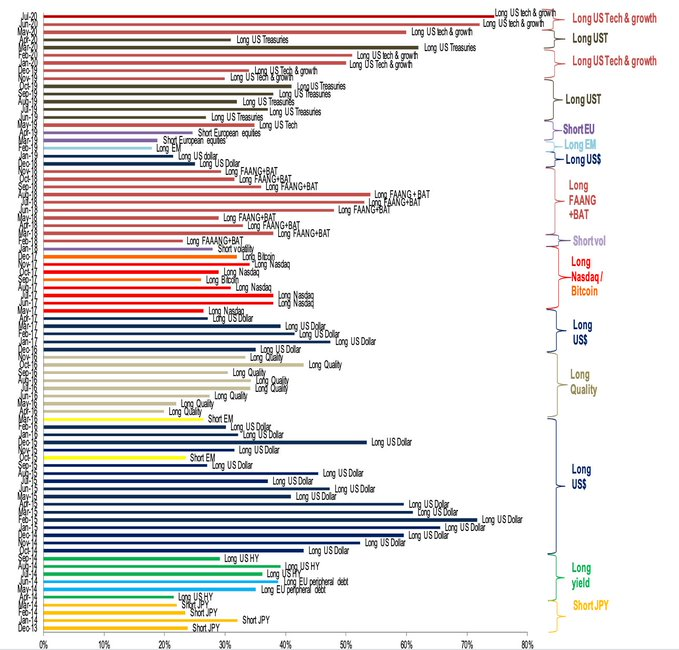

•74% say long US tech stocks are the most “crowded trade” – the most in the survey’s history.

BIGGEST TAIL RISKS:

1. 2nd wave of COVID infections as a top tail risk (52% of respondents).

2. US Elections – Blue Wave. Despite this risk, 34% plan to take no action ahead of the election. 31% are reducing risk, 15% are buying volatility and 13% are selling the U.S. dollar.