270 panelists – with $805 billion in assets under management – participated in the BofA Global Research fund manager survey, taken July 2 to 8, 2021.

OUTLOOK:

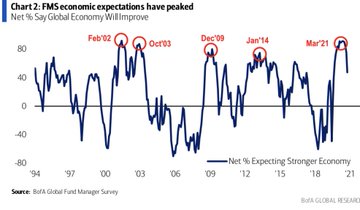

-Expectations that the global economy will improve at 47%, down from a 91% peak in March.

-The percent saying global profits will improve has peaked, at 53% versus a 89% peak in March.

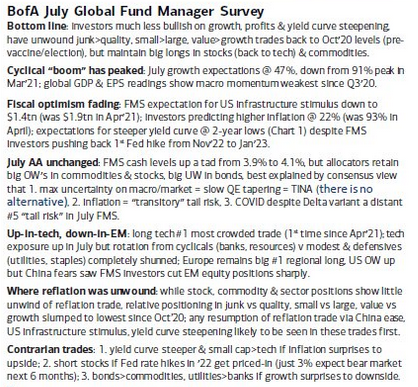

-The percent saying they expect higher inflation in the next 12 months is at 22% versus a high of 64% in April.

-70% say inflation is temporary.

-73% Of Investors Say Economy Is In Mid- Or Late-cycle, Up 9% From June.

-74% of fund managers still expect growth and inflation to be “above trend.”

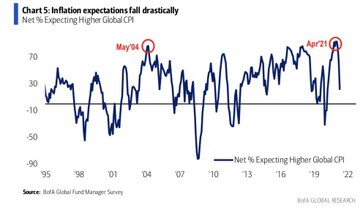

-70% of fund managers expect the Fed to signal tapering – an easing in the pace of the central bank’s asset purchases – in August or September this year.

-In terms of Federal Reserve policy, a net 39% of global investors polled in July expected the Fed to signal “tapering” at the Jackson Hole policy symposium in late August, while 31% of investors thought the central bank will wait until the September 21-22 meeting to unveil any changes.

SENTIMENT:

-The global economy has reached ‘Peak Boom’ and fund managers are much less bullish over growth, earnings and inflation compared to earlier in the year.

POSITIONING:

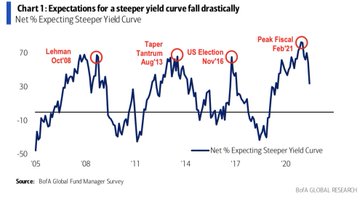

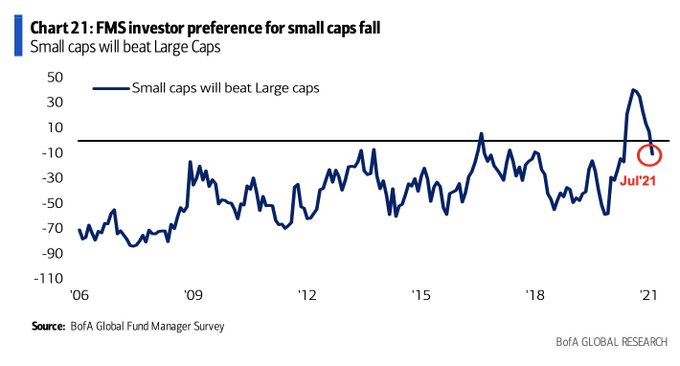

-Investors have unwound bets preferring junk over quality, small-cap over large-cap, and value over growth, back to October 2020 levels.

-Global investor allocation to commodities rose to a net 29% overweight in July, the highest reading ever.

-Bank of America pointed out that energy and financial companies represent just 18% of the MSCI All-Country World index now, versus 36% in 2006.

-Average cash balances rose to 4.1% in July from 3.9% in June.

-A net 58% of portfolio managers were overweight global equities in July, versus a net 61% overweight in June and a net 54% overweight in May.

-A net 68% of fund managers were underweight bonds, down from a net 69% underweight in June.

-On regional equity asset allocation, global investors favored U.S. and eurozone stocks. A net 45% of managers were overweight eurozone stocks, the highest since January 2018 and up from a net 41% overweight in June and a net 35% overweight in May.

-Allocation to U.S. stocks rose to a net 11% overweight in July, compared to a net 6% overweight in June and May.

-Fund managers trimmed global emerging market (GEM) holdings to a net 14% overweight, the smallest since October 2020. This compared to a net 31% overweight in June and a net 30% overweight in May and is well down from the record net 62% overweight seen in January.

-Portfolio managers had a net 6% underweight in Japanese equity markets this month, versus a net 4% underweight in June and a net 2% overweight in May.

-UK equity allocations showed managers with a net 1% overweight in July, compared to a net 4% overweight in June and a net 2% overweight in May.

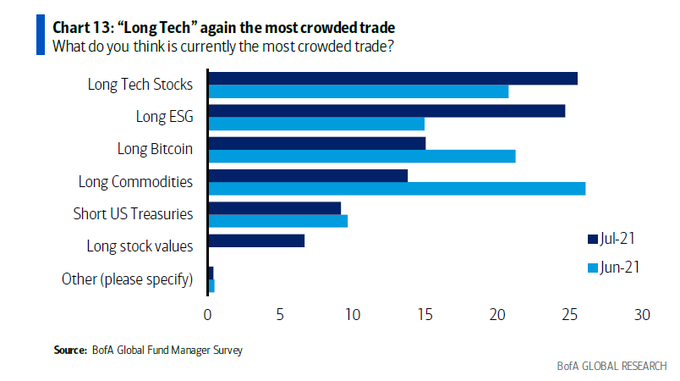

MOST CROWDED TRADES:

1. Technology 26%

2. ESG 25%

3. Bitcoin 15%

4. Long Commodities 14%

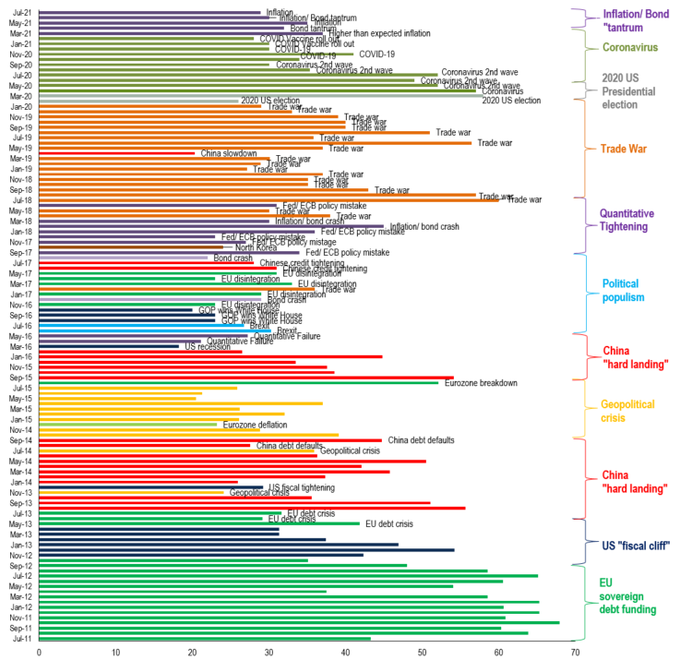

BIGGEST TAIL RISKS:

1. Inflation 29%

2. Taper Tantrum 26%

3. Asset Bubbles 15%

4. China Slowdown 13%

5. COVID-19 13%

BANK OF AMERICA COMMENTARY: