As a long time Country fan, the song that came to mind when writing this piece today was Kenny Rogers’ “The Gambler.”

He said, “If you’re gonna play the game, boy

You gotta learn to play it right

You’ve got to know when to hold ’em

Know when to fold ’em

Know when to walk away

And know when to run”

Since mid-August we had been suggesting buying stocks when everyone else was running to bonds. After the price recovery – last week we suggested, “if you got ’em, hold ’em,” and this week, Kenny Rogers sings the same tune along with us – “know when to hold ’em.”

Here are the previous weekly articles for review:

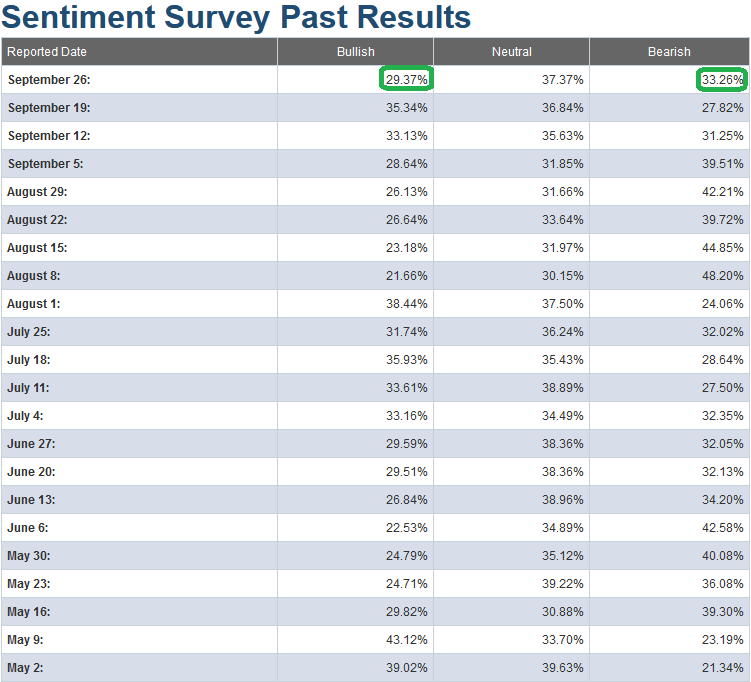

So what do the AAII Sentiment Survey Results point to this week?

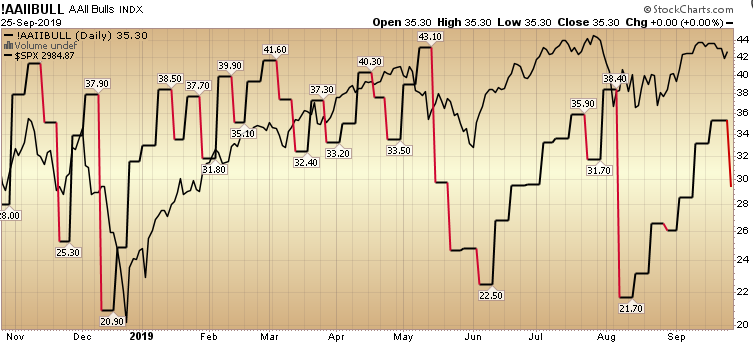

We have what is potentially a “pause that refreshes.” If you look at the move off the lows in January of this year, after the first big thrust off the bottom, folks were so shell shocked from what happened in December that they were looking back in the rear view mirror waiting for the next shoe to drop (see chart above). Bullish sentiment dropped ~5% (~38.5 back to ~33.5) after that first big move off the bottom (from 20.90 to 38.5). You will see that while it appeared sentiment had made its full move and was reversing, the stock market was less than halfway done at that point. It simply needed to bring in more “bricks” to build the wall of worry – which would subsequently be scaled back to new highs.

We got a similar “pause that refreshes” this week with Bullish Sentiment dropping ~6% (from 35.34 to 29.37) and Bearish Sentiment rising from (from 27.82 to 33.26). Everyone is looking for another big flush because “that’s what happens in September and October” (and most managers are still overweight cash and need a pullback to catch up). September was also supposed to be the “worst month of the year” and we’re positive. When everyone’s looking for the same thing, you might not get it. The implication here is that we have to “know when to hold ’em.” This week’s retreat in sentiment may also have created an opportunity to add selectively in laggard names and sectors which we will discuss below.

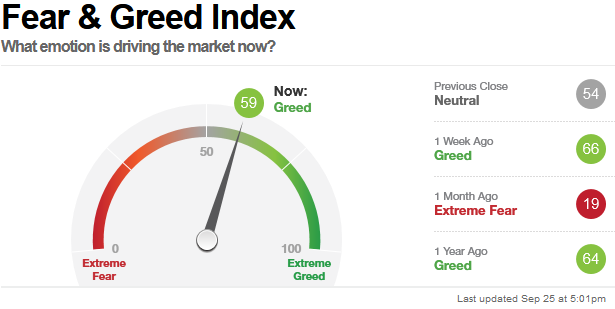

This is also confirmed by the CNN Fear and Greed Index which has also dropped a bit in the past week, meaning skepticism is still prevalent. This compilation of technical indicators has dropped 7 points in the past week – from 66 to 59. We cover this and other indicators in our daily “Indicator of the Day” videos – which you can view for free here:

Applied Market Indicator of the Day Video Library

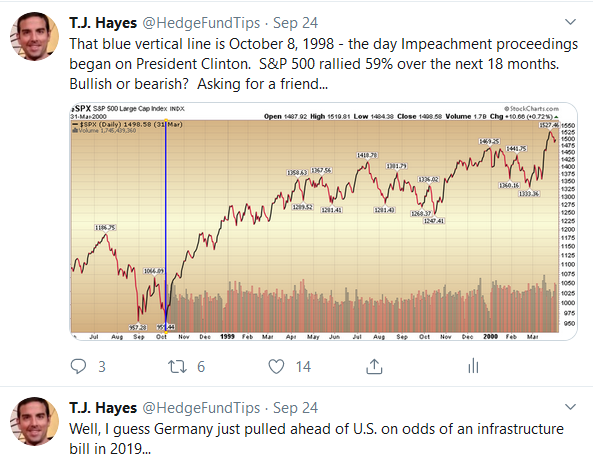

While the impeachment proceedings have potentially put a damper in sentiment, they are just one more brick in the wall of worry. The only two recent instances we have of impeachment precedent were 1998-1999 and 1973-1974. I put these tweets (and replies) out on Twitter right after Speaker Pelosi’s announcement on Tuesday – after the market close:

While the data set is too small to draw any definitive conclusions, the similarities to 1998 are plentiful – while the similarities to 1973-1974 are scarce.

On October 8, 1998 (see tweet above), the 2/10 yield curve had inverted a couple of months prior (check), the Fed had completed its first easing rate cut in years the month before (check), and the maximum possibility of impeachment was in the House – not in the Senate (check) – although yesterday’s transcript (and Ukrainian President’s testimony) probably diminishes that possibility. Oil prices were weak (check), and everyone felt we were in or near a tech bubble (check). They also felt the impeachment would crater the economy.

Well, they were wrong by ~59% and 18 months, as that is what the S&P 500 appreciated from Oct. 8, 1998 when impeachment proceedings began in the House, to the peak of the market in 2000. It is also consistent with what historically happens to equities in the 12-24 months after a 2/10 inversion. They rise ~mid-30’s% before peaking.

On the flip side, an oil shortage and price spike was the impetus for the crash in 1973-1974. The economy had been materially deteriorating for some time prior to impeachment proceedings. It does not resemble today’s economic backdrop.

The other point I made (in the tweets above) was that this renewed partisan acrimony is likely to table any progress on bipartisan bills. It’s now more likely that Germany will pass an infrastructure bill (or fiscal stimulus) in 2019 than the US. It is ALSO likely that the parties will not come together on anything related to drug pricing – which could let biotech, pharma, and healthcare out of the penalty box for a while (they have lagged and could have a window of opportunity here as their earnings estimates have continued to improve while simultaneously prices of the sector components have dropped). See our recent article that discusses this potential opportunity in the biotech sector:

Biotech EPS UP 8.58%, Price DOWN 9.52% (in last 2 months)

So with that all said, while we think there’s more room to run here, there was another line in Kenny’s song that should be heeded,

“You never count your money when you’re sittin’ at the table. There’ll be time enough for countin’ when the dealin’s done…”Â