Unwinding the “Most Crowded Trades”

On Friday, I joined Liz Claman on Fox Business to discuss the economy, labor market, SAHM rule and more. Thanks to Jake Mack, Kathryn Meyers and Liz for having me on:

Watch in HD directly on Fox Business

More on the Carry Trade

Many have been asking why the Nikkei (Japanese Equities) were down 25% in just a few days. We discussed how it works, what’s happening and the outlook going forward, with Charles Payne, on Fox Business this Monday. Thanks to Nick Palazzo and Charles for having me on:

Here were my “show notes” ahead of the segment:

Marcel Munch re-posted an excerpt I did on this exact subject (in March) that predicted the events we have now seen in the past week (scroll down and click on the play button):

Watch it again https://t.co/hU28IcbqRi

— Marcel Münch (@_mm85) August 5, 2024

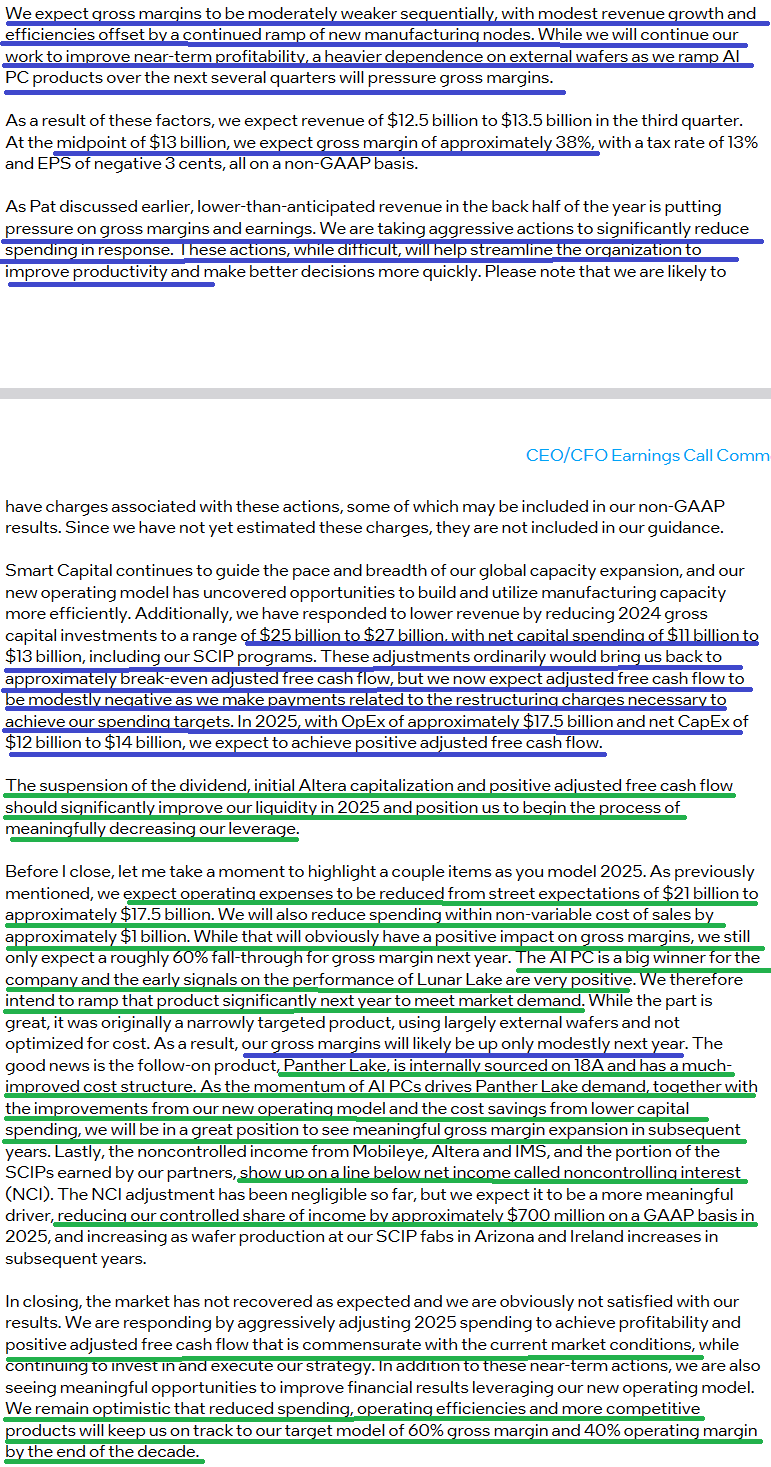

Intel

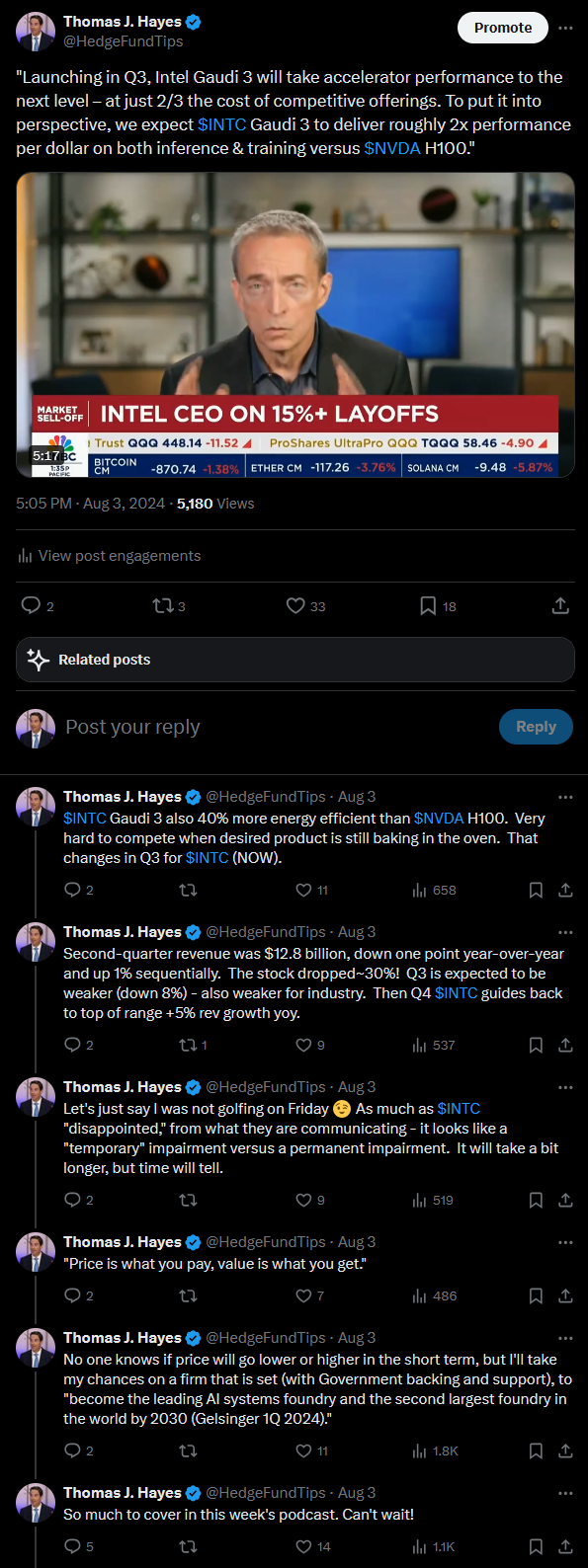

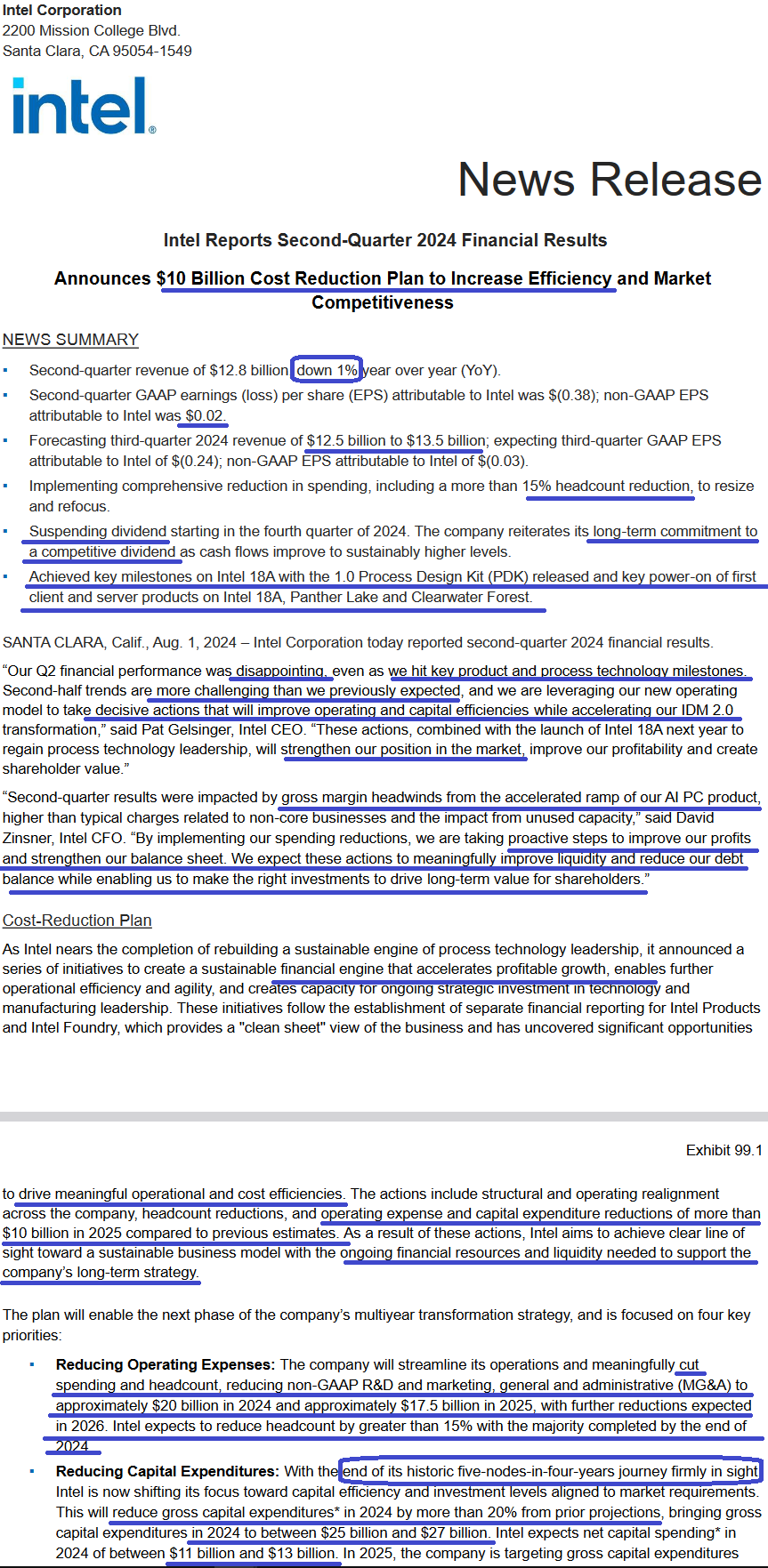

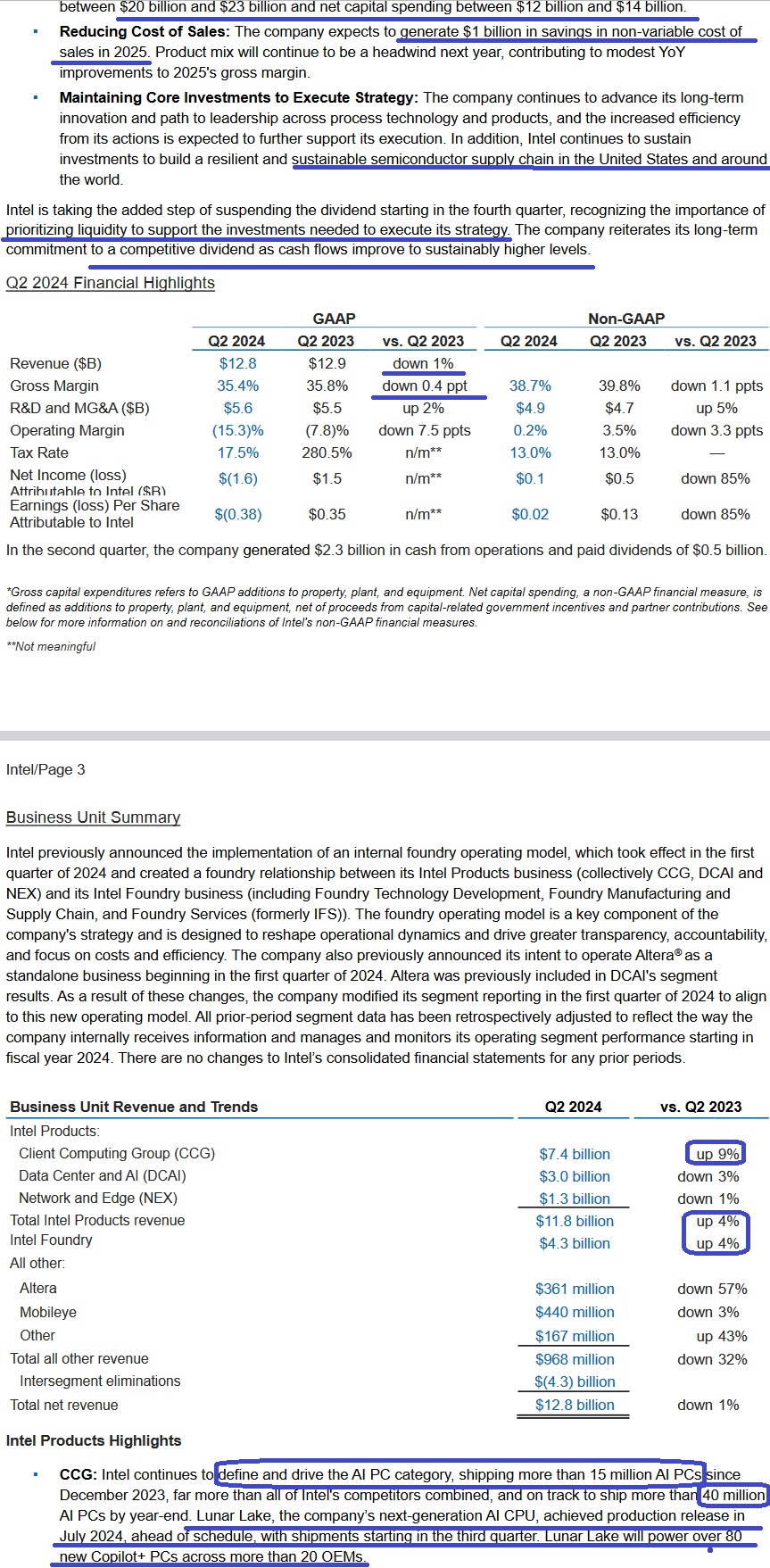

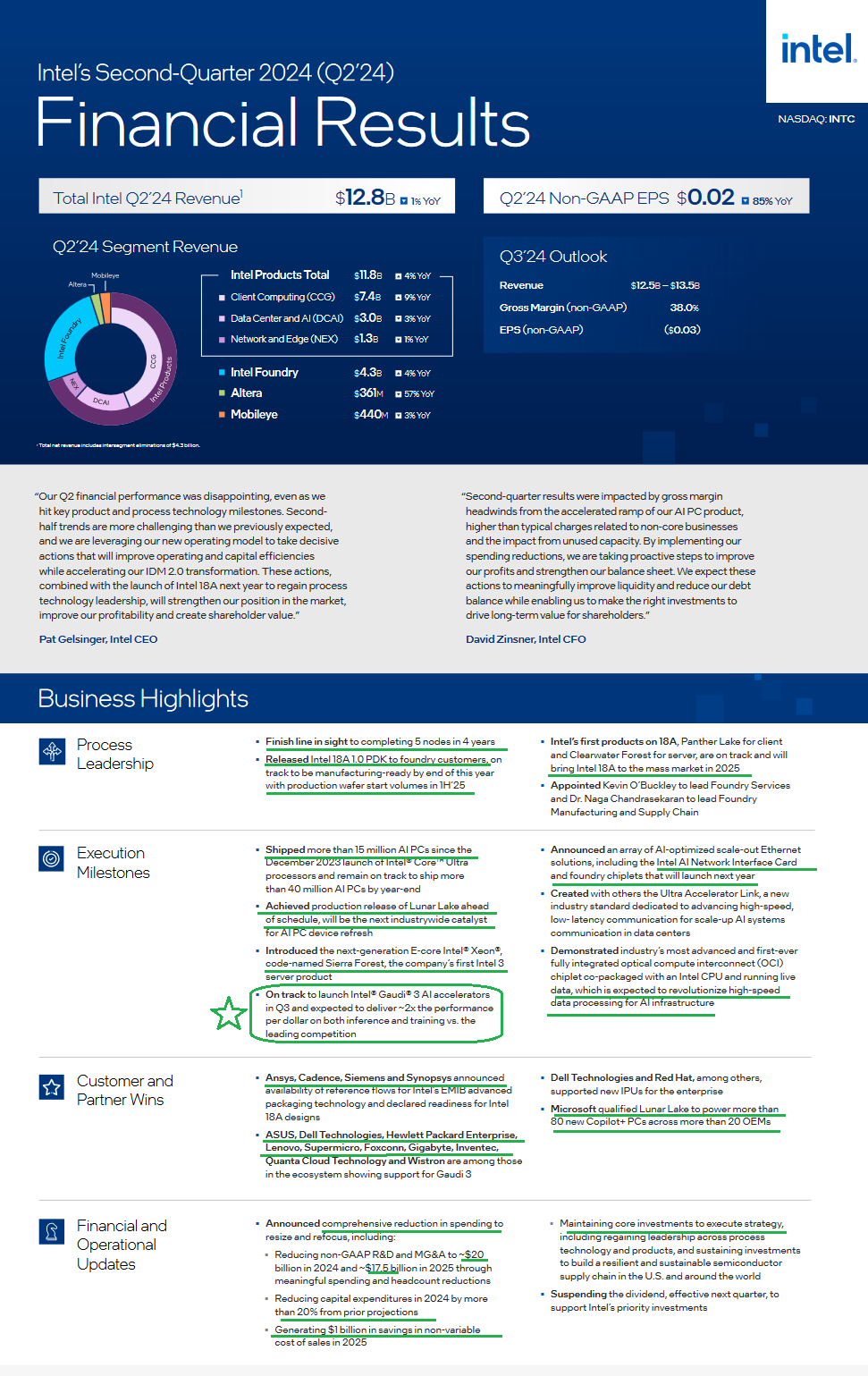

On Thursday August 2, Intel reported earnings for Q2. Revenues dropped 1% yoy and the stock dropped ~30%. Here’s what CEO Pat Gelsinger had to say about the results and outlook on CNBC the night after the earnings call:

Here were my initial thoughts on X:

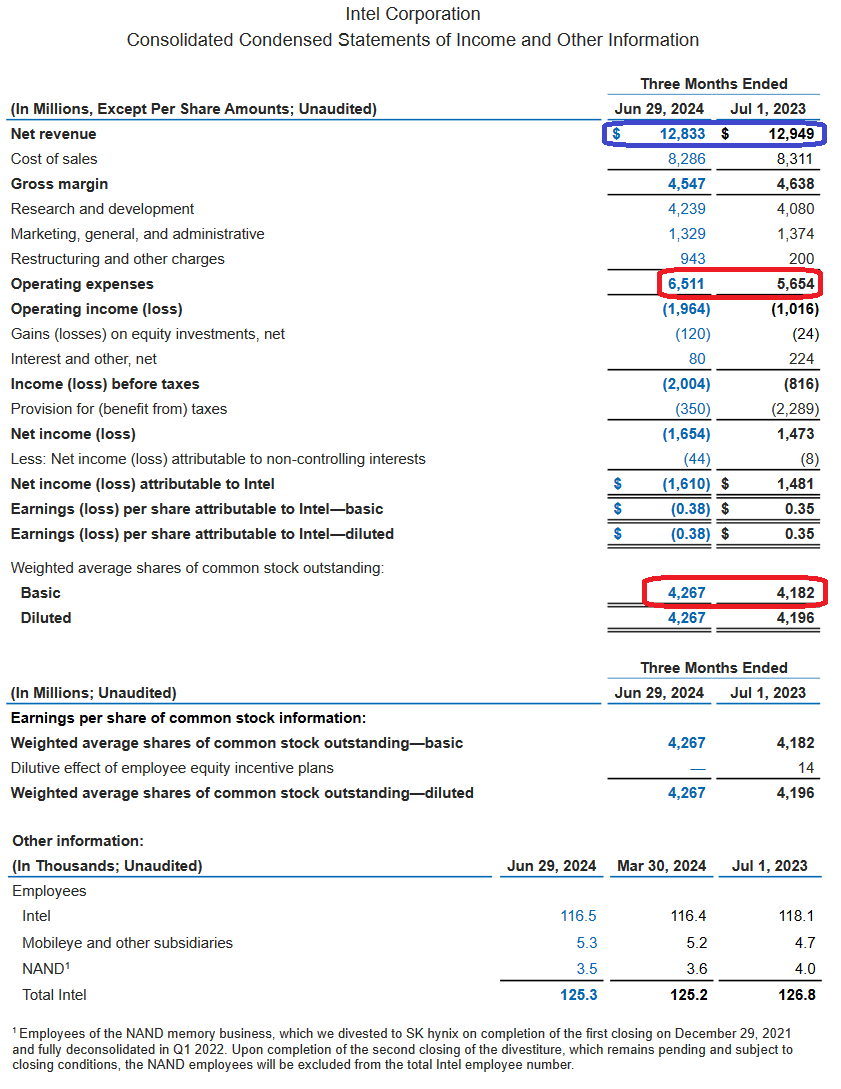

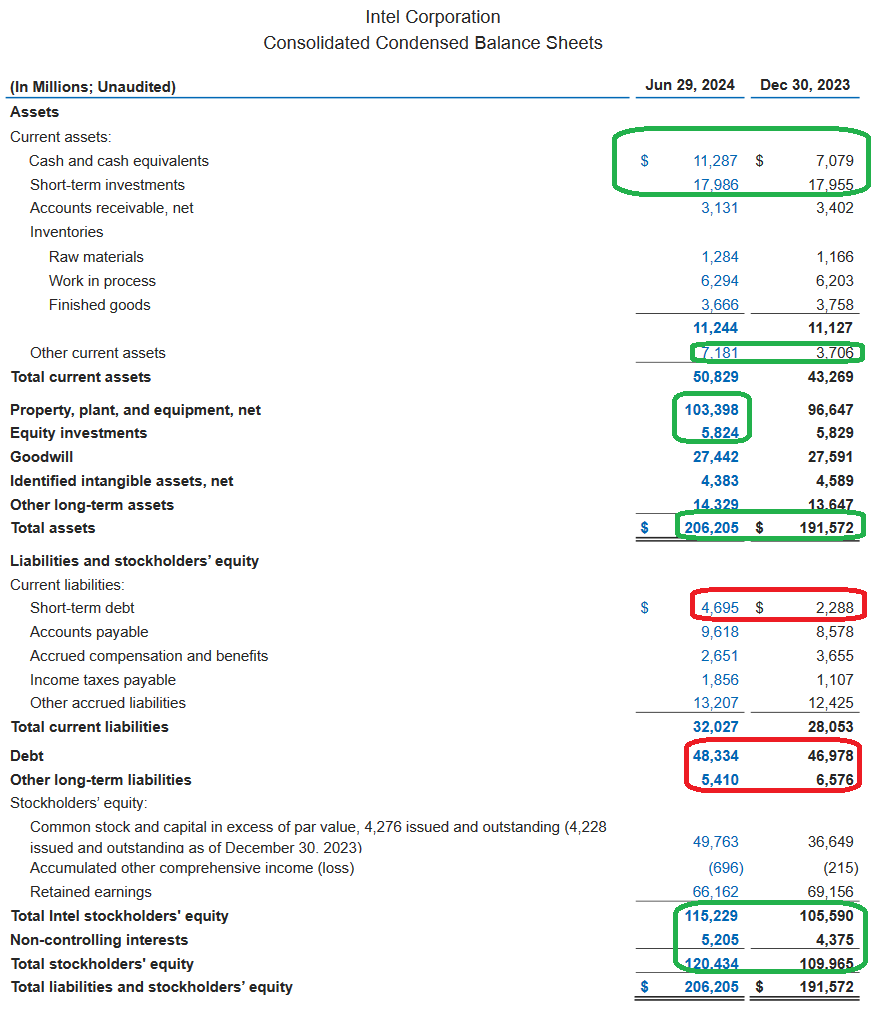

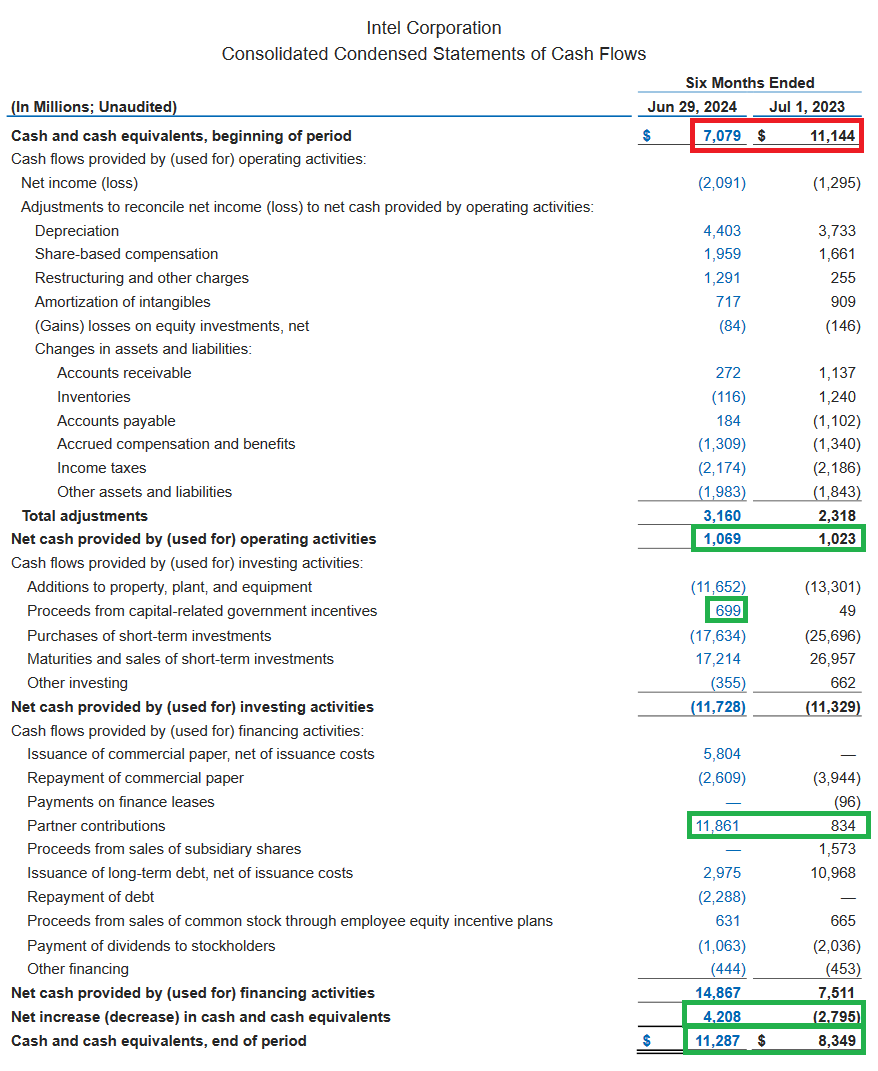

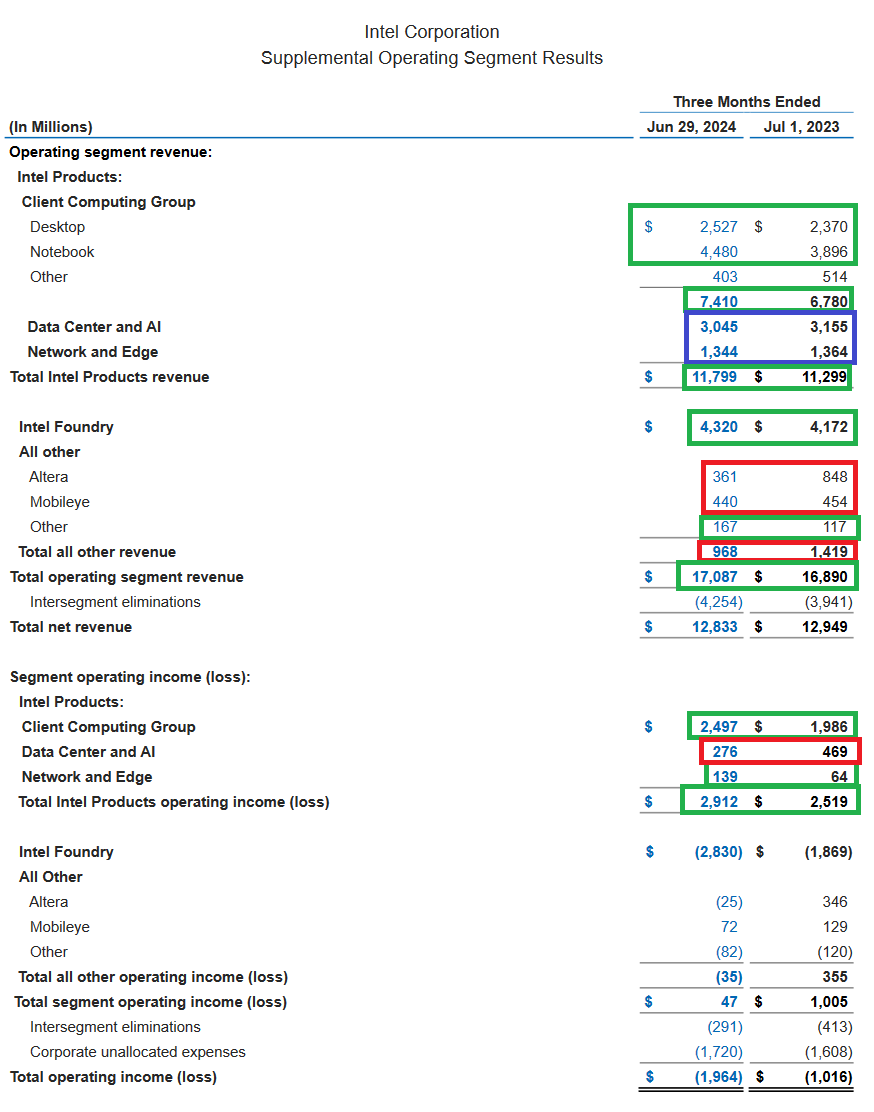

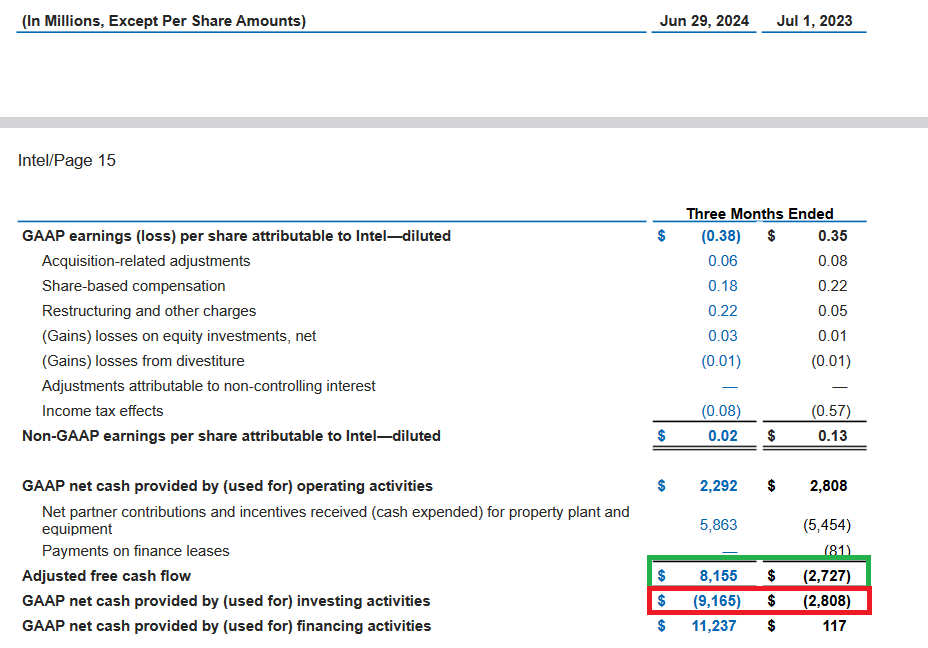

Here were the results:

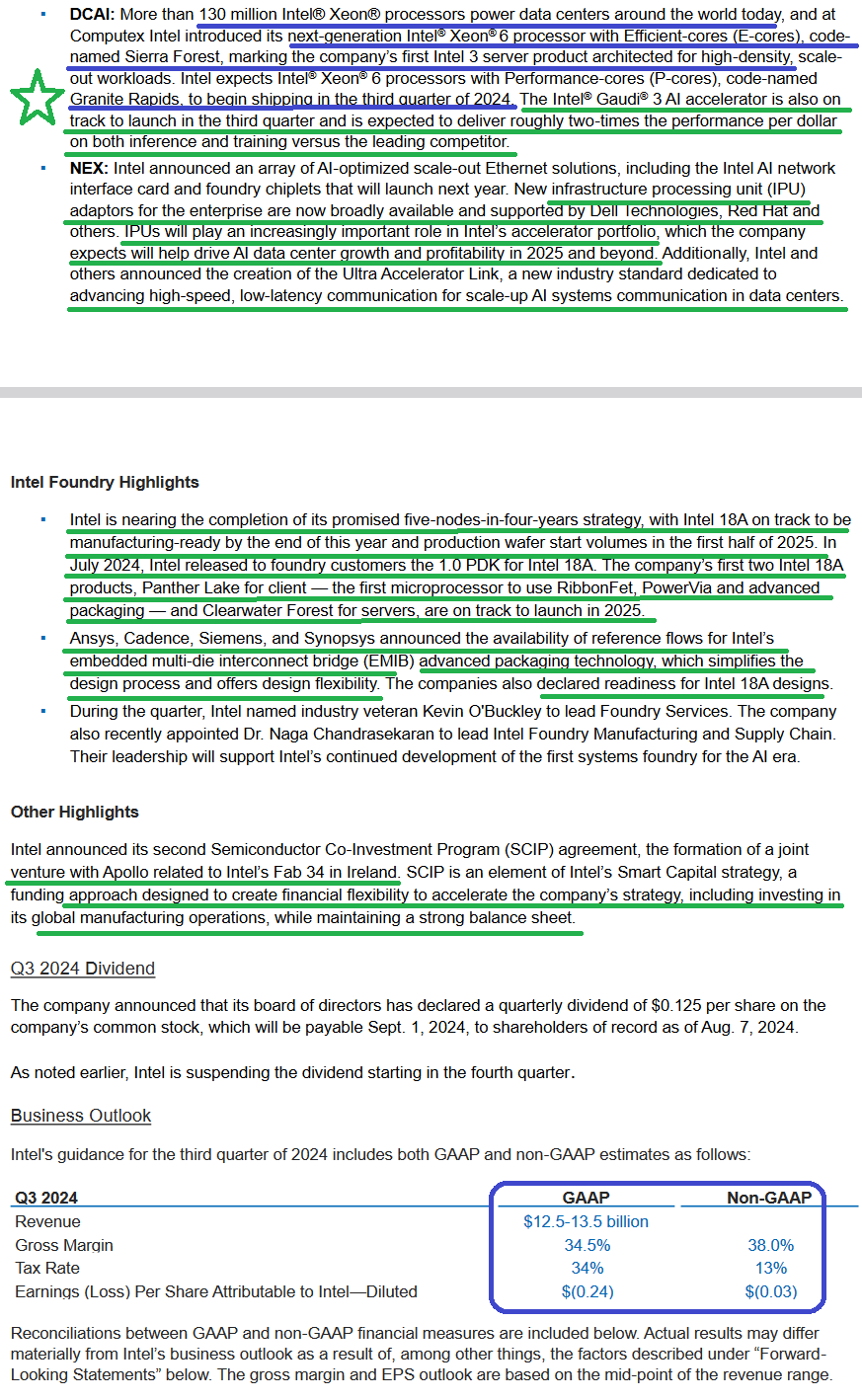

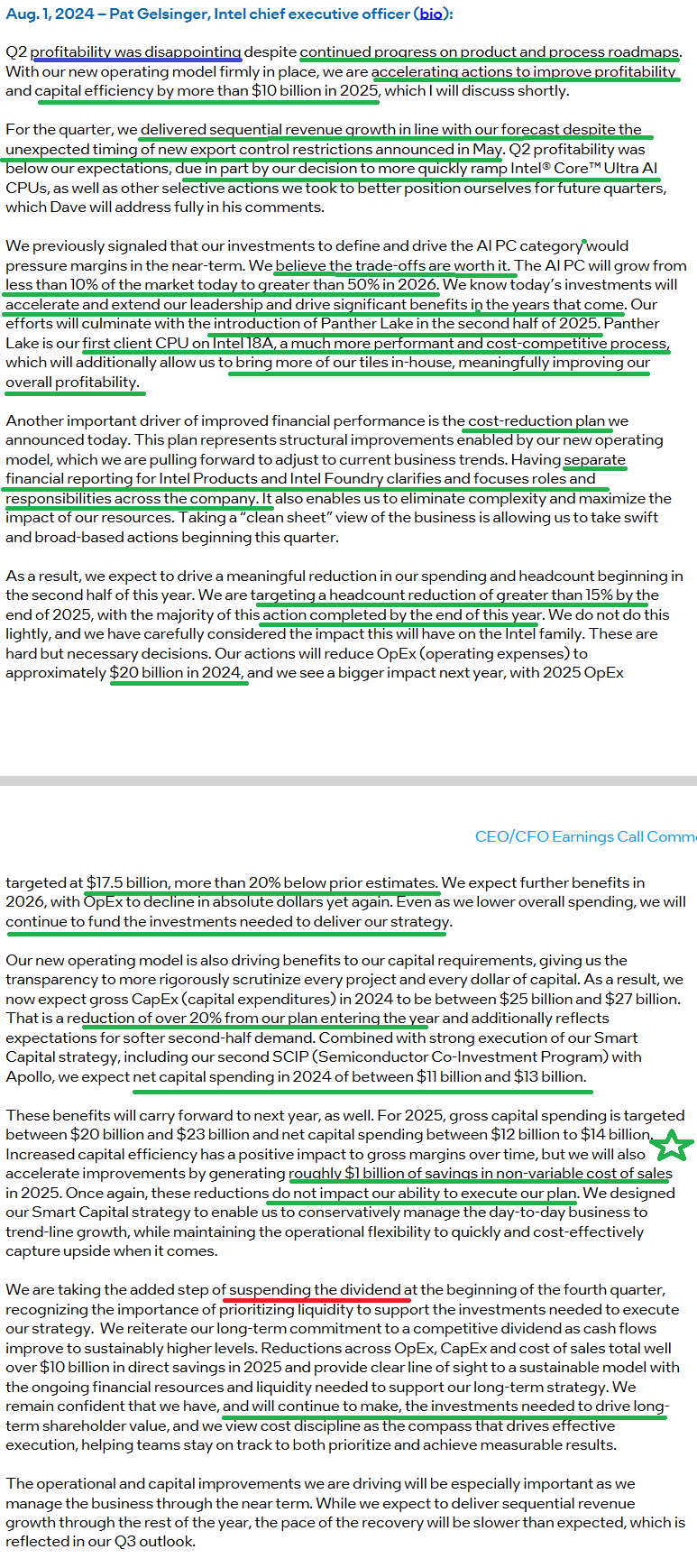

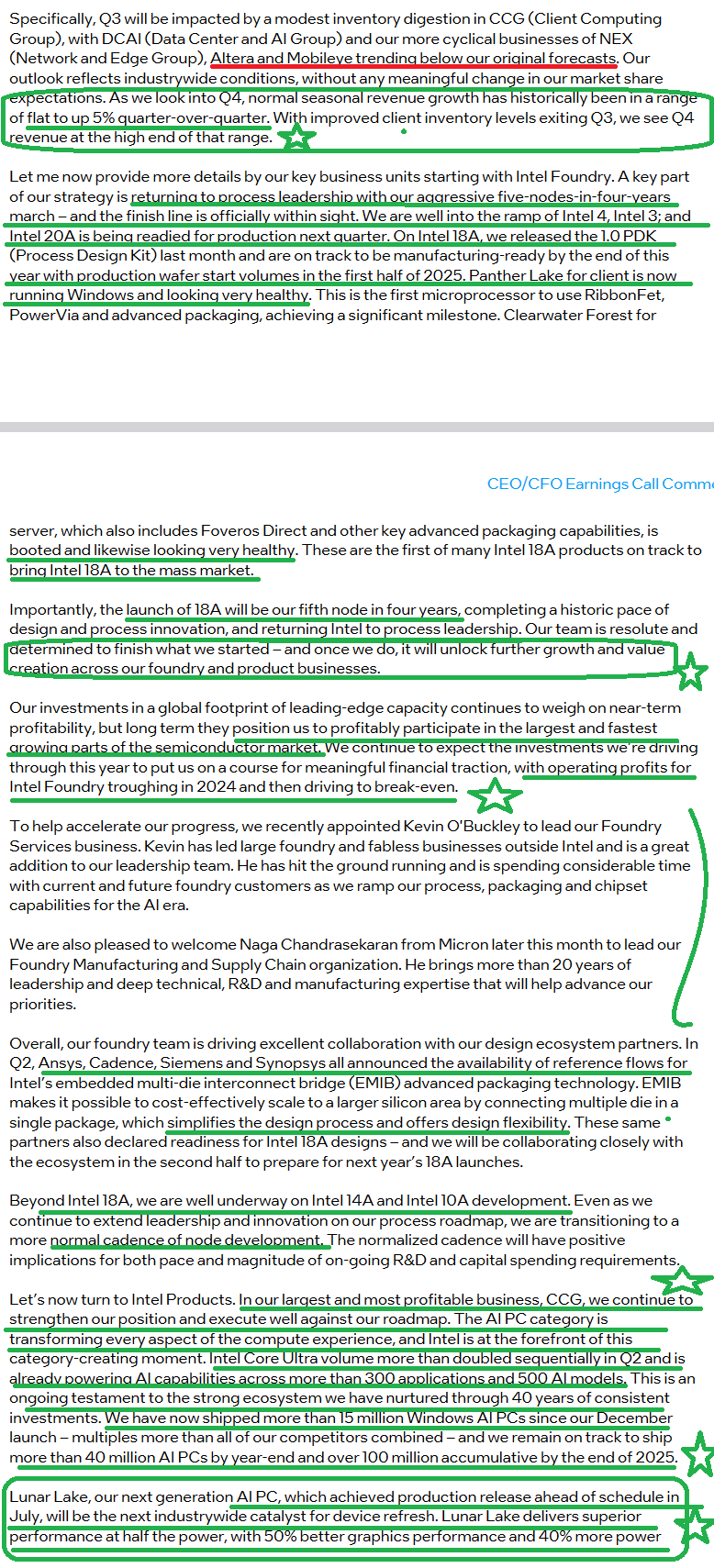

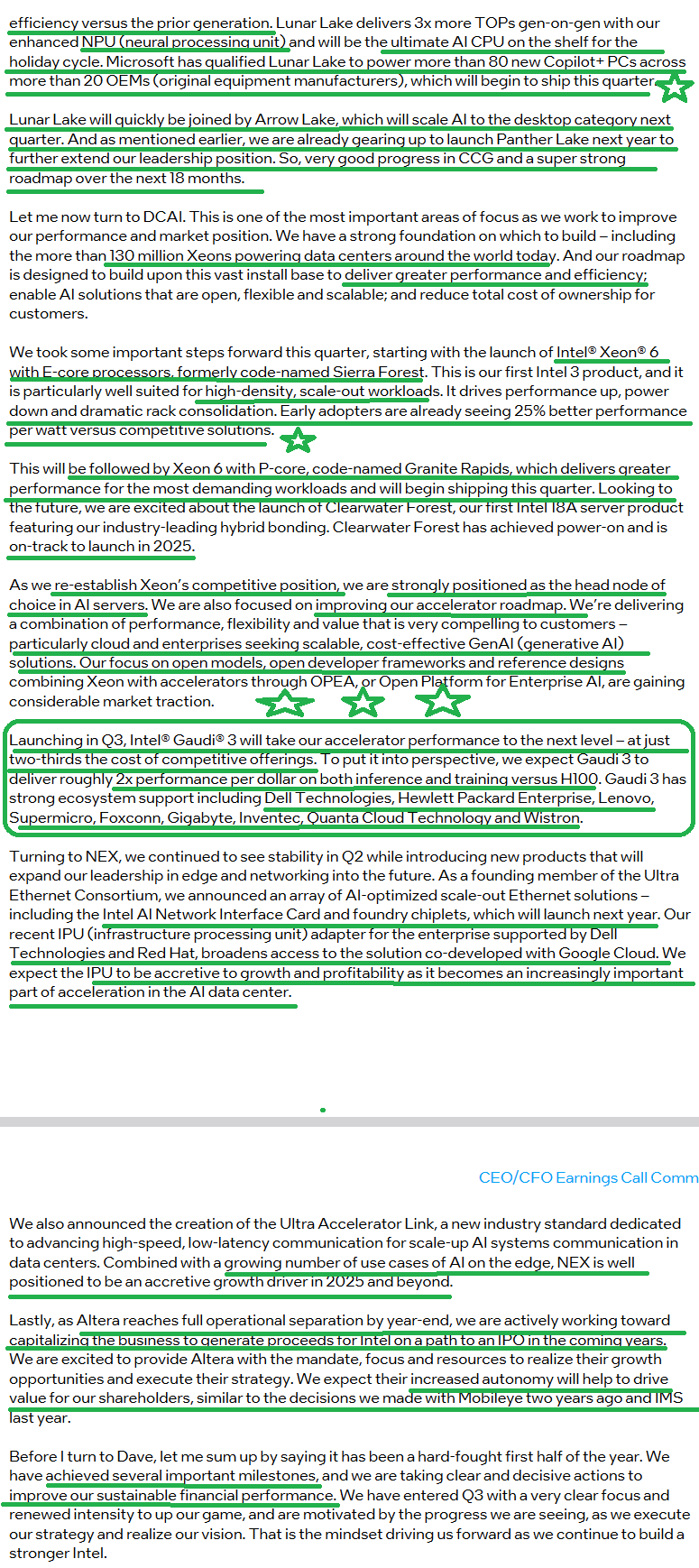

Earnings Call:

Earnings Call:

A few skeptical analysts were out supportive of our macro thesis for Intel (referenced in the Twitter posts above). The Government has decided to make Intel a duopoly with TSMC. If you doubt their ability to subsidize an industry and make shareholders wealthy, just look at Tesla.

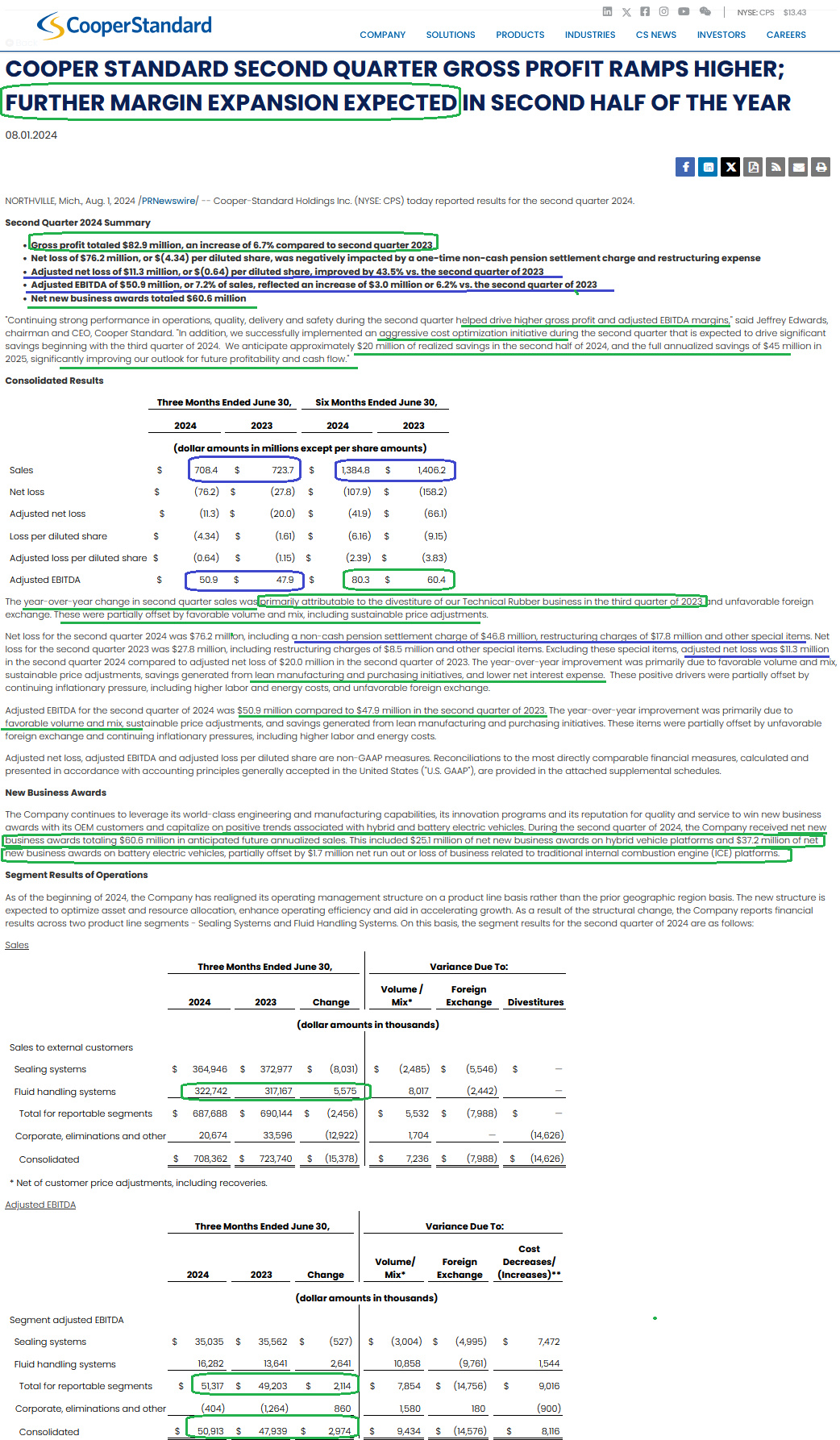

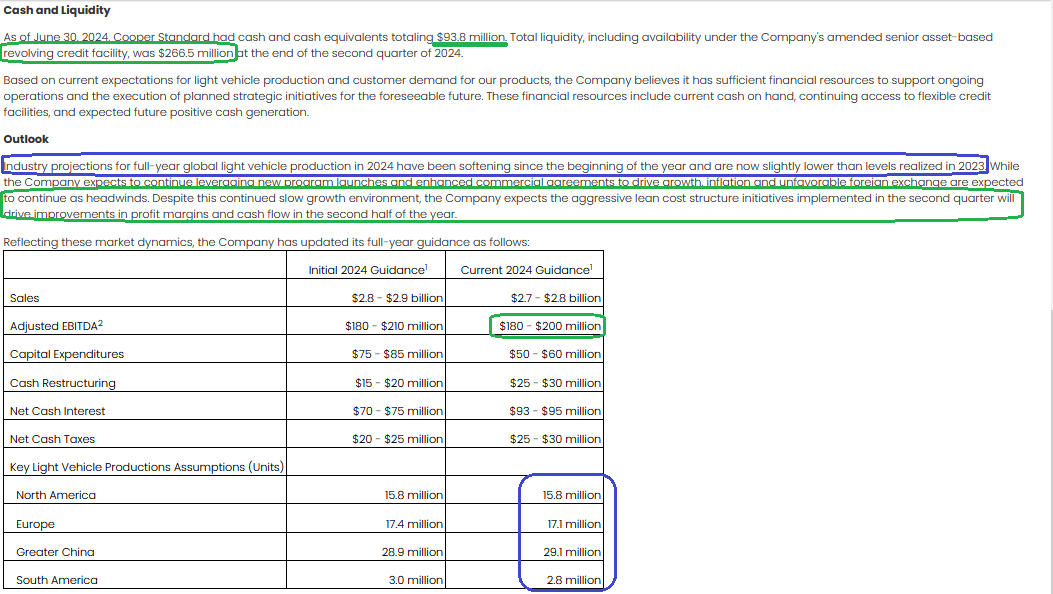

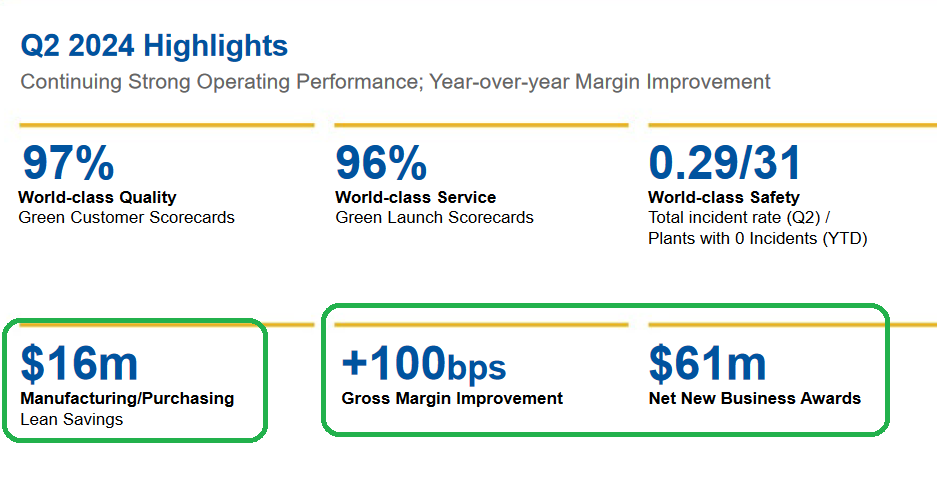

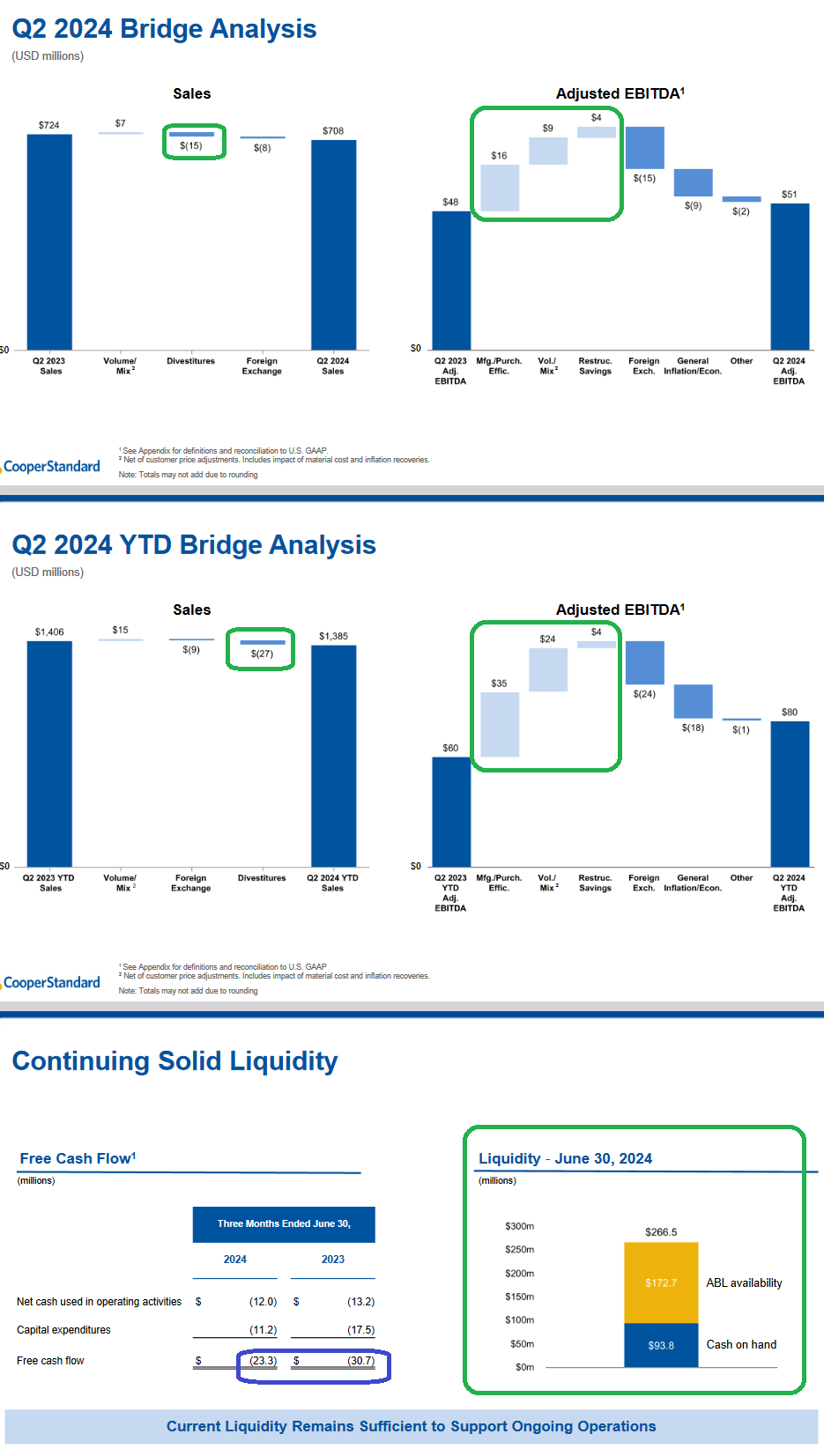

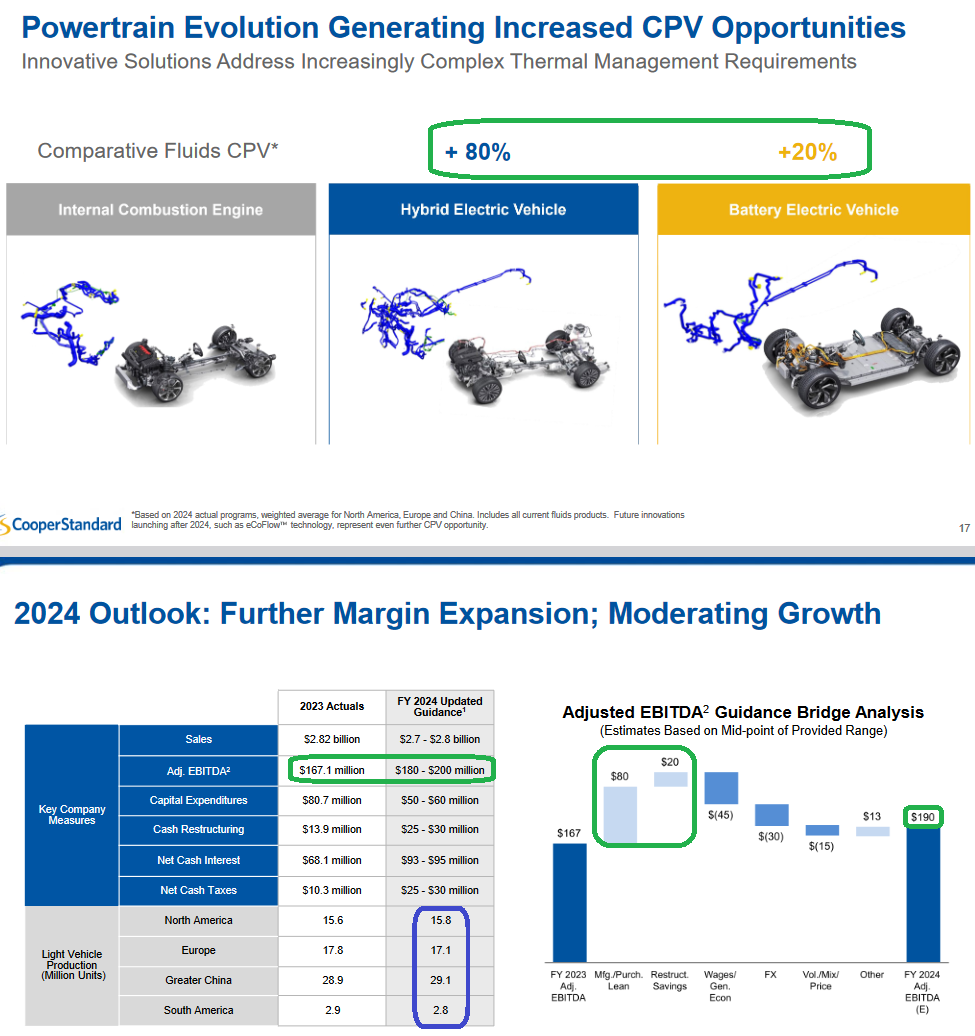

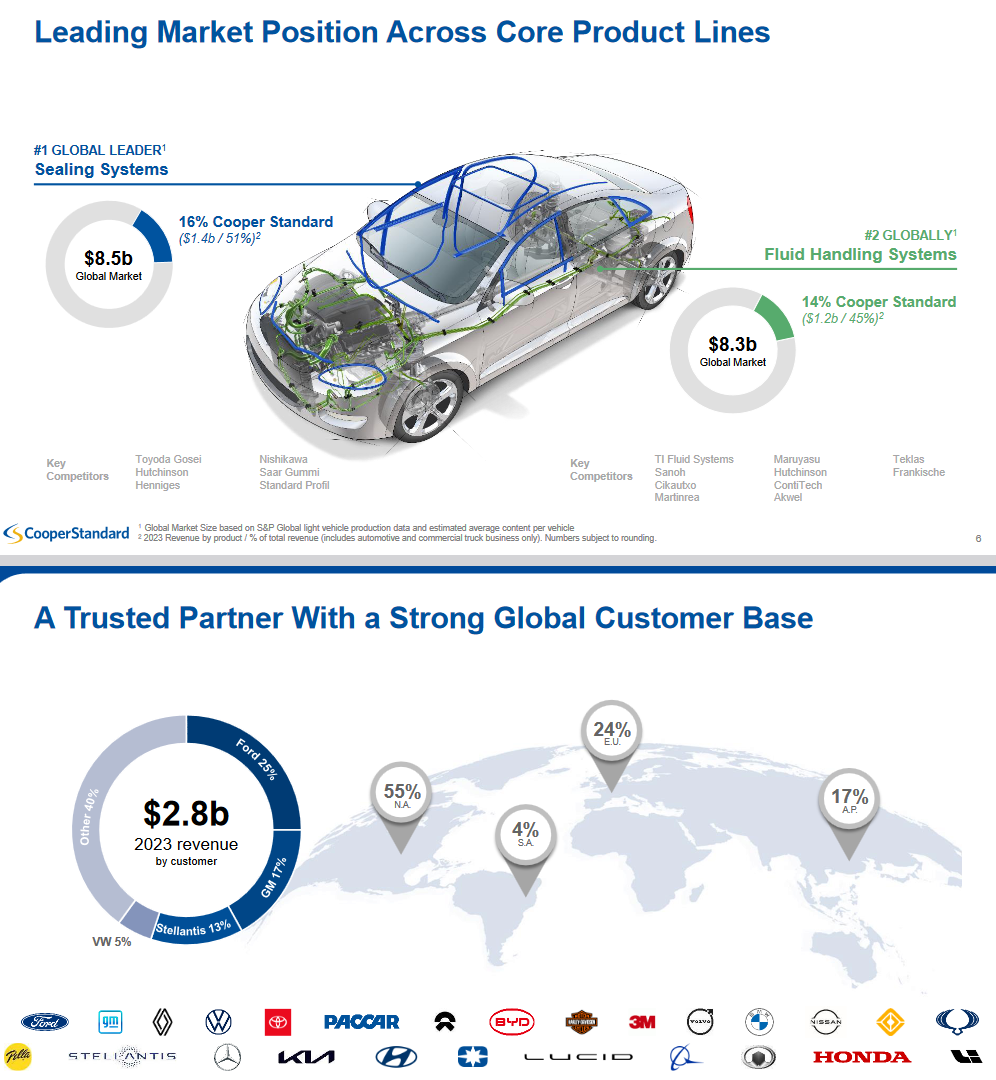

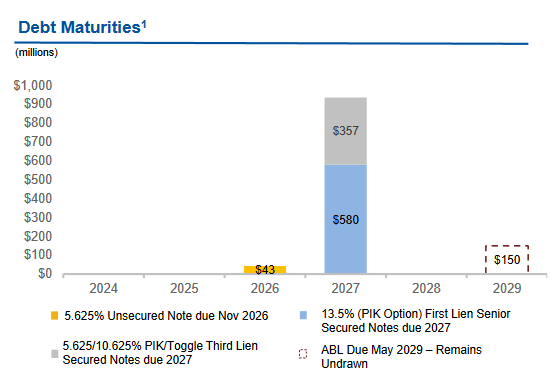

Cooper Standard

Cooper Standard

Go HERE to see historic thesis and updates for Cooper Standard (CPS)

Big news:

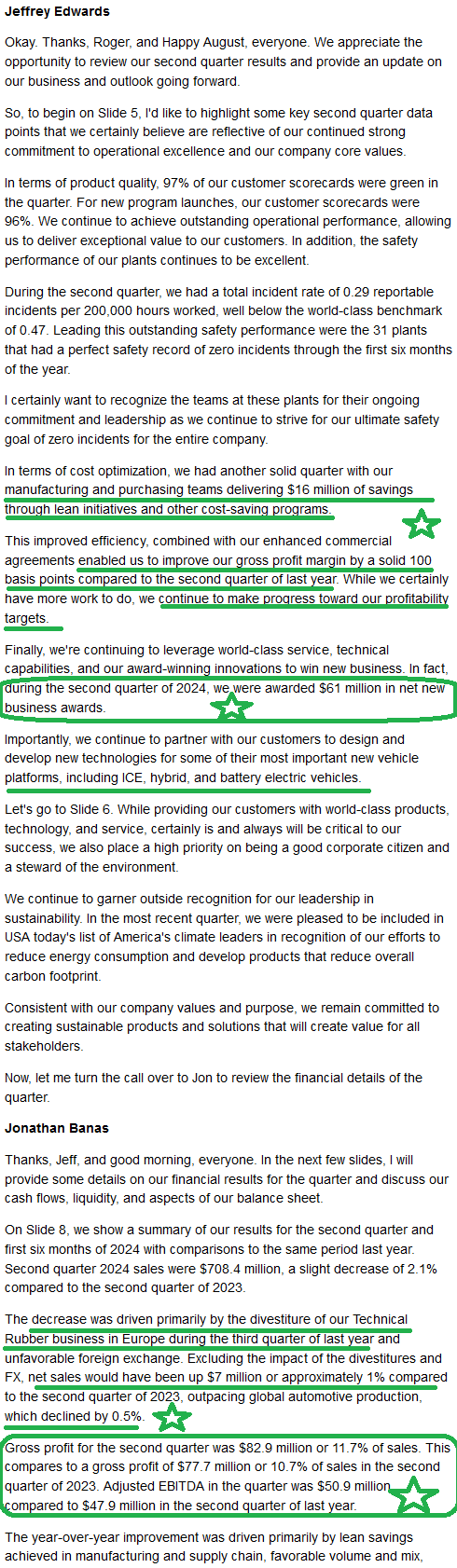

Earnings Results:

Earnings Results:

Earnings Call Transcript:

Earnings Call Transcript:

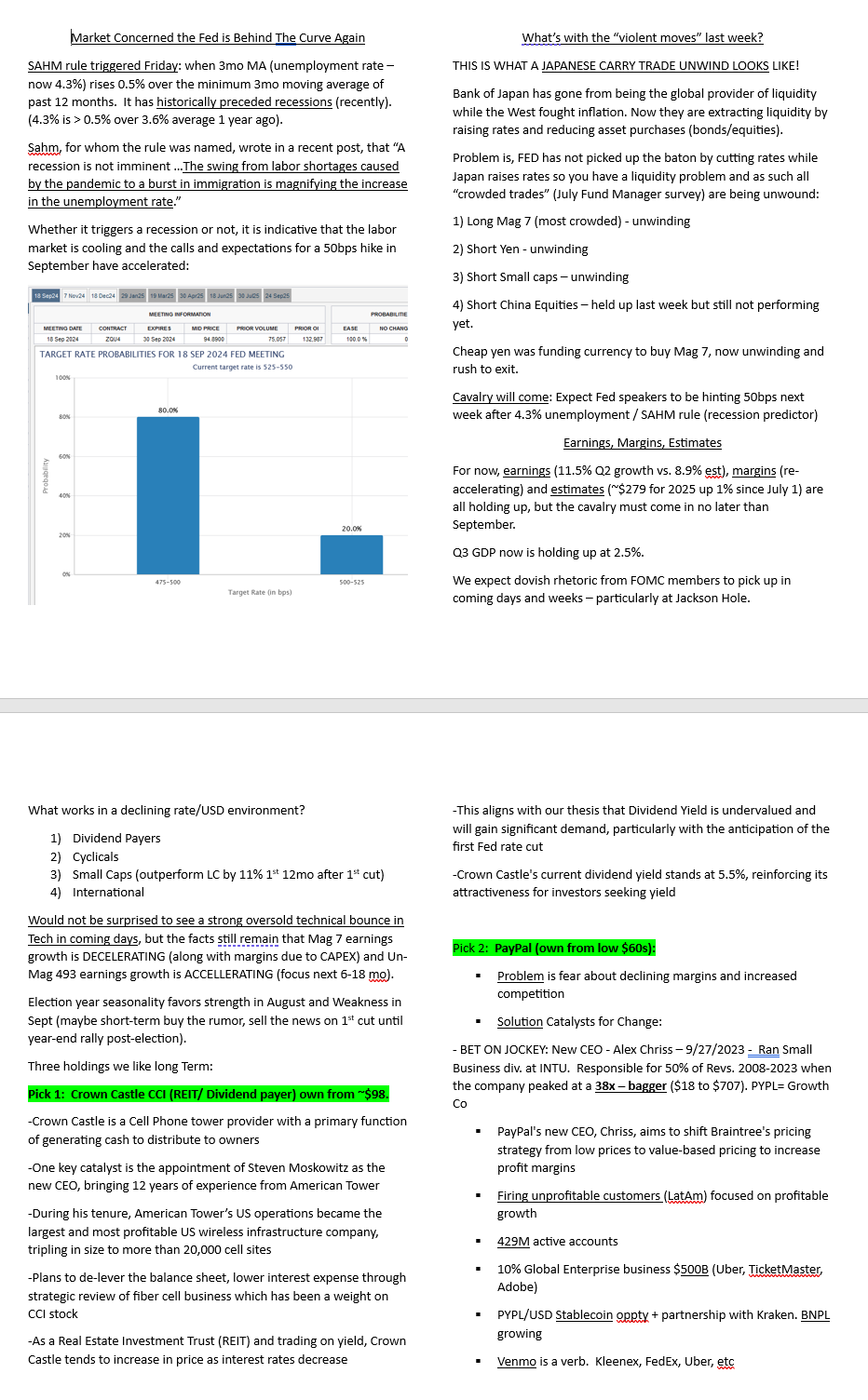

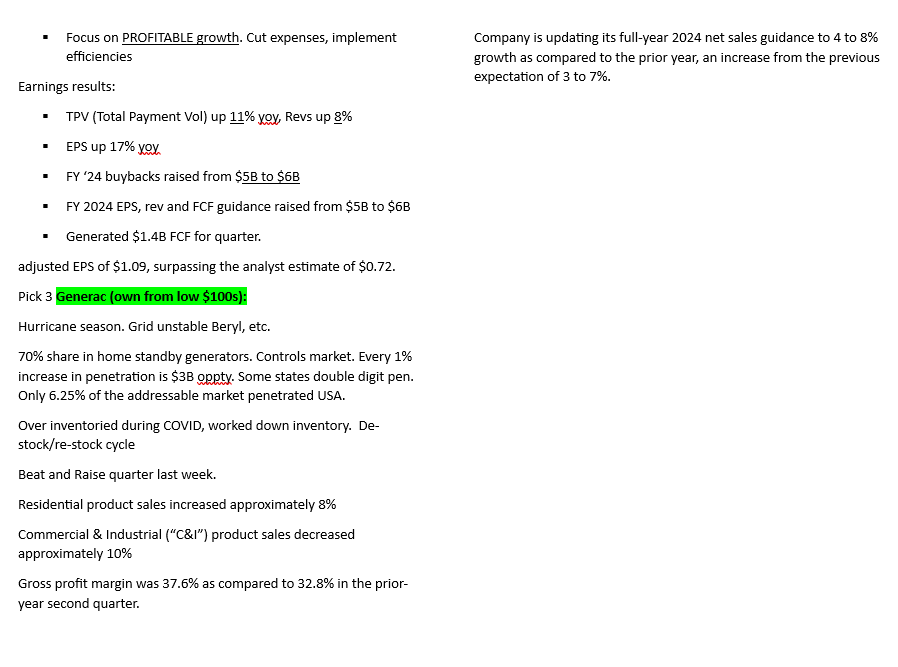

Now onto the shorter term view for the General Market:

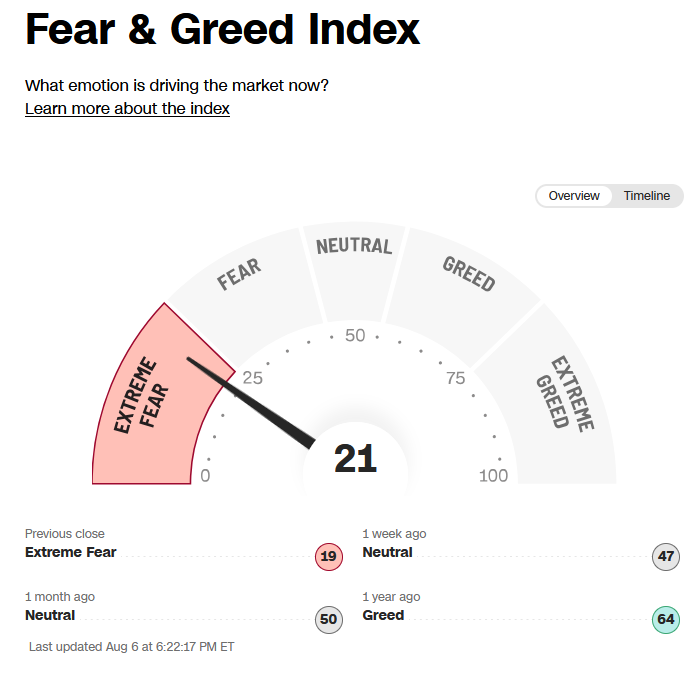

The CNN “Fear and Greed” collapsed from 52 last week to 21 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

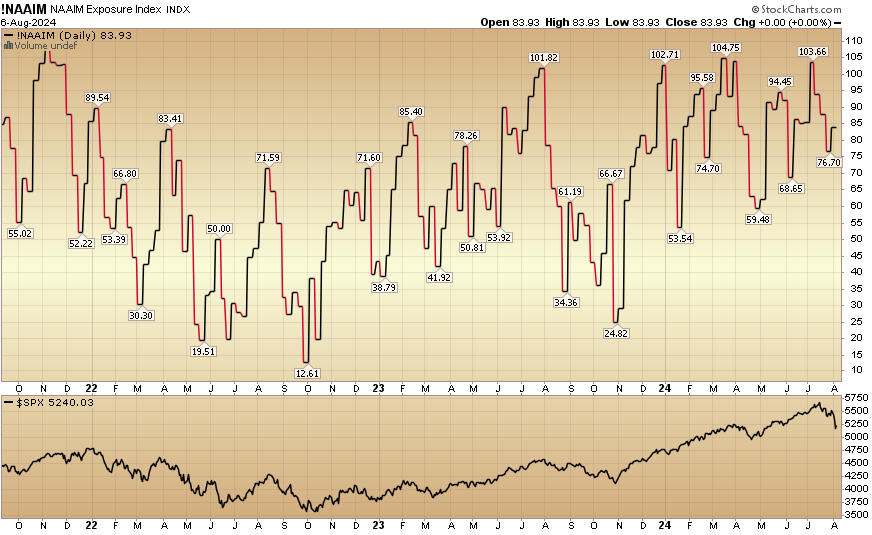

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 83.93% this week from 76.7% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 83.93% this week from 76.7% equity exposure last week.

Our podcast|videocast will be out sometime between now and Saturday. We’ll have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1, Q2 and Q3 raises so far this year. We have now successfully closed out our Q3 raise for smaller ($1M accounts).

Larger accounts $5-10M+ can still access bespoke service at their timing preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.