The March 4-10 survey covered 341 managers with $1 trillion in assets under management.

OUTLOOK:

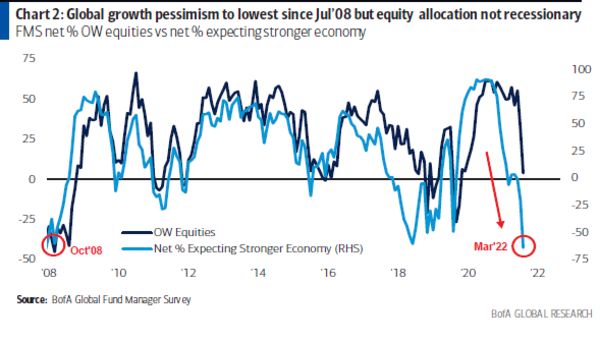

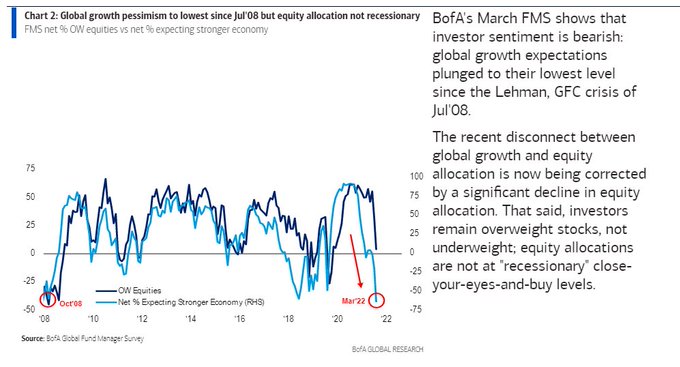

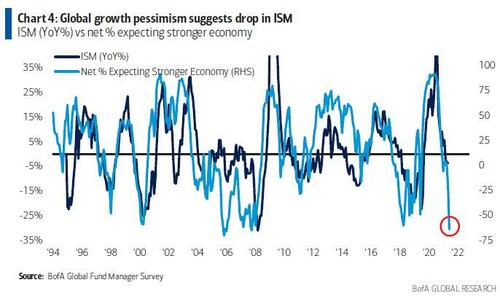

-A net 64% of fund managers looked for weaker economic growth in the coming 12 months, the worst outlook since July 2008, versus a net 20% looking for weaker growth in February and a net 1% with that view in January.

-A net 64% of fund managers looked for weaker economic growth in the coming 12 months, the worst outlook since July 2008, versus a net 20% looking for weaker growth in February and a net 1% with that view in January.

-A net 5% of fund managers looked for lower global CPI in the coming 12 months, the lowest since October 2021. This is compared to a net 56% with that view in February, which was the most since January 2009.

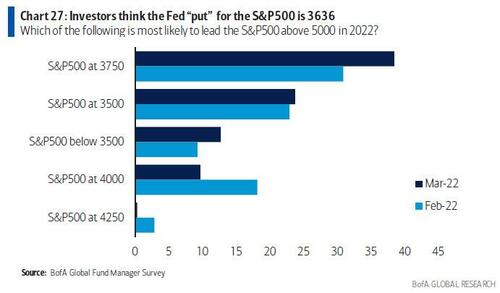

-Investors saw the so-called “Fed-put” for the S&P 500 at 3,636 or 12.9% lower than Monday’s S&P 500 close of 4,173.11. Under this “Fed-put” notion, the Federal Reserve would purportedly take policy easing action to prevent further stock losses if this downside support was broken. Last month, the “Fed-put” was seen at 3,698.

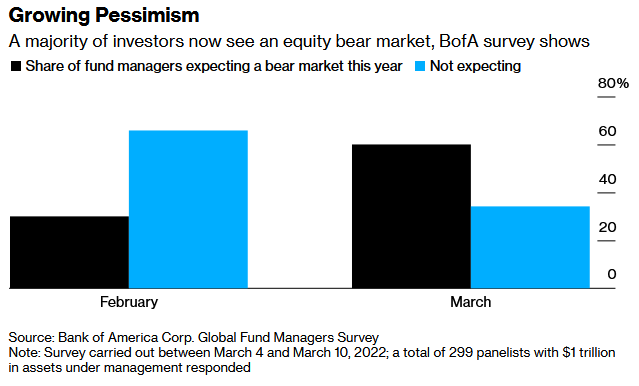

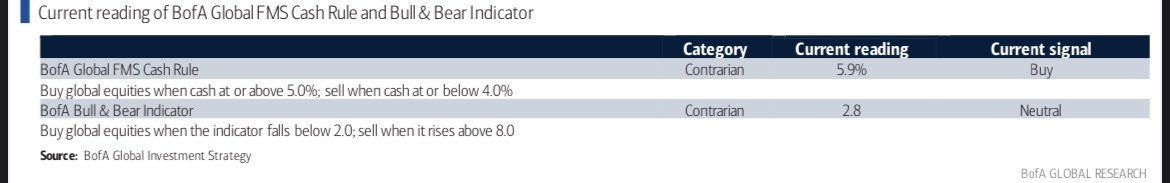

-Almost three-quarters expect a bear market in equity investments in 2022, and global equity allocations are at their lowest level since May 2020.

-Consumer confidence lowest in 10 yrs.

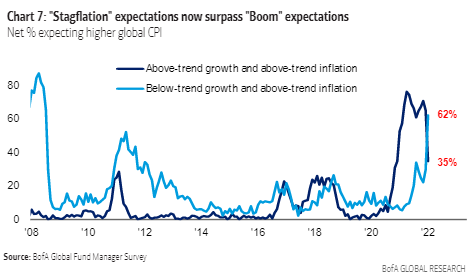

-“Stagflation” expectations jumped to 62% of responses, highest since Sept. 2008, up from 30% in the February survey.

-“Boom” expectations are now at 35%, down from 65%.

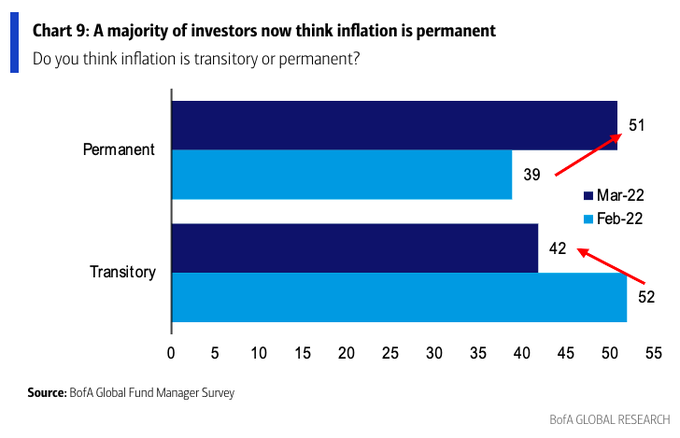

-51% of respondents think inflation is permanent while 42% think it’s transitory.

-Investors expect Fed hikes; see 4.4 Fed hikes in 2022, up from 4 in February.

SENTIMENT:

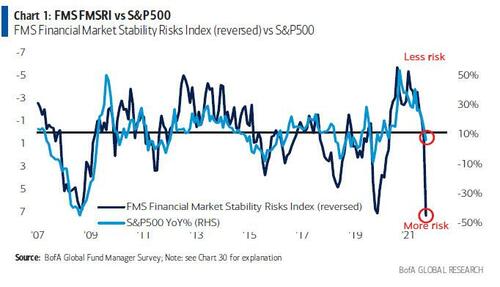

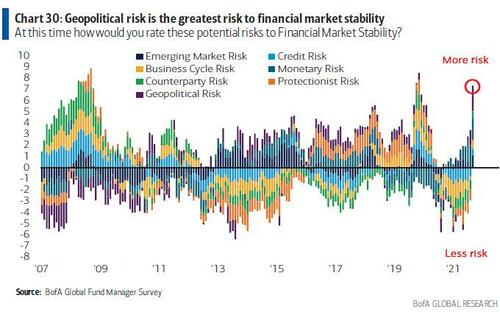

-In March, fund managers were again asked to rate the top potential risks to financial market stability. A net 95% of those polled said “Geopolitical Risk,” a net 81% said “Monetary Risk” and a net 61% said “Business Cycle Risk.”

-Investors are more concerned about the outlook for global growth than at any time since the financial crisis in 2008.

-Most investors now expect global equities to slump into a bear market this year.

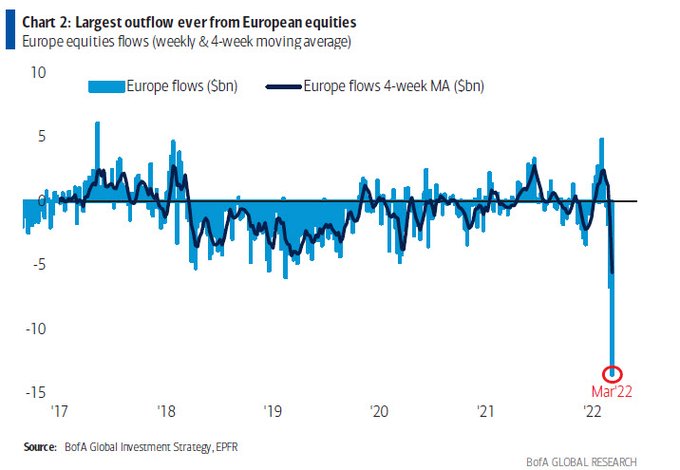

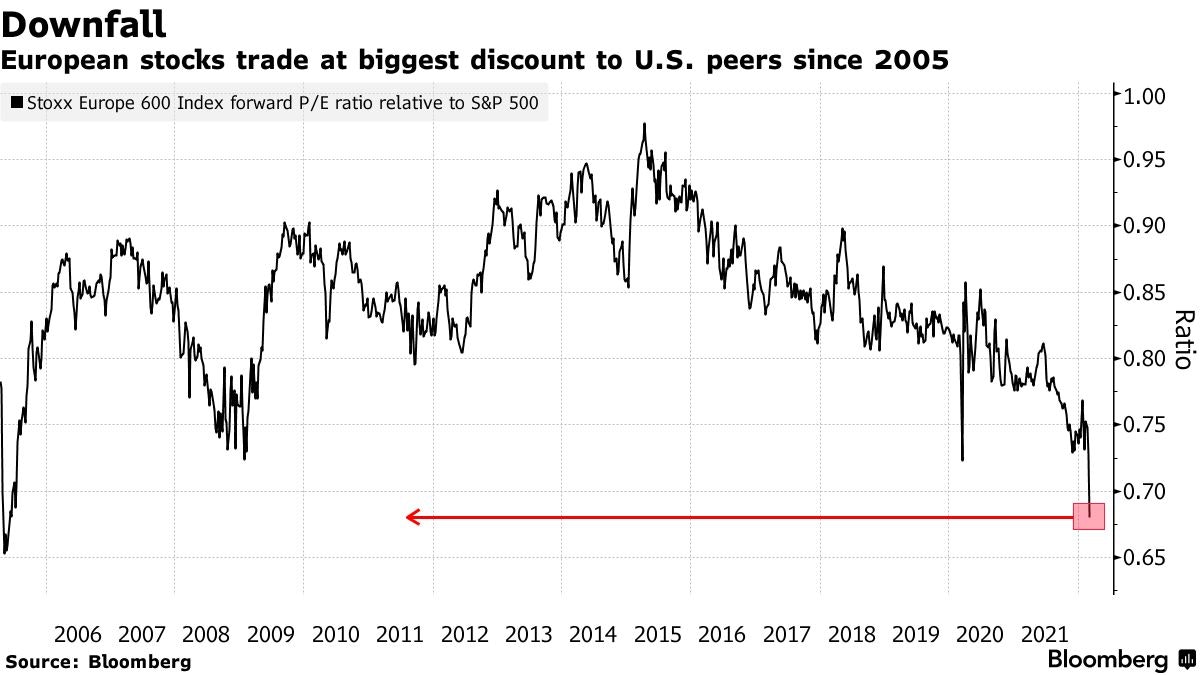

-A net 69% of respondents expect the European economy to weaken over the coming year, the highest share since 2011. The 81 percentage point swing from February’s net 12% who still expected to see growth marks the biggest month-on-month drop since BoFA’s records began in 1994.

-61% of investors think the European market has peaked for this cycle, up from 22% in the previous edition of the survey.

POSITIONING:

-The allocation to global equities slumps to lowest since May’20.

-The allocation to global equities slumps to lowest since May’20.

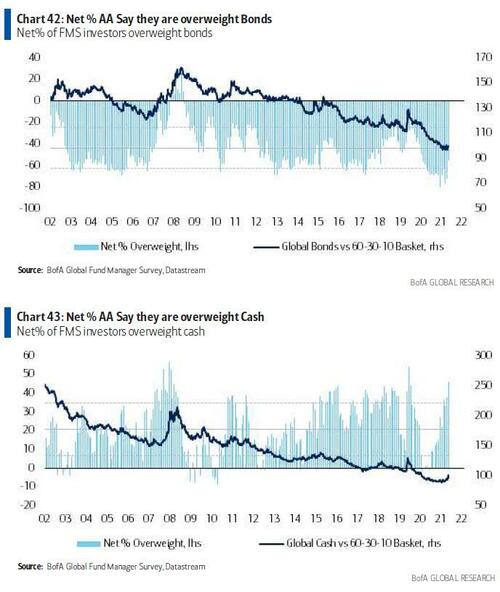

-Allocation to cash rose to a net 46% overweight this month, compared to a net 38% overweight in February and a net 33% overweight in January.

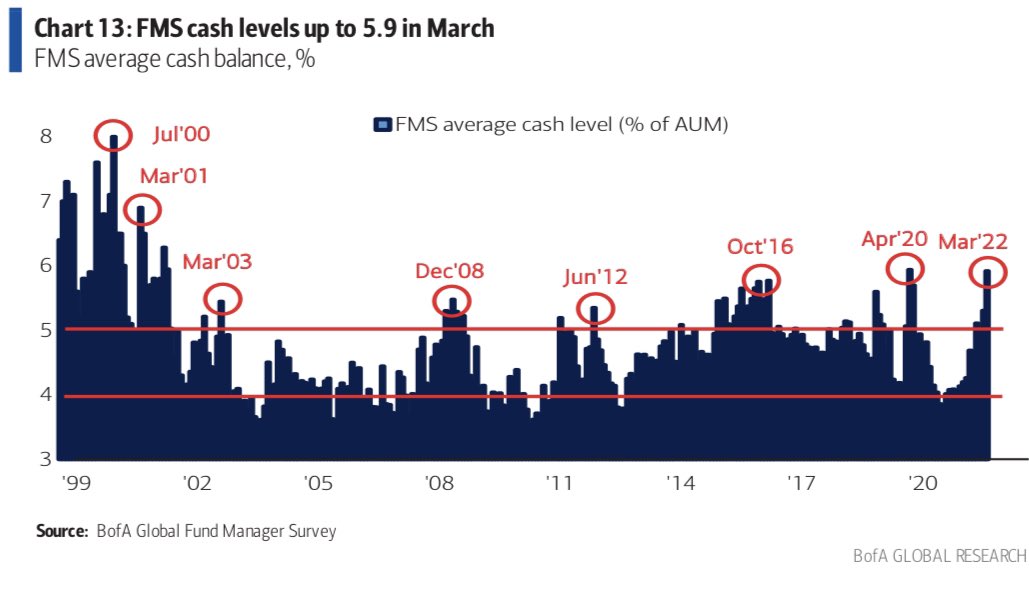

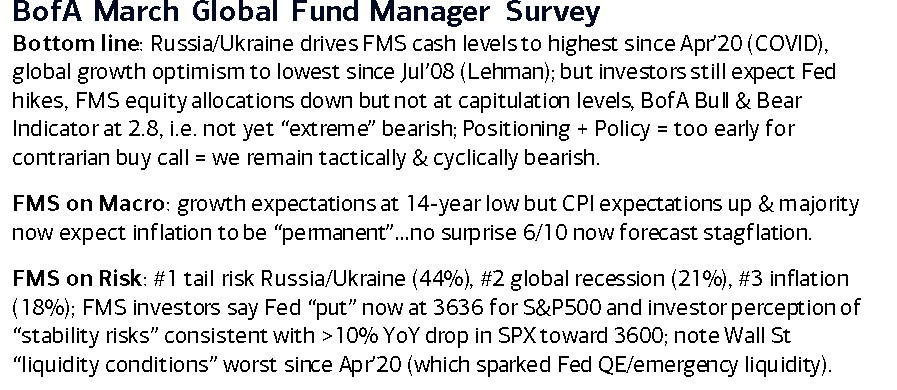

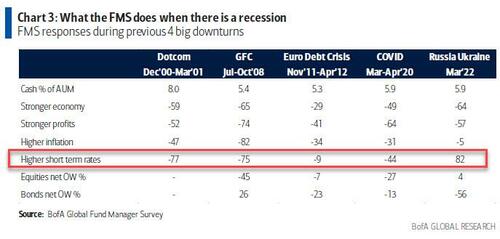

-Average cash balances rose to 5.9% in March from 5.3% in February and 5.0% in January.

-A net 4% of portfolio managers were overweight global equities in March, down from a net 31% overweight in February and a net 55% overweight in January.

-A net 56% of managers were underweight bonds, compared to a net 72% underweight in February and a net 77% underweight in January.

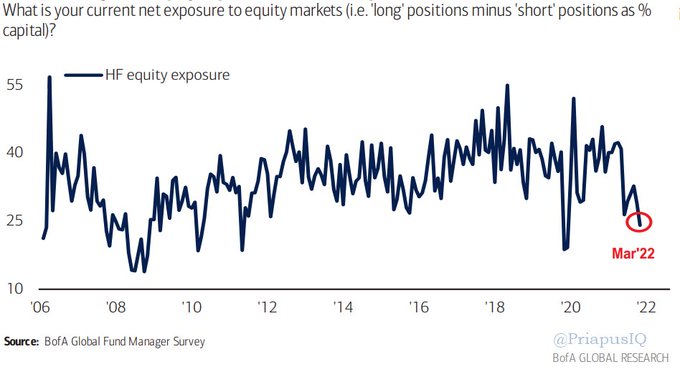

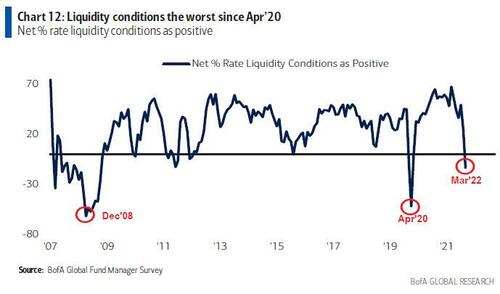

-Hedge funds net exposure to stock markets is at its lowest level since April 2020.

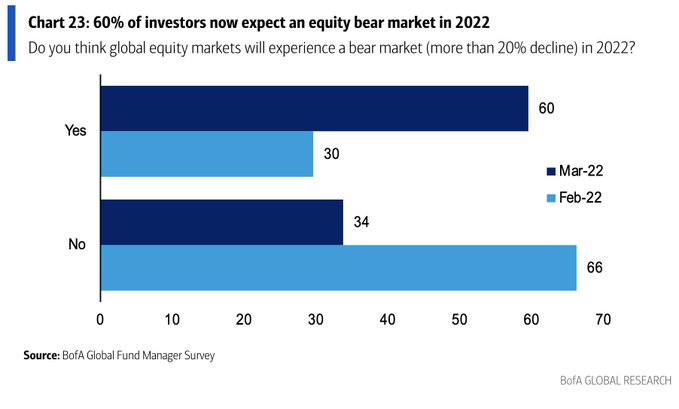

-Commodity allocations surged to a record high 33%.

-Cash levels surged to the highest since April 2020 6%.

-Exposure to equities fell to the lowest in nearly two years.

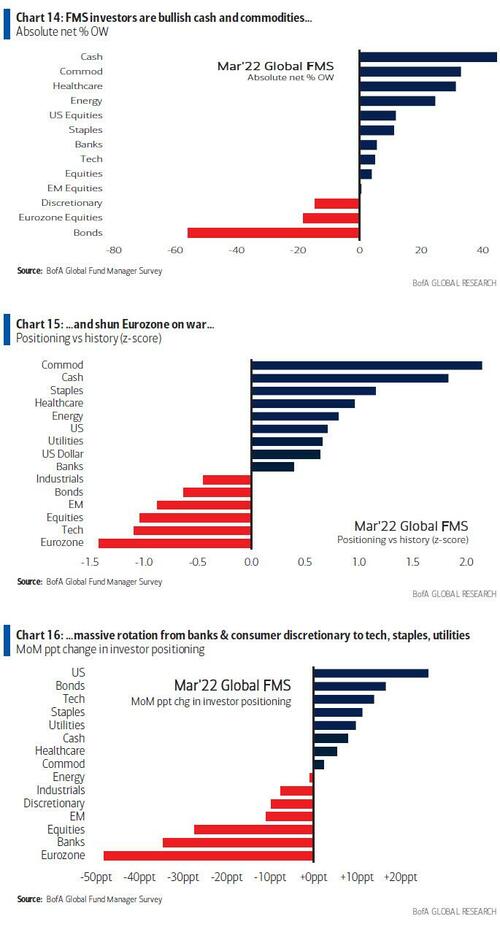

-Equity investors are rotating from banks and consumer discretionary stocks into technology, staples and utilities, and from small-cap to large-cap stocks.

-Liquidity conditions have deteriorated to the worst since April 2020.

-Investors are long cash, commodities, healthcare and energy.

-Investors shun bonds, Eurozone stocks, and discretionary sector.

-This month, a net 18% of managers were underweight eurozone stocks, a sharp decline from the net 30% overweight seen in February and the net 35% overweight seen in January.

-Fund managers had a net 1% overweight exposure to global emerging markets (GEM) in March, compared to a net 11% overweight in February and a net 2% underweight in January.

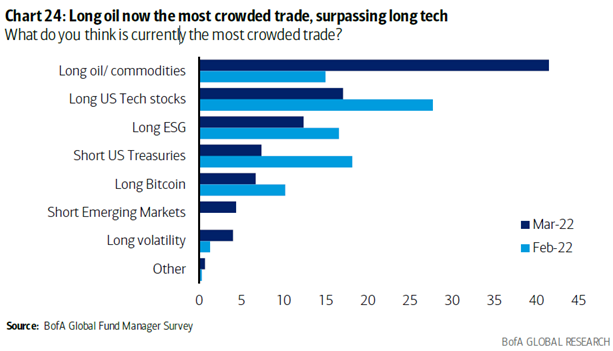

MOST CROWDED TRADES:

1) long oil/commodities

2) long technology stocks and

3) long ESG

-In March, the “most crowded” trades deemed by global managers were: “Long Oil/Commodities” (42% of those polled), “Long Tech Stocks” (17%), “Long ESG” (12%), “Short U.S. Treasuries (7%) and “Long Bitcoin” (7%).

-In February, the “most crowded” trades were: “Long Tech Stocks” (28% of those polled), “Short US Treasuries” (18%), “Long ESG” (17%), “Long Commodities” (15%) and “Long Bitcoin” (10%).

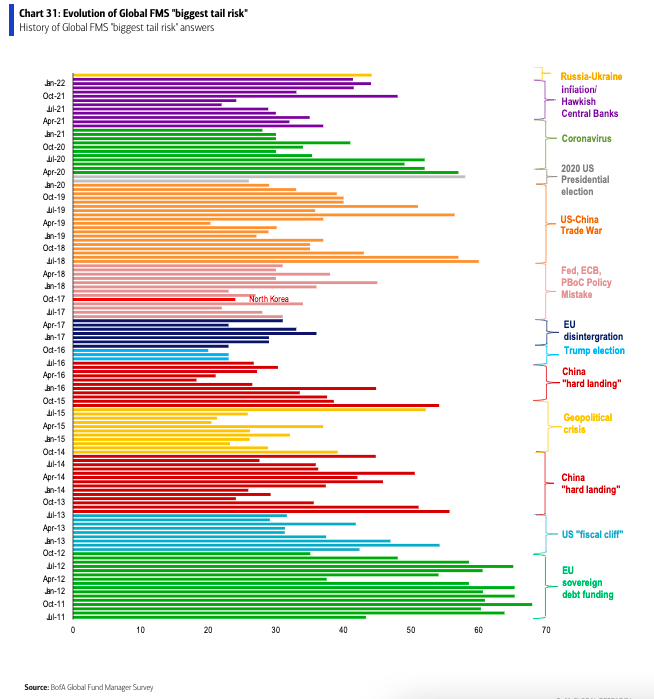

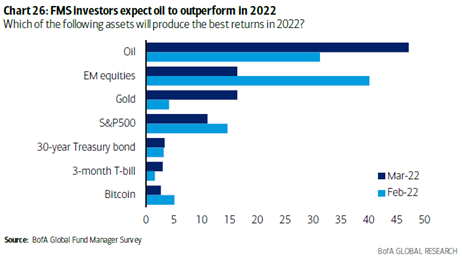

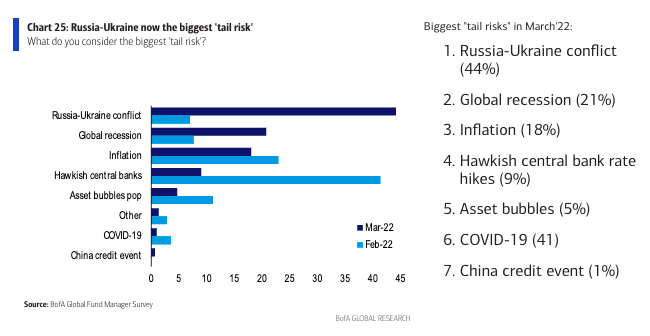

BIGGEST TAIL RISKS:

1) War in Ukraine 44%

1) War in Ukraine 44%

2) Recession 21%

3) Inflation 18%

4) Hawkish rate hikes 9%

5) Asset Bubbles 5%

6) Covid 19 4%

7) China Credit Event 1%

BANK OF AMERICA COMMENTARY:

-This month’s “cash” reading “triggers FMS Cash Rule tactical ‘Buy’ signal,” which would suggest U.S. equity returns of +1.3%, +4.0% and +6.5% on a one-month, three-month, six-month basis respectively, BoA Global noted.

-“Cash levels are recessionary. Economic growth and profit expectations are recessionary,” BofA Global said.

-“But because inflation expectations are not recessionary, expectations for short-term interest rates are for hikes, not cuts,” the survey said.

-“Economic growth and profit expectations are recessionary,” BofA strategists led by Michael Hartnett wrote in a note to clients.