Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $500B AUM. Here are the key takeaways from the survey published on March 16, 2020:

SENTIMENT:

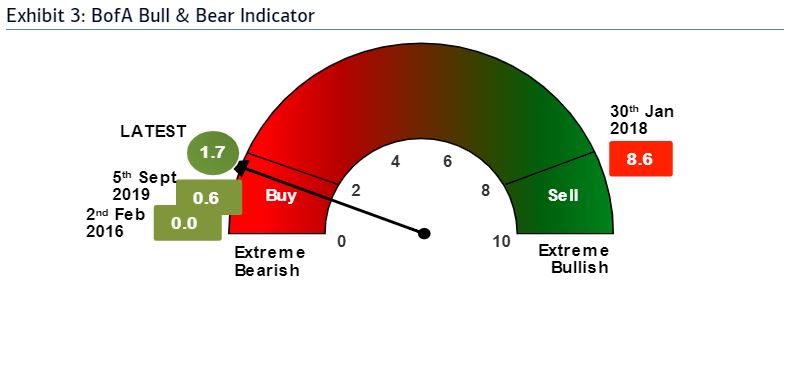

- SENTIMENT CLOSE TO 2008/2009 GFC BEAR EXTREMES IN TERMS OF CASH & CORPORATE LEVERAGE.

- Per featured image above, the despondent outlook has triggered a “buy signal” for the bank’s flagship sentiment index (the BofA Bull & Bear Indicator) for the first time since August 2019.

- The index tumbled to 1.7 in March from 2.5. This index also triggered a buy signal in July 2008, two months before Lehman Brothers collapsed. In other words if you had a short term outlook, it was wrong. If you had a 1+ year outlook you did fantastic.

- Sentiment among global fund managers has collapsed due to COVID19 and the oil shock as investors increasingly expect a global recession and fear the surging risk of debt defaults.

OUTLOOK:

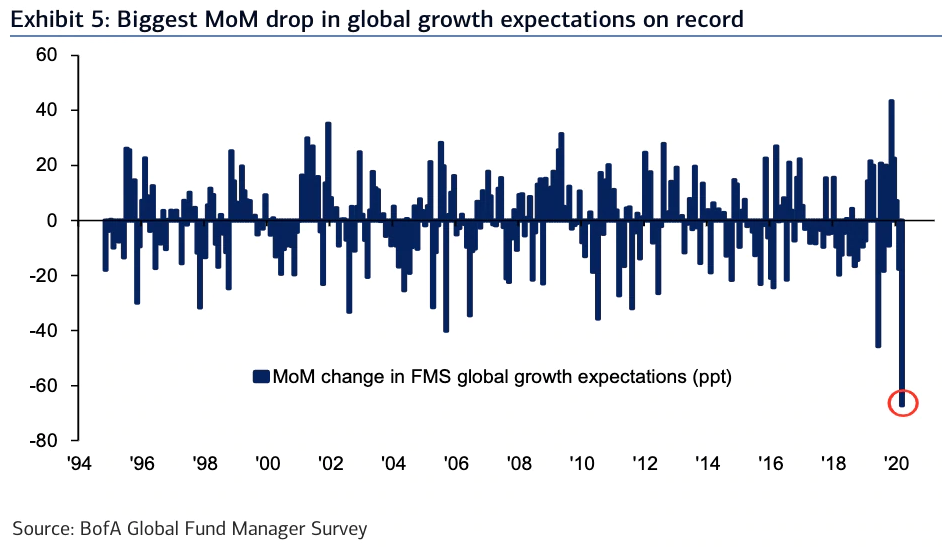

- BIGGEST MONTHLY DROP IN GLOBAL GROWTH EXPECTATIONS EVER (survey since 1994).

- Net 49% of surveyed managers expecting global growth to deteriorate over the next 12 months. This is down from down from net 18% that in February expected growth to continue.

- Fund managers’ global growth expectations were the lowest in the survey’s 25-year history.

- Global earnings per share expectations were the lowest since October 2008.

- 61% — the highest since June 2009 — of managers urged corporations to improve balance sheets amid fear many companies are too leveraged.

- 83% of fund managers expect below-trend growth and inflation over the next year, up 16 percentage points from February.

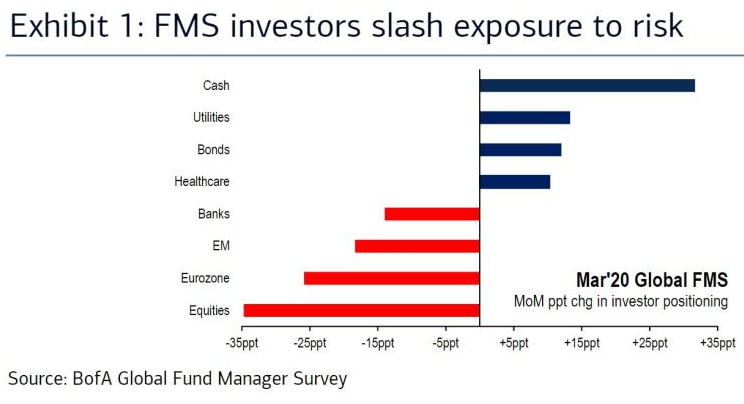

POSITIONING:

- Cash levels among fund managers saw the fourth-biggest month-to-month jump ever, from 4% to 5.1%. This was the biggest increase since 2001 and above the 10-year average of 4.6%.

- The February cash level had been the lowest since March 2013.

- Biggest monthly collapse in global equity allocations ever, led by flight from eurozone & emerging markets.

- The allocation to global equities dropped 35 percentage points (the largest such drop since 2001) to a net 2% underweight (a six-month low).

- Investors moved into cash over bonds.

- Investment into banking stocks was the lowest since July 2016 (See below what happened to Bank Stocks/Financials the last time allocation was this low – green vertical line):

- Large-cap stocks are expected to outperform small-cap stocks over the next 12 months, according to a net 51% of survey respondents, up 12 percentage points from February.

- Defensive sectors utilities and healthcare were the most popular since early 2009.

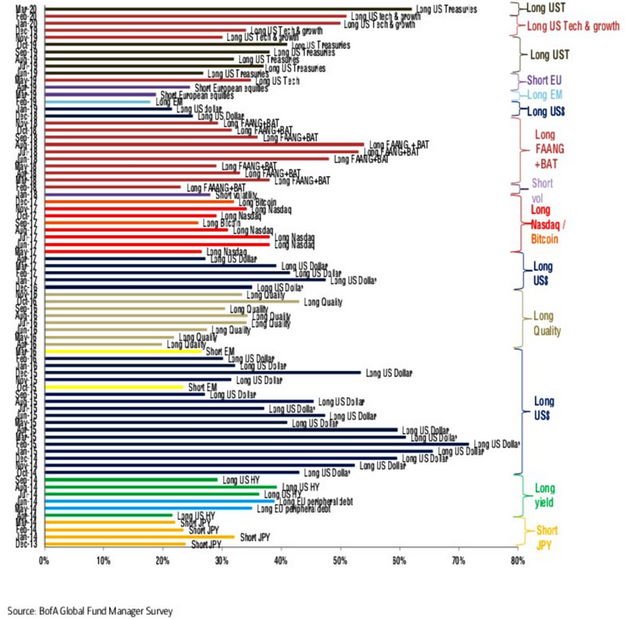

Most Crowded Trade:

- US Treasuries

- Long US Tech & Growth

- Long Gold

- Long IG Corporate Bonds

Biggest Tail Risks:

- The coronavirus pandemic is by far the No. 1 tail risk among surveyed managers, at 58%, up from 21% in the February survey.

- Monetary policy impotence.

- Outcome of the 2020 U.S. presidential election.

- Popping up of the bond bubble.

Global Inflation Expectations:

- Inflation expectations dropped 71 percentage points from last month to a net 31% of survey participants expecting a higher global consumer price index in the next 12 months.

- This is the lowest inflation expectation among surveyed managers since January 2012.

What is needed to rally:

- Further macro and market policy moves.

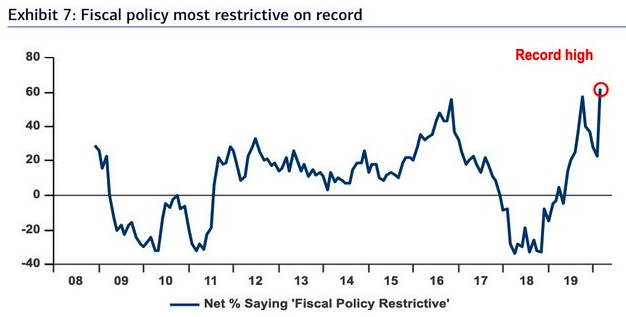

- 62% of investors said that fiscal policy is too restrictive.

- Belief that the virus is peaking in Europe & U.S.