~200 Managers overseeing ~$600B AUM responded to this month’s BofA survey.

OUTLOOK:

-Managers said a yield of 2.5% would make bonds more attractive than stocks on a relative basis.

-43% of Managers said that a 10-year yield of 2% could spark a 10% correction in the S&P 500.

-A record 89% of respondents expecting global corporate profits to improve this year.

-Only 15% think U.S. equities are in a bubble.

-25% say it’s an early-stage bull market.

-55% say a late-stage bull market.

-A net 93% of fund managers expect higher inflation in the next 12 months. This is up 7% from the prior month’s survey and an all-time high.

-48% of the fund manager expect the global economy to deliver a V-shaped recovery (was 10% in May 2020).

-A net 91% of the investors expect a stronger economy (record high).

-66% expect a steeper US yield curve, down from February.

SENTIMENT:

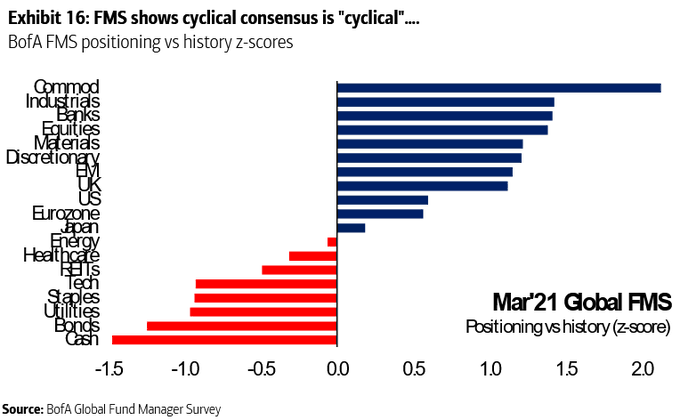

-Investors are currently their most optimistic on commodities in the survey’s near two-decade history.

-Only 15% of the fund managers believe we’re in a bubble.

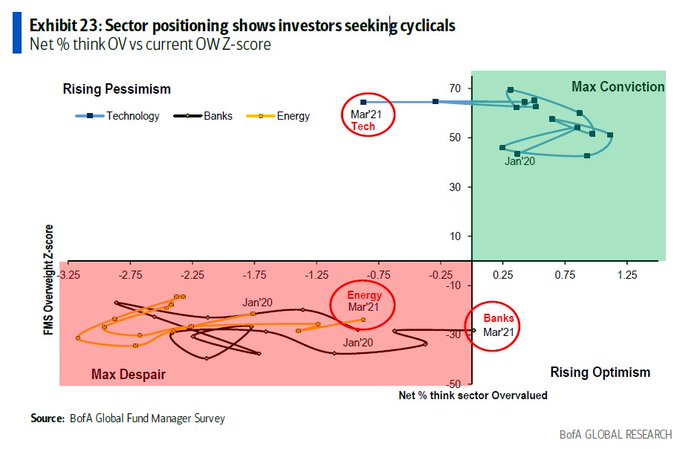

-A record 52% of managers expect value to beat growth over the next 12 months.

POSITIONING:

-Managers dumping tech stocks at the fastest pace in fifteen years.

-Lowest overweight for the Tech sector since January 2009.

-Exposure to commodities now sits at an all-time high.

-Fund managers increased their cash allocation to 4% from 3.8%.

-Net exposure for the hedge funds to equities is the highest since June 2020.

MOST CROWDED TRADES:

1. Long Tech (34%)

2. Bitcoin (24%)

3. ESG (15%)

4. Long Global Cyclicals (8%)

BIGGEST TAIL RISKS:

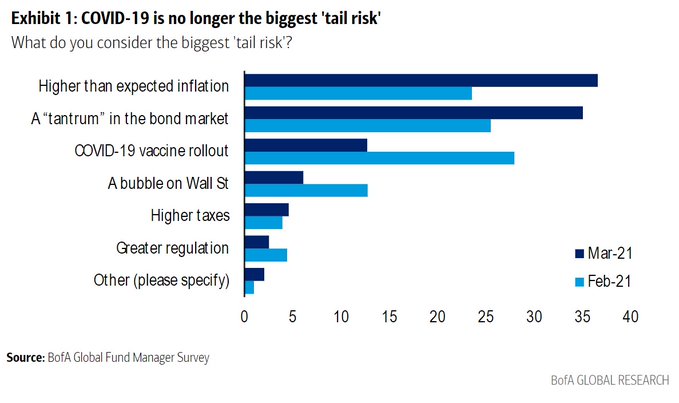

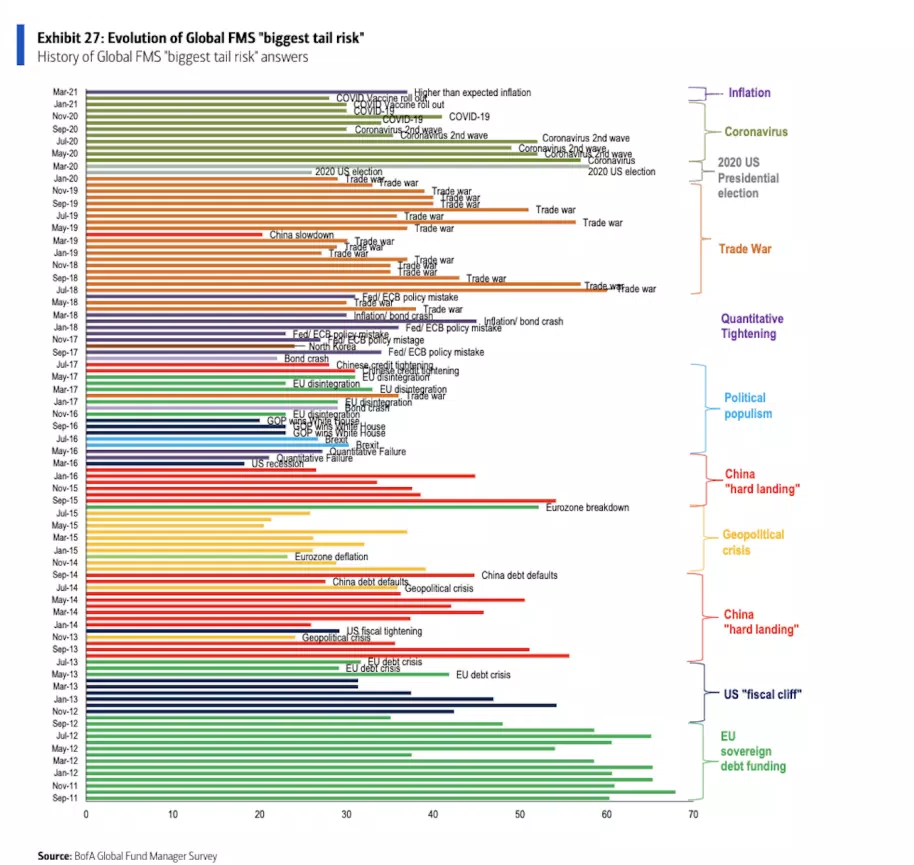

“A year ago, COVID-19 was named a global pandemic on March 11th. COVID-19 has been named for the last 12 months as the number one investor ‘tail risk’,” the survey noted. “This month however, for the 1st time since Feb’20, it is no longer the largest risk. Inflation (37%) & taper tantrums (35%) are now seen as bigger risks.”

1. Higher than expected inflation (37%).

2. A “Tantrum” in the bond market (35%).

3. COVID-19 vaccine rollout.

BANK OF AMERICA COMMENTARY:

-Fund Managers are “unambiguously bullish.”

-BofA Bull & Bear Indicator unchanged at 7.2 (Bullish).