I was quoted in the Financial Times today. Please check out Jennifer Ablan’s (U.S. Markets Editor) full article, “Record Wall Street rally triggers boom in options” here:

Click Here to View The Full Article at Financial Times

Source: Financial Times 2/19/2020

Here is some additional commentary about the subject that could not fit in the article but may be helpful to those trying to understand the implications of this extreme:

We have a severe case of F.O.M.O. (fear of missing out) among active managers. The majority unperformed their benchmarks in 2019 trading too conservatively on trade fears, and now the rally has continued. They are scrambling to get exposure after a 19% (S&P 500) and 27% (Nasdaq) move off the August 2019 lows. This is common behavior off of steep draw-downs like we had in December 2018 (nearly 20% correction).

Managers become shell shocked and the “recency bias” keeps them perpetually scared and waiting for the next shoe to drop – which is exactly when it doesn’t. Instead, the market continues to climb the “wall of worry” until everyone is finally and reluctantly drawn back into the boat – at which time the trap door opens once again.

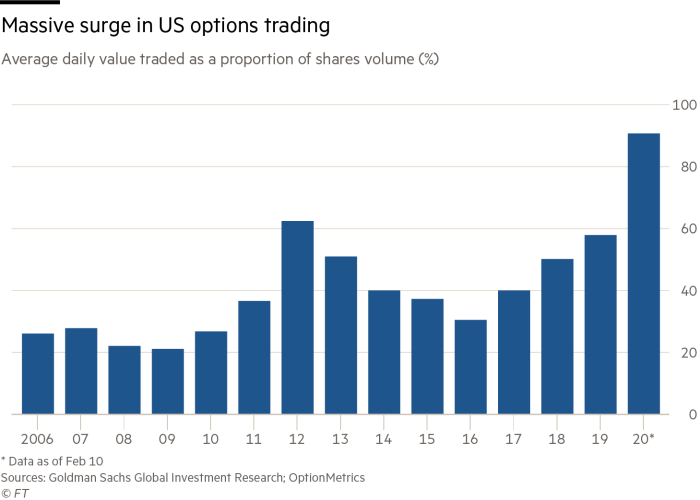

The last time we had single stock option notional volumes (as a percentage of shares notional) this high was 2012. This was immediately following the >20% correction in Aug-October 2011. As the market recovered, managers were too conservative waiting for the next shoe to drop – and it never came. The market just kept trending up 32% off its lows until all of the managers who missed the recovery and were behind their benchmarks panicked back into the market with leverage – through call options to try to make up for lost ground – at the exact wrong time.

By the time call option volume hit historic levels in Spring 2012, the market was perfectly teed up for a correction to digest the gains. The market fell 10.9% from April-June 2012 rendering most of the new call premium worthless. While there may be a little room left to run now, the risk:reward ratio is not favorable to be initiating new exposure in the short term – following a 43% rally in the S&P 500 off the December 2018 lows. A better time will come to reload in coming months, when much of this new option premium has decayed.

Why are Managers buying options versus just the stock?

When managers get caught behind their benchmark, and the correction they were expecting fails to materialize, they have to figure out a way to “catch up.” This often happens at the absolute worst time as most of the move is exhausted and they are forced to participate right before the trend changes (against them). The reason call volume explodes after a large up move (following a big correction like August-Oct 2011, and Oct-Dec 2018) is because it is the easiest way for these managers to gain more exposure to the move – in an attempt to catch up, while putting less capital at risk because they recognize they missed most of the run.

Example: If I want to buy 100,000 shares of Microsoft at $190 it will take $19M, but I could control 100,000 shares (right to buy 100,000 shares at $190) for $795,000 for three months. This is what managers do when they’ve missed the move, they may try to “control” more shares through options than they would ordinarily buy with stock to try to catch up. In this example they could control 200,000 shares at $190 strike for 3 months for ~$1.6M versus simply buying 100,000 shares for $19M. So twice the exposure to any upside for 8.3% of the capital.

There is also an element of euphoria that can take place as the key stocks (flavors of the day) continue to run and everyone wants to participate. As is always the case in markets, “opinion follows trend.” So not only is there a panic among managers to catch up through the leverage of options (more exposure to the move at less cost than buying the underlying stock), there is also a narrative that the most favored stocks can do no wrong and that trees grow to the sky – after such large moves in the market (42% off December 2018 lows, and 19% off August 2019 lows for the S&P 500).