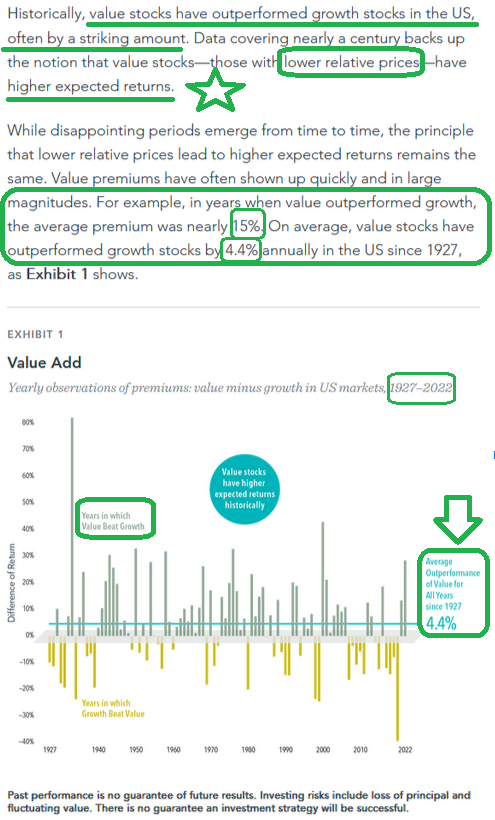

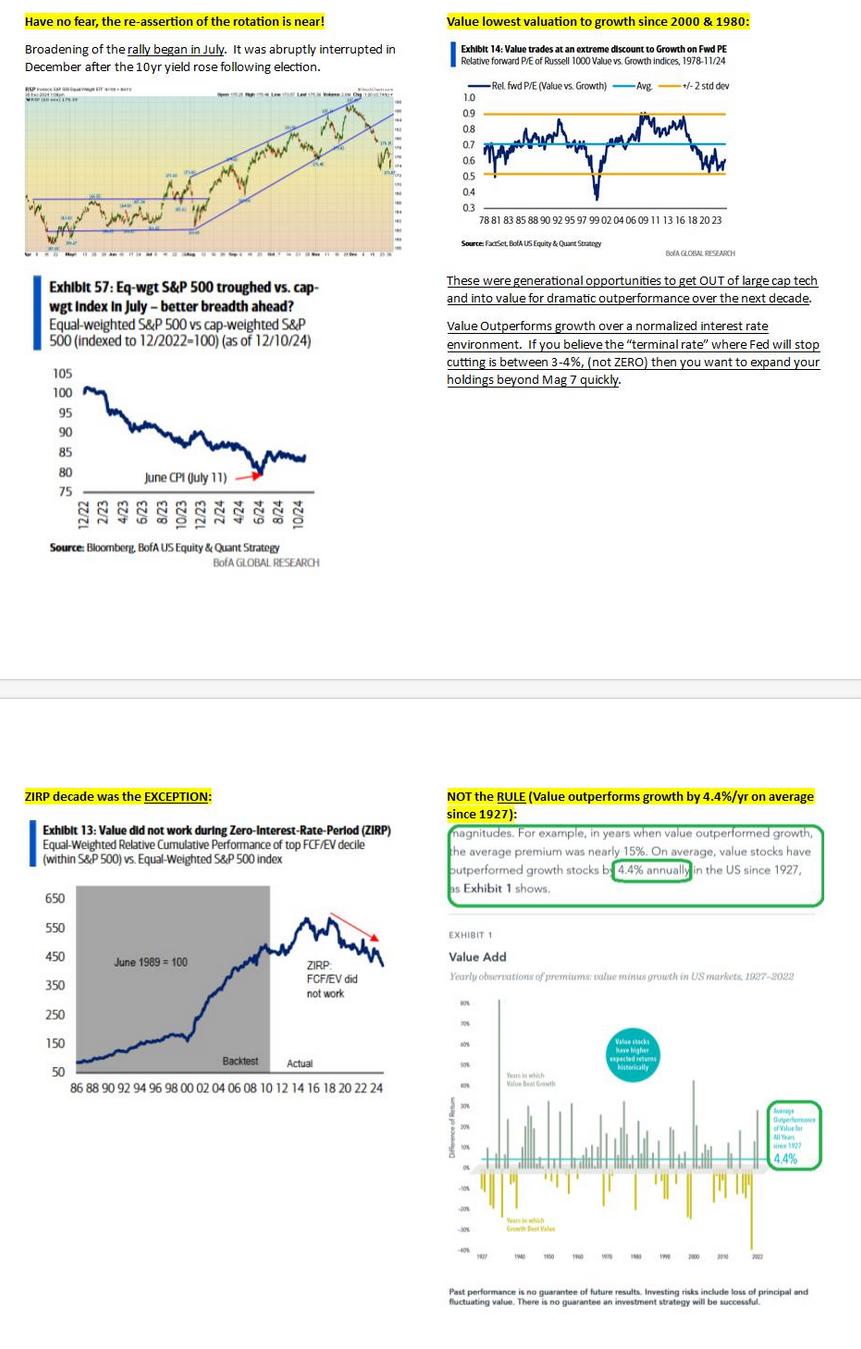

In a year like 2024, it is easy to forget the fact that since 1927 “Value” has outperformed “Growth” by 4.4% per year:

Source: Dimensional

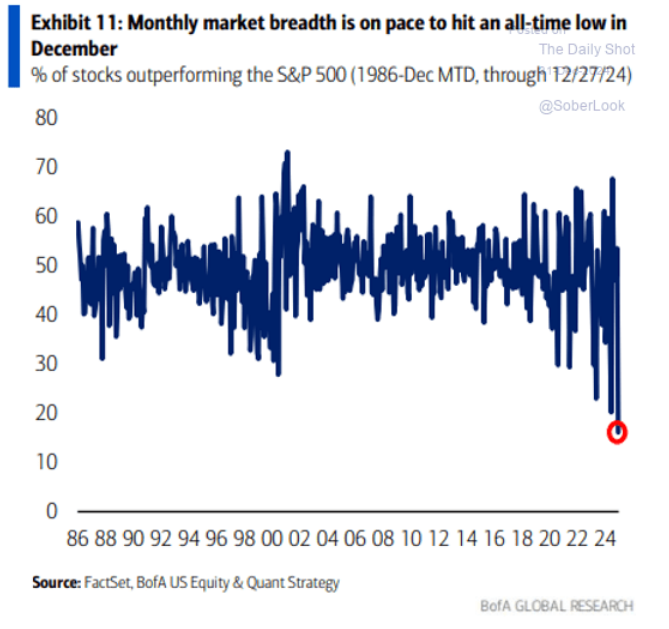

This was compounded by the weakest month of market breadth (December) since the 2000 tech peak:

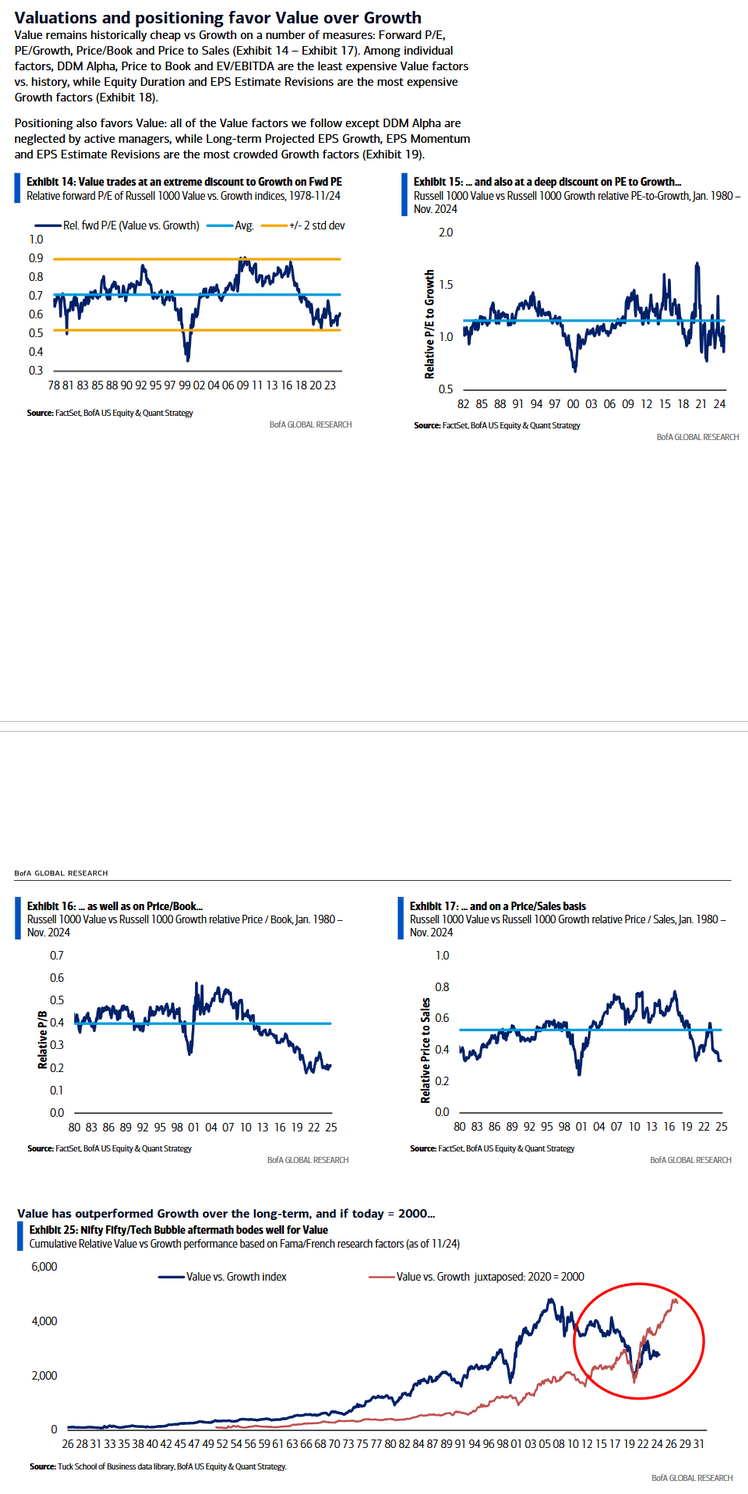

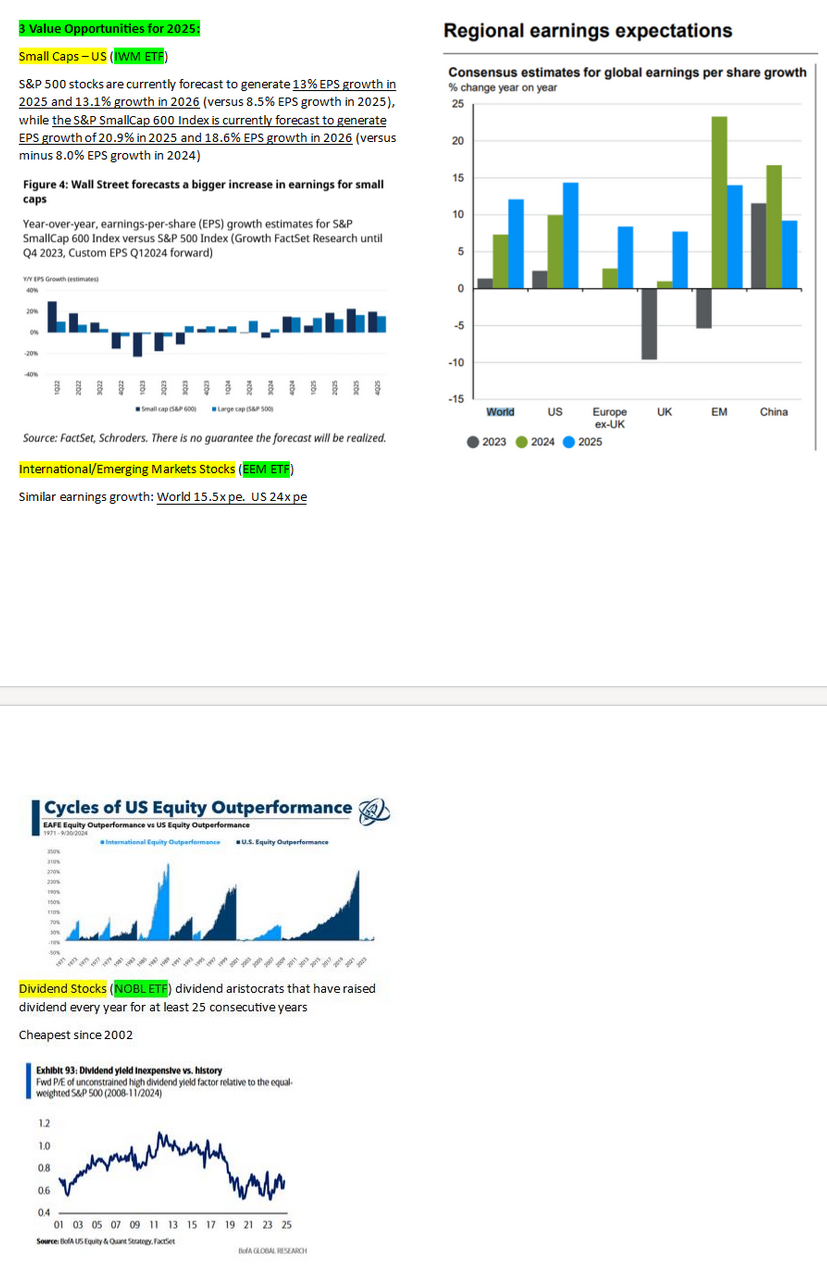

More factors pointing to a rubber band that is stretched and on its way back to the mean:

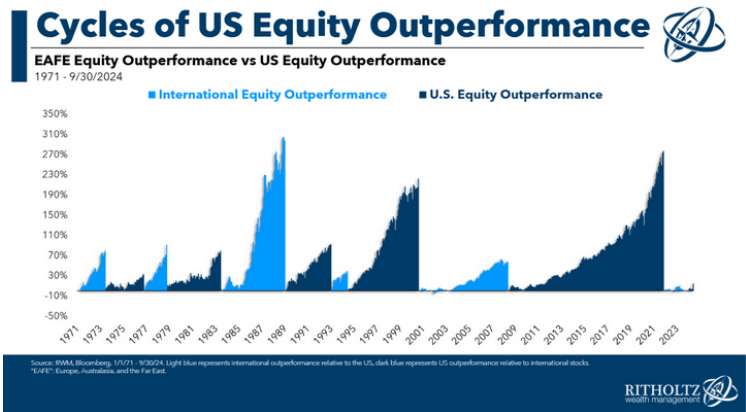

Did we mention that International equity “out-performance” runs in regular cycles as well? What do you think comes next?

I had the pleasure to join Ash Webster on Fox Business “Varney & Co” on Tuesday to discuss these very topics. Thanks to Christian Dagger and Preston Mizell for having me on:

Watch in HD Directly on Fox Business

Here were my notes ahead of the segment:

On Friday I joined Brian Sozzi and Brad Smith on Yahoo! Finance to discuss the theme “The Last Shall Be First” and special opportunities for 2025. Thanks to Brian, Brad, Justin Oliver and Kayla Hawkins for having me on:

Watch full show in HD directly on Yahoo! Finance

On Thursday I joined Ash Webster on Fox Business “Varney & Co” to discuss market laggards that can outperform in 2025. Thanks to Christian Dagger and Preston Mizell for having me on:

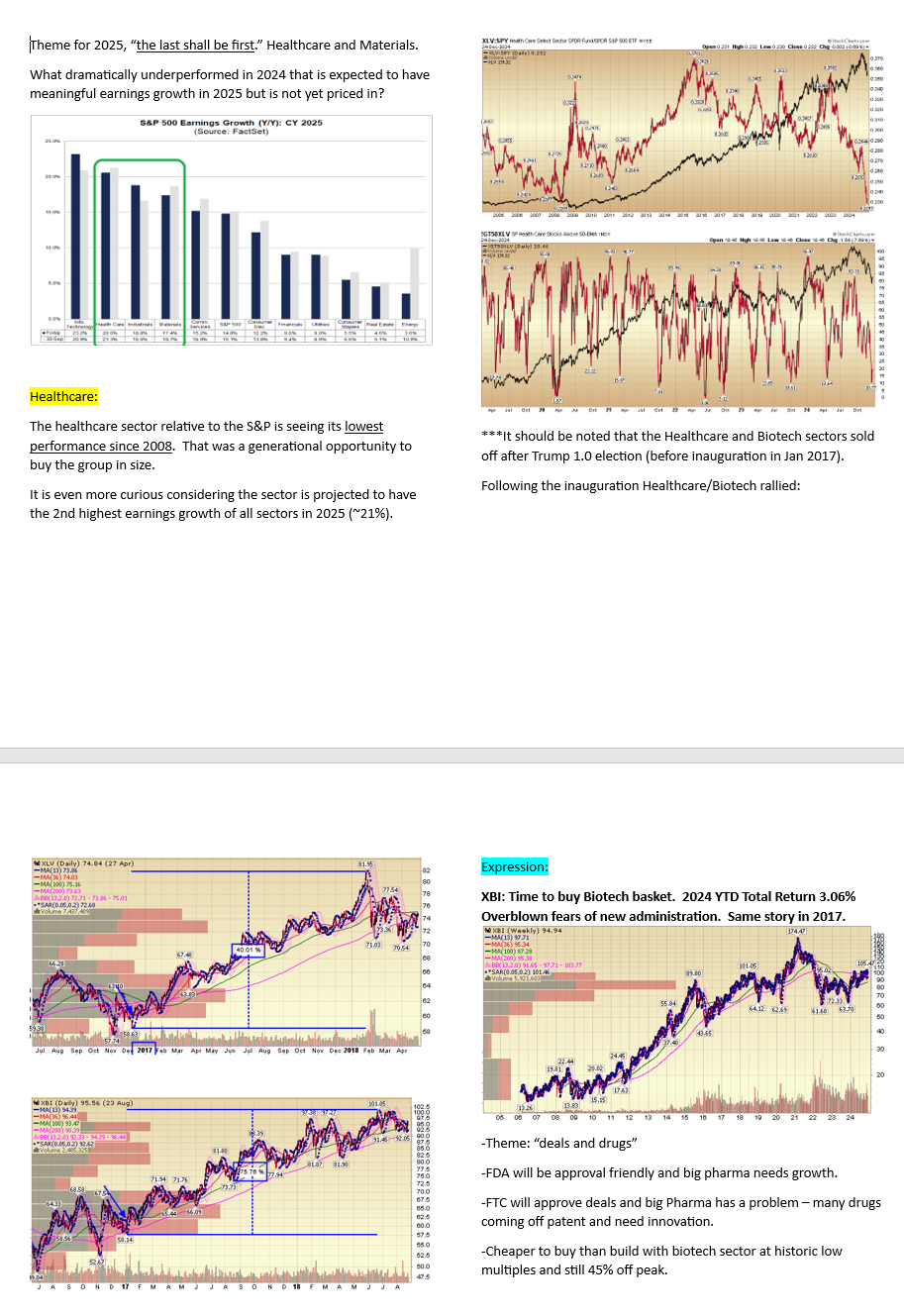

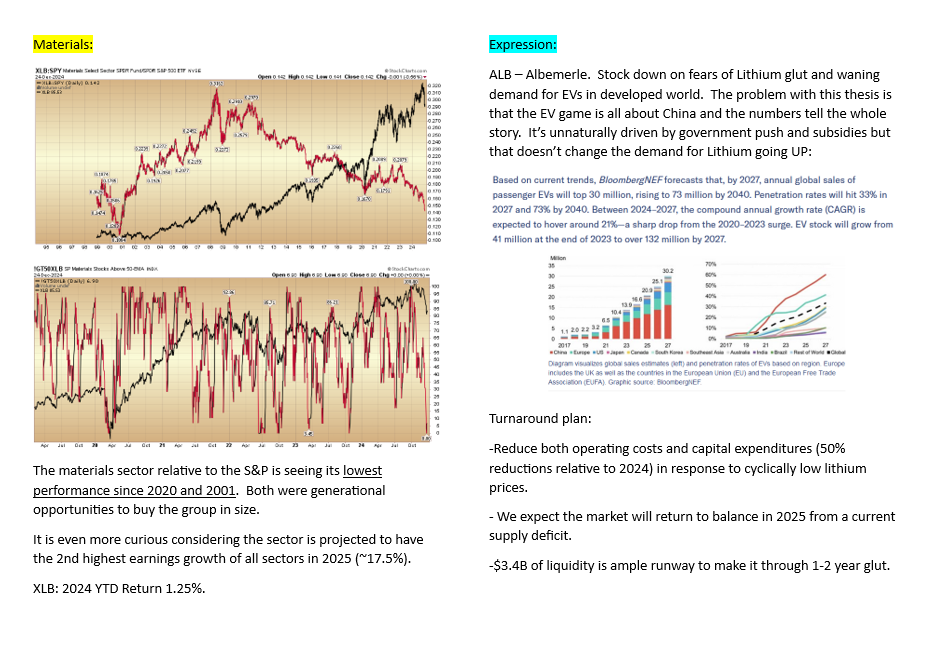

Here were my notes ahead of the segment:

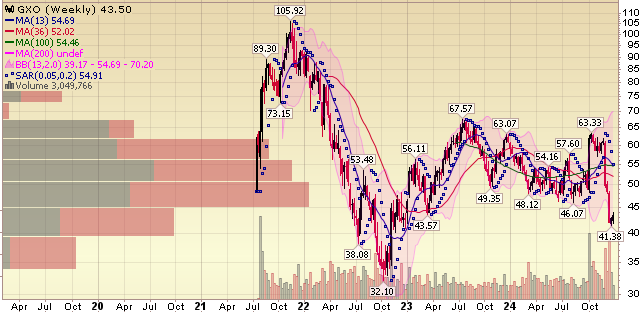

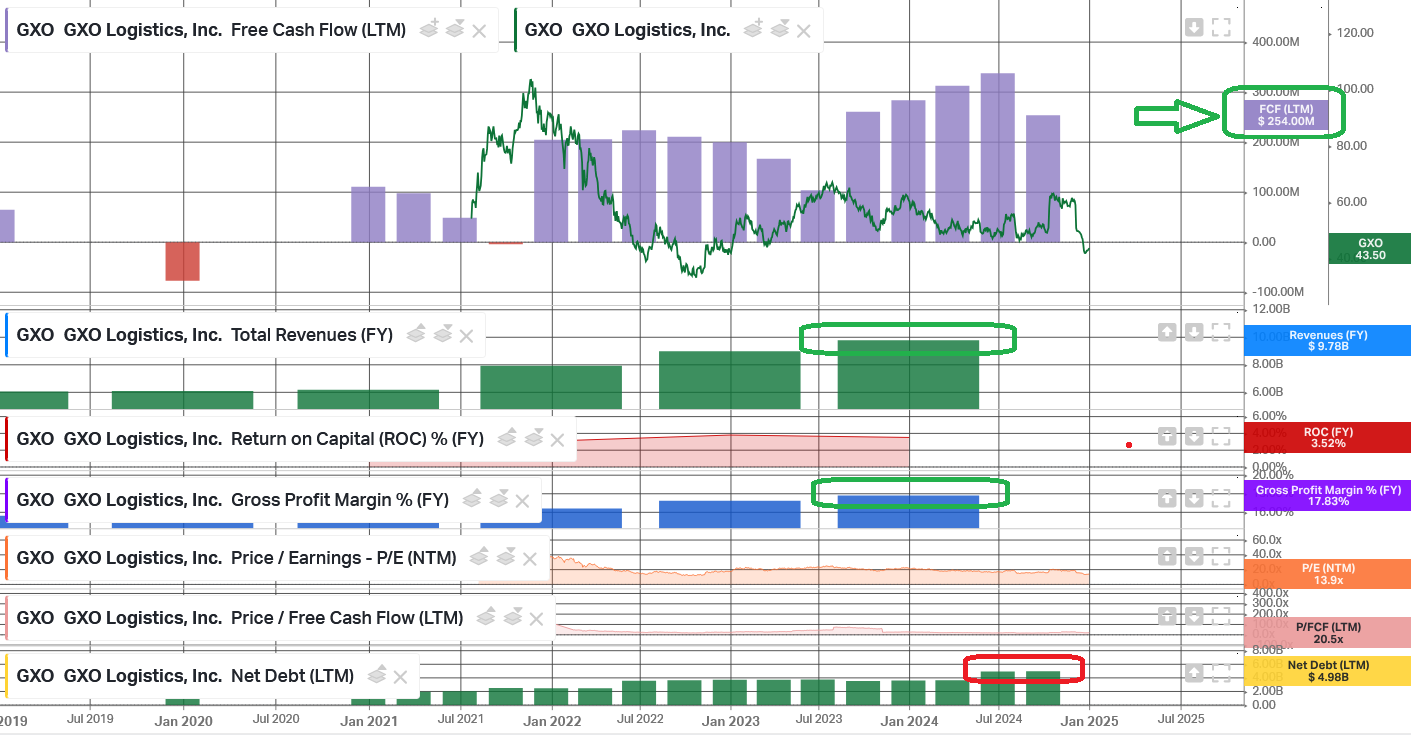

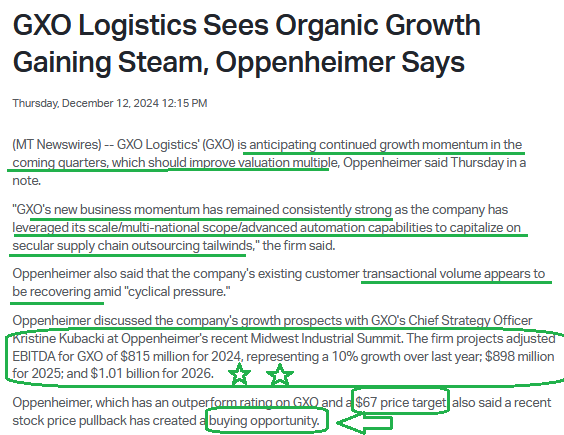

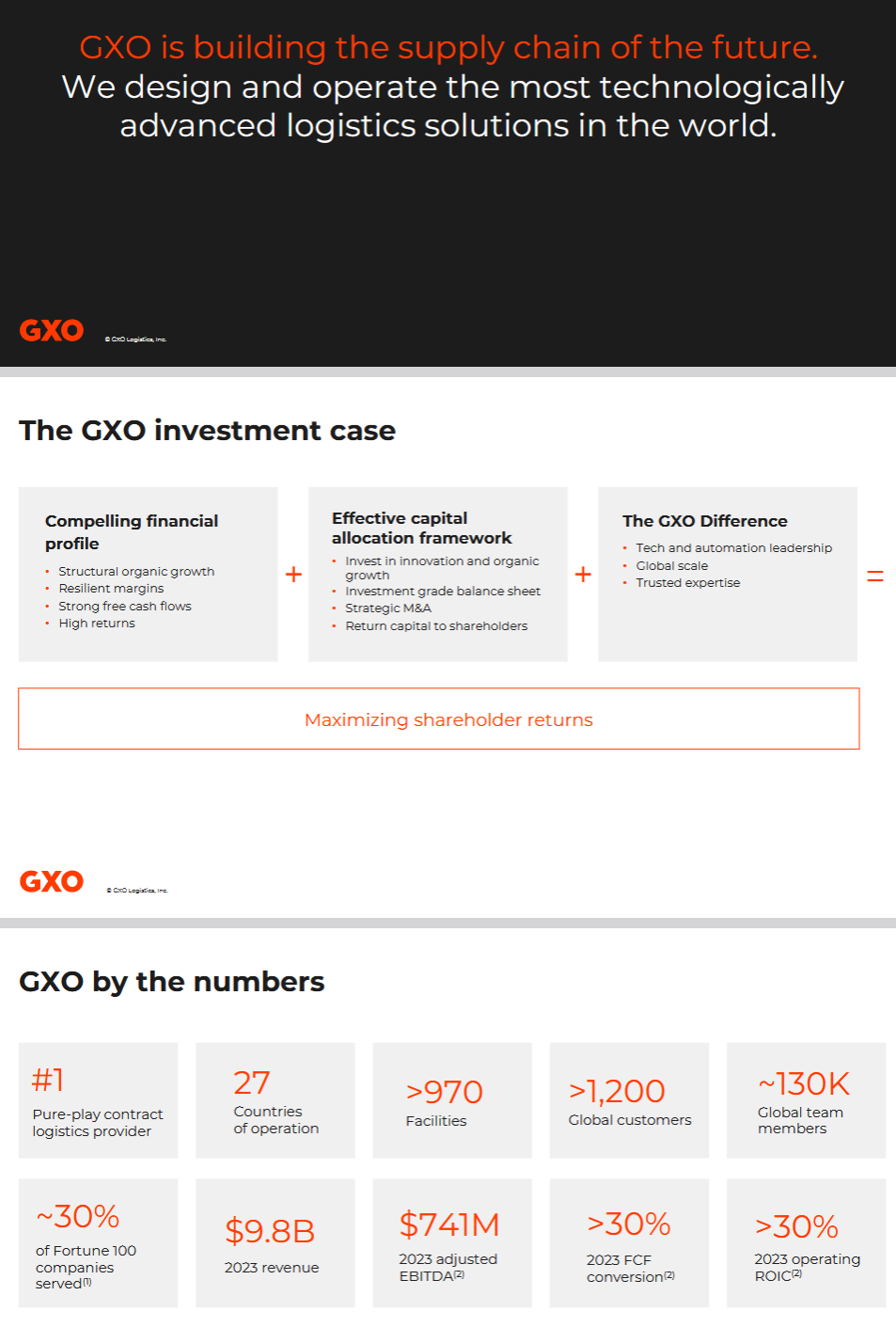

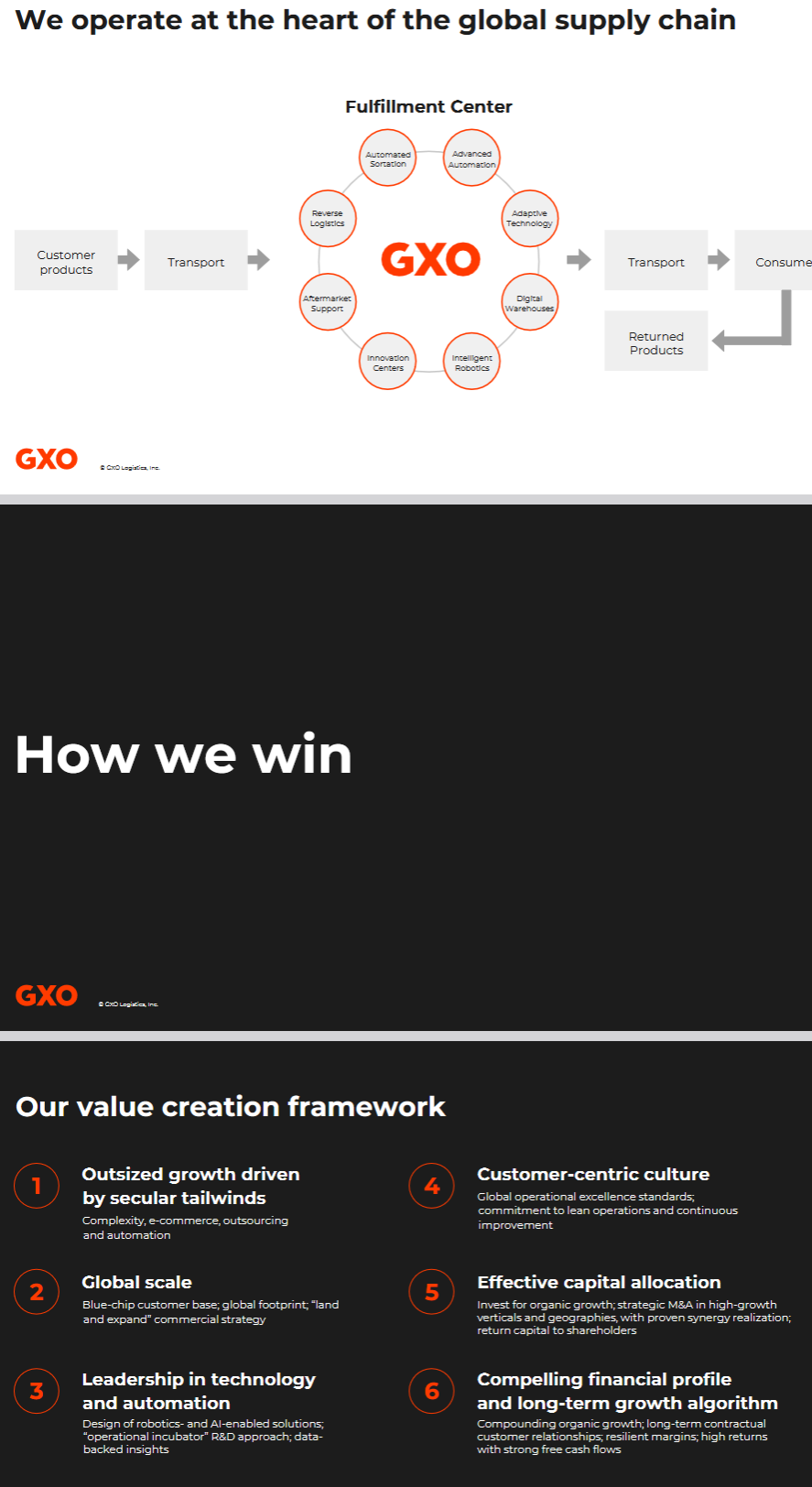

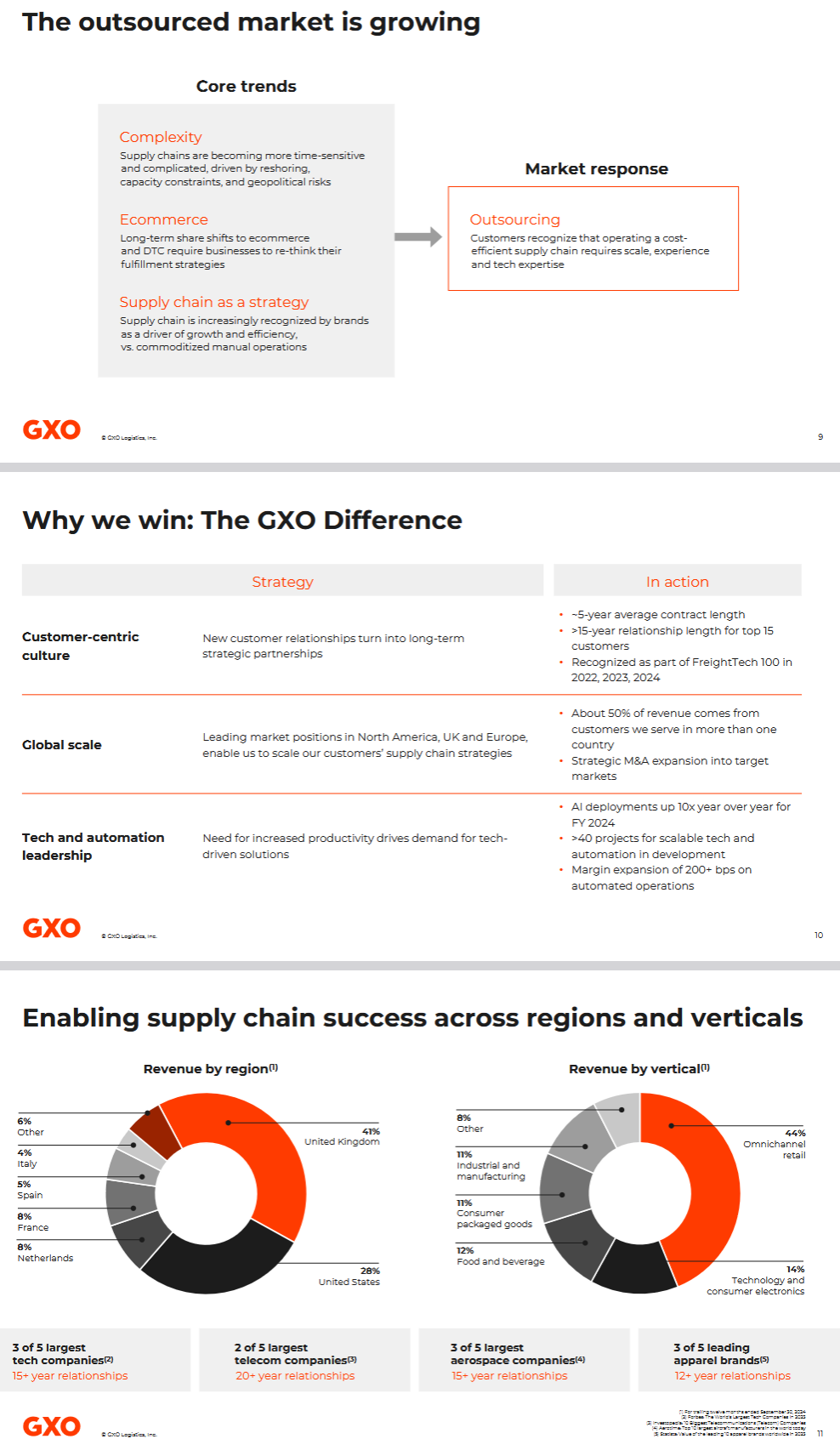

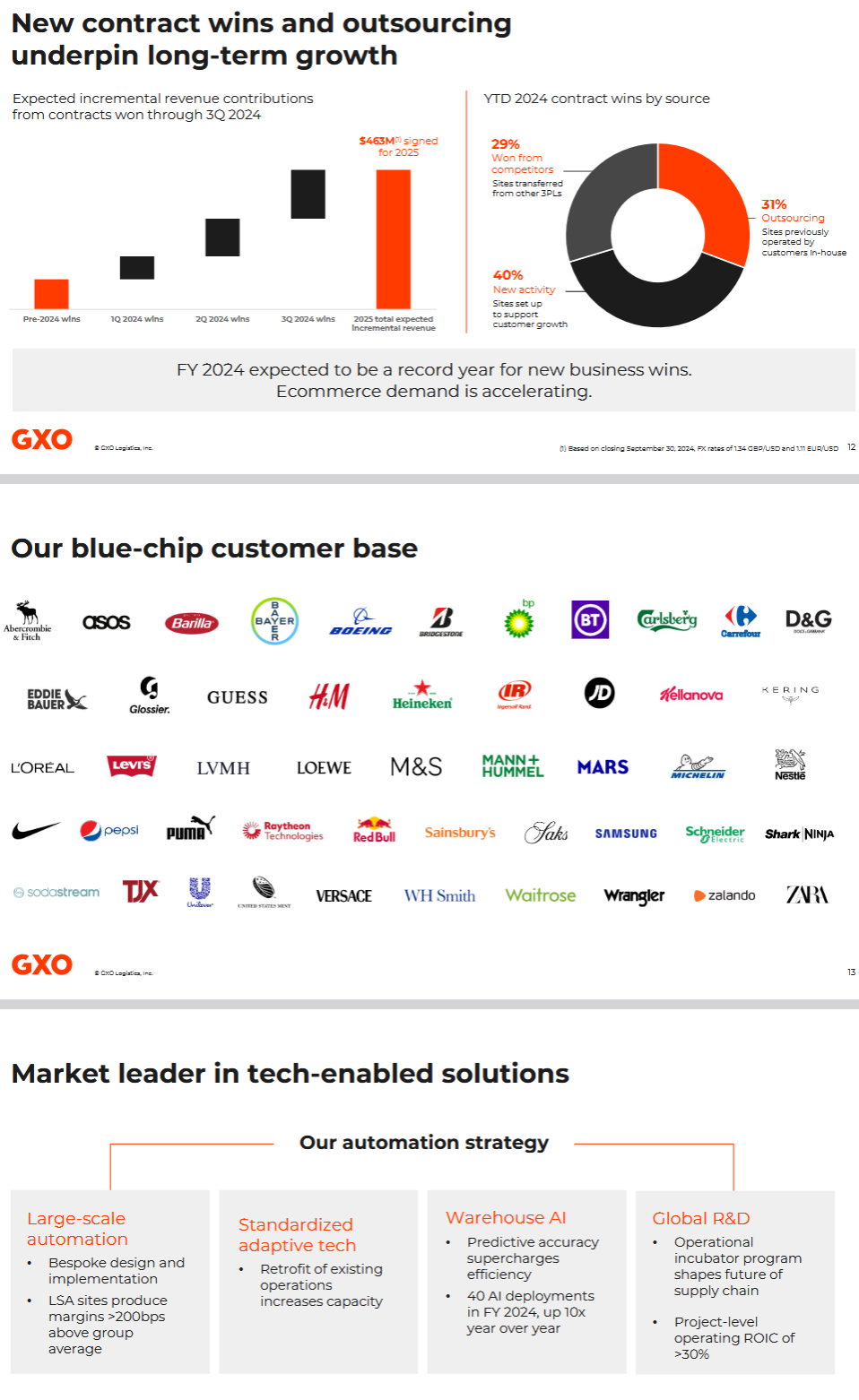

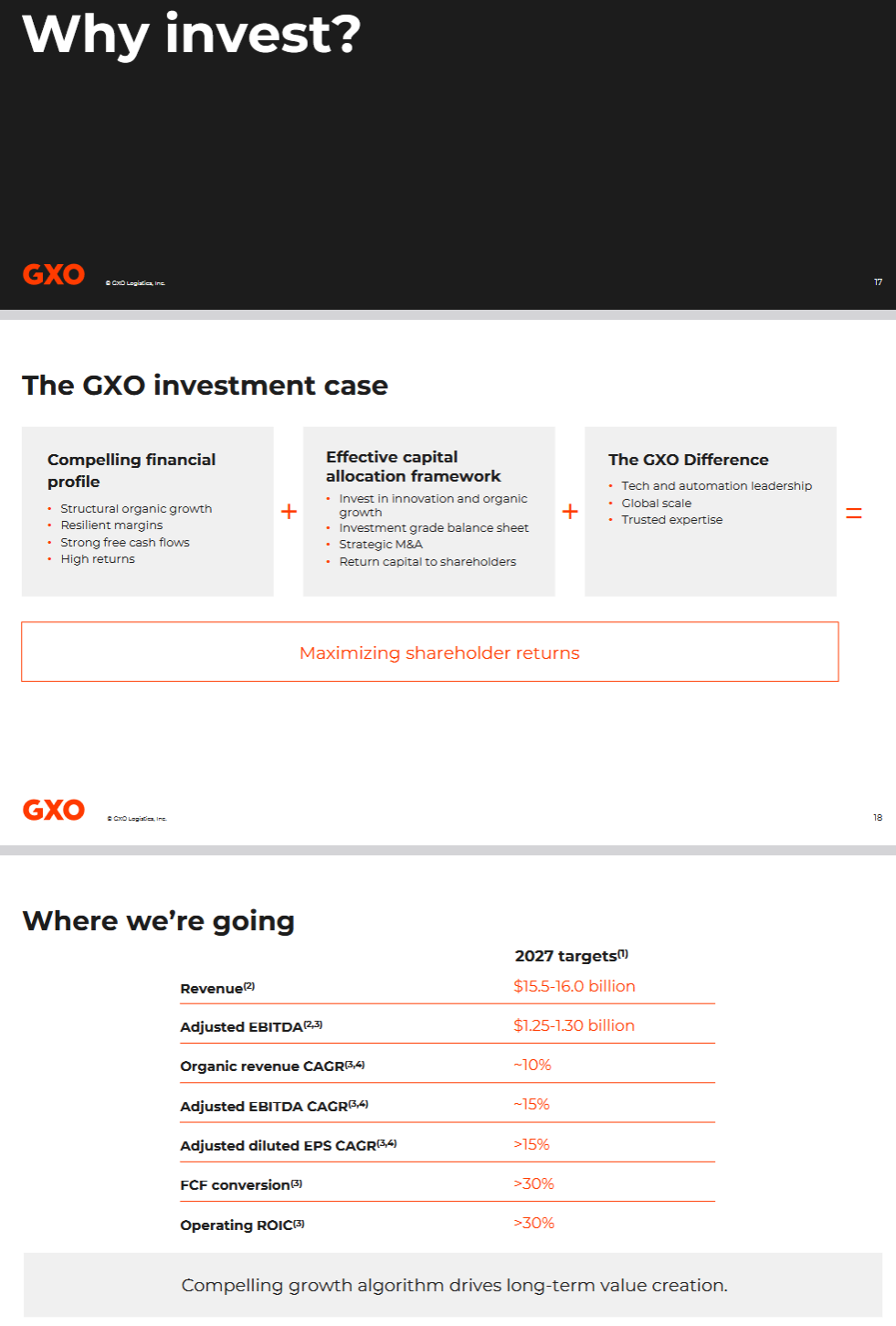

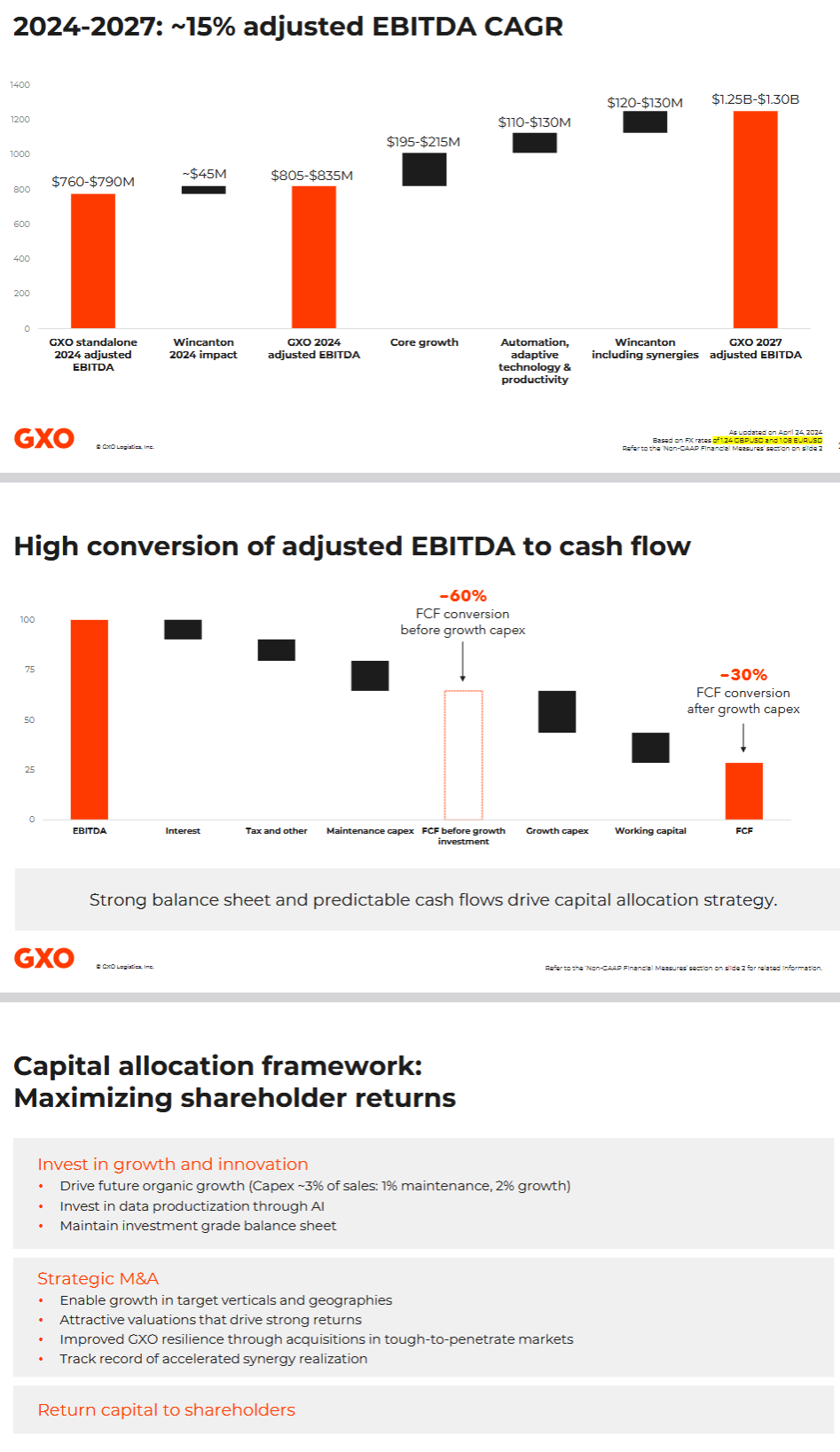

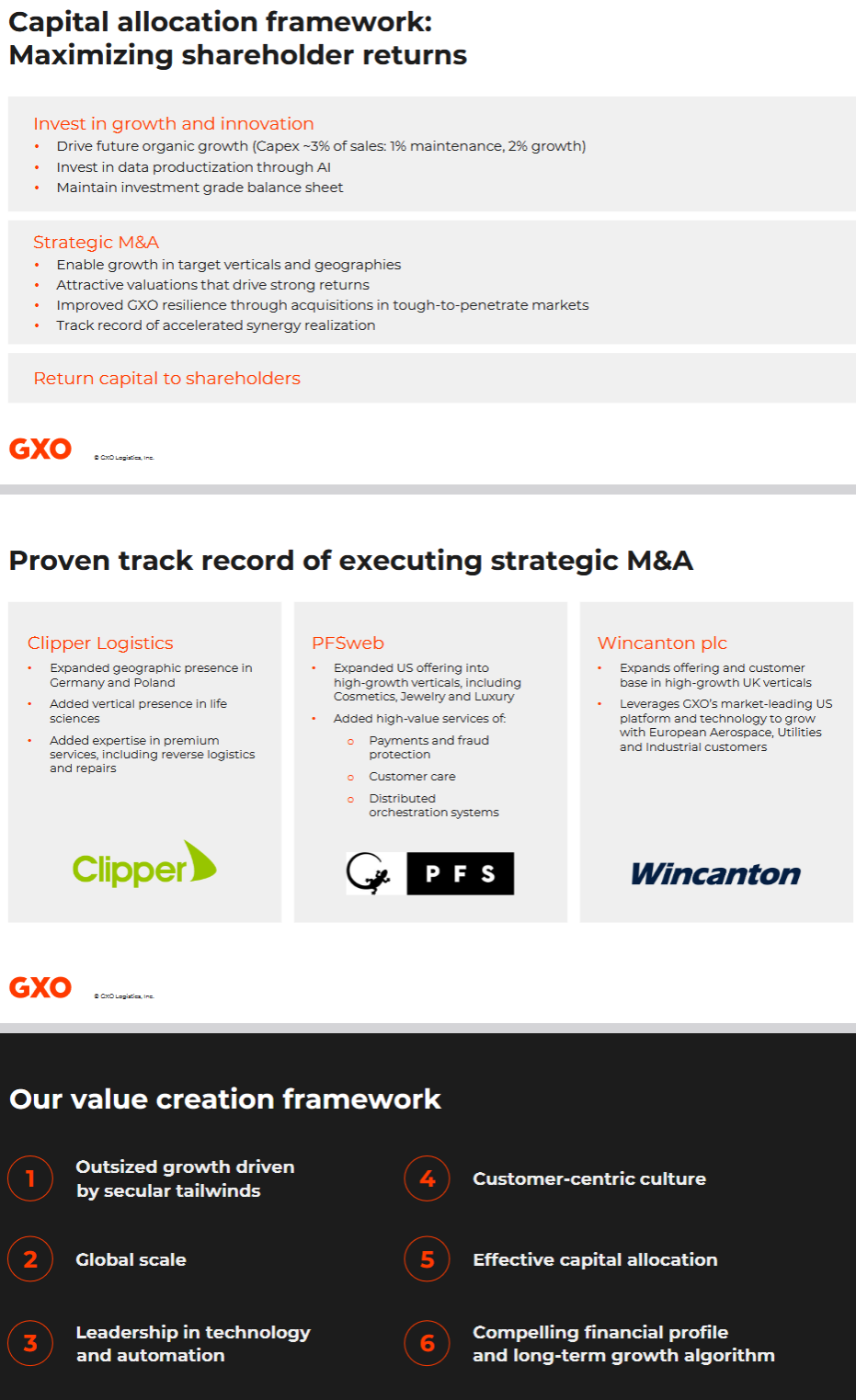

GXO Logistics Update

2 Key Overhangs on the Stock:

#1 – Surprise retirement of the CEO and information vacuum until new one is appointed:

Malcolm Wilson, the CEO of GXO Logistics, has announced his plans to retire in 2025 (he is currently 65 years old). Here are the key details about his retirement:

- Wilson informed the board of directors about his intention to retire and will continue to lead the company during the executive search process for his successor.

- He has been serving as CEO since August 2021 when GXO was spun off from XPO Logistics.

- During Wilson’s tenure, GXO experienced significant growth: The company grew to 130,000 employees and over 200 million square feet of facility space across the Americas, Europe, and Asia Pacific. Revenue increased from $7.9 billion in 2021 to $11 billion in the twelve months ended September 30, 2024. Adjusted EBITDA rose from $633 million in 2021 to $757 million in the same period. GXO achieved a return on invested capital of more than 30% per year. Under Wilson’s leadership, GXO made several acquisitions, including Clipper Logistics and Wincanton.

- Brad Jacobs, chairman of the GXO Board of Directors, praised Wilson’s contributions to both GXO and its legacy parent XPO, spanning nearly a decade.

- The news of Wilson’s retirement came as a surprise to many inside and outside the company.

- There have been reports of GXO exploring sale options in recent months, but the board has turned down several acquisition offers and intends to remain an independent company.

- Wilson described his time at GXO as “the highlight of my three decades in logistics.”

- The announcement of Wilson’s retirement led to a nearly 12% drop in GXO’s shares after regular trading in New York on the day of the announcement.

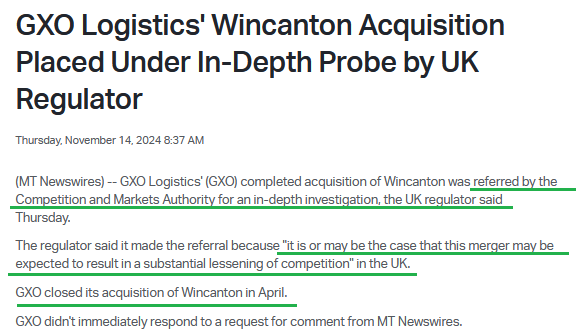

- GXO is currently working through regulatory hurdles for its acquisition of Wincanton.

- The company will now focus on finding a suitable successor to lead GXO Logistics into its next phase of growth and innovation in the contract logistics industry.

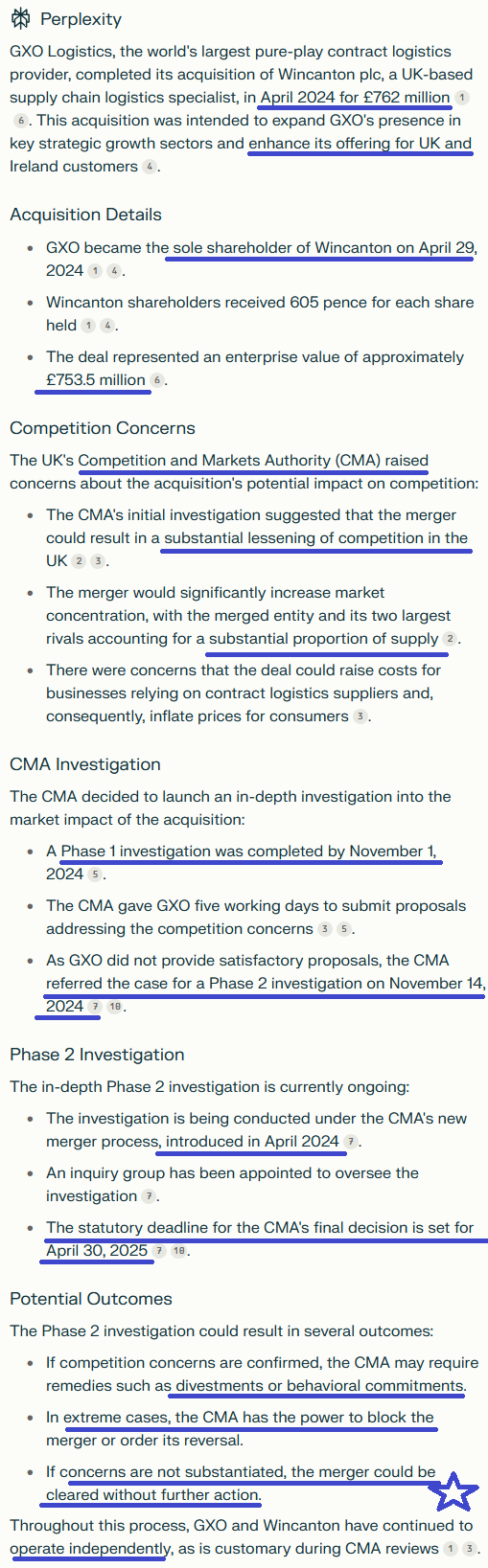

#2 – Referral of Wincanton acquisition to CMA in UK (after the fact):

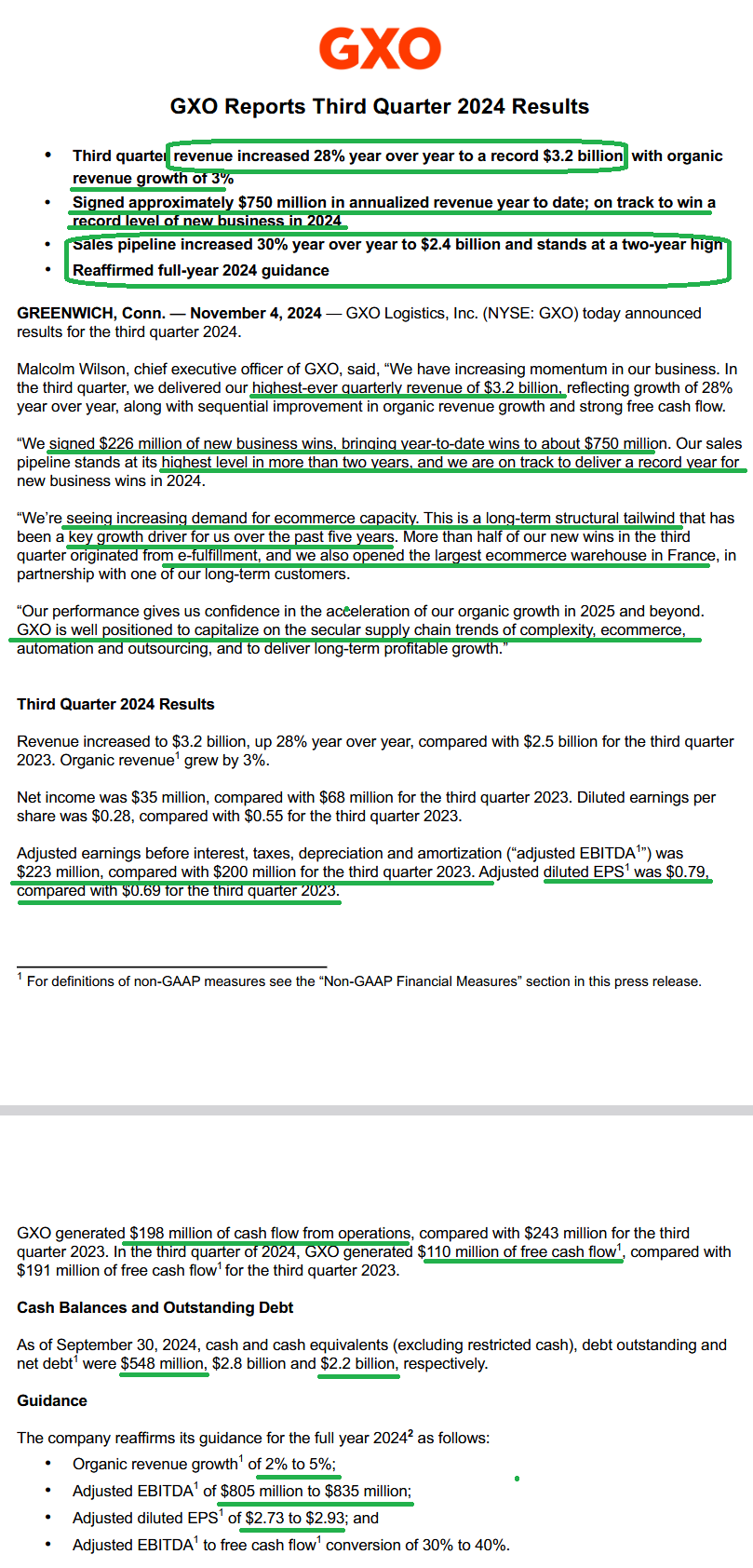

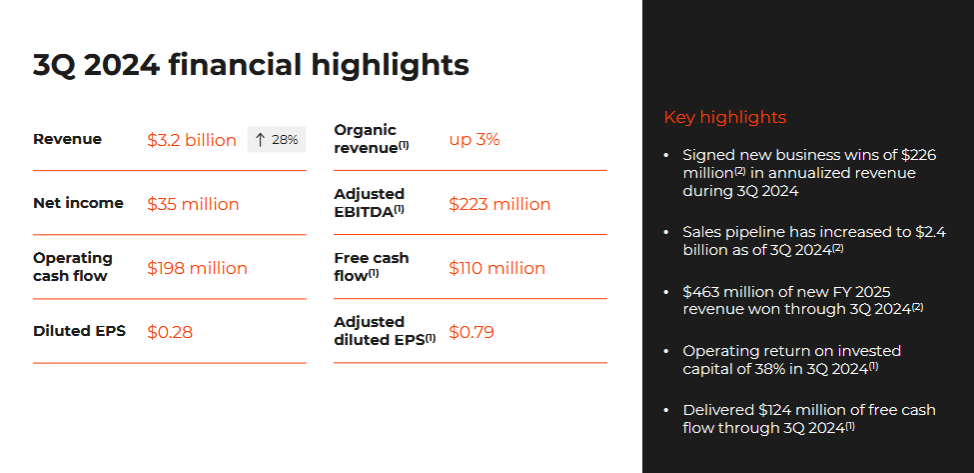

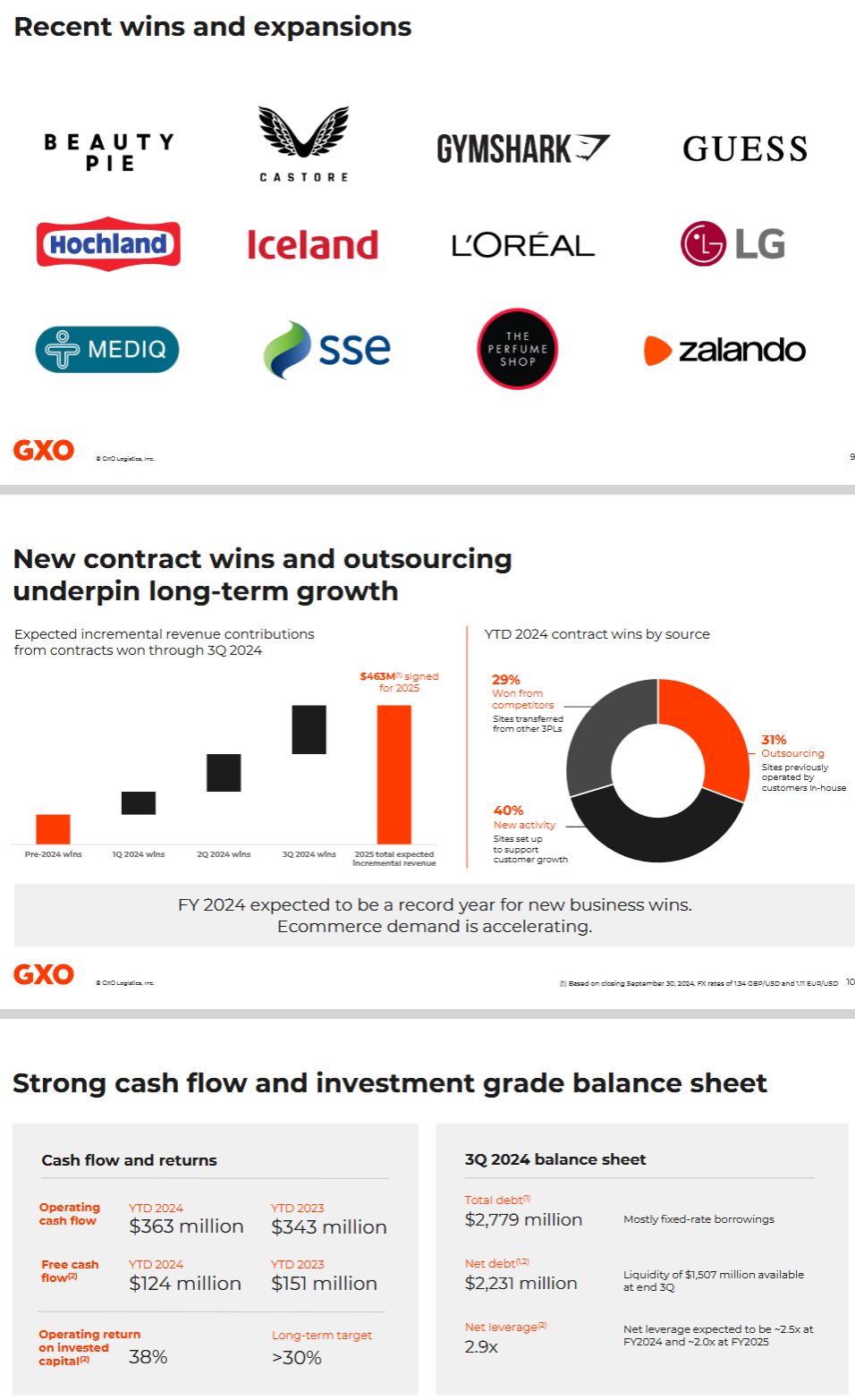

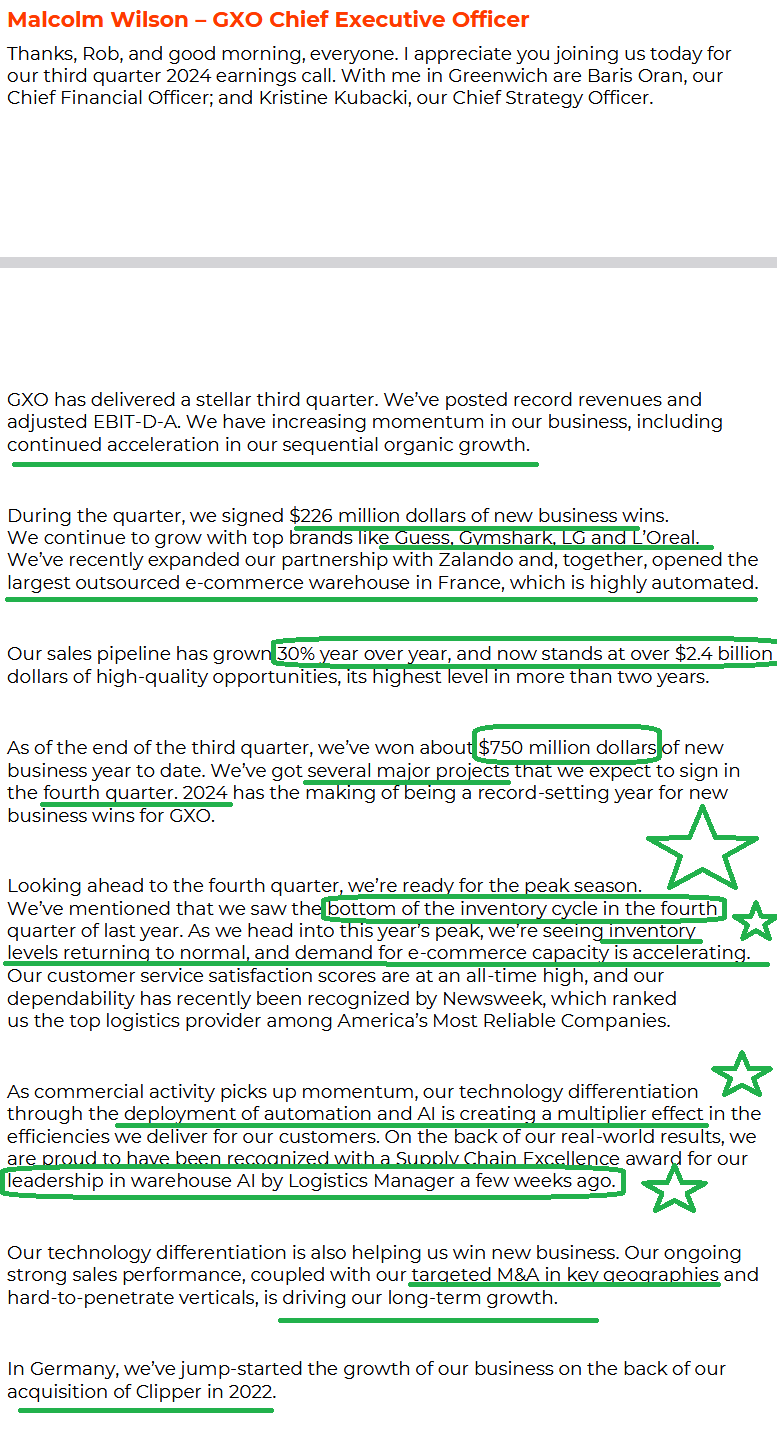

Earnings Results:

Key Points from Earnings Call:

Key Points from Earnings Call:

General Market

The CNN “Fear and Greed” declined from 30 last week to 28 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

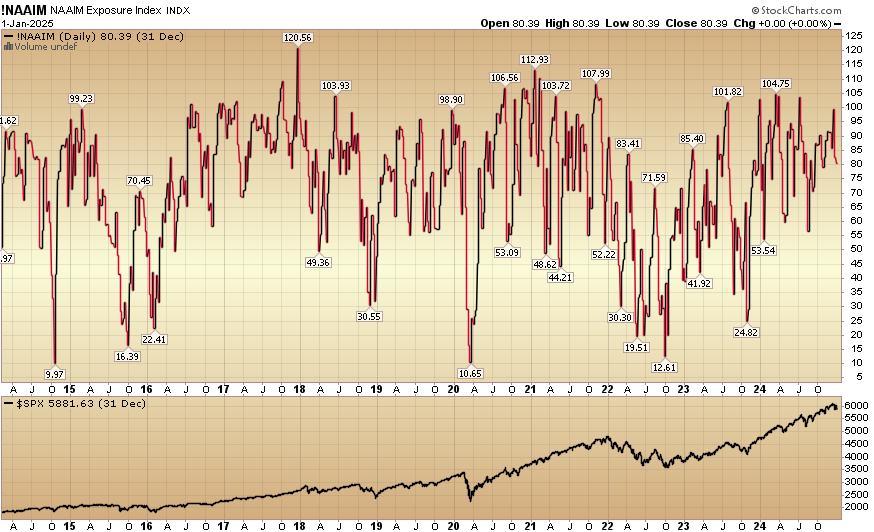

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) declined to 80.39 this week from 82.50% equity exposure last week.

Our podcast|videocast will be out tonight. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our 2024 raises. You could not be better positioned for what we believe will be a highly rewarding year in 2025. This view is based on much of the data we have shared in recent weeks on our podcast|videocast(s), as well as our proprietary methods of expressing and executing upon those views on your behalf.

We re-opened to smaller accounts $1M+ again starting last week (because we want to be fully positioned as soon as possible before the inauguration – based on some of the data we have referenced on recent podcast|videocast episodes) and will remain open for the next couple of weeks (but close no later than the inauguration).

Congratulations to all of you I had the pleasure of speaking with and on-boarding last week – after we opened up. We expect your applications to be approved before the end of this week by IB so that we can begin deploying capital immediately.

To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms