The November survey covered 388 managers with $1.2 trillion in assets under management.

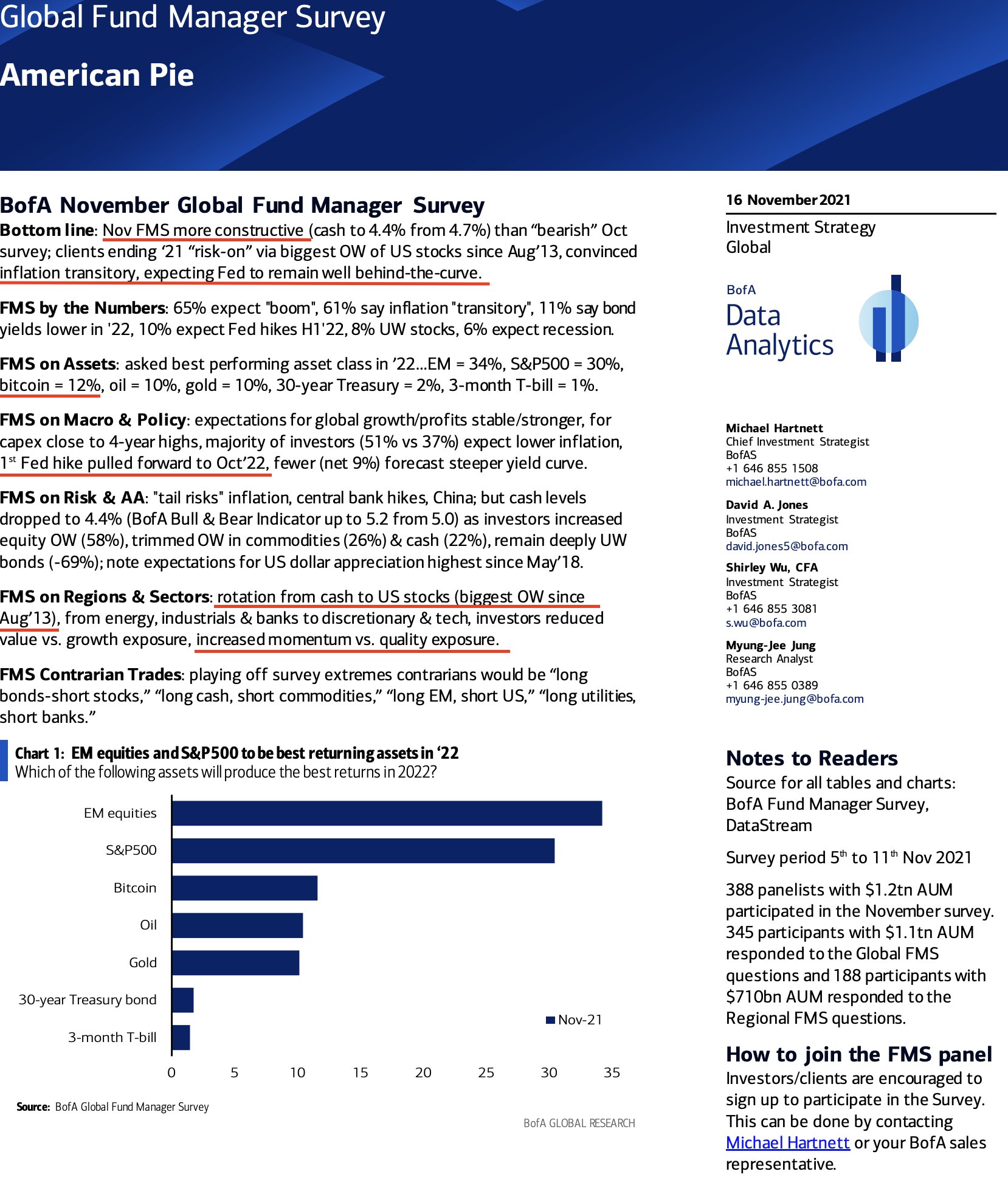

OUTLOOK:

-Managers say emerging market equities will produce the best returns next year, by a 34% to 30% margin over the S&P 500.

-Bitcoin was forecast to be the best asset next year by 12%.

-Global growth expectations have stabilized. A net 3% expect improvement, compared to a net 6% who did not last month.

-Just 6% say there will be a recession in the next 12 months.

-Those expecting a steeper curve fell to the lowest level since February 2019.

-Majority Thinks Inflation Is Transitory At 61%. 35% say permanent.

-Investors now see on average 1.5 Fed rate hikes next year, up from 1.1 last month.

-39% expect 2 rate hikes in 2022.

-80% expect the Fed to raise rates between now and 1Q23.

-51% expect lower inflation over the next 12 months.

SENTIMENT:

-Investors are heading into year end in a “risk-on” mood, having reduced cash allocations to 4.4%.

-Managers expect the Federal Reserve to remain “well behind the curve” in setting its monetary policy (not expecting the Fed to tighten aggressively).

-Fears about price pressures abated, investors rotated out of inflation assets, to discretionary and tech from energy, industrial and banks, while reducing value exposure to the benefit of growth.

-59% majority thinks bitcoin is in a bubble.

POSITIONING:

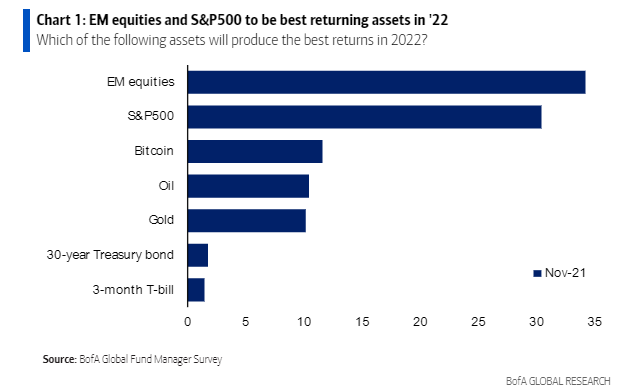

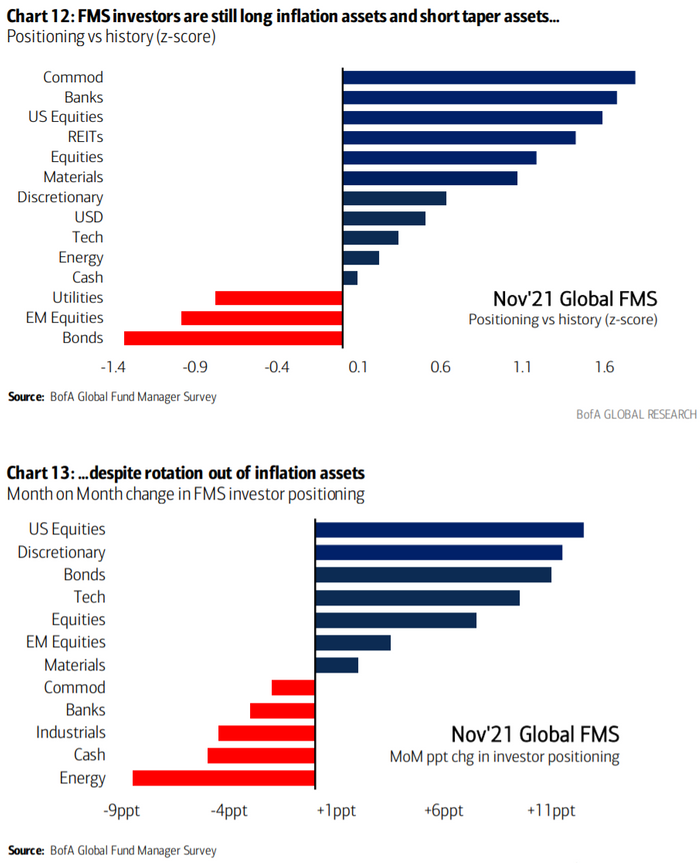

-Positioning vs. history: OW Commodities, Banks, US equities, REITs, Materials; UW Bonds, EM equities, Utilities.

-MoM positioning changes: Increases in US equities, Discretionary, Bonds, Tech, EM equities; Decreases in Energy, Cash, Industrials, Banks, Commodities.

-Most overweight to U.S. equities in eight years.

-Allocation to U.S. equities jumped 13 points in November to 29% overweight — the highest reading since August 2013.

-The monthly change saw investors sour on inflation plays, as energy, industrial and banks positions declined, while U.S. equities, consumer discretionary, bonds and tech improved.The monthly change saw investors sour on inflation plays, as energy, industrial and banks positions declined, while U.S. equities, consumer discretionary, bonds and tech improved.

-Nov positioning more constructive (cash to 4.4% from 4.7%)

-Investors increased their overall equity overweight and trimmed their overweight in commodities while remaining deeply underweight on bonds.

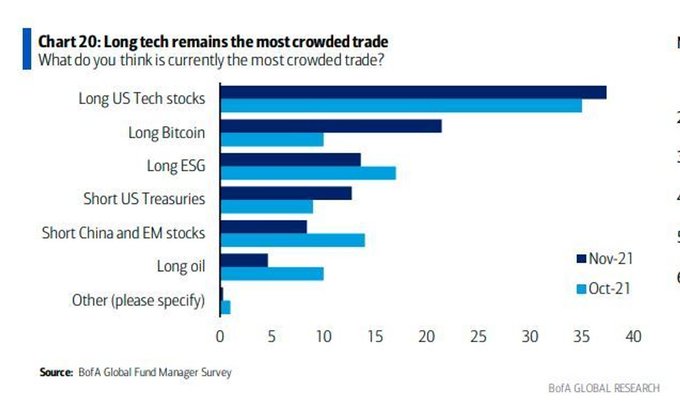

MOST CROWDED TRADES:

1. Long Tech Stocks 37%

2. Bitcoin 21%

3. Long ESG 14%

4. Short US Treasuries 13%

5. Short China/EM 8%

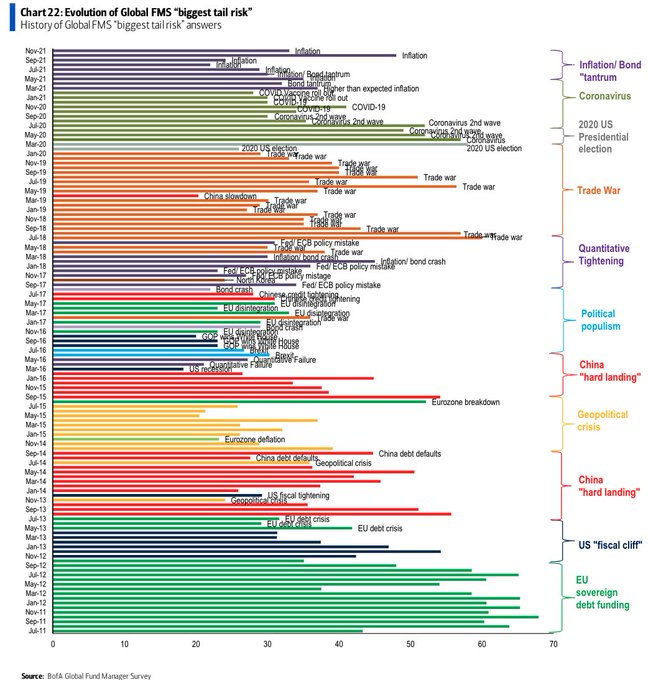

BIGGEST TAIL RISKS:

1. Transitory inflation (33%)

2. Rate hikes (22%)

3. China (20%)

4. Asset bubbles (16%)

BANK OF AMERICA COMMENTARY: