The October survey covered 371 managers with $1.1 Trillion in assets under management.

OUTLOOK:

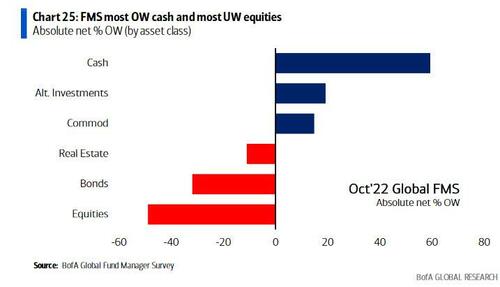

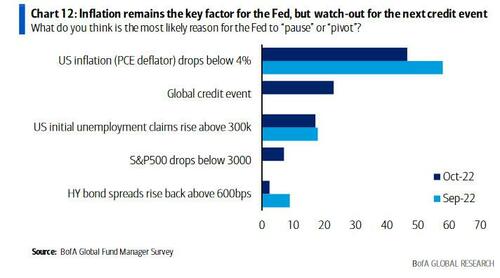

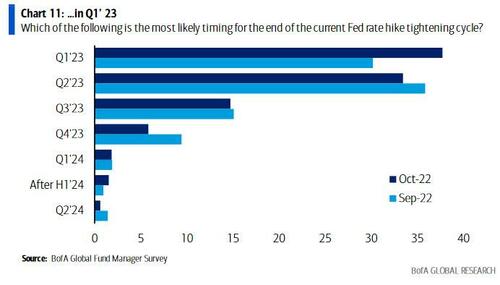

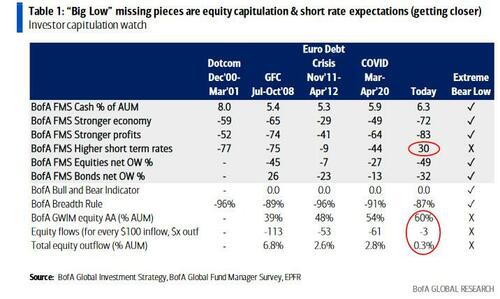

-38% (majority) of FMS investors expect the Fed tightening cycle to end in Q1 2023 – one quarter faster than a month ago:

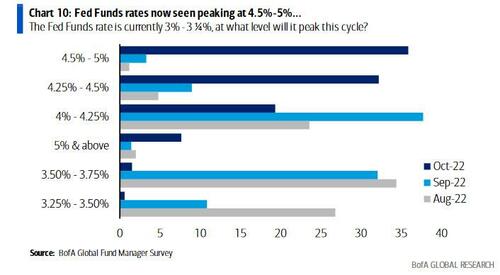

-Fed funds rate is now seen peaking around 4.5% – 5.0%, up 50bps in the past month:

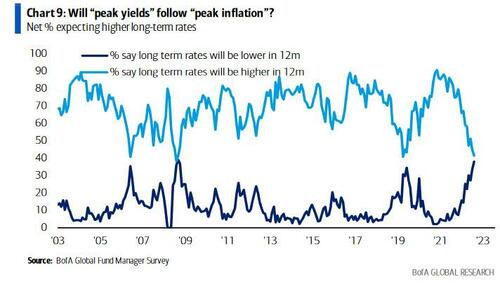

-Most investors since Nov’08 expect lower bond yields next 12 months:

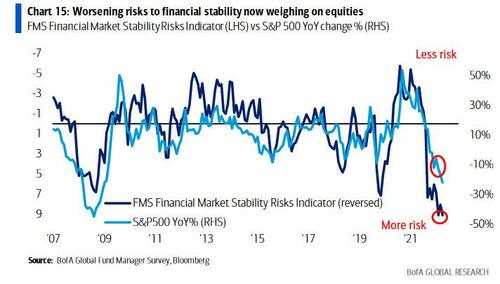

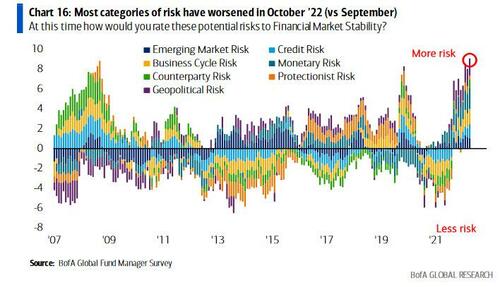

-BofA’s FMS financial market stability risk metrics are at all-time high.

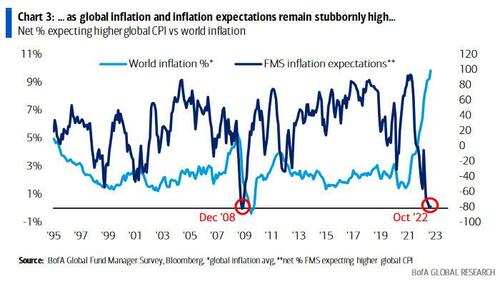

-FMS inflation expectations are finally tumbling.

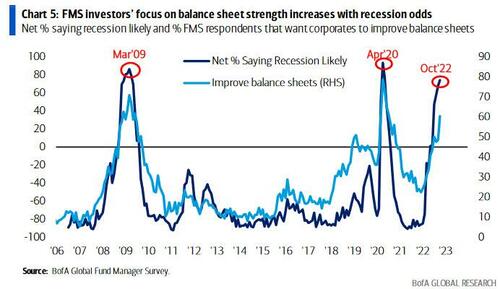

-Global growth expectations net -72%, near all-time low:

-Global growth expectations net -72%, near all-time low:

SENTIMENT:

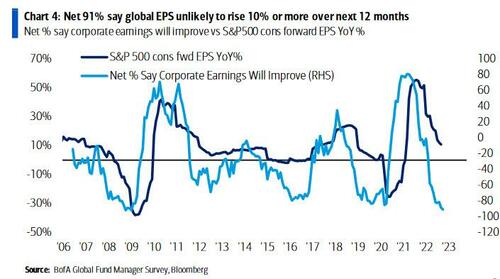

– 91% of FMS investors (net) say that global corporate earnings are unlikely to rise 10% or more in the next year, the most since the GFC

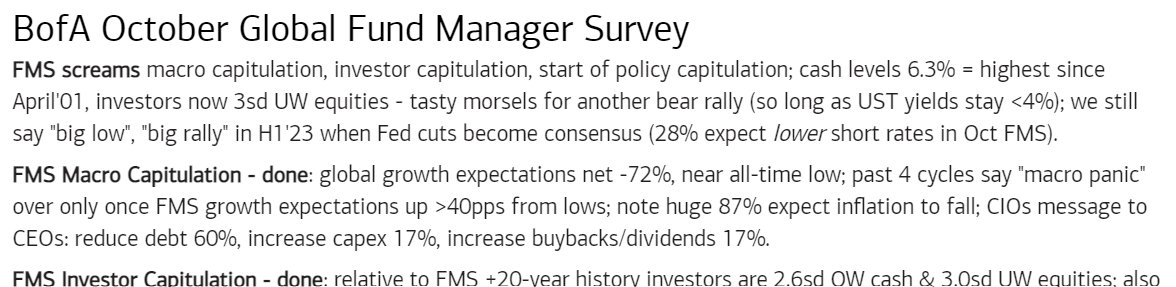

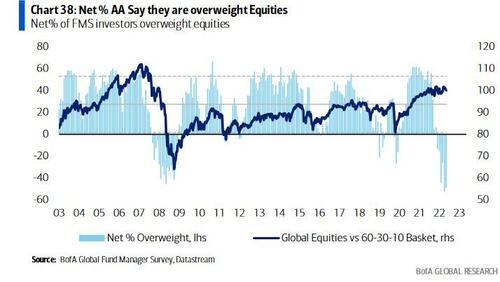

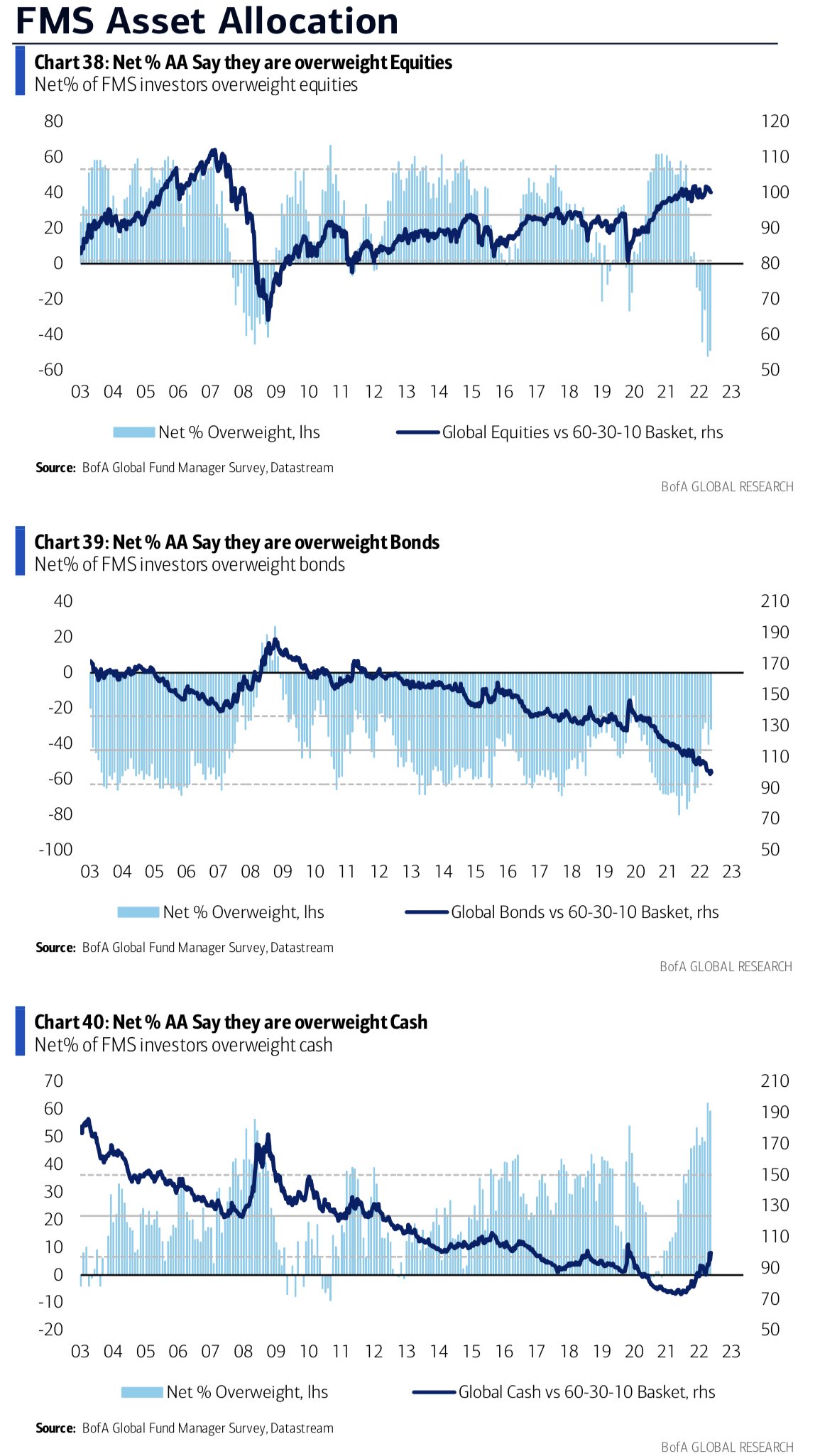

POSITIONING:

POSITIONING:

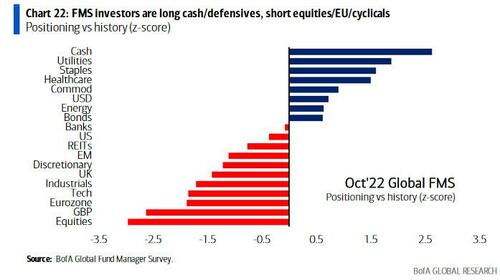

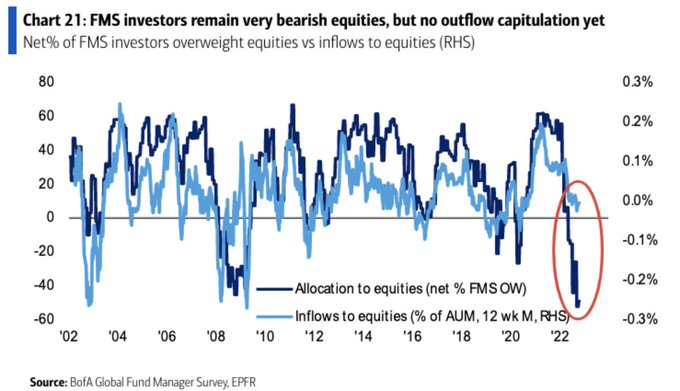

-Investors are now 3-sigma Underweight equities, surpassing even the panic during the peak of the 2008-2009 GFC:

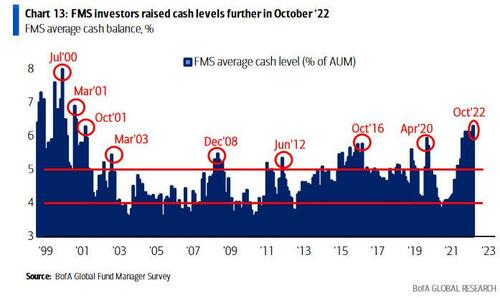

-Relative to FMS +20-year history investors are 2.6-sigma OW cash:

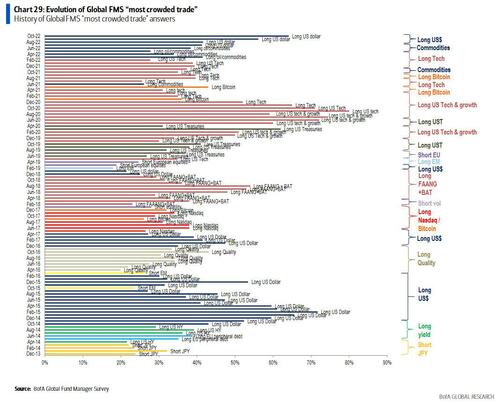

MOST CROWDED TRADES:

MOST CROWDED TRADES:

-Long USD:

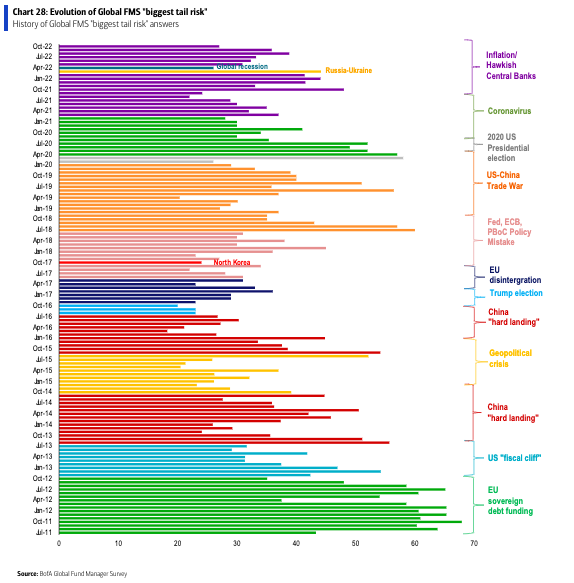

BIGGEST TAIL RISKS:

BANK OF AMERICA COMMENTARY:

Contrarian trades: long sterling vs USD, long stocks vs cash, long EU stocks vs US, long consumer discretionary vs healthcare.