Data Source: Finviz

Indicator of the Day (video): Volatility index – CBOE S&P 500 6-Month

Quote of the Day…

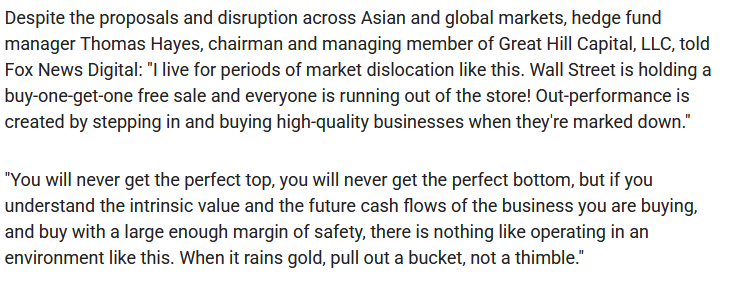

Tom Hayes – Quoted in Fox Business article – 4/7/2025

Thanks to Preston Mizell for including me in his article on Fox Business. You can find it here:

Thanks to Preston Mizell for including me in his article on Fox Business. You can find it here:

Click Here to View The Full Fox Business Article

Be in the know. 30 key reads for Tuesday…

- Scott Bessent says up to 70 nations want to negotiate over Trump’s tariffs (foxbusiness)

- Musk made direct appeals to Trump to reverse new tariffs, Washington Post reports (reuters)

- Bessent Sees ‘Good Deals’ Potential as US Works Priority List (bloomberg)

- Top Vietnam Official Rushes to Washington for Talks on Trade (bloomberg)

- Bessent Says Everything Is on Negotiating Table With Tariffs (bloomberg)

- Can companies exploit differences between Trump’s tariff rates? (ft)

- Vietnam to buy US defence, security products to tackle trade gap (reuters)

- Watch CNBC’s full interview with Treasury Secretary Scott Bessent (youtube)

- The False Tariff Headline That Sent Stocks on a $2 Trillion Ride (wsj)

- Some US consumers stockpile goods ahead of Trump’s new tariffs (reuters)

- Levi’s Earnings Beat Forecasts. Tariffs to Have ‘Minimal Impact’ This Quarter. (barrons)

- “Risk-Reward is Skewed To The Upside”: Goldman Traders Turn Bullish (zerohedge)

- Hedge funds pile up record short bets against stocks as traders go into ‘self-protection mode’ (cnbc)

- US Stock Market Outlook: From ‘Priced to Perfection’ to Time to Buy (morningstar)

- 3 Reasons for Hope as the Market Selloff Continues (barrons)

- 124 Stocks Hit Undervalued Territory in Tariff Selloff (morningstar)

- 3 Stocks to Buy and Hold During Tariff Chaos (morningstar)

- Bank of America, Chewy, and 16 More Stocks to Help You Hide From Tariff Chaos (barrons)

- Alibaba Chases International AI Users With New Qwen Upgrades (bloomberg)

- DeepSeek, Alibaba help China narrow gap with US in leading AI models: Stanford report (scmp)

- China state firms pledge to boost share purchases to calm markets (reuters)

- China Traders Boost Monetary Easing Bets as Tariffs Roil Markets (bloomberg)

- China’s Record Equity Risk Premium Bodes Well for State Buying (bloomberg)

- China Readies Policies To Counter Tariffs (chinalastnight)

- Many U.S. Companies Plan to Keep China Ties, Survey Finds (wsj)

- Americans Have $35 Trillion in Housing Wealth—and It’s Costing Them (wsj)

- Jeep Maker Stellantis Offers to Help Suppliers Pay Tariff Costs (bloomberg)

- Diageo Reaches Ciroc Deal With LeBron James-Backed Tequila (bloomberg)

- Generac’s new line of generators targets growing data center demand (reuters)

- Advanced Micro Devices Stock Gets a Downgrade. Nvidia and Intel Are Part of the Problem. (barrons)

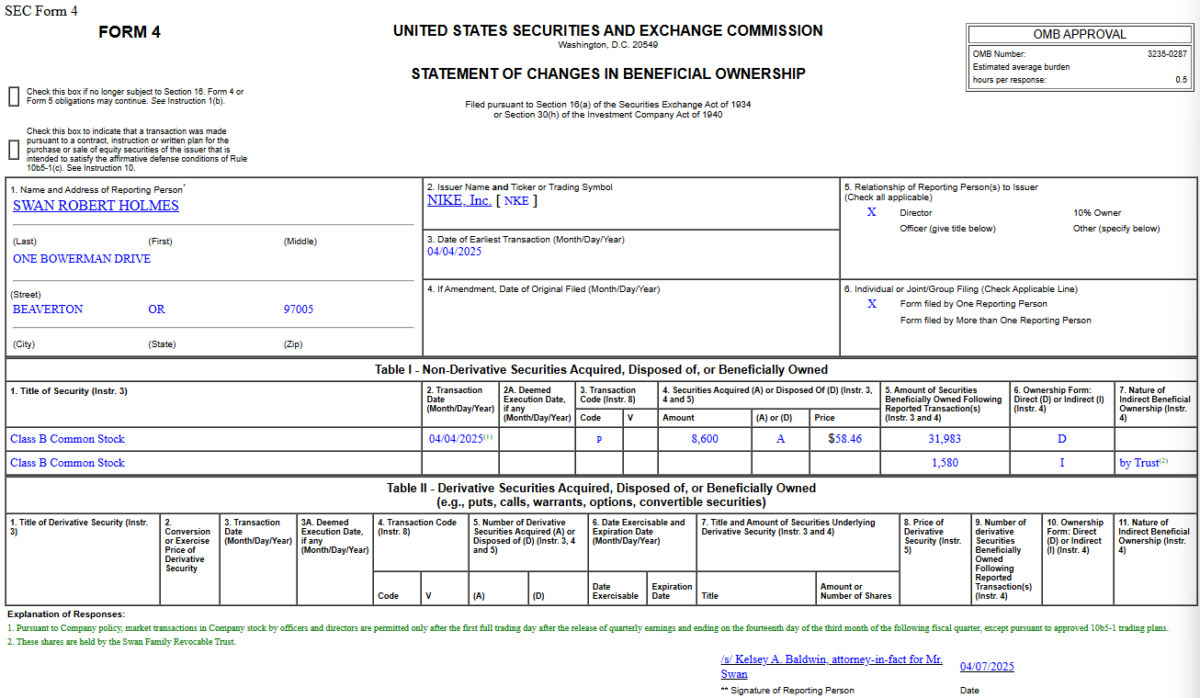

Insider Buying in NIKE, Inc. (NKE)

Where is money flowing today?

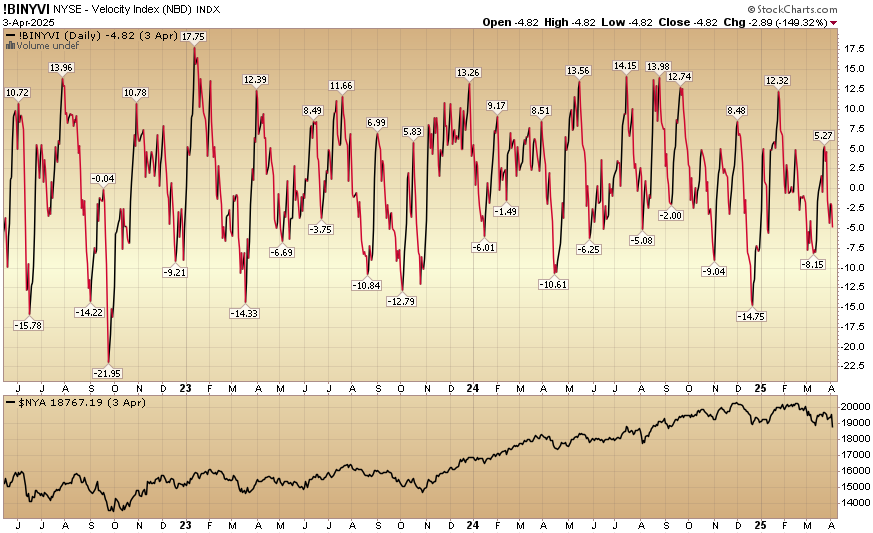

Indicator of the Day (video): NYSE Velocity Index

Quote of the Day…

Be in the know. 20 key reads for Monday…

- China Discusses Accelerating Stimulus to Counter Trump Tariffs (bloomberg)

- Yuan Devaluation Market Chatter Grows as Trade War Worsens (bloomberg)

- China sovereign fund steps in to support stocks plunging on trade war (reuters)

- Goldman Sachs expects significant Chinese fiscal easing to offset tariffs (reuters)

- Vietnam Offers to Remove Tariffs on US After Trump’s Action (bloomberg)

- India Seeks US Trade Talks, Signaling No Retaliatory Tariffs (bloomberg)

- Trump says he can’t say what will happen to markets as his team claims 50 countries are seeking tariff deals (marketwatch)

- South Korea’s Trade Minister Heads to US After Hit by 25% Tariff (bloomberg)

- Philippines Mulls Cutting Tariffs on US Products, Its Trade Chief Says (bloomberg)

- Ishiba to Talk With Trump as Japan’s Nikkei Enters Bear Market (bloomberg)

- Hedge funds capitulate, investors brace for margin calls in market rout (reuters)

- Americans Are Sitting on a Cash Pile as Stocks Reel (wsj)

- The Stock Market’s Fear Gauges Point to a Bounce, Not a Bottom (wsj)

- Treasury Yields Fall. Why They Could Have Further to Drop. (barrons)

- Automakers seek ‘opportunity in the chaos’ of Trump’s tariffs (cnbc)

- Trump’s Trade War Raises Bar for Fed Rate Cuts (nytimes)

- Wall Street Starts to Speak Out Against Trump’s Tariffs (wsj)

- How Global Trade Could Survive Trump’s Tariffs (wsj)

- Warren’s Winning (zerohedge)

- Hisense Partners with GXO to Manage its Logistics Operations in Spain (investing)