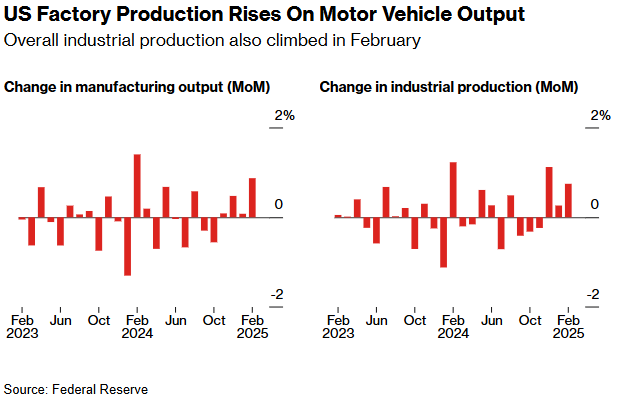

- US Factory Production Rises by Most in a Year on Auto Output (bloomberg)

- Investors Are Ditching U.S. Stocks. When That Could Be a Buy Signal. (barrons)

- China markets are set to outperform Wall Street as U.S. exceptionalism comes to a pause (cnbc)

- China Banks Cut Consumer Loan Rates to Record Low to Spur Demand (bloomberg)

- Confidence in German economy surges as parliament approves huge spending plan (marketwatch)

- Tencent AI Plans Seen as Key for Further China Tech Stock Gains (bloomberg)

- Retail investors ditch buy-the-dip mentality during the market correction (cnbc)

- Big Tech’s data center boom poses new risk to US grid operators (reuters)

- The ‘Energy Transition’ May Be Disappearing, but Renewable Energy Isn’t (barrons)

- Why China is suddenly flooding the market with powerful AI models (ft)

- China Electric Vehicles Roar (Silently) (chinalastnight)

- Dollar Is In The Crosshairs As Europe Jumps US Ship (zerohedge)

- Japan Airlines to buy 17 more Boeing 737-8s (reuters)

- Ram Owner Wants to Bring Cheaper Pickup Back to US (bloomberg)

- Dell CEO explains why he thinks the PC refresh cycle is starting (cnbc)

- The North Face Just Took an Era-Defining ’90s Jacket Off Ice (gq)

- Nike Returns to Sports While Investors Impatiently Await Reset (bloomberg)

- 10 Best Value Stocks to Buy for the Long Term (morningstar)

- March Dot Plot to Highlight Fed Officials’ Outlook (wsj)

- Nvidia Was Once a Hot Stock, Why It’s Now Leaving the Market Cold. (barrons)

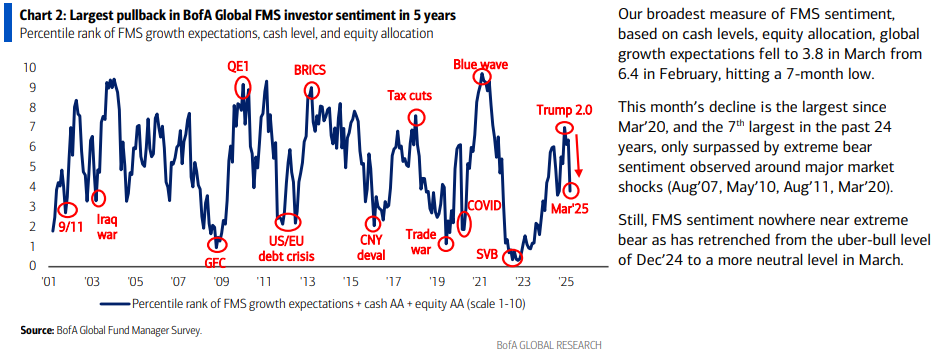

March 2025 Bank of America Global Fund Manager Survey Results (Summary)

The March survey covered 205 institutional fund managers with $477 billion under management. Continue reading “March 2025 Bank of America Global Fund Manager Survey Results (Summary)”

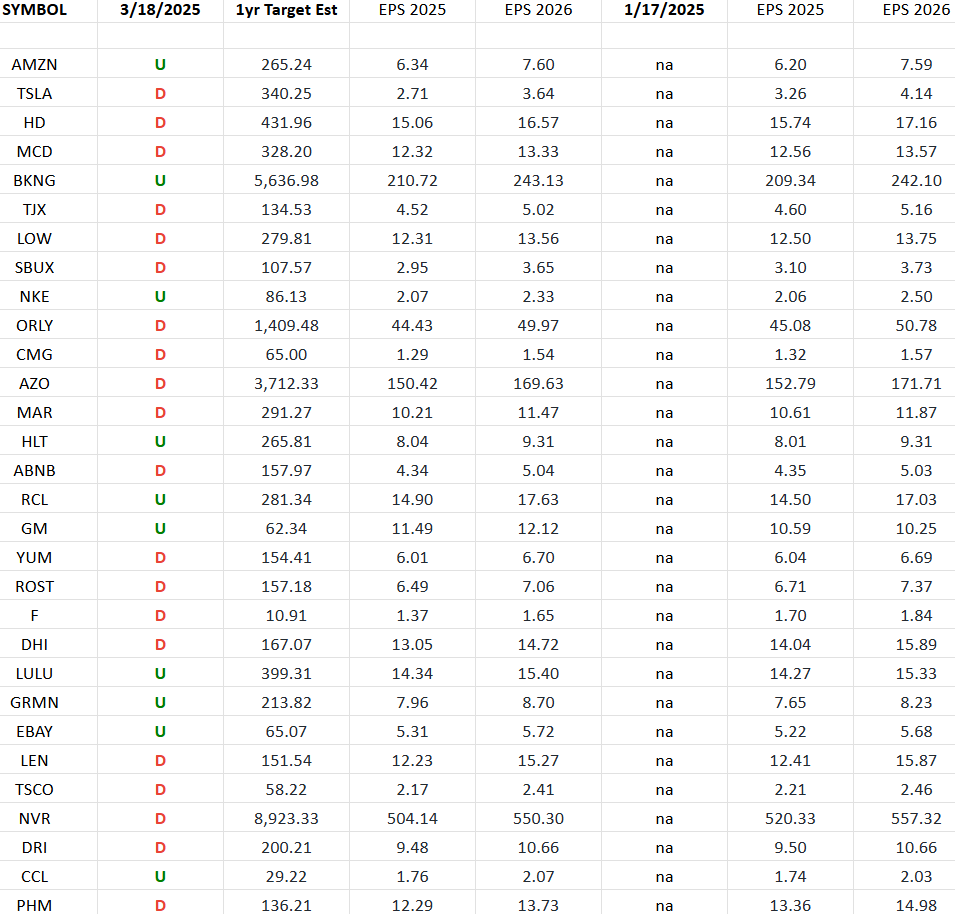

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks.

Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

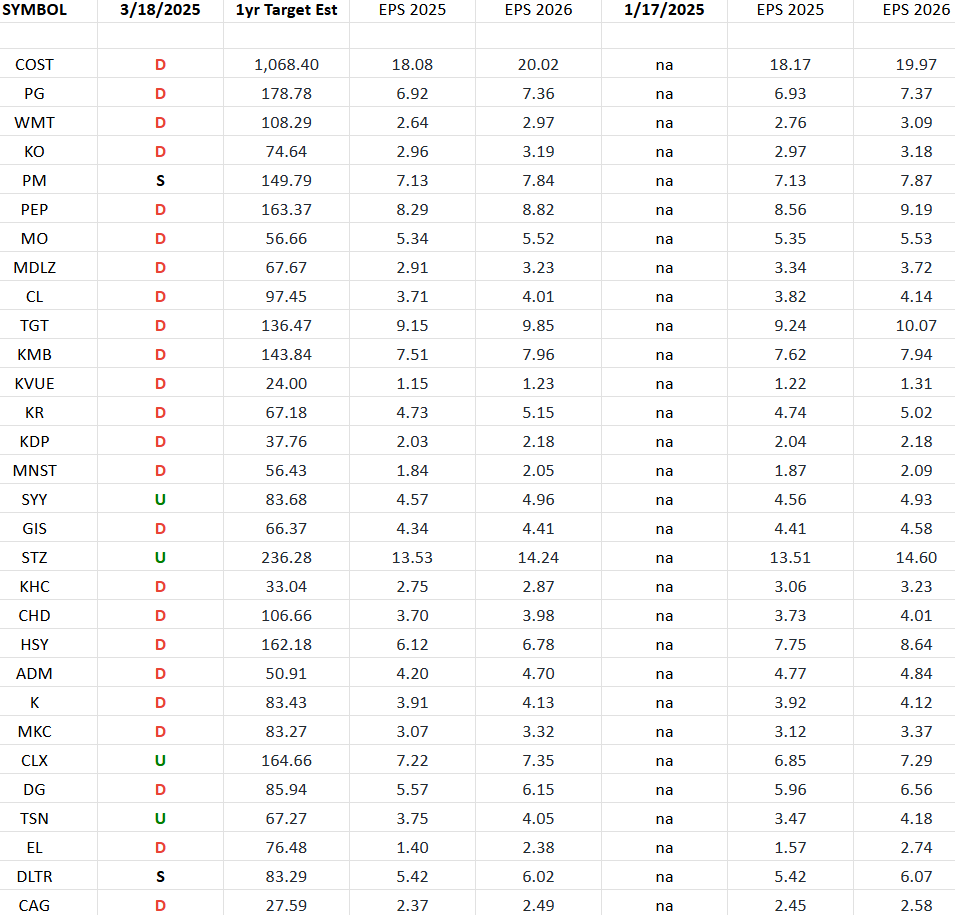

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

Where is money flowing today?

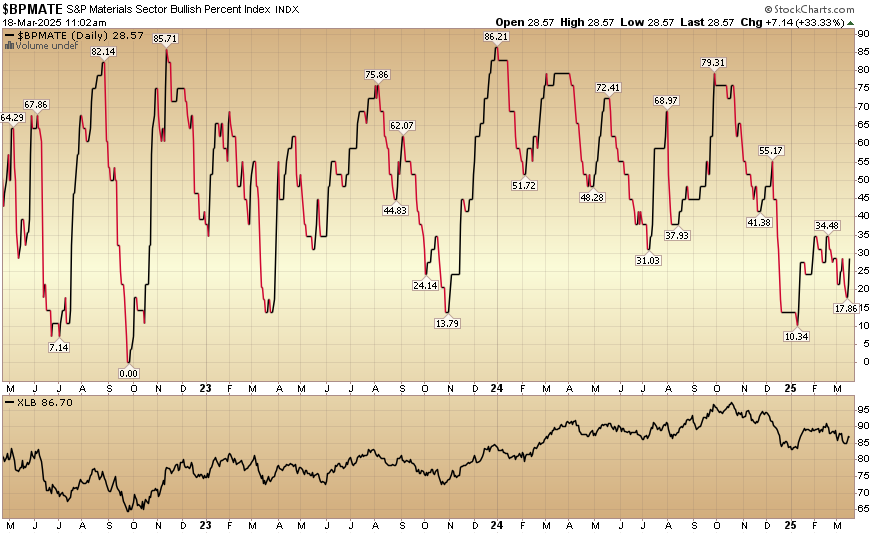

Indicator of the Day (video): Bullish Percent Materials

Quote of the Day…

Be in the know. 26 key reads for Tuesday…

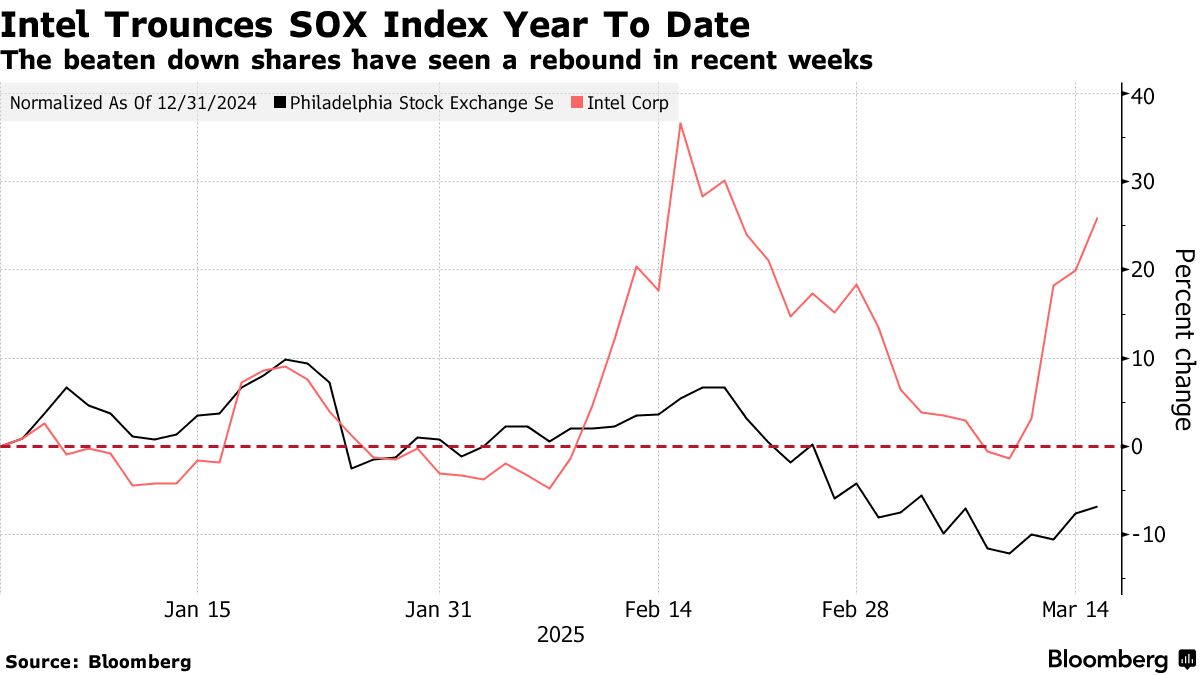

- Intel’s new CEO is putting his money where his mouth is (marketwatch)

- Exclusive: Intel’s new CEO plots overhaul of manufacturing and AI operations (reuters)

- Intel’s New CEO Faces ‘Show Me’ Moment After $22 Billion Rally (bloomberg)

- Why is China spending billions to get people to open their wallets? (bbc)

- Alibaba and Other Chinese Stocks Are Crushing U.S. Shares. Here’s Why. (barrons)

- More China Consumers Feel Better Off, Deutsche Bank Survey Shows (bloomberg)

- China’s Onshore Markets See Record Inflows Despite Trade Angst (bloomberg)

- Hong Kong stocks hit 3-year high on hopes Trump-Xi talks could ease trade tensions (scmp)

- Alibaba’s ‘killer app’: Quark draws positive reviews in China as AI agent race heats up (scmp)

- The Action Plan For Boosting Consumption Includes Stock Market & Real Estate Support (chinalastnight)

- Donald Trump says China’s Xi Jinping to visit US in ‘not too distant future’ (ft)

- Cheap Chinese Cars Are Taking Over Roads From Brazil to South Africa (bloomberg)

- Warren Buffett said it’s best to ‘be greedy when others are fearful,’ Thomas Hayes says (foxbusiness)

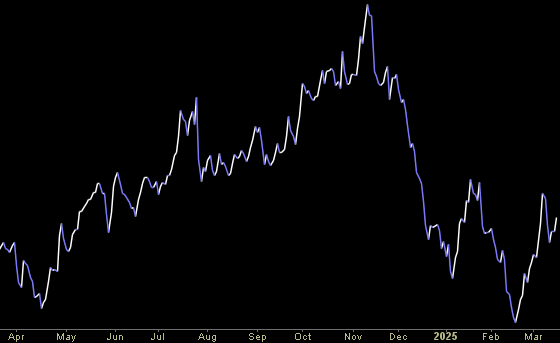

- BofA Survey Shows Biggest-Ever Drop in US Stock Allocations (bloomberg)

- Corporate Insiders’ Buying Burst Gives Confidence to S&P Bulls (bloomberg)

- Bessent Sees No Reason for Recession, Economic Data ‘Healthy’ (bloomberg)

- How many rate cuts does the market expect this year? (foxbusiness)

- Cadillac expects one of every three vehicle sales to be EVs in 2025 (cnbc)

- More home builders cut prices to lure buyers put off by high costs (marketwatch)

- US Housing Starts Increase by More Than Forecast After Storms (bloomberg)

- Germany’s economic sentiment hits 2-year high, EU exports to US soar (yahoo)

- Euro hits five-month high before German vote on massive spending surge (streetinsider)

- Short Positioning Can Push Euro Yet Higher (zerohedge)

- What to Expect During Disney’s Annual Meeting (morningstar)

- Norwegian Cruise Stock Gets an Upgrade. Why Demand Fears Are Just ‘Noise.’ (barrons)

- Yeti Stock Surges on Deal with Activist (barrons)

Tom Hayes – Fox Business Appearance – Claman Countdown – 3/17/2025

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 17, 2025

Watch in HD Directly on Fox Business News