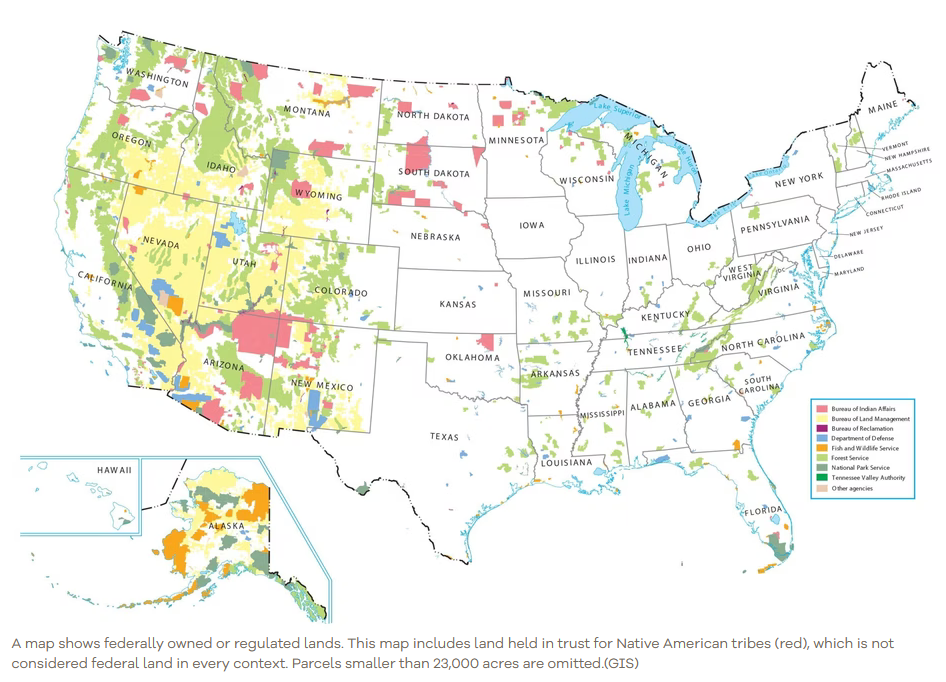

- Federal Land Can Be Home Sweet Home (wsj)

- A Solution to the Housing Shortage (cityjournal)

- Trump Moves Forward With Plans To Use Federal Land To Build Affordable Housing (realtor)

- HUD Secretary Scott Turner and DOI Secretary Doug Burgum Announce Joint Task Force To Use Federal Lands for Affordable Housing (hud.gov)

- Weekly mortgage demand from homebuyers is strongest in nearly two months (cnbc)

- Home buyers could see more deals on new homes as builders worry about a pullback (marketwatch)

- US New-Home Sales Rise Slightly Following Weather-Related Plunge (bloomberg)

- China Stocks Getting Back Into Investors’ Good Books (wsj)

- ‘China is back’ with stock appetite at post-2021 high, Morgan Stanley raises targets (scmp)

- China seen leading in chipmaking investment again in 2025, SEMI group says (reuters)

- China Floods the World With AI Models After DeepSeek Success (bloomberg)

- China Will Ramp Up Stimulus If Growth Falters, PBOC Adviser Says (bloomberg)

- Alibaba Teams Up With BMW to Develop AI for Cars in China (bloomberg)

- Alibaba, Ant partner with home province Zhejiang to support China’s AI drive (scmp)

- U.S. Adds Export Restrictions to More Chinese Tech Firms Over Security Concerns (nytimes)

- Nvidia Stock Stutters. Fears China Could Tighten AI Chip Controls Intensify. (barrons)

- Nvidia’s China sales face threat from Beijing’s environmental curbs (ft)

- Three Energy Charts Suggest China’s Demand Recovery Underway (zerohedge)

- Are There Now Real Alternatives To The US Equity Market? (zerohedge)

- Dollar Suffers Its Worst Month Since 2023 as Bullish Bets Recede (bloomberg)

- U.S. Faces Uphill Task to Refill Natural Gas Storage for Next Winter (wsj)

- Shell Wants to Be a Natural Gas Behemoth. Oil’s Growth Is Ending. (barrons)

- Boeing production of Patriot component hits record (reuters)

- Bring on the F-47 Fighter Jet (wsj)

- Exclusive: Advance Auto Parts completes mass closures, plans to open over 100 new stores (usatoday)

- 10 Cheap Wide-Moat Stocks for 2025 (morningstar)

- Dollar Tree Loss Widens, Confirms Sale of Family Dollar Business (wsj)

- Mobileye Stock Gains. Why a New Deal Has Shares Soaring. (barrons)

Hedge Fund Tips (PCN) – Position Completion Notification

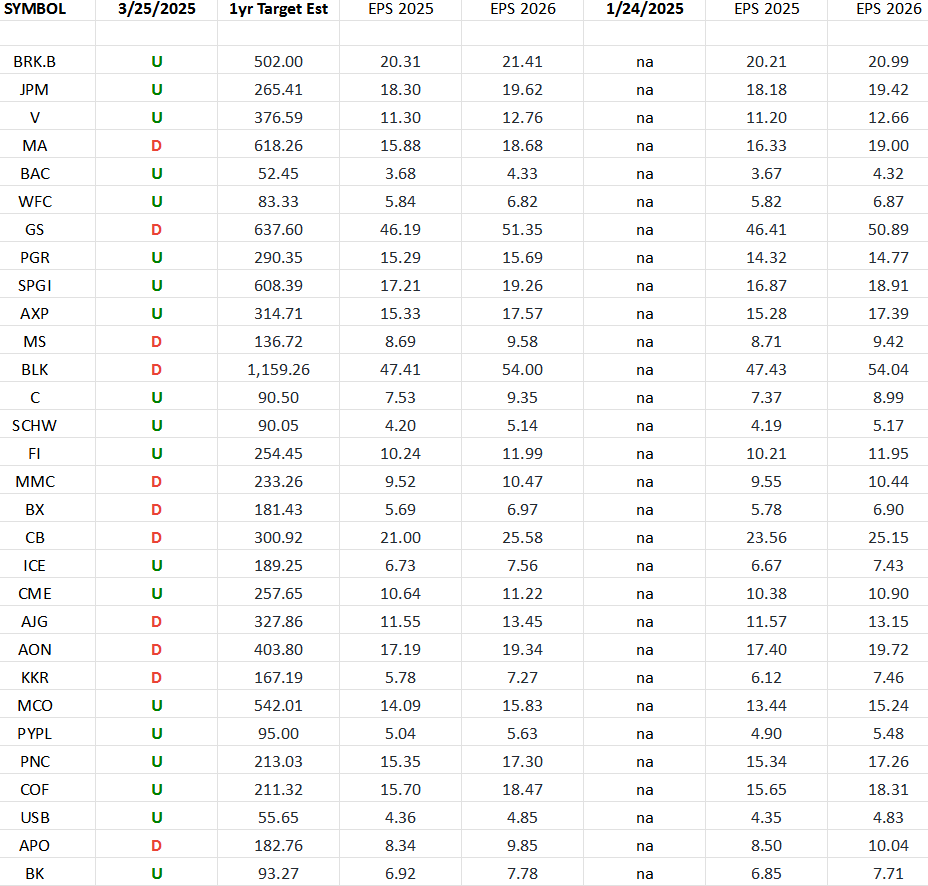

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

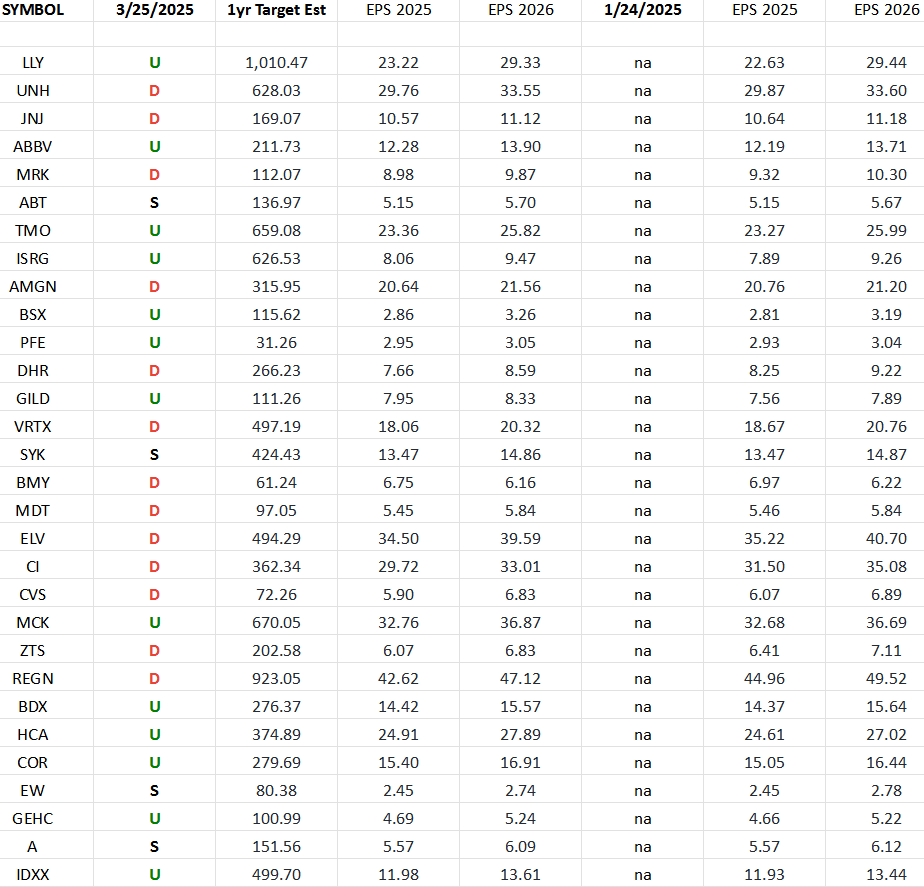

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2025 and 2026 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Where is money flowing today?

Indicator of the Day (video): AAII Bullish Percent

Quote of the Day…

Be in the know. 18 key reads for Tuesday…

- Boeing Goes for Two Defense Wins in a Row With Navy Jet Fighter (barrons)

- Alibaba Stock Gains. Its AI Chips Could Be Gaining Traction in China. (barrons)

- Boeing Gets Lifeline in Pentagon Deal to Build Most Expensive Jet Fighter Ever (wsj)

- China Adviser Urges Boosting Consumption to 70% of GDP by 2035 (bloomberg)

- Alibaba says to restart hiring, sees signs of start of AI bubble in the US (reuters)

- Crown Castle Fires CEO After Selling Business Segments (wsj)

- Retailers Bulk Up Inventories to Blunt Tariff Impact (wsj)

- What Covid’s One-Hit Wonders Should Have Taught Us (wsj)

- Home Prices Likely Kept Climbing in January. Why a Slowdown Is Coming. (barrons)

- Housing Hopes! Goldman Sees Incremental Confidence From Prospective Buyers (zerohedge)

- Rising Temperatures Drive Surge in Energy Demand, IEA Says (wsj)

- German Business Confidence Climbs After Lawmakers Unlock Spending Increase (wsj)

- Tariffs Might Be Lighter Than Expected. It’s a Relief for Markets. (barrons)

- China explores services subsidy to boost weak domestic demand (ft)

- Chinese AI start-ups overhaul business models after DeepSeek’s success (ft)

- American CEOs Visit Beijing, Investors Ask: 5 BYDs or 1 Tesla? (chinalastnight)

- China’s commerce minister meets with Boeing Global president (reuters)

- Smithfield Foods expects growth in sales, profit on strong packaged meats demand (reuters)