Data Source: Finviz

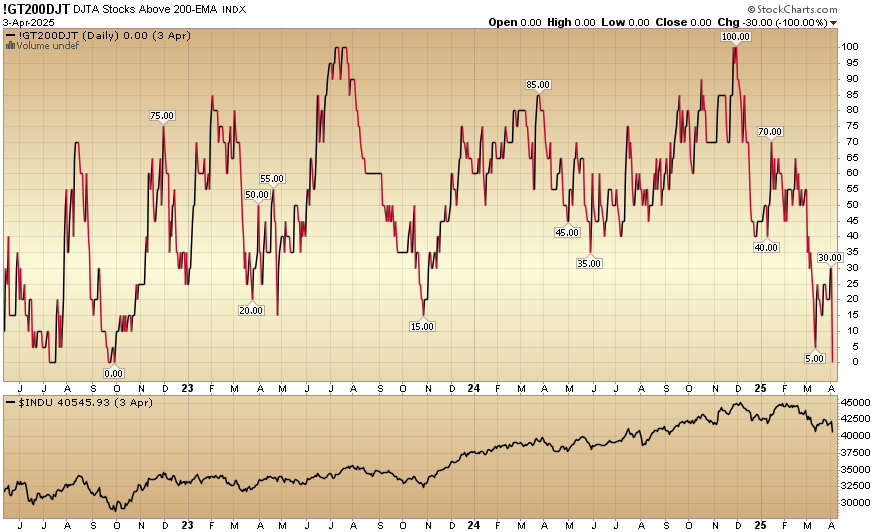

Indicator of the Day (video): DJ Transport Stocks Above 200 EMA

Quote of the Day…

Be in the know. 25 key reads for Friday…

- Why This Is China’s Year in Markets (bloomberg)

- China Retaliates Against Trump Tariffs With 34% Levy on U.S. Goods (barrons)

- Cheap Shein and Temu Finds Are History. This Import Loophole Is Now Closed. (barrons)

- Gold and Foreign Stocks Are Winning. Here Are the Losers. (barrons)

- Donald Trump triggers race to offer US concessions before tariffs hit (ft)

- A Market-Rattling Attempt to Make the American Economy Trump Always Wanted (wsj)

- Ford rolls out discounts — and Volvo, Mercedes eye upping US production as Trump’s auto tariffs rev up (nypost)

- Volvo Cars’ new CEO vows to produce more cars in US (reuters)

- Fed to cut rates five times in 2025 to shore up economy amid tariff storm: Citi (streetinsider)

- Fed to go big with June start to interest-rate cuts, traders bet (yahoo)

- Euro Emerges as Unlikely Winner From Trump’s Trade Shock (bloomberg)

- Dollar Weakens as Investors Seek Safety Elsewhere (wsj)

- Mortgage Rates in US Slip for a Second Week, Dropping to 6.64% (bloomberg)

- Hiring Defied Expectations in March, With 228,000 New Jobs (wsj)

- Intel Gains on Report of Joint Venture Deal With TSMC (bloomberg)

- Alcohol Industry Dodges Worst of Trump’s Tariffs — For Now (bloomberg)

- Consumer Staples Gain on Rush to Safety After Tariffs Spark Market Rout (wsj)

- Exempt or Not, the Chip Industry Won’t Escape Tariffs (wsj)

- Lululemon stock falls as Trump’s tariffs put it in the ‘bullseye.’ This analyst still says buy. (marketwatch)

- The ‘Magnificent Seven’ saw a record $1 trillion wipeout — and Apple led the way (marketwatch)

- Mizuho maintains PayPal stock Outperform rating, $96 target (investing)

- Retail Traders Step In to Buy as Others Flee in Tariff Rout (bloomberg)

- US Energy Chief Plans to Use Federal Land to Build Data Centers (bloomberg)

- These Are Scary Times. Market Downturns Can Be a Buying Opportunity. (barrons)

- Why You Should Ignore Everything Going On in the Market Right Now (barrons)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

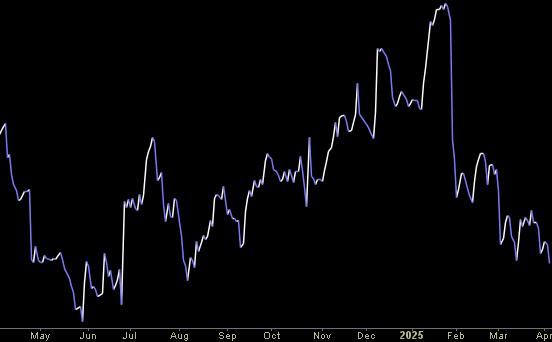

Where is money flowing today?

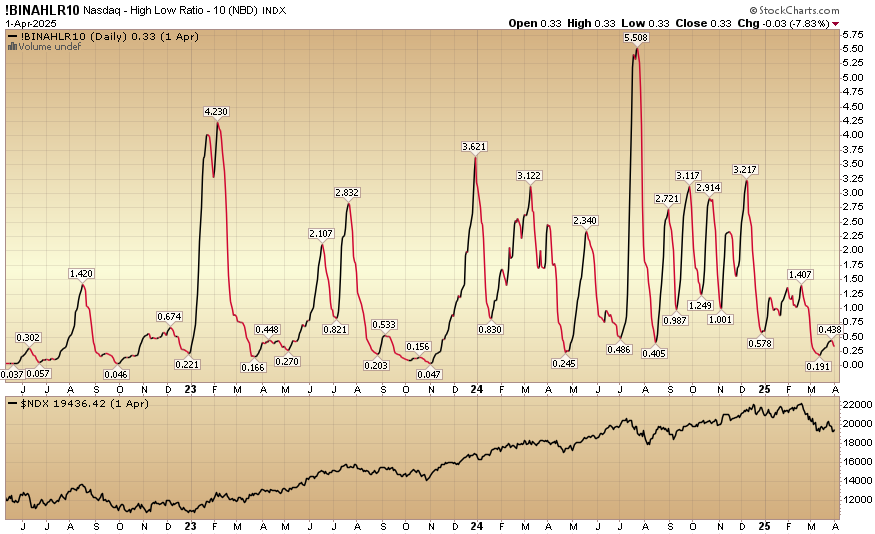

Indicator of the Day (video): Nasdaq High Low Ratio

Quote of the Day…

Be in the know. 28 key reads for Thursday…

- Traders Bet on More Fed Cuts With 10-Year Yield Headed Toward 4% (bloomberg)

- What to Know About the U.S. Trade Imbalance, in Charts (wsj)

- Trump’s ‘Reciprocal’ Tariff Formula Is All About Trade Deficits (bloomberg)

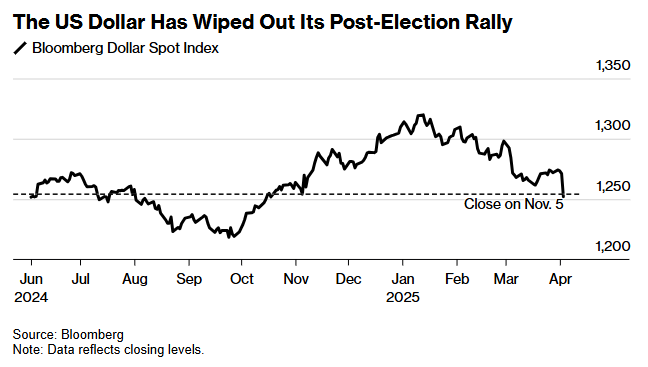

- Trump’s Tariffs Were Supposed to Boost the Dollar. Why the Opposite Happened. (wsj)

- 10-year Treasury yield falls to lowest level since October after Trump unveils sweeping tariffs (cnbc)

- Dollar Drops by Most Since 2022 as Traders Brace for More Pain (bloomberg)

- Will Today Go Down In History As The Beginning Of A New Era? (zerohedge)

- Chinese Stock Investors Flock to Hong Kong to Bargain Hunt (bloomberg)

- China Stocks Post Modest Losses as US Tariffs Spur Stimulus Bets (bloomberg)

- Alibaba Steps Up AI Game With Qwen 3, Challenging DeepSeek’s Low-Cost AI Success (yahoo)

- China Services Gauge Shows Acceleration in Activity Expansion (wsj)

- Tariff Loophole That Helped Temu, Shein Will Close May 2 (bloomberg)

- Xiaomi delivers record cars in March as winners emerge in China’s EV race (cnbc)

- Ford Motor Company will offer employee pricing to all US shoppers: ‘Handshake deal with every American’ (foxbusiness)

- Hyundai Motor says no plan for price hikes in US for now (reuters)

- Auto giants surprisingly resilient as sweeping U.S. tariffs spare Canada and Mexico for now (cnbc)

- Euro jumps over 2% against dollar after hefty US tariffs announced (streetinsider)

- Europe LNG Demand Is So Hot That Cargoes Land at Wider Discounts (bloomberg)

- Intel Stock Has Broken Its Winning Streak. This Could Help It Rally Again. (barrons)

- Intel’s new CEO Lip-Bu Tan makes his case for a revived Intel (yahoo)

- Boeing Has Made ‘Drastic’ Changes to Root Out Defects, CEO Says (bloomberg)

- Is Apple Pay really a problem for PayPal? Wall Street analyst weighs in (streetinsider)

- Growing Recession Worries Are Hitting Fintechs. 2 Bargain Stocks to Consider. (barrons)

- This Ultracheap Stock to Buy Is a Compelling Value Investment (morningstar)

- GXO Logistics, Inc. renews multi-year contract with Grupa Żywiec in Poland (investing)

- Retailers Are Dreading Tariffs. 8 Companies That Could Weather the Storm. (barrons)

- Want to Bring Factories Back? This Is What It Takes. (barrons)

- In shaky times, investors should hold their nerve (ft)