-

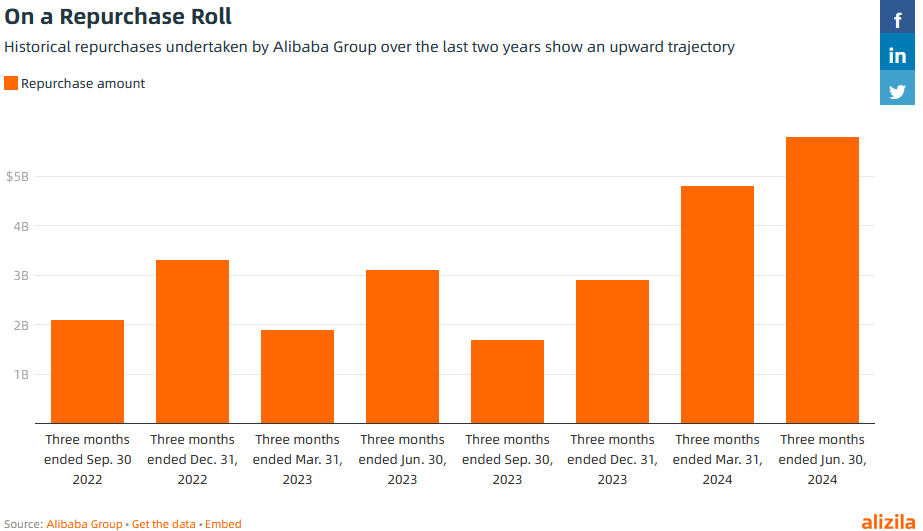

- Shareholders of Chinese e-commerce giant Alibaba have approved a plan to upgrade its Hong Kong listing to primary status, the company said on Friday, a move that is expected to attract huge investments from mainland China. (reuters)

- Alibaba gains as it swaps Hong Kong listing status to tap China funds (scmp)

- Alibaba swaps its listing status in Hong Kong, clears the way for mainland investments. The move would qualify the technology behemoth to sell shares to mainland China’s 220 million stock investors (scmp)

- China Vows to Quicken Buying Unsold Homes for Public Housing (bloomberg)

- China Bond Trading Collapses Amid PBOC Crackdown on Record Rally (bloomberg)

- ‘It’s Just Atrocious’: Jobs Data Snafu Stirs Fury on Wall Street (bloomberg)

- Here’s everything to expect from Fed Chair Powell’s speech Friday in Jackson Hole (cnbc)

- Yen Climbs as Ueda Indicates That Rates Can Go Higher in Japan (bloomberg)

- US 30-year fixed-rate mortgage slips to lowest level since May 2023 (reuters)

- Auto Industry’s EV Retreat Hastens (wsj)

- Advance Auto Parts to Sell Worldpac to Carlyle for $1.5 Billion (wsj)

- Jackson Hole History Points to Powell Sidestepping Market Shocks (bloomberg)

- Estee Lauder has ‘lots of positives ahead’ – Piper Sandler (streetinsider)

- Investors’ expectations for European inflation fall to lowest since 2022 (ft)

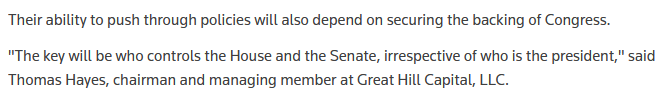

Tom Hayes – Quoted in Reuters article – 8/22/2024

Thanks to Medha Singh for including me in her article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

Where is money flowing today?

Indicator of the Day (video): Rydex Ratio – URSA/NOVA Funds

Quote of the Day…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

ARKK Innovation Fund Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Ark Innovation Fund (ARKK) top weighted stocks.

Oil & Gas Equipment & Services Earnings Estimates and Revisions

In the spreadsheet above I have tracked the earnings estimates for the Oil & Gas Equipment & Services ETF (XES) top 30 weighted stocks. Continue reading “Oil & Gas Equipment & Services Earnings Estimates and Revisions”

Be in the know. 16 key reads for Thursday…

- Alibaba, Tencent Cast Wide Net for AI Upstarts (wsj)

- Fed policymakers see job market key to rate-cut decision (reuters)

- July home sales break a four-month losing streak as supply rises nearly 20% over last year (cnbc)

- Disney puts Morgan Stanley’s James Gorman in charge of finding Bob Iger’s successor (nypost)

- S. Added 818,000 Fewer Jobs Than Reported Earlier (nytimes)

- Fed Minutes Show a Cut ‘Likely’ to Come in September (nytimes)

- Summer spending boom showcases China’s service consumption potential (cn)

- The Fed is taking on risk they don’t have to take, says Wharton’s Jeremy Siegel (cnbc)

- The key to a soft landing is the Fed getting off data dependence, says Fundstrat’s Tom Lee (cnbc)

- com: No. of Overseas Payment Buyers Mount 30%+ YoY in 1H (aastocks)

- China names healthcare, education, tech as likely venues for more foreign investment (scmp)

- Major retail stores are cutting prices to entice customers as inflation soars (foxbusiness)

- Why China Is Battling Its Own Government Bond Market (barrons)

- Advance Auto Stock Skids. Earnings Miss Overshadows $1.5 Billion Sale of Worldpac. (barrons)

- Discount-Hungry Shoppers Propel Sales Gains for Target, T.J. Maxx (wsj)

- McDonald’s to Invest $1.30 Billion in U.K., Ireland Over Next 4 Years (wsj)

Babalicious Stock Market (and Sentiment Results)…

On Thursday, I joined Suart Varney on Fox Business to discuss Stock Market, Election, Seasonality, GXO Logistics, Paypal and more. Thanks to Christian Dagger, Preston Mizell and Stuart for having me on: Continue reading “Babalicious Stock Market (and Sentiment Results)…”