Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notifications

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 13 key reads for Monday…

- New-Vehicle Sales Incentives Climb Higher in July, According to Kelley Blue Book Estimates (coxautoinc)

- Alibaba’s long-awaited China stock link may provide timely boost (scmp)

- U.S. Recession Odds Cut by Goldman. This Is Why. (barrons)

- Goldman Sachs Strategists Say US Sales Forecasts for 2025 Are Too High (bloomberg)

- China, US Team Up on Contact Group to Handle ‘Financial Stress’ (bloomberg)

- Dolly Parton $650 million empire: from humble roots to queen of country music, movies and now makeup (foxbusiness)

- Start-up failures rise 60% as founders face hangover from boom years (ft)

- Fed’s Daly backs gradual interest rate cuts as inflation ‘confidence’ mounts (ft)

- What clues will Jackson Hole provide about the timing of US rate cuts? (ft)

- Tech giants boost Hong Kong stocks as investors eye Fed’s Jackson Hole meet (scmp)

- At 8 am this morning, a State Council release from Prime Minister Li Qiang expressed the need to “expand domestic demand more effectively, focus on boosting consumption, and take targeted measures to smoot the economic cycle” Wow! The statement continues with a “Focus on areas with strong growth and the driving force to promote consumption, accelerate the expansion and quality of service consumption, effectively promote bulk consumption.” (chinalastnight)

- Berkshire Hathaway Likes Ulta Beauty. Should You? (wsj)

- The stock market’s dream scenario has been revived (businessinsider)

Be in the know. 10 key reads for Sunday…

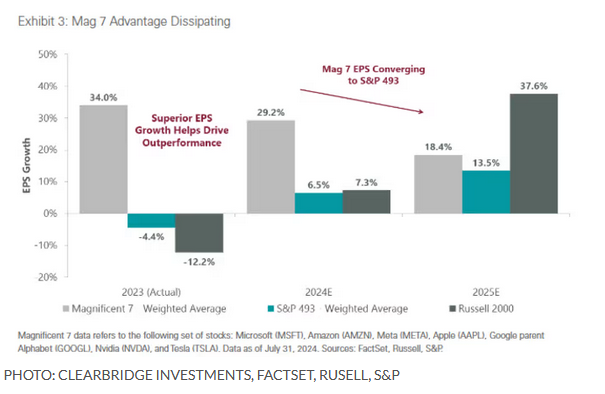

- Expectations for strong earnings growth in 2025 and a history of outperforming after Fed rate cuts could help small caps retake the lead later this year (marketwatch)

- 14% of PCs shipped globally in Q2 2024 were AI-capable (canalys)

- Why In-the-Know Travelers Head to the Connecticut Coast for Their New England Fix (wsj)

- Where to Find the Best and Butteriest Lobster Rolls in Connecticut (wsj)

- US Consumer Confidence Beats Expectations (tradingeconomics)

- The Holy Grail Cars? Get Them While They Last. (nytimes)

- Sneaker Talk With Birdwell CEO Eric Crane (forbes)

- Alibaba says its math-specific AI model outperforms rivals (technode)

- AliViews: Eddie Wu on Alibaba’s Q1 Earnings (alizila)

- High interest rates have dimmed the solar sector. Will coming cuts put a shine on their stocks? (apnews)

Quote of the Day…

Be in the know. 15 key reads for Saturday…

- Fed’s Powell Will Set the Stage for the First Rate Cut in Years at Jackson Hole (barrons)

- Consumer Sentiment Reading Erases S&P 500’s Decline (barrons)

- Walmart Lauds AI. That’s Good News for Tech Stocks. (barrons)

- Southwest Airlines, Rocket Lab USA, and More Stocks See Action From Activist Investors (barrons)

- What’s Wrong With Starbucks? (wsj)

- US Office Market Shows Bottoming Signs, Moody’s Analytics Says (bloomberg)

- Look inside the Breakers, a 70-room, 138,300-square-foot mansion that belonged to one of America’s wealthiest Gilded Age families (businessinsider)

- ‘Deadpool & Wolverine’ becomes the highest-grossing R-rated film of all time (cnbc)

- Private jet flights are down 15% in two years as Covid-era demand wanes (cnbc)

- This Disney restaurant marked a Michelin first: What to expect at Victoria & Albert’s (usatoday)

- History shows investors should keep a tight leash on risk once the Fed cuts rates, strategist says (marketwatch)

- New-home construction plunges to lowest level since May 2020 (marketwatch)

- Japan’s economy bounces back, supporting case for more rate hikes (cnn)

- Disney has a price problem. It has ambitious plans to fix that (cnn)

- UAW president slams Stellantis CEO over job cuts, alleged price gouging (cnbc)