Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – August 16, 2024

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 252

Hedge Fund Tips with Tom Hayes – Podcast – Episode 252

Where is money flowing today?

Indicator of the Day (video): DOW Advances Index

Be in the know. 20 key reads for Friday…

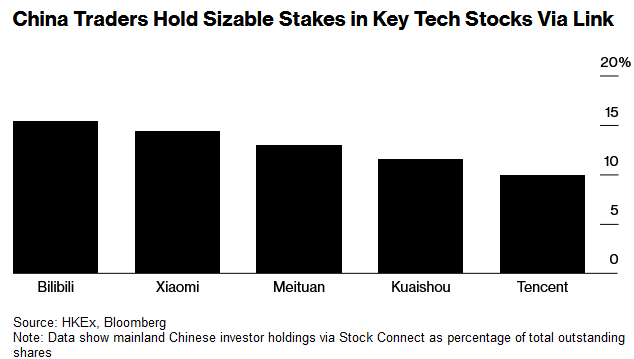

- Alibaba’s Long-Awaited China Stock Link May Provide Timely Boost (bloomberg)

- Apple Opens Up Payment Options, Boosting PayPal Stock. This Analyst Sees Long-Term Positives. (barrons)

- Great Hill Capital Chairman Thomas Hayes discusses the impact the 2024 election may have on the stock market during an appearance on ‘Varney & Co.’ (foxbusiness)

- Intel Disappointed Investors. For Corporate Customers, It’s Still Good Enough. (wsj)

- Lululemon CEO Calvin McDonald Buys Up Disney Stock (barrons)

- United CEO expresses ‘renewed confidence’ in Boeing after meeting with new leader Ortberg (cnbc)

- China’s industrial output up 5.1 pct in July (cn)

- Alibaba, JD.com, PBOC, & Economic Data Reviewed! (chinalastnight)

- Fed’s Musalem Sees Interest-Rate ‘Adjustment’ Coming (barrons)

- The U.S. Economy Is Still Strong. The Latest Data Make it Clear. (barrons)

- Retail Sales Surged in July. The Fed Can Breathe a Sigh of Relief. (barrons)

- Nike shares pop as Bill Ackman’s Pershing Square discloses a $229 million stake (streetinsider)

- Estee Lauder stock upgraded by RBC Capital on improved risk-reward balance (investing)

- How Walmart Allayed Worry About the U.S. Shopper and Sent Its Stock Soaring (barrons)

- Jobless Claims Fall, Suggesting Continued Labor Market Strength (barrons)

- Cooling July Inflation Sets Stage for Fed’s September Rate Cut (wsj)

- Michael Burry of ‘Big Short’ fame ups his bets on Chinese Internet stocks (marketwatch)

- Tech war: China pumps up state subsidies for chip industry to counter US sanctions (scmp)

- China’s July home prices fall at a slower pace as state support shows ‘some effect’ (scmp)

- Nike is a great brand that’s just out of favor, says 13D Monitor’s Ken Squire (cnbc)

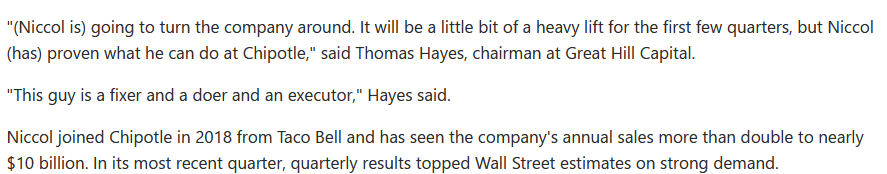

Tom Hayes – Quoted in Reuters article – 8/15/2024

Thanks to Reuters for including me in this article. You can find it here:

Click Here to View The Full Reuters Article

Tom Hayes – BBC Appearance – 8/15/2024

REIT Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “REIT Earnings Estimates/Revisions”

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks.