- BofA’s Hartnett Says EM Stocks Will Outperform Everything Else (bloomberg)

- Earnings Sank Alibaba. The Stock Can Make a Comeback. (barrons)

- Big Chinese companies like Alibaba show that AI-powered ads are giving shopping a boost (cnbc)

- China calls U.S. trade talks ‘good’ but quiet on next steps, as Trump hints at Xi call (cnbc)

- Capital flows back to US-listed China ETFs post big selloff (reuters)

- Alibaba, NetEase, & KE Holdings Report Q1 (chinalastnight)

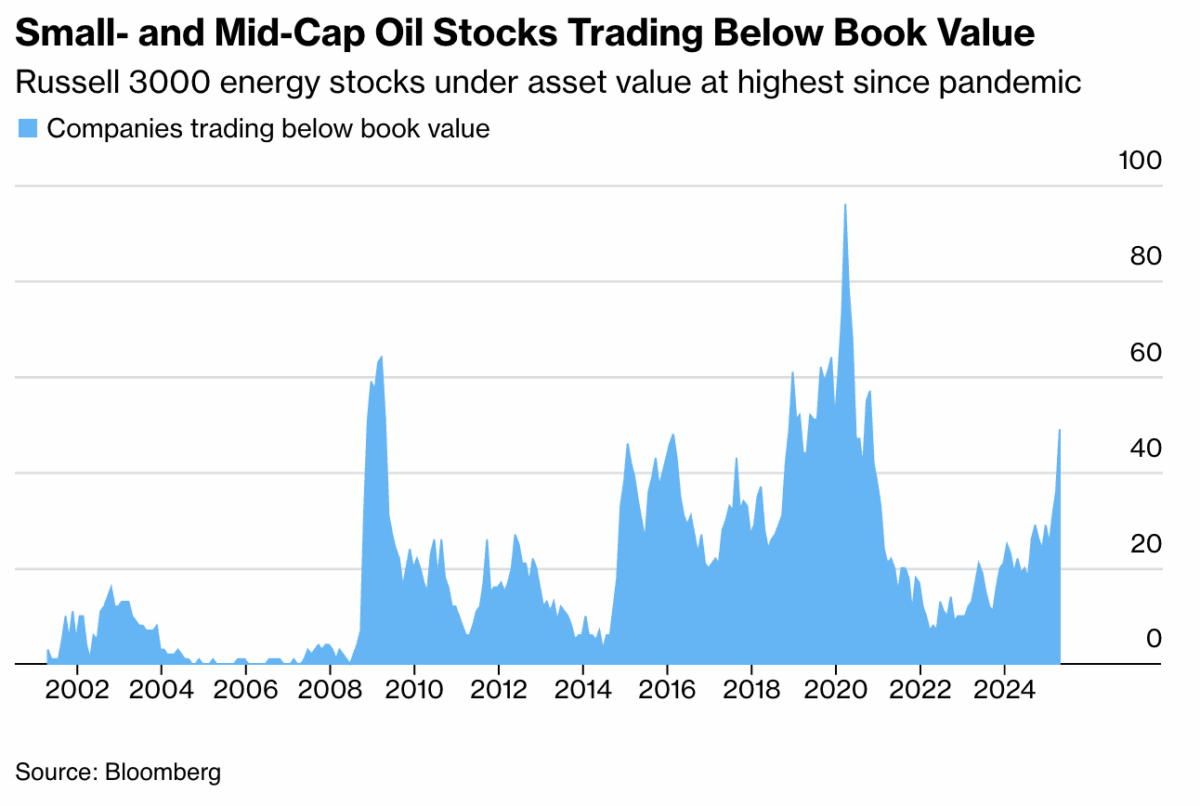

- A Trade Made for Buffett: Energy Stocks Priced Below Book Value (bloomberg)

- US set to cut capital requirements for banks, FT reports (reuters)

- Boeing Stock Rises Again. Wall Street Is More Positive on Sales. (barrons)

- Trump announces $14.5 billion Etihad order for 28 Boeing planes with GE engines (reuters)

- Boeing stock target raised to $230 by TD Cowen (investing)

- Goldman Unveils New ‘Trump Trade’ (zerohedge)

- From Panic to FOMO: Wall Street’s Sentiment Whiplash (zerohedge)

- Smart Money Loses to Retail Crowd That Bet on Stock Rebound (bloomberg)

- How to Invest Like Warren Buffett (morningstar)

- EU Exports to U.S. Surge Ahead of Trump Tariffs (wsj)

- Weight-Loss Drugs Providing a Boost to US Meat Demand, JBS Says (bloomberg)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 291

Hedge Fund Tips with Tom Hayes – Podcast – Episode 291

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

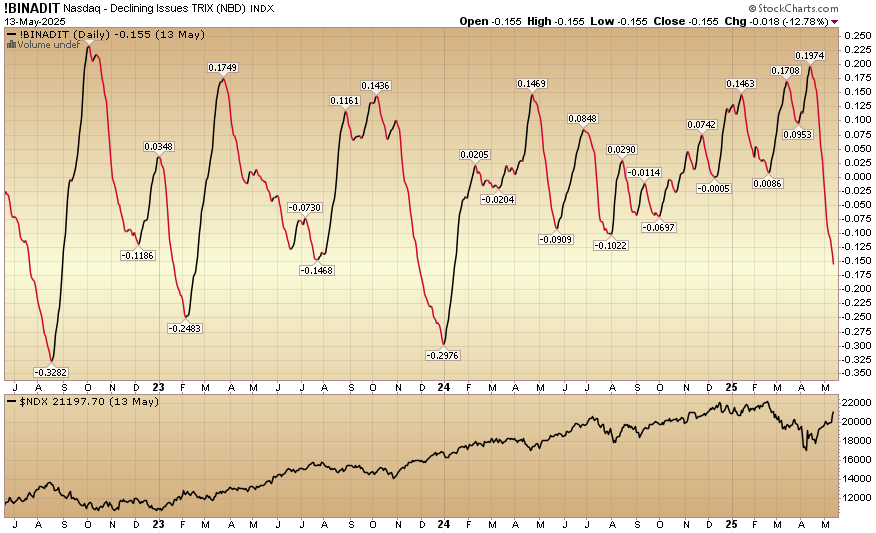

Indicator of the Day (video): Nasdaq – Declining Issues TRIX

Quote of the Day…

Be in the know. 24 key reads for Thursday…

- Alibaba Revenue Grows Despite Competition, Boosting Profit (wsj)

- Alibaba’s quarterly revenue grows 7% as AI-driven cloud business remains buoyant (scmp)

- Alibaba’s financial health in 12 charts (techinasia)

- Alibaba Sustains AI Frenzy With Second Video Upgrade in Weeks (bloomberg)

- Boeing inks record-breaking deal for Qatar Airways to buy up to 210 planes (cnbc)

- Boeing stock target raised at Wolfe after ’a big beautiful order’ from Qatar (investing)

- Boeing Booms From Trump’s Trade Deals. This Can Lift Aerospace, Defense Stocks Higher. (barrons)

- AI Boom Has Generac Looking to Data Centers for Growth (bloomberg)

- Millions of Americans at Risk of Summer Power Shortfall, Regulator Says (bloomberg)

- Generac Rethinking Supply Chain Amid Tariffs, CEO Jagdfeld Says (youtube)

- A Less-Generous Warren Buffett Would Be $67 Billion Richer Than Elon Musk (bloomberg)

- There Are Still Stock Bears Left To Throw In The Towel (zerohedge)

- Wall Street’s sudden rebound catches investors ‘offside’ (ft)

- US poised to dial back bank rules imposed in wake of 2008 crisis (ft)

- Why Trade Deals and Tax Cuts May Be a Recipe for US Success (bloomberg)

- Trump’s Tax Bill Could Give Babies $1,000 ‘MAGA’ Accounts. How It Works. (barrons)

- A Trade War Winner? The Booming Business of Returned Products. (nytimes)

- Ford and Tesla Are Best-Positioned for Trump’s Car Tariffs. These Companies Are the Worst. (barrons)

- Ford CEO Jim Farley says company will be ‘advantaged’ around tariffs: ‘Fairest fight in decades’ (nypost)

- EU Trade Officials See Signs of Optimism for US Tariff Deal (bloomberg)

- Trump Says India Offered to Remove All Tariffs on US Goods (bloomberg)

- UK Economy Has Best Quarter in a Year With 0.7% Expansion (bloomberg)

- Perplexity, PayPal partner to provide easy payment checkouts to users (reuters)

- BofA lifts Albemarle stock price target to $93 on cost cuts (investing)