Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 27 key reads for Wednesday…

- Johnson & Johnson to Settle Talc Claims for $8.9 Billion (barrons)

- The Economy May Be Weakening. Here’s What That Means for Interest Rate Hikes. (barrons)

- Google-Owner Alphabet Says Its Chips Can Beat Nvidia’s. What This Means for AI. (barrons)

- Companies See a Slowdown Ahead. This Figure Tells the Story. (barrons)

- How the Dollar’s Decline Could Add to Inflation Problems (barrons)

- Here’s what is really behind OPEC+ oil-production cuts, say energy analysts (marketwatch)

- Alibaba’s Split-Up Brings Back Cash Inflow Into China’s Bourses (finance.yahoo)

- Telecom Competition Is ‘Destructive.’ Why Comcast Is Rated as a Winner. (barrons)

- ADP data show private sector of U.S. economy adding a fewer-than-forecast 145,000 jobs in March (marketwatch)

- The commodity supercycle is still young, these strategists say. Here’s why. (marketwatch)

- Good Friday complicates how stock-market traders will digest March U.S. jobs report (marketwatch)

- U.S. Job Openings Dropped in February (wsj)

- Tech Shines, Cyclicals Lose as Traders Bet on Growth Shock (wsj)

- Jamie Dimon Says Effects of Banking Crisis Will Be Felt for ‘Years to Come’ (nytimes)

- UBS Chairman’s Top-Secret Prep Paid Off in Credit Suisse Moment (bloomberg)

- US 30-Year Mortgage Rate Falls to Seven-Week Low (bloomberg)

- You Can Go on the Ultimate James Bond Vacation for $74,000 (bloomberg)

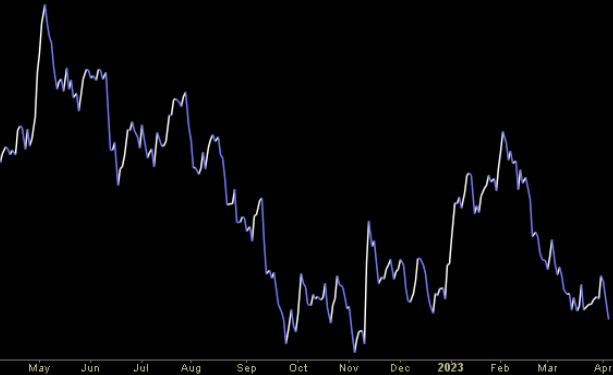

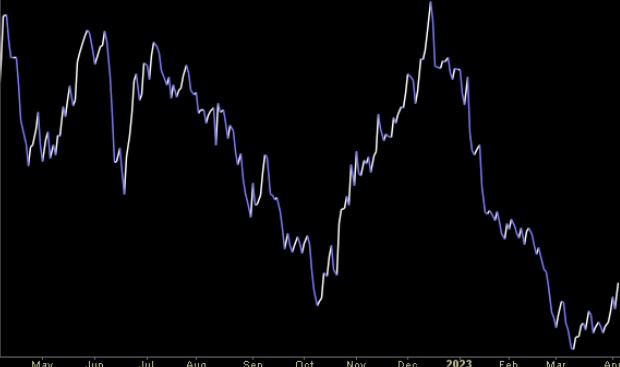

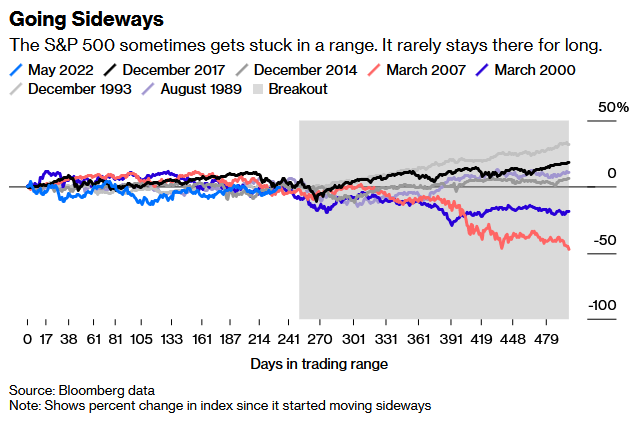

- Stock Market Cassandras and Pollyannas Are Stuck in Limbo (bloomberg)

- How the market’s biggest companies manage their cash and investments (cnbc)

- Adani could deliver ‘multibagger’ returns, an investor who bet $2 billion on the troubled business empire says (businessinsider)

- Jimmy Buffett, LeBron James, Tom Ford, and Tiger Woods are all officially billionaires (businessinsider)

- BofA witnessed the biggest week of equity outflows since October (streetinsider)

- China, Malaysia to discuss Asian Monetary Fund to reduce dependence on US dollar (foxbusiness)

- China’s reopening expected to release pent-up demand for art after 2022 decline

- Fund Star Terry Smith Builds $1 Billion Fortune With Riches Held Offshore (bloomberg)

- How China Aims to Counter US ‘Containment’ Efforts in Tech (bloomberg)

- The US Warehouse Capital Boomed During the Pandemic. Now It’s Facing a Slowdown bloomberg)

Tom Hayes – CGTN America Appearance – 4/4/2023

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 24 key reads for Tuesday…

- Intel Scores an Upgrade. Fundamentals May Have Bottomed, Analyst Says. (barrons)

- Benchmark bullish on Alibaba (BABA) stock, sees over 80% upside potential (streetinsider)

- GM’s first-quarter sales up 18% (marketwatch)

- Opinion: ‘The Fed’s problems should worry everyone.’ Powell’s dysfunctional Fed is losing respect at home and abroad. (marketwatch)

- Saudi First America Last. The Energy Report 04/04/2023 (Phil Flynn)

- Jamie Dimon Says Bank Crisis ‘Is Not Yet Over,’ JPMorgan Plans For The Future (investors)

- Bank Deposits Are Holding Steady. 3 Stocks Worth a Look. (barrons)

- Bank Borrowing From the Fed Falls Further, Signaling End to Bank Drama (barrons)

- Dollar weakness on Fed rate revisions pushes pound back above $1.25, euro near $1.10 (marketwatch)

- Milton Friedman’s School Choice Revolution (wsj)

- The Masters Is Feeling the Shockwaves of LIV Golf (wsj)

- The ‘King Kong’ of Weight-Loss Drugs Is Coming (wsj)

- Auto Sales Withstand Higher Interest Rates (nytimes)

- Bubba Watson Knows People Are Mad. He Loves LIV Golf Anyway. (nytimes)

- Are Offices Truly Worth as Little as REITs Imply? (bloomberg)

- The Weak Are Getting Found Out in Banking (bloomberg)

- The NYC Landlord Who Says the ‘Golden Age’ of Being a Landlord Is Over (bloomberg)

- Ford’s first quarter sales increase 10.1% on improved F-Series truck production (cnbc)

- Finland becomes a member of NATO, doubling the military alliance’s border with Russia (cnbc)

- China’s homebuyers are starting to come back (cnbc)

- Wharton Professor Jeremy Siegel says the surge in oil prices won’t be a big problem for inflation as natural gas keeps plummeting (businessinsider)

- Australia Central Bank Joins Canada In Hitting “Pause” On Rate Hikes (zerohedge)

- Sterling hits 10-month high as recession fears ease (ft)

- Alibaba launches budget shopping channel on Taobao to heat up online price war (scmp)

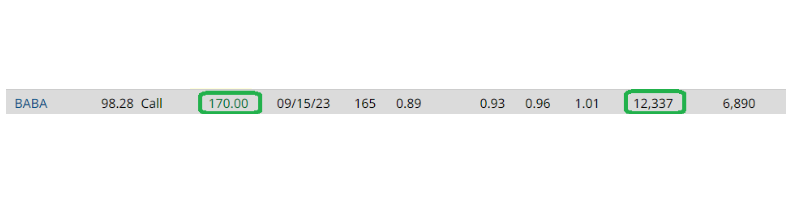

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: Barchart

On Monday some institution/fund purchased 12,337 contracts of Sep. 2023 $170.00 strike calls (or the right to buy 1,233,700 shares of Alibaba Group Holding Limited (BABA) at $170.00). The open interest was just 6,890 prior to this purchase.

Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”