Data Source: Finviz

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 12 key reads for Monday…

- Alibaba’s CFO Sees Multiple Ways To Boost Shareholder Value Beyond Share buybacks (alizila)

- Investors Are Too Spooked by Washington’s PBM Crackdown (wsj)

- Advance Auto Is in Low Gear. It Needs to Upshift Fast. (barrons)

- Humana Stock Is a Bet on Healthcare for Seniors (barrons)

- Bank Stocks Are Beaten Up. Is Now a Buying Opportunity? (barrons)

- See the giant tuna that broke a rod in half during 2-hour fight with Texas fishermen (nypost)

- The Value of Regional Banks (nytimes)

- OPEC+ Makes Shock Million-Barrel Cut in New Inflation Risk (bloomberg)

- Charlie Munger shares investing advice and slams stock-market gamblers in a newly surfaced conversation. Here are his 9 best quotes. (businessinsider)

- Brazil’s Lula says economy to grow ‘more than pessimists think’ (reuters)

- Intel stock gets an upgrade from longtime bear: ‘We hate this call but think it’s the right one’ (marketwatch)

- ‘Son of a Sinner’ Jelly Roll reigns at the Country Music Television awards show (npr)

Be in the know. 16 key reads for Sunday…

- From Boat Chases to Martini Classes, These James Bond-Themed Vacations Will Immerse You in the World of 007 (robbreport)

- Why EV owners are getting grumpy about home charging (marketwatch)

- 3M – “This stock is currently uninvestable,” RBC Capital Markets analyst Deane Dray said in a phone interview. (bloomberg)

- Tiger Global Looks to Rebound From a Disastrous 2022 (institutionalinvestor)

- Charlie Munger in Conversation with Todd Combs | Singleton Prize for CEO Excellence (youtube)

- Buffett’s Other Guru (humbledollar)

- REITs Are Getting Caught Up in the Wave of Banking Fear (morningstar)

- 10 Undervalued Wide-Moat Stocks (morningstar)

- Ken Kencel on the Rise of Private Capital (bloomberg)

- JPM Head Of Cash Trading: “Bears Are Beginning To Pivot… We’re Seeing The Early Stage Of A Hedge Fund Risk-On Chase” (zerohedge)

- Meet The 2024 Lamborghini Revuelto, The Most Powerful Raging Bull Ever (maxim)

- Transcript: Matt King Sees a $1 Trillion Liquidity Drain Coming to Markets (bloomberg)

- Barclays Strategist Joe Abate Sees A ‘Second Wave’ of Deposit Outflows Coming for Banks (bloomberg)

- Masters 2023: We’ve used 20 years of data to create the perfectly average Masters champion (golfdigest)

- 10 Best Spa Resorts 2023 (worth)

- How does the Federal Reserve’s discount window work? (npr)

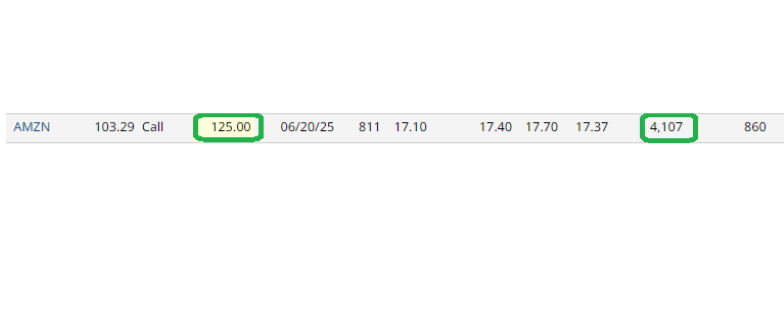

Unusual Option Activity – Amazon.com, Inc. (AMZN)

Data Source: Barchart

On Friday some institution/fund purchased 4,107 contracts of Jun. 2025 $125.00 strike calls (or the right to buy 410,700 shares of Amazon.com, Inc. (AMZN) at $125.00). The open interest was just 860 prior to this purchase.

Continue reading “Unusual Option Activity – Amazon.com, Inc. (AMZN)”

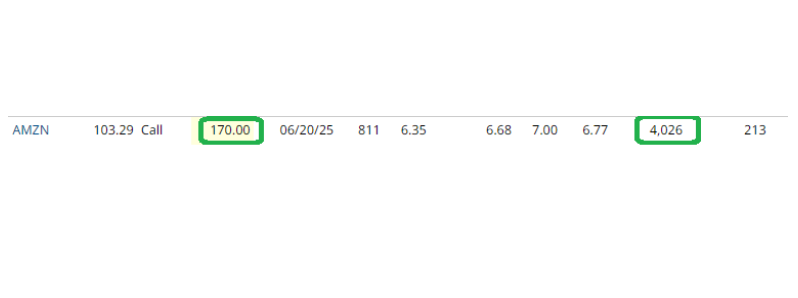

Unusual Option Activity – Amazon.com, Inc. (AMZN)

Data Source: Barchart

On Friday some institution/fund purchased 4,026 contracts of Jun. 2025 $170.00 strike calls (or the right to buy 402,600 shares of Amazon.com, Inc. (AMZN) at $170.00). The open interest was just 213 prior to this purchase.

Continue reading “Unusual Option Activity – Amazon.com, Inc. (AMZN)”

Be in the know. 15 key reads for Saturday…

- Bearish Sentiment on Stocks Is Best Thing Rally Has Going for It (bloomberg)

- Deposits at Small U.S. Banks Stabilized Last Week (barrons)

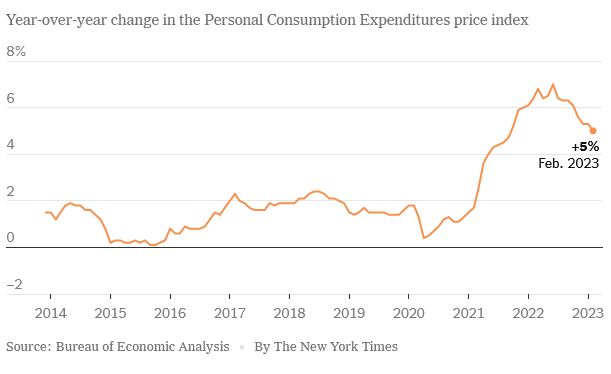

- The Fed’s Preferred Inflation Gauge Cooled Notably in February (nytimes)

- Rolls-Royce’s CEO Has a Turnaround Plan. The Stock Is Revving Up. (barrons)

- There’s a simple reason why it’s very likely that the stock market bottomed in October (businessinsider)

- China’s Consumers Extend Economic Rebound From Pandemic (wsj)

- Google cuts lavish employee perks — including ‘micro-kitchens’ in push to save (nypost)

- TikTok hires ex-Obama officials, ex-Disney exec in trying to avoid US ban (nypost)

- ‘Big Short’ hedge boss was ‘wrong to say sell’ as Nasdaq 100 enters bull market (nypost)

- How we know the super-rich are finally clamping down on spending (nypost)

- The Big Read. China truce with business — for now (ft)

- Flood of cash into US money market funds could add to banking strains (ft)

- Macau Gaming Revenue Jumps to Three-Year High on Tourism Boom (bloomberg)

- David Einhorn regrets selling his early Apple stake, predicts the Fed will pull back in fighting inflation, and reveals he’s betting on AI in a new interview. Here are the elite investor’s 8 best quotes. (businessinsider)

- Morningstar: Buy these 10 cheap stocks that will maintain higher-than-average dividends as a looming economic slowdown makes it even harder to find strong returns (businessinsider)

Where is money flowing today?

Be in the know. 22 key reads for Friday…

- Jack Ma Engineered Alibaba’s Breakup From Overseas (wsj)

- This Week in China: Stock Market Starts to Believe in Recovery (bloomberg)

- Fed-Favored Inflation Gauge Rises by Less Than Forecast, Spending Moderates (bloomberg)

- BofA Says Investors Poured $508 Billion Into Cash This Quarter (bloomberg)

- 2023 has been bad for the bears. Here are 5 reasons why it’s going to get even worse. (marketwatch)

- Cornering Classic Cars (bloomberg)

- Mickey Drexler interview: Here’s what retailers could learn from Steve Jobs (nypost)

- Flight to Money Funds Is Adding to the Strains on Small Banks (bloomberg)

- How Moneyball Investing Ran Into a Data Squeeze Play (bloomberg)

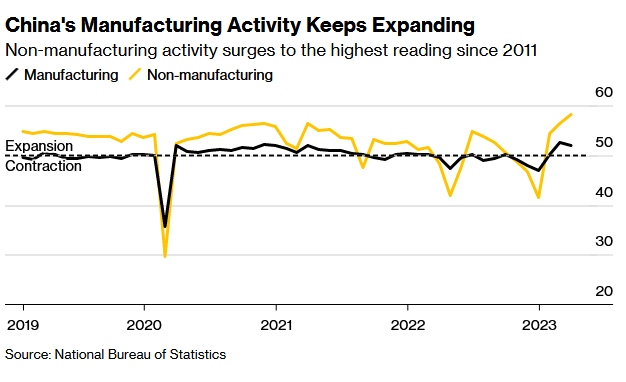

- China’s Strong PMIs Show Economic Recovery Gaining Traction (bloomberg)

- Cooper Standard Honored by General Motors as Supplier of the Year (cps)

- Michael Burry Says He Was ‘Wrong to Say Sell,’ Congratulates Dip Buyers (bloomberg)

- Small Banks Are Losing to Big Banks. Their Customers Are About to Feel It. (wsj)

- Dungeons & Dragons’ Epic Quest to Finally Make Money (bloomberg)

- China’s chip industry will be ‘reborn’ under U.S. sanctions, Huawei says, confirming breakthrough (cnbc)

- The dollar slipped this quarter after surging in 2022. Its struggles could be a sign of things to come. (businessinsider)

- Ford just upped the price of electric F-150 Lightning pickup – again (usatoday)

- Billionaire investor Bill Gross says the Fed easing up in fighting inflation could fuel a rally in government bonds (businessinsider)

- China Home Sales Continue to Rise in Latest Sign of Recovery (bloomberg)

- U.S. consumer spending retreats in February; inflation cools (reuters)

- Chinese companies rush for U.S. listings ahead of new rules (reuters)

- Rolls-Royce replaces finance director as new chief shakes up top team (ft)