- U.S. lawmakers to examine merits of higher FDIC bank deposit insurance cap (cnbc)

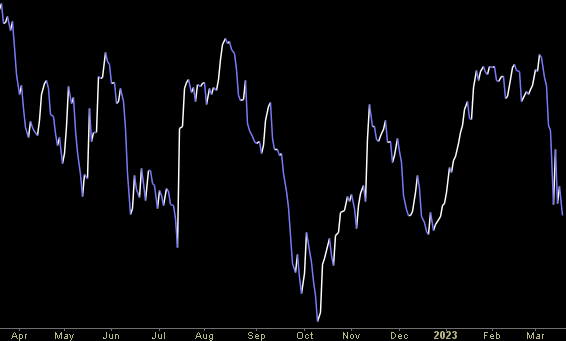

- “The market stops panicking when central banks start panicking” (zerohedge)

- Elizabeth Warren Slams Powell for Weak Regulation, Oversight of SVB (bloomberg)

- UBS To Buy CS For $3 Billion As AT1 Bonds Get Wiped Out In Record Bail-In; Swiss Govt Grants CHF9BN Guarantee; SNB Offers $100 Billion Liquidity Backstop (zerohedge)

- The Longer It Takes The Fed To “Go Big”, The Deeper The Damage Will Be, And The Bigger The “Big” Will Be (zerohedge)

- Mega-cap Tech is the new Safe Haven (zerohedge)

- UBS to Buy Credit Suisse in $3.3 Billion Deal to End Crisis (bloomberg)

- Fed and Global Central Banks Move to Boost Dollar Funding (bloomberg)

- Warren Says She Favors Increasing FDIC’s Deposit Insurance Cap (bloomberg)

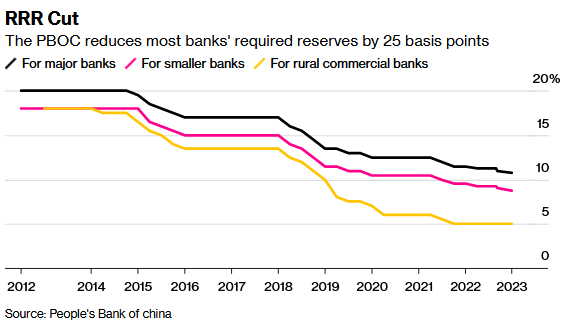

- China’s Surprise RRR Cut Puts Focus on Bank Lending Rates (bloomberg)

- S. bank deposit outflows, unrelated to Credit Suisse, have stabilized, U.S. official says (reuters)

- Credit Suisse’s $17 Billion of Risky Bonds Are Now Worthless (bloomberg)

Be in the know. 15 key reads for Sunday…

- China makes surprise rate cut to boost banking liquidity and the economy (cnn)

- Billionaire Advice: 17 Stock Ideas And Life Lessons From Value Investor Mario Gabelli (forbes)

- Cliff Asness on Quant Value Investing (bloomberg)

- Huge Crowds Force Disney World to Make Big Changes (thestreet)

- A bifurcated housing market: Average Idaho homeowner sees equity decline by $21K while typical Florida homeowner gained $49K in 2022 (fortune)

- Bentley Had Its Best Year Ever in 2022, With Record Profits and Deliveries (robbreport)

- This Bonkers 1,000 HP Flying Supercar Soars Like a Jet and Looks Like a Bugatti (robbreport)

- What It’s Like to Stay at the Ned Doha, the Luxe Hotel and Members’ Club That Just Debuted in the Middle East (robbreport)

- Ferrari, Porsche & BMW To Battle For Racing Supremacy At Le Mans’ 100th Anniversary (maxim)

- Where To Eat, Drink & Stay In Istanbul (maxim)

- Ideas From Benjamin Graham, The Father Of Value Investing (forbes)

- Muscle Is the Cornerstone of Longevity (worth)

- Bullish Sign Is Flashing for Some as Stocks Skirt the Precipice (bloomberg)

- 2 questions that helped Patagonia’s CEO go from packing boxes for $6 an hour to leading a $3 billion brand (cnbc)

- Banks borrow record-breaking $160B from Fed crisis lending programs (foxbusiness)

Be in the know. 20 key reads for Saturday…

- Alibaba Group Holding Ltd.’s American depository receipts, for example, recently traded at about 9.6 times expected earnings over the next 12 months. That compares with a valuation that approached 30 times earnings in 2019 and 2020. The S&P 500 has a forward multiple of about 17.5. “I think history has demonstrated time and again that stocks can feel uninvestable today but turn out to be great investments going forward.” (wsj)

- Why Bank Carnage in the West May Boost China’s Appeal (bloomberg)

- Spinoffs usually outperform their parent companies, Goldman Sachs research finds (marketwatch)

- Goldman Strategists See More US Spinoffs With Companies Squeezed (bloomberg)

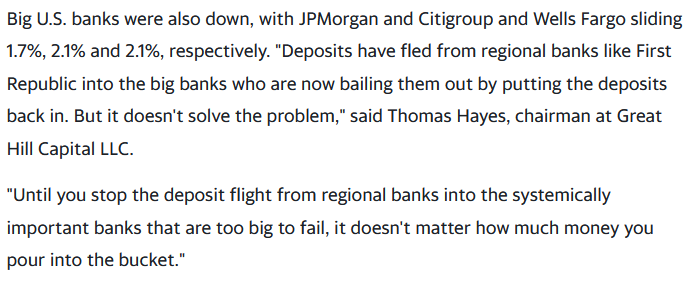

- Banks Survived Another Week—and the Biggest Ones Look Like Winners (barrons)

- The Fed Gets a Dose of Its Own Medicine (barrons)

- Seagen, Newell Brands See Activist Action (barrons)

- The Best Advice Warren Buffett Gave to Amex’s CEO (barrons)

- Banking Emergency? JPMorgan Comes to the Rescue Again. (barrons)

- Why Wall Street Analysts Missed the Banking Turmoil (barrons)

- Tumbling Bank Stocks Raise Deposit Risks, and Yield a Few Bargains (barrons)

- The News on Banks Has Been Bad. Some Investors See Opportunity. (barrons)

- Berkshire’s Warren Buffett Shows Bank CEOs How They Should Have Managed Risk (barrons)

- This Bond Yield Fell to a Key Level. What it Means for Stocks. (barrons)

- American Express CEO Says the Business Is ‘Firing on All Cylinders’ (barrons)

- 10 Undervalued Quality Healthcare Stocks (morningstar)

- Chinese Developer Evergrande Nears Landmark Restructuring Deal (wsj)

- Billionaire David Tepper Bought SVB Financial Bonds, FT Says (bloomberg)

- Ferrari Unveils Its First Soft-Top Front-Engine Model Since 1969 (bloomberg)

- Nobel economist Paul Krugman says the Silicon Valley Bank collapse has led to ‘apocalyptic rhetoric’ in markets, but almost none of it is true (businessinsider)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 178

Article referenced in VideoCast above:

Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 168

Article referenced in Podcast above:

Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 3/17/2023

Thanks to for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 21 key reads for Friday…

- Banks Borrow $164.8 Billion From Fed in Rush to Backstop Liquidity (bloomberg)

- Alibaba forges cooperation with Chongqing on connected cars, digital infrastructure as e-commerce giant bolsters ties with more local governments (scmp)

- FedEx jumps after lifting profit view amid pressure on e-commerce parcel volume (reuters)

- China Cuts Reserve Requirement Ratio To Boost Economy (bloomberg)

- First Republic Set to Get $30 Billion of Deposits in Rescue (bloomberg)

- The Yield Curve Inversion Is Shrinking (barrons)

- China cuts banks’ reserve ratio for first time in 2023 to aid recovery (reuters)

- Intel’s stock nabs an upgrade: ‘Things are moving enough in the right direction.’ (marketwatch)

- The Fed Gets a Dose of Its Own Medicine. Rate Hikes Have Dried Up Its Income Stream. (barrons)

- Companies Ponder Moving Cash to Big Banks After Silicon Valley Bank Failure (barrons)

- Quantitative Easing Left the Banking System Vulnerable (barrons)

- Charles Schwab Insiders Loaded Up on Shares (barrons)

- Why the Return of Chinese Shoppers Could Help Nike More Than Adidas (barrons)

- Barney Frank defends role at Signature Bank: ‘I need to make money’ (ft)

- China Unexpectedly Cuts Reserve Ratio For Banks, Injecting $73BN To Stimulate Economy (zerohedge)

- This Week in China: Chinese Bank Stocks Are World’s Best as US, Europe Crack (bloomberg)

- While Rising to Pop Stardom, Taylor Swift Built a Real-Estate Empire Worth North of $150 Million (wsj)

- Don’t Count Out the Consumer Yet (wsj)

- Stock Trader’s Almanac says investors should remain calm and is calling for stock gains of 10-15% this year (streetinsider)

- Michael R. Bloomberg: New York’s Legal Marijuana Policies Endanger Kids (bloomberg)

- UK backs Rolls-Royce project to build a nuclear reactor on the moon (cnbc)

Tom Hayes – Fox Business Appearance – Charles Payne – 3/16/2023

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 16, 2023