Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 16, 2023

Where is money flowing today?

Be in the know. 11 key reads for Thursday…

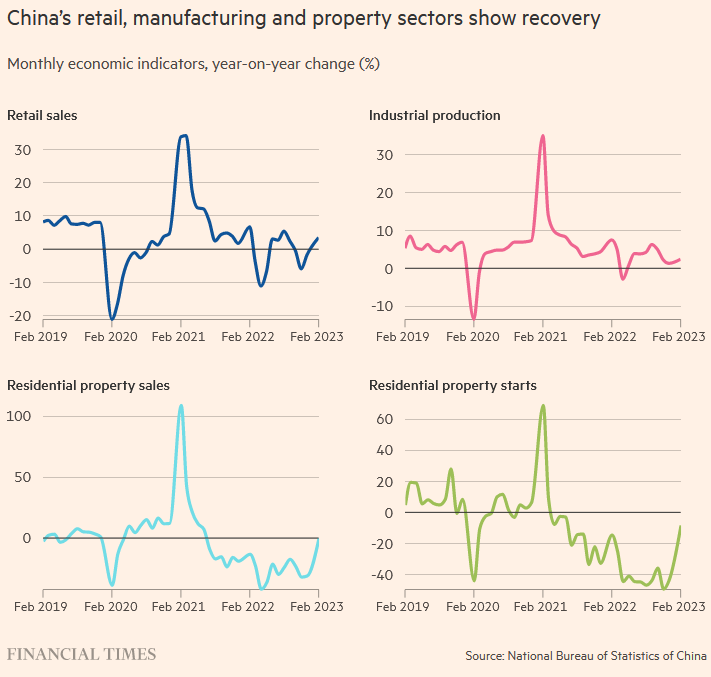

- China’s consumer spending rebounds after end of Covid curbs (ft)

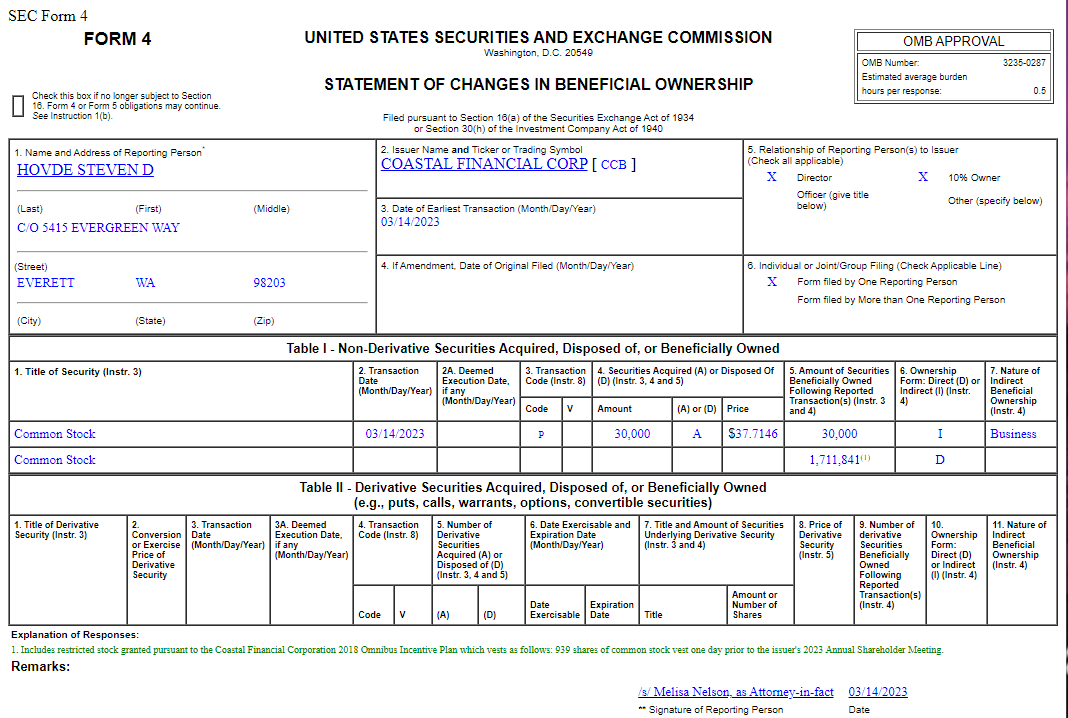

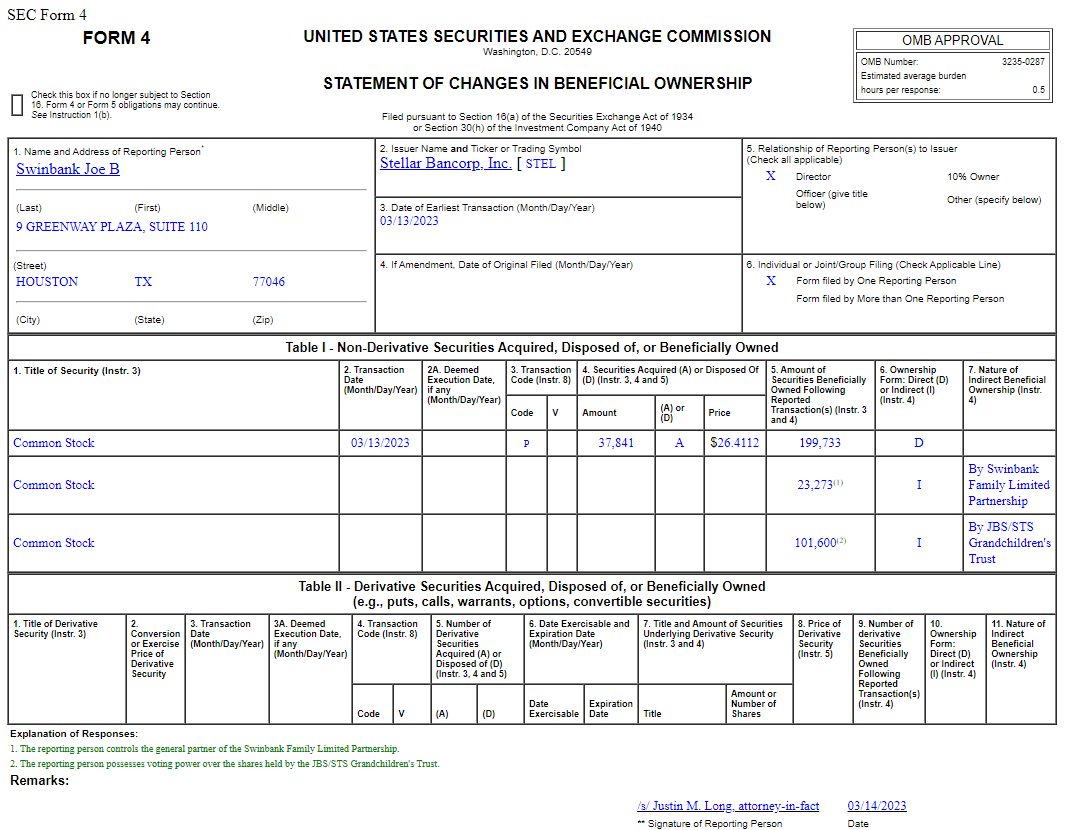

- Fifth Third board member bought $1.3 million worth of stock after it tumbled (marketwatch)

- ECB Raises Rates (barrons)

- Bank Failures, Market Turmoil Fuel Bets on a Pause in Fed Interest-Rate Increases (wsj)

- China’s Economy Rebounds, Spurred by Consumption (wsj)

- JPMorgan Analysts See Credit Suisse Takeover as Likely Scenario (bloomberg)

- BofA Gets More Than $15 Billion in Deposits After SVB Fails (bloomberg)

- Chinese ride-hailing giant Didi plans expansion after Beijing’s crackdown ends (cnbc)

- Here’s what Wall Street thinks ahead of critical Fed meeting (foxbusiness)

- China’s home prices rise for first time in 18 months in sign of rebound (scmp)

- Positive Economic Data and Important News from Alibaba & Baidu As Markets Face European Bank Headwind (chinalastnight)

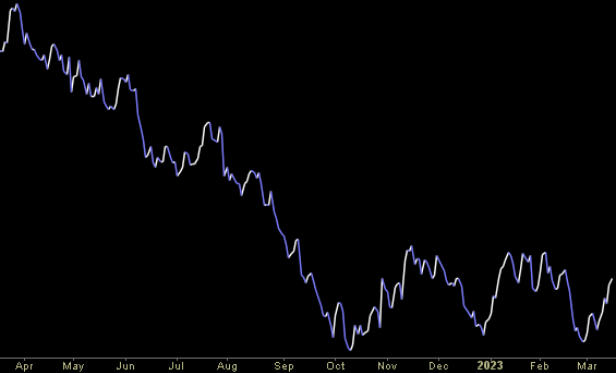

Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…

“Recency bias, or availability bias, is a cognitive error identified in behavioral economics whereby people incorrectly believe that recent events will occur again soon. This tendency is irrational, as it obscures the true or objective probabilities of events occurring, leading people to make poor decisions.” Investopedia

Continue reading “Deja Vu NOT All Over Again – Stock Market (and Sentiment Results)…”

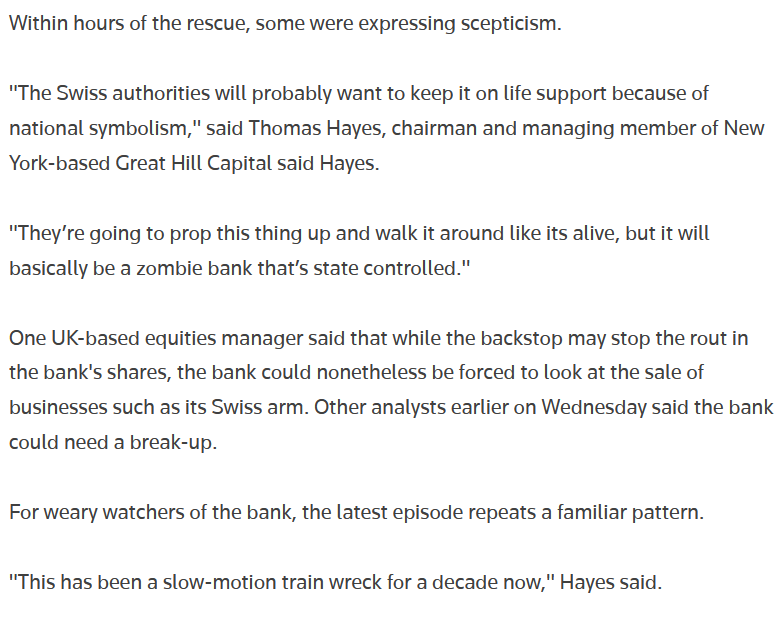

Tom Hayes – Quoted in Reuters article – 3/15/2023

Thanks to Davide Barbuscia for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Hedge Fund Trade Tip (PCN) – Position Completion Notification

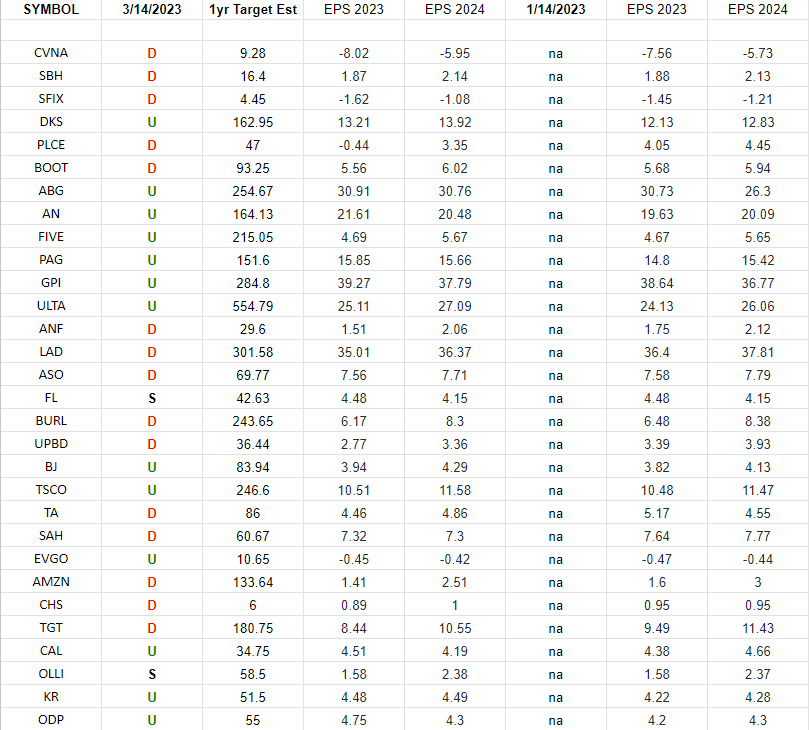

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”